Grunnleggende statistikk

| Institusjonelle aksjer (Long) | 106 514 119 (ex 13D/G) - change of 2,61MM shares 2,51% MRQ |

| Institusjonell verdi (Long) | $ 5 693 281 USD ($1000) |

Institusjonelt eierskap og aksjonærer

Sunoco LP - Limited Partnership (US:SUN) har 330 institusjonelle eiere og aksjonærer som har sendt inn 13D/G- eller 13F-skjemaer til Securities Exchange Commission (SEC). Disse institusjonene eier til sammen 106,514,119 aksjer. De største aksjonærene inkluderer AMLP - ALERIAN MLP ETF, Alps Advisors Inc, Invesco Ltd., Goldman Sachs Group Inc, MLPRX - Invesco Oppenheimer SteelPath MLP Income Fund Class C, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd., MLPA - Global X MLP ETF, GLPAX - Goldman Sachs MLP Energy Infrastructure Fund Class A Shares, MLPEX - Invesco Oppenheimer SteelPath MLP Select 40 Fund Class C, and Energy Income Partners, LLC .

Sunoco LP - Limited Partnership (NYSE:SUN) institusjonell eierstruktur viser nåværende posisjoner i selskapet fordelt på institusjoner og fond, samt de siste endringene i posisjonsstørrelse. De største aksjonærene kan være individuelle investorer, verdipapirfond, hedgefond eller institusjoner. Schedule 13D indikerer at investoren eier (eller har eid) mer enn 5 % av selskapet og har til hensikt (eller hadde til hensikt) å aktivt forfølge en endring i forretningsstrategien. Schedule 13G indikerer en passiv investering på over 5 %.

The share price as of September 12, 2025 is 50,11 / share. Previously, on September 13, 2024, the share price was 53,50 / share. This represents a decline of 6,34% over that period.

Fondssentiment-score

Fondssentiment Score (også kjent som akkumulering av eierskap poengsum) viser hvilke aksjer som er mest kjøpt av fond. Den er resultatet av en sofistikert, kvantitativ flerfaktormodell som identifiserer selskaper med de høyeste nivåene av institusjonell akkumulering. Beregningsmodellen for poeng bruker en kombinasjon av den totale økningen i antall offentliggjorte eiere, endringer i porteføljeallokeringen til disse eierne og andre beregninger. Tallet går fra 0 til 100, der høyere tall indikerer en høyere grad av akkumulering i forhold til sammenlignbare selskaper, der 50 er gjennomsnittet.

Oppdateringsfrekvens: Daglig

Sjekk ut Ownership Explorer, som inneholder en liste over de høyest rangerte selskapene.

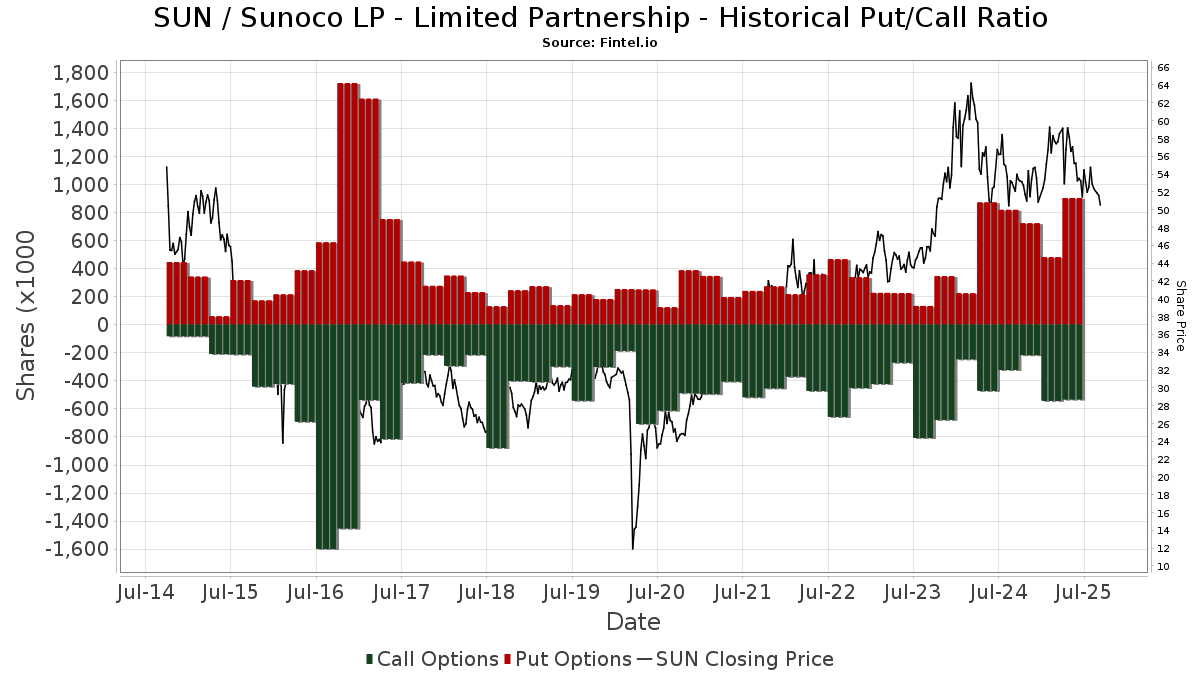

Institusjonell Put/Call-forhold

I tillegg til å rapportere standard aksje- og gjeldsemisjoner må institusjoner med mer enn 100 millioner kroner i forvaltningskapital også oppgi beholdningen av put- og callopsjoner. Siden put-opsjoner generelt indikerer et negativt sentiment, og call-opsjoner indikerer et positivt sentiment, kan vi få et inntrykk av det generelle institusjonelle sentimentet ved å plotte forholdet mellom put- og call-opsjoner. Diagrammet til høyre viser det historiske forholdet mellom put- og call-opsjoner for dette instrumentet.

Ved å bruke Put/Call-forholdet som en indikator på investorsentimentet kan man overvinne en av de viktigste svakhetene ved å bruke totalt institusjonelt eierskap, nemlig at en betydelig andel av forvaltningskapitalen investeres passivt for å følge indekser. Passivt forvaltede fond kjøper vanligvis ikke opsjoner, slik at indikatoren for put/call-forhold i større grad gjenspeiler stemningen i aktivt forvaltede fond.

