Grunnleggende statistikk

| Short Interest | 4 477 005 shares - source: NYSE |

| Short Interest Ratio | 12,53 Days to Cover |

| Short Interest % Float | 10,31 % - source: NYSE (short interest), Capital IQ (float) |

| Off-Exchange Short Volume | 105 479 shares - source: FINRA (inc. Dark Pool volume) |

| Off-Exchange Short Volume Ratio | 64,77 % - source: FINRA (inc. Dark Pool volume) |

Introduksjon

Denne short rente-trackeren inneholder en rekke data om korte renter, hentet fra en rekke ulike partnere. Dataene er organisert etter oppdateringshyppighet, med intradag-data øverst (tilgjengelighet av short aksjer, short lånegebyr-rate), daglige data ( short volum, mislykkede leveranser) i midten, og de langsomst oppdaterte dataene (kort rente) nederst. Merk at korte renter publiseres to ganger i måneden, etter en tidsplan fastsatt av FINRA.

Short Squeeze Score

Short Squeeze Score er resultatet av en sofistikert, flerfaktorbasert kvantitativ modell som identifiserer selskaper som har høyest risiko for å oppleve en short squeeze. Scoringsmodellen bruker en kombinasjon av korte renter, flyt, gebyrsatser for shortlån og andre beregninger. Tallet går fra 0 til 100, der høyere tall indikerer høyere risiko for en short squeeze i forhold til sammenlignbare selskaper, mens 50 er gjennomsnittet.

Oppdateringsfrekvens: Intradag

Se våre lister over short squeeze for USA, Canada, Australia og Hongkong.

Short lånegebyr-rate

GVA / Granite Construction Incorporated short lånegebyr-rate er vist i tabellen nedenfor. Denne tabellen viser renten som må betales av en shortselger av US:GVA til långiveren av det aktuelle verdipapiret. Dette gebyret vises som en årlig prosentsats (ÅOP). Långivere er fond eller enkeltpersoner som eier verdipapiret og som har meddelt megleren at de er villige til å låne det ut. Utbytte som utbetales til et shorted verdipapir, går til eieren/långiveren av verdipapiret, ikke til låntakeren.

- Start, Min., Maks., Siste (lånepriser)

- Disse representerer dagens innlånsrenter, med renten ved starten av dagen, ved slutten av dagen (eller senest inneværende dag), dagens minimumsrente og dagens maksimumsrente. I motsetning til de implisitte innlånsrentene for opsjoner, presenterer kilden vår for disse dataene dem alltid som positive tall, og de representerer en annualisert rente som låntakeren betaler for aksjene.

Oppdateringsfrekvens: Intradag hvert 30. minutt.

| Dato | Start | Min | Maks | Siste |

|---|---|---|---|---|

| 2025-09-12 | 0,26 | 0,26 | 0,26 | 0,26 |

| 2025-09-11 | 0,39 | 0,26 | 0,39 | 0,26 |

| 2025-09-10 | 0,39 | 0,39 | 0,39 | 0,39 |

| 2025-09-09 | 0,40 | 0,39 | 0,40 | 0,39 |

| 2025-09-08 | 0,39 | 0,39 | 0,40 | 0,40 |

| 2025-09-05 | 0,38 | 0,38 | 0,39 | 0,39 |

| 2025-09-04 | 0,38 | 0,38 | 0,38 | 0,38 |

| 2025-09-03 | 0,37 | 0,37 | 0,39 | 0,38 |

| 2025-09-02 | 0,37 | 0,37 | 0,37 | 0,37 |

| 2025-09-01 | 0,37 | 0,37 | 0,37 | 0,37 |

Short-salgsvolum (utenfor børs levert av FINRA)

GVA / Granite Construction Incorporated short-salgsvolumet utenfor børs vises i følgende diagram. Shortsalgsvolumet viser antall handler som er markert som shortsalg på ulike handelsplasser. Hvis du vil ha mer informasjon om hvordan du tolker disse dataene, kan du lese denne informasjonsmeldingen fra FINRA.

Oppdateringsfrekvens: Daglig ved dagens slutt

- FINRAs ikke-fritatte volum

- Antall short-aksjer som er omsatt. Dette tallet oppgis ikke av FINRA, men vi beregner det ved å trekke "fritatt" fra "Short-volumet"

- FINRA fritatte volum

- Antall short-aksjer solgt som var fritatt fra uptick-regelen. Dette oppgis av FINRA. Dette tallet er inkludert i både "Short Volum" og " Totale volum".

- FINRAs short-volum

- Antall shortsolgte aksjer rapportert av FINRA. Dette inkluderer både fritatte og ikke-fritatte.

- FINRAs totale volum

- Totalt antall aksjer handlet utenfor børs rapportert av FINRA.

