Grunnleggende statistikk

| Institusjonelle eiere | 219 total, 218 long only, 0 short only, 1 long/short - change of 4,78% MRQ |

| Gjennomsnittlig porteføljeallokering | 0.1058 % - change of −7,07% MRQ |

| Institusjonelle aksjer (Long) | 23 029 591 (ex 13D/G) - change of 2,92MM shares 14,50% MRQ |

| Institusjonell verdi (Long) | $ 341 402 USD ($1000) |

Institusjonelt eierskap og aksjonærer

Pearson plc - Depositary Receipt (Common Stock) (US:PSO) har 219 institusjonelle eiere og aksjonærer som har sendt inn 13D/G- eller 13F-skjemaer til Securities Exchange Commission (SEC). Disse institusjonene eier til sammen 23,029,591 aksjer. De største aksjonærene inkluderer Morgan Stanley, BlackRock, Inc., Goldman Sachs Group Inc, Millennium Management Llc, Dimensional Fund Advisors Lp, Northern Trust Corp, Arrowstreet Capital, Limited Partnership, Invesco Ltd., Renaissance Technologies Llc, and Qube Research & Technologies Ltd .

Pearson plc - Depositary Receipt (Common Stock) (NYSE:PSO) institusjonell eierstruktur viser nåværende posisjoner i selskapet fordelt på institusjoner og fond, samt de siste endringene i posisjonsstørrelse. De største aksjonærene kan være individuelle investorer, verdipapirfond, hedgefond eller institusjoner. Schedule 13D indikerer at investoren eier (eller har eid) mer enn 5 % av selskapet og har til hensikt (eller hadde til hensikt) å aktivt forfølge en endring i forretningsstrategien. Schedule 13G indikerer en passiv investering på over 5 %.

The share price as of September 10, 2025 is 14,04 / share. Previously, on September 11, 2024, the share price was 13,65 / share. This represents an increase of 2,86% over that period.

Fondssentiment-score

Fondssentiment Score (også kjent som akkumulering av eierskap poengsum) viser hvilke aksjer som er mest kjøpt av fond. Den er resultatet av en sofistikert, kvantitativ flerfaktormodell som identifiserer selskaper med de høyeste nivåene av institusjonell akkumulering. Beregningsmodellen for poeng bruker en kombinasjon av den totale økningen i antall offentliggjorte eiere, endringer i porteføljeallokeringen til disse eierne og andre beregninger. Tallet går fra 0 til 100, der høyere tall indikerer en høyere grad av akkumulering i forhold til sammenlignbare selskaper, der 50 er gjennomsnittet.

Oppdateringsfrekvens: Daglig

Sjekk ut Ownership Explorer, som inneholder en liste over de høyest rangerte selskapene.