13D/G-arkiveringer

Vi presenterer 13D/G-arkiveringene separat fra 13F-arkiveringene fordi de behandles forskjellig av SEC. 13D/G-arkiveringene kan sendes inn av grupper av investorer (med én leder), mens 13D/G-arkiveringene ikke kan sendes inn. Dette fører til situasjoner der en investor kan sende inn en 13D/G-rapport med én verdi for alle aksjene (som representerer alle aksjene som eies av investorgruppen), men deretter sende inn en 13F-melding med en annen verdi for alle aksjene (som kun representerer deres eget eierskap). Dette betyr at aksjeeierskap i 13D/G-arkiveringene og 13F-arkiveringene ofte ikke er direkte sammenlignbare, og vi presenterer dem derfor separat.

Merk: Fra og med 16. mai 2021 viser vi ikke lenger eiere som ikke har sendt inn en 13D/G i løpet av det siste året. Tidligere viste vi hele historikken for 13D/G-arkiveringer. Generelt må enheter som er pålagt å sende inn 13D/G-arkiveringer, sende inn minst én gang i året før de sender inn en avsluttende rapport. Det hender imidlertid at fond trekker seg ut av posisjoner uten å sende inn en avsluttende innlevering (dvs. at de avvikler), slik at visning av hele historikken av og til fører til forvirring om det nåværende eierskapet. For å unngå forvirring viser vi nå bare "nåværende" eiere, det vil si eiere som har sendt inn informasjon i løpet av det siste året.

Upgrade to unlock premium data.

| Fildato | Skjema | Investor | Tidligere aksjer |

Siste aksjer |

Δ Aksjer (prosent) |

Eierandel (prosent) |

Δ Eierandel (prosent) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-07-09 | ALPS ADVISORS INC | 23,132,625 | 23,489,829 | 1.54 | 15.38 | 1.52 | ||

| 2024-11-08 | Invesco Ltd. | 1,227,260 | 8,670,067 | 606.46 | 6.40 | 326.67 |

13F- og NPORT-arkiveringer

Detaljer om 13F-arkiveringer er gratis. Detaljer om NP-arkiveringer krever et premium-medlemskap. Grønne rader indikerer nye posisjoner. Røde rader indikerer lukkede posisjoner. Klikk på lenke ikonet for å se hele transaksjonshistorikken.

Oppgrader

for å låse opp premiedata og eksportere til Excel. ![]() .

.

| Fildato | Kilde | Investor | Type | Gjennomsnittlig pris (estimert) |

Aksjer | Δ Aksjer (%) |

Rapportert verdi ($1000) | Verdi (%) | Portallokering (%) | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-08 | 13F | Nbc Securities, Inc. | 266 | 166,00 | 0 | |||||

| 2025-08-04 | 13F | Arkadios Wealth Advisors | 7 399 | 4,15 | 397 | −3,88 | ||||

| 2025-07-31 | 13F | Carnegie Capital Asset Management, LLC | 5 847 | 12,33 | 313 | 15,93 | ||||

| 2025-08-11 | 13F | Annis Gardner Whiting Capital Advisors, LLC | 800 | 0,00 | 43 | −8,70 | ||||

| 2025-08-13 | 13F | MONECO Advisors, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-06-17 | NP | GSRAX - Goldman Sachs Rising Dividend Growth Fund Class A | 107 226 | −18,63 | 6 235 | −15,99 | ||||

| 2025-05-12 | 13F | Simplex Trading, Llc | 0 | −100,00 | 0 | |||||

| 2025-04-25 | 13F | Kieckhefer Group Llc | 0 | −100,00 | 0 | |||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 670 269 | 4,00 | 35 920 | −4,01 | ||||

| 2025-07-10 | 13F | Exchange Traded Concepts, Llc | 114 820 | −3,05 | 6 153 | −10,51 | ||||

| 2025-07-14 | 13F | Farmers & Merchants Investments Inc | 257 | 0,00 | 14 | −7,14 | ||||

| 2025-07-07 | 13F | Wealth Alliance Advisory Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Spirit Of America Management Corp/ny | 13 500 | 0,00 | 723 | −7,66 | ||||

| 2025-08-15 | 13F | Security National Bank Of Sioux City Iowa /ia/ | 7 000 | 0,00 | 375 | −7,64 | ||||

| 2025-08-14 | 13F | Avid Wealth Partners LLC | 6 398 | −59,59 | 343 | −62,79 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 26 248 | 1 407 | ||||||

| 2025-05-07 | 13F | Sheaff Brock Investment Advisors, LLC | 4 376 | 254 | ||||||

| 2025-08-12 | 13F | MAI Capital Management | 5 587 | 0,05 | 299 | −7,72 | ||||

| 2025-07-21 | 13F | DHJJ Financial Advisors, Ltd. | 500 | 0,00 | 27 | −10,34 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 3 736 | 30,31 | 200 | 20,48 | ||||

| 2025-08-05 | 13F | Key FInancial Inc | 973 | 1,67 | 52 | −5,45 | ||||

| 2025-07-29 | NP | SPMHX - Invesco Oppenheimer SteelPath MLP Alpha Fund Class R5 | 893 961 | 0,00 | 48 220 | −8,28 | ||||

| 2025-08-12 | 13F | Marshall & Sterling Wealth Advisors Inc. | 602 | 0,00 | 32 | −5,88 | ||||

| 2025-08-08 | 13F | Wealth Alliance | 5 561 | 298 | ||||||

| 2025-05-09 | 13F | Delta Financial Group, Inc. | 9 094 | 1 | ||||||

| 2025-08-13 | 13F | Congress Wealth Management LLC / DE / | 19 522 | −0,49 | 1 046 | −7,35 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 1 327 | 163,29 | 71 | 184,00 | ||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 80 | −97,40 | 4 | −97,75 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 18 984 | −12,19 | 1 017 | −18,96 | ||||

| 2025-08-12 | 13F | Journey Strategic Wealth Llc | 10 458 | −14,90 | 560 | −21,46 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 161 332 | −14,94 | 8 646 | −21,49 | ||||

| 2025-07-30 | NP | SOAEX - Spirit of America Energy Fund Class A | 13 500 | 0,00 | 728 | −8,20 | ||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 1 078 | 0,00 | 57 | −8,06 | ||||

