Grunnleggende statistikk

| Institusjonelle eiere | 79 total, 73 long only, 4 short only, 2 long/short - change of 6,76% MRQ |

| Aksjekurs | 20,00 |

| Gjennomsnittlig porteføljeallokering | 0.2594 % - change of −6,55% MRQ |

| Institusjonelle aksjer (Long) | 9 231 312 (ex 13D/G) - change of 0,96MM shares 11,55% MRQ |

| Institusjonell verdi (Long) | $ 234 903 USD ($1000) |

Institusjonelt eierskap og aksjonærer

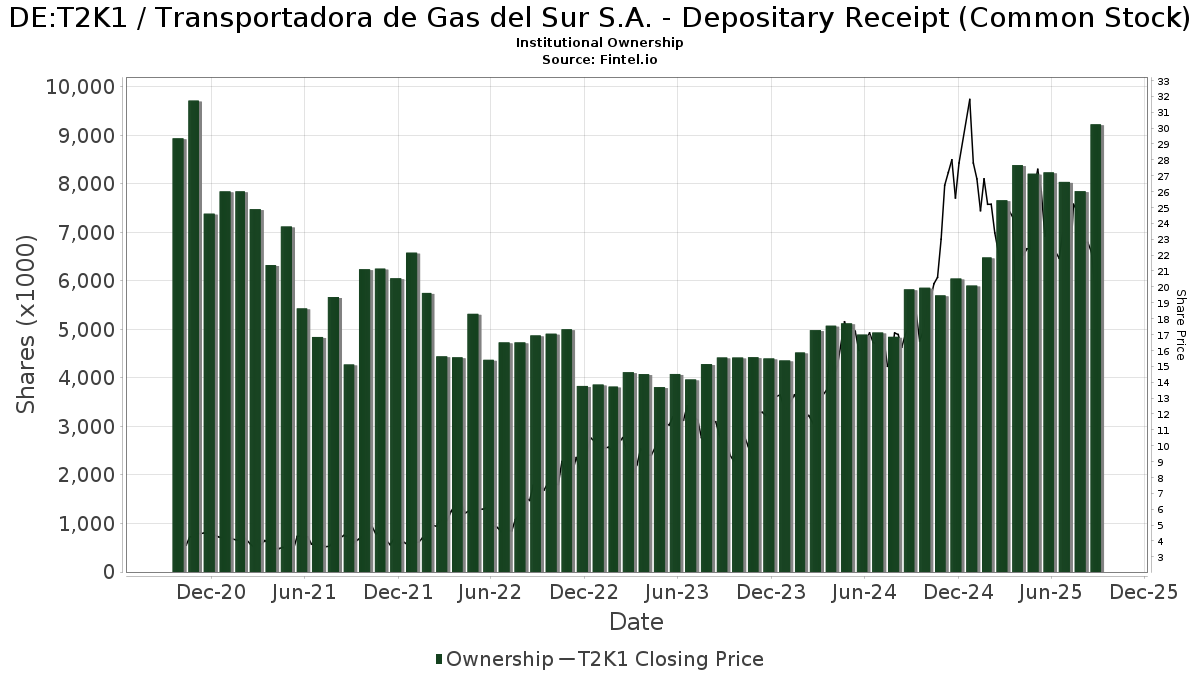

Transportadora de Gas del Sur S.A. - Depositary Receipt (Common Stock) (DE:T2K1) har 79 institusjonelle eiere og aksjonærer som har sendt inn 13D/G- eller 13F-skjemaer til Securities Exchange Commission (SEC). Disse institusjonene eier til sammen 9,232,057 aksjer. De største aksjonærene inkluderer MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd., ARGT - Global X MSCI Argentina ETF, Encompass Capital Advisors LLC, TT International Asset Management LTD, SPX Equities Gestao de Recursos Ltda, Balyasny Asset Management Llc, Morgan Stanley, Fourth Sail Capital LP, VR Advisory Services Ltd, and Arrowstreet Capital, Limited Partnership .

Transportadora de Gas del Sur S.A. - Depositary Receipt (Common Stock) (BST:T2K1) institusjonell eierstruktur viser nåværende posisjoner i selskapet fordelt på institusjoner og fond, samt de siste endringene i posisjonsstørrelse. De største aksjonærene kan være individuelle investorer, verdipapirfond, hedgefond eller institusjoner. Schedule 13D indikerer at investoren eier (eller har eid) mer enn 5 % av selskapet og har til hensikt (eller hadde til hensikt) å aktivt forfølge en endring i forretningsstrategien. Schedule 13G indikerer en passiv investering på over 5 %.

The share price as of September 10, 2025 is 20,00 / share. Previously, on September 11, 2024, the share price was 17,50 / share. This represents an increase of 14,29% over that period.

Fondssentiment-score

Fondssentiment Score (også kjent som akkumulering av eierskap poengsum) viser hvilke aksjer som er mest kjøpt av fond. Den er resultatet av en sofistikert, kvantitativ flerfaktormodell som identifiserer selskaper med de høyeste nivåene av institusjonell akkumulering. Beregningsmodellen for poeng bruker en kombinasjon av den totale økningen i antall offentliggjorte eiere, endringer i porteføljeallokeringen til disse eierne og andre beregninger. Tallet går fra 0 til 100, der høyere tall indikerer en høyere grad av akkumulering i forhold til sammenlignbare selskaper, der 50 er gjennomsnittet.