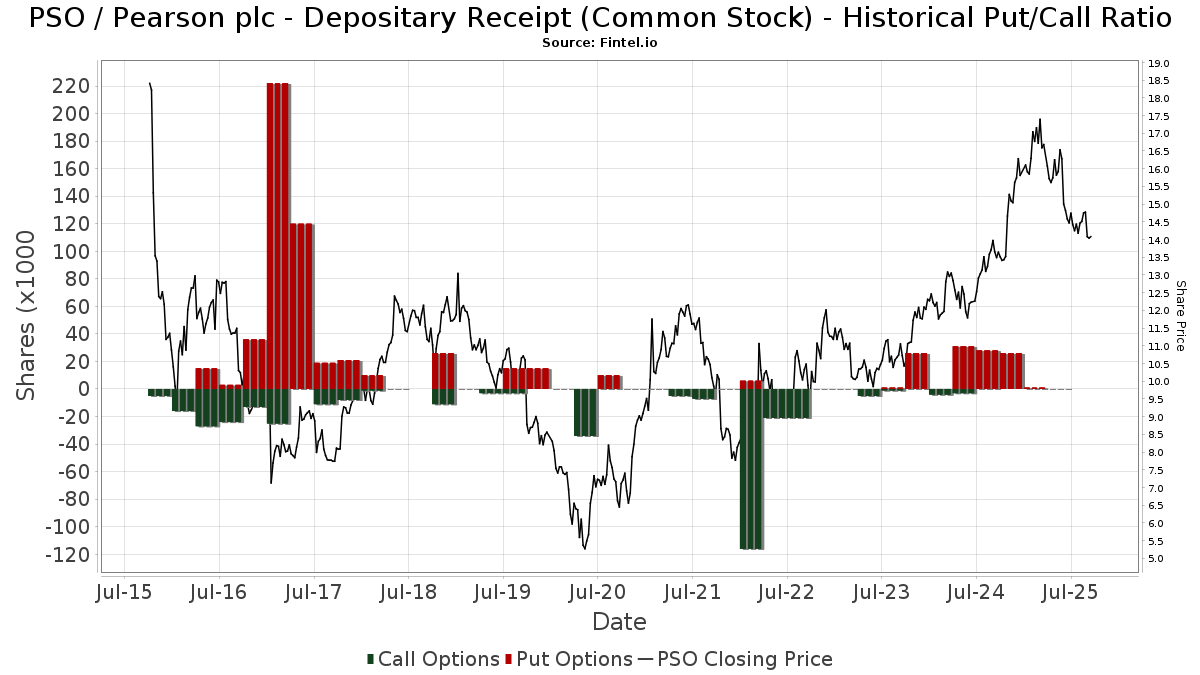

Institusjonell Put/Call-forhold

I tillegg til å rapportere standard aksje- og gjeldsemisjoner må institusjoner med mer enn 100 millioner kroner i forvaltningskapital også oppgi beholdningen av put- og callopsjoner. Siden put-opsjoner generelt indikerer et negativt sentiment, og call-opsjoner indikerer et positivt sentiment, kan vi få et inntrykk av det generelle institusjonelle sentimentet ved å plotte forholdet mellom put- og call-opsjoner. Diagrammet til høyre viser det historiske forholdet mellom put- og call-opsjoner for dette instrumentet.

Ved å bruke Put/Call-forholdet som en indikator på investorsentimentet kan man overvinne en av de viktigste svakhetene ved å bruke totalt institusjonelt eierskap, nemlig at en betydelig andel av forvaltningskapitalen investeres passivt for å følge indekser. Passivt forvaltede fond kjøper vanligvis ikke opsjoner, slik at indikatoren for put/call-forhold i større grad gjenspeiler stemningen i aktivt forvaltede fond.

13F- og NPORT-arkiveringer

Detaljer om 13F-arkiveringer er gratis. Detaljer om NP-arkiveringer krever et premium-medlemskap. Grønne rader indikerer nye posisjoner. Røde rader indikerer lukkede posisjoner. Klikk på lenke ikonet for å se hele transaksjonshistorikken.

Oppgrader

for å låse opp premiedata og eksportere til Excel. ![]() .

.

| Fildato | Kilde | Investor | Type | Gjennomsnittlig pris (estimert) |

Aksjer | Δ Aksjer (%) |

Rapportert verdi ($1000) | Verdi (%) | Portallokering (%) | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Bridgefront Capital, LLC | 11 970 | 179 | ||||||

| 2025-07-24 | 13F | PDS Planning, Inc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 13 197 | 83,67 | 197 | 71,30 | ||||

| 2025-07-16 | 13F | Formidable Asset Management, LLC | 22 891 | −5,40 | 342 | −11,89 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 4 031 | 10,53 | 65 | 10,34 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 3 038 760 | 12,80 | 45 369 | 5,19 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 408 | 0,00 | 6 | 0,00 | ||||

| 2025-06-26 | NP | DFAX - Dimensional World ex U.S. Core Equity 2 ETF | 89 400 | −3,82 | 1 453 | −6,26 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 11 796 | 0 | ||||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 187 733 | −4,16 | 2 803 | −10,65 | ||||

| 2025-08-12 | 13F | Rhumbline Advisers | 14 397 | 2,55 | 215 | −4,46 | ||||

| 2025-07-24 | 13F | Jfs Wealth Advisors, Llc | 264 | 0,00 | 4 | −25,00 | ||||

| 2025-08-12 | 13F | Trexquant Investment LP | 58 232 | 869 | ||||||

| 2025-07-30 | 13F | Princeton Global Asset Management LLC | 767 | 11 | ||||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 25 056 | −4,95 | 374 | −11,37 | ||||

| 2025-07-29 | NP | RBB FUND, INC. - Aquarius International Fund | 15 198 | 0,00 | 242 | −7,63 | ||||