| 2025-06-25 | NP | EIPX - FT Energy Income Partners Strategy ETF | 105 143 | 3,43 | 6 114 | 6,78 | ||||

| 2025-05-06 | 13F | AE Wealth Management LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 27 349 | −29,99 | 1 466 | −35,38 | ||||

| 2025-08-14 | 13F | IHT Wealth Management, LLC | 10 302 | 2,10 | 552 | −5,64 | ||||

| 2025-08-14 | 13F | Recurrent Investment Advisors LLC | 933 586 | 0,08 | 50 031 | −7,63 | ||||

| 2025-07-28 | 13F | Rosenberg Matthew Hamilton | 1 835 | 98 | ||||||

| 2025-08-13 | 13F | Icon Advisers Inc/co | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Natixis | 15 100 | −57,05 | 809 | −60,67 | ||||

| 2025-07-17 | 13F | Wolff Wiese Magana Llc | 176 | 162,69 | 9 | 200,00 | ||||

| 2025-08-14 | 13F | Fmr Llc | 24 189 | 13,78 | 1 296 | 5,02 | ||||

| 2025-08-13 | 13F | Cary Street Partner Investment Advisory Llc | 6 116 | 0,00 | 328 | −7,89 | ||||

| 2025-08-14 | 13F | UBS Group AG | 1 151 153 | 12,30 | 61 690 | 3,66 | ||||

| 2025-06-09 | NP | Bmc Fund Inc | 473 | 0,00 | 28 | 3,85 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 190 659 | 3,10 | 10 217 | −4,83 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 3 500 | −38,60 | 188 | −43,33 | |||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 82 100 | 1 809,30 | 4 400 | 1 666,67 | |||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | Call | 43 400 | 2 326 | |||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 166 822 | 4,94 | 8 940 | −3,14 | ||||

| 2025-06-25 | NP | Duff & Phelps Global Utility Income Fund Inc. | 91 000 | −9,00 | 5 292 | 4,15 | ||||

| 2025-05-12 | 13F | Greenland Capital Management LP | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Mcdonald Partners Llc | 15 506 | 0,03 | 831 | −7,67 | ||||

| 2025-07-30 | 13F | Green Square Capital Advisors Llc | 7 038 | 0,00 | 377 | −7,60 | ||||

| 2025-08-13 | 13F | Grantham, Mayo, Van Otterloo & Co. LLC | Put | 395 100 | 21 173 | |||||

| 2025-08-14 | 13F | Van Eck Associates Corp | 33 757 | 14,43 | 2 | 0,00 | ||||

| 2025-08-12 | 13F | Advisors Asset Management, Inc. | 50 528 | 2,03 | 2 708 | −5,84 | ||||

| 2025-07-02 | 13F | Crumly & Associates Inc. | 4 711 | 0,00 | 252 | −7,69 | ||||

| 2025-07-29 | 13F | Stephens Inc /ar/ | 6 569 | −13,75 | 352 | −20,36 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 330 | 0,00 | 18 | −10,53 | ||||

| 2025-08-14 | 13F | Clarity Asset Management, Inc. | 400 | 21 | ||||||

| 2025-08-14 | 13F | Dividend Asset Capital, Llc | 21 978 | −13,40 | 1 178 | −20,10 | ||||

| 2025-05-30 | NP | ICBAX - ICON Natural Resources and Infrastructure Fund Investor Class | 56 000 | 55,56 | 3 251 | 75,63 | ||||

| 2025-07-07 | 13F | Thurston, Springer, Miller, Herd & Titak, Inc. | 200 | 11 | ||||||

| 2025-07-29 | 13F | Private Trust Co Na | 650 | 0,00 | 35 | −8,11 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 75 133 | 69,77 | 4 | 100,00 | ||||

| 2025-07-21 | 13F | Hudson Valley Investment Advisors Inc /adv | 12 030 | 0,00 | 645 | −7,74 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 12 721 | −1,48 | 682 | −9,08 | ||||

| 2025-07-17 | 13F | Coastline Trust Co | 180 | 0,00 | 10 | −10,00 | ||||

| 2025-08-01 | 13F | Bessemer Group Inc | 1 360 | 41,67 | 0 | |||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 8 420 | −15,25 | 451 | −21,70 | ||||

| 2025-07-21 | 13F | Hilltop National Bank | 80 | 0,00 | 4 | 0,00 | ||||

| 2025-07-17 | 13F | Centennial Wealth Advisory LLC | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | Avidian Wealth Solutions, LLC | 6 785 | −1,15 | 364 | −8,79 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 32 159 | −66,14 | 1 723 | −68,75 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 24 700 | 66,89 | 1 341 | 53,08 | |||

| 2025-08-18 | 13F | Wolverine Trading, Llc | 5 988 | 325 | ||||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 22 800 | 121,36 | 1 238 | 103,28 | |||

| 2025-08-11 | 13F | Pineridge Advisors LLC | 173 | 1,76 | 9 | 0,00 | ||||

| 2025-07-31 | 13F | Waldron Private Wealth LLC | 71 000 | 0,00 | 3 805 | −7,71 | ||||

| 2025-08-19 | 13F | Anchor Investment Management, LLC | 3 000 | 0,00 | 161 | −8,05 | ||||

| 2025-06-30 | NP | INVESCO ACTIVELY MANAGED EXCHANGE-TRADED FUND TRUST - Invesco SteelPath MLP & Energy Infrastructure ETF | 8 340 | 485 | ||||||

| 2025-07-23 | NP | Lmp Capital & Income Fund Inc. | 81 658 | 0,00 | 4 405 | −8,29 | ||||

| 2025-08-04 | 13F | IFG Advisory, LLC | 13 755 | 0,00 | 737 | −7,64 | ||||

| 2025-07-30 | NP | AMLP - ALERIAN MLP ETF | 23 527 894 | 3,79 | 1 269 095 | −4,81 | ||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Pensionmark Financial Group, Llc | 4 500 | −6,25 | 241 | −13,31 | ||||

| 2025-08-07 | 13F | Midwest Trust Co | 7 595 | 407 | ||||||

| 2025-08-06 | 13F | Kayne Anderson Capital Advisors Lp | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Peak6 Llc | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Put | 64 800 | 68,31 | 3 473 | 55,35 | |||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 64 881 | −7,65 | 3 477 | −14,78 | ||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Call | 19 700 | 24,68 | 1 056 | 15,05 | |||