Oppdateringsfrekvens: Daglig

Sjekk ut Ownership Explorer, som inneholder en liste over de høyest rangerte selskapene.

13F- og NPORT-arkiveringer

Detaljer om 13F-arkiveringer er gratis. Detaljer om NP-arkiveringer krever et premium-medlemskap. Grønne rader indikerer nye posisjoner. Røde rader indikerer lukkede posisjoner. Klikk på lenke ikonet for å se hele transaksjonshistorikken.

Oppgrader

for å låse opp premiedata og eksportere til Excel. ![]() .

.

| Fildato | Kilde | Investor | Type | Gjennomsnittlig pris (estimert) |

Aksjer | Δ Aksjer (%) |

Rapportert verdi ($1000) | Verdi (%) | Portallokering (%) | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 409 812 | −21,15 | 10 614 | −22,82 | ||||

| 2025-05-08 | 13F | XTX Topco Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 10 700 | 105,26 | 277 | 102,19 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 10 000 | 0 | ||||||

| 2025-08-12 | 13F | SPX Equities Gestao de Recursos Ltda | 837 142 | 21 682 | ||||||

| 2025-08-26 | NP | NOEMX - Northern Emerging Markets Equity Index Fund | 0 | 0 | ||||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 3 967 | −0,28 | 103 | −2,86 | ||||

| 2025-06-23 | NP | Global Macro Capital Opportunities Portfolio - Global Macro Capital Opportunities Portfolio | 90 216 | 0,33 | 2 294 | −9,65 | ||||

| 2025-05-09 | 13F | William Blair Investment Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Aquatic Capital Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 25 343 | 656 | ||||||

| 2025-08-26 | NP | MCTOX - Modern Capital Tactical Opportunities Fund Class A Shares | 11 989 | 0,00 | 311 | −2,21 | ||||

| 2025-08-13 | 13F | Jump Financial, LLC | 0 | −100,00 | 0 | |||||

| 2025-04-25 | 13F | Shilanski & Associates, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 483 | 0 | ||||||

| 2025-07-16 | 13F | ORG Partners LLC | 70 | 2 | ||||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 1 900 | 72,73 | 0 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 318 248 | 30,01 | 8 243 | 27,27 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 3 225 | −9,97 | 84 | −11,70 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 26 000 | 642,86 | 1 | ||||

| 2025-08-08 | 13F | Itau Unibanco Holding S.A. | 65 251 | −26,26 | 1 690 | 84 400,00 | ||||

| 2025-05-13 | 13F | Schroder Investment Management Group | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Oaktree Capital Management Lp | 137 630 | −71,60 | 3 565 | −72,20 | ||||

| 2025-05-09 | 13F | R Squared Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-07-23 | 13F | Ameliora Wealth Management Ltd. | 714 | 0,00 | 22 | 5,00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 0 | −100,00 | 0 | |||||

| 2025-07-22 | 13F | Old National Bancorp /in/ | 8 900 | 0,00 | 231 | −2,13 | ||||

| 2025-07-21 | 13F | Ping Capital Management, Inc. | 58 500 | 7,93 | 1 515 | 5,65 | ||||

| 2025-08-14 | 13F | Glenorchy Capital Ltd | 46 244 | −2,11 | 1 198 | −4,16 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 29 721 | 77,38 | 1 | |||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 43 459 | −25,24 | 1 126 | −26,85 | ||||

| 2025-07-28 | 13F | Allianz Asset Management GmbH | 22 500 | −19,42 | 583 | −21,14 | ||||

| 2025-08-14 | 13F | Banco BTG Pactual S.A. | 82 657 | 2 141 | ||||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 18 837 | 488 | ||||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 26 857 | 706 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 4 379 | −12,30 | 113 | −14,39 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 0 | −100,00 | 0 | |||||

| 2025-07-30 | NP | APIE - ActivePassive International Equity ETF | 6 739 | 189 | ||||||

| 2025-08-14 | 13F | Millennium Management Llc | 38 538 | −73,22 | 998 | −73,79 | ||||

| 2025-06-27 | NP | ARGT - Global X MSCI Argentina ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 476 900 | −12,39 | 37 558 | −21,11 | ||||

| 2025-05-08 | NP | QGBLX - Quantified Global Fund Investor Class | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Turim 21 Investimentos Ltda. | 17 903 | 464 | ||||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 19 054 | −21,93 | 493 | −23,57 | ||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 27 953 | −0,09 | 1 | |||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 1 627 579 | 9,19 | 42 154 | 6,88 | ||||

| 2025-07-31 | 13F | Anthracite Investment Company, Inc. | 36 500 | 0,00 | 945 | −2,07 | ||||

| 2025-08-04 | 13F | Yorktown Management & Research Co Inc | 10 300 | 0,00 | 267 | −2,21 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 114 073 | 3,96 | 2 954 | 1,76 | ||||