- FINRAs forholdstall for shortvolum

- FINRAs short-volum / FINRAs totale volum

| Markedsdato | FINRA Ikke-fritatt volum |

FINRA Fritatt volum |

FINRAs Short volum |

FINRAs Totale volum |

FINRA Short Volum Forholdstall |

||||

|---|---|---|---|---|---|---|---|---|---|

| 2025-09-11 | 105 479 | + | 0 | = | 105 479 | / | 162 844 | = | 64,77 |

| 2025-09-10 | 48 963 | + | 0 | = | 48 963 | / | 112 847 | = | 43,39 |

| 2025-09-09 | 61 809 | + | 0 | = | 61 809 | / | 108 160 | = | 57,15 |

| 2025-09-08 | 182 878 | + | 0 | = | 182 878 | / | 258 227 | = | 70,82 |

| 2025-09-05 | 281 693 | + | 0 | = | 281 693 | / | 331 858 | = | 84,88 |

| 2025-09-04 | 75 041 | + | 0 | = | 75 041 | / | 146 824 | = | 51,11 |

| 2025-09-03 | 72 107 | + | 0 | = | 72 107 | / | 109 691 | = | 65,74 |

| 2025-09-02 | 65 339 | + | 0 | = | 65 339 | / | 107 523 | = | 60,77 |

| 2025-08-29 | 61 235 | + | 0 | = | 61 235 | / | 120 483 | = | 50,82 |

| 2025-08-28 | 60 146 | + | 0 | = | 60 146 | / | 148 891 | = | 40,40 |

Short-salgsvolum (kombinert børs + utenfor børs)

Det kombinerte short-salgsvolumet på og utenfor børs for GVA / Granite Construction Incorporated er oppgitt i tabellen nedenfor. For å beregne et nøyaktig shortvolumforhold samler vi inn data fra en rekke handelsplasser, men ikke ALLE handelsplasser. Dette er viktig fordi det betyr at de aggregerte kolonnene for short- og totalvolum ikke viser de faktiske volumene på tvers av alle handelsplasser, men bare de handelsplassene vi sporer.

- FINRA Short-volum

- Antall short-aksjer handlet utenfor børs rapportert av FINRA. Dette inkluderer både fritatte og ikke-fritatte.

- CBOE Short-volum

- Antall short-aksjer handlet rapportert av CBOE.

- PSX/BX Short-volum

- Antall short-aksjer handlet rapportert av NASDAQ på handelsplassene PSX/BX

- Aggregert Short-volum

- FINRA short-volum + CBOE short-volum + PSX/BX short-volum. Dette er ikke det totale shortvolumet på alle handelsplasser.

- Aggregert totalt volum

- FINRA Totalt volum + CBOE Totalt volum + PSX/BX Totalt volum. Dette er ikke det totale volumet på alle handelsplasser.

- Aggregert Short-volum-forhold

- Aggregert shortvolum / aggregert totalt volum.

* Kolonnen for aggregert shortvolum og aggregert totalvolum viser ikke det faktiske totalvolumet på alle markedsplasser, men bare de markedsplassene vi følger.

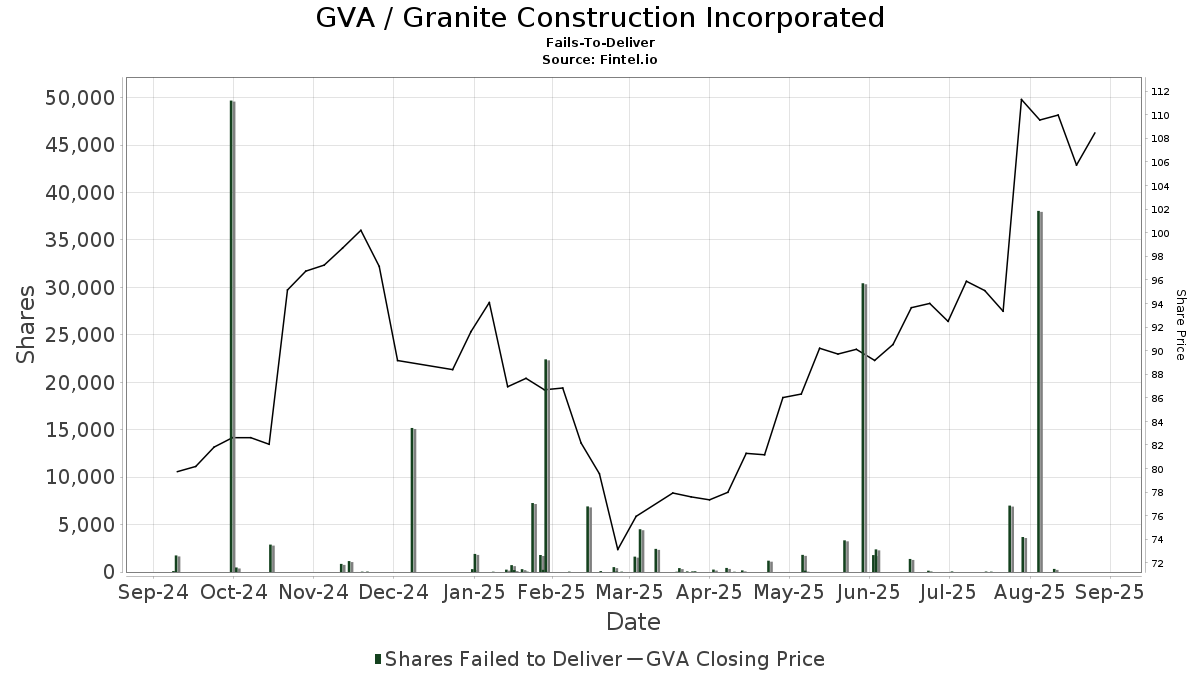

Mislykkede leveranser

Verdiene for totalt antall aksjer som ikke ble levert, representerer den samlede nettosaldoen av aksjer som ikke ble levert på en bestemt oppgjørsdag. Mislykkede leveranser på en gitt dag er et kumulativt antall av alle mislykkede leveranser frem til den dagen, pluss nye mislykkede leveranser som inntreffer den dagen, minus mislykkede leveranser som gjøres opp den dagen. Tallet er ikke et daglig antall mislykkede leveranser, men et kombinert tall som inkluderer både nye mislykkede leveranser på rapporteringsdagen og eksisterende mislykkede leveranser. Med andre ord gjenspeiler disse tallene det aggregerte antallet mislykkede leveranser på et bestemt tidspunkt, og kan ha liten eller ingen sammenheng med gårsdagens aggregerte leveranser. Det er derfor viktig å merke seg at det ikke er mulig å fastslå alderen på feilene ved å se på disse tallene. Hvis alle aksjene ble levert på en bestemt dag, vil det ikke være noen oppføring i tabellen.

