Grunnleggende statistikk

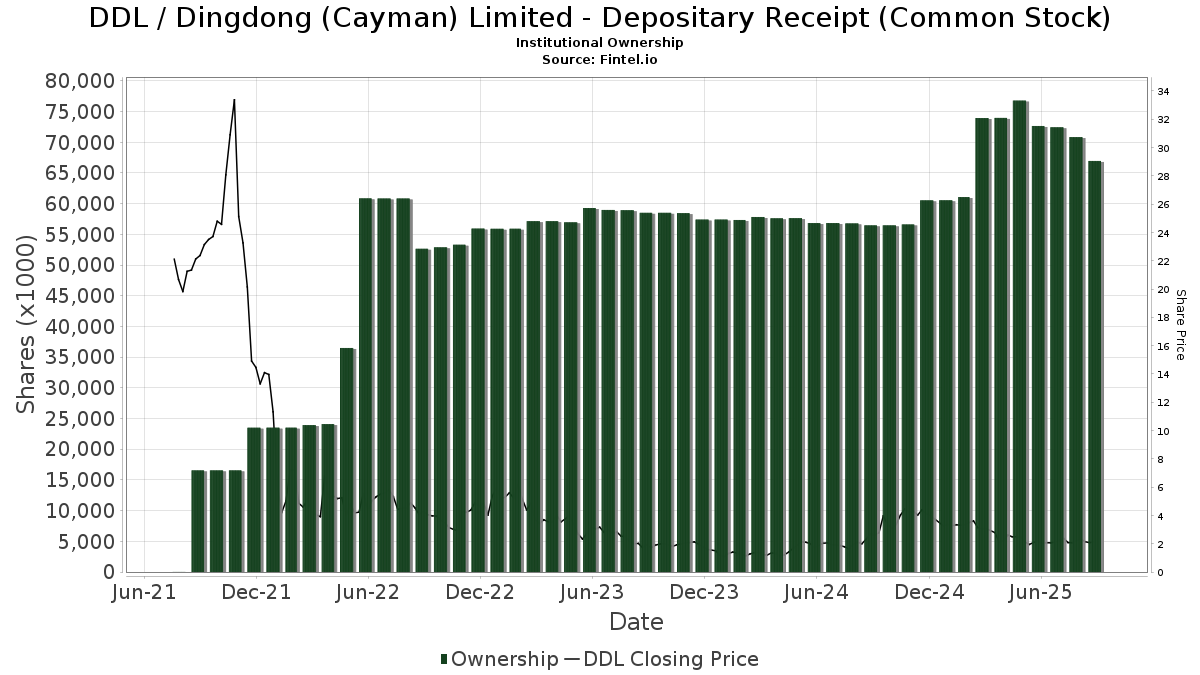

| Institusjonelle eiere | 71 total, 70 long only, 0 short only, 1 long/short - change of −7,79% MRQ |

| Gjennomsnittlig porteføljeallokering | 0.1658 % - change of −78,91% MRQ |

| Institusjonelle aksjer (Long) | 66 948 934 (ex 13D/G) - change of −5,49MM shares −7,58% MRQ |

| Institusjonell verdi (Long) | $ 131 863 USD ($1000) |

Institusjonelt eierskap og aksjonærer

Dingdong (Cayman) Limited - Depositary Receipt (Common Stock) (US:DDL) har 71 institusjonelle eiere og aksjonærer som har sendt inn 13D/G- eller 13F-skjemaer til Securities Exchange Commission (SEC). Disse institusjonene eier til sammen 66,948,934 aksjer. De største aksjonærene inkluderer Capital Today Evergreen Fund, L.P., Galileo (PTC) Ltd, SC CHINA HOLDING Ltd, Platinum Investment Management Ltd, Vanguard Group Inc, Connor, Clark & Lunn Investment Management Ltd., Allspring Global Investments Holdings, LLC, VGTSX - Vanguard Total International Stock Index Fund Investor Shares, VEIEX - Vanguard Emerging Markets Stock Index Fund Investor Shares, and Arrowstreet Capital, Limited Partnership .

Dingdong (Cayman) Limited - Depositary Receipt (Common Stock) (NYSE:DDL) institusjonell eierstruktur viser nåværende posisjoner i selskapet fordelt på institusjoner og fond, samt de siste endringene i posisjonsstørrelse. De største aksjonærene kan være individuelle investorer, verdipapirfond, hedgefond eller institusjoner. Schedule 13D indikerer at investoren eier (eller har eid) mer enn 5 % av selskapet og har til hensikt (eller hadde til hensikt) å aktivt forfølge en endring i forretningsstrategien. Schedule 13G indikerer en passiv investering på over 5 %.

The share price as of September 12, 2025 is 2,20 / share. Previously, on September 13, 2024, the share price was 2,93 / share. This represents a decline of 24,91% over that period.

