| Totale insidere | 24 |

Insider Sentiment Score

Insider Sentiment Score finner selskapene som blir kjøpt av bedriftsinsidere.

Det er resultatet av en sofistikert, flerfaktor kvantitativ modell som identifiserer selskaper som har de høyeste nivåene av insiderakkumulasjon. Scoringsmodellen bruker en kombinasjon av netto antall insidere som kjøper de siste 90 dagene, det totale antallet kjøpte aksjer som en prosentandel av flyten, og det totale antallet aksjer eid av insidere. Tallet varierer fra 0 til 100, hvor høyere tall indikerer en høyere grad av akkumulasjon sammenlignet med jevnaldrende, og 50 er gjennomsnittet.

Oppdateringsfrekvens: Daglig

Se Insidernes Topp Picks, som gir en liste over selskaper med høyest akkumulasjon blant insidere.

Officer Sentiment Score

Officer Sentiment Score finner selskaper som kjøpes av bedriftsoffiserer.

Per definisjon er Corporate Officers Corporate Insiders, men i motsetning til noen av de andre innsiderne (10 % aksjonærer og styremedlemmer), jobber offiserer for selskapet på daglig basis, og de bruker sine egne penger når de handler . (10 % aksjonærer og styremedlemmer er ofte fondsforvaltere som forvalter andres penger.) Som sådan er innsidehandler utført av offiserer mye mer betydningsfulle og bør behandles på riktig måte.

Som Insider Sentiment Score er Officer Sentiment Score resultatet av en sofistikert, flerfaktor kvantitativ modell som identifiserer selskaper med de høyeste nivåene av akkumulasjon blant ledelsen.

Oppdateringsfrekvens: Daglig

Se Insidernes Topp Picks, som gir en liste over selskaper med høyest insider-sentiment.

Nøkkelindikatorer for insidere

Dette kortet viser hvordan selskapet rangerer langs ulike indikatorer for insidere. Percentile-rangeringen viser hvordan dette selskapet sammenligner seg med andre selskaper på USAs markeder. Høyere rangeringer indikerer bedre situasjoner.

For eksempel, er det generelt akseptert at insiderkjøp er en positiv indikator, så derfor ville selskaper som insiderkjøper mer, rangere høyere enn selskaper med mindre insiderkjøp (eller til og med insidersalg).

Netto antall insidere som kjøper (Rangering)

N/A

Nettotall av innsidekjøp som kjøper er det totale antallet insidere som har kjøpt minus det totale antallet insidere som har solgt de siste 90 dagene. Den prosentvise rangeringen vises her (rangerer fra 0 til 100%).

Prosent av aksjeflyt kjøpt av insidere (rang)

N/A

Prosenten av aksjeflyt kjøpt av innsidere er det totale antallet aksjer som er blitt kjøpt av innsidere minus det totale antallet aksjer solgt av innsidere de siste 90 dagene, delt på totalt antall utestående aksjer og multiplisert med 100.

Diagram over innsidehandel

New York Mortgage Trust, Inc. - Preferred Stock insiderhandel vises i følgende diagram. Innsidere er ledere, direktører eller viktige investorer i et selskap. Generelt sett er det ulovlig for insidere å handle med aksjer i sine selskaper basert på materiell, ikke-offentlig informasjon. Dette betyr ikke at det er ulovlig for dem å gjøre any handler i deres egne selskaper. Imidlertid må de rapportere alle handler til SEC via en Form 4.

Insiderliste og lønnsomhetsmålinger

Denne tabellen viser listen over kjente insidere, og er automatisk generert fra arkiveringer offentliggjort av SEC. I tillegg til navn, siste tittel og direktør-, offiser- eller 10 % eier-betegnelse, gir vi de nyeste offentliggjorte beholdningene. I tillegg gir vi, når det er mulig, den historiske handelsytelsen for insidere. Den historiske handelsytelsen er et vektet gjennomsnitt av ytelsen til faktiske kjøpstransaksjoner som er gjort av insidere på det åpne markedet. For mer informasjon om hvordan dette blir beregnet, kan du se dette YouTube-webinaret.

See our leaderboard of most profitable insider traders.

| Innsider | Gjennomsnittlig fortjeneste (%) | Aksjer eid |

Splitt justert |

|---|---|---|---|

| Steven M Abreu Director - [D] | 0 | 0 | |

| David A Akre Co-Chief Executive Officer, Director - [D] [O] | 0 | 0 | |

| David R Bock Director - [D] | 179 469 | 44 867 | |

| Gena Cheng Director - [D] | 21 599 | 21 599 | |

| Clement Michael B. Director - [D] | 82 631 | 82 631 | |

| Donlon Kevin M. President - [O] | 597 842 | 149 460 | |

| Joseph V Fierro COO - The N.Y. Mort. Co., LLC - [O] | 0 | 0 | |

| James J Fowler Director - [D] | 21 903 | 1 095 |

| Innsider | Gjennomsnittlig fortjeneste (%) | Aksjer eid |

Splitt justert |

|---|---|---|---|

| Audrey Greenberg Director - [D] | 28 222 | 28 222 | |

| Alan Bradley Howe Senior VP & General Counsel - [O] | 0 | 0 | |

| Alan L Hainey Director - [D] | 286 648 | 71 662 | |

| Nicholas Mah President - [O] | 207 007 | 207 007 | |

| Steven R Mumma Director - [D] | 491 541 | 491 541 | |

| Kristine Rimando Nario Chief Financial Officer - [O] | 137 522 | 137 522 | |

| Douglas E Neal Director - [D] | 54 827 | 13 707 | |

| Steven G Norcutt Director - [D] | 79 688 | 79 688 |

| Innsider | Gjennomsnittlig fortjeneste (%) | Aksjer eid |

Splitt justert |

|---|---|---|---|

| Mary Dwyer Pembroke Director - [D] | 0 | 0 | |

| Lisa A Pendergast Director - [D] | 54 485 | 54 485 | |

| Raymond A JR Redlingshafer President & CIO, Director - [D] [O] | 0 | 0 | |

| Nathan R Reese Chief Operating Officer - [O] | 316 867 | 79 217 | |

| Steven B Schnall Co-Chief Executive Officer, Director - [D] [O] | 100 | 100 | |

| Jason T Serrano Chief Executive Officer, Director - [D] [O] | 320 828 | 320 828 | |

| Jerome F Sherman Director - [D] | 0 | 0 | |

| Thomas William White Director - [D] | 0 | 0 |

Report errors via our new Insider Auditing Tool

Analyse av sporrekord for insiderkjøp - Kortsiktig lønnsomhetsanalyse

I denne seksjonen analyserer vi lønnsomheten til hver ikke-planlagte, åpne markeds innsidekjøp gjort i ADAMH / New York Mortgage Trust, Inc. - Preferred Stock. Denne analysen hjelper til med å forstå om insidere konsekvent genererer unormale avkastninger og er verdt å følge. Denne analysen gjelder for ett år etter hver handel, og resultatene er teoretiske .