Oppdateringsfrekvens: SEC publiserer daglige data i batcher som leveres to ganger i måneden med ca. to ukers forsinkelse. For eksempel vil daglige data for mars måned komme i midten av april.

Disse dataene er IKKE splittjusterte - de gjenspeiler rådataene fra SEC.

| Dato | Pris | Kvantitet | Verdi |

|---|---|---|---|

| 2025-08-13 | 109,37 | 3 687 | 403 247,19 |

| 2025-08-08 | 100,94 | 7 000 | 706 580,00 |

| 2025-08-01 | 94,47 | 38 | 3 589,86 |

| 2025-07-30 | 94,71 | 51 | 4 830,21 |

| 2025-07-17 | 92,48 | 59 | 5 456,32 |

| 2025-07-09 | 92,65 | 33 | 3 057,45 |

| 2025-07-08 | 93,71 | 139 | 13 025,69 |

| 2025-07-01 | 93,51 | 1 376 | 128 669,76 |

| 2025-06-18 | 88,77 | 2 385 | 211 716,45 |

| 2025-06-17 | 89,22 | 1 782 | 158 990,04 |

| 2025-06-13 | 89,49 | 30 433 | 2 723 449,17 |

| 2025-06-06 | 90,66 | 3 339 | 302 713,74 |

| 2025-05-22 | 86,32 | 143 | 12 343,76 |

| 2025-05-21 | 87,00 | 1 806 | 157 122,00 |

| 2025-05-08 | 81,17 | 1 193 | 96 835,81 |

| 2025-04-28 | 79,92 | 172 | 13 746,24 |

| 2025-04-25 | 80,00 | 28 | 2 240,00 |

| 2025-04-22 | 75,18 | 429 | 32 252,22 |

| 2025-04-17 | 77,35 | 257 | 19 878,95 |

| 2025-04-10 | 77,60 | 78 | 6 052,80 |

GVA Short rente (Daglige oppdateringer fra Fintel)

Denne delen bruker offisiell short rente levert av NYSE og gir noen merverdimetrikker som beregnes daglig. Short rente oppdateres to ganger i måneden etter en fastsatt tidsplan, men flyt kan oppdateres hyppigere (selv om det ikke endrer seg hver dag), så gir vi daglige oppdateringer av Short rente % Float for de siste femten dagene. Dager for å dekke beregnes daglig basert på de siste fem dagene med handelsvolum.

Oppdateringsfrekvens: Short rente - to ganger i måneden. Flyt - daglig (men endres sjelden) Publiseringsplan for Short rente

Disse dataene er splittjusterte.

| Markedsdato | Short rente (aksjer) |

Dager til dekning | Flyt (MM-aksjer) |

Flyt minus SI (MM aksjer) |

Short rente % Flyt |

|---|---|---|---|---|---|

| 2025-09-11 | |||||

| 2025-09-10 | |||||

| 2025-09-09 | |||||

| 2025-09-08 | |||||

| 2025-09-05 | |||||

| 2025-09-04 | |||||

| 2025-09-03 | |||||

| 2025-09-02 | |||||

| 2025-09-01 | |||||

| 2025-08-29 |

Kilde: Short rente oppgitt av NYSE- utestående aksjer og aksjeflyt oppgitt av Capital IQ.

Short rente (offisielle NYSE-data)

Denne dataen er den offisielle shortrente dataen, som levert av NYSE. Short rente er det totale antallet åpne shortposisjoner i et verdipapir. Dager til dekning er short rente dividert med gjennomsnittlig volum. Dager til dekning som er oppgitt her er den offiselle verdien levert av NYSE og kan avvike fra Dager til dekning publisert andre steder på Fintel, fordi vi bruker en kortere tilbakeblikk-analyse når vi beregner gjennomsnittlig volum.

Oppdateringsfrekvens: To ganger i måneden

Disse dataene er IKKE splittjusterte - de gjenspeiler rådataene fra børsen.

| Oppgjørs dato |

Short rente | Prosentvis endring | Dager til dekning | Flyt (MM aksjer) | Short rente % av Flyt |

