Grunnleggende statistikk

| Institusjonelle eiere | 230 total, 230 long only, 0 short only, 0 long/short - change of 11,65% MRQ |

| Gjennomsnittlig porteføljeallokering | 0.7133 % - change of −10,73% MRQ |

| Institusjonelle aksjer (Long) | 22 392 091 (ex 13D/G) - change of −1,60MM shares −6,69% MRQ |

| Institusjonell verdi (Long) | $ 1 458 227 USD ($1000) |

Institusjonelt eierskap og aksjonærer

iShares Trust - iShares U.S. Small-Cap Equity Factor ETF (US:SMLF) har 230 institusjonelle eiere og aksjonærer som har sendt inn 13D/G- eller 13F-skjemaer til Securities Exchange Commission (SEC). Disse institusjonene eier til sammen 22,392,091 aksjer. De største aksjonærene inkluderer Strategic Financial Services, Inc,, Wells Fargo & Company/mn, Ameriprise Financial Inc, LPL Financial LLC, Acropolis Investment Management, LLC, Financial Management Professionals, Inc., Ullmann Financial Group, Inc., BlackRock, Inc., Charles Schwab Investment Management Inc, and Clearwater Capital Advisors, LLC .

iShares Trust - iShares U.S. Small-Cap Equity Factor ETF (ARCA:SMLF) institusjonell eierstruktur viser nåværende posisjoner i selskapet fordelt på institusjoner og fond, samt de siste endringene i posisjonsstørrelse. De største aksjonærene kan være individuelle investorer, verdipapirfond, hedgefond eller institusjoner. Schedule 13D indikerer at investoren eier (eller har eid) mer enn 5 % av selskapet og har til hensikt (eller hadde til hensikt) å aktivt forfølge en endring i forretningsstrategien. Schedule 13G indikerer en passiv investering på over 5 %.

The share price as of September 12, 2025 is 74,32 / share. Previously, on September 13, 2024, the share price was 64,49 / share. This represents an increase of 15,24% over that period.

Fondssentiment-score

Fondssentiment Score (også kjent som akkumulering av eierskap poengsum) viser hvilke aksjer som er mest kjøpt av fond. Den er resultatet av en sofistikert, kvantitativ flerfaktormodell som identifiserer selskaper med de høyeste nivåene av institusjonell akkumulering. Beregningsmodellen for poeng bruker en kombinasjon av den totale økningen i antall offentliggjorte eiere, endringer i porteføljeallokeringen til disse eierne og andre beregninger. Tallet går fra 0 til 100, der høyere tall indikerer en høyere grad av akkumulering i forhold til sammenlignbare selskaper, der 50 er gjennomsnittet.

Oppdateringsfrekvens: Daglig

Sjekk ut Ownership Explorer, som inneholder en liste over de høyest rangerte selskapene.

