Grunnleggende statistikk

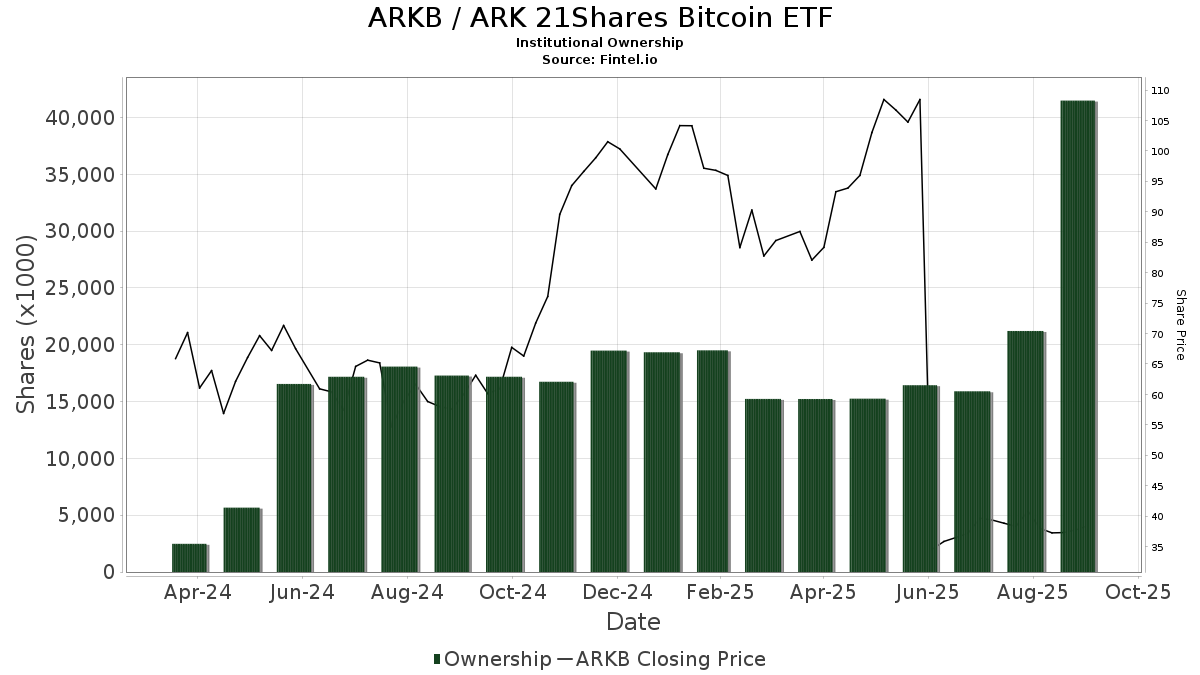

| Institusjonelle eiere | 164 total, 160 long only, 0 short only, 4 long/short - change of 7,19% MRQ |

| Gjennomsnittlig porteføljeallokering | 0.3865 % - change of 20,74% MRQ |

| Institusjonelle aksjer (Long) | 41 483 608 (ex 13D/G) - change of 25,05MM shares 152,37% MRQ |

| Institusjonell verdi (Long) | $ 1 571 088 USD ($1000) |

Institusjonelt eierskap og aksjonærer

ARK 21Shares Bitcoin ETF (US:ARKB) har 164 institusjonelle eiere og aksjonærer som har sendt inn 13D/G- eller 13F-skjemaer til Securities Exchange Commission (SEC). Disse institusjonene eier til sammen 41,483,608 aksjer. De største aksjonærene inkluderer Jane Street Group, Llc, ARK Investment Management LLC, Millennium Management Llc, Schonfeld Strategic Advisors LLC, Hbk Investments L P, ARKW - ARK Next Generation Internet ETF, Apollo Management Holdings, L.P., Susquehanna International Group, Llp, Kaleidoscope Capital Lp, and ARKF - ARK Fintech Innovation ETF .

ARK 21Shares Bitcoin ETF (BATS:ARKB) institusjonell eierstruktur viser nåværende posisjoner i selskapet fordelt på institusjoner og fond, samt de siste endringene i posisjonsstørrelse. De største aksjonærene kan være individuelle investorer, verdipapirfond, hedgefond eller institusjoner. Schedule 13D indikerer at investoren eier (eller har eid) mer enn 5 % av selskapet og har til hensikt (eller hadde til hensikt) å aktivt forfølge en endring i forretningsstrategien. Schedule 13G indikerer en passiv investering på over 5 %.

