Grunnleggende statistikk

| Institusjonelle eiere | 218 total, 217 long only, 0 short only, 1 long/short - change of 14,74% MRQ |

| Gjennomsnittlig porteføljeallokering | 0.0718 % - change of −5,57% MRQ |

| Institusjonelle aksjer (Long) | 18 966 222 (ex 13D/G) - change of 1,00MM shares 5,54% MRQ |

| Institusjonell verdi (Long) | $ 844 166 USD ($1000) |

Institusjonelt eierskap og aksjonærer

Chunghwa Telecom Co., Ltd. - Depositary Receipt (Common Stock) (US:CHT) har 218 institusjonelle eiere og aksjonærer som har sendt inn 13D/G- eller 13F-skjemaer til Securities Exchange Commission (SEC). Disse institusjonene eier til sammen 18,966,222 aksjer. De største aksjonærene inkluderer Renaissance Technologies Llc, BlackRock, Inc., Vanguard Group Inc, Morgan Stanley, Connor, Clark & Lunn Investment Management Ltd., VEIEX - Vanguard Emerging Markets Stock Index Fund Investor Shares, Northern Trust Corp, Schroder Investment Management Group, Td Asset Management Inc, and Acadian Asset Management Llc .

Chunghwa Telecom Co., Ltd. - Depositary Receipt (Common Stock) (NYSE:CHT) institusjonell eierstruktur viser nåværende posisjoner i selskapet fordelt på institusjoner og fond, samt de siste endringene i posisjonsstørrelse. De største aksjonærene kan være individuelle investorer, verdipapirfond, hedgefond eller institusjoner. Schedule 13D indikerer at investoren eier (eller har eid) mer enn 5 % av selskapet og har til hensikt (eller hadde til hensikt) å aktivt forfølge en endring i forretningsstrategien. Schedule 13G indikerer en passiv investering på over 5 %.

The share price as of September 11, 2025 is 44,98 / share. Previously, on September 12, 2024, the share price was 39,01 / share. This represents an increase of 15,30% over that period.

Fondssentiment-score

Fondssentiment Score (også kjent som akkumulering av eierskap poengsum) viser hvilke aksjer som er mest kjøpt av fond. Den er resultatet av en sofistikert, kvantitativ flerfaktormodell som identifiserer selskaper med de høyeste nivåene av institusjonell akkumulering. Beregningsmodellen for poeng bruker en kombinasjon av den totale økningen i antall offentliggjorte eiere, endringer i porteføljeallokeringen til disse eierne og andre beregninger. Tallet går fra 0 til 100, der høyere tall indikerer en høyere grad av akkumulering i forhold til sammenlignbare selskaper, der 50 er gjennomsnittet.

Oppdateringsfrekvens: Daglig

Sjekk ut Ownership Explorer, som inneholder en liste over de høyest rangerte selskapene.