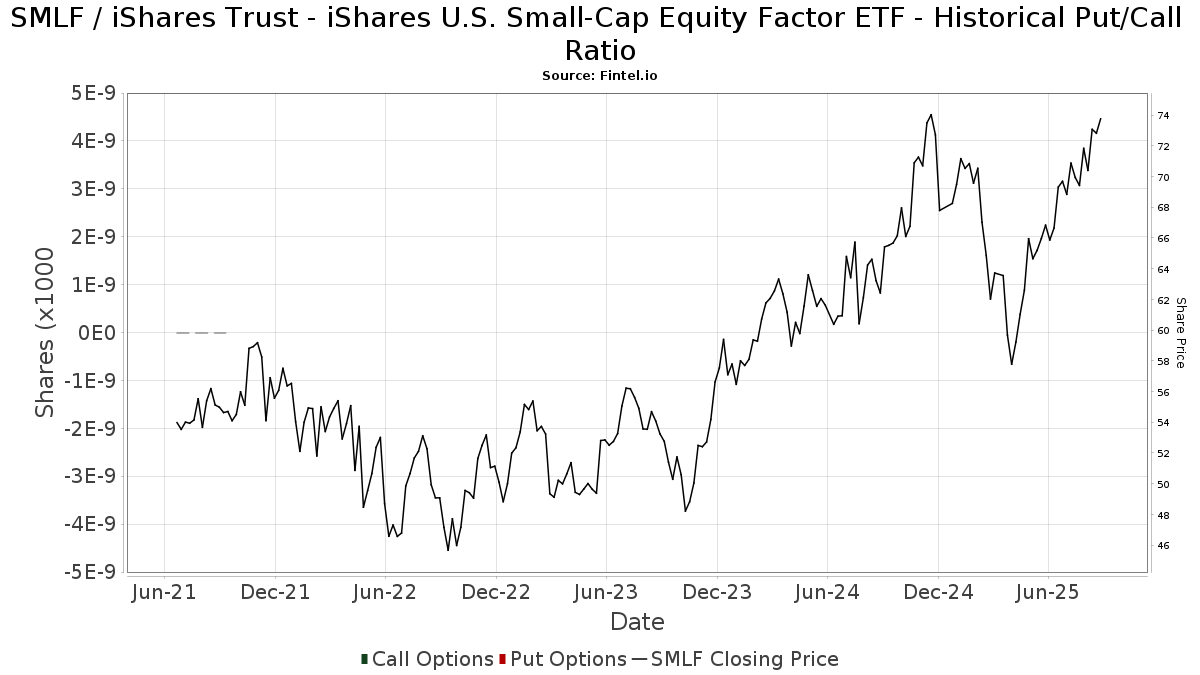

Institusjonell Put/Call-forhold

I tillegg til å rapportere standard aksje- og gjeldsemisjoner må institusjoner med mer enn 100 millioner kroner i forvaltningskapital også oppgi beholdningen av put- og callopsjoner. Siden put-opsjoner generelt indikerer et negativt sentiment, og call-opsjoner indikerer et positivt sentiment, kan vi få et inntrykk av det generelle institusjonelle sentimentet ved å plotte forholdet mellom put- og call-opsjoner. Diagrammet til høyre viser det historiske forholdet mellom put- og call-opsjoner for dette instrumentet.

Ved å bruke Put/Call-forholdet som en indikator på investorsentimentet kan man overvinne en av de viktigste svakhetene ved å bruke totalt institusjonelt eierskap, nemlig at en betydelig andel av forvaltningskapitalen investeres passivt for å følge indekser. Passivt forvaltede fond kjøper vanligvis ikke opsjoner, slik at indikatoren for put/call-forhold i større grad gjenspeiler stemningen i aktivt forvaltede fond.

13D/G-arkiveringer

Vi presenterer 13D/G-arkiveringene separat fra 13F-arkiveringene fordi de behandles forskjellig av SEC. 13D/G-arkiveringene kan sendes inn av grupper av investorer (med én leder), mens 13D/G-arkiveringene ikke kan sendes inn. Dette fører til situasjoner der en investor kan sende inn en 13D/G-rapport med én verdi for alle aksjene (som representerer alle aksjene som eies av investorgruppen), men deretter sende inn en 13F-melding med en annen verdi for alle aksjene (som kun representerer deres eget eierskap). Dette betyr at aksjeeierskap i 13D/G-arkiveringene og 13F-arkiveringene ofte ikke er direkte sammenlignbare, og vi presenterer dem derfor separat.

Merk: Fra og med 16. mai 2021 viser vi ikke lenger eiere som ikke har sendt inn en 13D/G i løpet av det siste året. Tidligere viste vi hele historikken for 13D/G-arkiveringer. Generelt må enheter som er pålagt å sende inn 13D/G-arkiveringer, sende inn minst én gang i året før de sender inn en avsluttende rapport. Det hender imidlertid at fond trekker seg ut av posisjoner uten å sende inn en avsluttende innlevering (dvs. at de avvikler), slik at visning av hele historikken av og til fører til forvirring om det nåværende eierskapet. For å unngå forvirring viser vi nå bare "nåværende" eiere, det vil si eiere som har sendt inn informasjon i løpet av det siste året.

Upgrade to unlock premium data.

13F- og NPORT-arkiveringer

Detaljer om 13F-arkiveringer er gratis. Detaljer om NP-arkiveringer krever et premium-medlemskap. Grønne rader indikerer nye posisjoner. Røde rader indikerer lukkede posisjoner. Klikk på lenke ikonet for å se hele transaksjonshistorikken.

Oppgrader

for å låse opp premiedata og eksportere til Excel. ![]() .

