Grunnleggende statistikk

| Institusjonelle aksjer (Long) | 18 329 119 - 23,68% (ex 13D/G) - change of −2,38MM shares −11,51% MRQ |

| Institusjonell verdi (Long) | $ 20 044 USD ($1000) |

Institusjonelt eierskap og aksjonærer

Alto Ingredients, Inc. (US:ALTO) har 108 institusjonelle eiere og aksjonærer som har sendt inn 13D/G- eller 13F-skjemaer til Securities Exchange Commission (SEC). Disse institusjonene eier til sammen 18,329,119 aksjer. De største aksjonærene inkluderer Vanguard Group Inc, BlackRock, Inc., VTSMX - Vanguard Total Stock Market Index Fund Investor Shares, Renaissance Technologies Llc, Peapod Lane Capital LLC, VEXMX - Vanguard Extended Market Index Fund Investor Shares, D. E. Shaw & Co., Inc., Creative Financial Designs Inc /adv, Geode Capital Management, Llc, and Dimensional Fund Advisors Lp .

Alto Ingredients, Inc. (NasdaqCM:ALTO) institusjonell eierstruktur viser nåværende posisjoner i selskapet fordelt på institusjoner og fond, samt de siste endringene i posisjonsstørrelse. De største aksjonærene kan være individuelle investorer, verdipapirfond, hedgefond eller institusjoner. Schedule 13D indikerer at investoren eier (eller har eid) mer enn 5 % av selskapet og har til hensikt (eller hadde til hensikt) å aktivt forfølge en endring i forretningsstrategien. Schedule 13G indikerer en passiv investering på over 5 %.

The share price as of September 12, 2025 is 1,18 / share. Previously, on September 13, 2024, the share price was 1,54 / share. This represents a decline of 23,38% over that period.

Fondssentiment-score

Fondssentiment Score (også kjent som akkumulering av eierskap poengsum) viser hvilke aksjer som er mest kjøpt av fond. Den er resultatet av en sofistikert, kvantitativ flerfaktormodell som identifiserer selskaper med de høyeste nivåene av institusjonell akkumulering. Beregningsmodellen for poeng bruker en kombinasjon av den totale økningen i antall offentliggjorte eiere, endringer i porteføljeallokeringen til disse eierne og andre beregninger. Tallet går fra 0 til 100, der høyere tall indikerer en høyere grad av akkumulering i forhold til sammenlignbare selskaper, der 50 er gjennomsnittet.

Oppdateringsfrekvens: Daglig

Sjekk ut Ownership Explorer, som inneholder en liste over de høyest rangerte selskapene.