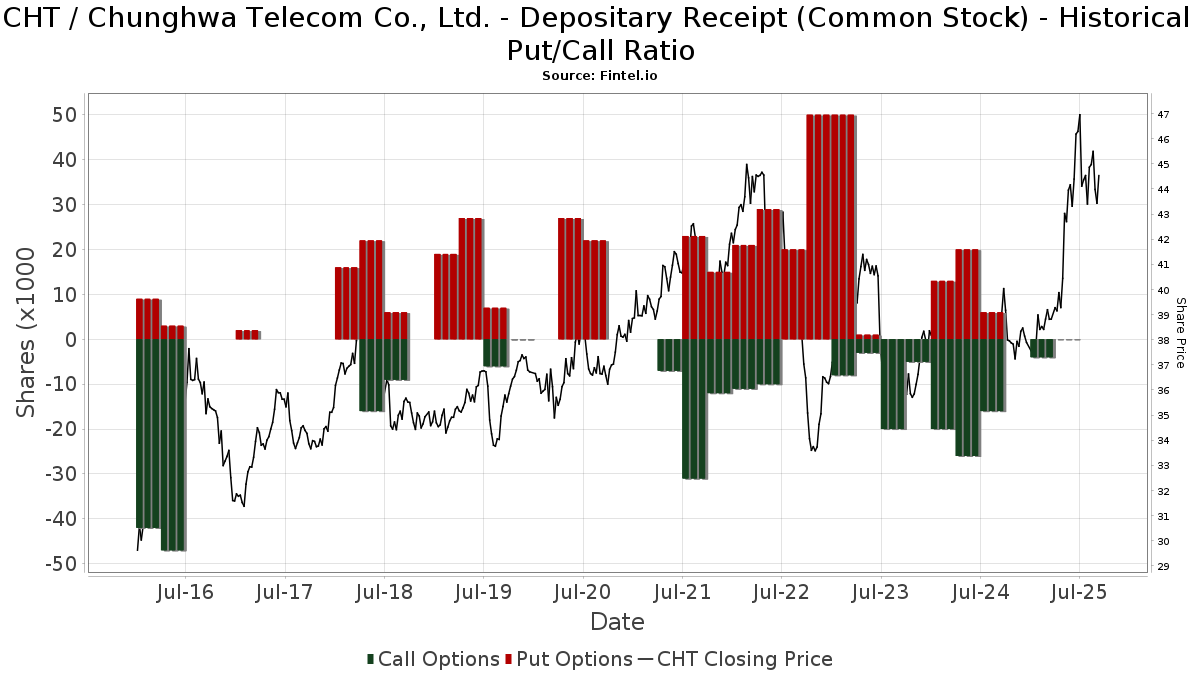

Institusjonell Put/Call-forhold

I tillegg til å rapportere standard aksje- og gjeldsemisjoner må institusjoner med mer enn 100 millioner kroner i forvaltningskapital også oppgi beholdningen av put- og callopsjoner. Siden put-opsjoner generelt indikerer et negativt sentiment, og call-opsjoner indikerer et positivt sentiment, kan vi få et inntrykk av det generelle institusjonelle sentimentet ved å plotte forholdet mellom put- og call-opsjoner. Diagrammet til høyre viser det historiske forholdet mellom put- og call-opsjoner for dette instrumentet.

Ved å bruke Put/Call-forholdet som en indikator på investorsentimentet kan man overvinne en av de viktigste svakhetene ved å bruke totalt institusjonelt eierskap, nemlig at en betydelig andel av forvaltningskapitalen investeres passivt for å følge indekser. Passivt forvaltede fond kjøper vanligvis ikke opsjoner, slik at indikatoren for put/call-forhold i større grad gjenspeiler stemningen i aktivt forvaltede fond.

13F- og NPORT-arkiveringer

Detaljer om 13F-arkiveringer er gratis. Detaljer om NP-arkiveringer krever et premium-medlemskap. Grønne rader indikerer nye posisjoner. Røde rader indikerer lukkede posisjoner. Klikk på lenke ikonet for å se hele transaksjonshistorikken.

Oppgrader

for å låse opp premiedata og eksportere til Excel. ![]() .

.

| Fildato | Kilde | Investor | Type | Gjennomsnittlig pris (estimert) |

Aksjer | Δ Aksjer (%) |

Rapportert verdi ($1000) | Verdi (%) | Portallokering (%) | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-29 | 13F | Private Trust Co Na | 25 | −68,35 | 1 | −66,67 | ||||

| 2025-06-30 | NP | VEU - Vanguard FTSE All-World ex-US Index Fund ETF Shares | 381 442 | 0,00 | 15 426 | 4,12 | ||||

| 2025-06-23 | NP | UUPIX - Ultraemerging Markets Profund Investor Class | 1 590 | 10,88 | 64 | 16,36 | ||||

| 2025-07-25 | 13F | Yousif Capital Management, Llc | 12 229 | 3,08 | 570 | 22,37 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - World ex U.S. Core Equity Portfolio Institutional Class Shares | 3 400 | 0,00 | 137 | 3,79 | ||||

