| Utestående aksjer | 739,096 shares |

| Innsideraksjer | 12 318 876 shares |

| Totale insidere | 35 |

Insider Sentiment Score

Insider Sentiment Score finner selskapene som blir kjøpt av bedriftsinsidere.

Det er resultatet av en sofistikert, flerfaktor kvantitativ modell som identifiserer selskaper som har de høyeste nivåene av insiderakkumulasjon. Scoringsmodellen bruker en kombinasjon av netto antall insidere som kjøper de siste 90 dagene, det totale antallet kjøpte aksjer som en prosentandel av flyten, og det totale antallet aksjer eid av insidere. Tallet varierer fra 0 til 100, hvor høyere tall indikerer en høyere grad av akkumulasjon sammenlignet med jevnaldrende, og 50 er gjennomsnittet.

Oppdateringsfrekvens: Daglig

Se Insidernes Topp Picks, som gir en liste over selskaper med høyest akkumulasjon blant insidere.

Officer Sentiment Score

Officer Sentiment Score finner selskaper som kjøpes av bedriftsoffiserer.

Per definisjon er Corporate Officers Corporate Insiders, men i motsetning til noen av de andre innsiderne (10 % aksjonærer og styremedlemmer), jobber offiserer for selskapet på daglig basis, og de bruker sine egne penger når de handler . (10 % aksjonærer og styremedlemmer er ofte fondsforvaltere som forvalter andres penger.) Som sådan er innsidehandler utført av offiserer mye mer betydningsfulle og bør behandles på riktig måte.

Som Insider Sentiment Score er Officer Sentiment Score resultatet av en sofistikert, flerfaktor kvantitativ modell som identifiserer selskaper med de høyeste nivåene av akkumulasjon blant ledelsen.

Oppdateringsfrekvens: Daglig

Se Insidernes Topp Picks, som gir en liste over selskaper med høyest insider-sentiment.

Nøkkelindikatorer for insidere

Dette kortet viser hvordan selskapet rangerer langs ulike indikatorer for insidere. Percentile-rangeringen viser hvordan dette selskapet sammenligner seg med andre selskaper på USAs markeder. Høyere rangeringer indikerer bedre situasjoner.

For eksempel, er det generelt akseptert at insiderkjøp er en positiv indikator, så derfor ville selskaper som insiderkjøper mer, rangere høyere enn selskaper med mindre insiderkjøp (eller til og med insidersalg).

Prosent av aksjeflyt kjøpt av insidere (rang)

0.000 %( )

6151 out of 11226Prosenten av aksjeflyt kjøpt av innsidere er det totale antallet aksjer som er blitt kjøpt av innsidere minus det totale antallet aksjer solgt av innsidere de siste 90 dagene, delt på totalt antall utestående aksjer og multiplisert med 100.

Diagram over innsidehandel

Elah Holdings, Inc. insiderhandel vises i følgende diagram. Innsidere er ledere, direktører eller viktige investorer i et selskap. Generelt sett er det ulovlig for insidere å handle med aksjer i sine selskaper basert på materiell, ikke-offentlig informasjon. Dette betyr ikke at det er ulovlig for dem å gjøre any handler i deres egne selskaper. Imidlertid må de rapportere alle handler til SEC via en Form 4.

Insiderliste og lønnsomhetsmålinger

Denne tabellen viser listen over kjente insidere, og er automatisk generert fra arkiveringer offentliggjort av SEC. I tillegg til navn, siste tittel og direktør-, offiser- eller 10 % eier-betegnelse, gir vi de nyeste offentliggjorte beholdningene. I tillegg gir vi, når det er mulig, den historiske handelsytelsen for insidere. Den historiske handelsytelsen er et vektet gjennomsnitt av ytelsen til faktiske kjøpstransaksjoner som er gjort av insidere på det åpne markedet. For mer informasjon om hvordan dette blir beregnet, kan du se dette YouTube-webinaret.

See our leaderboard of most profitable insider traders.

| Innsider | Gjennomsnittlig fortjeneste (%) | Aksjer eid |

Splitt justert |

|---|---|---|---|

|

Robert H Alpert

Director, 10% Owner -

[D]

|

184 439 | 184 439 | |

| Michael Blitzer Director - [D] | 700 000 | 700 000 | |

| Peter C B Bynoe Director - [D] | 92 801 | 92 801 | |

| Craig T Bouchard - | 24 823 | 24 823 | |

| David N Brody Sr. VP; Counsel & Secretary - [O] | 14 215 | 14 215 | |

| Brown Randolph E. Director - [D] | 100 | 100 | |

| G Christopher Colville Chief Executive Officer, Director - [D] [O] | 788 622 | 788 622 | |

| Jeffrey Crusinberry Senior VP and Treasurer - [O] | 20 979 | 20 979 | |

| Patrick Deconinck Director - [D] | 39 711 | 39 711 | |

| Thomas Donatelli Executive Vice President - [O] | 407 405 | 407 405 | |

|

Goldman Sachs Asset Management, L.p.