Utestående aksjer (MM aksjer) |

Short rente % av SO |

|---|---|---|---|---|---|---|---|

| 2025-08-29 | 4 477 005 | 7,37 | 10,11 | ||||

| 2025-08-15 | 4 169 580 | 5,09 | 4,76 | ||||

| 2025-07-31 | 3 967 628 | 1,21 | 7,68 | ||||

| 2025-07-15 | 3 920 004 | 3,32 | 10,47 | ||||

| 2025-06-30 | 3 794 104 | −1,91 | 6,39 | ||||

| 2025-06-13 | 3 867 878 | −0,31 | 8,11 | ||||

| 2025-05-30 | 3 880 022 | −9,48 | 7,89 | ||||

| 2025-05-15 | 4 286 451 | −7,74 | 5,69 | ||||

| 2025-04-30 | 4 646 303 | −7,59 | 8,98 | ||||

| 2025-04-15 | 5 028 055 | 12,01 | 6,08 | ||||

| 2025-03-31 | 4 488 851 | 0,61 | 6,03 | ||||

| 2025-03-14 | 4 461 747 | 2,07 | 4,93 | ||||

| 2025-02-28 | 4 371 263 | −11,06 | 6,46 | ||||

| 2025-02-14 | 4 915 118 | 3,56 | 8,08 | ||||

| 2025-01-31 | 4 746 000 | 7,01 | 8,03 | ||||

| 2025-01-15 | 4 434 904 | −2,93 | 9,98 | ||||

| 2024-12-31 | 4 568 891 | 0,79 | 6,51 | ||||

| 2024-12-13 | 4 533 082 | 2,11 | 8,54 | ||||

| 2024-11-29 | 4 439 328 | 0,09 | 10,29 | ||||

| 2024-11-15 | 4 435 363 | 4,52 | 5,60 | ||||

| 2024-10-31 | 4 243 706 | −6,39 | 5,17 | ||||

| 2024-10-15 | 4 533 521 | 5,46 | 8,21 | ||||

| 2024-09-30 | 4 298 609 | −10,64 | 6,05 | ||||

| 2024-09-13 | 4 810 521 | −3,91 | 10,83 | ||||

| 2024-08-30 | 5 006 284 | −15,03 | 11,16 | ||||

| 2024-08-15 | 5 891 569 | −5,03 | 9,72 | ||||

| 2024-07-31 | 6 203 386 | 5,49 | 6,70 | ||||

| 2024-07-15 | 5 880 657 | 8,42 | 6,94 | ||||

| 2024-06-28 | 5 424 058 | 7,98 | 8,39 | ||||

| 2024-06-14 | 5 023 025 | 7,92 | 7,08 | ||||

| 2024-05-31 | 4 654 471 | −2,39 | 18,17 | ||||

| 2024-05-15 | 4 768 260 | 7,65 | 7,82 | ||||

| 2024-04-30 | 4 429 603 | 0,92 | 17,81 | ||||

| 2024-04-15 | 4 389 024 | 5,41 | 12,56 | ||||

| 2024-03-28 | 4 163 588 | −3,87 | 10,93 | ||||

| 2024-03-15 | 4 331 397 | 4,84 | 11,99 | ||||

| 2024-02-29 | 4 131 378 | 4,38 | 7,96 | ||||

| 2024-02-15 | 3 958 194 | −2,50 | 14,13 | ||||

| 2024-01-31 | 4 059 608 | 1,89 | 10,69 | ||||

| 2024-01-12 | 3 984 235 | −4,93 | 9,37 | ||||

| 2023-12-29 | 4 190 892 | −1,92 | 18,78 | ||||

| 2023-12-15 | 4 272 753 | 5,01 | 11,34 | ||||

| 2023-11-30 | 4 069 038 | −10,97 | 14,37 | ||||

| 2023-11-15 | 4 570 268 | 13,21 | 10,36 | ||||

| 2023-10-31 | 4 036 816 | 1,02 | 11,27 | ||||

| 2023-10-13 | 3 996 155 | −5,51 | 16,53 | ||||

| 2023-09-29 | 4 229 055 | 2,24 | 11,54 | ||||

| 2023-09-15 | 4 136 434 | 1,03 | 14,66 | ||||

| 2023-08-31 | 4 094 350 | −3,73 | 24,90 | ||||

| 2023-08-15 | 4 252 886 | −0,84 | 19,14 | ||||

| 2023-07-31 | 4 288 906 | 6,32 | 8,68 | ||||

| 2023-07-14 | 4 033 811 | 0,48 | 17,19 | ||||

| 2023-06-30 | 4 014 404 | 2,03 | 11,82 | ||||

| 2023-06-15 | 3 934 525 | −0,19 | 6,73 | ||||

| 2023-05-31 | 3 942 165 | −15,95 | 8,64 | ||||

| 2023-05-15 | 4 690 110 | −3,07 | 6,79 | ||||

| 2023-04-28 | 4 838 676 | 1,42 | 22,42 | ||||

| 2023-04-14 | 4 771 014 | −6,42 | 13,72 | ||||

| 2023-03-31 | 5 098 527 | −0,98 | 11,12 | ||||

| 2023-03-15 | 5 148 915 | 0,22 | 15,55 | ||||

| 2023-02-28 | 5 137 532 | 2,65 | 13,49 | ||||

| 2023-02-15 | 5 005 020 | −5,57 | 12,69 | ||||

| 2023-01-31 | 5 300 264 | −0,47 | 10,87 | ||||

| 2023-01-13 | 5 325 183 | 1,41 | 27,51 | ||||

| 2022-12-30 | 5 250 991 | 1,89 | 23,23 | ||||

| 2022-12-15 | 5 153 343 | 2,01 | 23,41 | ||||

| 2022-11-30 | 5 051 564 | −5,50 | 24,27 | ||||

| 2022-11-15 | 5 345 341 | 1,01 | 16,68 | ||||

| 2022-10-31 | 5 292 084 | 1,21 | 14,70 | ||||

| 2022-10-14 | 5 228 656 | 3,68 | 16,63 | ||||

| 2022-09-30 | 5 043 204 | −1,61 | 12,50 | ||||

| 2022-09-15 | 5 125 566 | 2,04 | 15,82 | ||||

| 2022-08-31 | 5 022 850 | 2,76 | 15,45 | ||||

| 2022-08-15 | 4 887 718 | 1,19 | 8,45 | ||||

| 2022-07-29 | 4 830 404 | 1,74 | 12,55 | ||||

| 2022-07-15 | 4 747 952 | 6,20 | 18,97 | ||||

| 2022-06-30 | 4 470 974 | −1,90 | 10,17 | ||||

| 2022-06-15 | 4 557 515 | −3,72 | 14,51 | ||||

