| Innsideraksjer | 28 817 305 shares |

Insider Sentiment Score

Insider Sentiment Score finner selskapene som blir kjøpt av bedriftsinsidere.

Det er resultatet av en sofistikert, flerfaktor kvantitativ modell som identifiserer selskaper som har de høyeste nivåene av insiderakkumulasjon. Scoringsmodellen bruker en kombinasjon av netto antall insidere som kjøper de siste 90 dagene, det totale antallet kjøpte aksjer som en prosentandel av flyten, og det totale antallet aksjer eid av insidere. Tallet varierer fra 0 til 100, hvor høyere tall indikerer en høyere grad av akkumulasjon sammenlignet med jevnaldrende, og 50 er gjennomsnittet.

Oppdateringsfrekvens: Daglig

Se Insidernes Topp Picks, som gir en liste over selskaper med høyest akkumulasjon blant insidere.

Officer Sentiment Score

Officer Sentiment Score finner selskaper som kjøpes av bedriftsoffiserer.

Per definisjon er Corporate Officers Corporate Insiders, men i motsetning til noen av de andre innsiderne (10 % aksjonærer og styremedlemmer), jobber offiserer for selskapet på daglig basis, og de bruker sine egne penger når de handler . (10 % aksjonærer og styremedlemmer er ofte fondsforvaltere som forvalter andres penger.) Som sådan er innsidehandler utført av offiserer mye mer betydningsfulle og bør behandles på riktig måte.

Som Insider Sentiment Score er Officer Sentiment Score resultatet av en sofistikert, flerfaktor kvantitativ modell som identifiserer selskaper med de høyeste nivåene av akkumulasjon blant ledelsen.

Oppdateringsfrekvens: Daglig

Se Insidernes Topp Picks, som gir en liste over selskaper med høyest insider-sentiment.

Nøkkelindikatorer for insidere

Dette kortet viser hvordan selskapet rangerer langs ulike indikatorer for insidere. Percentile-rangeringen viser hvordan dette selskapet sammenligner seg med andre selskaper på USAs markeder. Høyere rangeringer indikerer bedre situasjoner.

For eksempel, er det generelt akseptert at insiderkjøp er en positiv indikator, så derfor ville selskaper som insiderkjøper mer, rangere høyere enn selskaper med mindre insiderkjøp (eller til og med insidersalg).

Netto antall insidere som kjøper (Rangering)

N/A

Nettotall av innsidekjøp som kjøper er det totale antallet insidere som har kjøpt minus det totale antallet insidere som har solgt de siste 90 dagene. Den prosentvise rangeringen vises her (rangerer fra 0 til 100%).

Prosent av aksjeflyt kjøpt av insidere (rang)

N/A

Prosenten av aksjeflyt kjøpt av innsidere er det totale antallet aksjer som er blitt kjøpt av innsidere minus det totale antallet aksjer solgt av innsidere de siste 90 dagene, delt på totalt antall utestående aksjer og multiplisert med 100.

Diagram over innsidehandel

Lyon William Homes insiderhandel vises i følgende diagram. Innsidere er ledere, direktører eller viktige investorer i et selskap. Generelt sett er det ulovlig for insidere å handle med aksjer i sine selskaper basert på materiell, ikke-offentlig informasjon. Dette betyr ikke at det er ulovlig for dem å gjøre any handler i deres egne selskaper. Imidlertid må de rapportere alle handler til SEC via en Form 4.

Insiderliste og lønnsomhetsmålinger

Denne tabellen viser listen over kjente insidere, og er automatisk generert fra arkiveringer offentliggjort av SEC. I tillegg til navn, siste tittel og direktør-, offiser- eller 10 % eier-betegnelse, gir vi de nyeste offentliggjorte beholdningene. I tillegg gir vi, når det er mulig, den historiske handelsytelsen for insidere. Den historiske handelsytelsen er et vektet gjennomsnitt av ytelsen til faktiske kjøpstransaksjoner som er gjort av insidere på det åpne markedet. For mer informasjon om hvordan dette blir beregnet, kan du se dette YouTube-webinaret.

See our leaderboard of most profitable insider traders.

| Innsider | Gjennomsnittlig fortjeneste (%) | Aksjer eid |

Splitt justert |

|---|

Report errors via our new Insider Auditing Tool

Analyse av sporrekord for insiderkjøp - Kortsiktig lønnsomhetsanalyse

I denne seksjonen analyserer vi lønnsomheten til hver ikke-planlagte, åpne markeds innsidekjøp gjort i WLH / Lyon William Homes. Denne analysen hjelper til med å forstå om insidere konsekvent genererer unormale avkastninger og er verdt å følge. Denne analysen gjelder for ett år etter hver handel, og resultatene er teoretiske .

Følgende tabell viser de mest nylige åpne markedskjøpene som ikke var en del av en automatisk handelsplan.

Justert pris er prisen justert for splitt. Justerte aksjer er aksjer justert for splitt.

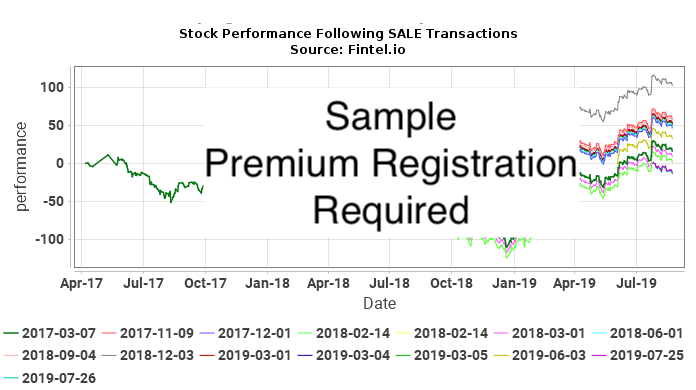

Analyse av sporrekord for insidesalg - Kortsiktig tapanalyse

I denne seksjonen analyserer vi kortsiktig tap til hver ikke-planlagte, åpne markeds innsidekjøp gjort i WLH / Lyon William Homes. Et konsekvent mønster av tap unngåelse kan antyde at fremtidige salgstransaksjoner kan forutsi nedgang i pris. Denne analysen gjelder for ett år etter hver handel, og resultatene er teoretiske .

Følgende tabell viser de mest nylige åpne markedssalgene som ikke var en del av en automatisk trading plan.

Justert pris er prisen justert for splitt. Justerte aksjer er aksjer justert for splitt.

Transaksjonshistorikk

Klikk på lenkeikonet for å se hele transaksjonshistorikken. Transaksjoner rapportert som en del av en automatisk handelsplan 10b5-1 vil ha en X i kolonnen merket 10b-5.

| Fil dato |

Handels dato |

Skjema | Innsider | Ticker | Verdipapirnavn | Kode | Direkte | Utøvelses pris |

Enhets pris |

Enheter endret |

Verdi endret (1K) |

Gjenværende Opsjoner |

Gjenværende Aksjer |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2020-02-06 | 2020-02-06 | 4 | HARRISON THOMAS F | WLH | CLASS A COMMON STOCK | D | −1 944 | 0 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | HARRISON THOMAS F | WLH | CLASS A COMMON STOCK | D | −27 143 | 1 944 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | Hunt Gary H | WLH | CLASS A COMMON STOCK | D | −2 385 | 0 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | Hunt Gary H | WLH | CLASS A COMMON STOCK | D | −41 601 | 2 385 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | SCHELL LYNN CARLSON | WLH | CLASS A COMMON STOCK | D | −1 944 | 0 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | SCHELL LYNN CARLSON | WLH | CLASS A COMMON STOCK | D | −63 473 | 1 944 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | SEVERN COLIN T | WLH | STOCK OPTION (RIGHT TO BUY) | D | 8,66 | −28 364 | 0 | |||||