Fondssentiment-score

Fondssentiment Score (også kjent som akkumulering av eierskap poengsum) viser hvilke aksjer som er mest kjøpt av fond. Den er resultatet av en sofistikert, kvantitativ flerfaktormodell som identifiserer selskaper med de høyeste nivåene av institusjonell akkumulering. Beregningsmodellen for poeng bruker en kombinasjon av den totale økningen i antall offentliggjorte eiere, endringer i porteføljeallokeringen til disse eierne og andre beregninger. Tallet går fra 0 til 100, der høyere tall indikerer en høyere grad av akkumulering i forhold til sammenlignbare selskaper, der 50 er gjennomsnittet.

Oppdateringsfrekvens: Daglig

Sjekk ut Ownership Explorer, som inneholder en liste over de høyest rangerte selskapene.

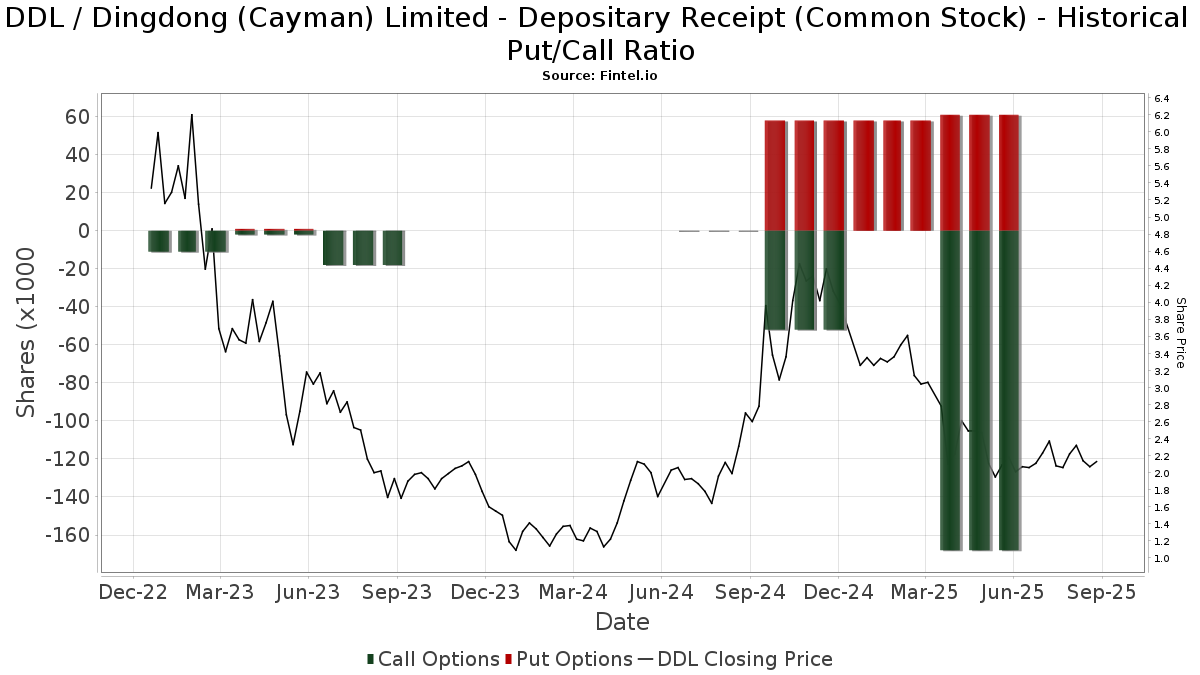

Institusjonell Put/Call-forhold

I tillegg til å rapportere standard aksje- og gjeldsemisjoner må institusjoner med mer enn 100 millioner kroner i forvaltningskapital også oppgi beholdningen av put- og callopsjoner. Siden put-opsjoner generelt indikerer et negativt sentiment, og call-opsjoner indikerer et positivt sentiment, kan vi få et inntrykk av det generelle institusjonelle sentimentet ved å plotte forholdet mellom put- og call-opsjoner. Diagrammet til høyre viser det historiske forholdet mellom put- og call-opsjoner for dette instrumentet.

Ved å bruke Put/Call-forholdet som en indikator på investorsentimentet kan man overvinne en av de viktigste svakhetene ved å bruke totalt institusjonelt eierskap, nemlig at en betydelig andel av forvaltningskapitalen investeres passivt for å følge indekser. Passivt forvaltede fond kjøper vanligvis ikke opsjoner, slik at indikatoren for put/call-forhold i større grad gjenspeiler stemningen i aktivt forvaltede fond.

13F- og NPORT-arkiveringer

Detaljer om 13F-arkiveringer er gratis. Detaljer om NP-arkiveringer krever et premium-medlemskap. Grønne rader indikerer nye posisjoner. Røde rader indikerer lukkede posisjoner. Klikk på lenke ikonet for å se hele transaksjonshistorikken.