| 2025-08-12 | 13F | American Century Companies Inc | 71 990 | 7,74 | 1 075 | 0,47 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 10 432 | 68,20 | 156 | 56,57 | ||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 47 462 | −0,44 | 709 | −7,21 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Hilltop National Bank | 5 585 | 0,00 | 83 | −7,78 | ||||

| 2025-08-14 | 13F | LMR Partners LLP | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 605 707 | 1 072,42 | 9 043 | 993,47 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 11 932 | 16,93 | 179 | 9,20 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - World ex U.S. Targeted Value Portfolio Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 18 663 | 0,00 | 303 | −2,57 | ||||

| 2025-08-13 | 13F | Grantham, Mayo, Van Otterloo & Co. LLC | 181 651 | −11,53 | 2 712 | −17,49 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 3 131 | −24,37 | 0 | |||||

| 2025-08-11 | 13F | Cornerstone Planning Group LLC | 82 | 82,22 | 1 | |||||

| 2025-07-17 | 13F | Crane Advisory, LLC | 13 705 | 0,00 | 197 | −8,41 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 780 369 | 8,89 | 11 651 | 1,54 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 2 378 336 | 6,00 | 35 509 | −1,16 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 41 744 | 19,83 | 623 | 11,85 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 0 | −100,00 | 0 | |||||

| 2025-07-28 | NP | AVSD - Avantis Responsible International Equity ETF | 6 095 | 0,00 | 97 | −7,62 | ||||

| 2025-08-05 | 13F | NewSquare Capital LLC | 418 | 514,71 | 6 | 500,00 | ||||

| 2025-07-16 | 13F | Highline Wealth Partners Llc | 60 | 0,00 | 1 | |||||

| 2025-08-08 | 13F | Crossmark Global Holdings, Inc. | 155 771 | 0,69 | 2 326 | −6,10 | ||||

| 2025-06-27 | NP | PID - Invesco International Dividend Achievers ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 506 787 | −32,64 | 8 235 | −34,34 | ||||

| 2025-08-12 | 13F | Fca Corp /tx | 16 000 | 0,00 | 239 | −7,03 | ||||

| 2025-08-12 | 13F | Manchester Capital Management LLC | 30 | 0 | ||||||

| 2025-08-15 | 13F | WealthCollab, LLC | 1 742 | 0,00 | 26 | −3,70 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 1 351 | −23,06 | 20 | −28,57 | ||||

| 2025-07-15 | 13F | Ballentine Partners, LLC | 31 308 | −13,60 | 467 | −19,48 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 0 | −100,00 | 0 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 25 001 | 15,69 | 373 | 8,12 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 8 453 | −41,80 | 126 | −45,69 | ||||

| 2025-07-11 | 13F | UMA Financial Services, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 1 736 | 375,62 | 26 | 400,00 | ||||

| 2025-07-07 | 13F | Versant Capital Management, Inc | 9 320 | −41,91 | 139 | −45,70 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Eqis Capital Management, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | Yousif Capital Management, Llc | 10 790 | 0,00 | 161 | −6,40 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 12 576 | 188 | ||||||

| 2025-08-06 | 13F | Savant Capital, LLC | 17 608 | 46,73 | 263 | 36,46 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 22 888 | −73,75 | 342 | −75,56 | ||||

| 2025-07-25 | 13F | JustInvest LLC | 119 193 | 7,46 | 1 780 | 0,23 | ||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 6 030 | 519,73 | 0 | |||||

| 2025-08-14 | 13F | Point72 Hong Kong Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 32 642 | −31,44 | 487 | −36,09 | ||||

| 2025-08-12 | 13F | Dimensional Fund Advisors Lp | 1 176 710 | −6,82 | 17 568 | −13,10 | ||||

| 2025-08-11 | 13F | Bell Investment Advisors, Inc | 520 | 0,00 | 8 | −12,50 | ||||

| 2025-08-13 | 13F | Natixis Advisors, L.p. | 99 686 | 13,93 | 1 | 0,00 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 1 449 535 | 101,00 | 21 642 | 87,45 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 58 923 | 1 025,56 | 880 | 959,04 | ||||

