Grunnleggende statistikk

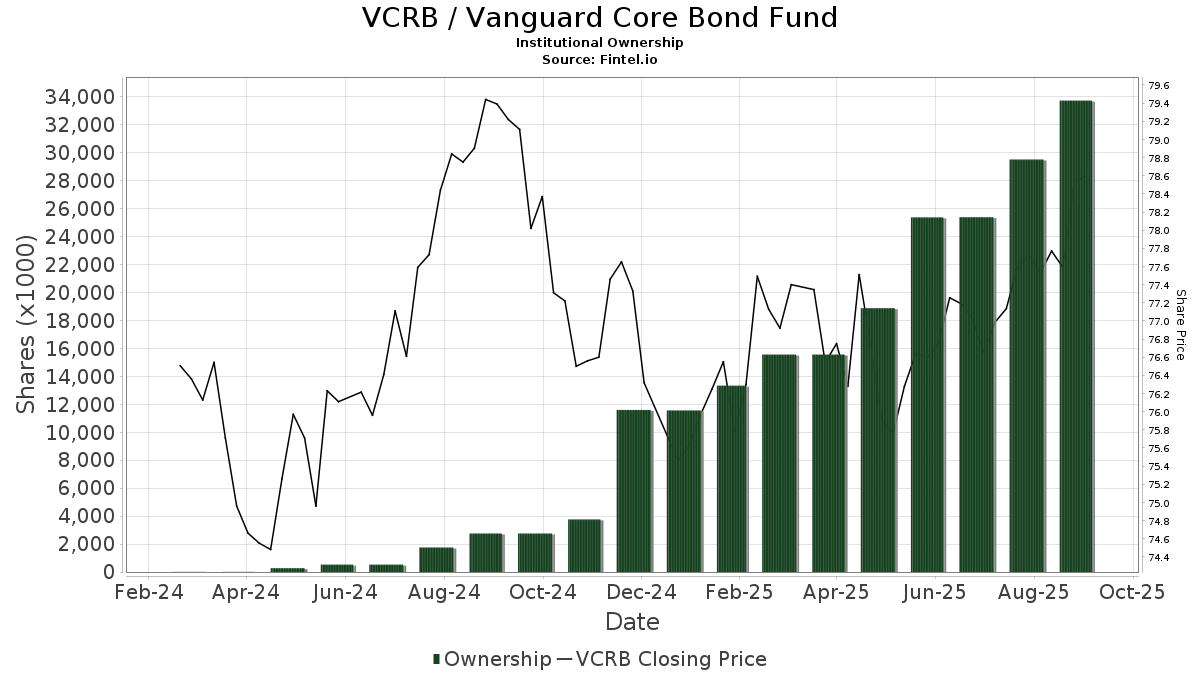

| Institusjonelle eiere | 169 total, 169 long only, 0 short only, 0 long/short - change of 25,00% MRQ |

| Gjennomsnittlig porteføljeallokering | 1.8087 % - change of −2,22% MRQ |

| Institusjonelle aksjer (Long) | 33 735 640 (ex 13D/G) - change of 8,39MM shares 33,07% MRQ |

| Institusjonell verdi (Long) | $ 2 489 102 USD ($1000) |

Institusjonelt eierskap og aksjonærer

Vanguard Core Bond Fund (US:VCRB) har 169 institusjonelle eiere og aksjonærer som har sendt inn 13D/G- eller 13F-skjemaer til Securities Exchange Commission (SEC). Disse institusjonene eier til sammen 33,735,640 aksjer. De største aksjonærene inkluderer HBK Sorce Advisory LLC, Signaturefd, Llc, Martel Wealth Advisors Inc, Assetmark, Inc, Brinker Capital Investments, LLC, Orion Portfolio Solutions, LLC, Diversified Portfolios, Inc., Smith & Howard Wealth Management, LLC, BKD Wealth Advisors, LLC, and Financial Engines Advisors L.L.C. .

Vanguard Core Bond Fund (NasdaqGM:VCRB) institusjonell eierstruktur viser nåværende posisjoner i selskapet fordelt på institusjoner og fond, samt de siste endringene i posisjonsstørrelse. De største aksjonærene kan være individuelle investorer, verdipapirfond, hedgefond eller institusjoner. Schedule 13D indikerer at investoren eier (eller har eid) mer enn 5 % av selskapet og har til hensikt (eller hadde til hensikt) å aktivt forfølge en endring i forretningsstrategien. Schedule 13G indikerer en passiv investering på over 5 %.

