Grunnleggende statistikk

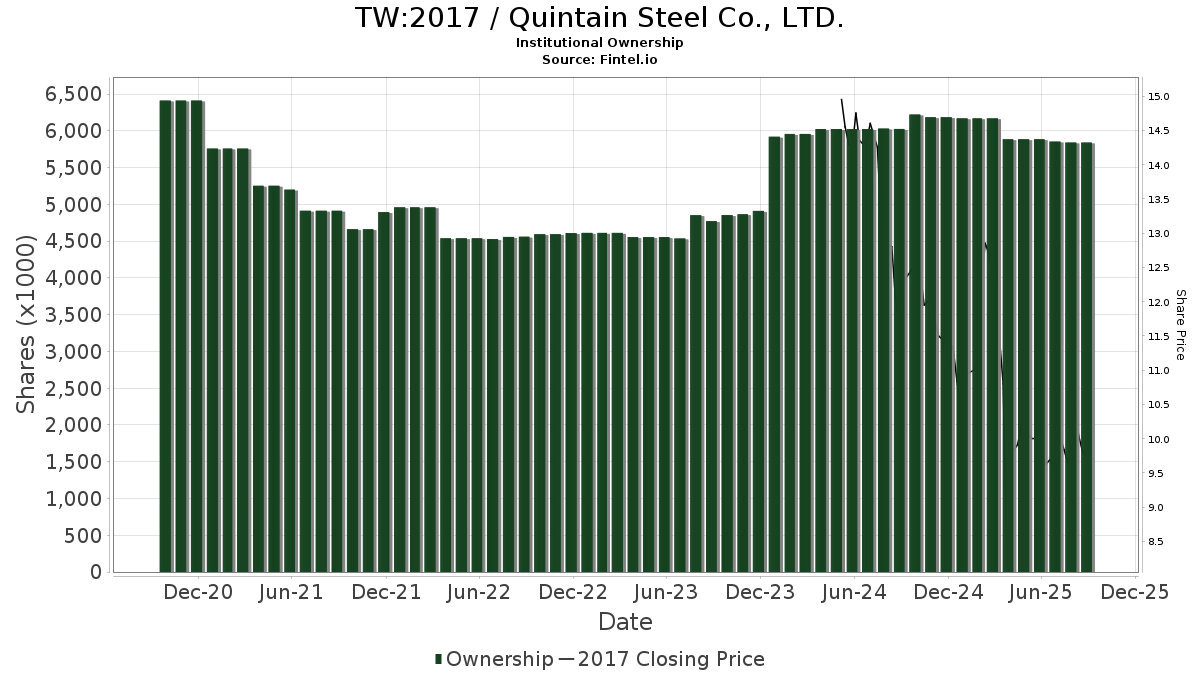

| Institusjonelle aksjer (Long) | 5 842 975 - 1,37% (ex 13D/G) - change of −0,04MM shares −0,76% MRQ |

| Institusjonell verdi (Long) | $ 1 812 USD ($1000) |

Institusjonelt eierskap og aksjonærer

Quintain Steel Co., LTD. (TW:2017) har 18 institusjonelle eiere og aksjonærer som har sendt inn 13D/G- eller 13F-skjemaer til Securities Exchange Commission (SEC). Disse institusjonene eier til sammen 5,842,975 aksjer. De største aksjonærene inkluderer DFCEX - Emerging Markets Core Equity Portfolio - Institutional Class, Dimensional Emerging Markets Value Fund - Dimensional Emerging Markets Value Fund, Dfa Investment Trust Co - The Emerging Markets Small Cap Series, AVEM - Avantis Emerging Markets Equity ETF, DFAX - Dimensional World ex U.S. Core Equity 2 ETF, DFEM - Dimensional Emerging Markets Core Equity 2 ETF, SPEM - SPDR(R) Portfolio Emerging Markets ETF, DFA INVESTMENT DIMENSIONS GROUP INC - Emerging Markets Social Core Equity Portfolio Shares, DFAE - Dimensional Emerging Core Equity Market ETF, and DAADX - Emerging Markets ex China Core Equity Portfolio Institutional Class .

Quintain Steel Co., LTD. (TWSE:2017) institusjonell eierstruktur viser nåværende posisjoner i selskapet fordelt på institusjoner og fond, samt de siste endringene i posisjonsstørrelse. De største aksjonærene kan være individuelle investorer, verdipapirfond, hedgefond eller institusjoner. Schedule 13D indikerer at investoren eier (eller har eid) mer enn 5 % av selskapet og har til hensikt (eller hadde til hensikt) å aktivt forfølge en endring i forretningsstrategien. Schedule 13G indikerer en passiv investering på over 5 %.

The share price as of September 10, 2025 is 9,75 / share. Previously, on September 11, 2024, the share price was 11,70 / share. This represents a decline of 16,67% over that period.

Fondssentiment-score

Fondssentiment Score (også kjent som akkumulering av eierskap poengsum) viser hvilke aksjer som er mest kjøpt av fond. Den er resultatet av en sofistikert, kvantitativ flerfaktormodell som identifiserer selskaper med de høyeste nivåene av institusjonell akkumulering. Beregningsmodellen for poeng bruker en kombinasjon av den totale økningen i antall offentliggjorte eiere, endringer i porteføljeallokeringen til disse eierne og andre beregninger. Tallet går fra 0 til 100, der høyere tall indikerer en høyere grad av akkumulering i forhold til sammenlignbare selskaper, der 50 er gjennomsnittet.

Oppdateringsfrekvens: Daglig

Sjekk ut Ownership Explorer, som inneholder en liste over de høyest rangerte selskapene.

13F- og NPORT-arkiveringer

Detaljer om 13F-arkiveringer er gratis. Detaljer om NP-arkiveringer krever et premium-medlemskap. Grønne rader indikerer nye posisjoner. Røde rader indikerer lukkede posisjoner. Klikk på lenke ikonet for å se hele transaksjonshistorikken.

Oppgrader

for å låse opp premiedata og eksportere til Excel. ![]() .

.