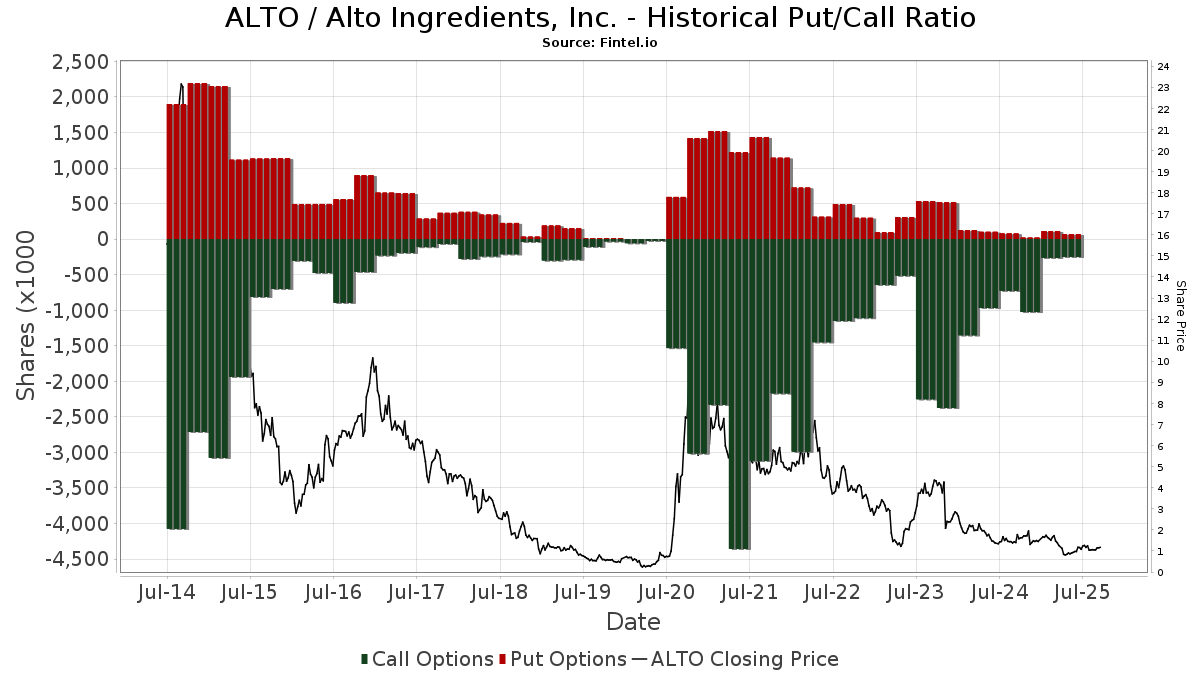

Institusjonell Put/Call-forhold

I tillegg til å rapportere standard aksje- og gjeldsemisjoner må institusjoner med mer enn 100 millioner kroner i forvaltningskapital også oppgi beholdningen av put- og callopsjoner. Siden put-opsjoner generelt indikerer et negativt sentiment, og call-opsjoner indikerer et positivt sentiment, kan vi få et inntrykk av det generelle institusjonelle sentimentet ved å plotte forholdet mellom put- og call-opsjoner. Diagrammet til høyre viser det historiske forholdet mellom put- og call-opsjoner for dette instrumentet.

Ved å bruke Put/Call-forholdet som en indikator på investorsentimentet kan man overvinne en av de viktigste svakhetene ved å bruke totalt institusjonelt eierskap, nemlig at en betydelig andel av forvaltningskapitalen investeres passivt for å følge indekser. Passivt forvaltede fond kjøper vanligvis ikke opsjoner, slik at indikatoren for put/call-forhold i større grad gjenspeiler stemningen i aktivt forvaltede fond.

13D/G-arkiveringer

Vi presenterer 13D/G-arkiveringene separat fra 13F-arkiveringene fordi de behandles forskjellig av SEC. 13D/G-arkiveringene kan sendes inn av grupper av investorer (med én leder), mens 13D/G-arkiveringene ikke kan sendes inn. Dette fører til situasjoner der en investor kan sende inn en 13D/G-rapport med én verdi for alle aksjene (som representerer alle aksjene som eies av investorgruppen), men deretter sende inn en 13F-melding med en annen verdi for alle aksjene (som kun representerer deres eget eierskap). Dette betyr at aksjeeierskap i 13D/G-arkiveringene og 13F-arkiveringene ofte ikke er direkte sammenlignbare, og vi presenterer dem derfor separat.

Merk: Fra og med 16. mai 2021 viser vi ikke lenger eiere som ikke har sendt inn en 13D/G i løpet av det siste året. Tidligere viste vi hele historikken for 13D/G-arkiveringer. Generelt må enheter som er pålagt å sende inn 13D/G-arkiveringer, sende inn minst én gang i året før de sender inn en avsluttende rapport. Det hender imidlertid at fond trekker seg ut av posisjoner uten å sende inn en avsluttende innlevering (dvs. at de avvikler), slik at visning av hele historikken av og til fører til forvirring om det nåværende eierskapet. For å unngå forvirring viser vi nå bare "nåværende" eiere, det vil si eiere som har sendt inn informasjon i løpet av det siste året.

Upgrade to unlock premium data.

| Fildato | Skjema | Investor | Tidligere aksjer |

Siste aksjer |

Δ Aksjer (prosent) |

Eierandel (prosent) |

Δ Eierandel (prosent) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-03-18 | Radoff Family Foundation | 3,625,000 | 3,625,000 | 0.00 | 4.70 | 0.00 | ||

| 2025-01-07 | DOMO Capital Management, LLC | 5,420,069 | 7.10 |

13F- og NPORT-arkiveringer

Detaljer om 13F-arkiveringer er gratis. Detaljer om NP-arkiveringer krever et premium-medlemskap. Grønne rader indikerer nye posisjoner. Røde rader indikerer lukkede posisjoner. Klikk på lenke ikonet for å se hele transaksjonshistorikken.

Oppgrader

for å låse opp premiedata og eksportere til Excel. ![]() .

.

Other Listings

| DE:FPR | € 0,95 |