Grunnleggende statistikk

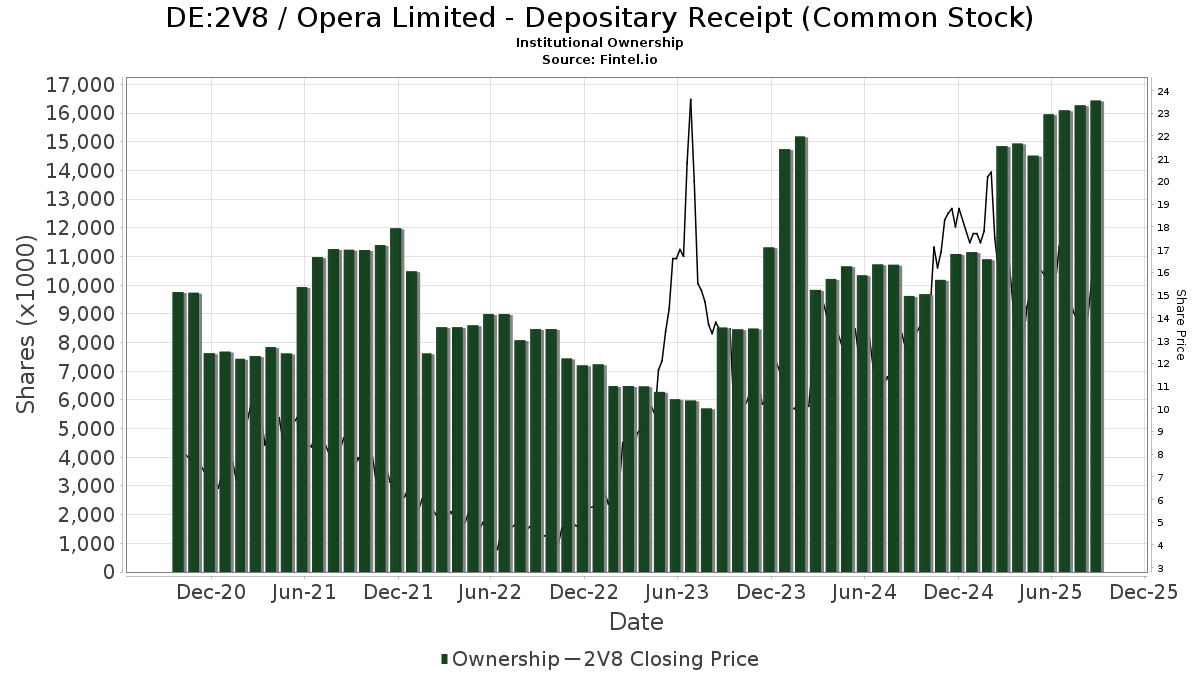

| Institusjonelle eiere | 179 total, 172 long only, 0 short only, 7 long/short - change of −1,65% MRQ |

| Aksjekurs | 16,62 |

| Gjennomsnittlig porteføljeallokering | 0.2073 % - change of −2,92% MRQ |

| Institusjonelle aksjer (Long) | 16 439 714 (ex 13D/G) - change of 0,44MM shares 2,73% MRQ |

| Institusjonell verdi (Long) | $ 304 778 USD ($1000) |

Institusjonelt eierskap og aksjonærer

Opera Limited - Depositary Receipt (Common Stock) (DE:2V8) har 179 institusjonelle eiere og aksjonærer som har sendt inn 13D/G- eller 13F-skjemaer til Securities Exchange Commission (SEC). Disse institusjonene eier til sammen 16,439,714 aksjer. De største aksjonærene inkluderer Toroso Investments, LLC, BLOK - Amplify Transformational Data Sharing ETF, Arrowstreet Capital, Limited Partnership, Portolan Capital Management, LLC, Marshall Wace, Llp, G2 Investment Partners Management LLC, Driehaus Capital Management Llc, Lord, Abbett & Co. Llc, Citadel Advisors Llc, and FSAKX - Strategic Advisers U.S. Total Stock Fund .