| 2020-02-06 | 2020-02-06 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | −31 802 | 0 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | −50 324 | 31 802 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | −61 909 | 82 126 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | LILJESTROM JASON R | WLH | CLASS A COMMON STOCK | D | −21 201 | 0 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | LILJESTROM JASON R | WLH | CLASS A COMMON STOCK | D | −30 644 | 21 201 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | LILJESTROM JASON R | WLH | CLASS A COMMON STOCK | D | −28 507 | 51 845 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | Ammerman Douglas K | WLH | CLASS A COMMON STOCK | D | −1 944 | 0 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | Ammerman Douglas K | WLH | CLASS A COMMON STOCK | D | −56 075 | 1 944 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | Anderson Eric A. | WLH | CLASS A COMMON STOCK | D | −3 534 | 0 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | Anderson Eric A. | WLH | CLASS A COMMON STOCK | D | −10 600 | 3 534 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | LYON WILLIAM H | WLH | STOCK OPTION (RIGHT TO BUY) | D | 25,82 | −120 000 | 0 | |||||

| 2020-02-06 | 2020-02-06 | 4 | LYON WILLIAM H BY LLC | WLH | CLASS B COMMON STOCK WARRANT (RIGHT TO BUY) | I | 17,08 | −1 907 550 | 0 | |||||

| 2020-02-06 | 2020-02-06 | 4 | LYON WILLIAM H BY LLC | WLH | CLASS B COMMON STOCK | I | −4 817 394 | 0 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | LYON WILLIAM H BY TRUST | WLH | CLASS A COMMON STOCK | I | −2 933 | 0 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | LYON WILLIAM H | WLH | CLASS A COMMON STOCK | D | −29 446 | 0 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | LYON WILLIAM H | WLH | CLASS A COMMON STOCK | D | −55 345 | 29 446 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | LYON WILLIAM H | WLH | CLASS A COMMON STOCK | D | −234 217 | 84 791 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | ZAIST MATTHEW R | WLH | STOCK OPTION (RIGHT TO BUY) | D | 8,66 | −120 000 | 0 | |||||

| 2020-02-06 | 2020-02-06 | 4 | ZAIST MATTHEW R BY LLC | WLH | CLASS A COMMON STOCK | I | −161 516 | 0 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | −507 123 | 0 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | DOYLE BRIAN W | WLH | STOCK OPTION (RIGHT TO BUY) | D | 8,66 | −77 819 | 0 | |||||

| 2020-02-06 | 2020-02-06 | 4 | DOYLE BRIAN W | WLH | CLASS A COMMON STOCK | D | −47 114 | 0 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | DOYLE BRIAN W | WLH | CLASS A COMMON STOCK | D | −67 329 | 47 114 | ||||||

| 2020-02-06 | 2020-02-06 | 4 | DOYLE BRIAN W | WLH | CLASS A COMMON STOCK | D | −122 495 | 114 443 | ||||||

| 2020-02-03 | 2020-01-30 | 4 | DOYLE BRIAN W | WLH | CLASS A COMMON STOCK | D | 47 114 | 236 938 | ||||||

| 2020-02-03 | 2020-01-30 | 4 | LILJESTROM JASON R | WLH | CLASS A COMMON STOCK | D | 21 201 | 80 352 | ||||||

| 2020-02-03 | 2020-01-30 | 4 | LYON WILLIAM H | WLH | CLASS A COMMON STOCK | D | 29 446 | 319 008 | ||||||

| 2020-02-03 | 2020-01-30 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | 31 802 | 144 035 | ||||||

| 2020-01-23 | 2020-01-21 | 4 | ZAIST MATTHEW R BY LLC | WLH | STOCK OPTION (RIGHT TO BUY) | I | 8,66 | −166 380 | 0 | |||||

| 2020-01-23 | 2020-01-21 | 4 | ZAIST MATTHEW R | WLH | STOCK OPTION (RIGHT TO BUY) | D | 8,66 | −3 317 | 0 | |||||

| 2020-01-23 | 2020-01-21 | 4 | ZAIST MATTHEW R BY LLC | WLH | CLASS A COMMON STOCK | I | 22,0600 | −108 890 | −2 402 | 161 516 | ||||

| 2020-01-23 | 2020-01-21 | 4 | ZAIST MATTHEW R BY LLC | WLH | CLASS A COMMON STOCK | I | 8,6625 | 166 380 | 1 441 | 270 406 | ||||

| 2020-01-23 | 2020-01-21 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 22,0600 | −1 302 | −29 | 507 123 | ||||

| 2020-01-23 | 2020-01-21 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 8,6625 | 3 317 | 29 | 508 425 | ||||

| 2019-12-23 | 2019-12-19 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 20,0400 | −284 691 | −5 705 | 505 108 | ||||

| 2019-12-23 | 2019-12-19 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 101 293 | 789 799 | ||||||

| 2019-12-23 | 2019-12-19 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 179 534 | 688 506 | ||||||

| 2019-12-23 | 2019-12-19 | 4 | LYON WILLIAM H | WLH | CLASS A COMMON STOCK | D | 20,0400 | −17 826 | −357 | 289 562 | ||||

| 2019-03-05 | 2019-03-01 | 4 | DOYLE BRIAN W | WLH | CLASS A COMMON STOCK | D | 23 557 | 189 824 | ||||||

| 2019-03-05 | 2019-03-01 | 4 | DOYLE BRIAN W | WLH | CLASS A COMMON STOCK | D | 14,1500 | −14 933 | −211 | 166 267 | ||||

| 2019-03-05 | 2019-03-01 | 4 | LILJESTROM JASON R | WLH | CLASS A COMMON STOCK | D | 10 600 | 59 151 | ||||||

| 2019-03-05 | 2019-03-01 | 4 | LILJESTROM JASON R | WLH | CLASS A COMMON STOCK | D | 14,1500 | −6 870 | −97 | 48 551 | ||||

| 2019-03-05 | 2019-03-01 | 4 | Ammerman Douglas K | WLH | CLASS A COMMON STOCK | D | 7 773 | 58 019 | ||||||

| 2019-03-05 | 2019-03-01 | 4 | Anderson Eric A. | WLH | CLASS A COMMON STOCK | D | 14 134 | 14 134 | ||||||

| 2019-03-05 | 2019-03-01 | 4 | HARRISON THOMAS F | WLH | CLASS A COMMON STOCK | D | 7 773 | 29 087 | ||||||

| 2019-03-05 | 2019-03-01 | 4 | Hunt Gary H | WLH | CLASS A COMMON STOCK | D | 9 540 | 43 986 | ||||||

| 2019-03-05 | 2019-03-01 | 4 | SCHELL LYNN CARLSON | WLH | CLASS A COMMON STOCK | D | 7 773 | 65 417 | ||||||

| 2019-03-05 | 2019-03-01 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 50 647 | 508 972 | ||||||

| 2019-03-05 | 2019-03-01 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 14,1500 | −42 837 | −606 | 458 325 | ||||

| 2019-03-05 | 2019-03-01 | 4 | LYON WILLIAM H | WLH | CLASS A COMMON STOCK | D | 14 723 | 307 388 | ||||||

| 2019-03-05 | 2019-03-01 | 4 | LYON WILLIAM H | WLH | CLASS A COMMON STOCK | D | 14,1500 | −31 144 | −441 | 292 665 | ||||

| 2019-03-05 | 2019-03-01 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | 15 901 | 112 233 | ||||||

| 2019-03-05 | 2019-03-01 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | 14,1500 | −12 160 | −172 | 96 332 | ||||

| 2019-02-22 | 2019-02-20 | 4 | LILJESTROM JASON R | WLH | CLASS A COMMON STOCK | D | 9 752 | 55 421 | ||||||

| 2019-02-22 | 2019-02-20 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 46 600 | 501 162 | ||||||

| 2019-02-22 | 2019-02-20 | 4 | LYON WILLIAM H | WLH | CLASS A COMMON STOCK | D | 27 093 | 323 809 | ||||||

| 2019-02-22 | 2019-02-20 | 4 | DOYLE BRIAN W | WLH | CLASS A COMMON STOCK | D | 21 673 | 181 200 | ||||||

| 2019-02-22 | 2019-02-20 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | 14 629 | 108 492 | ||||||

| 2019-01-23 | 2019-01-18 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 134 650 | 454 562 | ||||||

| 2018-11-27 | 2018-11-26 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 12,1200 | −58 802 | −713 | 3 175 925 | ||||

| 2018-11-21 | 2018-11-20 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 11,7600 | −83 300 | −980 | 3 234 727 | ||||