Følgende tabell viser de mest nylige åpne markedskjøpene som ikke var en del av en automatisk handelsplan.

Justert pris er prisen justert for splitt. Justerte aksjer er aksjer justert for splitt.

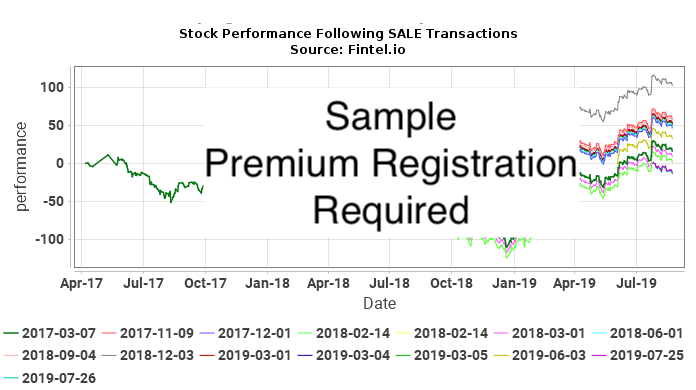

Analyse av sporrekord for insidesalg - Kortsiktig tapanalyse

I denne seksjonen analyserer vi kortsiktig tap til hver ikke-planlagte, åpne markeds innsidekjøp gjort i ADAMH / New York Mortgage Trust, Inc. - Preferred Stock. Et konsekvent mønster av tap unngåelse kan antyde at fremtidige salgstransaksjoner kan forutsi nedgang i pris. Denne analysen gjelder for ett år etter hver handel, og resultatene er teoretiske .

Følgende tabell viser de mest nylige åpne markedssalgene som ikke var en del av en automatisk trading plan.

Justert pris er prisen justert for splitt. Justerte aksjer er aksjer justert for splitt.

Transaksjonshistorikk

Klikk på lenkeikonet for å se hele transaksjonshistorikken. Transaksjoner rapportert som en del av en automatisk handelsplan 10b5-1 vil ha en X i kolonnen merket 10b-5.

| Fil dato |

Handels dato |

Skjema | Innsider | Ticker | Verdipapirnavn | Kode | Direkte | Utøvelses pris |

Enhets pris |

Enheter endret |

Verdi endret (1K) |

Gjenværende Opsjoner |

Gjenværende Aksjer |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025-06-13 | 2025-06-11 | 4 | Clement Michael B. | NYMT | Common Stock, par value $0.01 per share | D | 18 462 | 82 631 | ||||||

| 2025-01-29 | 2025-01-27 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 6,0500 | −7 684 | −46 | 207 007 | ||||

| 2025-01-29 | 2025-01-27 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 6,0500 | −11 841 | −72 | 320 828 | ||||

| 2025-01-29 | 2025-01-27 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 6,0500 | −9 628 | −58 | 491 541 | ||||

| 2025-01-02 | 2025-01-01 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 6,0600 | −7 133 | −43 | 137 522 | ||||

| 2025-01-02 | 2025-01-01 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 12 310 | 144 655 | ||||||

| 2025-01-02 | 2025-01-01 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 6,0600 | −5 656 | −34 | 132 345 | ||||

| 2025-01-02 | 2025-01-01 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 9 766 | 138 001 | ||||||

| 2025-01-02 | 2025-01-01 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 6,0600 | −2 204 | −13 | 128 235 | ||||

| 2025-01-02 | 2025-01-01 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 4 200 | 130 439 | ||||||

| 2025-01-02 | 2025-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 6,0600 | −20 536 | −124 | 332 669 | ||||

| 2025-01-02 | 2025-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 41 032 | 353 205 | ||||||

| 2025-01-02 | 2025-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 6,0600 | −17 635 | −107 | 312 173 | ||||

| 2025-01-02 | 2025-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 34 180 | 329 808 | ||||||

| 2025-01-02 | 2025-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 6,0600 | −6 316 | −38 | 295 628 | ||||

| 2025-01-02 | 2025-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 12 320 | 301 944 | ||||||

| 2025-01-02 | 2025-01-01 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 6,0600 | −17 009 | −103 | 214 691 | ||||

| 2025-01-02 | 2025-01-01 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 32 122 | 231 700 | ||||||

| 2025-01-02 | 2025-01-01 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 6,0600 | −14 002 | −85 | 199 578 | ||||

| 2025-01-02 | 2025-01-01 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 24 414 | 213 580 | ||||||

| 2025-01-02 | 2025-01-01 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 6,0600 | −4 118 | −25 | 189 166 | ||||

| 2025-01-02 | 2025-01-01 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 7 467 | 193 284 | ||||||

| 2024-01-29 | 2024-01-27 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 8,3800 | −14 289 | −120 | 501 169 | ||||

| 2024-01-29 | 2024-01-27 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 8,3800 | −4 727 | −40 | 126 239 | ||||

| 2024-01-29 | 2024-01-27 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 8,3800 | −17 328 | −145 | 289 624 | ||||

| 2024-01-29 | 2024-01-27 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 8,3800 | −11 177 | −94 | 185 817 | ||||

| 2024-01-25 | 2024-01-24 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 8,2300 | −17 447 | −144 | 130 966 | ||||

| 2024-01-25 | 2024-01-24 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 32 181 | 148 413 | ||||||

| 2024-01-25 | 2024-01-24 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 8,2300 | −43 884 | −361 | 306 952 | ||||

| 2024-01-25 | 2024-01-24 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 85 817 | 350 836 | ||||||

| 2024-01-25 | 2024-01-24 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 8,2300 | −30 992 | −255 | 196 994 | ||||

| 2024-01-25 | 2024-01-24 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 57 212 | 227 986 | ||||||

| 2024-01-25 | 2024-01-24 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 8,2300 | −52 062 | −428 | 515 458 | ||||

| 2024-01-25 | 2024-01-24 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 102 980 | 567 520 | ||||||

| 2024-01-03 | 2024-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 8,5300 | −17 156 | −146 | 265 019 | ||||

| 2024-01-03 | 2024-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 34 180 | 282 175 | ||||||

| 2024-01-03 | 2024-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 8,5300 | −6 265 | −53 | 247 995 | ||||

| 2024-01-03 | 2024-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 12 321 | 254 260 | ||||||

| 2024-01-03 | 2024-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 8,5300 | −5 923 | −51 | 241 939 | ||||

| 2024-01-03 | 2024-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 11 291 | 247 862 | ||||||

| 2024-01-03 | 2024-01-01 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 8,5300 | −13 179 | −112 | 170 774 | ||||

| 2024-01-03 | 2024-01-01 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 24 414 | 183 953 | ||||||

| 2024-01-03 | 2024-01-01 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 8,5300 | −4 206 | −36 | 159 539 | ||||

| 2024-01-03 | 2024-01-01 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 7 467 | 163 745 | ||||||