| 2022-05-31 | 4 733 835 | 4,78 | 13,89 | ||||

| 2022-05-13 | 4 517 771 | −0,97 | 9,67 | ||||

| 2022-04-29 | 4 561 976 | −4,57 | 15,85 | ||||

| 2022-04-14 | 4 780 487 | 0,94 | 12,75 | ||||

| 2022-03-31 | 4 736 115 | 2,77 | 12,61 | ||||

| 2022-03-15 | 4 608 601 | 14,25 | 6,90 | ||||

| 2022-02-28 | 4 033 931 | −2,87 | 7,67 | ||||

| 2022-02-15 | 4 153 133 | 7,44 | 12,88 | ||||

| 2022-01-31 | 3 865 395 | 9,35 | 14,05 | ||||

| 2022-01-14 | 3 535 008 | 1,67 | 12,78 | ||||

| 2021-12-31 | 3 477 002 | 7,89 | 11,05 | ||||

| 2021-12-15 | 3 222 860 | −3,48 | 6,88 | ||||

| 2021-11-30 | 3 339 127 | 1,19 | 10,45 | ||||

| 2021-11-15 | 3 299 973 | 3,44 | 8,41 | ||||

| 2021-10-29 | 3 190 106 | 1,86 | 8,43 | ||||

| 2021-10-15 | 3 131 733 | 1,21 | 16,55 | ||||

| 2021-09-30 | 3 094 356 | 6,00 | 6,83 | ||||

| 2021-09-15 | 2 919 133 | 0,04 | 10,28 | ||||

| 2021-08-31 | 2 917 958 | −0,11 | 11,35 | ||||

| 2021-08-13 | 2 921 261 | 2,44 | 7,94 | ||||

| 2021-07-30 | 2 851 625 | 3,36 | 11,93 | ||||

| 2021-07-15 | 2 758 801 | −10,81 | 11,35 | ||||

| 2021-06-30 | 3 093 206 | −0,83 | 6,26 | ||||

| 2021-06-15 | 3 118 977 | 5,78 | 11,99 | ||||

| 2021-05-28 | 2 949 165 | 3,75 | 10,95 | ||||

| 2021-05-14 | 2 842 646 | −8,99 | 4,88 | ||||

| 2021-04-30 | 3 123 520 | −1,60 | 11,22 | ||||

| 2021-04-15 | 3 174 408 | −14,36 | 12,86 | ||||

| 2021-03-31 | 3 719 641 | 9,55 | 8,81 | ||||

| 2021-03-15 | 3 395 406 | 5,53 | 9,12 | ||||

| 2021-02-26 | 3 217 613 | −0,05 | 9,50 | ||||

| 2021-02-12 | 3 219 325 | −9,33 | 11,61 | ||||

| 2021-01-29 | 3 550 493 | −12,09 | 12,39 | ||||

| 2021-01-15 | 4 038 560 | −11,71 | 8,17 |

Kilde: Short rente oppgitt av NYSE- utestående aksjer og aksjeflyt oppgitt av Capital IQ.

Funds Disclosing Short Positions - Europe

This section shows European institutions, funds, and major shareholders that have reported short positions in the security.

Upgrade to unlock premium data.

| File Date | Owner | Issuer | ISIN | Total Capitalization Shorted (%) |

|---|---|---|---|---|

| 2025-09-05 | Citadel Advisors LLC | GREGGS PLC | GB00B63QSB39 | 0,50 |

| 2025-08-18 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,49 |

| 2025-08-14 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,51 |

| 2025-08-13 | JPMorgan Asset Management (UK) Ltd | GREGGS PLC | GB00B63QSB39 | 1,32 |

| 2025-08-08 | ExodusPoint Capital Management, LP | GREGGS PLC | GB00B63QSB39 | 0,74 |

| 2025-08-04 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,49 |

| 2025-07-31 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,86 |

| 2025-07-29 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,76 |

| 2025-07-28 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,56 |

| 2025-07-24 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,60 |

| 2025-07-23 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,50 |

| 2025-07-22 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,69 |

| 2025-07-21 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,70 |

| 2025-07-14 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,69 |

| 2025-07-09 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,70 |

| 2025-07-02 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,69 |

| 2025-06-27 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,59 |

| 2025-06-24 | Wellington Management International Ltd | GREGGS PLC | GB00B63QSB39 | 0,46 |

| 2025-06-16 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,60 |

| 2025-06-05 | JPMorgan Asset Management (UK) Ltd | GREGGS PLC | GB00B63QSB39 | 0,49 |

| 2025-06-02 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,51 |

| 2025-05-12 | JPMorgan Asset Management (UK) Ltd | GREGGS PLC | GB00B63QSB39 | 0,58 |

| 2025-04-23 | GLG Partners LP | GREGGS PLC | GB00B63QSB39 | 0,46 |

| 2025-04-09 | JPMorgan Asset Management (UK) Ltd | GREGGS PLC | GB00B63QSB39 | 0,64 |