| 2018-11-16 | 2018-11-16 | 4 | ZAIST MATTHEW R BY LLC | WLH | CLASS A COMMON STOCK | I | 11,8290 | 3 000 | 35 | 104 026 | ||||

| 2018-11-16 | 2018-11-15 | 4 | ZAIST MATTHEW R BY LLC | WLH | CLASS A COMMON STOCK | I | 11,4590 | 5 000 | 57 | 101 026 | ||||

| 2018-11-14 | 2018-11-13 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 12,1800 | −114 015 | −1 389 | 3 318 027 | ||||

| 2018-11-14 | 2018-11-12 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 12,1600 | −52 585 | −639 | 3 432 042 | ||||

| 2018-08-21 | 2018-08-09 | 4 | DOYLE BRIAN W | WLH | CLASS A COMMON STOCK | D | 21,4300 | −7 329 | −157 | 159 527 | ||||

| 2018-07-12 | 2018-07-10 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 23,7500 | 10 790 | 256 | 3 484 627 | ||||

| 2018-04-06 | 2018-04-04 | 4 | DOYLE BRIAN W | WLH | CLASS A COMMON STOCK | D | 28,0191 | −15 596 | −437 | 166 856 | ||||

| 2018-03-02 | 2018-03-01 | 4 | LYON WILLIAM H | WLH | CLASS A COMMON STOCK | D | 25,2800 | −43 961 | −1 111 | 296 716 | ||||

| 2018-03-02 | 2018-03-01 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 25,2800 | −50 050 | −1 265 | 319 912 | ||||

| 2018-03-02 | 2018-03-01 | 4 | DOYLE BRIAN W | WLH | CLASS A COMMON STOCK | D | 25,2800 | −18 681 | −472 | 182 452 | ||||

| 2018-03-02 | 2018-03-01 | 4 | LILJESTROM JASON R | WLH | CLASS A COMMON STOCK | D | 25,2800 | −5 389 | −136 | 45 669 | ||||

| 2018-03-02 | 2018-03-01 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | 25,2800 | −13 756 | −348 | 97 207 | ||||

| 2018-02-26 | 2018-02-22 | 4 | DOYLE BRIAN W | WLH | CLASS A COMMON STOCK | D | 12 714 | 201 133 | ||||||

| 2018-02-26 | 2018-02-22 | 4 | LILJESTROM JASON R | WLH | CLASS A COMMON STOCK | D | 5 722 | 51 058 | ||||||

| 2018-02-26 | 2018-02-22 | 4 | LYON WILLIAM H | WLH | CLASS A COMMON STOCK | D | 15 891 | 340 677 | ||||||

| 2018-02-26 | 2018-02-22 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | 8 581 | 110 963 | ||||||

| 2018-02-26 | 2018-02-22 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 27 334 | 369 962 | ||||||

| 2018-02-26 | 2018-02-22 | 4 | Ammerman Douglas K | WLH | CLASS A COMMON STOCK | D | 4 195 | 50 246 | ||||||

| 2018-02-26 | 2018-02-22 | 4 | SCHELL LYNN CARLSON | WLH | CLASS A COMMON STOCK | D | 4 195 | 57 644 | ||||||

| 2018-02-26 | 2018-02-22 | 4 | HARRISON THOMAS F | WLH | CLASS A COMMON STOCK | D | 4 195 | 21 314 | ||||||

| 2018-02-26 | 2018-02-22 | 4 | Hunt Gary H | WLH | CLASS A COMMON STOCK | D | 5 148 | 34 446 | ||||||

| 2018-02-26 | 2018-02-22 | 4 | NIEMANN MATTHEW R | WLH | CLASS A COMMON STOCK | D | 4 195 | 43 963 | ||||||

| 2018-02-20 | 2018-02-15 | 4 | DOYLE BRIAN W | WLH | CLASS A COMMON STOCK | D | 48 650 | 188 419 | ||||||

| 2018-02-20 | 2018-02-15 | 4 | LILJESTROM JASON R | WLH | CLASS A COMMON STOCK | D | 22 702 | 45 336 | ||||||

| 2018-02-20 | 2018-02-15 | 4 | LYON WILLIAM H | WLH | CLASS A COMMON STOCK | D | 111 848 | 324 786 | ||||||

| 2018-02-20 | 2018-02-15 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | 44 219 | 102 382 | ||||||

| 2018-02-20 | 2018-02-15 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 137 251 | 342 628 | ||||||

| 2018-01-30 | 2018-01-29 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 29,2300 | −34 300 | −1 003 | 3 495 417 | ||||

| 2018-01-23 | 2018-01-22 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 32,1300 | −41 600 | −1 337 | 3 529 717 | ||||

| 2018-01-18 | 2018-01-16 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 31,7600 | −44 700 | −1 420 | 3 571 317 | ||||

| 2018-01-08 | 2018-01-05 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 30,9900 | −31 200 | −967 | 3 616 017 | ||||

| 2018-01-03 | 2018-01-02 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 29,1800 | −31 200 | −910 | 3 647 217 | ||||

| 2017-12-22 | 2017-12-21 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 28,3800 | −6 049 | −172 | 3 678 417 | ||||

| 2017-12-20 | 2017-12-18 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 28,5100 | −11 620 | −331 | 3 684 466 | ||||

| 2017-12-20 | 2017-12-18 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 29,0300 | −23 931 | −695 | 3 696 086 | ||||

| 2017-12-14 | 2017-12-14 | 4 | LYON WILLIAM H By LLC | WLH | Class B Common Stock | I | 29,8900 | 871 865 | 26 060 | 4 817 394 | ||||

| 2017-12-14 | 2017-12-14 | 4 | LYON WILLIAM H By LLC | WLH | Class B Common Stock | I | 29,2300 | 131 645 | 3 848 | 3 945 529 | ||||

| 2017-12-14 | 2017-12-13 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 28,3600 | −5 100 | −145 | 3 720 017 | ||||

| 2017-12-13 | 2017-12-12 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 28,7300 | −6 493 | −187 | 3 725 117 | ||||

| 2017-12-13 | 2017-12-11 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 28,8500 | −19 607 | −566 | 3 731 610 | ||||

| 2017-11-30 | 2017-11-28 | 4 | Hunt Gary H | WLH | Class A Common Stock | D | 29,3344 | −2 500 | −73 | 29 298 | ||||

| 2017-11-30 | 2017-11-28 | 4 | SEVERN COLIN T | WLH | Class A Common Stock | D | 29,2640 | −7 500 | −219 | 58 163 | ||||

| 2017-11-21 | 2017-11-17 | 4 | ZAIST MATTHEW R By LLC | WLH | Class A Common Stock | I | 28,8289 | −25 000 | −721 | 96 026 | ||||

| 2017-09-20 | 2017-09-18 | 4 | Paulson Property Management II LLC See | WLH | Class A Common Stock par value $.01 per share | I | 23,8100 | −3 322 666 | −79 113 | 0 | ||||

| 2017-09-12 | 2017-09-11 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 24,3500 | −41 600 | −1 013 | 3 751 217 | ||||

| 2017-08-29 | 2017-08-25 | 4 | Hunt Gary H | WLH | Class A Common Stock | D | 22,8705 | −8 500 | −194 | 31 798 | ||||

| 2017-08-09 | 2017-08-08 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 23,0900 | −36 550 | −844 | 3 792 817 | ||||

| 2017-08-08 | 2017-08-07 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 22,7000 | −15 450 | −351 | 3 829 367 | ||||

| 2017-08-02 | 2017-08-01 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 22,7400 | −10 563 | −240 | 3 844 817 | ||||

| 2017-08-02 | 2017-07-31 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 22,7400 | −10 237 | −233 | 3 855 380 | ||||

| 2017-07-27 | 2017-07-26 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 23,3800 | −1 700 | −40 | 3 865 617 | ||||

| 2017-07-26 | 2017-07-25 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 23,4100 | −34 959 | −818 | 3 867 317 | ||||

| 2017-07-26 | 2017-07-24 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 23,2900 | −15 341 | −357 | 3 902 276 | ||||

| 2017-07-20 | 2017-07-19 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 23,5800 | −16 422 | −387 | 3 917 617 | ||||

| 2017-07-19 | 2017-07-18 | 4 | GMT CAPITAL CORP | WLH | Common - Class A | D | 23,3700 | −14 178 | −331 | 3 934 039 | ||||