| 2025-05-05 | 13F | Eagle Bay Advisors LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 16 762 | −7,31 | 250 | −13,49 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Glenmede Trust Co Na | 23 885 | 106,07 | 382 | 105,38 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 122 036 | 10 061,20 | 1 822 | 9 489,47 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 25 661 | −0,68 | 383 | −7,26 | ||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 128 574 | −10,02 | 1 920 | −16,20 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 147 174 | 19,78 | 2 197 | 11,69 | ||||

| 2025-08-12 | 13F | AlphaCore Capital LLC | 4 708 | 70 | ||||||

| 2025-04-30 | 13F | Genus Capital Management Inc. | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 3 913 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 140 839 | 96,51 | 2 103 | 83,26 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - World ex U.S. Core Equity Portfolio Institutional Class Shares | 70 351 | −5,47 | 1 143 | −7,82 | ||||

| 2025-08-11 | 13F | Dorsey Wright & Associates | 78 634 | −38,35 | 1 174 | −42,51 | ||||

| 2025-08-14 | 13F | Fmr Llc | 273 186 | −6,06 | 4 079 | −12,40 | ||||

| 2025-08-05 | 13F | Ellevest, Inc. | 16 858 | −17,31 | 252 | −23,01 | ||||

| 2025-05-02 | 13F | Cable Hill Partners, LLC | 16 813 | 1,38 | 277 | 3,37 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 206 395 | 3,72 | 3 081 | −3,27 | ||||

| 2025-07-17 | 13F | Vermillion Wealth Management, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Evergreen Capital Management Llc | 19 985 | 1,45 | 298 | −6,58 | ||||

| 2025-08-07 | 13F | Sierra Ocean, Llc | 831 | 0,00 | 12 | −7,69 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 6 990 | 196,69 | 104 | 181,08 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 2 042 649 | −4,76 | 30 497 | −11,18 | ||||

| 2025-05-15 | 13F | Newbridge Financial Services Group, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Franklin Resources Inc | 16 817 | 0,50 | 251 | −5,99 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 445 228 | 109,58 | 6 647 | 95,44 | ||||

| 2025-07-21 | 13F | Qrg Capital Management, Inc. | 157 281 | 145,86 | 2 348 | 129,30 | ||||

| 2025-07-14 | 13F | U.S. Capital Wealth Advisors, LLC | 12 294 | 6,26 | 184 | −1,08 | ||||

| 2025-08-06 | 13F | Fox Run Management, L.l.c. | 21 892 | 327 | ||||||

| 2025-08-14 | 13F | Henry James International Management Inc. | 0 | −100,00 | 0 | |||||

| 2025-06-26 | NP | DFIC - Dimensional International Core Equity 2 ETF | 234 442 | 0,00 | 3 810 | −2,53 | ||||

| 2025-06-27 | NP | SPWO - SP Funds S&P World (ex-US) ETF | 2 165 | 54,75 | 35 | 52,17 | ||||

| 2025-08-12 | 13F | Seeds Investor Llc | 12 734 | −10,56 | 190 | −16,30 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 189 991 | 25,48 | 2 837 | 17,00 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 5 113 | 13,24 | 76 | 5,56 | ||||

| 2025-07-28 | 13F | Ritholtz Wealth Management | 17 761 | 265 | ||||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 3 484 | 0,00 | 52 | −5,45 | ||||

| 2025-05-02 | 13F | Bogart Wealth, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 730 | 0,00 | 11 | −9,09 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 100 | 0 | |||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 261 605 | 672,15 | 3 906 | 620,48 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 100 | 0 | |||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 23 895 | 245,45 | 357 | 223,64 | ||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 2 133 | 3 131,82 | 32 | 3 000,00 | ||||

| 2025-08-14 | 13F | Principal Street Partners, LLC | 29 784 | 100,00 | 445 | 86,55 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 29 137 | 0,47 | 435 | −6,25 | ||||

| 2025-07-17 | 13F | Global Trust Asset Management, LLC | 4 300 | 64 | ||||||

| 2025-08-13 | 13F | Cerity Partners LLC | 156 978 | 1,93 | 2 344 | −4,95 | ||||

| 2025-08-01 | 13F | Shilanski & Associates, Inc. | 11 755 | 0,46 | 176 | −6,42 | ||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 75 944 | −3,24 | 1 134 | −9,79 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 650 600 | 59,54 | 9 713 | 48,79 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 166 143 | 2 481 | ||||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 62 | 0,00 | 1 | |||||