Opera Limited - Depositary Receipt (Common Stock) (DB:2V8) institusjonell eierstruktur viser nåværende posisjoner i selskapet fordelt på institusjoner og fond, samt de siste endringene i posisjonsstørrelse. De største aksjonærene kan være individuelle investorer, verdipapirfond, hedgefond eller institusjoner. Schedule 13D indikerer at investoren eier (eller har eid) mer enn 5 % av selskapet og har til hensikt (eller hadde til hensikt) å aktivt forfølge en endring i forretningsstrategien. Schedule 13G indikerer en passiv investering på over 5 %.

The share price as of September 10, 2025 is 16,62 / share. Previously, on September 11, 2024, the share price was 12,50 / share. This represents an increase of 32,96% over that period.

Fondssentiment-score

Fondssentiment Score (også kjent som akkumulering av eierskap poengsum) viser hvilke aksjer som er mest kjøpt av fond. Den er resultatet av en sofistikert, kvantitativ flerfaktormodell som identifiserer selskaper med de høyeste nivåene av institusjonell akkumulering. Beregningsmodellen for poeng bruker en kombinasjon av den totale økningen i antall offentliggjorte eiere, endringer i porteføljeallokeringen til disse eierne og andre beregninger. Tallet går fra 0 til 100, der høyere tall indikerer en høyere grad av akkumulering i forhold til sammenlignbare selskaper, der 50 er gjennomsnittet.

Oppdateringsfrekvens: Daglig

Sjekk ut Ownership Explorer, som inneholder en liste over de høyest rangerte selskapene.

13F- og NPORT-arkiveringer

Detaljer om 13F-arkiveringer er gratis. Detaljer om NP-arkiveringer krever et premium-medlemskap. Grønne rader indikerer nye posisjoner. Røde rader indikerer lukkede posisjoner. Klikk på lenke ikonet for å se hele transaksjonshistorikken.

Oppgrader

for å låse opp premiedata og eksportere til Excel. ![]() .

.

| Fildato | Kilde | Investor | Type | Gjennomsnittlig pris (estimert) |

Aksjer | Δ Aksjer (%) |

Rapportert verdi ($1000) | Verdi (%) | Portallokering (%) | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Soviero Asset Management, LP | 0 | −100,00 | 0 | |||||

| 2025-08-28 | NP | BLOK - Amplify Transformational Data Sharing ETF | 1 164 213 | 5,01 | 22 004 | 24,51 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 11 156 | −16,40 | 211 | −0,94 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 137 232 | −14,68 | 2 594 | 1,17 | ||||

| 2025-06-26 | NP | ISCF - iShares Edge MSCI Multifactor Intl Small-Cap ETF | 14 720 | −43,89 | 251 | −47,71 | ||||

| 2025-08-11 | 13F | Bell Investment Advisors, Inc | 44 | −38,89 | 1 | −100,00 | ||||

| 2025-07-22 | NP | GXUS - Goldman Sachs MarketBeta(R) Total International Equity ETF | 1 447 | 0,00 | 27 | −3,70 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 4 016 | 46,73 | 76 | 74,42 | ||||

| 2025-07-11 | 13F | Harbour Capital Advisors, LLC | 16 500 | 331 | ||||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 86 800 | 95,06 | 1 641 | 131,31 | ||||

| 2025-07-30 | NP | AUERX - Auer Growth Fund | 34 000 | 0,00 | 624 | −1,74 | ||||

| 2025-08-11 | 13F | Bellwether Advisors, LLC | 130 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 103 452 | −32,78 | 1 955 | −20,30 | ||||

| 2025-08-26 | NP | EQ ADVISORS TRUST - 1290 VT Micro Cap Portfolio Class IB | 81 122 | 60,15 | 1 533 | 89,96 | ||||

| 2025-08-12 | 13F | Handelsbanken Fonder AB | 0 | −100,00 | 0 | |||||

| 2025-07-16 | 13F | Signaturefd, Llc | 5 224 | 9,91 | 99 | 30,67 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Call | 33 400 | −22,69 | 631 | −8,28 | |||