| 2025-08-26 | NP | Profunds - Profund Vp Emerging Markets | 6 484 | 9,27 | 302 | 30,17 | ||||

| 2025-07-29 | 13F | Hoese & Co LLP | 250 | 12 | ||||||

| 2025-07-28 | NP | AVXC - Avantis Emerging Markets ex-China Equity ETF | 5 393 | 4,17 | 234 | 16,42 | ||||

| 2025-08-12 | 13F | Rhumbline Advisers | 230 188 | −12,93 | 10 729 | 3,50 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-06-26 | NP | DFAE - Dimensional Emerging Core Equity Market ETF | 88 000 | 6,02 | 3 559 | 10,39 | ||||

| 2025-06-26 | NP | TWAAX - Thrivent International Allocation Fund Class A | 1 302 | −40,60 | 53 | −38,82 | ||||

| 2025-08-05 | 13F | Key FInancial Inc | 227 | 0,00 | 11 | 25,00 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 163 | −3,55 | 8 | 16,67 | ||||

| 2025-05-13 | 13F | Mondrian Investment Partners LTD | 201 153 | −15,00 | 7 887 | −14,19 | ||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 7 767 | 0,26 | 362 | 19,47 | ||||

| 2025-08-08 | 13F | Creative Planning | 317 369 | 18,02 | 14 793 | 40,29 | ||||

| 2025-04-11 | 13F | First Affirmative Financial Network | 32 108 | 3,06 | 1 259 | 7,25 | ||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 840 | 1 083,10 | 0 | |||||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 44 077 | 47,31 | 2 054 | 75,11 | ||||

| 2025-07-30 | 13F | Whittier Trust Co | 334 | 70,41 | 16 | 114,29 | ||||

| 2025-08-01 | 13F | Bessemer Group Inc | 11 515 | 0,88 | 1 | |||||

| 2025-08-07 | 13F | Profund Advisors Llc | 8 898 | 16,18 | 415 | 38,00 | ||||

| 2025-08-14 | 13F | Syon Capital Llc | 4 906 | 229 | ||||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 22 371 | −2,68 | 1 043 | 15,65 | ||||

| 2025-08-13 | 13F | West Family Investments, Inc. | 47 872 | −0,29 | 2 231 | 18,54 | ||||

| 2025-07-18 | 13F | Robeco Institutional Asset Management B.V. | 136 807 | 0,00 | 6 377 | 18,87 | ||||

| 2025-06-26 | NP | DFEM - Dimensional Emerging Markets Core Equity 2 ETF | 38 188 | 0,00 | 1 544 | 4,11 | ||||

| 2025-08-11 | 13F | Morling Financial Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Jfs Wealth Advisors, Llc | 267 | −30,65 | 12 | −20,00 | ||||

| 2025-07-30 | 13F | Whittier Trust Co Of Nevada Inc | 5 883 | −18,10 | 274 | −2,49 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 210 | 388,37 | 10 | 800,00 | ||||

| 2025-07-29 | NP | RBB FUND, INC. - Aquarius International Fund | 4 171 | 0,00 | 181 | 11,73 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 9 530 | 85,19 | 444 | 120,90 | ||||

| 2025-05-08 | 13F | Waldron Private Wealth LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 347 | 16 | ||||||

| 2025-08-13 | 13F | Kayne Anderson Rudnick Investment Management Llc | 14 562 | 0,17 | 679 | 19,16 | ||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 56 012 | 21,54 | 2 611 | 44,44 | ||||

| 2025-08-29 | NP | MPLAX - Praxis International Index Fund Class A | 139 043 | −7,55 | 6 481 | 9,89 | ||||

| 2025-08-07 | 13F | Sierra Ocean, Llc | 1 132 | 4,62 | 53 | 23,81 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-08-08 | 13F | D'Orazio & Associates, Inc. | 6 720 | 11,85 | 313 | 33,19 | ||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 43 898 | −0,49 | 2 046 | 18,33 | ||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 1 133 | 53 | ||||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 18 656 | 15,19 | 870 | 36,85 | ||||