.

| Fildato | Kilde | Investor | Type | Gjennomsnittlig pris (estimert) |

Aksjer | Δ Aksjer (%) |

Rapportert verdi ($1000) | Verdi (%) | Portallokering (%) | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-04 | 13F | Assetmark, Inc | 95 | 6 | ||||||

| 2025-07-15 | 13F | Cora Capital Advisors Llc | 85 566 | −1,42 | 5 814 | 7,77 | ||||

| 2025-08-06 | 13F | Vantage Financial Partners, LLC | 12 187 | 11,41 | 828 | 21,94 | ||||

| 2025-08-12 | 13F/A | Cozad Asset Management Inc | 80 780 | 31,44 | 5 489 | 43,69 | ||||

| 2025-07-14 | 13F | Painted Porch Advisors LLC | 65 | 0,00 | 4 | 0,00 | ||||

| 2025-08-14 | 13F | Talisman Wealth Advisors LLC | 13 570 | 24,69 | 922 | 36,39 | ||||

| 2025-07-21 | 13F | Qrg Capital Management, Inc. | 7 453 | −8,34 | 506 | 0,20 | ||||

| 2025-08-08 | 13F | Good Life Advisors, LLC | 10 378 | −1,22 | 705 | 7,96 | ||||

| 2025-08-12 | 13F | Putnam Fl Investment Management Co | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 708 | 1 120,69 | 48 | 1 500,00 | ||||

| 2025-08-06 | 13F | Mascagni Wealth Management, Inc. | 4 312 | −68,34 | 293 | −65,37 | ||||

| 2025-08-11 | 13F | Vista Cima Wealth Management LLC | 59 304 | 3,23 | 4 030 | 12,86 | ||||

| 2025-07-21 | 13F | Synergy Financial Management, LLC | 3 456 | 235 | ||||||

| 2025-07-17 | 13F | Park Place Capital Corp | 8 852 | 607 | ||||||

| 2025-07-22 | 13F | Ergawealth Advisors, Inc. | 6 413 | −8,41 | 436 | 0,00 | ||||

| 2025-07-16 | 13F | Plancorp, LLC | 13 113 | −16,19 | 891 | −8,33 | ||||

| 2025-08-08 | 13F | Glassman Wealth Services | 485 | 0,00 | 33 | 6,67 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 236 009 | 29,27 | 16 037 | 41,31 | ||||

| 2025-08-07 | 13F | Addison Advisors LLC | 76 029 | −2,26 | 5 166 | 6,85 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 119 | 8 | ||||||

| 2025-07-08 | 13F | First International Bank & Trust | 180 244 | −6,02 | 12 248 | 2,73 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 2 982 | −11,91 | 203 | −3,81 | ||||

| 2025-07-18 | 13F | Bartlett & Co. Wealth Management Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Wharton Business Group, LLC | 22 125 | 0,00 | 2 | 0,00 | ||||

| 2025-08-13 | 13F | Dynamic Wealth Strategies, LLC | 20 402 | 9,24 | 1 386 | 19,48 | ||||

| 2025-04-22 | 13F | Veridan Wealth LLC | 3 726 | −16,98 | 232 | −25,72 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 24 | 1 | ||||||

| 2025-08-05 | 13F | Sigma Planning Corp | 6 587 | 5,99 | 448 | 15,80 | ||||

| 2025-08-26 | NP | Northern Lights Variable Trust - TOPS Aggressive Growth ETF Portfolio Class 2 shares | 102 893 | 5,51 | 6 992 | 15,32 | ||||

| 2025-05-09 | 13F | Ball & Co Wealth Management Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 161 473 | 33,89 | 10 976 | 46,35 | ||||

| 2025-07-08 | 13F | RMR Wealth Builders | 5 212 | 354 | ||||||

| 2025-08-14 | 13F | Diversify Advisory Services, LLC | 8 442 | 596 | ||||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 490 822 | 11,28 | 33 351 | 21,64 | ||||

| 2025-07-29 | 13F | Wingate Wealth Advisors, Inc. | 9 562 | −14,41 | 650 | −6,48 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 2 075 308 | 10,35 | 141 017 | 20,63 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 495 397 | 3,37 | 33 662 | 13,00 | ||||

| 2025-08-11 | 13F | United Capital Financial Advisers, Llc | 70 955 | −16,35 | 4 821 | −8,55 | ||||

| 2025-08-07 | 13F | Weil Company, Inc. | 48 409 | 125,14 | 3 289 | 146,18 | ||||

| 2025-08-11 | 13F | Westover Capital Advisors, LLC | 20 206 | −0,71 | 1 373 | 8,46 | ||||