| 2025-08-13 | 13F | Walleye Trading LLC | 6 791 | 128 | ||||||

| 2025-08-13 | 13F | Walleye Trading LLC | Put | 2 600 | −40,91 | 49 | −30,00 | |||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 20 | 0 | ||||||

| 2025-08-13 | 13F | OMERS ADMINISTRATION Corp | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 14 857 | 281 | ||||||

| 2025-08-19 | 13F | State of Wyoming | 2 340 | 44 | ||||||

| 2025-08-12 | 13F | North Star Asset Management Inc | 12 150 | 230 | ||||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 126 918 | −9,27 | 2 399 | 7,58 | ||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 12 131 | −3,28 | 229 | 15,08 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 50 | −98,32 | 1 | −100,00 | ||||

| 2025-08-14 | 13F | Scientech Research LLC | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 5 000 | 0,00 | 94 | 18,99 | ||||

| 2025-08-07 | 13F | Zurcher Kantonalbank (Zurich Cantonalbank) | 0 | −100,00 | 0 | |||||

| 2025-07-15 | 13F | North Star Investment Management Corp. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | G2 Investment Partners Management LLC | 700 000 | −33,54 | 13 230 | −21,20 | ||||

| 2025-07-08 | 13F | Richard P Slaughter Associates Inc | 41 800 | −39,11 | 790 | −27,79 | ||||

| 2025-08-11 | 13F | Bradley Foster & Sargent Inc/ct | 26 256 | 496 | ||||||

| 2025-07-17 | 13F | Klein Pavlis & Peasley Financial, Inc. | 75 100 | 2,88 | 1 419 | 20,46 | ||||

| 2025-08-28 | NP | FRNKX - Frank Value Fund INVESTOR CLASS | 59 023 | 1,74 | 1 116 | 20,67 | ||||

| 2025-06-25 | NP | TDVI - FT Vest Technology Dividend Target Income ETF | 2 104 | 1 284,21 | 36 | 3 400,00 | ||||

| 2025-05-02 | 13F/A | Mackenzie Financial Corp | 18 724 | 355 | ||||||

| 2025-06-27 | NP | LFGY - YieldMax(TM) Crypto Industry & Tech Portfolio Option Income ETF | 201 698 | 125,64 | 3 443 | 110,26 | ||||

| 2025-08-14 | 13F | Manufacturers Life Insurance Company, The | 14 150 | 267 | ||||||

| 2025-06-24 | NP | SFILX - Schwab Fundamental International Small Company Index Fund Institutional Shares | 9 211 | 15,54 | 157 | 7,53 | ||||

| 2025-08-14 | 13F | Toronto Dominion Bank | 70 | 1 | ||||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 193 507 | 50,48 | 3 657 | 78,48 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 32 369 | −2,26 | 612 | 15,94 | ||||

| 2025-08-07 | 13F | Hennion & Walsh Asset Management, Inc. | 93 497 | −13,88 | 1 767 | 2,14 | ||||

| 2025-07-23 | 13F | Roundview Capital LLC | 36 388 | 688 | ||||||

| 2025-07-31 | 13F | Shaker Investments Llc/oh | 38 939 | 0,00 | 736 | 18,55 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 97 707 | −16,22 | 1 847 | −0,65 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 367 | 0,00 | 7 | 20,00 | ||||

| 2025-08-14 | 13F | IHT Wealth Management, LLC | 11 700 | 0,00 | 221 | 18,82 | ||||

| 2025-04-24 | 13F | Trust Co Of Vermont | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 348 819 | −18,37 | 6 593 | −3,22 | ||||

| 2025-07-25 | 13F | JustInvest LLC | 12 652 | 239 | ||||||

| 2025-08-14 | 13F | Millennium Management Llc | 419 035 | 107,61 | 7 920 | 146,16 | ||||

| 2025-08-14 | 13F | Driehaus Capital Management Llc | 670 248 | 4,24 | 12 668 | 23,60 | ||||

| 2025-08-12 | 13F | Virtu Financial LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 0 | −100,00 | 0 | |||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 0 | −100,00 | 0 | |||||