| 2025-06-26 | NP | Thrivent Core Funds - Thrivent Core Emerging Markets Equity Fund | 9 576 | −29,76 | 387 | −26,84 | ||||

| 2025-08-11 | 13F | Bell Investment Advisors, Inc | 455 | −20,87 | 21 | −4,55 | ||||

| 2025-07-25 | 13F | JustInvest LLC | 118 456 | 17,76 | 5 521 | 39,98 | ||||

| 2025-08-14 | 13F | Glenmede Investment Management, LP | 4 516 | 210 | ||||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 11 615 | 5,74 | 1 | |||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 144 | 29,73 | 7 | 50,00 | ||||

| 2025-08-11 | 13F | Vanguard Group Inc | 2 115 089 | −0,46 | 98 584 | 18,32 | ||||

| 2025-06-27 | NP | HAOSX - Harbor Overseas Fund Institutional Class | 8 076 | 327 | ||||||

| 2025-06-26 | NP | DAADX - Emerging Markets ex China Core Equity Portfolio Institutional Class | 18 891 | 0,00 | 764 | 4,09 | ||||

| 2025-08-12 | 13F | Dimensional Fund Advisors Lp | 452 982 | 4,04 | 21 124 | 23,72 | ||||

| 2025-07-16 | 13F | Kathmere Capital Management, LLC | 43 304 | 7,98 | 2 018 | 28,37 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 296 | 957,14 | 14 | 1 200,00 | ||||

| 2025-06-26 | NP | DFAX - Dimensional World ex U.S. Core Equity 2 ETF | 7 515 | 0,00 | 304 | 4,12 | ||||

| 2025-07-25 | 13F | Hazlett, Burt & Watson, Inc. | 250 | 0,00 | 0 | |||||

| 2025-07-28 | NP | AVEEX - Avantis Emerging Markets Equity Fund Institutional Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 25 406 | 0,00 | 1 105 | 11,85 | ||||

| 2025-05-15 | 13F | Aquatic Capital Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | GeoWealth Management, LLC | 1 925 | −0,10 | 90 | 18,67 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 256 261 | 33,33 | 11 944 | 58,49 | ||||

| 2025-08-14 | 13F | Modern Wealth Management, LLC | 5 016 | −23,38 | 234 | −8,98 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 540 | −99,18 | 25 | −99,04 | ||||

| 2025-08-14 | 13F | Evergreen Capital Management Llc | 14 577 | 679 | ||||||

| 2025-06-26 | NP | SNTKX - Steward International Enhanced Index Fund Class A | 44 597 | 0,00 | 1 804 | 4,10 | ||||

| 2025-08-11 | 13F | United Capital Financial Advisers, Llc | 7 740 | −9,63 | 361 | 7,46 | ||||

| 2025-07-31 | 13F | R Squared Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Texas Yale Capital Corp. | 9 000 | 0,00 | 419 | 19,03 | ||||

| 2025-07-15 | 13F | Ballentine Partners, LLC | 41 561 | 9,80 | 1 937 | 30,53 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 100 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 56 | 0 | ||||||

| 2025-05-01 | 13F | Bleakley Financial Group, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-30 | 13F | Drive Wealth Management, Llc | 8 634 | 402 | ||||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 7 338 | −25,46 | 342 | −11,17 | ||||

| 2025-08-14 | 13F | Atomi Financial Group, Inc. | 9 551 | 16,18 | 445 | 38,20 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - Emerging Markets Social Core Equity Portfolio Shares | 12 202 | 0,00 | 493 | 4,23 | ||||

| 2025-08-14 | 13F | Xponance, Inc. | 5 899 | 13,16 | 275 | 34,31 | ||||

| 2025-06-30 | NP | VT - Vanguard Total World Stock Index Fund ETF Shares | 81 784 | 0,00 | 3 307 | 4,12 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 109 845 | 43,69 | 5 120 | 70,80 | ||||