The share price as of September 12, 2025 is 38,86 / share. Previously, on September 13, 2024, the share price was 19,91 / share. This represents an increase of 95,18% over that period.

Fondssentiment-score

Fondssentiment Score (også kjent som akkumulering av eierskap poengsum) viser hvilke aksjer som er mest kjøpt av fond. Den er resultatet av en sofistikert, kvantitativ flerfaktormodell som identifiserer selskaper med de høyeste nivåene av institusjonell akkumulering. Beregningsmodellen for poeng bruker en kombinasjon av den totale økningen i antall offentliggjorte eiere, endringer i porteføljeallokeringen til disse eierne og andre beregninger. Tallet går fra 0 til 100, der høyere tall indikerer en høyere grad av akkumulering i forhold til sammenlignbare selskaper, der 50 er gjennomsnittet.

Oppdateringsfrekvens: Daglig

Sjekk ut Ownership Explorer, som inneholder en liste over de høyest rangerte selskapene.

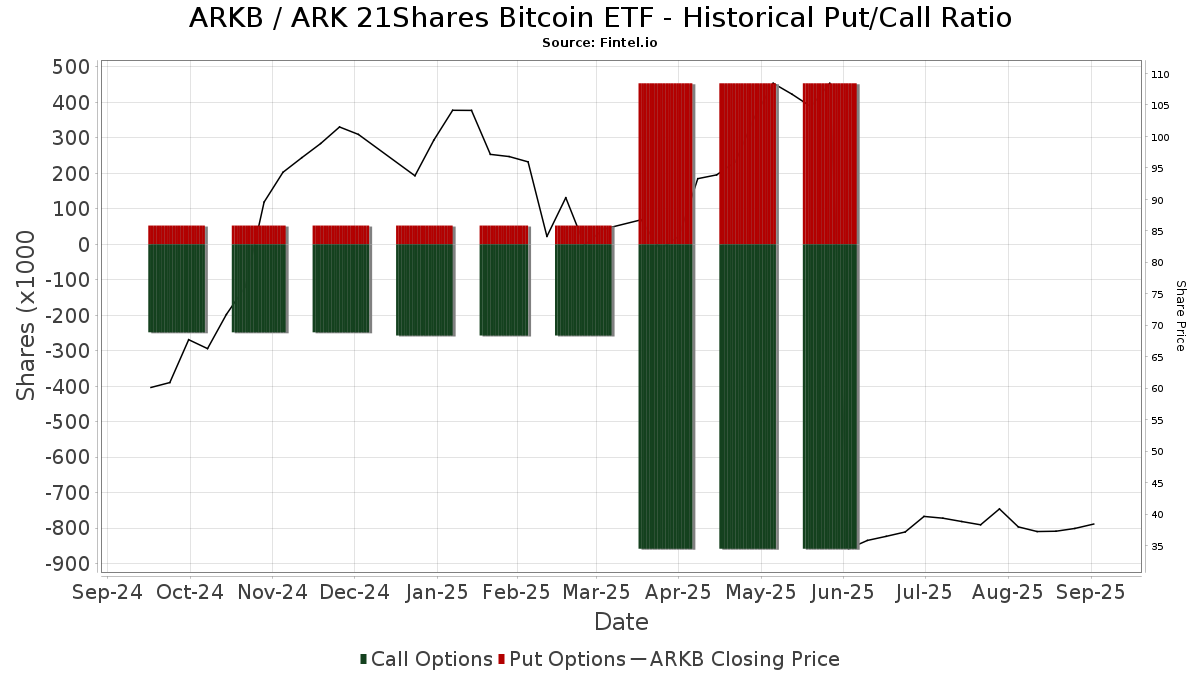

Institusjonell Put/Call-forhold

I tillegg til å rapportere standard aksje- og gjeldsemisjoner må institusjoner med mer enn 100 millioner kroner i forvaltningskapital også oppgi beholdningen av put- og callopsjoner. Siden put-opsjoner generelt indikerer et negativt sentiment, og call-opsjoner indikerer et positivt sentiment, kan vi få et inntrykk av det generelle institusjonelle sentimentet ved å plotte forholdet mellom put- og call-opsjoner. Diagrammet til høyre viser det historiske forholdet mellom put- og call-opsjoner for dette instrumentet.