| 2024-01-03 | 2024-01-01 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 8,5300 | −4 259 | −36 | 156 278 | ||||

| 2024-01-03 | 2024-01-01 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 7 527 | 160 537 | ||||||

| 2024-01-03 | 2024-01-01 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 8,5300 | −5 279 | −45 | 116 232 | ||||

| 2024-01-03 | 2024-01-01 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 9 766 | 121 511 | ||||||

| 2024-01-03 | 2024-01-01 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 8,5300 | −2 143 | −18 | 111 745 | ||||

| 2024-01-03 | 2024-01-01 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 4 200 | 113 888 | ||||||

| 2024-01-03 | 2024-01-01 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 8,5300 | −2 162 | −18 | 109 688 | ||||

| 2024-01-03 | 2024-01-01 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 4 234 | 111 850 | ||||||

| 2023-06-14 | 2023-06-13 | 4 | Pendergast Lisa A | NYMT | Common Stock, par value $0.01 per share | D | 11 953 | 54 485 | ||||||

| 2023-06-14 | 2023-06-13 | 4 | Clement Michael B. | NYMT | Common Stock, par value $0.01 per share | D | 11 953 | 64 169 | ||||||

| 2023-06-14 | 2023-06-13 | 4 | Greenberg Audrey | NYMT | Common Stock, par value $0.01 per share | D | 11 953 | 28 222 | ||||||

| 2023-06-14 | 2023-06-13 | 4 | Cheng Gena | NYMT | Common Stock, par value $0.01 per share | D | 11 953 | 21 599 | ||||||

| 2023-06-14 | 2023-06-13 | 4 | Norcutt Steven G | NYMT | Common Stock, par value $0.01 per share | D | 11 953 | 79 688 | ||||||

| 2023-06-14 | 2023-06-13 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 11 953 | 464 540 | ||||||

| 2023-02-07 | 2023-02-04 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 3,1600 | −42 340 | −134 | 1 810 348 | ||||

| 2023-02-07 | 2023-02-04 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 3,1600 | −5 305 | −17 | 430 465 | ||||

| 2023-02-07 | 2023-02-04 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 3,1600 | −4 746 | −15 | 316 867 | ||||

| 2023-02-07 | 2023-02-04 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 3,1600 | −36 023 | −114 | 946 284 | ||||

| 2023-02-07 | 2023-02-04 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 3,1600 | −18 569 | −59 | 612 041 | ||||

| 2023-01-31 | 2023-01-27 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 3,0900 | −47 666 | −147 | 982 307 | ||||

| 2023-01-31 | 2023-01-27 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 128 411 | 1 029 973 | ||||||

| 2023-01-31 | 2023-01-27 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 3,0900 | −47 255 | −146 | 901 562 | ||||

| 2023-01-31 | 2023-01-27 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 131 877 | 948 817 | ||||||

| 2023-01-31 | 2023-01-27 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 3,0900 | −15 431 | −48 | 321 613 | ||||

| 2023-01-31 | 2023-01-27 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 42 804 | 337 044 | ||||||

| 2023-01-31 | 2023-01-27 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 3,0900 | −3 713 | −11 | 294 240 | ||||

| 2023-01-31 | 2023-01-27 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 4 045 | 297 953 | ||||||

| 2023-01-31 | 2023-01-27 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 3,0900 | −19 406 | −60 | 435 770 | ||||

| 2023-01-31 | 2023-01-27 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 48 154 | 455 176 | ||||||

| 2023-01-31 | 2023-01-27 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 3,0900 | −13 036 | −40 | 407 022 | ||||

| 2023-01-31 | 2023-01-27 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 22 371 | 420 058 | ||||||

| 2023-01-31 | 2023-01-27 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 3,0900 | −34 500 | −107 | 630 610 | ||||

| 2023-01-31 | 2023-01-27 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 85 607 | 665 110 | ||||||

| 2023-01-31 | 2023-01-27 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 3,0900 | −29 349 | −91 | 579 503 | ||||

| 2023-01-31 | 2023-01-27 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 48 544 | 608 852 | ||||||

| 2023-01-31 | 2023-01-27 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 3,0900 | −55 551 | −172 | 1 852 688 | ||||

| 2023-01-31 | 2023-01-27 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 154 093 | 1 908 239 | ||||||

| 2023-01-31 | 2023-01-27 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 3,0900 | −56 653 | −175 | 1 754 146 | ||||

| 2023-01-31 | 2023-01-27 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 19 417 | 1 810 799 | ||||||

| 2023-01-04 | 2023-01-01 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 2,5600 | −21 025 | −54 | 1 791 382 | ||||

| 2023-01-04 | 2023-01-01 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 54 201 | 1 812 407 | ||||||

| 2023-01-04 | 2023-01-01 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 2,5600 | −13 420 | −34 | 1 758 206 | ||||

| 2023-01-04 | 2023-01-01 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 32 102 | 1 771 626 | ||||||

| 2023-01-04 | 2023-01-01 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 2,5600 | −6 223 | −16 | 293 908 | ||||

| 2023-01-04 | 2023-01-01 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 14 935 | 300 131 | ||||||

| 2023-01-04 | 2023-01-01 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 2,5600 | −6 294 | −16 | 285 196 | ||||

| 2023-01-04 | 2023-01-01 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 15 056 | 291 490 | ||||||

| 2023-01-04 | 2023-01-01 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 2,5600 | −3 728 | −10 | 276 434 | ||||

| 2023-01-04 | 2023-01-01 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 8 917 | 280 162 | ||||||

| 2023-01-04 | 2023-01-01 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 2,5600 | −7 695 | −20 | 397 687 | ||||

| 2023-01-04 | 2023-01-01 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 16 801 | 405 382 | ||||||

| 2023-01-04 | 2023-01-01 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 2,5600 | −7 801 | −20 | 388 581 | ||||

| 2023-01-04 | 2023-01-01 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 16 938 | 396 382 | ||||||

| 2023-01-04 | 2023-01-01 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 2,5600 | −4 620 | −12 | 379 444 | ||||

| 2023-01-04 | 2023-01-01 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 10 032 | 384 064 | ||||||

| 2023-01-04 | 2023-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 2,5600 | −18 238 | −47 | 816 940 | ||||

| 2023-01-04 | 2023-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 49 283 | 835 178 | ||||||

| 2023-01-04 | 2023-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 2,5600 | −18 581 | −48 | 785 895 | ||||

| 2023-01-04 | 2023-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 45 167 | 804 476 | ||||||

| 2023-01-04 | 2023-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 2,5600 | −11 348 | −29 | 759 309 | ||||

| 2023-01-04 | 2023-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 26 752 | 770 657 | ||||||

| 2023-01-04 | 2023-01-01 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 2,5600 | −12 676 | −32 | 560 308 | ||||

| 2023-01-04 | 2023-01-01 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 29 869 | 572 984 | ||||||