| 2025-06-30 | NP | VEIEX - Vanguard Emerging Markets Stock Index Fund Investor Shares | 1 176 664 | −6,03 | 47 584 | −2,15 | ||||

| 2025-08-12 | 13F | American Century Companies Inc | 329 461 | 17,59 | 15 356 | 39,78 | ||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 43 040 | 3,59 | 2 006 | 23,14 | ||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 729 | 34 | ||||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | −100,00 | 0 | |||||

| 2025-07-14 | 13F | Foster Group, Inc. | 11 443 | −9,85 | 533 | 7,24 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 2 910 | −2,94 | 0 | |||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 144 | 0,00 | 7 | 20,00 | ||||

| 2025-06-26 | NP | DEXC - Dimensional Emerging Markets ex China Core Equity ETF | 5 900 | 20,41 | 239 | 25,26 | ||||

| 2025-05-01 | 13F | Schechter Investment Advisors, LLC | 9 081 | −31,38 | 356 | −28,51 | ||||

| 2025-05-13 | 13F | Thrivent Financial For Lutherans | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Glenmede Trust Co Na | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 172 | 8 | ||||||

| 2025-08-11 | 13F | Brown Brothers Harriman & Co | 306 | 14 | ||||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 1 253 331 | 12,23 | 58 418 | 33,41 | ||||

| 2025-08-06 | 13F | Savant Capital, LLC | 29 691 | 1 384 | ||||||

| 2025-08-14 | 13F | Millennium Management Llc | 6 570 | 306 | ||||||

| 2025-05-14 | 13F | Van Hulzen Asset Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 310 705 | 9,59 | 14 482 | 30,26 | ||||

| 2025-08-25 | 13F | Fulcrum Equity Management | 5 374 | 250 | ||||||

| 2025-08-04 | 13F | Capital Performance Advisors Llp | 6 558 | 306 | ||||||

| 2025-08-12 | 13F | XTX Topco Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 1 308 | −37,95 | 61 | −26,51 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 103 | 0,00 | 5 | 0,00 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 4 591 | 1 006,27 | 214 | 1 231,25 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-07-09 | 13F | Aaron Wealth Advisors LLC | 5 564 | 259 | ||||||

| 2025-08-13 | 13F | Schroder Investment Management Group | 675 278 | 2,70 | 31 475 | 21,89 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-06-26 | NP | Dfa Investment Trust Co - The Emerging Markets Series This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 111 161 | 0,00 | 4 495 | 4,12 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-15 | 13F | WealthCollab, LLC | 291 | 0,00 | 14 | 18,18 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-14 | 13F | Abound Wealth Management | 32 | −13,51 | 1 | 0,00 | ||||

| 2025-07-23 | 13F | High Note Wealth, LLC | 5 | 0,00 | 0 | |||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Driehaus Capital Management Llc | 36 471 | 0,00 | 1 700 | 18,81 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 246 | 11 | ||||||

| 2025-08-14 | 13F | Ieq Capital, Llc | 28 423 | 338,90 | 1 325 | 423,32 | ||||

| 2025-07-08 | 13F | Gallacher Capital Management LLC | 9 283 | −7,34 | 433 | 10,20 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 531 | 25 | ||||||

| 2025-07-18 | 13F | Deltec Asset Management Llc | 10 398 | 0,00 | 485 | 18,92 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-27 | NP | THRIVENT SERIES FUND INC - Thrivent International Allocation Portfolio Class A | 5 226 | 116,94 | 244 | 158,51 | ||||

| 2025-07-16 | 13F | Highline Wealth Partners Llc | 158 | 20,61 | 7 | 40,00 | ||||

| 2025-08-06 | 13F | True Wealth Design, LLC | 49 | −41,67 | 2 | −33,33 | ||||

| 2025-08-14 | 13F | Riggs Asset Managment Co. Inc. | 93 | 4 | ||||||

| 2025-08-12 | 13F | Putnam Fl Investment Management Co | 7 477 | 349 | ||||||

| 2025-08-07 | 13F | Vise Technologies, Inc. | 5 500 | 256 | ||||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 522 | −11,97 | 24 | 4,35 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 352 | 5,39 | 16 | 33,33 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 0 | −100,00 | 0 | ||||