| 2025-08-01 | 13F | Strategic Financial Services, Inc, | 3 744 652 | 3,82 | 254 449 | 13,49 | ||||

| 2025-08-07 | 13F | Guidance Capital, Inc | 12 103 | 8,44 | 826 | 17,66 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 76 | 5 | ||||||

| 2025-07-09 | 13F | Pallas Capital Advisors LLC | 25 756 | 1 750 | ||||||

| 2025-08-26 | NP | Northern Lights Variable Trust - TOPS Managed Risk Growth ETF Portfolio Class 1 shares | 42 482 | −5,94 | 2 887 | 2,81 | ||||

| 2025-07-10 | 13F | Exchange Traded Concepts, Llc | 198 569 | 11,73 | 13 493 | 22,14 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 0 | −100,00 | 0 | |||||

| 2025-08-26 | NP | Northern Lights Variable Trust - TOPS Growth ETF Portfolio Class 2 shares | 76 624 | 6,75 | 5 207 | 16,70 | ||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 148 598 | 3,04 | 10 097 | 12,64 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 15 280 | −8,61 | 1 038 | −0,10 | ||||

| 2025-04-29 | 13F | Financial Network Wealth Management LLC | 566 | 0 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 29 224 | −78,26 | 1 986 | −76,24 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 4 095 | −94,02 | 278 | −93,46 | ||||

| 2025-07-24 | 13F | Capital Advisors, Ltd. LLC | 9 000 | −2,48 | 1 | |||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 10 750 | 730 | ||||||

| 2025-07-17 | 13F | Western Financial Corp/CA | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | River Wealth Advisors LLC | 328 683 | 22 334 | ||||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 53 266 | −2,51 | 3 619 | 6,57 | ||||

| 2025-08-11 | 13F | Brown Brothers Harriman & Co | 3 564 | 0,00 | 242 | 9,50 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 36 346 | 2 470 | ||||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 37 | 2 | ||||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 5 862 | 0,00 | 398 | 9,34 | ||||

| 2025-08-08 | 13F | Hibernia Wealth Partners, LLC | 17 773 | 100,19 | 1 208 | 119,06 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 130 422 | 25,04 | 9 | 33,33 | ||||

| 2025-07-09 | 13F | Searcy Financial Services Inc /adv | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Landmark Wealth Management, Inc. | 12 118 | −53,73 | 823 | −49,42 | ||||

| 2025-08-08 | 13F | Citizens Financial Group Inc/ri | 10 571 | 718 | ||||||

| 2025-07-21 | 13F | Mendota Financial Group, LLC | 158 | 0,00 | 11 | 11,11 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 70 887 | 6,48 | 4 817 | 16,38 | ||||

| 2025-08-06 | 13F | Reston Wealth Management Llc | 260 590 | 2,79 | 17 707 | 12,37 | ||||

| 2025-08-08 | 13F | Kingsview Wealth Management, LLC | 13 175 | −10,57 | 895 | −2,19 | ||||

| 2025-07-14 | 13F | Abound Wealth Management | 0 | −100,00 | 0 | |||||

| 2025-04-22 | 13F | Jfs Wealth Advisors, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | XY Planning Network, Inc. | 4 333 | 294 | ||||||

| 2025-07-29 | 13F | BKM Wealth Management, LLC | 24 695 | −12,96 | 1 678 | −4,82 | ||||

| 2025-07-25 | 13F | Tranquility Partners, LLC | 3 924 | 0,00 | 267 | 9,47 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 193 569 | −6,95 | 13 153 | 1,72 | ||||

| 2025-07-23 | 13F | Valmark Advisers, Inc. | 371 206 | 1,54 | 25 223 | 10,99 | ||||

| 2025-07-31 | 13F | Optimum Investment Advisors | 250 | 0,00 | 17 | 6,67 | ||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 9 657 | 81,32 | 656 | 98,19 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 130 070 | 36,30 | 9 | 60,00 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 56 | 9,80 | 4 | 0,00 | ||||

| 2025-08-11 | 13F | Wealthspire Advisors, LLC | 7 099 | −0,39 | 482 | 9,05 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 738 | −9,67 | 50 | 2,04 | ||||

| 2025-08-14 | 13F | UBS Group AG | 195 096 | 0,80 | 13 257 | 10,19 | ||||

| 2025-07-22 | 13F | HFM Investment Advisors, LLC | 216 | 28,57 | 15 | 40,00 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 11 285 | 10,22 | 781 | 22,64 | ||||