| 2025-07-31 | 13F | CVA Family Office, LLC | 79 | 0,00 | 4 | 0,00 | ||||

| 2025-08-13 | 13F | Custom Index Systems, Llc | 11 418 | 17,04 | 612 | 7,95 | ||||

| 2025-05-14 | 13F | Peak6 Llc | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-11 | 13F | Citigroup Inc | 247 417 | 448,45 | 13 259 | 406,26 | ||||

| 2025-07-28 | 13F | Davidson Trust Co | 9 000 | 0,00 | 482 | −7,66 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 63 302 | −2,82 | 3 392 | −10,29 | ||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 45 761 | −42,73 | 2 452 | −47,13 | ||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 5 684 | 305 | ||||||

| 2025-08-14 | 13F | Vivaldi Asset Management, LLC | 3 926 | 210 | ||||||

| 2025-08-14 | 13F | GWM Advisors LLC | 7 088 | 226,18 | 380 | 200,79 | ||||

| 2025-07-30 | 13F | Studio Investment Management Llc | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Creative Planning | 36 641 | 0,11 | 1 964 | −7,62 | ||||

| 2025-06-25 | NP | SMLPX - Westwood Salient MLP & Energy Infrastructure Fund Institutional Shares | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 1 058 | 0,00 | 57 | −8,20 | ||||

| 2025-08-12 | 13F | Bowen Hanes & Co Inc | 600 000 | 0,00 | 32 154 | −7,70 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 771 976 | −54,41 | 41 370 | −57,92 | ||||

| 2025-08-04 | 13F | Flagship Harbor Advisors, Llc | 0 | −100,00 | 0 | |||||

| 2025-06-25 | NP | AMZA - InfraCap MLP ETF | 1 000 764 | −19,97 | 58 194 | −17,38 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 233 | 1,75 | 12 | −7,69 | ||||

| 2025-07-21 | 13F | Monticello Wealth Management, Llc | 4 674 | 0,73 | 251 | −7,06 | ||||

| 2025-08-14 | 13F | Great Valley Advisor Group, Inc. | 0 | −100,00 | 0 | |||||

| 2025-05-05 | 13F | Eagle Bay Advisors LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 21 154 | −42,12 | 1 134 | −46,61 | ||||

| 2025-08-18 | 13F | Castleark Management Llc | 27 840 | 0,00 | 1 492 | −7,74 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 6 213 | 185,39 | 333 | 161,42 | ||||

| 2025-07-18 | 13F | Liberty Capital Management, Inc. | 4 384 | 0,00 | 235 | −7,87 | ||||

| 2025-08-14 | 13F | Talon Private Wealth, LLC | 2 050 | 110 | ||||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 671 | 1,36 | 36 | −7,89 | ||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 90 | 0,00 | 5 | −20,00 | ||||

| 2025-08-08 | 13F | Citizens Financial Group Inc/ri | 4 639 | 0,00 | 249 | −7,81 | ||||

| 2025-08-12 | 13F | Barr E S & Co | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Summit Financial, LLC | 93 181 | 0,00 | 4 994 | −7,71 | ||||

| 2025-07-23 | NP | EIPI - FT Energy Income Partners Enhanced Income ETF | 256 448 | −1,27 | 13 833 | −9,45 | ||||

| 2025-08-12 | 13F | Jaffetilchin Investment Partners, LLC | 6 883 | −0,68 | 369 | −8,46 | ||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Oxbow Advisors, LLC | 10 595 | 32,44 | 568 | 22,20 | ||||

| 2025-05-15 | 13F | Virtus Investment Advisers, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 4 665 | 5,07 | 250 | −4,58 | ||||

| 2025-07-28 | 13F | Allianz Asset Management GmbH | 146 300 | −51,95 | 7 840 | −55,65 | ||||

| 2025-08-05 | 13F | Sigma Planning Corp | 16 306 | −10,90 | 874 | −17,80 | ||||

| 2025-07-31 | 13F | Richards, Merrill & Peterson, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Cooperman Leon G | 1 470 000 | 415,79 | 78 777 | 376,08 | ||||

| 2025-08-13 | 13F | Brown Advisory Inc | 12 174 | 10,95 | 652 | 2,35 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 31 266 | −4,10 | 1 676 | −11,47 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 33 750 | 6,02 | 2 | 0,00 | ||||

| 2025-07-10 | 13F | Focus Financial Network, Inc. | 19 200 | 10,64 | 1 029 | 2,09 | ||||

| 2025-06-25 | NP | CFLGX - ClearBridge Tactical Dividend Income Fund Class A This fund is a listed as child fund of Clearbridge, Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 32 166 | 0,00 | 1 870 | 3,26 | ||||

| 2025-07-21 | 13F | Quent Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 6 566 | −36,59 | 352 | −41,60 | ||||

| 2025-07-23 | 13F | Cohen Capital Management, Inc. | 8 210 | 0,00 | 440 | −7,77 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 2 014 | −29,70 | 108 | −35,54 | ||||

| 2025-08-11 | 13F | Cornerstone Planning Group LLC | 909 | 49 | ||||||

| 2025-07-25 | 13F | Cwm, Llc | 392 | 3,70 | 0 | |||||

| 2025-07-25 | 13F | Cypress Capital Group | 8 620 | 462 | ||||||

| 2025-07-23 | 13F | PARK CIRCLE Co | 36 350 | 0,00 | 1 948 | −7,73 | ||||

| 2025-07-29 | 13F | Kanawha Capital Management Llc | 3 800 | 0,00 | 204 | −7,73 | ||||

| 2025-08-26 | NP | FIRST TRUST VARIABLE INSURANCE TRUST - First Trust Multi Income Allocation Portfolio Class I This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 668 | 5,03 | 36 | −2,78 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 5 300 | −71,20 | 0 | −100,00 | |||

| 2025-08-13 | 13F | Rudius Management LP | 33 | 0,00 | 2 | 0,00 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 4 100 | −74,38 | 0 | ||||

| 2025-07-14 | 13F | U.S. Capital Wealth Advisors, LLC | 9 996 | 7,87 | 536 | −0,56 | ||||

| 2025-07-24 | 13F | Baldwin Brothers Inc/ma | 11 360 | 0,00 | 609 | −7,74 | ||||