| 2025-05-12 | 13F | C2P Capital Advisory Group, LLC d.b.a. Prosperity Capital Advisors | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-06 | 13F | Stone House Investment Management, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Worth Venture Partners, LLC | 21 350 | 35,85 | 404 | 61,20 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 704 | 70,05 | 13 | 116,67 | ||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 617 | 3 529,41 | 12 | |||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 100 | 0,00 | 2 | 0,00 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 70 041 | 1,16 | 1 324 | 19,95 | ||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 29 883 | 564 | ||||||

| 2025-06-26 | NP | ETISX - E*TRADE No Fee International Index Fund | 47 | 1 | ||||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Caption Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-13 | 13F | Sei Investments Co | 18 736 | 0,00 | 355 | 0,00 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 10 923 | −0,63 | 206 | 17,71 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 7 441 | 141 | ||||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 16 100 | −26,48 | 304 | −12,89 | |||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 198 500 | 79,64 | 3 752 | 113,00 | |||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Call | 36 300 | 15,61 | 686 | 37,20 | |||

| 2025-08-13 | 13F | First Trust Advisors Lp | 74 803 | 2,55 | 1 414 | 21,60 | ||||

| 2025-08-14 | 13F | Van Eck Associates Corp | 4 556 | 0 | ||||||

| 2025-04-10 | 13F | Thurston, Springer, Miller, Herd & Titak, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Portolan Capital Management, LLC | 876 440 | −42,70 | 16 565 | −32,07 | ||||

| 2025-08-14 | 13F | Man Group plc | 30 639 | 579 | ||||||

| 2025-08-15 | 13F | Caxton Associates Llp | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 10 100 | 9,78 | 0 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 38 200 | 45,25 | 1 | ||||

| 2025-05-09 | 13F | R Squared Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-26 | NP | DRIOX - Driehaus International Small Cap Growth Fund | 86 268 | 2,12 | 1 630 | 21,10 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 742 | 2,91 | 12 | −15,38 | ||||

| 2025-08-01 | 13F | Redwood Park Advisors LLC | 176 | 0,00 | 3 | 50,00 | ||||

| 2025-08-07 | 13F | Samalin Investment Counsel, LLC | 79 389 | 15,72 | 1 500 | 37,24 | ||||

| 2025-08-14 | 13F | Whetstone Capital Advisors, LLC | 370 472 | 7 002 | ||||||

| 2025-07-25 | 13F | Allspring Global Investments Holdings, LLC | 17 000 | 0,00 | 321 | 18,89 | ||||

| 2025-08-06 | 13F | Fox Run Management, L.l.c. | 29 289 | 554 | ||||||

| 2025-08-28 | NP | PMEFX - PENN MUTUAL AM 1847 INCOME FUND I Shares | 50 419 | 31,23 | 953 | 55,56 | ||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 21 478 | −12,93 | 406 | 3,05 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 1 425 | 0,00 | 27 | 18,18 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 20 019 | 0,41 | 378 | 19,24 | ||||

| 2025-05-14 | 13F | Mml Investors Services, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Headwater Capital Co Ltd | 50 000 | 945 | ||||||

| 2025-08-26 | NP | GLBIX - Leuthold Global Fund Institutional Class | 3 627 | 0,00 | 69 | 19,30 | ||||

| 2025-07-21 | 13F | Qrg Capital Management, Inc. | 15 496 | 293 | ||||||

| 2025-08-14 | 13F | Boothbay Fund Management, Llc | 135 246 | −33,07 | 2 556 | −20,65 | ||||

| 2025-08-14 | 13F | State Of Wisconsin Investment Board | 252 274 | −5,10 | 4 768 | 12,51 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 33 130 | −2,23 | 1 | |||||

| 2025-08-14 | 13F | Voloridge Investment Management, Llc | 158 952 | 55,63 | 3 004 | 84,52 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 33 100 | −36,22 | 626 | −24,43 | |||

| 2025-05-01 | 13F | BankPlus Trust Department | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Credit Agricole S A | 231 523 | 28,98 | 3 690 | 8,56 | ||||