| 2025-08-11 | 13F | United Capital Financial Advisers, Llc | 13 912 | −0,16 | 208 | −7,17 | ||||

| 2025-07-30 | NP | APIE - ActivePassive International Equity ETF | 208 111 | 19,98 | 3 319 | 10,89 | ||||

| 2025-08-29 | NP | MPLAX - Praxis International Index Fund Class A | 121 055 | 0,00 | 1 807 | −6,76 | ||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 46 370 | 24,66 | 692 | 16,30 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 9 017 | −3,51 | 135 | −10,07 | ||||

| 2025-07-29 | NP | GBFFX - GMO Benchmark-Free Fund Class III | 21 329 | 34,20 | 340 | 24,09 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 51 946 | −1,52 | 776 | −8,18 | ||||

| 2025-08-13 | 13F | Rsm Us Wealth Management Llc | 14 244 | 19,31 | 213 | 10,99 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 159 986 | −1,82 | 2 389 | −8,44 | ||||

| 2025-05-09 | 13F | GeoWealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 246 894 | 348,00 | 3 686 | 317,91 | ||||

| 2025-07-15 | 13F | Td Private Client Wealth Llc | 3 492 | 113,84 | 52 | 100,00 | ||||

| 2025-08-26 | NP | LST - Leuthold Select Industries ETF | 5 989 | 89 | ||||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 5 241 | 12,66 | 78 | 4,05 | ||||

| 2025-03-26 | NP | DFALX - Large Cap International Portfolio - Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 50 913 | −12,88 | 849 | −0,59 | ||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 700 902 | −15,18 | 10 464 | −20,90 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 10 633 | 159 | ||||||

| 2025-08-06 | 13F | Hallmark Capital Management Inc | 0 | −100,00 | 0 | |||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 7 353 | −28,17 | 110 | −33,13 | ||||

| 2025-08-05 | 13F | Key FInancial Inc | 3 | 0 | ||||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 24 | −96,30 | 0 | −100,00 | ||||

| 2025-05-15 | 13F | CAPROCK Group, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Addison Advisors LLC | 7 570 | 0,00 | 113 | −6,61 | ||||

| 2025-08-14 | 13F | Aquatic Capital Management LLC | 33 968 | −23,57 | 507 | −28,69 | ||||

| 2025-07-29 | 13F | Salomon & Ludwin, LLC | 4 | 0 | ||||||

| 2025-08-04 | 13F | AdvisorShares Investments LLC | 54 740 | 18,31 | 817 | 9,81 | ||||

| 2025-08-06 | 13F | Genus Capital Management Inc. | 33 840 | −29,41 | 505 | −34,16 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 40 989 | 19,25 | 612 | 11,09 | ||||

| 2025-08-14 | 13F | Alliancebernstein L.p. | 222 595 | 34 680,47 | 3 323 | 23 635,71 | ||||

| 2025-07-29 | NP | GIMFX - GMO Implementation Fund | 40 218 | 16,40 | 641 | 7,55 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 0 | −100,00 | 0 | ||||

| 2025-08-14 | 13F | Diversify Advisory Services, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Diversify Wealth Management, Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 70 845 | 61,78 | 1 058 | 50,78 | ||||

| 2025-08-14 | 13F | Point72 Asia (Singapore) Pte. Ltd. | 0 | −100,00 | 0 | |||||

| 2025-07-15 | 13F | Maseco Llp | 307 | 5 | ||||||

| 2025-08-14 | 13F | Alaska Permanent Fund Corp | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Clean Yield Group | 137 | 0,00 | 2 | 0,00 | ||||

| 2025-08-01 | 13F | Bessemer Group Inc | 431 | −23,72 | 0 | |||||

| 2025-08-27 | NP | FORH - Formidable ETF | 22 891 | −5,40 | 342 | −11,89 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Claro Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Binnacle Investments Inc | 43 | 0,00 | 1 | |||||

| 2025-07-21 | 13F | Credential Qtrade Securities Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 693 250 | 34,61 | 10 350 | 25,53 | ||||

| 2025-08-05 | 13F | GHP Investment Advisors, Inc. | 699 | 1,30 | 10 | −9,09 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 190 870 | 129,05 | 2 850 | 113,57 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 26 923 | 402 | ||||||