| 2017-07-18 | 2017-07-17 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 23,8700 | −16 200 | −387 | 3 948 217 | ||||

| 2017-07-12 | 2017-07-10 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 23,8600 | −52 000 | −1 241 | 3 964 417 | ||||

| 2017-07-11 | 2017-07-07 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 23,3800 | −1 527 | −36 | 4 016 417 | ||||

| 2017-07-10 | 2017-07-06 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 23,3300 | −15 179 | −354 | 4 017 944 | ||||

| 2017-07-07 | 2017-07-05 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 23,5300 | −30 669 | −722 | 4 033 123 | ||||

| 2017-07-06 | 2017-07-03 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 23,5300 | −30 669 | −722 | 4 033 123 | ||||

| 2017-06-28 | 2017-06-27 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 23,7000 | −1 736 | −41 | 4 068 417 | ||||

| 2017-06-28 | 2017-06-26 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 23,5000 | −50 264 | −1 181 | 4 070 153 | ||||

| 2017-06-22 | 2017-06-20 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 22,8900 | −14 900 | −341 | 4 120 417 | ||||

| 2017-06-21 | 2017-06-19 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 22,5500 | −37 100 | −837 | 4 135 317 | ||||

| 2017-06-15 | 2017-06-13 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 22,5900 | −32 300 | −730 | 4 172 417 | ||||

| 2017-06-13 | 2017-06-12 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 22,5200 | −19 700 | −444 | 4 204 717 | ||||

| 2017-06-12 | 2017-06-08 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 22,5900 | −9 991 | −226 | 4 224 417 | ||||

| 2017-06-09 | 2017-06-07 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 22,6500 | −8 489 | −192 | 4 234 408 | ||||

| 2017-06-07 | 2017-06-06 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 22,4800 | −21 513 | −484 | 4 242 897 | ||||

| 2017-06-07 | 2017-06-05 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 22,8400 | −12 007 | −274 | 4 264 410 | ||||

| 2017-06-02 | 2017-05-31 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 22,4000 | −40 828 | −915 | 4 276 417 | ||||

| 2017-06-01 | 2017-05-30 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 22,6600 | −11 172 | −253 | 4 317 245 | ||||

| 2017-05-25 | 2017-05-23 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 23,3300 | −23 349 | −545 | 4 328 417 | ||||

| 2017-05-24 | 2017-05-22 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 23,3900 | −28 651 | −670 | 4 351 766 | ||||

| 2017-05-17 | 2017-05-15 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 23,4400 | −52 000 | −1 219 | 4 380 417 | ||||

| 2017-05-12 | 2017-05-09 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 23,1600 | 41 968 | 972 | 4 432 417 | ||||

| 2017-05-10 | 2017-05-08 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 22,1000 | 10 032 | 222 | 4 474 385 | ||||

| 2017-05-03 | 2017-05-01 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 21,9900 | −52 000 | −1 143 | 4 484 417 | ||||

| 2017-04-26 | 2017-04-24 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 21,8300 | −52 000 | −1 135 | 4 536 417 | ||||

| 2017-03-15 | 2017-03-14 | 4 | GMT CAPITAL CORP | WLH | Common Class A | D | 19,6000 | −12 543 | −246 | 4 588 417 | ||||

| 2017-03-15 | 2017-03-13 | 4 | GMT CAPITAL CORP | WLH | Common Class A | D | 19,8600 | −39 457 | −784 | 4 600 960 | ||||

| 2017-03-03 | 2017-03-01 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | 18,4300 | −6 744 | −124 | 67 400 | ||||

| 2017-03-03 | 2017-03-01 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 18,4300 | −19 416 | −358 | 205 377 | ||||

| 2017-03-03 | 2017-03-01 | 4 | DOYLE BRIAN W | WLH | CLASS A COMMON STOCK | D | 18,4300 | −7 884 | −145 | 139 769 | ||||

| 2017-03-03 | 2017-03-01 | 4 | LILJESTROM JASON R | WLH | CLASS A COMMON STOCK | D | 18,4300 | −2 462 | −45 | 22 634 | ||||

| 2017-02-28 | 2017-02-24 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | 12 624 | 74 144 | ||||||

| 2017-02-28 | 2017-02-24 | 4 | LILJESTROM JASON R | WLH | CLASS A COMMON STOCK | D | 6 482 | 25 096 | ||||||

| 2017-02-28 | 2017-02-24 | 4 | DOYLE BRIAN W | WLH | CLASS A COMMON STOCK | D | 13 890 | 147 653 | ||||||

| 2017-02-28 | 2017-02-24 | 4 | LYON WILLIAM H | WLH | CLASS A COMMON STOCK | D | 31 931 | 212 938 | ||||||

| 2017-02-28 | 2017-02-24 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 39 182 | 224 793 | ||||||

| 2017-02-28 | 2017-02-24 | 4 | HARRISON THOMAS F | WLH | CLASS A COMMON STOCK | D | 5 555 | 17 119 | ||||||

| 2017-02-28 | 2017-02-24 | 4 | SCHELL LYNN CARLSON | WLH | CLASS A COMMON STOCK | D | 5 555 | 53 449 | ||||||

| 2017-02-28 | 2017-02-24 | 4 | Hunt Gary H | WLH | CLASS A COMMON STOCK | D | 6 944 | 40 298 | ||||||

| 2017-02-28 | 2017-02-24 | 4 | Ammerman Douglas K | WLH | CLASS A COMMON STOCK | D | 11 666 | 46 051 | ||||||

| 2017-02-28 | 2017-02-24 | 4 | NIEMANN MATTHEW R | WLH | CLASS A COMMON STOCK | D | 5 555 | 39 768 | ||||||

| 2017-02-23 | 3 | DOYLE BRIAN W | WLH | Class A Common Stock | D | 238 024 | ||||||||

| 2017-02-23 | 3 | DOYLE BRIAN W | WLH | Class A Common Stock | D | 238 024 | ||||||||

| 2017-02-23 | 2017-02-21 | 4 | LYON WILLIAM H | WLH | CLASS A COMMON STOCK | D | 41 578 | 181 007 | ||||||

| 2017-02-23 | 2017-02-21 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 46 198 | 185 611 | ||||||

| 2017-02-23 | 2017-02-21 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | 14 629 | 61 520 | ||||||

| 2017-02-23 | 2017-02-21 | 4 | DOYLE BRIAN W | WLH | CLASS A COMMON STOCK | D | 14 751 | 133 763 | ||||||

| 2017-02-23 | 2017-02-21 | 4 | LILJESTROM JASON R | WLH | CLASS A COMMON STOCK | D | 5 900 | 18 614 | ||||||

| 2017-01-05 | 2017-01-03 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 19,0300 | −166 330 | −3 165 | 4 640 417 | ||||

| 2016-12-30 | 2016-12-29 | 4 | GMT CAPITAL CORP | WLH | COMMON - CLASS A | D | 19,6900 | 26 570 | 523 | 4 806 747 | ||||

| 2016-08-15 | 2016-08-12 | 4 | GMT CAPITAL CORP | WLH | COMMON | D | 15,9400 | 62 400 | 995 | 4 833 317 | ||||

| 2016-06-09 | 2016-06-07 | 4 | GMT CAPITAL CORP | WLH | Common Stock | D | 16,3900 | 208 000 | 3 409 | 4 770 917 | ||||

| 2016-05-18 | 2016-05-16 | 4 | GMT CAPITAL CORP | WLH | Common Class A | D | 14,3000 | 436 100 | 6 236 | 4 562 917 | ||||

| 2016-04-13 | 2016-04-11 | 4 | GMT CAPITAL CORP | WLH | Common Class A | D | 14,2700 | 72 700 | 1 037 | 4 126 817 | ||||

| 2016-04-05 | 2016-03-31 | 4 | GMT CAPITAL CORP | WLH | Class A Common Stock | D | 14,2100 | 982 894 | 13 967 | 3 881 392 | ||||

| 2016-04-05 | 2016-04-04 | 4 | GMT CAPITAL CORP | WLH | Class A Common Stock | D | 14,2700 | 172 725 | 2 465 | 4 054 117 | ||||