| 2025-07-31 | 13F | Catalyst Capital Advisors LLC | 13 500 | 0,00 | 255 | 18,60 | ||||

| 2025-08-29 | NP | WTAI - WisdomTree Artificial Intelligence and Innovation Fund NA | 97 949 | −1,73 | 1 851 | 16,56 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 102 123 | −0,92 | 1 930 | 17,54 | ||||

| 2025-07-11 | 13F | Adirondack Trust Co | 854 | 58,74 | 16 | 100,00 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-18 | 13F | Founders Capital Management | 600 | 0,00 | 11 | 22,22 | ||||

| 2025-07-30 | NP | APIE - ActivePassive International Equity ETF | 41 821 | 239,84 | 767 | 234,93 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 64 500 | 67,97 | 1 219 | 99,18 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 113 600 | −50,37 | 2 147 | −41,15 | |||

| 2025-08-05 | 13F | Redwood Wealth Management Group, LLC | 27 715 | −0,72 | 524 | 17,79 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 88 500 | 180,95 | 1 673 | 233,07 | |||

| 2025-05-12 | 13F | Jpmorgan Chase & Co | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | 588 226 | 56,63 | 11 117 | 85,72 | ||||

| 2025-08-12 | 13F | Coston, McIsaac & Partners | 32 | 0 | ||||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 839 487 | −24,97 | 15 866 | −11,03 | ||||

| 2025-04-15 | 13F | SG Americas Securities, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Continuum Advisory, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | American Trust Investment Advisors, LLC | 132 432 | −27,06 | 2 503 | −13,55 | ||||

| 2025-07-11 | 13F | UMA Financial Services, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Greykasell Wealth Strategies, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-16 | 13F | Highline Wealth Partners Llc | 51 | 0,00 | 1 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 299 943 | −44,53 | 5 669 | −34,24 | ||||

| 2025-08-13 | 13F | JT Stratford LLC | 138 280 | 1,06 | 2 613 | 19,81 | ||||

| 2025-08-25 | NP | STCE - Schwab Crypto Thematic ETF | 80 141 | 1,32 | 1 515 | 20,16 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Penn Mutual Asset Management, LLC | 50 419 | 31,23 | 953 | 55,56 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | 4 156 | 79 | ||||||

| 2025-08-13 | 13F | Walleye Capital LLC | Call | 38 500 | −17,38 | 728 | −2,02 | |||

| 2025-05-14 | 13F | WealthCollab, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Walleye Capital LLC | Put | 700 | −75,00 | 13 | −70,45 | |||

| 2025-06-27 | NP | EAISX - Parametric International Equity Fund Investor Class | 7 000 | 0,00 | 119 | −7,03 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 17 968 | −10,82 | 339 | 5,61 | ||||

| 2025-05-02 | 13F | Napatree Capital Llc | 26 160 | −2,30 | 417 | −17,95 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 22 098 | 1 086,15 | 448 | 1 393,33 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 12 958 | 245 | ||||||

| 2025-06-30 | NP | PDN - Invesco FTSE RAFI Developed Markets ex-U.S. Small-Mid ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 541 | 26 | ||||||

| 2025-07-28 | 13F | Td Asset Management Inc | 16 331 | −6,56 | 309 | 10,79 | ||||

| 2025-08-14 | 13F | Graham Capital Management, L.P. | 17 349 | 328 | ||||||

| 2025-08-05 | 13F | Huntington National Bank | 2 399 | −13,52 | 45 | 2,27 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | CWM Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-11 | 13F/A | Livforsakringsbolaget Skandia, Omsesidigt | 128 000 | 89,07 | 20 192 | 1 774,84 | ||||

| 2025-08-14 | 13F | Aquatic Capital Management LLC | 13 514 | −44,74 | 255 | −34,45 | ||||

| 2025-08-12 | 13F | Legal & General Group Plc | 164 066 | 1 614,92 | 3 101 | 1 939,47 | ||||

| 2025-04-16 | 13F | Wealth Enhancement Advisory Services, Llc | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 8 570 | −64,40 | 162 | −57,96 | ||||