Ved å bruke Put/Call-forholdet som en indikator på investorsentimentet kan man overvinne en av de viktigste svakhetene ved å bruke totalt institusjonelt eierskap, nemlig at en betydelig andel av forvaltningskapitalen investeres passivt for å følge indekser. Passivt forvaltede fond kjøper vanligvis ikke opsjoner, slik at indikatoren for put/call-forhold i større grad gjenspeiler stemningen i aktivt forvaltede fond.

13F- og NPORT-arkiveringer

Detaljer om 13F-arkiveringer er gratis. Detaljer om NP-arkiveringer krever et premium-medlemskap. Grønne rader indikerer nye posisjoner. Røde rader indikerer lukkede posisjoner. Klikk på lenke ikonet for å se hele transaksjonshistorikken.

Oppgrader

for å låse opp premiedata og eksportere til Excel. ![]() .

.

| Fildato | Kilde | Investor | Type | Gjennomsnittlig pris (estimert) |

Aksjer | Δ Aksjer (%) |

Rapportert verdi ($1000) | Verdi (%) | Portallokering (%) | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-06 | 13F | Prospera Financial Services Inc | 71 631 | 2 564 | ||||||

| 2025-08-13 | 13F | Certior Financial Group, Llc | 15 000 | 193,54 | 537 | 27,62 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 10 650 | 199,16 | 381 | 30,48 | ||||

| 2025-07-01 | 13F | Harbor Investment Advisory, Llc | 1 155 | 208,00 | 41 | 36,67 | ||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-05-07 | 13F | Atlas Legacy Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 12 137 | 210,57 | 434 | 35,20 | ||||

| 2025-08-08 | 13F | Woodley Farra Manion Portfolio Management Inc | 9 000 | 322 | ||||||

| 2025-05-16 | 13F/A | Kestra Investment Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 224 500 | 1 033,84 | 8 035 | 393,79 | |||

| 2025-08-12 | 13F | Titleist Asset Management, Llc | 478 234 | 197,86 | 17 116 | 29,69 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 40 158 | 1 531,11 | 1 437 | 611,39 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 90 336 | 214,43 | 3 233 | 36,93 | ||||

| 2025-07-15 | 13F | Well Done, LLC | 75 870 | 200,00 | 2 715 | 15,14 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 81 041 | 247,00 | 2 900 | 51,12 | ||||

| 2025-06-25 | NP | ARKF - ARK Fintech Innovation ETF | 636 601 | 0,00 | 59 770 | −7,34 | ||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 180 000 | 200,00 | 6 442 | 30,62 | ||||

| 2025-05-05 | 13F | Transce3nd, LLC | 0 | −100,00 | 0 | |||||

| 2025-04-30 | 13F | Kedalion Capital Management LLP | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | State Of Michigan Retirement System | 300 000 | 200,00 | 10 737 | 30,62 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 7 045 | 231,06 | 0 | |||||

| 2025-04-18 | 13F | Pacific Capital Wealth Advisors, Inc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Clark Financial Services Group Inc /bd | 12 229 | 202,17 | 438 | 31,63 | ||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 1 884 | 223,71 | 0 | |||||

| 2025-07-17 | 13F | Global Trust Asset Management, LLC | 600 | 21 | ||||||

| 2025-05-09 | 13F | Pnc Financial Services Group, Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-24 | 13F | Cyndeo Wealth Partners, LLC | 385 551 | 205,69 | 13 799 | 33,10 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 0 | −100,00 | 0 | |||||

| 2025-04-29 | 13F | Element Wealth, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Q Fund Management (Hong Kong) Ltd | 24 000 | 200,00 | 859 | 30,59 | ||||

| 2025-04-29 | 13F | Hm Payson & Co | 30 | 0,00 | 2 | 0,00 | ||||

| 2025-08-08 | 13F | Creative Planning | 54 938 | 199,73 | 1 966 | 30,54 | ||||

| 2025-04-17 | 13F | Dynamic Advisor Solutions LLC | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Mustard Seed Financial, LLC | 37 791 | 183,95 | 1 353 | 23,58 | ||||