| 2025-07-18 | 13F | Dogwood Wealth Management LLC | 288 | 4 | ||||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 81 604 | −2,80 | 1 218 | −9,37 | ||||

| 2025-07-17 | 13F | Albion Financial Group /ut | 252 | 0,00 | 4 | −25,00 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 9 296 | −63,53 | 139 | −66,18 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Glenmede Investment Management, LP | 24 549 | 367 | ||||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 21 244 | 317 | ||||||

| 2025-08-13 | 13F | M&t Bank Corp | 18 115 | 10,34 | 271 | 2,66 | ||||

| 2025-07-09 | 13F | Bruce G. Allen Investments, LLC | 249 | −41,13 | 4 | −50,00 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - International Vector Equity Portfolio Shares | 6 300 | 0,00 | 102 | −2,86 | ||||

| 2025-08-07 | 13F | Zions Bancorporation, National Association /ut/ | 64 | 0,00 | 1 | −100,00 | ||||

| 2025-06-26 | NP | DFIEX - International Core Equity Portfolio - Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 349 430 | −27,06 | 5 678 | −28,89 | ||||

| 2025-07-28 | NP | AVDEX - Avantis International Equity Fund Institutional Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 5 145 | 0,00 | 82 | −6,82 | ||||

| 2025-04-22 | 13F | Mendota Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Graham Capital Management, L.P. | 43 848 | 655 | ||||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 209 273 | −6,50 | 3 124 | −12,81 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 7 909 | −2,50 | 118 | −8,53 | ||||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 23 837 | 76,40 | 356 | 64,35 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 1 635 | −1,21 | 24 | −7,69 | ||||

| 2025-06-30 | NP | CNGLX - Commonwealth Global Fund | 16 000 | 0,00 | 260 | −2,26 | ||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 47 612 | −16,45 | 762 | −16,99 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 79 | 0,00 | 1 | 0,00 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 50 683 | −10,44 | 757 | −16,46 | ||||

| 2025-06-26 | NP | DFSI - Dimensional International Sustainability Core 1 ETF | 32 917 | 0,00 | 535 | −2,55 | ||||

| 2025-08-12 | 13F | Atlas Capital Advisors Llc | 26 872 | 0,00 | 401 | −6,74 | ||||

| 2025-07-31 | 13F | MQS Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 21 161 | −13,06 | 316 | −19,02 | ||||

| 2025-07-21 | 13F | Cromwell Holdings LLC | 3 761 | 0,00 | 56 | −8,20 | ||||

| 2025-08-14 | 13F | Syon Capital Llc | 28 510 | 6,86 | 426 | −0,47 | ||||

| 2025-08-13 | 13F | Twin Peaks Wealth Advisors, LLC | 265 | 4 | ||||||

| 2025-08-04 | 13F | Atria Investments Llc | 52 557 | 62,02 | 785 | 51,06 | ||||

| 2025-08-07 | 13F | Campbell & CO Investment Adviser LLC | 33 590 | 501 | ||||||

| 2025-07-29 | 13F | Private Trust Co Na | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 54 312 | −8,49 | 811 | −14,74 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 19 041 | −9,21 | 284 | −16,22 | ||||

| 2025-07-28 | NP | AVDE - Avantis International Equity ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 59 103 | 50,65 | 943 | 39,14 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - International Sustainability Core 1 Portfolio Shares | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-30 | 13F | Cullen/frost Bankers, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 7 843 | −16,63 | 117 | −22,00 | ||||

| 2025-07-30 | 13F | Ethic Inc. | 153 648 | −11,20 | 2 283 | −18,03 | ||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 10 344 | 154 | ||||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 499 | 134,27 | 7 | 133,33 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 21 879 | 24,19 | 327 | 15,60 | ||||

| 2025-07-31 | 13F | CVA Family Office, LLC | 96 | −49,74 | 1 | −66,67 | ||||

| 2025-08-14 | 13F | 13D Management LLC | 458 338 | −2,72 | 6 843 | −9,29 | ||||

| 2025-07-16 | 13F | ORG Wealth Partners, LLC | 225 | 0,00 | 3 | 0,00 | ||||

| 2025-07-15 | 13F | Mather Group, Llc. | 14 745 | 0,00 | 220 | −6,78 | ||||

| 2025-08-14 | 13F | UBS Group AG | 31 596 | −57,43 | 472 | −60,35 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 1 186 | 18 | ||||||