| 2025-08-14 | 13F | Clark Capital Management Group, Inc. | 5 500 | 295 | ||||||

| 2025-08-08 | 13F | Kingsview Wealth Management, LLC | 9 584 | 0,58 | 514 | −7,23 | ||||

| 2025-07-28 | NP | Neuberger Berman Mlp Income Fund Inc. | 420 000 | 0,00 | 22 655 | −8,28 | ||||

| 2025-08-13 | 13F | Transce3nd, LLC | 376 | 0,00 | 20 | −4,76 | ||||

| 2025-08-14 | 13F | Susquehanna Fundamental Investments, Llc | 35 402 | −64,49 | 1 897 | −67,22 | ||||

| 2025-08-08 | 13F | Compass Wealth Management LLC | 0 | −100,00 | 0 | |||||

| 2025-07-29 | NP | OSPPX - Invesco Oppenheimer SteelPath MLP Alpha Plus Fund Class R6 | 366 903 | −0,80 | 19 791 | −9,02 | ||||

| 2025-08-01 | 13F | Boyd Watterson Asset Management Llc/oh | 146 | 0,00 | 8 | −12,50 | ||||

| 2025-05-30 | NP | FLDZ - RiverNorth Patriot ETF | 252 | 6,33 | 15 | 16,67 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 231 | 0,00 | 12 | −15,38 | ||||

| 2025-07-23 | 13F | Kingswood Wealth Advisors, Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-04 | 13F | L.m. Kohn & Company | 5 400 | 0,00 | 289 | −7,67 | ||||

| 2025-07-28 | 13F | Private Wealth Asset Management, LLC | 406 | 0,00 | 22 | −8,70 | ||||

| 2025-08-14 | 13F | IPG Investment Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | Gables Capital Management Inc. | 40 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Financial Network Wealth Advisors LLC | 98 | 0,00 | 5 | 0,00 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 6 901 | 22,34 | 370 | 12,84 | ||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 7 365 | 0,00 | 395 | −7,73 | ||||

| 2025-08-06 | 13F | Ing Groep Nv | 183 100 | −33,66 | 9 812 | −38,77 | ||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 4 631 | 2,21 | 248 | −5,70 | ||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 11 798 | 0,00 | 632 | −7,74 | ||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 4 243 | 3,19 | 227 | −4,62 | ||||

| 2025-08-14 | 13F | Glen Eagle Advisors, LLC | 143 | 0,00 | 8 | −12,50 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 103 | 0,00 | 6 | 0,00 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 1 633 | 0,00 | 88 | 3,57 | ||||

| 2025-09-02 | NP | EIPIX - EIP Growth and Income Fund Class I | 28 320 | 0,00 | 1 566 | −4,86 | ||||

| 2025-08-07 | 13F | King Luther Capital Management Corp | 6 143 | 0,00 | 329 | −7,58 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Garrett Wealth Advisory Group, LLC | 4 933 | 0,00 | 264 | −7,69 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 190 | 90,00 | 10 | 100,00 | ||||

| 2025-07-22 | 13F | DAVENPORT & Co LLC | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Cascade Investment Group, Inc. | 24 875 | −2,36 | 1 333 | −9,87 | ||||

| 2025-08-14 | 13F | Icon Wealth Advisors, LLC | 2 443 | 19,23 | 131 | 10,17 | ||||

| 2025-07-17 | 13F | Independence Bank of Kentucky | 1 022 | 0,00 | 55 | −8,47 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 4 919 | 14,98 | 264 | 6,05 | ||||

| 2025-08-14 | 13F | Hilltop Holdings Inc. | 11 937 | −1,88 | 640 | −9,49 | ||||

| 2025-06-25 | NP | VLPAX - Virtus Duff & Phelps Select MLP and Energy Fund Class A | 22 263 | 86,08 | 1 295 | 92,27 | ||||

| 2025-08-11 | 13F | Independent Advisor Alliance | 9 254 | 13,57 | 496 | 4,65 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 24 587 | −4,40 | 1 318 | −11,79 | ||||

| 2025-08-28 | NP | Amplify ETF Trust - Amplify Natural Resources Dividend Income ETF | 1 824 | −64,66 | 98 | −67,56 | ||||

| 2025-07-21 | NP | GLPAX - Goldman Sachs MLP Energy Infrastructure Fund Class A Shares | 2 409 916 | −11,38 | 129 991 | −18,72 | ||||

| 2025-07-30 | NP | ALTY - Global X SuperDividend Alternatives ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 8 305 | 4,02 | 448 | −4,69 | ||||

| 2025-08-26 | NP | MDIV - Multi-Asset Diversified Income Index Fund This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 45 759 | −42,73 | 2 452 | −47,13 | ||||

| 2025-07-21 | 13F | Patriot Financial Group Insurance Agency, LLC | 4 856 | −2,78 | 260 | −10,03 | ||||

| 2025-07-11 | 13F | Miller Howard Investments Inc /ny | 691 096 | 0,56 | 37 036 | −7,18 | ||||

| 2025-08-07 | 13F | American Financial Group Inc | 19 500 | 0,00 | 1 045 | −7,69 | ||||

| 2025-08-14 | 13F | Caption Management, LLC | Put | 28 000 | 0,00 | 1 501 | −7,69 | |||

| 2025-05-01 | 13F | High Note Wealth, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Lee Financial Co | 3 819 | 205 | ||||||

| 2025-05-14 | 13F | Caitlin John, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 9 559 | −0,84 | 512 | −8,41 | ||||

| 2025-07-18 | 13F | PFG Investments, LLC | 5 671 | −14,82 | 304 | −21,50 | ||||

| 2025-04-14 | NP | TPYP - Tortoise North American Pipeline Fund | 128 241 | 2,72 | 7 542 | 6,98 | ||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 685 | −44,94 | 37 | −50,00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 0 | −100,00 | 0 | |||||

| 2025-07-09 | 13F | Gilman Hill Asset Management, LLC | 23 009 | 23,21 | 1 233 | 13,75 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 46 783 | 672,38 | 2 507 | 614,25 | ||||

| 2025-08-06 | 13F | Moors & Cabot, Inc. | 15 424 | 0,00 | 827 | −7,71 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 35 902 | 7,21 | 1 924 | −1,08 | ||||

| 2025-07-29 | 13F | Uhlmann Price Securities, Llc | 8 786 | −10,24 | 471 | −17,25 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 41 101 | 681,09 | 2 262 | 641,31 | ||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 560 | 0,00 | 30 | −6,25 | ||||