| 2025-08-11 | 13F | NewEdge Wealth, LLC | 32 781 | 191,33 | 1 282 | 38,64 | ||||

| 2025-07-30 | 13F | ARK Investment Management LLC | 6 622 008 | 130,77 | 237 002 | 0,48 | ||||

| 2025-08-11 | 13F | Elequin Capital Lp | 280 830 | 94 138,26 | 10 051 | 41 775,00 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 2 754 | 225,15 | 99 | 42,03 | ||||

| 2025-08-04 | 13F | Grant Street Asset Management, Inc. | 9 000 | 322 | ||||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 57 587 | 172,83 | 2 | 100,00 | ||||

| 2025-04-24 | 13F | Decker Retirement Planning Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-11 | 13F | OxenFree Capital LLC | 24 990 | 200,00 | 894 | 23,14 | ||||

| 2025-08-14 | 13F | Paragon Private Wealth Management, LLC | 15 487 | 135,76 | 554 | 2,78 | ||||

| 2025-07-23 | 13F | MADDEN SECURITIES Corp | 221 784 | 211,11 | 7 938 | 35,47 | ||||

| 2025-08-14 | 13F | Wealth Preservation Advisors, LLC | 31 749 | 214,88 | 1 136 | 37,20 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 194 250 | 455,25 | 6 952 | 141,81 | ||||

| 2025-08-11 | 13F | Rpo Llc | 77 070 | 315,70 | 2 758 | 81,09 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 340 700 | 143,18 | 12 194 | 5,88 | |||

| 2025-07-28 | 13F | Kiker Wealth Management, LLC | 900 | 200,00 | 32 | 33,33 | ||||

| 2025-08-01 | 13F | Koss-Olinger Consulting, LLC | 60 000 | 2 147 | ||||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 1 | 0,00 | 0 | |||||

| 2025-07-15 | 13F | Missouri Trust & Investment Co | 300 | 200,00 | 11 | 25,00 | ||||

| 2025-08-05 | 13F | Chase Investment Counsel Corp | 44 676 | 200,00 | 2 | 0,00 | ||||

| 2025-07-23 | 13F | Richardson Capital Management LLC | 7 647 | 200,00 | 274 | 30,62 | ||||

| 2025-08-07 | 13F | Encompass More Asset Management | 6 745 | 241 | ||||||

| 2025-08-14 | 13F | Farringdon Capital, Ltd. | 128 870 | 195,65 | 4 612 | 28,75 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 999 300 | 4 565,27 | 35 765 | 1 932,05 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 175 400 | 790,36 | 6 278 | 287,71 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 352 600 | 316,29 | 12 620 | 81,26 | |||

| 2025-08-14 | 13F | Verition Fund Management LLC | 150 000 | 200,00 | 5 368 | 30,61 | ||||

| 2025-08-18 | 13F | Hollencrest Capital Management | 6 300 | 200,00 | 225 | 30,81 | ||||

| 2025-08-05 | 13F | Optivise Advisory Services LLC | 10 519 | 161,34 | 376 | 13,94 | ||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 127 579 | 157,87 | 4 566 | 12,30 | ||||

| 2025-05-14 | 13F | Flow Traders U.s. Llc | 0 | −100,00 | 0 | |||||

| 2025-05-16 | 13F | Jones Financial Companies Lllp | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | Indiana Trust & Investment Management CO | 2 610 | 200,00 | 93 | 30,99 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 4 228 533 | 206,81 | 151 339 | 33,58 | ||||

| 2025-07-28 | 13F | Axxcess Wealth Management, Llc | 26 213 | 161,82 | 938 | 14,11 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 11 645 | 417 | ||||||

| 2025-08-12 | 13F | Virtu Financial LLC | 193 212 | 7 | ||||||

| 2025-08-13 | 13F/A | Claudia M.p. Batlle, Crp (r) Llc | 10 000 | 358 | ||||||

| 2025-08-06 | 13F | Vestmark Advisory Solutions, Inc. | 15 750 | 445,74 | 564 | 137,55 | ||||

| 2025-08-05 | 13F | Carolinas Wealth Consulting Llc | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Harel Insurance Investments & Financial Services Ltd. | 661 | 0 | ||||||