| 2023-01-04 | 2023-01-01 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 2,5600 | −13 806 | −35 | 543 115 | ||||

| 2023-01-04 | 2023-01-01 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 30 111 | 556 921 | ||||||

| 2023-01-04 | 2023-01-01 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 2,5600 | −8 214 | −21 | 526 810 | ||||

| 2023-01-04 | 2023-01-01 | 4 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 17 835 | 535 024 | ||||||

| 2023-01-03 | 3 | Mah Nicholas | NYMT | Common Stock, par value $0.01 per share | D | 517 189 | ||||||||

| 2022-06-10 | 2022-06-09 | 4 | Clement Michael B. | NYMT | Common Stock, par value $0.01 per share | D | 38 586 | 208 867 | ||||||

| 2022-06-08 | 2022-06-06 | 4 | Clement Michael B. | NYMT | Common Stock, par value $0.01 per share | D | 38 586 | 170 281 | ||||||

| 2022-06-08 | 2022-06-06 | 4 | Cheng Gena | NYMT | Common Stock, par value $0.01 per share | D | 38 586 | 38 586 | ||||||

| 2022-06-08 | 2022-06-06 | 4 | Greenberg Audrey | NYMT | Common Stock, par value $0.01 per share | D | 38 586 | 65 076 | ||||||

| 2022-06-08 | 2022-06-06 | 4 | Norcutt Steven G | NYMT | Common Stock, par value $0.01 per share | D | 38 586 | 270 942 | ||||||

| 2022-06-08 | 2022-06-06 | 4 | Pendergast Lisa A | NYMT | Common Stock, par value $0.01 per share | D | 38 586 | 170 128 | ||||||

| 2022-02-08 | 2022-02-04 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 3,6300 | −36 016 | −131 | 743 905 | ||||

| 2022-01-31 | 2022-01-27 | 4 | Reese Nathan R | NYMT | Restricted Stock Units | D | 44 803 | 83 831 | ||||||

| 2022-01-31 | 2022-01-27 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 3,7200 | −16 745 | −62 | 271 245 | ||||

| 2022-01-31 | 2022-01-27 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 45 840 | 287 990 | ||||||

| 2022-01-31 | 2022-01-27 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 24 359 | 242 150 | ||||||

| 2022-01-31 | 2022-01-27 | 4 | Serrano Jason T | NYMT | Restricted Stock Units | D | 147 849 | 264 935 | ||||||

| 2022-01-31 | 2022-01-27 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 3,7200 | −84 906 | −316 | 779 921 | ||||

| 2022-01-31 | 2022-01-27 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 171 901 | 864 827 | ||||||

| 2022-01-31 | 2022-01-27 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 175 968 | 692 926 | ||||||

| 2022-01-31 | 2022-01-27 | 4 | Nario Kristine Rimando | NYMT | Restricted Stock Units | D | 50 403 | 94 310 | ||||||

| 2022-01-31 | 2022-01-27 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 45 840 | 374 032 | ||||||

| 2022-01-31 | 2022-01-27 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 52 866 | 328 192 | ||||||

| 2022-01-31 | 2022-01-27 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 206 281 | 1 739 524 | ||||||

| 2022-01-31 | 2022-01-27 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 211 162 | 1 533 243 | ||||||

| 2022-01-10 | 2022-01-07 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 3,8100 | −60 048 | −229 | 516 958 | ||||

| 2022-01-04 | 2022-01-01 | 4 | Reese Nathan R | NYMT | Restricted Stock Units | D | −15 056 | 39 028 | ||||||

| 2022-01-04 | 2022-01-01 | 4 | Reese Nathan R | NYMT | Restricted Stock Units | D | −8 917 | 54 084 | ||||||

| 2022-01-04 | 2022-01-01 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 15 056 | 217 791 | ||||||

| 2022-01-04 | 2022-01-01 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 8 917 | 202 735 | ||||||

| 2022-01-04 | 2022-01-01 | 4 | Nario Kristine Rimando | NYMT | Restricted Stock Units | D | −16 938 | 43 907 | ||||||

| 2022-01-04 | 2022-01-01 | 4 | Nario Kristine Rimando | NYMT | Restricted Stock Units | D | −10 032 | 60 845 | ||||||

| 2022-01-04 | 2022-01-01 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 16 938 | 275 326 | ||||||

| 2022-01-04 | 2022-01-01 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 10 032 | 258 388 | ||||||

| 2022-01-04 | 2022-01-01 | 4 | Serrano Jason T | NYMT | Restricted Stock Units | D | −45 167 | 117 086 | ||||||

| 2022-01-04 | 2022-01-01 | 4 | Serrano Jason T | NYMT | Restricted Stock Units | D | −26 752 | 162 253 | ||||||

| 2022-01-04 | 2022-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 3,7200 | −18 805 | −70 | 577 006 | ||||

| 2022-01-04 | 2022-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 45 167 | 595 811 | ||||||

| 2022-01-04 | 2022-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 3,7200 | −11 352 | −42 | 550 644 | ||||

| 2022-01-04 | 2022-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 26 752 | 561 996 | ||||||

| 2022-01-04 | 2022-01-01 | 4 | Mumma Steven R | NYMT | Restricted Stock Units | D | −54 201 | 140 503 | ||||||

| 2022-01-04 | 2022-01-01 | 4 | Mumma Steven R | NYMT | Restricted Stock Units | D | −32 103 | 194 704 | ||||||

| 2022-01-04 | 2022-01-01 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 3,7200 | −21 619 | −80 | 1 322 081 | ||||

| 2022-01-04 | 2022-01-01 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 54 201 | 1 343 700 | ||||||

| 2022-01-04 | 2022-01-01 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 3,7200 | −13 388 | −50 | 1 289 499 | ||||

| 2022-01-04 | 2022-01-01 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 32 103 | 1 302 887 | ||||||

| 2021-07-12 | 2021-07-09 | 4 | Greenberg Audrey | NYMT | Common Stock, par value $0.01 per share | D | 26 490 | 26 490 | ||||||

| 2021-06-16 | 2021-06-14 | 4 | Clement Michael B. | NYMT | Common Stock, par value $0.01 per share | D | 25 532 | 131 695 | ||||||

| 2021-06-16 | 2021-06-14 | 4 | Bock David R | NYMT | Common Stock, par value $0.01 per share | D | 25 532 | 179 469 | ||||||

| 2021-06-16 | 2021-06-14 | 4 | Norcutt Steven G | NYMT | Common Stock, par value $0.01 per share | D | 25 532 | 232 356 | ||||||

| 2021-06-16 | 2021-06-14 | 4 | Pendergast Lisa A | NYMT | Common Stock, par value $0.01 per share | D | 51 064 | 131 542 | ||||||

| 2021-06-16 | 2021-06-14 | 4 | Hainey Alan L | NYMT | Common Stock, par value $0.01 per share | D | 25 532 | 286 648 | ||||||