| 2025-04-08 | GLG Partners LP | GREGGS PLC | GB00B63QSB39 | 0,54 |

| 2025-03-04 | JPMorgan Asset Management (UK) Ltd | GREGGS PLC | GB00B63QSB39 | 0,70 |

| 2025-01-23 | JPMorgan Asset Management (UK) Ltd | GREGGS PLC | GB00B63QSB39 | 0,51 |

| 2024-01-10 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,44 |

| 2024-01-08 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,65 |

| 2023-06-23 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,49 |

| 2023-05-24 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,55 |

| 2023-05-22 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,69 |

| 2023-05-16 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,75 |

| 2023-04-17 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,81 |

| 2023-03-17 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,78 |

| 2023-02-17 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,87 |

| 2023-02-14 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 1,06 |

| 2023-02-10 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 1,13 |

| 2023-02-08 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 1,29 |

| 2023-02-06 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 1,38 |

| 2023-01-20 | Qube Research & Technologies Limited | GREGGS PLC | GB00B63QSB39 | 0,50 |

| 2023-01-13 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 1,48 |

| 2023-01-09 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 1,79 |

| 2022-12-28 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,88 |

| 2022-12-19 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,99 |

| 2022-12-08 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 2,09 |

| 2022-12-05 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 2,15 |

| 2022-12-02 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,46 |

| 2022-12-01 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,58 |

| 2022-11-15 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 2,21 |

| 2022-10-25 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,68 |

| 2022-10-21 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 2,10 |

| 2022-10-19 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,73 |

| 2022-10-07 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 2,04 |

| 2022-10-06 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,56 |

| 2022-08-02 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,44 |

| 2022-07-28 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 2,10 |

| 2022-07-25 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,69 |

| 2022-07-21 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,76 |

| 2022-07-19 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 2,03 |

| 2022-07-14 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,83 |

| 2022-07-07 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,93 |

| 2022-07-06 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,86 |

| 2022-06-30 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 1,00 |

| 2022-06-28 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,79 |

| 2022-06-22 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,90 |

| 2022-06-16 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,81 |

| 2022-06-15 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,71 |

| 2022-06-09 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,62 |

| 2022-05-17 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,67 |

| 2022-05-16 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,32 |

| 2022-05-13 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,24 |

| 2022-05-12 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,83 |

| 2022-05-11 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,69 |

| 2021-01-06 | ELEVA CAPITAL SAS | Greggs Plc | GB00B63QSB39 | 0,00 |

| 2020-10-15 | ELEVA CAPITAL SAS | Greggs Plc | GB00B63QSB39 | 0,62 |

| 2020-07-29 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,39 |

| 2020-07-28 | Citadel Advisors LLC | Greggs Plc | GB00B63QSB39 | 0,26 |

| 2020-07-22 | Citadel Advisors LLC | Greggs Plc | GB00B63QSB39 | 0,60 |

| 2020-07-21 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 1,03 |

| 2020-07-16 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,93 |

| 2020-07-15 | Citadel Advisors LLC | Greggs Plc | GB00B63QSB39 | 0,59 |

| 2020-07-13 | Citadel Advisors LLC | Greggs Plc | GB00B63QSB39 | 0,60 |

| 2020-07-02 | Citadel Advisors LLC | Greggs Plc | GB00B63QSB39 | 0,72 |

| 2020-07-01 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 1,13 |

| 2020-06-23 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 1,09 |

| 2020-06-22 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 1,11 |

| 2020-06-19 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 1,08 |

| 2020-06-16 | Citadel Advisors LLC | Greggs Plc | GB00B63QSB39 | 0,60 |

| 2020-06-09 | Citadel Advisors LLC | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2020-06-05 | Citadel Advisors LLC | Greggs Plc | GB00B63QSB39 | 0,49 |

| 2020-05-12 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 1,01 |

| 2020-05-11 | Citadel Advisors LLC | Greggs Plc | GB00B63QSB39 | 0,52 |

| 2020-05-06 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,80 |

| 2020-05-05 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,79 |

| 2020-05-01 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,91 |

| 2020-04-29 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,81 |

| 2020-04-28 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,78 |

| 2020-04-24 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,66 |

| 2020-04-23 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,53 |

| 2020-04-20 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,46 |

| 2020-04-17 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,52 |

| 2020-03-20 | KUVARI PARTNERS LLP | Greggs Plc | GB00B63QSB39 | 0,45 |

| 2020-03-18 | KUVARI PARTNERS LLP | Greggs Plc | GB00B63QSB39 | 0,56 |

| 2020-03-13 | Voleon Capital Management LP | Greggs Plc | GB00B63QSB39 | 0,45 |

| 2020-03-11 | Voleon Capital Management LP | Greggs Plc | GB00B63QSB39 | 0,52 |

| 2020-02-26 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,49 |

| 2020-02-20 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,49 |

| 2020-02-18 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2020-01-06 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,48 |

| 2019-12-09 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,51 |

| 2019-11-21 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 0,48 |

| 2019-11-12 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,51 |

| 2019-11-11 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 0,59 |

| 2019-10-29 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,49 |

| 2019-10-18 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2019-10-15 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,49 |

| 2019-10-14 | Public Equity Partners Management, L.P. | Greggs Plc | GB00B63QSB39 | 0,38 |

| 2019-10-11 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2019-10-10 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,49 |