| 2025-08-13 | 13F | Brown Advisory Inc | 30 525 | 200,00 | 1 092 | 30,62 | ||||

| 2025-07-31 | 13F | Buckingham Strategic Partners | 7 152 | 256 | ||||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 200 964 | 230,32 | 7 | 40,00 | ||||

| 2025-07-10 | 13F | Oliver Lagore Vanvalin Investment Group | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 15 950 | −69,52 | 571 | −86,75 | ||||

| 2025-08-12 | 13F | Centric Wealth Management | 5 226 | 202 | ||||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 157 818 | 157,47 | 5 648 | 12,11 | ||||

| 2025-08-13 | 13F | Lauer Wealth, LLC | 9 600 | 276,47 | 380 | 56,61 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Put | 5 400 | 1 700,00 | 193 | 704,17 | |||

| 2025-08-14 | 13F | Modern Wealth Management, LLC | 27 189 | 294,56 | 973 | 71,91 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Call | 1 500 | 150,00 | 54 | 8,16 | |||

| 2025-08-13 | 13F | Lido Advisors, LLC | 16 573 | 272,34 | 593 | 62,47 | ||||

| 2025-08-08 | 13F | Empower Advisory Group, LLC | 8 946 | 172,49 | 320 | 18,96 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | 1 077 | −83,58 | 39 | −92,95 | ||||

| 2025-08-14 | 13F | Vivaldi Capital Management, LLC | 25 086 | 54,58 | 898 | −32,71 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 29 218 | 137,78 | 1 046 | 3,47 | ||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 9 315 | 127,14 | 333 | −1,19 | ||||

| 2025-05-14 | 13F | Walleye Capital LLC | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | Meritage Portfolio Management | 27 351 | 200,00 | 979 | 30,57 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 1 767 | 63 | ||||||

| 2025-08-14 | 13F | Freedom Financial Partners LLC | 50 575 | 195,73 | 1 810 | 28,83 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 6 | 0 | ||||||

| 2025-07-31 | 13F | Richards, Merrill & Peterson, Inc. | 0 | −100,00 | 0 | |||||

| 2025-05-09 | 13F | CoreCap Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-07 | 13F | Nkcfo Llc | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | EMC Capital Management | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Aristides Capital LLC | 195 030 | 200,00 | 6 980 | 30,64 | ||||

| 2025-07-17 | 13F | Avondale Wealth Management | 9 119 | 199,97 | 326 | 30,92 | ||||

| 2025-08-14 | 13F | Vienna Asset Management LLC | 6 111 | 219 | ||||||

| 2025-08-08 | 13F | Advyzon Investment Management, LLC | 14 731 | 47,47 | 527 | −35,81 | ||||

| 2025-08-14 | 13F | Comerica Bank | 482 | 46,50 | 17 | −37,04 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 89 512 | 209,38 | 3 204 | 34,69 | ||||

| 2025-08-18 | 13F/A | Apollo Management Holdings, L.P. | 1 275 000 | 13,84 | 45 632 | −50,43 | ||||

| 2025-07-15 | 13F | Surience Private Wealth Llc | 38 375 | 642,84 | 1 373 | 223,82 | ||||

| 2025-08-12 | 13F | Vestor Capital, Llc | 619 370 | 18 | ||||||

| 2025-07-30 | 13F | Avidian Wealth Solutions, LLC | 11 037 | 200,00 | 395 | 30,79 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 1 155 | 200,00 | 0 | |||||

| 2025-08-15 | 13F | First Heartland Consultants, Inc. | 17 663 | 215,81 | 632 | 37,69 | ||||

| 2025-07-15 | 13F | Garrett Investment Advisors LLC | 6 858 | 245 | ||||||

| 2025-08-14 | 13F | GWM Advisors LLC | 50 024 | 219,19 | 1 790 | 38,98 | ||||

| 2025-08-14 | 13F | Fmr Llc | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Venture Visionary Partners LLC | 36 705 | 169,41 | 1 314 | 17,34 | ||||

| 2025-07-25 | 13F | NorthRock Partners, LLC | 11 795 | 204,78 | 422 | 32,39 | ||||

| 2025-07-09 | 13F | Pallas Capital Advisors LLC | 9 335 | 182,37 | 334 | 23,25 | ||||