| 2021-02-16 | 2021-02-13 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 3,9800 | −12 795 | −51 | 1 270 784 | ||||

| 2021-02-08 | 2021-02-04 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 3,9400 | −5 032 | −20 | 193 818 | ||||

| 2021-02-08 | 2021-02-04 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 3,9400 | −24 082 | −95 | 535 244 | ||||

| 2021-02-08 | 2021-02-05 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 3,9900 | −15 681 | −63 | 1 283 579 | ||||

| 2021-02-08 | 2021-02-04 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 3,9400 | −42 423 | −167 | 1 299 260 | ||||

| 2021-01-29 | 2021-01-27 | 4 | Reese Nathan R | NYMT | Restricted Stock Units | D | 45 167 | 63 001 | ||||||

| 2021-01-29 | 2021-01-27 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 3,8200 | −29 434 | −112 | 198 850 | ||||

| 2021-01-29 | 2021-01-27 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 74 555 | 228 284 | ||||||

| 2021-01-29 | 2021-01-27 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 6 544 | 153 729 | ||||||

| 2021-01-29 | 2021-01-27 | 4 | Nario Kristine Rimando | NYMT | Restricted Stock Units | D | 50 813 | 70 877 | ||||||

| 2021-01-29 | 2021-01-27 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 74 555 | 248 356 | ||||||

| 2021-01-29 | 2021-01-27 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 44 175 | 173 801 | ||||||

| 2021-01-29 | 2021-01-27 | 4 | Mumma Steven R | NYMT | Restricted Stock Units | D | 162 602 | 226 807 | ||||||

| 2021-01-29 | 2021-01-27 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 3,8200 | −117 927 | −450 | 1 341 683 | ||||

| 2021-01-29 | 2021-01-27 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 298 218 | 1 459 610 | ||||||

| 2021-01-29 | 2021-01-27 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 141 361 | 1 161 392 | ||||||

| 2021-01-29 | 2021-01-27 | 4 | Serrano Jason T | NYMT | Restricted Stock Units | D | 135 501 | 189 005 | ||||||

| 2021-01-29 | 2021-01-27 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 117 801 | 559 326 | ||||||

| 2021-01-05 | 2021-01-01 | 4 | Serrano Jason T | NYMT | Restricted Stock Units | D | −26 753 | 53 504 | ||||||

| 2021-01-05 | 2021-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 3,6900 | −14 386 | −53 | 441 525 | ||||

| 2021-01-05 | 2021-01-01 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 26 753 | 455 911 | ||||||

| 2021-01-05 | 2021-01-01 | 4 | Nario Kristine Rimando | NYMT | Restricted Stock Units | D | −10 032 | 20 064 | ||||||

| 2021-01-05 | 2021-01-01 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 10 032 | 129 626 | ||||||

| 2021-01-05 | 2021-01-01 | 4 | Reese Nathan R | NYMT | Restricted Stock Units | D | −8 918 | 17 834 | ||||||

| 2021-01-05 | 2021-01-01 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 8 918 | 147 185 | ||||||

| 2021-01-05 | 2021-01-01 | 4 | Mumma Steven R | NYMT | Restricted Stock Units | D | −32 103 | 64 205 | ||||||

| 2021-01-05 | 2021-01-01 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 3,6900 | −12 983 | −48 | 1 020 031 | ||||

| 2021-01-05 | 2021-01-01 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 32 103 | 1 033 014 | ||||||

| 2020-07-06 | 2020-07-01 | 4 | Norcutt Steven G | NYMT | Common Stock, par value $0.01 per share | D | 93 023 | 206 824 | ||||||

| 2020-07-06 | 2020-07-01 | 4 | Bock David R | NYMT | Common Stock, par value $0.01 per share | D | 46 512 | 146 840 | ||||||

| 2020-07-06 | 2020-07-01 | 4 | Pendergast Lisa A | NYMT | Common Stock, par value $0.01 per share | D | 46 512 | 80 478 | ||||||

| 2020-07-06 | 2020-07-01 | 4 | Clement Michael B. | NYMT | Common Stock, par value $0.01 per share | D | 46 512 | 106 163 | ||||||

| 2020-07-06 | 2020-07-01 | 4 | Hainey Alan L | NYMT | Common Stock, par value $0.01 per share | D | 46 512 | 244 504 | ||||||

| 2020-03-13 | 2020-03-13 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 4,2198 | 5 000 | 21 | 138 267 | ||||

| 2020-03-13 | 2020-03-13 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 3,9200 | 16 090 | 63 | 429 158 | ||||

| 2020-03-13 | 2020-03-13 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 3,9050 | 400 | 2 | 413 068 | ||||

| 2020-03-13 | 2020-03-13 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 3,9100 | 43 510 | 170 | 412 668 | ||||

| 2020-03-13 | 2020-03-13 | 4 | Norcutt Steven G | NYMT | Common Stock, par value $0.01 per share | D | 4,0893 | 6 100 | 25 | 113 801 | ||||

| 2020-03-13 | 2020-03-13 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 4,0200 | 32 000 | 129 | 1 000 911 | ||||

| 2020-03-13 | 2020-03-13 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 4,0000 | 7 500 | 30 | 119 594 | ||||

| 2020-03-11 | 2020-03-10 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 5,4599 | 49 503 | 270 | 968 911 | ||||

| 2020-03-11 | 2020-03-10 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 5,4500 | 497 | 3 | 919 408 | ||||

| 2020-03-11 | 2020-03-11 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 5,4000 | 11 000 | 59 | 112 094 | ||||

| 2020-02-18 | 2020-02-13 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 6,2800 | −8 726 | −55 | 918 911 | ||||

| 2020-02-06 | 2020-02-05 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 6,3600 | −14 954 | −95 | 927 637 | ||||

| 2020-02-06 | 2020-02-04 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 248 815 | 942 591 | ||||||

| 2020-02-06 | 2020-02-04 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 207 346 | 369 158 | ||||||

| 2020-02-06 | 2020-02-04 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 39 494 | 133 267 | ||||||

| 2020-02-06 | 2020-02-04 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 39 494 | 101 094 | ||||||

| 2020-01-03 | 2020-01-01 | 4 | Reese Nathan R | NYMT | Restricted Stock Units | D | 26 752 | 26 752 | ||||||

| 2020-01-03 | 2020-01-01 | 4 | Nario Kristine Rimando | NYMT | Restricted Stock Units | D | 30 096 | 30 096 | ||||||

| 2020-01-03 | 2020-01-01 | 4 | Serrano Jason T | NYMT | Restricted Stock Units | D | 80 257 | 80 257 | ||||||

| 2020-01-03 | 2020-01-01 | 4 | Mumma Steven R | NYMT | Restricted Stock Units | D | 96 308 | 96 308 | ||||||

| 2019-07-02 | 2019-06-28 | 4 | Hainey Alan L | NYMT | Common Stock, par value $0.01 per share | D | 19 355 | 167 988 | ||||||