| 2025-08-13 | 13F | KDK Private Wealth Management, LLC | 3 503 | 0,00 | 238 | 9,68 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 157 | 11 | ||||||

| 2025-07-24 | 13F | Edge Financial Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Bell Investment Advisors, Inc | 2 361 | 160 | ||||||

| 2025-08-12 | 13F | Founders Financial Alliance, LLC | 700 | 0,29 | 48 | 9,30 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 74 023 | −1,93 | 5 030 | 7,21 | ||||

| 2025-07-15 | 13F | Financial Management Professionals, Inc. | 520 851 | 3,96 | 35 392 | 13,64 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 323 208 | 15,95 | 22 | 23,53 | ||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 459 | 31 | ||||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 275 | 19 | ||||||

| 2025-05-06 | 13F | Venturi Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Colonial Trust Co / SC | 850 | −10,53 | 58 | −3,39 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 1 568 204 | 36,71 | 106 565 | 49,44 | ||||

| 2025-07-29 | 13F | Empirical Asset Management, LLC | 18 885 | 1,06 | 1 283 | 10,51 | ||||

| 2025-07-09 | 13F | Dynamic Advisor Solutions LLC | 3 031 | 206 | ||||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 23 297 | −4,85 | 1 583 | 4,08 | ||||

| 2025-08-11 | 13F | Independent Advisor Alliance | 5 228 | 0,00 | 355 | 9,57 | ||||

| 2025-08-06 | 13F | DDFG, Inc | 84 028 | 2,64 | 5 710 | 12,21 | ||||

| 2025-08-11 | 13F | Empowered Funds, LLC | 17 461 | 1 186 | ||||||

| 2025-08-13 | 13F | WCG Wealth Advisors LLC | 123 891 | 2,79 | 8 418 | 12,36 | ||||

| 2025-08-11 | 13F | Atlantic Private Wealth, LLC | 250 | 17 | ||||||

| 2025-08-26 | NP | Northern Lights Variable Trust - TOPS Moderate Growth ETF Portfolio Class 1 shares | 60 952 | 1,76 | 4 142 | 11,23 | ||||

| 2025-08-12 | 13F | Ascent Wealth Partners, LLC | 10 655 | 0,00 | 724 | 9,37 | ||||

| 2025-08-01 | 13F | Brookwood Investment Group LLC | 0 | −100,00 | 0 | |||||

| 2025-07-08 | 13F | Ptm Wealth Management, Llc | 163 062 | 11 385 | ||||||

| 2025-07-30 | 13F | Bogart Wealth, LLC | 1 001 | 0,00 | 68 | 9,68 | ||||

| 2025-07-14 | 13F | Golden State Equity Partners | 6 288 | 2,09 | 427 | 11,78 | ||||

| 2025-07-24 | 13F | Aurora Private Wealth, Inc. | 4 490 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | First Foundation Advisors | 6 021 | 0,00 | 409 | 9,36 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 41 402 | 23,23 | 2 813 | 34,72 | ||||

| 2025-07-17 | 13F | LifeGoal Wealth Advisors | 31 930 | 1,53 | 2 170 | 11,00 | ||||

| 2025-07-09 | 13F | Channel Wealth Llc | 4 404 | −24,07 | 299 | −16,94 | ||||

| 2025-07-16 | 13F | RWM Asset Management, LLC | 5 881 | 0,00 | 400 | 9,32 | ||||

| 2025-07-15 | 13F | Traction Financial Partners, LLC | 3 429 | 233 | ||||||

| 2025-08-05 | 13F | Integrity Financial Corp /WA | 176 | 23,94 | 12 | 37,50 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 151 512 | 10 | ||||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 5 034 | −2,39 | 342 | 6,88 | ||||

| 2025-07-16 | 13F | Novem Group | 45 366 | 3 083 | ||||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 4 157 | 0,19 | 282 | 9,73 | ||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 5 958 | 12,65 | 0 | |||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 29 | 2 | ||||||

| 2025-08-08 | 13F | Thoroughbred Financial Services, Llc | 35 254 | 3,88 | 2 | 0,00 | ||||