| 2025-05-27 | NP | HRITX - Hood River International Opportunity Fund Retirement Shares | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-06-30 | NP | APITX - Yorktown Growth Fund Class L Shares | 10 300 | 0,00 | 262 | −10,00 | ||||

| 2025-07-16 | 13F | ABS Direct Equity Fund LLC | 69 658 | 10,22 | 1 804 | 7,89 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 1 534 | 0,99 | 40 | −2,50 | ||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Voloridge Investment Management, Llc | 127 089 | 182,39 | 3 292 | 176,55 | ||||

| 2025-08-07 | 13F | Fourth Sail Capital LP | 253 168 | 37,07 | 6 557 | 34,17 | ||||

| 2025-07-24 | 13F | Lester Murray Antman dba SimplyRich | 64 518 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 10 200 | 264 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 16 721 | 433 | ||||||

| 2025-05-06 | 13F | Advisors Preferred, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-13 | 13F | Liontrust Investment Partners LLP | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 50 | 0,00 | 1 | 0,00 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 92 | 2 | ||||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Put | 20 300 | 526 | |||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 744 | 19 | ||||||

| 2025-05-15 | 13F | Brevan Howard Capital Management LP | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-04-22 | 13F | Channing Global Advisors, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 24 300 | −38,94 | 629 | −40,27 | |||

| 2025-08-13 | 13F | Pictet Asset Management Holding SA | 49 346 | 44,06 | 1 278 | 41,06 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 87 900 | 99,32 | 2 277 | 95,20 | |||

| 2025-05-16 | 13F | Jones Financial Companies Lllp | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-05-15 | 13F | Point72 (DIFC) Ltd | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 0 | −100,00 | 0 | |||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 397 | −49,10 | 10 | −50,00 | ||||

| 2025-08-13 | 13F | Mackenzie Financial Corp | 47 700 | 1 235 | ||||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 101 094 | 75,48 | 2 618 | 71,78 | ||||

| 2025-08-12 | 13F | Rhumbline Advisers | 2 | −60,00 | 0 | |||||

| 2025-05-28 | NP | BESIX - William Blair Emerging Markets Small Cap Growth Fund Class I | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-07 | 13F | Campbell & CO Investment Adviser LLC | 30 886 | −14,52 | 800 | −16,42 | ||||

| 2025-08-08 | 13F | North of South Capital LLP | 37 000 | 48,00 | 958 | 44,93 | ||||

| 2025-06-27 | NP | EAEMX - Parametric Emerging Markets Fund Investor Class | 2 413 | 0,00 | 61 | −10,29 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 117 680 | 22,38 | 3 048 | 19,77 | ||||

| 2025-08-25 | NP | EITEX - Parametric Tax-Managed Emerging Markets Fund Institutional Class | 16 270 | 0,00 | 421 | −2,09 | ||||

| 2025-08-14 | 13F | Encompass Capital Advisors LLC | 1 000 000 | 25 900 | ||||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 176 | 5 | ||||||

| 2025-04-29 | 13F | Hm Payson & Co | 3 220 | 0,00 | 85 | −9,57 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 8 896 | −5,69 | 230 | −7,63 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 15 400 | −79,82 | 399 | −80,28 | |||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 72 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 10 063 | −37,22 | 261 | −38,68 | ||||

| 2025-05-12 | 13F | Citigroup Inc | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Penserra Capital Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 0 | −100,00 | 0 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 19 | 0,00 | 0 | |||||

| 2025-07-10 | 13F | TT International Asset Management LTD | 993 934 | −19,04 | 25 743 | −20,75 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 14 100 | −54,66 | 365 | −55,60 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 17 973 | −15,17 | 466 | −16,96 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 35 | −5,41 | 1 | |||||

| 2025-05-15 | 13F | Hood River Capital Management LLC | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Seldon Capital Lp | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Insigneo Advisory Services, Llc | 21 129 | 84,66 | 547 | 81,13 | ||||

| 2025-05-14 | 13F | Credit Agricole S A | 335 | 9 | ||||||

| 2025-08-27 | NP | IEMSX - ABS Insights Emerging Markets Fund Super Institutional Class Shares | 7 600 | 0,00 | 197 | −2,49 | ||||

| 2025-08-13 | 13F | Centiva Capital, LP | 11 093 | 287 | ||||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 0 | −100,00 | 0 | |||||

| 2025-08-27 | NP | TIFF INVESTMENT PROGRAM - TIFF Multi-Asset Fund | Short | −745 | 163,25 | −19 | 137,50 | |||

| 2025-08-07 | 13F | Kempen Capital Management N.v. | 132 293 | 14,62 | 3 426 | 12,18 | ||||

| 2025-08-14 | 13F | VR Advisory Services Ltd | 215 761 | −50,11 | 5 588 | −51,16 | ||||

| 2025-06-24 | NP | FFTY - Innovator IBD(R) 50 ETF | 11 068 | 281 | ||||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | GWM Advisors LLC | 12 146 | −0,25 | 315 | −2,48 | ||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 182 354 | 10,96 | 4 723 | 8,60 |