| 2019-10-01 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,55 |

| 2019-09-25 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 0,77 |

| 2019-08-28 | Public Equity Partners Management, L.P. | Greggs Plc | GB00B63QSB39 | 0,72 |

| 2019-08-23 | Public Equity Partners Management, L.P. | Greggs Plc | GB00B63QSB39 | 0,57 |

| 2019-08-16 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 0,84 |

| 2019-08-15 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,67 |

| 2019-08-14 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,73 |

| 2019-08-13 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,89 |

| 2019-08-07 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,96 |

| 2019-08-05 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,07 |

| 2019-07-31 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,18 |

| 2019-07-30 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,22 |

| 2019-07-23 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,36 |

| 2019-06-21 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,45 |

| 2019-06-10 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 1,00 |

| 2019-05-15 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 0,95 |

| 2019-05-14 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 1,10 |

| 2019-04-23 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,56 |

| 2019-04-01 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 1,21 |

| 2019-03-11 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,67 |

| 2019-03-06 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 1,20 |

| 2019-02-19 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,70 |

| 2019-02-12 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,69 |

| 2019-01-28 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,79 |

| 2019-01-22 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,83 |

| 2019-01-09 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,75 |

| 2018-12-27 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,69 |

| 2018-11-27 | Jupiter Investment Management Limited | Greggs Plc | GB00B63QSB39 | 0,00 |

| 2018-11-20 | GSA Capital Partners LLP | Greggs Plc | GB00B63QSB39 | 0,41 |

| 2018-11-19 | GSA Capital Partners LLP | Greggs Plc | GB00B63QSB39 | 0,60 |

| 2018-11-09 | GSA Capital Partners LLP | Greggs Plc | GB00B63QSB39 | 0,59 |

| 2018-11-07 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,79 |

| 2018-11-05 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,80 |

| 2018-10-30 | GSA Capital Partners LLP | Greggs Plc | GB00B63QSB39 | 0,68 |

| 2018-10-16 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,73 |

| 2018-10-12 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,61 |

| 2018-10-10 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,51 |

| 2018-10-05 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,32 |

| 2018-10-04 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,49 |

| 2018-09-27 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,50 |

| 2018-08-31 | Jupiter Investment Management Limited | Greggs Plc | GB00B63QSB39 | 0,75 |

| 2018-08-28 | GSA Capital Partners LLP | Greggs Plc | GB00B63QSB39 | 0,79 |

| 2018-08-09 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,40 |

| 2018-07-31 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 1,02 |

| 2018-07-27 | GSA Capital Partners LLP | Greggs Plc | GB00B63QSB39 | 0,70 |

| 2018-07-20 | GSA Capital Partners LLP | Greggs Plc | GB00B63QSB39 | 0,61 |

| 2018-07-17 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,33 |

| 2018-07-16 | GSA Capital Partners LLP | Greggs Plc | GB00B63QSB39 | 0,52 |

| 2018-06-29 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 0,98 |

| 2018-06-25 | Marshall Wace LLP | Greggs Plc | GB00B63QSB39 | 0,48 |

| 2018-06-19 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 0,83 |

| 2018-06-14 | Marshall Wace LLP | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2018-06-08 | WorldQuant LLC | Greggs Plc | GB00B63QSB39 | 0,48 |

| 2018-05-30 | WorldQuant LLC | Greggs Plc | GB00B63QSB39 | 0,51 |

| 2018-05-22 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 0,71 |

| 2018-05-17 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 0,62 |

| 2018-05-15 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,25 |

| 2018-05-10 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,39 |

| 2018-04-19 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,39 |

| 2018-04-13 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,69 |

| 2018-04-11 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 0,53 |

| 2018-04-09 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,85 |

| 2018-04-04 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,98 |

| 2018-03-28 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 1,03 |

| 2018-03-23 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,41 |

| 2018-03-02 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,91 |

| 2018-02-28 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,81 |

| 2018-02-27 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,79 |

| 2018-02-20 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,80 |

| 2018-02-13 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,37 |

| 2018-02-05 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,42 |

| 2018-01-18 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,70 |

| 2018-01-16 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,39 |

| 2017-12-07 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,61 |

| 2017-11-21 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,41 |

| 2017-11-09 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2017-09-28 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,31 |

| 2017-09-22 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,48 |

| 2017-09-08 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,53 |

| 2017-08-10 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,22 |

| 2017-08-09 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,12 |

| 2017-07-26 | Marshall Wace LLP | Greggs Plc | GB00B63QSB39 | 0,58 |

| 2017-07-24 | Marshall Wace LLP | Greggs Plc | GB00B63QSB39 | 0,60 |

| 2017-07-07 | Marshall Wace LLP | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2017-07-06 | Threadneedle Asset Management Limited | Greggs Plc | GB00B63QSB39 | 0,66 |

| 2017-06-20 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,00 |

| 2017-06-14 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,92 |

| 2017-06-02 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,87 |

| 2017-06-01 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,62 |

| 2017-05-31 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,53 |

| 2017-05-19 | Jupiter Investment Management Limited | Greggs Plc | GB00B63QSB39 | 0,47 |

| 2017-05-18 | Jupiter Investment Management Limited | Greggs Plc | GB00B63QSB39 | 0,54 |

| 2017-04-12 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,44 |

| 2017-03-01 | Jupiter Investment Management Limited | Greggs Plc | GB00B63QSB39 | 0,78 |

| 2017-02-22 | Jupiter Investment Management Limited | Greggs Plc | GB00B63QSB39 | 0,63 |