| 2019-07-02 | 2019-06-28 | 4 | Bock David R | NYMT | Common Stock, par value $0.01 per share | D | 19 355 | 95 633 | ||||||

| 2019-07-02 | 2019-06-28 | 4 | Pendergast Lisa A | NYMT | Common Stock, par value $0.01 per share | D | 19 355 | 33 966 | ||||||

| 2019-07-02 | 2019-06-28 | 4 | Norcutt Steven G | NYMT | Common Stock, par value $0.01 per share | D | 19 355 | 107 701 | ||||||

| 2019-07-02 | 2019-06-28 | 4 | Clement Michael B. | NYMT | Common Stock, par value $0.01 per share | D | 19 355 | 59 651 | ||||||

| 2019-06-17 | 2019-06-14 | 4 | Hainey Alan L | NYMT | Common Stock, par value $0.01 per share | D | 6,2700 | −10 000 | −63 | 144 296 | ||||

| 2019-05-20 | 2019-05-16 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 6,0700 | −15 816 | −96 | 693 776 | ||||

| 2019-02-12 | 2019-02-08 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 6,3400 | −22 823 | −145 | 709 592 | ||||

| 2019-02-07 | 2019-02-05 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 14 016 | 93 773 | ||||||

| 2019-02-07 | 2019-02-05 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 12 992 | 61 600 | ||||||

| 2019-02-07 | 2019-02-05 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 91 969 | 732 415 | ||||||

| 2019-01-08 | 3 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 0 | ||||||||

| 2019-01-08 | 2019-01-07 | 4 | Serrano Jason T | NYMT | Common Stock, par value $0.01 per share | D | 161 812 | 161 812 | ||||||

| 2018-06-06 | 2018-06-05 | 4 | Clement Michael B. | NYMT | Common Stock, par value $0.01 per share | D | 14 611 | 40 296 | ||||||

| 2018-06-06 | 2018-06-05 | 4 | Norcutt Steven G | NYMT | Common Stock, par value $0.01 per share | D | 14 611 | 88 346 | ||||||

| 2018-06-06 | 2018-06-05 | 4 | Bock David R | NYMT | Common Stock, par value $0.01 per share | D | 14 611 | 76 278 | ||||||

| 2018-06-06 | 2018-06-05 | 4 | Hainey Alan L | NYMT | Common Stock, par value $0.01 per share | D | 14 611 | 154 296 | ||||||

| 2018-06-06 | 2018-06-05 | 4 | Pendergast Lisa A | NYMT | Common Stock, par value $0.01 per share | D | 14 611 | 14 611 | ||||||

| 2018-05-18 | 2018-05-16 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 6,1700 | −16 080 | −99 | 640 446 | ||||

| 2018-03-22 | 3 | Pendergast Lisa A | NYMT | Common Stock, par value $0.01 per share | D | 0 | ||||||||

| 2018-02-20 | 2018-02-13 | 4/A | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 75 042 | 656 526 | ||||||

| 2018-02-20 | 2018-02-13 | 4/A | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 13 102 | 48 608 | ||||||

| 2018-02-20 | 2018-02-13 | 4/A | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 15 246 | 79 757 | ||||||

| 2018-02-16 | 2018-02-16 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 13 102 | 48 608 | ||||||

| 2018-02-16 | 2018-02-16 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 75 042 | 656 526 | ||||||

| 2018-02-16 | 2018-02-16 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 15 246 | 79 757 | ||||||

| 2017-12-13 | 2017-12-12 | 4 | Hainey Alan L | NYMT | Common Stock, par value $0.01 per share | D | 6,3800 | −200 | −1 | 131 371 | ||||

| 2017-05-23 | 2017-05-22 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 6 258 | 581 484 | ||||||

| 2017-05-23 | 2017-05-23 | 4 | Clement Michael B. | NYMT | Common Stock, par value $0.01 per share | D | 14 730 | 25 685 | ||||||

| 2017-05-23 | 2017-05-23 | 4 | Bock David R | NYMT | Common Stock, par value $0.01 per share | D | 14 730 | 61 667 | ||||||

| 2017-05-23 | 2017-05-23 | 4 | Norcutt Steven G | NYMT | Common Stock, par value $0.01 per share | D | 14 730 | 73 735 | ||||||

| 2017-05-23 | 2017-05-23 | 4 | Hainey Alan L | NYMT | Common Stock, par value $0.01 per share | D | 14 730 | 124 425 | ||||||

| 2017-05-17 | 2017-05-16 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 6,1200 | −17 284 | −106 | 575 226 | ||||

| 2017-02-27 | 2017-02-25 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 6,4400 | −3 913 | −25 | 592 510 | ||||

| 2017-02-24 | 2017-02-18 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 6,5200 | −26 442 | −172 | 596 423 | ||||

| 2017-02-24 | 2017-02-13 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 6,6600 | −15 330 | −102 | 622 865 | ||||

| 2017-02-10 | 2017-02-08 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 138 237 | 638 195 | ||||||

| 2017-02-10 | 2017-02-08 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 12 185 | 35 506 | ||||||

| 2017-02-10 | 2017-02-08 | 4 | Donlon Kevin M. | NYMT | Common Stock, par value $0.01 per share | D | 78 842 | 597 842 | ||||||

| 2017-02-10 | 2017-02-08 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 17 727 | 64 511 | ||||||

| 2016-06-20 | 3 | Clement Michael B. | NYMT | Common Stock, par value $0.01 per share | D | 0 | ||||||||

| 2016-06-20 | 2016-06-16 | 4 | Clement Michael B. | NYMT | Common Stock, par value $0.01 per share | D | 10 955 | 10 955 | ||||||

| 2016-06-10 | 2016-06-09 | 4 | Donlon Kevin M. | NYMT | Common Stock, par value $0.01 per share | D | 6,3046 | 58 004 | 366 | 519 000 | ||||

| 2016-06-01 | 2016-05-31 | 4 | Donlon Kevin M. | NYMT | Common Stock, par value $0.01 per share | D | 5,9172 | 203 396 | 1 204 | 460 996 | ||||

| 2016-05-24 | 2016-05-23 | 4 | Donlon Kevin M. | NYMT | Common Stock, par value $0.01 per share | D | 5,6000 | 1 600 | 9 | 257 600 | ||||

| 2016-05-23 | 2016-05-20 | 4 | Donlon Kevin M. | NYMT | Common Stock, par value $0.01 per share | D | 5,5991 | 50 000 | 280 | 256 000 | ||||

| 2016-05-18 | 2016-05-17 | 4 | Donlon Kevin M. | NYMT | Common Stock, par value $0.01 per share | D | 5,6644 | 200 000 | 1 133 | 206 000 | ||||

| 2016-05-16 | 3 | Donlon Kevin M. | NYMT | 7.75% Series B Cumulative Redeemable Preferred Stock | D | 8 000 | ||||||||

| 2016-05-16 | 3 | Donlon Kevin M. | NYMT | Common Stock, par value $0.01 per share | D | 13 000 | ||||||||