The share price as of September 12, 2025 is 78,57 / share. Previously, on September 13, 2024, the share price was 79,53 / share. This represents a decline of 1,21% over that period.

Fondssentiment-score

Fondssentiment Score (også kjent som akkumulering av eierskap poengsum) viser hvilke aksjer som er mest kjøpt av fond. Den er resultatet av en sofistikert, kvantitativ flerfaktormodell som identifiserer selskaper med de høyeste nivåene av institusjonell akkumulering. Beregningsmodellen for poeng bruker en kombinasjon av den totale økningen i antall offentliggjorte eiere, endringer i porteføljeallokeringen til disse eierne og andre beregninger. Tallet går fra 0 til 100, der høyere tall indikerer en høyere grad av akkumulering i forhold til sammenlignbare selskaper, der 50 er gjennomsnittet.

Oppdateringsfrekvens: Daglig

Sjekk ut Ownership Explorer, som inneholder en liste over de høyest rangerte selskapene.

Institusjonell Put/Call-forhold

I tillegg til å rapportere standard aksje- og gjeldsemisjoner må institusjoner med mer enn 100 millioner kroner i forvaltningskapital også oppgi beholdningen av put- og callopsjoner. Siden put-opsjoner generelt indikerer et negativt sentiment, og call-opsjoner indikerer et positivt sentiment, kan vi få et inntrykk av det generelle institusjonelle sentimentet ved å plotte forholdet mellom put- og call-opsjoner. Diagrammet til høyre viser det historiske forholdet mellom put- og call-opsjoner for dette instrumentet.

Ved å bruke Put/Call-forholdet som en indikator på investorsentimentet kan man overvinne en av de viktigste svakhetene ved å bruke totalt institusjonelt eierskap, nemlig at en betydelig andel av forvaltningskapitalen investeres passivt for å følge indekser. Passivt forvaltede fond kjøper vanligvis ikke opsjoner, slik at indikatoren for put/call-forhold i større grad gjenspeiler stemningen i aktivt forvaltede fond.

13F- og NPORT-arkiveringer

Detaljer om 13F-arkiveringer er gratis. Detaljer om NP-arkiveringer krever et premium-medlemskap. Grønne rader indikerer nye posisjoner. Røde rader indikerer lukkede posisjoner. Klikk på lenke ikonet for å se hele transaksjonshistorikken.

Oppgrader

for å låse opp premiedata og eksportere til Excel. ![]() .

.

| Fildato | Kilde | Investor | Type | Gjennomsnittlig pris (estimert) |

Aksjer | Δ Aksjer (%) |

Rapportert verdi ($1000) | Verdi (%) | Portallokering (%) | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-30 | 13F | Mid-American Wealth Advisory Group, Inc. | 394 | 31 | ||||||

| 2025-07-31 | 13F | Conservest Capital Advisors, Inc. | 16 869 | 1 309 | ||||||

| 2025-07-09 | 13F | Dynamic Advisor Solutions LLC | 10 550 | 29,45 | 818 | 29,64 | ||||

| 2025-08-08 | 13F | Kaizen Financial Strategies | 122 783 | 2,79 | 9 525 | 3,00 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 13 457 | −1,69 | 1 044 | −1,51 | ||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 31 155 | 10,96 | 2 417 | 11,13 | ||||

| 2025-07-01 | 13F | Harbor Investment Advisory, Llc | 12 203 | 13,12 | 947 | 13,29 | ||||

| 2025-08-08 | 13F | D'Orazio & Associates, Inc. | 29 450 | 2 285 | ||||||

| 2025-08-14 | 13F | Ariadne Wealth Management, LP | 3 973 | 0,00 | 309 | 1,65 | ||||

| 2025-08-14 | 13F | Ancora Advisors, LLC | 328 | 25 | ||||||

| 2025-07-09 | 13F | Keystone Wealth Services, LLC | 5 093 | 43,42 | 395 | 44,16 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 235 | 18 | ||||||

| 2025-07-29 | 13F | Private Trust Co Na | 1 929 | −0,98 | 150 | −0,67 | ||||

| 2025-08-07 | 13F | Meeder Advisory Services, Inc. | 331 656 | 25 730 | ||||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 704 242 | 237,91 | 54 635 | 238,57 | ||||

