Grunnleggende statistikk

| Institusjonelle eiere | 1 total, 1 long only, 0 short only, 0 long/short - change of 12,90% MRQ |

| Gjennomsnittlig porteføljeallokering | 0.1822 % - change of −24,81% MRQ |

| Institusjonelle aksjer (Long) | 1 218 000 (ex 13D/G) |

| Institusjonell verdi (Long) | $ 1 091 USD ($1000) |

Institusjonelt eierskap og aksjonærer

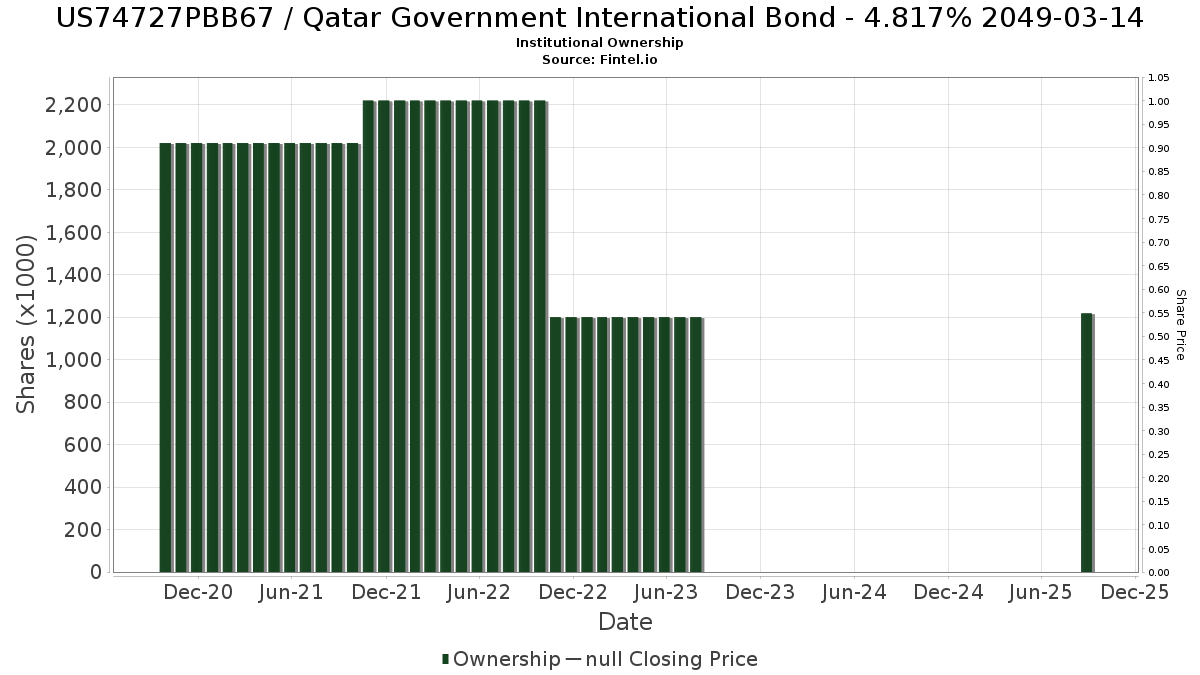

Qatar Government International Bond (QA:US74727PBB67) har 1 institusjonelle eiere og aksjonærer som har sendt inn 13D/G- eller 13F-skjemaer til Securities Exchange Commission (SEC). Disse institusjonene eier til sammen 1,218,000 aksjer. De største aksjonærene inkluderer MXLMX - Great-West Multi-Sector Bond Fund Investor Class .

Qatar Government International Bond (US74727PBB67) institusjonell eierstruktur viser nåværende posisjoner i selskapet fordelt på institusjoner og fond, samt de siste endringene i posisjonsstørrelse. De største aksjonærene kan være individuelle investorer, verdipapirfond, hedgefond eller institusjoner. Schedule 13D indikerer at investoren eier (eller har eid) mer enn 5 % av selskapet og har til hensikt (eller hadde til hensikt) å aktivt forfølge en endring i forretningsstrategien. Schedule 13G indikerer en passiv investering på over 5 %.

13F- og NPORT-arkiveringer

Detaljer om 13F-arkiveringer er gratis. Detaljer om NP-arkiveringer krever et premium-medlemskap. Grønne rader indikerer nye posisjoner. Røde rader indikerer lukkede posisjoner. Klikk på lenke ikonet for å se hele transaksjonshistorikken.

Oppgrader

for å låse opp premiedata og eksportere til Excel. ![]() .

.