| 2025-08-06 | 13F | True Wealth Design, LLC | 31 | 6,90 | 0 | |||||

| 2025-06-26 | NP | FSGEX - Fidelity Series Global ex U.S. Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 223 811 | −15,84 | 3 637 | −17,96 | ||||

| 2025-07-24 | 13F | Lester Murray Antman dba SimplyRich | 47 975 | 0,00 | 1 | |||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 32 800 | 490 | ||||||

| 2025-04-11 | 13F | First Affirmative Financial Network | 15 129 | 0,85 | 242 | 0,41 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 167 | 0,00 | 2 | 0,00 | ||||

| 2025-07-24 | 13F | JNBA Financial Advisors | 21 252 | −22,08 | 317 | −27,29 | ||||

| 2025-08-25 | NP | AADR - AdvisorShares Dorsey Wright ADR ETF | 54 740 | 18,31 | 817 | 10,41 | ||||

| 2025-06-26 | NP | Dfa Investment Trust Co - The Dfa International Value Series This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 373 096 | −12,63 | 6 063 | −14,84 | ||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 1 428 | −1,72 | 21 | −8,70 | ||||

| 2025-08-21 | NP | DDDAX - 13D Activist Fund Class A | 458 338 | 0,00 | 6 843 | −6,75 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 269 | −37,30 | 4 | −33,33 | ||||

| 2025-04-29 | 13F | Callan Capital, LLC | 18 626 | 3,68 | 298 | 3,11 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 84 703 | 18,20 | 1 265 | 10,20 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 1 947 | 37,99 | 29 | 31,82 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 1 768 | 2,79 | 26 | −3,70 | ||||

| 2025-08-12 | 13F | Gitterman Wealth Management, LLC | 15 150 | −1,76 | 226 | −8,13 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 1 620 | 0 | ||||||

| 2025-03-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - International Social Core Equity Portfolio Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 11 612 | −65,56 | 194 | −60,77 | ||||

| 2025-07-16 | 13F | ORG Partners LLC | 163 | 2 | ||||||

| 2025-08-12 | 13F | Personal Cfo Solutions, Llc | 10 473 | −2,96 | 156 | −9,30 | ||||

| 2025-07-30 | NP | ENDW - Cambria Endowment Style ETF | 13 | 0 | ||||||

| 2025-08-14 | 13F | Hrt Financial Lp | 39 519 | 220,46 | 1 | |||||

| 2025-07-11 | 13F | Pinnacle Bancorp, Inc. | 228 | 3 | ||||||

| 2025-08-11 | 13F | Renaissance Group Llc | 408 688 | 0,05 | 6 102 | −6,70 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 25 382 | 1,27 | 379 | −5,74 | ||||

| 2025-05-15 | 13F | Optiver Holding B.V. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 607 | 1 858,06 | 9 | |||||

| 2025-08-14 | 13F | Barometer Capital Management Inc. | 10 011 | −66,86 | 149 | −69,15 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 51 | 5 000,00 | 1 | |||||

| 2025-07-17 | 13F | Park Place Capital Corp | 996 | 0,00 | 15 | 0,00 | ||||

| 2025-08-14 | 13F | Wetherby Asset Management Inc | 71 556 | 10,32 | 1 068 | 2,20 | ||||

| 2025-07-24 | 13F | Callan Family Office, LLC | 20 579 | 307 | ||||||

| 2025-05-09 | 13F | Abc Arbitrage Sa | 0 | −100,00 | 0 | |||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 12 456 | 0 | ||||||

| 2025-08-11 | 13F | GW&K Investment Management, LLC | 142 | 0,00 | 0 | |||||

| 2025-08-08 | 13F | Creative Planning | 95 716 | −3,70 | 1 429 | −10,18 | ||||

| 2025-07-11 | 13F | Great Waters Wealth Management | 18 244 | 21,74 | 272 | 13,81 | ||||

| 2025-06-26 | NP | SNTKX - Steward International Enhanced Index Fund Class A | 97 434 | 0,00 | 1 583 | −2,52 | ||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 413 | 0,00 | 6 | 0,00 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 145 461 | −33,92 | 2 172 | −38,39 |

Other Listings

| DE:PESA | € 12,20 |