| 2025-08-20 | 13F | Tull Financial Group, Inc. | 459 913 | 118,09 | 35 680 | 118,52 | ||||

| 2025-08-04 | 13F | HBK Sorce Advisory LLC | 8 213 718 | 3,21 | 637 220 | 3,41 | ||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 46 105 | 3 577 | ||||||

| 2025-07-18 | 13F | Martel Wealth Advisors Inc | 1 384 604 | 2,36 | 107 418 | 2,56 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 3 973 | 20,39 | 308 | 20,78 | ||||

| 2025-07-15 | 13F | Smith & Howard Wealth Management, LLC | 872 703 | 67 704 | ||||||

| 2025-05-02 | 13F | Transcendent Capital Group LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | McIlrath & Eck, LLC | 115 743 | −5,83 | 8 979 | −5,64 | ||||

| 2025-07-31 | 13F | Schoolcraft Capital LLC | 373 229 | −7,52 | 28 955 | −7,34 | ||||

| 2025-07-15 | 13F | Signal Tree Financial Partners Llc | 15 803 | 48,40 | 1 226 | 48,67 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 6 701 | −43,64 | 520 | −43,59 | ||||

| 2025-08-13 | 13F | Daner Wealth Management, LLC | 11 866 | 161,31 | 919 | 165,61 | ||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Boston Family Office Llc | 55 546 | 84,27 | 4 | 100,00 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 2 611 | 1,08 | 203 | 1,00 | ||||

| 2025-05-07 | 13F | Magnolia Wealth Management, LLC | 581 996 | −3,02 | 45 064 | −0,95 | ||||

| 2025-07-16 | 13F | Plancorp, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | BCR Wealth Strategies, LLC | 254 508 | 64,42 | 20 | 72,73 | ||||

| 2025-07-14 | 13F | Farmers Trust Co | 7 918 | 0,00 | 614 | 0,16 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 30 300 | 7,82 | 2 351 | 8,05 | ||||

| 2025-07-17 | 13F | Enclave Advisors LLC | 33 148 | 7,09 | 2 572 | 7,30 | ||||

| 2025-08-13 | 13F | Brown Advisory Inc | 10 236 | 794 | ||||||

| 2025-07-22 | 13F | Gutierrez Wealth Advisory, LLC | 112 717 | 0,23 | 8 745 | 0,42 | ||||

| 2025-08-19 | 13F | Cape Investment Advisory, Inc. | 2 725 | 1 283,25 | 211 | 1 306,67 | ||||

| 2025-08-06 | 13F | SOUTH STATE Corp | 82 271 | −39,89 | 6 383 | −39,78 | ||||

| 2025-08-06 | 13F | Ethos Financial Group, LLC | 31 938 | 50,35 | 2 478 | 50,67 | ||||

| 2025-07-30 | 13F | Mills Wealth Advisors LLC | 387 849 | 22,58 | 30 089 | 22,82 | ||||

| 2025-08-01 | 13F | Gwn Securities Inc. | 0 | −100,00 | 0 | |||||

| 2025-05-05 | 13F | Morningstar Investment Services LLC | 297 313 | 23 | ||||||

| 2025-07-24 | 13F | Grand Wealth Management, Llc | 54 315 | 0,57 | 4 214 | 0,77 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Financial Engines Advisors L.L.C. | 825 903 | 3,61 | 64 074 | 3,81 | ||||

| 2025-07-29 | 13F | Swmg, Llc | 3 825 | −68,66 | 294 | −68,76 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 1 585 | −23,69 | 123 | −23,75 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 1 | 0 | ||||||

| 2025-07-15 | 13F | Patriot Investment Management Inc. | 27 393 | −0,47 | 2 125 | −0,28 | ||||

| 2025-08-01 | 13F | Ashton Thomas Private Wealth, LLC | 2 718 | 211 | ||||||

| 2025-07-15 | 13F | Verum Partners LLC | 245 018 | −4,13 | 19 009 | −3,95 | ||||

| 2025-07-30 | 13F | Cornerstone Advisory, LLC | 5 766 | 3,71 | 447 | 5,18 | ||||

| 2025-05-16 | 13F | American Trust | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-17 | 13F | Barry Investment Advisors, LLC | 73 231 | 37,77 | 5 681 | 38,06 | ||||

| 2025-08-13 | 13F | Strategic Family Wealth Counselors, L.L.C. | 63 121 | 9,84 | 4 897 | 10,05 | ||||