| 2025-08-14 | 13F | Arete Wealth Advisors, LLC | 18 671 | 203,00 | 1 | |||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 24 299 | 363,54 | 942 | 119,07 | ||||

| 2025-07-16 | 13F | American National Bank | 315 | 200,00 | 11 | 37,50 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 59 458 | 149,46 | 2 128 | 8,63 | ||||

| 2025-08-08 | 13F | Everett Harris & Co /ca/ | 6 000 | 215 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 11 436 418 | 128,36 | 409 309 | −0,57 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 48 800 | 269,70 | 1 747 | 60,92 | |||

| 2025-07-15 | 13F | Cordant, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 163 900 | 527,97 | 5 866 | 173,43 | |||

| 2025-07-17 | 13F | Campion Asset Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 100 | −93,56 | 4 | −97,64 | ||||

| 2025-08-13 | 13F | StoneX Group Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-30 | 13F | Strategic Blueprint, LLC | 106 629 | 209,46 | 3 816 | 34,75 | ||||

| 2025-08-08 | 13F | Citizens Financial Group Inc/ri | 27 573 | 200,00 | 987 | 30,60 | ||||

| 2025-07-16 | 13F | Perigon Wealth Management, LLC | 16 047 | 246,89 | 574 | 51,05 | ||||

| 2025-07-30 | 13F | Fogel Capital Management, Inc. | 7 950 | 200,00 | 285 | 30,88 | ||||

| 2025-08-12 | 13F | Cornerstone Select Advisors, LLC | 7 509 | 183,25 | 269 | 23,50 | ||||

| 2025-07-02 | 13F | HBW Advisory Services LLC | 34 555 | 202,82 | 1 237 | 31,91 | ||||

| 2025-08-15 | 13F | ROSS\JOHNSON & Associates LLC | 3 474 | 200,00 | 124 | 30,53 | ||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 4 255 | 77,14 | 152 | −22,84 | ||||

| 2025-07-23 | 13F | Castle Rock Wealth Management, LLC | 83 580 | 209,34 | 3 270 | 42,30 | ||||

| 2025-08-14 | 13F | Kerrisdale Advisers, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 6 060 | 126,97 | 217 | −1,37 | ||||

| 2025-07-28 | 13F | RFG Advisory, LLC | 9 642 | 205,80 | 345 | 33,20 | ||||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 121 101 | 208,43 | 4 334 | 34,30 | ||||

| 2025-07-14 | 13F | UMA Financial Services, Inc. | 300 | 200,00 | 11 | 25,00 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 180 | 21,62 | 6 | −50,00 | ||||

| 2025-07-21 | 13F | Rainey & Randall Investment Management Inc. | 22 074 | 200,00 | 790 | 30,79 | ||||

| 2025-08-14 | 13F | DRW Securities, LLC | 114 802 | 182,63 | 4 109 | 23,07 | ||||

| 2025-07-14 | 13F | Painted Porch Advisors LLC | 1 425 | 200,00 | 51 | 30,77 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 6 | 200,00 | 0 | |||||

| 2025-08-05 | 13F | Dunhill Financial, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 3 459 | 3 359,00 | 124 | 1 437,50 | ||||

| 2025-07-25 | 13F | Midwest Capital Advisors, LLC | 165 | 6 | ||||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 17 701 | 250,72 | 1 | |||||

| 2025-08-13 | 13F | Hbk Investments L P | 3 267 144 | 299,81 | 116 931 | 74,08 | ||||

| 2025-08-14 | 13F | Cantor Fitzgerald, L. P. | 21 175 | 211,63 | 758 | 35,66 | ||||

| 2025-07-16 | 13F | Dakota Wealth Management | 188 001 | 200,00 | 6 729 | 30,62 | ||||

| 2025-04-21 | 13F | ORG Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-07-07 | 13F | Global Wealth Strategies & Associates | 621 | 200,00 | 22 | 29,41 | ||||

| 2025-08-11 | 13F | Anfield Capital Management, LLC | 150 | 200,00 | 5 | 25,00 | ||||

| 2025-08-12 | 13F | One Charles Private Wealth Services, LLC | 91 764 | 198,90 | 3 284 | 30,16 | ||||