| 2016-03-25 | 3 | GMT CAPITAL CORP | WLH | Common Class A | D | 5 796 996 | ||||||||

| 2016-03-25 | 3 | GMT CAPITAL CORP | WLH | Common Class A | D | 5 796 996 | ||||||||

| 2016-03-23 | 2016-03-22 | 4 | Ammerman Douglas K | WLH | CLASS A COMMON STOCK | D | 6 484 | 34 385 | ||||||

| 2016-03-23 | 2016-03-22 | 4 | Hunt Gary H | WLH | CLASS A COMMON STOCK | D | 8 285 | 33 354 | ||||||

| 2016-03-23 | 2016-03-22 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | 8 555 | 48 300 | ||||||

| 2016-03-23 | 2016-03-22 | 4 | NIEMANN MATTHEW R | WLH | CLASS A COMMON STOCK | D | 6 484 | 34 213 | ||||||

| 2016-03-23 | 2016-03-22 | 4 | SCHELL LYNN CARLSON | WLH | CLASS A COMMON STOCK | D | 12 247 | 47 894 | ||||||

| 2016-03-23 | 2016-03-22 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 27 017 | 139 413 | ||||||

| 2016-03-23 | 2016-03-22 | 4 | HARRISON THOMAS F | WLH | CLASS A COMMON STOCK | D | 7 564 | 11 564 | ||||||

| 2016-03-23 | 2016-03-22 | 4 | LILJESTROM JASON R | WLH | CLASS A COMMON STOCK | D | 6 484 | 12 714 | ||||||

| 2016-03-23 | 2016-03-22 | 4 | LYON WILLIAM H | WLH | CLASS A COMMON STOCK | D | 24 315 | 139 429 | ||||||

| 2016-03-03 | 2016-03-01 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | 11,8600 | −5 586 | −66 | 39 745 | ||||

| 2016-03-03 | 2016-03-01 | 4 | ZAIST MATTHEW R BY LLC | WLH | CLASS A COMMON STOCK | I | 11,8600 | −6 698 | −79 | 121 026 | ||||

| 2016-03-03 | 2016-03-01 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 11,8600 | −10 222 | −121 | 112 396 | ||||

| 2016-03-03 | 2016-03-01 | 4 | LILJESTROM JASON R | WLH | CLASS A COMMON STOCK | D | 11,8600 | −1 255 | −15 | 6 230 | ||||

| 2016-03-03 | 2016-03-01 | 4 | LYON WILLIAM H | WLH | CLASS A COMMON STOCK | D | 11,8600 | −8 038 | −95 | 115 114 | ||||

| 2016-02-26 | 2016-02-24 | 4 | LYON WILLIAM | WLH | CLASS A COMMON STOCK | D | 9 999 | 74 008 | ||||||

| 2016-02-26 | 2016-02-24 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | 9 749 | 45 331 | ||||||

| 2016-02-26 | 2016-02-24 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 25 499 | 122 618 | ||||||

| 2016-02-26 | 2016-02-24 | 4 | LILJESTROM JASON R | WLH | CLASS A COMMON STOCK | D | 2 499 | 7 485 | ||||||

| 2016-02-26 | 2016-02-24 | 4 | LYON WILLIAM H | WLH | CLASS A COMMON STOCK | D | 26 999 | 123 152 | ||||||

| 2016-02-19 | 3 | LILJESTROM JASON R | WLH | CLASS A COMMON STOCK | D | 9 972 | ||||||||

| 2016-02-19 | 3 | LILJESTROM JASON R | WLH | CLASS A COMMON STOCK | D | 9 972 | ||||||||

| 2016-01-07 | 3 | HARRISON THOMAS F | WLH | CLASS A COMMON STOCK | D | 8 000 | ||||||||

| 2016-01-07 | 3 | HARRISON THOMAS F | WLH | CLASS A COMMON STOCK | D | 8 000 | ||||||||

| 2015-12-16 | 2015-12-16 | 4 | LYON WILLIAM | WLH | CLASS A COMMON STOCK | D | 15,6946 | 6 000 | 94 | 64 009 | ||||

| 2015-12-14 | 2015-12-11 | 4 | LYON WILLIAM | WLH | CLASS A COMMON STOCK | D | 15,3997 | 33 000 | 508 | 58 009 | ||||

| 2015-11-19 | 2015-11-19 | 4 | ZAIST MATTHEW R BY LLC | WLH | CLASS A COMMON STOCK | I | 16,1100 | 5 000 | 81 | 127 724 | ||||

| 2015-11-19 | 2015-11-19 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 16,1100 | 1 000 | 16 | 97 119 | ||||

| 2015-11-18 | 2015-11-17 | 4 | Hunt Gary H | WLH | CLASS A COMMON STOCK | D | 15,9961 | 1 840 | 29 | 25 069 | ||||

| 2015-08-19 | 2015-08-19 | 4 | Luxor Capital Group, LP By Separately Managed Account | WLH | Common stock, Class A, par value $0.01 | I | 23,7500 | −36 617 | −870 | 37 315 | ||||

| 2015-08-19 | 2015-08-19 | 4 | Luxor Capital Group, LP By Thebes B Onshore, LLC | WLH | Common stock, Class A, par value $0.01 | I | 23,7500 | −10 901 | −259 | 16 013 | ||||

| 2015-08-19 | 2015-08-19 | 4 | Luxor Capital Group, LP By Luxor Capital II Company LLC | WLH | Common stock, Class A, par value $0.01 | I | 23,7500 | −1 278 215 | −30 358 | 700 000 | ||||

| 2015-08-19 | 2015-08-19 | 4 | Luxor Capital Group, LP By Luxor Wavefront, LP | WLH | Common stock, Class A, par value $0.01 | I | 23,7500 | −105 376 | −2 503 | 285 799 | ||||

| 2015-08-19 | 2015-08-19 | 4 | Luxor Capital Group, LP By Luxor Capital Partners, LP | WLH | Common stock, Class A, par value $0.01 | I | 23,7500 | −568 891 | −13 511 | 1 355 661 | ||||

| 2015-04-01 | 2015-04-01 | 4 | ZAIST MATTHEW R | WLH | STOCK OPTION (RIGHT TO BUY) | D | 25,82 | 120 000 | 120 000 | |||||

| 2015-04-01 | 2015-04-01 | 4 | LYON WILLIAM H | WLH | STOCK OPTION (RIGHT TO BUY) | D | 25,82 | 120 000 | 120 000 | |||||

| 2015-03-16 | 2015-03-13 | 4 | Hunt Gary H | WLH | CLASS A COMMON STOCK | D | 22,8664 | −5 363 | −123 | 23 229 | ||||

| 2015-03-16 | 2015-03-13 | 4 | ZAIST MATTHEW R | WLH | STOCK OPTION (RIGHT TO BUY) | D | 8,66 | −9 883 | 0 | |||||

| 2015-03-16 | 2015-03-13 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 8,6625 | 9 883 | 86 | 96 119 | ||||

| 2015-03-13 | 2015-03-11 | 4 | SEVERN COLIN T | WLH | STOCK OPTION (RIGHT TO BUY) | D | 8,66 | −1 482 | 0 | |||||

| 2015-03-13 | 2015-03-11 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | 21,9900 | −584 | −13 | 49 767 | ||||

| 2015-03-13 | 2015-03-11 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | 8,6625 | 1 482 | 13 | 50 351 | ||||

| 2015-03-10 | 2015-03-06 | 4 | ROBINSON RICHARD S | WLH | CLASS A COMMON STOCK | D | 22,4692 | −3 042 | −68 | 18 454 | ||||

| 2015-03-10 | 2015-03-06 | 4 | ROBINSON RICHARD S | WLH | CLASS A COMMON STOCK | D | 22,4836 | −4 040 | −91 | 21 496 | ||||

| 2015-03-03 | 2015-03-02 | 4 | ROBINSON RICHARD S | WLH | STOCK OPTION (RIGHT TO BUY) | D | 8,66 | −1 112 | 0 | |||||

| 2015-03-03 | 2015-03-02 | 4 | ROBINSON RICHARD S | WLH | CLASS A COMMON STOCK | D | 22,6900 | −425 | −10 | 25 536 | ||||