| 2025-07-18 | 13F | Lynx Investment Advisory | 19 557 | 7,47 | 1 517 | 7,74 | ||||

| 2025-07-15 | 13F | SJS Investment Consulting Inc. | 250 309 | 52,05 | 19 419 | 52,35 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 41 227 | 322,11 | 3 198 | 323,02 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 189 | 15 | ||||||

| 2025-07-25 | 13F | Quantum Financial Planning Services, Inc. | 342 796 | 363,98 | 26 594 | 364,93 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Keystone Financial Group, Inc. | 305 | −78,49 | 23 | −78,70 | ||||

| 2025-08-06 | 13F | Rialto Wealth Management, LLC | 3 427 | 0,00 | 266 | 0,00 | ||||

| 2025-08-13 | 13F | Greenwich Wealth Management LLC | 56 823 | −32,91 | 4 | −33,33 | ||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 5 299 | 411 | ||||||

| 2025-08-04 | 13F | Atria Investments Llc | 11 544 | −48,37 | 896 | −48,30 | ||||

| 2025-07-23 | 13F | Lansing Street Advisors | 90 738 | 10,29 | 7 039 | 10,50 | ||||

| 2025-08-13 | 13F | Keystone Financial Group | 6 809 | 528 | ||||||

| 2025-05-08 | 13F | Great Valley Advisor Group, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 51 801 | 3,96 | 4 019 | 4,15 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 21 272 | 64,06 | 1 651 | 64,44 | ||||

| 2025-08-04 | 13F | Elite Life Management LLC | 45 173 | 1,22 | 3 505 | 1,42 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 781 | 61 | ||||||

| 2025-07-09 | 13F | Breakwater Investment Management | 82 930 | 475,42 | 6 434 | 476,95 | ||||

| 2025-07-23 | 13F | Penney Financial, LLC | 73 828 | 5 728 | ||||||

| 2025-08-08 | 13F | AJ Advisors, LLC | 126 686 | 8,05 | 9 828 | 8,26 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 5 827 | 452 | ||||||

| 2025-07-14 | 13F | UMA Financial Services, Inc. | 2 483 | 0,00 | 193 | 0,00 | ||||

| 2025-08-11 | 13F | Diversified Portfolios, Inc. | 891 655 | 15,29 | 69 175 | 15,51 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 56 679 | 4 397 | ||||||

| 2025-07-08 | 13F | ShankerValleau Wealth Advisors, Inc. | 156 621 | 3,56 | 12 151 | 3,77 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 0 | −100,00 | 0 | |||||

| 2025-07-16 | 13F | Novem Group | 4 333 | 336 | ||||||

| 2025-08-12 | 13F | Change Path, LLC | 84 165 | 40,63 | 6 530 | 40,89 | ||||

| 2025-07-24 | 13F | Bernard Wealth Management Corp. | 12 | 0,00 | 1 | |||||

| 2025-08-06 | 13F | Nicholas Hoffman & Company, LLC. | 39 800 | 6,81 | 3 088 | 7,00 | ||||

| 2025-07-25 | 13F | LRI Investments, LLC | 2 614 | −2,35 | 203 | −2,42 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 3 318 | 257 | ||||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 2 861 | 222 | ||||||

| 2025-08-11 | 13F | Brown Brothers Harriman & Co | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Mariner, LLC | 352 465 | 284,19 | 27 344 | 284,96 | ||||

| 2025-08-20 | 13F/A | Coppell Advisory Solutions LLC | 24 061 | 31,12 | 1 861 | 30,80 | ||||

| 2025-07-17 | 13F | San Luis Wealth Advisors LLC | 211 195 | −51,44 | 16 | −51,52 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 4 555 932 | 29,24 | 353 449 | 29,49 | ||||

| 2025-08-07 | 13F | Tfo-tdc, Llc | 2 911 | 226 | ||||||

| 2025-08-19 | 13F | Asset Dedication, LLC | 720 | 56 | ||||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 960 085 | 7,38 | 74 483 | 7,59 | ||||

| 2025-07-28 | 13F | Cornerstone Wealth Group, LLC | 278 667 | 0,50 | 21 619 | 0,70 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 79 862 | 8,71 | 6 | 20,00 | ||||

| 2025-07-28 | 13F | Axxcess Wealth Management, Llc | 24 260 | −31,81 | 1 882 | −31,66 | ||||

