Grunnleggende statistikk

| Institusjonelle eiere | 5 total, 5 long only, 0 short only, 0 long/short - change of −6,49% MRQ |

| Gjennomsnittlig porteføljeallokering | 0.3584 % - change of −12,31% MRQ |

| Institusjonelle aksjer (Long) | 11 648 000 (ex 13D/G) - change of −5,09MM shares −30,41% MRQ |

| Institusjonell verdi (Long) | $ 11 527 USD ($1000) |

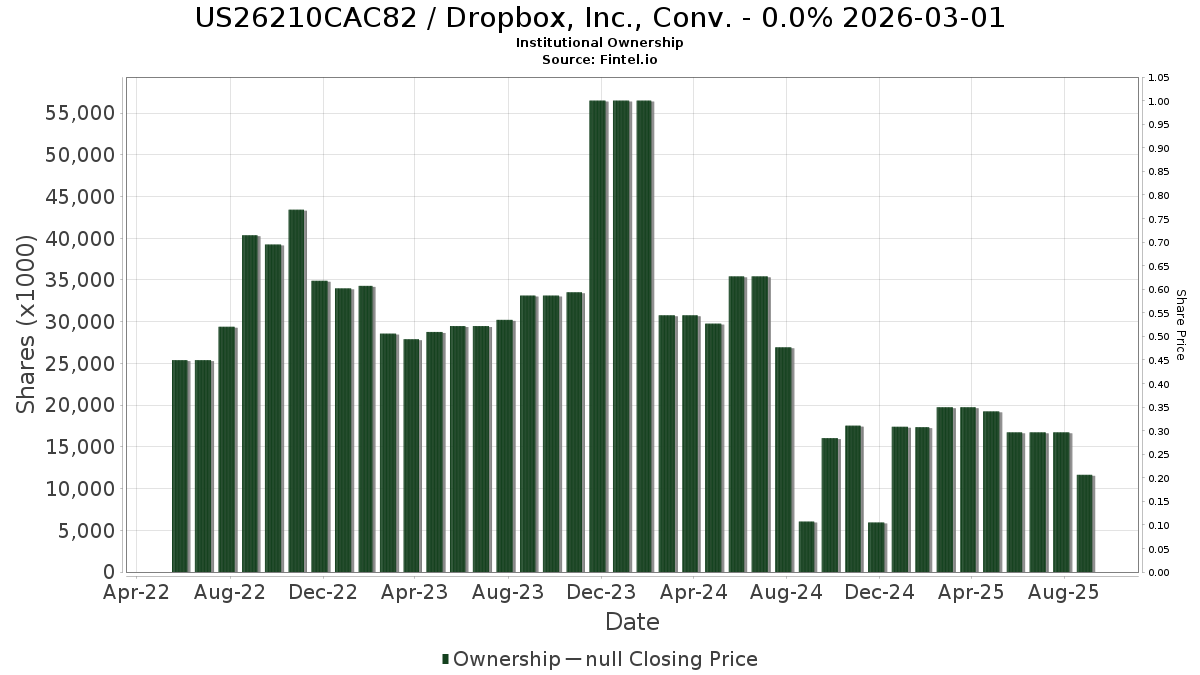

Institusjonelt eierskap og aksjonærer

Dropbox, Inc., Conv. (US:US26210CAC82) har 5 institusjonelle eiere og aksjonærer som har sendt inn 13D/G- eller 13F-skjemaer til Securities Exchange Commission (SEC). Disse institusjonene eier til sammen 11,648,000 aksjer. De største aksjonærene inkluderer Absolute Investment Advisers Llc, Bank of New York Mellon Corp, Oppenheimer Asset Management Inc., Stephens Inc /ar/, and Wiley Bros.-aintree Capital, Llc .

Dropbox, Inc., Conv. (US26210CAC82) institusjonell eierstruktur viser nåværende posisjoner i selskapet fordelt på institusjoner og fond, samt de siste endringene i posisjonsstørrelse. De største aksjonærene kan være individuelle investorer, verdipapirfond, hedgefond eller institusjoner. Schedule 13D indikerer at investoren eier (eller har eid) mer enn 5 % av selskapet og har til hensikt (eller hadde til hensikt) å aktivt forfølge en endring i forretningsstrategien. Schedule 13G indikerer en passiv investering på over 5 %.

13F- og NPORT-arkiveringer

Detaljer om 13F-arkiveringer er gratis. Detaljer om NP-arkiveringer krever et premium-medlemskap. Grønne rader indikerer nye posisjoner. Røde rader indikerer lukkede posisjoner. Klikk på lenke ikonet for å se hele transaksjonshistorikken.

Oppgrader

for å låse opp premiedata og eksportere til Excel. ![]() .

.