| 2015-03-03 | 2015-03-02 | 4 | ROBINSON RICHARD S | WLH | CLASS A COMMON STOCK | D | 8,6625 | 1 112 | 10 | 25 961 | ||||

| 2015-03-03 | 2015-03-01 | 4 | ROBINSON RICHARD S | WLH | CLASS A COMMON STOCK | D | 22,6900 | −490 | −11 | 24 849 | ||||

| 2015-03-03 | 2015-03-01 | 4 | ROBINSON RICHARD S | WLH | CLASS A COMMON STOCK | D | 22,6900 | −1 339 | −30 | 25 339 | ||||

| 2015-03-03 | 2015-03-01 | 4 | LYON WILLIAM | WLH | CLASS A COMMON STOCK | D | 22,6900 | −2 025 | −46 | 25 009 | ||||

| 2015-03-03 | 2015-03-01 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | 22,6900 | −1 080 | −25 | 48 869 | ||||

| 2015-03-03 | 2015-03-01 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | 22,6900 | −1 674 | −38 | 49 949 | ||||

| 2015-03-03 | 2015-03-01 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 22,6900 | −3 535 | −80 | 86 236 | ||||

| 2015-03-03 | 2015-03-01 | 4 | ZAIST MATTHEW R BY LLC | WLH | CLASS A COMMON STOCK | I | 22,6900 | −9 191 | −209 | 122 724 | ||||

| 2015-03-03 | 2015-03-01 | 4 | LYON WILLIAM H | WLH | CLASS A COMMON STOCK | D | 22,6900 | −4 909 | −111 | 96 153 | ||||

| 2015-03-03 | 2015-03-01 | 4 | LYON WILLIAM H | WLH | CLASS A COMMON STOCK | D | 22,6900 | −10 759 | −244 | 101 062 | ||||

| 2015-03-02 | 2015-02-26 | 4 | Luxor Capital Group, LP By Separately Managed Account | WLH | Common stock, Class A, par value $0.01 | I | 22,5800 | −131 940 | −2 979 | 73 932 | ||||

| 2015-03-02 | 2015-02-26 | 4 | Luxor Capital Group, LP By Luxor Capital II Company LLC | WLH | Common stock, Class A, par value $0.01 | I | 22,5800 | −1 230 000 | −27 773 | 1 978 215 | ||||

| 2015-03-02 | 2015-02-26 | 4 | Luxor Capital Group, LP By Luxor Wavefront, LP | WLH | Common stock, Class A, par value $0.01 | I | 22,5800 | −259 280 | −5 855 | 391 175 | ||||

| 2015-03-02 | 2015-02-26 | 4 | Luxor Capital Group, LP By Luxor Capital Partners, LP | WLH | Common stock, Class A, par value $0.01 | I | 22,5800 | −278 780 | −6 295 | 1 951 466 | ||||

| 2015-02-27 | 2015-02-25 | 4 | LYON WILLIAM H | WLH | CLASS A COMMON STOCK | D | 29 347 | 111 821 | ||||||

| 2015-02-27 | 2015-02-25 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 27 717 | 89 771 | ||||||

| 2015-02-27 | 2015-02-25 | 4 | ROBINSON RICHARD S | WLH | CLASS A COMMON STOCK | D | 2 717 | 26 678 | ||||||

| 2015-02-27 | 2015-02-25 | 4 | LYON WILLIAM | WLH | CLASS A COMMON STOCK | D | 10 869 | 27 034 | ||||||

| 2015-02-27 | 2015-02-25 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | 10 597 | 51 623 | ||||||

| 2015-02-23 | 2015-02-19 | 4 | LYON WILLIAM H | WLH | CLASS A COMMON STOCK | D | 28 224 | 82 474 | ||||||

| 2015-02-23 | 2015-02-19 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 28 224 | 62 054 | ||||||

| 2015-02-23 | 2015-02-19 | 4 | ROBINSON RICHARD S | WLH | CLASS A COMMON STOCK | D | 3 919 | 23 961 | ||||||

| 2015-02-23 | 2015-02-19 | 4 | Hunt Gary H | WLH | CLASS A COMMON STOCK | D | 5 000 | 28 592 | ||||||

| 2015-02-23 | 2015-02-03 | 4 | Hunt Gary H | WLH | CLASS A COMMON STOCK | D | −1 000 | 23 592 | ||||||

| 2015-02-23 | 2015-02-02 | 4 | Hunt Gary H | WLH | CLASS A COMMON STOCK | D | −1 000 | 24 592 | ||||||

| 2015-02-23 | 2015-02-19 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | 8 624 | 41 026 | ||||||

| 2015-02-23 | 2015-02-19 | 4 | NIEMANN MATTHEW R | WLH | CLASS A COMMON STOCK | D | 3 913 | 27 729 | ||||||

| 2015-02-23 | 2015-02-19 | 4 | SCHELL LYNN CARLSON | WLH | CLASS A COMMON STOCK | D | 7 391 | 35 647 | ||||||

| 2015-02-23 | 2015-02-19 | 4 | Ammerman Douglas K | WLH | CLASS A COMMON STOCK | D | 3 913 | 27 901 | ||||||

| 2015-02-23 | 2015-02-19 | 4 | LYON WILLIAM | WLH | CLASS A COMMON STOCK | D | 16 165 | 16 165 | ||||||

| 2014-12-05 | 2014-12-05 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 20,0657 | 3 000 | 60 | 33 830 | ||||

| 2014-11-26 | 2014-11-25 | 4 | SCHELL LYNN CARLSON | WLH | CLASS A COMMON STOCK | D | 20,8915 | 4 785 | 100 | 28 256 | ||||

| 2014-09-11 | 2014-09-10 | 4 | ROBINSON RICHARD S | WLH | Stock Option (Right to Buy) | D | 8,66 | −17 678 | 3 535 | |||||

| 2014-09-11 | 2014-09-10 | 4 | ROBINSON RICHARD S | WLH | Class A Common Stock | D | 24,6916 | −11 821 | −292 | 20 042 | ||||

| 2014-09-11 | 2014-09-10 | 4 | ROBINSON RICHARD S | WLH | Class A Common Stock | D | 24,8304 | −2 859 | −71 | 31 863 | ||||

| 2014-09-11 | 2014-09-10 | 4 | ROBINSON RICHARD S | WLH | Class A Common Stock | D | 25,0400 | −7 848 | −197 | 34 722 | ||||

| 2014-09-11 | 2014-09-10 | 4 | ROBINSON RICHARD S | WLH | Class A Common Stock | D | 8,6625 | 17 678 | 153 | 42 570 | ||||

| 2014-03-31 | 2014-03-28 | 4 | Luxor Capital Group, LP By Luxor Capital II Company LLC | WLH | Common stock, Class A, par value $0.01 | I | 27,2500 | −158 068 | −4 307 | 3 208 215 | ||||

| 2014-03-31 | 2014-03-28 | 4 | Luxor Capital Group, LP By Luxor Wavefront, LP | WLH | Common stock, Class A, par value $0.01 | I | 27,2500 | −32 048 | −873 | 650 455 | ||||

| 2014-03-31 | 2014-03-28 | 4 | Luxor Capital Group, LP By Luxor Capital Partners, LP | WLH | Common stock, Class A, par value $0.01 | I | 27,2500 | −109 884 | −2 994 | 2 230 246 | ||||

| 2014-03-31 | 2014-03-27 | 4 | Luxor Capital Group, LP By Luxor Spectrum Offshore Master Fund, LP | WLH | Common stock, Class A, par value $0.01 | I | 27,2500 | −337 467 | −9 196 | 0 | ||||

| 2014-03-31 | 2014-03-27 | 4 | Luxor Capital Group, LP By Luxor Capital II Company LLC | WLH | Common stock, Class A, par value $0.01 | I | 27,2500 | −688 045 | −18 749 | 3 366 283 | ||||

| 2014-03-31 | 2014-03-27 | 4 | Luxor Capital Group, LP By Luxor Wavefront, LP | WLH | Common stock, Class A, par value $0.01 | I | 27,2500 | −266 900 | −7 273 | 682 503 | ||||

| 2014-03-31 | 2014-03-27 | 4 | Luxor Capital Group, LP By Luxor Capital Partners, LP | WLH | Common stock, Class A, par value $0.01 | I | 27,2500 | −707 588 | −19 282 | 2 340 130 | ||||