| 2025-08-14 | 13F | Marshall Investment Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Momentous Wealth Management, Inc. | 327 879 | 8,62 | 25 437 | 8,83 | ||||

| 2025-07-24 | 13F | KC Investment Advisors, LLC | 88 855 | −50,11 | 6 893 | −50,01 | ||||

| 2025-07-25 | 13F | Envestnet Portfolio Solutions, Inc. | 48 562 | −10,55 | 3 767 | −10,37 | ||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 187 202 | 7,12 | 14 523 | 7,33 | ||||

| 2025-07-30 | 13F | Retirement Planning Group | 34 684 | −10,64 | 2 691 | −10,48 | ||||

| 2025-07-21 | 13F | Trellis Wealth Advisors LLC | 11 598 | 900 | ||||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 894 071 | 69 228 | ||||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | NorthLanding Financial Partners, LLC | 117 512 | 26,19 | 9 117 | 26,44 | ||||

| 2025-04-29 | 13F | Financial Network Wealth Management LLC | 70 424 | 5 | ||||||

| 2025-08-07 | 13F | Tilson Financial Group, Inc. | 431 491 | −0,45 | 33 | 0,00 | ||||

| 2025-08-11 | 13F | NewEdge Wealth, LLC | 288 067 | 22 340 | ||||||

| 2025-08-08 | 13F | CFO4Life Group, LLC | 157 305 | 9,55 | 12 204 | 9,76 | ||||

| 2025-08-13 | 13F | Continuum Advisory, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Invenio Wealth Partners Llc | 145 775 | 11 309 | ||||||

| 2025-07-15 | 13F | Hofer & Associates. Inc | 85 133 | 6 605 | ||||||

| 2025-04-29 | 13F | Proffitt & Goodson Inc | 0 | −100,00 | 0 | |||||

| 2025-07-28 | 13F | Keeler & Nadler Financial Planning & Wealth Management | 121 433 | 53,51 | 9 421 | 54,30 | ||||

| 2025-07-22 | 13F | Olistico Wealth, LLC | 2 005 | 18,36 | 156 | 18,32 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 120 292 | 676,68 | 9 332 | 694,89 | ||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 3 223 | 250 | ||||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 63 | 5 | ||||||

| 2025-07-18 | 13F | Truist Financial Corp | 102 022 | −2,80 | 7 915 | −2,62 | ||||

| 2025-08-08 | 13F | Crossmark Global Holdings, Inc. | 35 707 | 3,27 | 2 770 | 3,47 | ||||

| 2025-08-12 | 13F | Accredited Wealth Management, LLC | 1 480 | 0,00 | 115 | 0,00 | ||||

| 2025-07-10 | 13F | Compton Wealth Advisory Group, LLC | 99 301 | 31,33 | 7 704 | 31,59 | ||||

| 2025-08-13 | 13F | Victory Financial Group, Llc | 58 657 | −0,09 | 4 551 | 0,11 | ||||

| 2025-08-12 | 13F | Goepper Burkhardt LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | GeoWealth Management, LLC | 219 | 17 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 317 475 | 24 630 | ||||||

| 2025-07-02 | 13F | Dentgroup LLC | 3 536 | 274 | ||||||

| 2025-07-21 | 13F | Mendota Financial Group, LLC | 17 534 | 1 478,22 | 1 360 | 1 481,40 | ||||

| 2025-08-07 | 13F | Addison Advisors LLC | 890 | 69 | ||||||

| 2025-08-01 | 13F | Pasadena Private Wealth, LLC | 5 316 | 0,53 | 412 | 0,73 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 25 389 | −4,79 | 1 970 | −4,60 | ||||

| 2025-08-14 | 13F | TCG Advisory Services, LLC | 390 657 | 7,99 | 30 307 | 8,20 | ||||

| 2025-08-14 | 13F | Sentinus, LLC | 24 404 | −2,03 | 1 893 | −1,82 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 5 700 | 442 | ||||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 1 305 | 194,58 | 101 | 197,06 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 177 211 | 4,38 | 13 748 | 4,58 | ||||

| 2025-07-16 | 13F | Stephenson National Bank & Trust | 657 | 22,12 | 51 | 21,95 | ||||

| 2025-07-22 | 13F | Tandem Investment Partners LLC | 77 289 | 6,81 | 5 996 | 7,01 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 7 438 | 1 | ||||||