| 2017-02-01 | Jupiter Investment Management Limited | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2017-01-16 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2017-01-03 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,69 |

| 2016-12-06 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,70 |

| 2016-11-21 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,69 |

| 2016-11-18 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,77 |

| 2016-10-25 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,88 |

| 2016-10-21 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,63 |

| 2016-10-18 | Threadneedle Asset Management Limited | Greggs Plc | GB00B63QSB39 | 0,51 |

| 2016-10-10 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2016-02-08 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,46 |

| 2016-02-03 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,81 |

| 2016-01-22 | Farringdon Capital Management | Greggs Plc | GB00B63QSB39 | 0,37 |

| 2016-01-21 | Farringdon Capital Management | Greggs Plc | GB00B63QSB39 | 0,53 |

| 2016-01-19 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,70 |

| 2016-01-18 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,62 |

| 2016-01-15 | Farringdon Capital Management | Greggs Plc | GB00B63QSB39 | 0,94 |

| 2015-12-08 | Farringdon Capital Management | Greggs Plc | GB00B63QSB39 | 1,06 |

| 2015-11-04 | Farringdon Capital Management | Greggs Plc | GB00B63QSB39 | 0,90 |

| 2015-11-03 | Farringdon Capital Management | Greggs Plc | GB00B63QSB39 | 0,84 |

| 2015-08-04 | Farringdon Capital Management | Greggs Plc | GB00B63QSB39 | 0,77 |

| 2015-07-08 | Farringdon Capital Management | Greggs Plc | GB00B63QSB39 | 0,63 |

| 2015-05-01 | Farringdon Capital Management | Greggs Plc | GB00B63QSB39 | 0,55 |

| 2014-07-08 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,00 |

| 2014-07-01 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,95 |

| 2014-06-30 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,02 |

| 2014-06-24 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,94 |

| 2014-06-20 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,86 |

| 2014-06-19 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,78 |

| 2014-06-13 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,82 |

| 2014-06-10 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,91 |

| 2014-05-21 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,69 |

| 2014-05-19 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,81 |

| 2014-05-16 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,79 |

| 2014-05-14 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,84 |

| 2014-05-07 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,89 |

| 2014-05-01 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,97 |

| 2014-04-29 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,92 |

| 2014-04-24 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,02 |

| 2014-04-22 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,21 |

| 2014-04-08 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,01 |

| 2014-04-03 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,10 |

| 2014-03-31 | Cazenove Capital Management Limited | Greggs Plc | GB00B63QSB39 | 0,00 |

| 2014-03-28 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,03 |

| 2014-03-24 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,93 |

| 2014-03-18 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,81 |

| 2014-03-13 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,78 |

| 2014-03-05 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,81 |

| 2014-03-04 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,79 |

| 2014-02-26 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,95 |

| 2014-02-24 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,99 |

| 2014-02-20 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,13 |

| 2014-02-19 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,03 |

| 2014-02-12 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,19 |

| 2014-02-06 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,30 |

| 2014-02-05 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,27 |

| 2014-02-04 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,29 |

| 2014-01-31 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,30 |

| 2014-01-29 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,23 |

| 2014-01-28 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,18 |

| 2014-01-23 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,22 |

| 2014-01-21 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,43 |

| 2014-01-15 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,18 |

| 2014-01-14 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,25 |

| 2014-01-09 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,32 |

| 2014-01-03 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,20 |

| 2013-12-20 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,13 |

| 2013-11-27 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,30 |

| 2013-11-26 | JPMorgan Asset Management (UK) Ltd | Greggs Plc | GB00B63QSB39 | 0,69 |

| 2013-10-18 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,20 |

| 2013-10-10 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,72 |

| 2013-10-09 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,16 |

| 2013-10-04 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,04 |

| 2013-10-02 | Cazenove Capital Management Limited | Greggs Plc | GB00B63QSB39 | 0,70 |

| 2013-09-20 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,94 |

| 2013-09-16 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,80 |

| 2013-09-11 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,98 |

| 2013-09-10 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 2,04 |

| 2013-08-19 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,64 |

| 2013-08-12 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 2,01 |

| 2013-08-09 | JPMorgan Asset Management (UK) Ltd | Greggs Plc | GB00B63QSB39 | 0,79 |

| 2013-08-08 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,54 |

| 2013-08-06 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,47 |

| 2013-08-01 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,73 |

| 2013-07-29 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,61 |

| 2013-07-25 | Cazenove Capital Management Limited | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2013-07-18 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,84 |

| 2013-06-14 | ODEY ASSET MANAGEMENT LLP | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2013-05-16 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,79 |

| 2013-05-08 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,09 |

| 2013-05-07 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,78 |

| 2013-05-03 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,64 |

| 2013-05-02 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,54 |

| 2013-04-29 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,70 |

| 2013-04-18 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,80 |

| 2013-04-09 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,68 |

| 2013-04-03 | ODEY ASSET MANAGEMENT LLP | Greggs Plc | GB00B63QSB39 | 0,56 |

| 2013-03-27 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,86 |

| 2013-03-20 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,98 |

| 2013-03-14 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,05 |

| 2013-03-07 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,91 |

| 2013-02-20 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,82 |

| 2013-01-10 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,72 |

| 2013-01-03 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,64 |

| 2012-12-24 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,92 |

| 2012-12-21 | Artemis Investment Management LLP | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2012-11-20 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,84 |

| 2012-11-08 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,84 |

| 2012-11-01 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,98 |