| 2014-03-18 | 2014-03-14 | 4 | ZAIST MATTHEW R | WLH | STOCK OPTION (RIGHT TO BUY) | D | 8,66 | −49 434 | 9 883 | |||||

| 2014-03-18 | 2014-03-14 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 29,0600 | −18 604 | −541 | 30 830 | ||||

| 2014-03-18 | 2014-03-14 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 8,6625 | 49 434 | 428 | 49 434 | ||||

| 2014-03-07 | 2014-03-05 | 4 | ROBINSON RICHARD S | WLH | STOCK OPTION (RIGHT TO BUY) | D | 8,66 | −5 558 | 1 112 | |||||

| 2014-03-07 | 2014-03-05 | 4 | ROBINSON RICHARD S | WLH | CLASS A COMMON STOCK | D | 31,3900 | −1 534 | −48 | 24 892 | ||||

| 2014-03-07 | 2014-03-05 | 4 | ROBINSON RICHARD S | WLH | CLASS A COMMON STOCK | D | 8,6625 | 5 558 | 48 | 26 426 | ||||

| 2014-03-07 | 2014-03-06 | 4 | SEVERN COLIN T | WLH | STOCK OPTION (RIGHT TO BUY) | D | 8,66 | −7 411 | 1 482 | |||||

| 2014-03-07 | 2014-03-06 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | 31,2700 | −2 054 | −64 | 32 402 | ||||

| 2014-03-07 | 2014-03-06 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | 8,6625 | 7 411 | 64 | 34 456 | ||||

| 2014-03-04 | 2014-03-01 | 4 | ROBINSON RICHARD S | WLH | CLASS A COMMON STOCK | D | 30,9300 | −1 340 | −41 | 20 868 | ||||

| 2014-03-04 | 2014-03-01 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | 30,9300 | −1 674 | −52 | 27 045 | ||||

| 2014-03-04 | 2014-03-01 | 4 | ZAIST MATTHEW R BY LLC | WLH | CLASS A COMMON STOCK | I | 30,9300 | −7 699 | −238 | 131 915 | ||||

| 2014-03-04 | 2014-03-01 | 4 | LYON WILLIAM H | WLH | CLASS A COMMON STOCK | D | 30,9300 | −9 922 | −307 | 54 250 | ||||

| 2014-02-24 | 2014-02-20 | 4 | Ammerman Douglas K | WLH | CLASS A COMMON STOCK | D | 6 383 | 23 988 | ||||||

| 2014-02-24 | 2014-02-20 | 4 | Hunt Gary H | WLH | CLASS A COMMON STOCK | D | 3 968 | 25 592 | ||||||

| 2014-02-24 | 2014-02-20 | 4 | NIEMANN MATTHEW R | WLH | CLASS A COMMON STOCK | D | 6 211 | 23 816 | ||||||

| 2014-02-24 | 2014-02-20 | 4 | SCHELL LYNN CARLSON | WLH | CLASS A COMMON STOCK | D | 5 866 | 23 471 | ||||||

| 2014-01-02 | 2013-12-31 | 4 | ECKBERG J ERIC | WLH | Class A Common Stock | D | 22,0000 | −1 845 | −41 | 28 415 | ||||

| 2013-05-23 | 2013-05-21 | 4 | HICKCOX W THOMAS | WLH | STOCK OPTION (RIGHT TO BUY) | D | 8,67 | 16 390 | 16 390 | |||||

| 2013-05-23 | 2013-05-21 | 4 | HICKCOX W THOMAS | WLH | STOCK OPTION (RIGHT TO BUY) | D | 1,05 | −135 225 | 0 | |||||

| 2013-05-23 | 2013-05-21 | 4 | HICKCOX W THOMAS | WLH | STOCK OPTION (RIGHT TO BUY) | D | 8,67 | 63 636 | 63 636 | |||||

| 2013-05-23 | 2013-05-21 | 4 | HICKCOX W THOMAS | WLH | STOCK OPTION (RIGHT TO BUY) | D | 1,05 | −525 000 | 0 | |||||

| 2013-05-23 | 2013-05-21 | 4 | HICKCOX W THOMAS | WLH | CLASS D COMMON STOCK | D | −26 737 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | HICKCOX W THOMAS | WLH | CLASS D COMMON STOCK | D | −38 154 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | HICKCOX W THOMAS | WLH | CLASS A COMMON STOCK | D | 64 891 | 64 891 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | CONNELLY MARY J | WLH | STOCK OPTION (RIGHT TO BUY) | D | 8,67 | 12 022 | 12 022 | |||||

| 2013-05-23 | 2013-05-21 | 4 | CONNELLY MARY J | WLH | STOCK OPTION (RIGHT TO BUY) | D | 1,05 | −99 188 | 0 | |||||

| 2013-05-23 | 2013-05-21 | 4 | CONNELLY MARY J | WLH | STOCK OPTION (RIGHT TO BUY) | D | 8,67 | 53 090 | 53 090 | |||||

| 2013-05-23 | 2013-05-21 | 4 | CONNELLY MARY J | WLH | STOCK OPTION (RIGHT TO BUY) | D | 1,05 | −438 000 | 0 | |||||

| 2013-05-23 | 2013-05-21 | 4 | CONNELLY MARY J | WLH | CLASS D COMMON STOCK | D | −26 737 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | CONNELLY MARY J | WLH | CLASS D COMMON STOCK | D | −33 431 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | CONNELLY MARY J | WLH | CLASS A COMMON STOCK | D | 60 168 | 60 168 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | ROBINSON RICHARD S | WLH | STOCK OPTION (RIGHT TO BUY) | D | 8,67 | 6 669 | 6 669 | |||||

| 2013-05-23 | 2013-05-21 | 4 | ROBINSON RICHARD S | WLH | STOCK OPTION (RIGHT TO BUY) | D | 1,05 | −55 020 | 0 | |||||

| 2013-05-23 | 2013-05-21 | 4 | ROBINSON RICHARD S | WLH | STOCK OPTION (RIGHT TO BUY) | D | 8,67 | 21 212 | 21 212 | |||||

| 2013-05-23 | 2013-05-21 | 4 | ROBINSON RICHARD S | WLH | STOCK OPTION (RIGHT TO BUY) | D | 1,05 | −175 000 | 0 | |||||

| 2013-05-23 | 2013-05-21 | 4 | ROBINSON RICHARD S | WLH | CLASS D COMMON STOCK | D | −10 695 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | ROBINSON RICHARD S | WLH | CLASS D COMMON STOCK | D | −11 512 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | ROBINSON RICHARD S | WLH | CLASS A COMMON STOCK | D | 22 207 | 22 207 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Ammerman Douglas K | WLH | CLASS D COMMON STOCK | D | −1 782 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Ammerman Douglas K | WLH | CLASS D COMMON STOCK | D | −8 912 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Ammerman Douglas K | WLH | CLASS D COMMON STOCK | D | −6 909 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Ammerman Douglas K | WLH | CLASS A COMMON STOCK | D | 17 603 | 17 603 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Hunt Gary H | WLH | CLASS D COMMON STOCK | D | −14 260 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Hunt Gary H | WLH | CLASS D COMMON STOCK | D | −10 363 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Hunt Gary H | WLH | CLASS A COMMON STOCK | D | 24 623 | 24 623 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Luxor Capital Group, LP See | WLH | Convertible Preferred Stock | I | −2 711 823 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Luxor Capital Group, LP | WLH | Convertible Preferred Stock | D | −4 908 581 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Luxor Capital Group, LP | WLH | Convertible Preferred Stock | D | −21 219 798 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Luxor Capital Group, LP | WLH | Convertible Preferred Stock | D | −4 376 147 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Luxor Capital Group, LP | WLH | Convertible Preferred Stock | D | −25 791 356 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Luxor Capital Group, LP See | WLH | Class C Common Stock | I | −626 517 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Luxor Capital Group, LP | WLH | Class C Common Stock | D | −746 675 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Luxor Capital Group, LP | WLH | Class C Common Stock | D | −3 227 879 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Luxor Capital Group, LP | WLH | Class C Common Stock | D | −665 684 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Luxor Capital Group, LP | WLH | Class C Common Stock | D | −5 851 909 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Luxor Capital Group, LP See | WLH | Class A Common Stock | I | 25,0000 | −322 825 | −8 071 | 205 875 | ||||