| 2025-07-22 | 13F | Capital Advisors Inc/ok | 7 258 | 0,47 | 389 | −7,40 | ||||

| 2025-07-23 | 13F | Ellsworth Advisors, LLC | 34 565 | 10,28 | 1 852 | 1,81 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 227 | −78,09 | 12 | −80,00 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 81 000 | 62,00 | 4 341 | 49,50 | |||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 57 | −79,79 | 3 | −81,25 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 35 100 | −71,25 | 1 881 | −73,47 | |||

| 2025-08-26 | NP | AZBAX - AllianzGI Small-Cap Fund Class A | 4 380 | 0,00 | 235 | −7,87 | ||||

| 2025-08-14 | 13F | RMB Capital Management, LLC | 4 809 | 258 | ||||||

| 2025-08-14 | 13F | Snowden Capital Advisors LLC | 5 233 | 1,95 | 280 | −6,04 | ||||

| 2025-07-30 | 13F | Cullen/frost Bankers, Inc. | 1 955 | 0,00 | 105 | −7,96 | ||||

| 2025-08-14 | 13F | McIlrath & Eck, LLC | 3 436 | 0,20 | 184 | −7,54 | ||||

| 2025-08-13 | 13F | Basso Capital Management, L.p. | 5 680 | 0,00 | 304 | −7,60 | ||||

| 2025-08-13 | 13F | Virtus ETF Advisers LLC | 0 | −100,00 | 0 | |||||

| 2025-05-13 | 13F | UBS Group AG | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-15 | 13F | Captrust Financial Advisors | 41 789 | −1,06 | 2 239 | −8,69 | ||||

| 2025-08-12 | 13F | Longfellow Investment Management Co Llc | 574 | 0,00 | 31 | −9,09 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 158 961 | −0,10 | 8 518 | −7,80 | ||||

| 2025-06-25 | NP | EMLP - First Trust North American Energy Infrastructure Fund This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 143 935 | 6,62 | 66 520 | 10,07 | ||||

| 2025-08-28 | NP | Elevation Series Trust - RiverNorth Patriot ETF | 305 | 16 | ||||||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Tortoise Capital Advisors, L.l.c. | 1 404 738 | 15,75 | 75 280 | 6,84 | ||||

| 2025-05-29 | NP | CPAEX - Counterpoint Tactical Equity Fund Class A Shares | 6 386 | 7,53 | 371 | 21,31 | ||||

| 2025-07-15 | 13F | Retirement Income Solutions, Inc | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | CAPROCK Group, Inc. | 12 152 | 9,83 | 706 | 23,90 | ||||

| 2025-08-12 | 13F | Virtu Financial LLC | 12 752 | 1 | ||||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 365 953 | 5,47 | 19 611 | −2,65 | ||||

| 2025-07-25 | 13F | M.e. Allison & Co., Inc. | 11 745 | 0,00 | 629 | −7,64 | ||||

| 2025-08-13 | 13F | Jump Financial, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | TCG Advisory Services, LLC | 206 606 | −0,11 | 11 072 | −7,80 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 5 187 | 3,86 | 278 | 0,36 | ||||

| 2025-06-30 | NP | CVY - Invesco Zacks Multi-Asset Income ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 13 708 | −11,16 | 797 | −8,29 | ||||

| 2025-07-22 | 13F | Chung Wu Investment Group, LLC | 1 800 | 96 | ||||||

| 2025-08-06 | 13F | Atlantic Union Bankshares Corp | 11 | 1 | ||||||

| 2025-07-29 | NP | MLPEX - Invesco Oppenheimer SteelPath MLP Select 40 Fund Class C | 1 937 652 | −5,60 | 104 517 | −13,42 | ||||

| 2025-08-12 | 13F | PSI Advisors, LLC | 9 220 | 0,11 | 494 | −7,49 | ||||

| 2025-08-11 | 13F | Alps Advisors Inc | 23 489 829 | 1,54 | 1 258 820 | −6,27 | ||||

| 2025-08-18 | 13F/A | Westwood Holdings Group Inc | 29 030 | 13,42 | 1 556 | 4,64 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 4 278 | −5,02 | 229 | −12,26 | ||||

| 2025-04-29 | 13F | CoreFirst Bank & Trust | 0 | −100,00 | 0 | |||||

| 2025-07-22 | 13F | Kercheville Advisors, LLC | 154 080 | 0,00 | 8 257 | −7,69 | ||||

| 2025-08-07 | 13F | Alpha Cubed Investments, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 1 110 476 | −4,57 | 59 510 | −11,92 | ||||

| 2025-08-08 | 13F | Sittner & Nelson, Llc | 5 000 | 0,00 | 268 | −7,93 | ||||

| 2025-08-14 | 13F | Warren Averett Asset Management, LLC | 77 701 | 4,19 | 4 164 | −3,83 | ||||

| 2025-08-13 | 13F | Johnson Financial Group, Inc. | 1 200 | 0,00 | 64 | −7,25 | ||||

| 2025-08-19 | 13F | State of Wyoming | 2 080 | 111 | ||||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 9 483 | −9,26 | 1 | |||||

| 2025-08-12 | 13F | Tradition Wealth Management, LLC | 9 840 | 0,57 | 527 | −7,22 | ||||

| 2025-07-11 | 13F | Caldwell Securities, Inc | 261 | 0,00 | 14 | −13,33 | ||||

| 2025-07-23 | 13F | Sachetta, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-29 | NP | PIMCO Energy & Tactical Credit Opportunities Fund | 146 300 | −48,90 | 7 840 | −52,83 | ||||

| 2025-07-28 | 13F | Bridges Investment Management Inc | 4 927 | 0,00 | 264 | −7,69 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 174 100 | −4,97 | 9 330 | −12,28 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 44 100 | −47,00 | 2 363 | −51,08 | |||

| 2025-08-13 | 13F | M&t Bank Corp | 13 106 | 0,00 | 702 | −7,63 | ||||

| 2025-08-14 | 13F | Barnett & Company, Inc. | 42 333 | 0,00 | 2 269 | −7,69 | ||||

| 2025-08-11 | 13F | Summit Wealth Partners, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 14 976 | 13,14 | 803 | 4,43 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 56 245 | −8,16 | 3 014 | −15,22 | ||||