| 2025-08-14 | 13F | DZ BANK AG Deutsche Zentral Genossenschafts Bank, Frankfurt am Main | 145 000 | 0,00 | 6 758 | 18,87 | ||||

| 2025-05-15 | 13F | CAPROCK Group, Inc. | 11 305 | −1,96 | 443 | 2,07 | ||||

| 2025-08-12 | 13F | Legal & General Group Plc | 1 240 | 0,00 | 58 | 18,75 | ||||

| 2025-08-05 | 13F | Westside Investment Management, Inc. | 719 | 34 | ||||||

| 2025-07-14 | 13F | UMA Financial Services, Inc. | 568 | 11,59 | 26 | 36,84 | ||||

| 2025-07-29 | NP | SGLIX - SGI Global Equity Fund Class I Shares | 5 391 | −62,95 | 234 | −57,76 | ||||

| 2025-07-16 | 13F | Augustine Asset Management Inc | 17 696 | 0,00 | 825 | 18,90 | ||||

| 2025-08-14 | 13F | Wellington Management Group Llp | 39 488 | 1 841 | ||||||

| 2025-07-28 | NP | AVEM - Avantis Emerging Markets Equity ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 290 559 | 21,06 | 12 634 | 35,39 | ||||

| 2025-08-14 | 13F | Sei Investments Co | 61 030 | 13,30 | 2 844 | 34,66 | ||||

| 2025-08-29 | NP | John Hancock Hedged Equity & Income Fund | 15 087 | 703 | ||||||

| 2025-06-27 | NP | SPWO - SP Funds S&P World (ex-US) ETF | 3 573 | 41,73 | 144 | 48,45 | ||||

| 2025-08-14 | 13F | State Street Corp | 74 522 | 1,08 | 3 473 | 20,17 | ||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 572 484 | 22,96 | 27 | 44,44 | ||||

| 2025-08-01 | 13F | GoalVest Advisory LLC | 4 | 0,00 | 0 | |||||

| 2025-08-13 | 13F | Cerity Partners LLC | 71 794 | −9,54 | 3 346 | 7,55 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 13 940 | 5,30 | 650 | 25,05 | ||||

| 2025-07-28 | 13F | Td Asset Management Inc | 653 104 | −20,05 | 30 441 | −4,96 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 28 899 | 8,15 | 1 347 | 28,65 | ||||

| 2025-05-09 | 13F | Allianz Se | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 20 557 | 5,68 | 958 | 25,72 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 2 040 | 304,76 | 95 | 400,00 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 13 161 | 548,96 | 613 | 675,95 | ||||

| 2025-07-28 | NP | NSI - National Security Emerging Markets Index ETF | 6 051 | 38,44 | 263 | 55,62 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 4 195 | 664,12 | 195 | 828,57 | ||||

| 2025-07-24 | 13F | PDS Planning, Inc | 16 095 | −10,36 | 750 | 6,53 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 79 238 | 21,10 | 3 702 | 44,63 | ||||

| 2025-08-12 | 13F | Advisors Asset Management, Inc. | 3 711 | 57,71 | 173 | 86,96 | ||||

| 2025-07-17 | 13F | V-Square Quantitative Management LLC | 4 065 | 0,00 | 189 | 18,87 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 706 378 | 4,62 | 32 924 | 24,37 | ||||

| 2025-08-28 | NP | CWI - SPDR(R) MSCI ACWI EX-US ETF | 47 194 | 0,35 | 2 200 | 19,25 | ||||

| 2025-08-05 | 13F | NewSquare Capital LLC | 829 | 17,26 | 39 | 40,74 | ||||

| 2025-08-14 | 13F | Principal Street Partners, LLC | 6 174 | 288 | ||||||

| 2025-08-07 | 13F | Campbell & CO Investment Adviser LLC | 26 908 | 1 254 | ||||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 9 141 | 127,56 | 426 | 171,34 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 2 370 | 125,93 | 110 | 168,29 | ||||