| 2025-07-24 | 13F | Blair William & Co/il | 1 044 | −83,26 | 71 | −81,91 | ||||

| 2025-07-29 | 13F | Foster & Motley Inc | 11 064 | −8,52 | 1 | |||||

| 2025-08-08 | 13F | WASHINGTON TRUST Co | 9 999 | 0,00 | 679 | 9,34 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 6 879 | 37,39 | 467 | 50,16 | ||||

| 2025-08-26 | 13F/A | Thrivent Financial For Lutherans | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 3 440 | 1,15 | 234 | 10,43 | ||||

| 2025-08-14 | 13F | Fmr Llc | 143 920 | −96,13 | 9 779 | −95,77 | ||||

| 2025-05-12 | 13F | Townsquare Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Maia Wealth LLC | 3 555 | 0,00 | 242 | 16,43 | ||||

| 2025-07-08 | 13F | Arlington Trust Co LLC | 378 | 0,00 | 26 | 8,70 | ||||

| 2025-08-14 | 13F | BancorpSouth Bank | 3 160 | 215 | ||||||

| 2025-08-07 | 13F | Fox Financial, Inc | 286 455 | 1,46 | 19 465 | 10,91 | ||||

| 2025-08-14 | 13F | Peapack Gladstone Financial Corp | 66 351 | 506,39 | 5 | |||||

| 2025-08-12 | 13F | Clearwater Capital Advisors, LLC | 466 151 | 1,74 | 31 675 | 11,21 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 148 603 | 133,65 | 10 098 | 155,43 | ||||

| 2025-08-06 | 13F/A | Flagship Private Wealth, LLC | 24 114 | 55,02 | 1 639 | 69,57 | ||||

| 2025-07-16 | 13F | Perigon Wealth Management, LLC | 28 800 | 14,80 | 1 957 | 25,47 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 32 421 | −17,90 | 2 203 | −10,23 | ||||

| 2025-07-29 | 13F | Signature Estate & Investment Advisors Llc | 7 396 | −74,71 | 503 | −72,37 | ||||

| 2025-07-25 | 13F | Apollon Financial, LLC | 53 175 | −5,82 | 3 613 | 2,96 | ||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 96 | −95,26 | 6 | −95,20 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Brown Advisory Inc | 16 792 | 0,00 | 1 141 | 9,40 | ||||

| 2025-08-20 | NP | NATIONWIDE VARIABLE INSURANCE TRUST - NVIT iShares Global Equity ETF Fund II | 28 042 | 0,33 | 1 905 | 9,67 | ||||

| 2025-08-26 | NP | Northern Lights Variable Trust - TOPS Managed Risk Moderate Growth ETF Portfolio Class 1 shares | 26 838 | −7,26 | 1 824 | 1,39 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 18 647 | −14,30 | 1 267 | −6,29 | ||||

| 2025-08-26 | NP | Northern Lights Variable Trust - TOPS Managed Risk Flex ETF Portfolio | 20 715 | −7,66 | 1 408 | 0,93 | ||||

| 2025-08-11 | 13F | Wescott Financial Advisory Group, LLC | 4 997 | −1,03 | 340 | 8,31 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 157 180 | 3,11 | 10 680 | 12,72 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 308 | 21 | ||||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 139 921 | −8,34 | 9 508 | 0,19 | ||||

| 2025-07-24 | 13F | Cyndeo Wealth Partners, LLC | 21 438 | 4,39 | 1 457 | 14,11 | ||||

| 2025-07-29 | 13F | Harbor Asset Planning, Inc. | 33 484 | 2 275 | ||||||

| 2025-07-17 | 13F | Wolff Wiese Magana Llc | 180 | 0,00 | 12 | 9,09 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 602 | −2,27 | 41 | 5,26 | ||||

| 2025-07-10 | 13F | Wedmont Private Capital | 21 170 | 0,00 | 1 475 | 21,10 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | MGB Wealth Management, LLC | 216 | 0,00 | 15 | 7,69 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 193 276 | 186,84 | 13 133 | 213,59 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 8 | 1 | ||||||

| 2025-08-11 | 13F | Citigroup Inc | 748 | 51 | ||||||

| 2025-08-14 | 13F | Vista Private Wealth Partners. LLC | 131 398 | 4,73 | 8 929 | 14,49 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 237 | 7,24 | 16 | 23,08 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 22 093 | −2,63 | 2 | 0,00 | ||||

| 2025-08-04 | 13F | Integrity Alliance, Llc. | 210 643 | −36,34 | 14 313 | −30,41 | ||||