| 2016-05-16 | 3 | Donlon Kevin M. | NYMT | Common Stock, par value $0.01 per share | D | 13 000 | ||||||||

| 2016-05-16 | 3 | Donlon Kevin M. | NYMT | 7.75% Series B Cumulative Redeemable Preferred Stock | D | 8 000 | ||||||||

| 2016-05-16 | 2016-05-16 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 5,6900 | 100 000 | 569 | 499 958 | ||||

| 2016-05-13 | 2016-05-12 | 4 | Norcutt Steven G | NYMT | Common Stock, par value $0.01 per share | D | 12 281 | 59 005 | ||||||

| 2016-05-13 | 2016-05-12 | 4 | Bock David R | NYMT | Common Stock, par value $0.01 per share | D | 12 281 | 46 937 | ||||||

| 2016-05-13 | 2016-05-12 | 4 | Hainey Alan L | NYMT | Common Stock, par value $0.01 per share | D | 12 281 | 87 557 | ||||||

| 2016-05-13 | 2016-05-12 | 4 | Neal Douglas E | NYMT | Common Stock, par value $0.01 per share | D | 12 281 | 54 827 | ||||||

| 2016-03-08 | 2016-03-07 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 4,6600 | −11 425 | −53 | 399 958 | ||||

| 2016-02-26 | 2016-02-25 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 25 240 | 411 383 | ||||||

| 2016-02-26 | 2016-02-25 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 10 254 | 46 784 | ||||||

| 2016-02-26 | 2016-02-25 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $0.01 per share | D | 9 296 | 23 321 | ||||||

| 2016-02-19 | 2016-02-18 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 4,8800 | −26 207 | −128 | 386 143 | ||||

| 2016-02-16 | 2016-02-13 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 4,6100 | −15 306 | −71 | 412 350 | ||||

| 2015-08-10 | 2015-08-10 | 4 | Mumma Steven R | NYMT | Common Stock, par value $.01 per share | D | 6,6700 | 5 000 | 33 | 427 656 | ||||

| 2015-08-10 | 2015-08-10 | 4 | Mumma Steven R | NYMT | Common Stock, par value $.01 per share | D | 6,6700 | 5 000 | 33 | 427 656 | ||||

| 2015-08-10 | 2015-08-10 | 4 | Mumma Steven R | NYMT | Common Stock, par value $.01 per share | D | 6,6600 | 5 000 | 33 | 422 656 | ||||

| 2015-08-10 | 2015-08-10 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $.01 per share | D | 6,5890 | 2 200 | 14 | 14 025 | ||||

| 2015-06-02 | 2015-06-01 | 4 | Norcutt Steven G | NYMT | Common Stock, par value $.01 per share | D | 8 906 | 46 724 | ||||||

| 2015-06-02 | 2015-06-01 | 4 | Bock David R | NYMT | Common Stock, par value $.01 per share | D | 8 906 | 34 656 | ||||||

| 2015-06-02 | 2015-06-01 | 4 | Hainey Alan L | NYMT | Common Stock, par value $.01 per share | D | 8 906 | 70 174 | ||||||

| 2015-06-02 | 2015-06-01 | 4 | Neal Douglas E | NYMT | Common Stock, par value $.01 per share | D | 8 906 | 42 546 | ||||||

| 2015-03-12 | 2015-03-12 | 4 | Mumma Steven R | NYMT | Common Stock, par value $.01 per share | D | 7,9000 | −3 070 | −24 | 412 656 | ||||

| 2015-03-10 | 2015-03-07 | 4 | Mumma Steven R | NYMT | Common Stock, par value $.01 per share | D | 7,8000 | −11 680 | −91 | 415 726 | ||||

| 2015-02-20 | 2015-02-18 | 4 | Nario Kristine Rimando | NYMT | Common Stock, par value $.01 per share | D | 7 605 | 11 825 | ||||||

| 2015-02-20 | 2015-02-18 | 4 | Reese Nathan R | NYMT | Common Stock, par value $.01 per share | D | 12 546 | 36 530 | ||||||

| 2015-02-20 | 2015-02-18 | 4 | Mumma Steven R | NYMT | Common Stock, par value $.01 per share | D | 155 957 | 427 406 | ||||||

| 2015-02-18 | 2015-02-13 | 4 | Mumma Steven R | NYMT | Common Stock, par value $.01 per share | D | 7,7500 | −15 483 | −120 | 271 449 | ||||

| 2014-06-02 | 3/A | Nario Kristine Rimando | NYMT | Common Stock | D | 4 220 | ||||||||

| 2014-05-16 | 2014-05-14 | 4 | Norcutt Steven G | NYMT | Common Stock, par value $.01 per share | D | 7 000 | 37 818 | ||||||

| 2014-05-16 | 2014-05-14 | 4 | Bock David R | NYMT | Common Stock, par value $.01 per share | D | 7 000 | 25 750 | ||||||

| 2014-05-16 | 2014-05-14 | 4 | Hainey Alan L | NYMT | Common Stock, par value $.01 per share | D | 7 000 | 50 219 | ||||||

| 2014-05-16 | 2014-05-14 | 4 | Neal Douglas E | NYMT | Common Stock, par value $.01 per share | D | 7 000 | 33 640 | ||||||

| 2014-03-26 | 2012-04-04 | 4 | Hainey Alan L | NYMT | Common Stock, par value $.01 per share | D | 6,4800 | 400 | 3 | 43 219 | ||||

| 2014-03-26 | 2011-06-20 | 4 | Hainey Alan L | NYMT | Common Stock, par value $.01 per share | D | 6,5400 | 250 | 2 | 34 070 | ||||

| 2014-02-18 | 2014-02-13 | 4 | Mumma Steven R | NYMT | Common Stock, par value $0.01 per share | D | 91 576 | 286 932 | ||||||

| 2014-02-18 | 2014-02-13 | 4 | Reese Nathan R | NYMT | Common Stock, par value $0.01 per share | D | 5 338 | 23 984 | ||||||

| 2013-08-21 | 2013-08-20 | 4/A | Mumma Steven R | NYMT | Common Stock, par value $.01 per share | D | 5,6500 | 25 000 | 141 | 195 356 | ||||

| 2013-08-20 | 2013-08-20 | 4 | Mumma Steven R | NYMT | Common Stock, par value $.01 per share | D | 5,6500 | 25 000 | 141 | 195 356 | ||||

| 2013-08-19 | 2013-08-19 | 4 | Neal Douglas E | NYMT | Common Stock, par value $.01 per share | D | 5,6397 | 8 700 | 49 | 26 640 | ||||

| 2013-05-24 | 2013-05-22 | 4 | Norcutt Steven G | NYMT | Common Stock, par value $0.01 per share | D | 6 000 | 30 818 | ||||||

| 2013-05-24 | 2013-05-22 | 4 | Bock David R | NYMT | Common Stock, par value $0.01 per share | D | 6 000 | 18 750 | ||||||