| 2025-07-08 | 13F | Northwest & Ethical Investments L.P. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 129 440 | 142,61 | 6 033 | 188,52 | ||||

| 2025-07-21 | 13F | Ascent Group, LLC | 24 568 | 56,30 | 1 145 | 85,88 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 2 924 | −24,15 | 136 | −9,93 | ||||

| 2025-08-27 | NP | THRIVENT SERIES FUND INC - Thrivent Partner Emerging Markets Equity Portfolio Class A | 2 214 | 107,11 | 103 | 151,22 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 48 | −52,00 | 2 | −33,33 | ||||

| 2025-08-28 | NP | SPGM - SPDR(R) Portfolio MSCI Global Stock Market ETF | 21 889 | 2,96 | 1 020 | 22,45 | ||||

| 2025-08-12 | 13F | Summit Global Investments | 12 999 | 1 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 31 941 | 31,98 | 1 489 | 56,96 | ||||

| 2025-06-30 | NP | VGTSX - Vanguard Total International Stock Index Fund Investor Shares | 277 613 | 0,00 | 11 227 | 4,12 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | −100,00 | 0 | |||||

| 2025-07-15 | 13F | Public Employees Retirement System Of Ohio | 143 425 | 7,00 | 6 685 | 27,21 | ||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 46 087 | −11,31 | 1 807 | −7,62 | ||||

| 2025-07-23 | 13F | Venturi Wealth Management, LLC | 5 201 | 242 | ||||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 107 480 | 10,28 | 5 010 | 31,09 | ||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 48 845 | −15,70 | 2 277 | 0,22 | ||||

| 2025-07-25 | 13F | Allspring Global Investments Holdings, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Wealthstream Advisors, Inc. | 5 073 | 236 | ||||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | WPG Advisers, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | 46 894 | 11,63 | 2 186 | 32,67 | ||||

| 2025-06-30 | NP | VMNVX - Vanguard Global Minimum Volatility Fund Admiral Shares | 114 346 | 0,00 | 4 624 | 4,12 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 40 869 | 5,85 | 1 905 | 25,84 | ||||

| 2025-07-18 | 13F | BSW Wealth Partners | 4 777 | −7,67 | 223 | 9,90 | ||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 6 238 | 291 | ||||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 30 459 | −0,87 | 1 420 | 17,86 | ||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 29 521 | 0,00 | 1 376 | 18,84 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 5 585 | 6,24 | 219 | 10,66 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 431 | 331,00 | 20 | 566,67 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 818 | 0 | ||||||

| 2025-08-13 | 13F | Natixis Advisors, L.p. | 39 098 | −10,50 | 2 | 0,00 | ||||

| 2025-08-13 | 13F | Bare Financial Services, Inc | 215 | 10 | ||||||

| 2025-07-18 | 13F | Generali Investments CEE, investicni spolecnost, a.s. | 16 929 | 0,00 | 789 | 19,00 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 7 430 | −1,72 | 346 | 16,89 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 142 | 0,00 | 7 | 20,00 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 10 318 | −1,00 | 481 | 17,65 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 4 425 | 206 | ||||||

| 2025-06-30 | NP | AIM INTERNATIONAL MUTUAL FUNDS (INVESCO INTERNATIONAL MUTUAL FUNDS) - Invesco Oppenheimer Global Multi-Asset Growth Fund Class R6 | 6 350 | 109,09 | 257 | 118,80 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 43 434 | 14,20 | 2 024 | 35,75 | ||||

| 2025-08-14 | 13F | Fmr Llc | 47 835 | 43,29 | 2 230 | 70,41 | ||||

| 2025-08-14 | 13F | Wetherby Asset Management Inc | 31 651 | −4,26 | 1 475 | 18,57 | ||||