| 2025-08-12 | 13F | Left Brain Wealth Management, LLC | 21 000 | 100,19 | 397 | 137,13 | ||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 80 200 | 23,76 | 1 516 | 46,80 | ||||

| 2025-06-25 | NP | BKIE - BNY Mellon International Equity ETF | 1 588 | 27 | ||||||

| 2025-08-13 | 13F | Leuthold Group, Llc | 13 815 | 0,00 | 261 | 18,64 | ||||

| 2025-04-30 | 13F | Optimum Investment Advisors | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Maxi Investments CY Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 0 | −100,00 | 0 | |||||

| 2025-08-28 | NP | GWX - SPDR(R) S&P(R) International Small Cap ETF | 15 716 | −1,56 | 297 | 16,93 | ||||

| 2025-07-25 | NP | FNDC - Schwab Fundamental International Small Company Index ETF This fund is a listed as child fund of Charles Schwab Investment Management Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 42 556 | −1,82 | 781 | −3,47 | ||||

| 2025-08-01 | 13F | Motco | 200 | 3 | ||||||

| 2025-08-14 | 13F | State Street Corp | 29 116 | 13,89 | 550 | 35,14 | ||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 931 594 | 0,00 | 17 607 | 18,57 | ||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | Call | 0 | −100,00 | 0 | ||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | 49 976 | −47,46 | 945 | −37,73 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 3 926 | 0,00 | 74 | 19,35 | ||||

| 2025-08-14 | 13F | Peak6 Llc | Call | 52 900 | 1 000 | |||||

| 2025-08-12 | 13F | MAI Capital Management | 55 | 1 | ||||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 4 667 | 242,16 | 88 | 319,05 | ||||

| 2025-08-12 | 13F | Calton & Associates, Inc. | 13 235 | 0,38 | 250 | 19,05 | ||||

| 2025-08-25 | NP | TDIV - First Trust NASDAQ Technology Dividend Index Fund This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 74 803 | 2,55 | 1 414 | 21,60 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | State of Tennessee, Treasury Department | 4 366 | 83 | ||||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 8 853 | 500,20 | 167 | 626,09 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 51 076 | −7,71 | 965 | 9,41 | ||||

| 2025-08-14 | 13F | DZ BANK AG Deutsche Zentral Genossenschafts Bank, Frankfurt am Main | 12 285 | 99,17 | 232 | 136,73 | ||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 191 083 | 4 220,21 | 4 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 179 900 | 9,16 | 3 400 | 29,47 | |||

| 2025-07-24 | NP | FNCMX - Fidelity Nasdaq Composite Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 19 937 | 0,00 | 366 | −1,88 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 38 399 | 726 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 496 400 | 0,34 | 9 382 | 18,97 | |||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 0 | −100,00 | 0 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-06-26 | NP | LAMGX - Lord Abbett Micro-Cap Growth Fund Class A | 116 846 | 0,00 | 1 995 | −6,82 | ||||

| 2025-08-21 | NP | NODE - Onchain Economy ETF | 4 100 | 77 | ||||||

| 2025-08-14 | 13F | Harwood Advisory Group, LLC | 625 | 0,00 | 12 | 0,00 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 3 929 | −68,62 | 75 | −62,31 | ||||

| 2025-05-15 | 13F | Schonfeld Strategic Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Creative Planning | 10 021 | 189 | ||||||

| 2025-08-11 | 13F | EntryPoint Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-21 | NP | MXMTX - Great-West Small Cap Growth Fund Investor Class | 37 446 | 80,91 | 708 | 114,89 | ||||

| 2025-05-12 | 13F | Fmr Llc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-07-29 | NP | FDLS - Inspire Fidelis Multi Factor ETF | 43 228 | −26,24 | 793 | −32,34 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 2 150 | 16,22 | 41 | 37,93 | ||||

| 2025-07-31 | 13F | Ingalls & Snyder Llc | 77 450 | 0,00 | 1 | 0,00 | ||||

| 2025-07-31 | 13F | CVA Family Office, LLC | 90 | 0,00 | 2 | 0,00 | ||||

| 2025-08-07 | 13F | Campbell & CO Investment Adviser LLC | 15 595 | 295 | ||||||