Oppgrader

for å låse opp premiedata og eksportere til Excel. ![]() .

.

| Fildato | Kilde | Investor | Type | Gjennomsnittlig pris (estimert) |

Aksjer | Δ Aksjer (%) |

Rapportert verdi ($1000) | Verdi (%) | Portallokering (%) | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Softbank Group Corp | 1 050 000 | 0,00 | 2 121 | −25,19 | ||||

| 2025-07-21 | 13F | Platinum Investment Management Ltd | 6 677 746 | −17,82 | 13 489 | −38,52 | ||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 26 583 | −8,56 | 54 | −32,05 | ||||

| 2025-06-30 | NP | VT - Vanguard Total World Stock Index Fund ETF Shares | 66 118 | 0,00 | 165 | −26,79 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Qrg Capital Management, Inc. | 15 793 | 32 | ||||||

| 2025-08-14 | 13F | Man Group plc | 531 235 | 24,00 | 1 073 | −7,18 | ||||

| 2025-05-15 | 13F | Two Sigma Investments, Lp | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 496 482 | −75,87 | 1 003 | −81,97 | ||||

| 2025-05-28 | NP | LEAIX - Lazard Emerging Markets Equity Advantage Portfolio Institutional Shares | 54 084 | 15,86 | 146 | −4,58 | ||||

| 2025-08-15 | 13F | Caxton Associates Llp | 72 668 | 147 | ||||||

| 2025-08-14 | 13F | Point72 (DIFC) Ltd | 2 900 | 6 | ||||||

| 2025-03-31 | NP | AEMGX - Acadian Emerging Markets Portfolio Investor Class Shares | 10 058 | 0,00 | 34 | −15,00 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 1 | 0,00 | 0 | |||||

| 2025-05-13 | 13F | Commonwealth Of Pennsylvania Public School Empls Retrmt Sys | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 1 197 257 | −31,53 | 2 | −50,00 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-13 | 13F | Healthcare Of Ontario Pension Plan Trust Fund | 0 | −100,00 | 0 | |||||

| 2025-05-29 | 13F/A | Legal & General Group Plc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-15 | 13F | Polymer Capital Management (HK) LTD | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | SC CHINA HOLDING Ltd | 11 141 166 | 0,00 | 22 505 | −22,60 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 165 526 | 334 | ||||||

| 2025-07-15 | 13F | Public Employees Retirement System Of Ohio | 206 206 | 35,98 | 417 | 1,71 | ||||

| 2025-08-11 | 13F | Kim, Llc | 928 008 | 0,00 | 1 875 | −25,19 | ||||

| 2025-08-15 | 13F | Harvest Fund Management Co., Ltd | 302 680 | 0,00 | 1 | |||||

| 2025-07-25 | 13F | Allspring Global Investments Holdings, LLC | 2 970 244 | −2,30 | 6 000 | −26,91 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 141 263 | 0 | ||||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 1 281 700 | 21,53 | 2 589 | −9,06 | ||||

| 2025-06-30 | NP | VFSNX - Vanguard FTSE All-World ex-US Small-Cap Index Fund Institutional Shares | 485 012 | −1,98 | 1 208 | −28,24 | ||||

| 2025-08-14 | 13F | Susquehanna Portfolio Strategies, LLC | 201 380 | 407 | ||||||

| 2025-08-04 | 13F | Capital Today Evergreen Fund, L.P. | 11 879 332 | 0,00 | 23 996 | −25,19 | ||||

| 2025-04-30 | 13F | Cornerstone Investment Partners, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 2 570 | −99,42 | 0 | −100,00 | ||||

| 2025-07-29 | NP | VSGX - Vanguard ESG International Stock ETF ETF Shares | 24 315 | 0,00 | 50 | −40,48 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 25 915 | 52 | ||||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 50 993 | −54,68 | 103 | −66,01 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 36 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 517 | 1 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 11 500 | 23 | |||||

| 2025-08-14 | 13F | Millennium Management Llc | 209 359 | −58,10 | 423 | −68,69 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 76 700 | 155 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 244 140 | 229,95 | 493 | 147,74 | ||||

| 2025-08-07 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 3 173 186 | 20,11 | 6 410 | −10,14 | ||||

| 2025-08-28 | NP | EWX - SPDR(R) S&P(R) EMERGING MARKETS SMALL CAP ETF | 97 411 | 0,00 | 197 | −25,48 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 505 | 71,77 | 1 | |||||

| 2025-08-11 | 13F | Vanguard Group Inc | 4 462 805 | −18,66 | 9 015 | −39,15 | ||||

| 2025-08-12 | 13F | Rhumbline Advisers | 815 | 0,00 | 2 | −50,00 | ||||

| 2025-08-13 | 13F | Mackenzie Financial Corp | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 1 082 782 | −17,73 | 2 187 | −38,45 | ||||