| 2025-07-28 | NP | AVSE - Avantis Responsible Emerging Markets Equity ETF | 1 559 | 13,13 | 68 | 26,42 | ||||

| 2025-06-26 | NP | HFIGX - Hartford Schroders Diversified Growth Fund Class I | 3 827 | 17,68 | 155 | 22,22 | ||||

| 2025-07-30 | 13F | Ethic Inc. | 53 719 | −18,24 | 2 518 | −2,59 | ||||

| 2025-04-21 | 13F | Catalina Capital Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 312 | −0,32 | 15 | 16,67 | ||||

| 2025-07-30 | 13F | Cullen/frost Bankers, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | BlackRock, Inc. | 2 679 481 | 7,03 | 124 891 | 27,23 | ||||

| 2025-05-05 | 13F | Transce3nd, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Atlas Capital Advisors Llc | 199 | 0,00 | 9 | 28,57 | ||||

| 2025-07-28 | 13F | Rosenberg Matthew Hamilton | 397 | 0,00 | 19 | 20,00 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 3 899 | 16 145,83 | 182 | |||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 217 162 | −18,68 | 8 441 | −3,04 | ||||

| 2025-08-13 | 13F | Twin Peaks Wealth Advisors, LLC | 269 | 12 | ||||||

| 2025-04-22 | 13F | Mizuho Securities Co. Ltd. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-28 | 13F | Morningstar Investment Management LLC | 68 000 | 0 | ||||||

| 2025-08-15 | 13F | Morgan Stanley | 1 300 893 | 6,70 | 60 635 | 26,84 | ||||

| 2025-04-23 | 13F | Continuum Advisory, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 23 624 | 2,80 | 1 101 | 22,20 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 23 675 | 211,06 | 1 103 | 270,13 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 2 894 055 | −5,52 | 134 892 | 12,31 | ||||

| 2025-08-27 | NP | RYWTX - Emerging Markets 2x Strategy Fund Class A | 2 021 | 143,79 | 94 | 193,75 | ||||

| 2025-08-15 | 13F | Binnacle Investments Inc | 302 | 0,00 | 14 | 27,27 | ||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 297 704 | 411,11 | 13 876 | 507,75 | ||||

| 2025-07-22 | 13F | Simplicity Wealth,LLC | 9 294 | 433 | ||||||

| 2025-06-26 | NP | DFCEX - Emerging Markets Core Equity Portfolio - Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 64 400 | 0,00 | 2 604 | 4,12 | ||||

| 2025-08-05 | 13F | Bridgewater Advisors Inc. | 9 038 | 6,69 | 394 | 16,57 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 32 | 1 | ||||||

| 2025-06-26 | NP | DFSE - Dimensional Emerging Markets Sustainability Core 1 ETF | 4 613 | 17,89 | 187 | 23,18 | ||||

| 2025-07-09 | 13F | Sivia Capital Partners, LLC | 7 752 | −16,94 | 361 | −1,10 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 35 830 | −0,87 | 1 670 | 17,85 | ||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 78 | 0,00 | 4 | 0,00 | ||||

| 2025-07-24 | 13F | Lester Murray Antman dba SimplyRich | 14 902 | 0,00 | 1 | |||||

| 2025-07-16 | 13F | Signaturefd, Llc | 35 457 | −1,99 | 1 653 | 16,50 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 63 | 3 | ||||||

| 2025-08-04 | 13F | Simon Quick Advisors, Llc | 7 740 | 361 | ||||||

| 2025-08-05 | 13F | Tsfg, Llc | 98 | 0,00 | 0 | |||||

| 2025-07-29 | 13F | Harbor Asset Planning, Inc. | 167 | 8 | ||||||

| 2025-08-14 | 13F | Axa S.a. | 13 024 | 0,00 | 607 | 19,02 | ||||

| 2025-04-22 | NP | APIE - ActivePassive International Equity ETF | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-08 | 13F | Crossmark Global Holdings, Inc. | 63 974 | −29,12 | 2 982 | −15,77 |

Other Listings

| DE:CHWD | € 37,80 |