| 2025-08-06 | 13F | Atlas Legacy Advisors, LLC | 11 760 | 20,26 | 799 | 26,42 | ||||

| 2025-08-11 | 13F | Cornerstone Planning Group LLC | 435 547 | 8,93 | 30 210 | 27,59 | ||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 249 612 | −2,62 | 16 961 | 6,45 | ||||

| 2025-08-14 | 13F | LWM Advisory Services, LLC | 19 836 | 10,92 | 1 348 | 21,24 | ||||

| 2025-08-13 | 13F | Colonial Trust Advisors | 3 258 | −2,25 | 221 | 6,76 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 50 | 3 | ||||||

| 2025-08-04 | 13F | Premier Path Wealth Partners, LLC | 37 134 | 1,95 | 2 523 | 11,44 | ||||

| 2025-07-11 | 13F | Diversified Trust Co | 5 270 | 0,00 | 358 | 9,48 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 71 | 0,00 | 5 | 0,00 | ||||

| 2025-08-13 | 13F | Sepio Capital, LP | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 15 215 | 325,12 | 1 034 | 365,32 | ||||

| 2025-07-09 | 13F | GEM Asset Management, LLC | 68 947 | 2,95 | 4 763 | 13,87 | ||||

| 2025-07-30 | 13F | Journey Advisory Group, LLC | 85 110 | −19,93 | 5 783 | −12,47 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 12 949 | 53,37 | 1 | |||||

| 2025-04-28 | 13F | Redmont Wealth Advisors Llc | 50 | 3 | ||||||

| 2025-07-21 | 13F | Barrett & Company, Inc. | 72 | 0,00 | 5 | 0,00 | ||||

| 2025-08-14 | 13F | Financial Advisory Service, Inc. | 0 | −100,00 | 0 | |||||

| 2025-05-09 | 13F | Wade Financial Advisory, Inc | 57 191 | −1,99 | 3 555 | −9,75 | ||||

| 2025-05-14 | 13F | Bnp Paribas Arbitrage, Sa | 0 | −100,00 | 0 | |||||

| 2025-08-26 | NP | Northern Lights Variable Trust - TOPS Balanced ETF Portfolio Class 1 shares | 19 979 | −0,74 | 1 358 | 8,47 | ||||

| 2025-08-04 | 13F | Arkadios Wealth Advisors | 3 183 | 216 | ||||||

| 2025-07-25 | 13F | Concord Wealth Partners | 122 | −72,27 | 8 | −70,37 | ||||

| 2025-07-31 | 13F | Leavell Investment Management, Inc. | 4 080 | 277 | ||||||

| 2025-08-08 | 13F | Creative Planning | 6 968 | 473 | ||||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 9 817 | 38,62 | 667 | 50,90 | ||||

| 2025-05-14 | 13F | Flow Traders U.s. Llc | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Aspen Wealth Strategies, LLC | 66 871 | 2,56 | 4 544 | 12,12 | ||||

| 2025-08-13 | 13F | Millstone Evans Group, LLC | 212 | 0,00 | 14 | 7,69 | ||||

| 2025-04-29 | 13F | Brookstone Capital Management | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Pensionmark Financial Group, Llc | 3 337 | 227 | ||||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 6 668 | 0,08 | 453 | 9,42 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 123 249 | −28,85 | 8 375 | −22,23 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 26 576 | −2,41 | 1 856 | 9,63 | ||||

| 2025-08-11 | 13F | GKV Capital Management Co., Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-26 | NP | Northern Lights Variable Trust - TOPS Managed Risk Balanced ETF Portfolio Class 2 shares | 7 758 | −5,21 | 527 | 3,74 | ||||

| 2025-08-05 | 13F | Cherry Tree Wealth Management, LLC | 201 | 14 | ||||||

| 2025-08-14 | 13F | Modern Wealth Management, LLC | 64 758 | 18,93 | 4 400 | 30,02 | ||||

| 2025-07-24 | 13F | Costello Asset Management, INC | 40 | 0,00 | 3 | 0,00 | ||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 1 508 | 100,27 | 102 | 121,74 | ||||

| 2025-08-18 | 13F | Pacific Center for Financial Services | 399 104 | −1,07 | 27 119 | 8,14 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 1 321 | 11,29 | 90 | 21,92 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 963 855 | 52,78 | 65 494 | 67,01 | ||||

