Grunnleggende statistikk

| Institusjonelle eiere | 13 total, 13 long only, 0 short only, 0 long/short - change of 0,00% MRQ |

| Gjennomsnittlig porteføljeallokering | 0.0018 % - change of 0,35% MRQ |

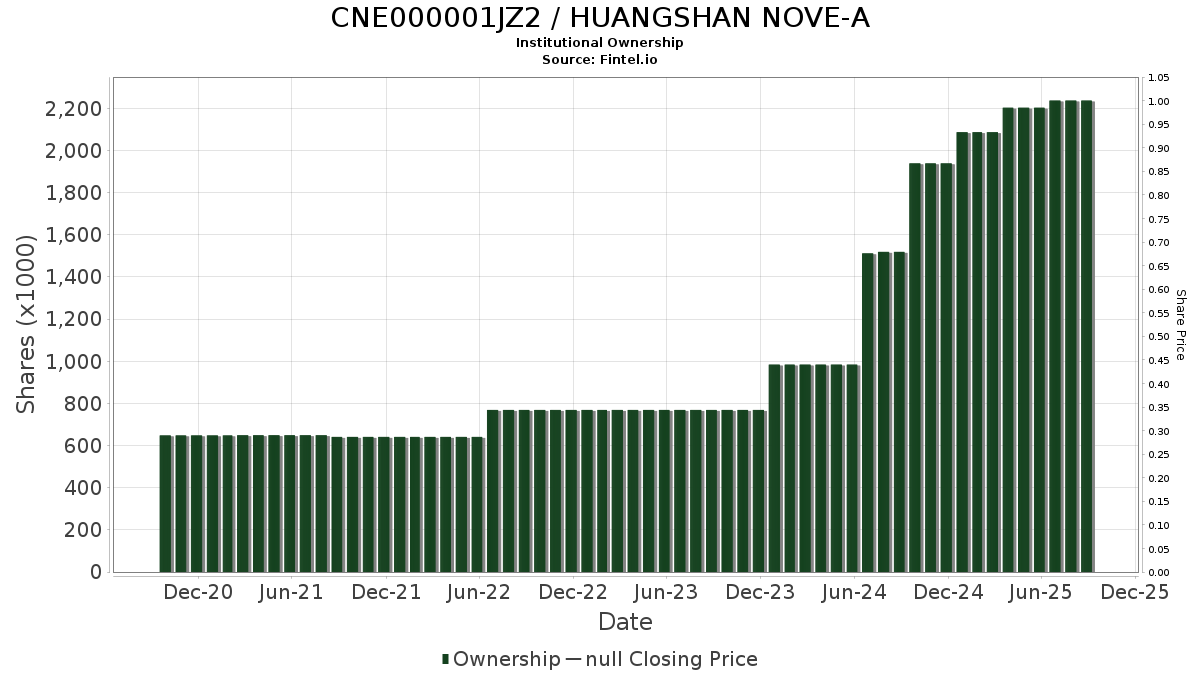

| Institusjonelle aksjer (Long) | 2 237 260 (ex 13D/G) - change of 0,03MM shares 1,54% MRQ |

| Institusjonell verdi (Long) | $ 3 286 USD ($1000) |

Institusjonelt eierskap og aksjonærer

HUANGSHAN NOVE-A (CN:CNE000001JZ2) har 13 institusjonelle eiere og aksjonærer som har sendt inn 13D/G- eller 13F-skjemaer til Securities Exchange Commission (SEC). Disse institusjonene eier til sammen 2,237,260 aksjer. De største aksjonærene inkluderer VEIEX - Vanguard Emerging Markets Stock Index Fund Investor Shares, VGTSX - Vanguard Total International Stock Index Fund Investor Shares, DFCEX - Emerging Markets Core Equity Portfolio - Institutional Class, DFEM - Dimensional Emerging Markets Core Equity 2 ETF, Dfa Investment Trust Co - The Emerging Markets Small Cap Series, VFSNX - Vanguard FTSE All-World ex-US Small-Cap Index Fund Institutional Shares, DFAE - Dimensional Emerging Core Equity Market ETF, DFA INVESTMENT DIMENSIONS GROUP INC - Emerging Markets Social Core Equity Portfolio Shares, DFAX - Dimensional World ex U.S. Core Equity 2 ETF, and DFA INVESTMENT DIMENSIONS GROUP INC - Emerging Markets Sustainability Core 1 Portfolio Institutional Class .

HUANGSHAN NOVE-A (CNE000001JZ2) institusjonell eierstruktur viser nåværende posisjoner i selskapet fordelt på institusjoner og fond, samt de siste endringene i posisjonsstørrelse. De største aksjonærene kan være individuelle investorer, verdipapirfond, hedgefond eller institusjoner. Schedule 13D indikerer at investoren eier (eller har eid) mer enn 5 % av selskapet og har til hensikt (eller hadde til hensikt) å aktivt forfølge en endring i forretningsstrategien. Schedule 13G indikerer en passiv investering på over 5 %.

13F- og NPORT-arkiveringer

Detaljer om 13F-arkiveringer er gratis. Detaljer om NP-arkiveringer krever et premium-medlemskap. Grønne rader indikerer nye posisjoner. Røde rader indikerer lukkede posisjoner. Klikk på lenke ikonet for å se hele transaksjonshistorikken.

Oppgrader

for å låse opp premiedata og eksportere til Excel. ![]() .

.