| 2013-05-24 | 2013-05-22 | 4 | Hainey Alan L | NYMT | Common Stock, par value $0.01 per share | D | 6 000 | 33 820 | ||||||

| 2013-05-24 | 2013-05-22 | 4 | Neal Douglas E | NYMT | Common Stock, par value $0.01 per share | D | 6 000 | 17 940 | ||||||

| 2013-03-08 | 2013-03-07 | 4 | Mumma Steven R | NYMT | Common Stock, par value $.01 per share | D | 70 126 | 170 356 | ||||||

| 2013-03-08 | 2013-03-07 | 4 | Reese Nathan R | NYMT | Common Stock, par value $.01 per share | D | 5 259 | 18 646 | ||||||

| 2013-01-02 | 2012-12-31 | 4 | Norcutt Steven G | NYMT | Common Stock, par value $.01 per share | D | 6,3200 | 617 | 4 | 24 818 | ||||

| 2013-01-02 | 2012-12-31 | 4 | Hainey Alan L | NYMT | Common Stock, par value $.01 per share | D | 6,3200 | 1 780 | 11 | 27 820 | ||||

| 2013-01-02 | 2012-12-31 | 4 | Neal Douglas E | NYMT | Common Stock, par value $.01 per share | D | 6,3200 | 3 560 | 22 | 11 940 | ||||

| 2012-06-07 | 3/A | Bock David R | NYMT | Common Stock | D | 2 750 | ||||||||

| 2012-06-07 | 2012-06-05 | 4 | Norcutt Steven G | NYMT | Common Stock, par value $.01 per share | D | 6,6500 | 1 000 | 7 | 24 201 | ||||

| 2012-06-07 | 2012-06-05 | 4 | Norcutt Steven G | NYMT | Common Stock, par value $.01 per share | D | 5 000 | 23 201 | ||||||

| 2012-06-07 | 2012-06-05 | 4 | Bock David R | NYMT | Common Stock, par value $.01 per share | D | 6,6500 | 5 000 | 33 | 12 750 | ||||

| 2012-06-07 | 2012-06-05 | 4 | Bock David R | NYMT | Common Stock, par value $.01 per share | D | 5 000 | 7 750 | ||||||

| 2012-06-07 | 2012-06-05 | 4 | Hainey Alan L | NYMT | Common Stock, par value $.01 per share | D | 6,6500 | 2 000 | 13 | 26 040 | ||||

| 2012-06-07 | 2012-06-05 | 4 | Hainey Alan L | NYMT | Common Stock, par value $.01 per share | D | 5 000 | 24 040 | ||||||

| 2012-06-07 | 2012-06-05 | 4 | Neal Douglas E | NYMT | Common Stock, par value $.01 per share | D | 6,6500 | 3 380 | 22 | 8 380 | ||||

| 2012-06-07 | 2012-06-05 | 4 | Neal Douglas E | NYMT | Common Stock, par value $.01 per share | D | 5 000 | 5 000 | ||||||

| 2012-04-06 | 2012-04-04 | 4 | Hainey Alan L | NYMT | Common Stock, par value $.01 per share | D | 6,5000 | 500 | 3 | 19 040 | ||||

| 2012-04-06 | 2012-04-04 | 4 | Hainey Alan L | NYMT | Common Stock, par value $.01 per share | D | 6,4800 | 817 | 5 | 18 540 | ||||

| 2012-04-06 | 2012-04-03 | 4 | Hainey Alan L | NYMT | Common Stock, par value $.01 per share | D | 6,5600 | 1 000 | 7 | 17 723 | ||||

| 2012-03-16 | 2012-03-15 | 4 | Norcutt Steven G | NYMT | Common Stock, par value $.01 per share | D | 6,7500 | 3 000 | 20 | 18 201 | ||||

| 2012-03-14 | 2012-03-12 | 4 | Mumma Steven R | NYMT | Common Stock, par value $.01 per share | D | 20 804 | 100 230 | ||||||

| 2012-03-14 | 2012-03-12 | 4 | Reese Nathan R | NYMT | Common Stock, par value $.01 per share | D | 1 387 | 13 387 | ||||||

| 2012-01-26 | 3 | Bock David R | NYMT | Common Stock | D | 2 000 | ||||||||

| 2012-01-09 | 2012-01-06 | 4 | Hainey Alan L | NYMT | Common Stock, par value $.01 per share | D | 7,1200 | 1 050 | 7 | 16 723 | ||||

| 2011-06-17 | 2011-06-15 | 4 | Hainey Alan L | NYMT | Common Stock, par value $.01 per share | D | 6,5400 | 250 | 2 | 14 336 | ||||

| 2011-06-17 | 2011-06-15 | 4 | Hainey Alan L | NYMT | Common Stock, par value $.01 per share | D | 6,5500 | 200 | 1 | 14 086 | ||||

| 2011-05-23 | 2011-05-19 | 4 | Norcutt Steven G | NYMT | Common Stock, par value $.01 per share | D | 1 031 | 13 864 | ||||||

| 2011-05-23 | 2011-05-19 | 4 | Hainey Alan L | NYMT | Common Stock, par value $.01 per share | D | 1 031 | 13 886 | ||||||

| 2008-01-28 | 3 | Fowler James J By JMP Realty Trust, Inc. | NMTR | Common Stock | I | 21 903 | ||||||||

| 2008-01-28 | 3 | Abreu Steven M | NMTR | No securities owned | D | 0 | ||||||||

| 2006-03-31 | 3 | HOWE ALAN BRADLEY | NTR | No securities owned | D | 0 | ||||||||

| 2004-06-29 | 3 | Bock David R | NTR | No securities owned. | D | 0 | ||||||||

| 2004-06-29 | 3 | Hainey Alan L | NTR | No securities owned. | D | 0 | ||||||||

| 2004-06-29 | 3 | Norcutt Steven G | NTR | No securities owned. | D | 0 | ||||||||

| 2004-06-29 | 3 | Pembroke Mary Dwyer | NTR | No securities owned. | D | 0 | ||||||||

| 2004-06-29 | 3 | Sherman Jerome F | NTR | No securities owned. | D | 0 | ||||||||

| 2004-06-29 | 3 | White Thomas William | NTR | No securities owned. | D | 0 | ||||||||

| 2004-06-23 | 3 | Akre David A | NTR | No securities owned. | D | 0 | ||||||||

| 2004-06-23 | 3 | Fierro Joseph V | NTR | No securities owned. | D | 0 | ||||||||

| 2004-06-23 | 3 | Mumma Steven R | NTR | No securities owned. | D | 0 | ||||||||

| 2004-06-23 | 3 | Redlingshafer Raymond A JR | NTR | No securities owned. | D | 0 | ||||||||

| 2004-06-23 | 3 | Schnall Steven B | NTR | Common Stock, par value $.01 per share | D | 100 |