| 2013-05-23 | 2013-05-21 | 4 | Luxor Capital Group, LP | WLH | Class A Common Stock | D | 25,0000 | −552 725 | −13 818 | 337 469 | ||||

| 2013-05-23 | 2013-05-21 | 4 | Luxor Capital Group, LP | WLH | Class A Common Stock | D | 25,0000 | −1 951 950 | −48 799 | 3 047 720 | ||||

| 2013-05-23 | 2013-05-21 | 4 | Luxor Capital Group, LP See | WLH | Class A Common Stock | I | 328 706 | 528 700 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Luxor Capital Group, LP | WLH | Class A Common Stock | D | 594 980 | 890 194 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Luxor Capital Group, LP | WLH | Class A Common Stock | D | 2 572 097 | 4 054 330 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Luxor Capital Group, LP | WLH | Class A Common Stock | D | 530 442 | 949 406 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Luxor Capital Group, LP | WLH | Class A Common Stock | D | 3 126 225 | 4 999 670 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Luxor Capital Group, LP See | WLH | Class A Common Stock | I | 75 941 | 199 994 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Luxor Capital Group, LP | WLH | Class A Common Stock | D | 90 506 | 295 214 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Luxor Capital Group, LP | WLH | Class A Common Stock | D | 391 258 | 1 482 233 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Luxor Capital Group, LP | WLH | Class A Common Stock | D | 80 689 | 418 964 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Luxor Capital Group, LP | WLH | Class A Common Stock | D | 709 322 | 1 873 445 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | NIEMANN MATTHEW R | WLH | CLASS D COMMON STOCK | D | −1 782 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | NIEMANN MATTHEW R | WLH | CLASS D COMMON STOCK | D | −8 912 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | NIEMANN MATTHEW R | WLH | CLASS D COMMON STOCK | D | −6 909 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | NIEMANN MATTHEW R | WLH | CLASS A COMMON STOCK | D | 17 603 | 17 603 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | SEVERN COLIN T | WLH | STOCK OPTION (RIGHT TO BUY) | D | 8,67 | 8 892 | 8 892 | |||||

| 2013-05-23 | 2013-05-21 | 4 | SEVERN COLIN T | WLH | STOCK OPTION (RIGHT TO BUY) | D | 1,05 | −73 360 | 0 | |||||

| 2013-05-23 | 2013-05-21 | 4 | SEVERN COLIN T | WLH | STOCK OPTION (RIGHT TO BUY) | D | 8,67 | 28 363 | 28 363 | |||||

| 2013-05-23 | 2013-05-21 | 4 | SEVERN COLIN T | WLH | STOCK OPTION (RIGHT TO BUY) | D | 1,05 | −234 000 | 0 | |||||

| 2013-05-23 | 2013-05-21 | 4 | SEVERN COLIN T | WLH | CLASS D COMMON STOCK | D | −13 368 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | SEVERN COLIN T | WLH | CLASS D COMMON STOCK | D | −15 350 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | SEVERN COLIN T | WLH | CLASS A COMMON STOCK | D | 28 718 | 28 718 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | ECKBERG J ERIC | WLH | CLASS D COMMON STOCK | D | −18 716 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | ECKBERG J ERIC | WLH | CLASS D COMMON STOCK | D | −11 544 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | ECKBERG J ERIC | WLH | CLASS A COMMON STOCK | D | 30 260 | 30 260 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | SCHELL LYNN CARLSON | WLH | CLASS D COMMON STOCK | D | −1 782 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | SCHELL LYNN CARLSON | WLH | CLASS D COMMON STOCK | D | −8 912 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | SCHELL LYNN CARLSON | WLH | CLASS D COMMON STOCK | D | −6 909 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | SCHELL LYNN CARLSON | WLH | CLASS A COMMON STOCK | D | 17 603 | 17 603 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | SINGER MAUREEN L | WLH | CLASS D COMMON STOCK | D | −2 139 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | SINGER MAUREEN L | WLH | CLASS A COMMON STOCK | D | 2 139 | 2 139 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | ZAIST MATTHEW R | WLH | STOCK OPTION (RIGHT TO BUY) | D | 8,67 | 59 316 | 59 316 | |||||

| 2013-05-23 | 2013-05-21 | 4 | ZAIST MATTHEW R | WLH | STOCK OPTION (RIGHT TO BUY) | D | 1,05 | −489 360 | 0 | |||||

| 2013-05-23 | 2013-05-21 | 4 | ZAIST MATTHEW R | WLH | STOCK OPTION (RIGHT TO BUY) | D | 8,67 | 169 696 | 169 696 | |||||

| 2013-05-23 | 2013-05-21 | 4 | ZAIST MATTHEW R | WLH | STOCK OPTION (RIGHT TO BUY) | D | 1,05 | −1 400 000 | 0 | |||||

| 2013-05-23 | 2013-05-21 | 4 | ZAIST MATTHEW R | WLH | CLASS D COMMON STOCK | D | −53 475 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | ZAIST MATTHEW R | WLH | CLASS D COMMON STOCK | D | −86 138 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | ZAIST MATTHEW R | WLH | CLASS A COMMON STOCK | D | 139 613 | 139 613 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | DOYLE BRIAN W | WLH | STOCK OPTION (RIGHT TO BUY) | D | 8,67 | 24 453 | 24 453 | |||||

| 2013-05-23 | 2013-05-21 | 4 | DOYLE BRIAN W | WLH | STOCK OPTION (RIGHT TO BUY) | D | 1,05 | −201 740 | 0 | |||||

| 2013-05-23 | 2013-05-21 | 4 | DOYLE BRIAN W | WLH | STOCK OPTION (RIGHT TO BUY) | D | 8,67 | 77 818 | 77 818 | |||||

| 2013-05-23 | 2013-05-21 | 4 | DOYLE BRIAN W | WLH | STOCK OPTION (RIGHT TO BUY) | D | 1,05 | −642 000 | 0 | |||||

| 2013-05-23 | 2013-05-21 | 4 | DOYLE BRIAN W | WLH | CLASS D COMMON STOCK | D | −32 085 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | DOYLE BRIAN W | WLH | CLASS D COMMON STOCK | D | −42 213 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | DOYLE BRIAN W | WLH | CLASS A COMMON STOCK | D | 74 298 | 74 298 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Paulson Property Management II LLC See | WLH | Convertible Preferred Stock | I | −12 173 913 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | Paulson Property Management II LLC See | WLH | Common Stock | I | 1 475 625 | 3 322 667 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | LYON WILLIAM H | WLH | CLASS D COMMON STOCK | D | −64 171 | 0 | ||||||

| 2013-05-23 | 2013-05-21 | 4 | LYON WILLIAM H | WLH | CLASS A COMMON STOCK | D | 64 171 | 64 171 | ||||||

| 2013-04-30 | 3 | LUXOR SPECTRUM OFFSHORE LTD See | WLH | Class A Common Stock | I | 1 023 437 | ||||||||

| 2013-04-30 | 3 | LUXOR SPECTRUM OFFSHORE LTD | WLH | Class A Common Stock | D | 9 604 012 | ||||||||

| 2013-04-30 | 3 | LUXOR SPECTRUM OFFSHORE LTD | WLH | Class A Common Stock | D | 2 790 770 | ||||||||

| 2013-04-30 | 3 | LUXOR SPECTRUM OFFSHORE LTD | WLH | Class A Common Stock | D | 9 000 548 | ||||||||

| 2013-04-30 | 3 | LUXOR SPECTRUM OFFSHORE LTD | WLH | Class A Common Stock | D | 1 688 842 | ||||||||

| 2013-04-30 | 3 | BARRACK THOMAS JR | WLH | CLASS A COMMON STOCK | D | 10 000 000 | ||||||||

| 2013-04-30 | 3 | PAULSON REAL ESTATE FUND II, L.P. See | WLH | Class A Common Stock | I | 15 238 095 | ||||||||

| 2013-04-30 | 3 | LYON WILLIAM H BY TRUST | WLH | CLASS A COMMON STOCK | I | 24 199 |