| 2025-07-29 | 13F | BKD Wealth Advisors, LLC | 828 445 | 70,87 | 64 271 | 71,20 | ||||

| 2025-07-29 | 13F | Chicago Partners Investment Group LLC | 107 504 | 970,33 | 8 276 | 974,81 | ||||

| 2025-08-12 | 13F | Ameritas Investment Partners, Inc. | 125 | 10 | ||||||

| 2025-07-15 | 13F | Garrett Investment Advisors LLC | 177 842 | −16,87 | 13 797 | −16,70 | ||||

| 2025-07-23 | 13F | L.K. Benson & Company, P.C. | 7 595 | 36,40 | 589 | 36,66 | ||||

| 2025-08-08 | 13F | TD Capital Management LLC | 7 629 | 198,82 | 592 | 200,00 | ||||

| 2025-07-23 | 13F | Ami Investment Management Inc | 173 405 | 13 453 | ||||||

| 2025-08-12 | 13F | LPL Financial LLC | 482 581 | 58,32 | 37 439 | 58,63 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 0 | −100,00 | 0 | |||||

| 2025-07-07 | 13F | Retirement Wealth Solutions LLC | 2 523 | 196 | ||||||

| 2025-07-29 | 13F | Signature Estate & Investment Advisors Llc | 6 257 | 485 | ||||||

| 2025-08-08 | 13F | Advyzon Investment Management, LLC | 6 685 | 519 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 0 | −100,00 | 0 | |||||

| 2025-07-07 | 13F | OMNI 360 Wealth, Inc. | 67 682 | 10,15 | 5 251 | 10,36 | ||||

| 2025-07-14 | 13F | Leonard Rickey Investment Advisors P.L.L.C. | 83 641 | 8,26 | 6 489 | 10,21 | ||||

| 2025-07-25 | 13F | Hazlett, Burt & Watson, Inc. | 337 | 0 | ||||||

| 2025-07-24 | 13F | Galvin, Gaustad & Stein, LLC | 48 054 | 165,20 | 3 728 | 165,72 | ||||

| 2025-07-30 | 13F | Bogart Wealth, LLC | 48 882 | 19,08 | 3 792 | 19,32 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 58 120 | 4 509 | ||||||

| 2025-08-01 | 13F | Zhang Financial LLC | 3 778 | 36,34 | 293 | 36,92 | ||||

| 2025-07-22 | 13F | Oak Hill Wealth Advisors, Llc | 16 328 | 1 252 | ||||||

| 2025-07-11 | 13F | Orrstown Financial Services Inc | 6 333 | 491 | ||||||

| 2025-08-12 | 13F | Up Strategic Wealth Investment Advisors Llc | 80 885 | 7,45 | 6 275 | 7,67 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 1 115 767 | 743,37 | 86 561 | 745,07 | ||||

| 2025-07-24 | 13F | Jfs Wealth Advisors, Llc | 1 044 | 81 | ||||||

| 2025-07-07 | 13F | Kings Path Partners LLC | 59 200 | 116,18 | 4 593 | 116,60 | ||||

| 2025-08-05 | 13F | Mission Wealth Management, Lp | 49 838 | 23,37 | 3 866 | 23,63 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 70 215 | 10,38 | 5 | 25,00 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 2 124 | 165 | ||||||

| 2025-07-31 | 13F | Topsail Wealth Management, LLC | 14 964 | 405,71 | 1 161 | 406,55 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 4 255 | −6,52 | 330 | −6,25 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 118 839 | 7,18 | 9 219 | 7,40 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 336 | −1,47 | 26 | 0,00 | ||||

| 2025-07-16 | 13F | Essex Financial Services, Inc. | 6 125 | 1,74 | 475 | 1,93 | ||||

| 2025-08-11 | 13F | Regal Investment Advisors LLC | 3 282 | 255 | ||||||

| 2025-08-04 | 13F | Savvy Advisors, Inc. | 23 265 | 1 805 | ||||||

| 2025-08-13 | 13F | Flow Traders U.s. Llc | 36 814 | 281,49 | 3 | |||||

| 2025-08-04 | 13F | Keybank National Association/oh | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 493 456 | 5,47 | 38 282 | 5,68 | ||||

| 2025-07-28 | 13F | Baker Boyer National Bank | 3 257 | 0,00 | 253 | 0,00 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 75 820 | 26,93 | 6 | 25,00 |