| 2025-08-14 | 13F | Galileo (PTC) Ltd | 11 716 130 | 0,00 | 23 667 | −25,19 | ||||

| 2025-08-28 | NP | GXC - SPDR(R) S&P(R) CHINA ETF | 17 736 | −10,15 | 36 | −33,96 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 68 900 | 134,35 | 139 | 75,95 | ||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 1 387 772 | 0,13 | 2 803 | −25,09 | ||||

| 2025-05-14 | 13F | Jump Financial, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | California Public Employees Retirement System | 191 715 | −39,88 | 387 | −55,00 | ||||

| 2025-05-13 | 13F | Russell Investments Group, Ltd. | 0 | −100,00 | 0 | |||||

| 2025-04-24 | 13F | Mirae Asset Global Investments Co., Ltd. | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | B. Metzler seel. Sohn & Co. AG | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 33 272 | 43 678,95 | 67 | |||||

| 2025-05-14 | 13F | Diametric Capital, LP | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Bank Of Nova Scotia | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Invesco Ltd. | 109 900 | −5,98 | 222 | −29,84 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 105 659 | −59,10 | 0 | |||||

| 2025-06-30 | NP | VGTSX - Vanguard Total International Stock Index Fund Investor Shares | 1 949 427 | −0,68 | 4 854 | −27,26 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 2 689 | 63,27 | 5 | 25,00 | ||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 344 875 | 12,66 | 697 | −15,74 | ||||

| 2025-07-30 | NP | APIE - ActivePassive International Equity ETF | 13 207 | 1,01 | 27 | −40,00 | ||||

| 2025-06-27 | NP | PGJ - Invesco Golden Dragon China ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 116 749 | 9,38 | 291 | −19,89 | ||||

| 2025-06-30 | NP | VEIEX - Vanguard Emerging Markets Stock Index Fund Investor Shares | 1 758 766 | 0,00 | 4 379 | −26,76 | ||||

| 2025-08-13 | 13F | Centiva Capital, LP | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 968 405 | 66,50 | 1 956 | 24,59 | ||||

| 2025-08-14 | 13F | Point72 Asia (Singapore) Pte. Ltd. | 8 433 | 421 550,00 | 17 | |||||

| 2025-06-03 | 13F | CWM Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 15 000 | 0,00 | 30 | −25,00 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | 505 398 | −15,58 | 1 021 | −36,88 | ||||

| 2025-08-14 | 13F | Banque Transatlantique SA | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Numerai GP LLC | 0 | −100,00 | 0 | |||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 6 143 | 10,03 | 12 | −20,00 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 20 515 | 41 | ||||||

| 2025-08-14 | 13F | Sei Investments Co | 13 725 | −86,34 | 28 | −90,04 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 491 115 | 283,26 | 992 | 187,54 | ||||

| 2025-08-14 | 13F | UBS Group AG | 32 357 | −94,23 | 65 | −95,71 | ||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 30 400 | −31,58 | 61 | −48,74 | ||||

| 2025-08-14 | 13F | State Street Corp | 254 949 | −4,63 | 515 | −28,71 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 1 100 396 | −18,48 | 2 223 | −39,02 | ||||

| 2025-08-28 | NP | SPEM - SPDR(R) Portfolio Emerging Markets ETF | 139 130 | 1,94 | 281 | −23,64 | ||||

| 2025-05-22 | NP | MXENX - Great-West Emerging Markets Equity Fund Institutional Class | 192 785 | −3,51 | 521 | −20,61 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 0 | −100,00 | 0 | |||||

| 2025-06-26 | NP | CRNSX - CATHOLIC RESPONSIBLE INVESTMENTS INTERNATIONAL SMALL-CAP FUND Institutional Shares | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-15 | 13F | Tiger Global Management Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 7 232 | 22,81 | 15 | −6,67 | ||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 26 818 | 54 | ||||||

| 2025-08-11 | 13F | Bell Investment Advisors, Inc | 341 | 0,00 | 1 | |||||

| 2025-08-13 | 13F | New York State Common Retirement Fund | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 401 068 | 36,46 | 810 | 2,14 | ||||

| 2025-07-29 | NP | FDLS - Inspire Fidelis Multi Factor ETF | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 80 100 | 162 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 61 300 | 4,79 | 124 | −21,66 | |||

| 2025-08-14 | 13F | Susquehanna Fundamental Investments, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Norges Bank | 293 800 | 593 | ||||||

| 2025-06-27 | NP | HAOSX - Harbor Overseas Fund Institutional Class | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-06-23 | NP | UGPIX - UltraChina ProFund Investor Class | 0 | −100,00 | 0 | −100,00 |

Other Listings

| DE:945 | € 1,75 |