| 2025-08-07 | 13F | Allworth Financial LP | 32 | 0,00 | 1 | |||||

| 2025-08-19 | 13F | MRP Capital Investments, LLC | 47 991 | 20,28 | 907 | 42,61 | ||||

| 2025-08-27 | NP | INSAX - Catalyst Insider Buying Fund Class A | 13 500 | 0,00 | 255 | 18,60 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 11 804 | −60,80 | 223 | −53,54 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 31 289 | 9,62 | 591 | 29,89 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Metavasi Capital LP | 208 235 | 3 936 | ||||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 26 494 | 15,48 | 501 | 36,99 | ||||

| 2025-04-30 | 13F | Cornerstone Investment Partners, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 3 093 | −10,19 | 58 | 7,41 | ||||

| 2025-08-12 | 13F | Trexquant Investment LP | 25 794 | 488 | ||||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 60 | 566,67 | 1 | |||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 4 108 | 46,30 | 76 | 66,67 | ||||

| 2025-05-15 | 13F | GWM Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 15 800 | 2,60 | 299 | 21,63 | ||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-05-14 | 13F | Peak6 Llc | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-05-14 | 13F | Peak6 Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 51 197 | 35,05 | 968 | 60,10 | ||||

| 2025-08-28 | NP | DTSGX - Small Company Growth Portfolio Investment Class | 5 898 | 58,68 | 111 | 88,14 | ||||

| 2025-07-15 | 13F | SJS Investment Consulting Inc. | 200 | 0,00 | 4 | 0,00 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 71 224 | −15,53 | 1 346 | 0,15 | ||||

| 2025-07-22 | NP | GSID - Goldman Sachs MarketBeta International Equity ETF | 4 031 | −3,59 | 74 | −6,41 | ||||

| 2025-05-15 | 13F | Wolverine Trading, Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 8 175 | 0,00 | 155 | 18,46 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 140 958 | 83,65 | 2 664 | 117,83 | ||||

| 2025-08-12 | 13F | Skopos Labs, Inc. | 347 | 0,00 | 6 | 0,00 | ||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 1 450 462 | 12,07 | 27 414 | 32,88 | ||||

| 2025-07-11 | 13F | Kingstone Capital Partners Texas, LLC | 245 280 | 3 | ||||||

| 2025-08-13 | 13F | Jump Financial, LLC | 149 768 | 246,93 | 2 831 | 311,34 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 97 800 | −19,37 | 1 848 | −4,40 | ||||

| 2025-08-14 | 13F | TCG Advisory Services, LLC | 9 000 | 0,00 | 170 | 18,88 | ||||

| 2025-05-15 | 13F | Point72 Hong Kong Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Harvey Capital Management Inc | 36 800 | 748 | ||||||

| 2025-08-14 | 13F | TCG Advisory Services, LLC | Call | 3 000 | 0,00 | 57 | 19,15 | |||

| 2025-05-12 | 13F | Prestige Wealth Management Group LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F/A | DLD Asset Management, LP | Call | 0 | −100,00 | 0 | ||||

| 2025-08-14 | 13F | Lord, Abbett & Co. Llc | 610 671 | 50,35 | 12 | 83,33 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 10 241 | −12,70 | 193 | 3,76 | ||||

| 2025-07-30 | NP | FSAKX - Strategic Advisers U.S. Total Stock Fund | 562 355 | −17,24 | 10 319 | −18,61 | ||||

| 2025-08-14 | 13F | Banque Transatlantique SA | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | USS Investment Management Ltd | 38 228 | 722 | ||||||

| 2025-08-14 | 13F | Stifel Financial Corp | 31 456 | −2,36 | 595 | 15,79 | ||||

| 2025-08-12 | 13F | Rhumbline Advisers | 8 120 | −0,81 | 153 | 17,69 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 259 035 | −1,89 | 4 896 | 16,33 |

Other Listings

| US:OPRA | USD 19,68 |