| 2025-07-22 | 13F | Beacon Financial Advisory LLC | 16 233 | 205,30 | 581 | 32,72 | ||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 10 614 | 223,50 | 380 | 40,89 | ||||

| 2025-08-12 | 13F | Wisconsin Wealth Advisors, LLC | 38 132 | 209,56 | 1 365 | 34,78 | ||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 1 500 | 200,00 | 54 | 26,19 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 50 493 | 166,20 | 1 807 | 15,91 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 420 | 23,53 | 15 | −46,43 | ||||

| 2025-06-25 | NP | ARKW - ARK Next Generation Internet ETF | 1 636 584 | −24,66 | 153 659 | −30,20 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 163 800 | 5 862 | ||||||

| 2025-08-14 | 13F | Benjamin Edwards Inc | 150 754 | 162,70 | 5 395 | 14,37 | ||||

| 2025-07-15 | 13F | BCS Wealth Management | 5 985 | 0 | ||||||

| 2025-08-11 | 13F | TRUE Private Wealth Advisors | 6 900 | 247 | ||||||

| 2025-07-30 | 13F | Brookstone Capital Management | 7 788 | 279 | ||||||

| 2025-08-13 | 13F | Financial & Tax Architects, LLC | 5 688 | 204 | ||||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 10 311 | 320,34 | 369 | 83,58 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 30 403 | 246,28 | 1 088 | 50,90 | ||||

| 2025-08-01 | 13F | Belvedere Trading LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Kaleidoscope Capital Lp | 674 568 | 444,87 | 24 143 | 137,24 | ||||

| 2025-07-16 | 13F | Strategic Investment Solutions, Inc. /IL | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Allworth Financial LP | 942 | 96,25 | 34 | −25,00 | ||||

| 2025-08-18 | 13F | N.E.W. Advisory Services LLC | 72 | −34,55 | 3 | −77,78 | ||||

| 2025-08-14 | 13F | First Foundation Advisors | 6 030 | 216 | ||||||

| 2025-08-01 | 13F | Belvedere Trading LLC | Call | 0 | −100,00 | 0 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 801 | 102,78 | 29 | −22,22 | ||||

| 2025-08-01 | 13F | Belvedere Trading LLC | Put | 0 | −100,00 | 0 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 528 | 19 | ||||||

| 2025-08-11 | 13F | Gr Financial Group, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 228 | 200,00 | 8 | 60,00 | ||||

| 2025-08-13 | 13F | Jump Financial, LLC | 21 780 | 780 | ||||||

| 2025-05-06 | 13F | Venturi Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Wolverine Trading, Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-07-22 | 13F | Wealthcare Advisory Partners LLC | 79 351 | 197,56 | 2 840 | 29,52 | ||||

| 2025-07-31 | 13F/A | Interchange Capital Partners, LLC | 24 918 | 131,11 | 892 | 0,56 | ||||

| 2025-08-11 | 13F | Landaas & Co /wi /adv | 8 987 | 322 | ||||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 1 917 | 200,00 | 69 | 30,77 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 122 468 | 198,46 | 4 | 33,33 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Impact Partnership Wealth, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-22 | 13F | Belpointe Asset Management LLC | 64 998 | 197,13 | 2 326 | 29,37 | ||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 3 326 587 | 1 227,83 | 119 059 | 478,15 | ||||

| 2025-08-14 | 13F | Visionary Wealth Advisors | 6 157 | 220 | ||||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 16 435 | 166,80 | 597 | 17,98 | ||||

| 2025-06-30 | NP | BLKC - Invesco Alerian Galaxy Blockchain Users and Decentralized Commerce ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 203 | −14,35 | 19 | −20,83 | ||||

| 2025-06-30 | NP | SATO - Invesco Alerian Galaxy Crypto Economy ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 624 | −23,34 | 59 | −29,27 | ||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | 25 677 | 88,52 | 919 | −17,96 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 15 418 | 227,90 | 552 | 42,75 | ||||

| 2025-07-23 | 13F | Meitav Dash Investments Ltd | 61 114 | 397,10 | 2 187 | 116,53 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 27 360 | 114,57 | 979 | −6,58 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-08 | 13F | United Asset Strategies, Inc. | 13 965 | 200,00 | 500 | 30,63 |