| 2025-07-25 | 13F | RHS Financial, LLC | 6 238 | 424 | ||||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 25 508 | 11 494,55 | 1 733 | 12 278,57 | ||||

| 2025-07-30 | 13F | Phillips Financial Management, Llc | 42 268 | −28,95 | 2 872 | −22,32 | ||||

| 2025-08-13 | 13F | Texas Capital Bank Wealth Management Services Inc | 3 796 | 258 | ||||||

| 2025-08-13 | 13F | GeoWealth Management, LLC | 83 594 | 10,43 | 5 680 | 20,72 | ||||

| 2025-07-31 | 13F | Ground Swell Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-01 | 13F | Marks Group Wealth Management, Inc | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 316 568 | 35,67 | 21 511 | 48,30 | ||||

| 2025-08-11 | 13F | Anfield Capital Management, LLC | 97 280 | 0,84 | 6 610 | 10,24 | ||||

| 2025-08-14 | 13F | Colony Group, LLC | 287 017 | 4,69 | 19 503 | 14,43 | ||||

| 2025-08-15 | 13F | Morse Asset Management, Inc | 557 | −2,11 | 38 | 5,71 | ||||

| 2025-07-16 | 13F | Signature Resources Capital Management, LLC | 548 | 0,00 | 37 | 8,82 | ||||

| 2025-08-26 | NP | Northern Lights Variable Trust - TOPS Conservative ETF Portfolio Class 1 shares | 6 354 | −0,25 | 432 | 9,11 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 17 338 | 20,70 | 1 178 | 32,06 | ||||

| 2025-08-04 | 13F | Beirne Wealth Consulting Services, LLC | 62 113 | 5,53 | 4 222 | 15,39 | ||||

| 2025-08-12 | 13F | AlphaCore Capital LLC | 48 | 0,00 | 3 | 50,00 | ||||

| 2025-07-30 | 13F | Avidian Wealth Solutions, LLC | 6 443 | −0,23 | 438 | 8,98 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 36 274 | 0,28 | 2 465 | 9,61 | ||||

| 2025-05-09 | 13F | NewEdge Wealth, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Family Office Research LLC | 201 512 | 3,90 | 13 693 | 13,58 | ||||

| 2025-08-14 | 13F | Redwood Financial Network Corp | 6 229 | 6,72 | 423 | 16,85 | ||||

| 2025-07-15 | 13F | FMA Wealth Management, LLC | 75 877 | 1,00 | 5 156 | 3,00 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 463 250 | 65,43 | 31 478 | 80,84 | ||||

| 2025-05-13 | 13F | Northern Trust Corp | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Gwn Securities Inc. | 3 349 | 3,56 | 228 | 13,43 | ||||

| 2025-07-11 | 13F | Ullmann Financial Group, Inc. | 510 064 | −9,16 | 34 659 | −0,70 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 54 398 | 8,44 | 3 696 | 18,54 | ||||

| 2025-07-14 | 13F | S.A. Mason LLC | 1 465 | 0,00 | 100 | 8,79 | ||||

| 2025-07-14 | 13F | Acropolis Investment Management, LLC | 870 884 | 4,00 | 59 177 | 13,69 | ||||

| 2025-08-11 | 13F | Strategic Wealth Partners, Ltd. | 426 | 29 | ||||||

| 2025-08-01 | 13F | SYM FINANCIAL Corp | 1 231 | 0,00 | 84 | 9,21 | ||||

| 2025-06-26 | NP | FGSM - Frontier Asset Global Small Cap Equity ETF | 166 231 | 7,86 | 10 145 | −6,55 | ||||

| 2025-06-26 | NP | FARX - Frontier Asset Absolute Return ETF | 6 776 | −6,38 | 414 | −18,86 | ||||

| 2025-08-12 | 13F | Howe & Rusling Inc | 185 | 0,00 | 13 | 9,09 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Rsm Us Wealth Management Llc | 5 081 | −33,26 | 345 | −27,06 | ||||

| 2025-08-07 | 13F | Montag A & Associates Inc | 29 500 | 0,00 | 2 005 | 9,33 | ||||

| 2025-08-14 | 13F | Comerica Bank | 4 364 | 85,78 | 297 | 102,74 | ||||

| 2025-08-01 | 13F | Schmidt P J Investment Management Inc | 25 258 | 7,89 | 1 716 | 17,94 | ||||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 1 707 | 116 |