| 2025-08-14 | 13F | Benjamin Edwards Inc | 7 741 | 0,00 | 415 | −7,80 | ||||

| 2025-08-08 | 13F | Good Life Advisors, LLC | 8 151 | 2,05 | 437 | −5,83 | ||||

| 2025-03-25 | 13F | Arrow Investment Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Empirical Asset Management, LLC | 28 505 | 0,00 | 1 528 | −7,73 | ||||

| 2025-07-31 | 13F | CNB Bank | 500 | 0,00 | 27 | −10,34 | ||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 8 886 | 3,45 | 476 | −4,42 | ||||

| 2025-06-26 | NP | HFCGX - Hennessy Cornerstone Growth Fund Investor Class | 125 100 | 7 275 | ||||||

| 2025-04-14 | NP | TORIX - Tortoise MLP & Pipeline Fund Institutional Class Shares | 650 759 | 0,00 | 38 271 | 4,16 | ||||

| 2025-07-22 | 13F | Wealthcare Advisory Partners LLC | 10 063 | 0,56 | 539 | −7,23 | ||||

| 2025-08-08 | 13F | Avalon Trust Co | 500 | 0,00 | 27 | −10,34 | ||||

| 2025-08-18 | 13F | Front Row Advisors LLC | 1 350 | 0,00 | 72 | −7,69 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 17 755 | 0,74 | 951 | −7,04 | ||||

| 2025-08-04 | 13F | ELCO Management Co., LLC | 26 185 | 0,36 | 1 403 | −7,33 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 6 504 694 | −0,29 | 348 587 | −7,96 | ||||

| 2025-06-30 | NP | RMLPX - Recurrent MLP & Infrastructure Fund Class I | 883 988 | 10,36 | 51 404 | 13,93 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 24 423 | −3,21 | 1 | 0,00 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 5 235 | 465,95 | 281 | 418,52 | ||||

| 2025-06-26 | NP | BlackRock Funds II - BLACKROCK MULTI-ASSET INCOME PORTFOLIO INVESTOR C SHARES | 16 653 | 0,00 | 968 | 3,20 | ||||

| 2025-07-14 | 13F | Armstrong Advisory Group, Inc | 211 | 2,93 | 11 | 10,00 | ||||

| 2025-08-07 | 13F | HighPoint Advisor Group LLC | 5 584 | 23,16 | 299 | 11,57 | ||||

| 2025-07-09 | 13F | Byrne Asset Management LLC | 200 | 0,00 | 11 | −9,09 | ||||

| 2025-08-01 | 13F | Rossby Financial, LCC | 200 | 0,00 | 11 | −9,09 | ||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 2 805 106 | −5,81 | 150 326 | −13,06 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 291 200 | 70,29 | 15 605 | 57,18 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 51 467 | 258,93 | 2 758 | 231,49 | ||||

| 2025-07-29 | 13F | International Assets Investment Management, Llc | 11 061 | −1,70 | 593 | −9,34 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 104 500 | −59,90 | 5 600 | −62,99 | |||

| 2025-08-14 | 13F | Glenmede Investment Management, LP | 38 800 | 2 079 | ||||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-08-18 | 13F | N.E.W. Advisory Services LLC | 181 | 0,00 | 10 | −10,00 | ||||

| 2025-07-14 | 13F | Counterpoint Mutual Funds LLC | 0 | −100,00 | 0 | |||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 530 | 0,00 | 28 | −6,67 | ||||

| 2025-08-13 | 13F | Finer Wealth Management, Inc. | 32 942 | 2,68 | 1 765 | −5,21 | ||||

| 2025-08-04 | 13F | Keybank National Association/oh | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Blackstone Group Inc | 1 796 281 | 2,38 | 96 263 | −5,51 | ||||

| 2025-07-24 | NP | FSDIX - Fidelity Strategic Dividend & Income Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 21 989 | 3,43 | 1 186 | −5,12 | ||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | −100,00 | 0 | |||||

| 2025-07-10 | 13F | Chickasaw Capital Management Llc | 144 429 | 4,66 | 8 | −12,50 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 444 238 | 35 410,63 | 24 | |||||

| 2025-08-06 | 13F | Ethos Financial Group, LLC | 4 142 | −46,74 | 222 | −51,00 | ||||

| 2025-04-21 | 13F | ORG Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-07-29 | NP | Tortoise Capital Series Trust - Tortoise Energy Infrastructure Total Return Fund A Class | 609 557 | 32 880 | ||||||

| 2025-08-12 | 13F | Inscription Capital, LLC | 3 740 | −31,69 | 200 | −39,39 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 300 | 16 | ||||||

| 2025-08-15 | 13F | Resources Management Corp /ct/ /adv | 1 780 | 0,00 | 0 | |||||

| 2025-07-18 | 13F | Bartlett & Co. Wealth Management Llc | 330 | 0,00 | 18 | −10,53 | ||||

| 2025-08-14 | 13F | Infrastructure Capital Advisors, Llc | 982 653 | 231,48 | 52 660 | 558,41 | ||||

| 2025-07-28 | 13F | WealthPLAN Partners, LLC | 7 214 | 0,14 | 387 | −7,66 | ||||

| 2025-08-12 | 13F | Clearbridge Investments, LLC | 662 929 | −3,28 | 35 526 | −10,73 | ||||

| 2025-08-13 | 13F | Baird Financial Group, Inc. | 16 266 | −2,14 | 872 | −9,74 | ||||

| 2025-07-07 | 13F | Global Wealth Strategies & Associates | 33 | 0,00 | 2 | 0,00 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 9 080 481 | −0,93 | 486 623 | −8,56 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 1 884 | 0,00 | 101 | −8,26 | ||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Cary Street Partners Financial Llc | 16 119 | 0,00 | 864 | −7,70 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 49 524 | 37,14 | 2 654 | 26,62 | ||||

| 2025-07-23 | NP | Clearbridge Energy Mlp Opportunity Fund Inc. This fund is a listed as child fund of Clearbridge, Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 409 772 | −5,21 | 22 103 | −13,05 | ||||

| 2025-08-11 | 13F | HHM Wealth Advisors, LLC | 1 200 | 0,00 | 64 | −7,25 | ||||

| 2025-07-07 | 13F | Fractal Investments LLC | 616 542 | 11,54 | 33 040 | 2,95 | ||||

| 2025-07-30 | NP | MLPA - Global X MLP ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2 783 223 | −5,86 | 150 127 | −13,66 | ||||

| 2025-07-28 | 13F | Mutual Advisors, LLC | 4 622 | 0,02 | 247 | −9,19 | ||||

| 2025-08-12 | 13F | Park Square Financial Group, LLC | 380 | 0,00 | 20 | −9,09 | ||||

| 2025-08-12 | 13F | Willis Investment Counsel | 4 883 | 0,00 | 262 | −7,77 | ||||

| 2025-05-15 | 13F | Nomura Holdings Inc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-05-12 | 13F | Sandy Spring Bank | 11 | 0,00 | 1 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-29 | NP | Tortoise Capital Series Trust - TORTOISE NORTH AMERICAN PIPELINE FUND | 114 989 | 6 203 | ||||||

| 2025-08-13 | 13F | Nbw Capital Llc | 76 009 | 1,92 | 4 073 | −5,91 | ||||

| 2025-08-14 | 13F | Abound Financial, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Financial Counselors Inc | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | Whittier Trust Co Of Nevada Inc | 50 351 | −30,24 | 2 698 | −35,61 | ||||

| 2025-05-08 | 13F | Gsa Capital Partners Llp | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Css Llc/il | Put | 12 500 | 670 | |||||

| 2025-04-28 | 13F | Strategic Financial Concepts, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-29 | NP | MLPRX - Invesco Oppenheimer SteelPath MLP Income Fund Class C | 5 854 810 | 1,74 | 315 808 | −6,69 | ||||

| 2025-08-13 | 13F | Baker Avenue Asset Management, LP | 10 000 | 0,00 | 536 | −7,76 | ||||

| 2025-07-25 | 13F | Stephens Consulting, LLC | 100 | 0,00 | 5 | 0,00 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 13 988 | −9,50 | 1 | |||||

| 2025-07-17 | 13F | CWA Asset Management Group, LLC | 4 087 | −5,70 | 219 | −12,75 | ||||

| 2025-05-15 | 13F | Glenmede Trust Co Na | 46 000 | 0,00 | 2 671 | 12,85 | ||||

| 2025-08-06 | 13F | Quadrant Private Wealth Management, LLC | 4 040 | 0,00 | 217 | −7,69 | ||||

| 2025-07-10 | 13F | Farmers & Merchants Trust Co of Chambersburg PA | 2 000 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 37 488 | 8,10 | 1 996 | −0,84 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 126 245 | 0,84 | 6 765 | 7,26 | ||||

| 2025-05-06 | 13F | Venturi Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | SWAN Capital LLC | 74 | 4 | ||||||

| 2025-07-31 | 13F | Oppenheimer Asset Management Inc. | 6 479 | −5,88 | 347 | −13,03 | ||||

| 2025-05-14 | 13F | Estabrook Capital Management | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Bokf, Na | 12 293 | 0,00 | 659 | −7,71 | ||||

| 2025-08-13 | 13F | Crescent Grove Advisors, LLC | 43 419 | 68,26 | 2 327 | 55,27 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 5 991 | 25,70 | 325 | 15,25 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 746 | 0,00 | 40 | −9,30 | ||||

| 2025-07-03 | 13F | Garde Capital, Inc. | 148 | 0,00 | 8 | −12,50 | ||||

| 2025-07-17 | 13F | XML Financial, LLC | 9 221 | −15,75 | 494 | −22,20 | ||||

| 2025-08-14 | 13F | Zurich Insurance Group Ltd/FI | 27 200 | 0,00 | 1 458 | −7,73 | ||||

| 2025-08-14 | 13F | Energy Income Partners, LLC | 1 883 992 | 4,07 | 100 963 | −3,94 | ||||

| 2025-08-29 | 13F | Total Investment Management Inc | 22 | 1 | ||||||

| 2025-06-26 | NP | GYLD - Arrow Dow Jones Global Yield ETF | 2 314 | −12,71 | 135 | −10,07 | ||||

| 2025-08-11 | 13F | United Advisor Group, LLC | 8 093 | 8,21 | 434 | −0,23 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 577 | 0,00 | 31 | −9,09 | ||||

| 2025-08-11 | 13F | Duff & Phelps Investment Management Co | 113 263 | 470,05 | 6 070 | 426,37 | ||||

| 2025-08-04 | 13F | Linscomb & Williams, Inc. | 14 740 | 0,00 | 790 | −7,72 | ||||

| 2025-07-08 | 13F/A | Adams Asset Advisors, LLC | 571 547 | 0,40 | 30 629 | −7,33 | ||||

| 2025-07-14 | 13F | Whitener Capital Management, Inc. | 4 510 | 0,22 | 242 | −7,66 | ||||

| 2025-07-21 | 13F | Sovereign Investment Advisors, LLC | 43 522 | 2 332 | ||||||

| 2025-07-29 | 13F | Harbor Asset Planning, Inc. | 762 | 41 | ||||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Hennessy Advisors Inc | 166 800 | 8 939 | ||||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 1 379 | 95,88 | 74 | 82,50 | ||||

| 2025-07-08 | 13F/A | Salem Investment Counselors Inc | 2 666 | 0,00 | 143 | −7,79 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 17 086 | 18,27 | 1 | |||||

| 2025-08-12 | 13F | BlackRock, Inc. | 16 924 | −61,95 | 907 | −64,91 | ||||

| 2025-08-06 | 13F | Texas Yale Capital Corp. | 90 666 | 11,28 | 4 859 | 2,71 | ||||

| 2025-07-11 | 13F | Quad-Cities Investment Group, LLC | 13 577 | 4,11 | 728 | −3,96 | ||||

| 2025-07-22 | 13F | Cedar Mountain Advisors, LLC | 93 | 0,00 | 5 | −20,00 | ||||

| 2025-07-08 | 13F | Strategic Advocates LLC | 5 977 | −9,93 | 320 | −16,88 | ||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 9 387 | −10,91 | 503 | −7,20 | ||||

| 2025-08-07 | 13F | Pinnacle Holdings, LLC | 41 450 | 0,00 | 2 221 | −7,69 | ||||

| 2025-08-14 | 13F | Aster Capital Management (DIFC) Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-21 | NP | EINC - VanEck Vectors Energy Income ETF | 24 521 | 21,00 | 1 314 | 11,73 |