10% Owner -

|

362 072 | 362 072 |

| Innsider | Gjennomsnittlig fortjeneste (%) | Aksjer eid |

Splitt justert |

|---|---|---|---|

| Kenneth S Grossman President, Director - [D] [O] | 356 250 | 356 250 | |

| Steven L Gidumal Director - [D] | 1 860 366 | 1 860 366 | |

| William K Hall Director - [D] | 51 477 | 51 477 | |

| Michael Hobey Chief Financial Officer - [O] | 295 | 295 | |

| Terrance J Hogan Executive Vice President - [O] | 473 | 473 | |

| Kelly G Howard EVP - General Counsel - [O] | 43 760 | 43 760 | |

| John Koral Director - [D] | 1 461 125 | 1 461 125 | |

| Patrick E Lamb Director - [D] | 108 955 | 108 955 | |

| Brian K Laibow | 0 | ||

| Deborah H Midanek Director - [D] | 353 618 | 353 618 | |

| Raj Maheshwari - | 80 427 | 80 427 | |

| William Christopher Manderson Executive VP & General Counsel - [O] | 28 832 | 28 832 |

| Innsider | Gjennomsnittlig fortjeneste (%) | Aksjer eid |

Splitt justert |

|---|---|---|---|

| Joseph McIntosh Director - [D] | 18 309 | 18 309 | |

| John A Miller Executive Vice President - [O] | 20 291 | 20 291 | |

| John F Nickoll Director - [D] | 425 698 | 425 698 | |

| Craig Forrest Noell Chief Executive Officer, Director - [D] [O] | 859 865 | 859 865 | |

| Olson Stephen J. Chief Acctg. Officer & Sr. VP - [O] | 293 744 | 293 744 | |

| Robert A Peiser Director - [D] | 1 000 | 1 000 | |

| Real Industry, Inc. Director - [D] | 82 059 | 82 059 | |

| Kyle Ross Chief Investment Officer - [O] | 232 253 | 232 253 | |

| Robert Schwab Director - [D] | 3 304 762 | 3 304 762 | |

| Philip Tinkler Director - [D] | 92 084 | 92 084 | |

| Douglas Tabor Director - [D] | 8 066 | 8 066 | |

|

C Clark Webb

Director, 10% Owner -

[D]

|

184 439 | 184 439 |

Report errors via our new Insider Auditing Tool

Analyse av sporrekord for insiderkjøp - Kortsiktig lønnsomhetsanalyse

I denne seksjonen analyserer vi lønnsomheten til hver ikke-planlagte, åpne markeds innsidekjøp gjort i ELLH / Elah Holdings, Inc.. Denne analysen hjelper til med å forstå om insidere konsekvent genererer unormale avkastninger og er verdt å følge. Denne analysen gjelder for ett år etter hver handel, og resultatene er teoretiske .

Følgende tabell viser de mest nylige åpne markedskjøpene som ikke var en del av en automatisk handelsplan.

Justert pris er prisen justert for splitt. Justerte aksjer er aksjer justert for splitt.

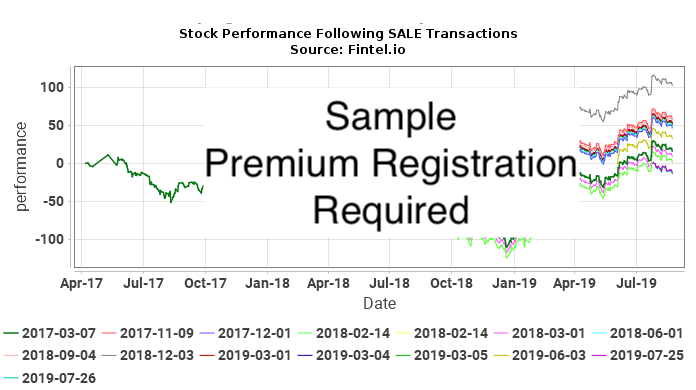

Analyse av sporrekord for insidesalg - Kortsiktig tapanalyse

I denne seksjonen analyserer vi kortsiktig tap til hver ikke-planlagte, åpne markeds innsidekjøp gjort i ELLH / Elah Holdings, Inc.. Et konsekvent mønster av tap unngåelse kan antyde at fremtidige salgstransaksjoner kan forutsi nedgang i pris. Denne analysen gjelder for ett år etter hver handel, og resultatene er teoretiske .

Følgende tabell viser de mest nylige åpne markedssalgene som ikke var en del av en automatisk trading plan.

Justert pris er prisen justert for splitt. Justerte aksjer er aksjer justert for splitt.

Transaksjonshistorikk

Klikk på lenkeikonet for å se hele transaksjonshistorikken. Transaksjoner rapportert som en del av en automatisk handelsplan 10b5-1 vil ha en X i kolonnen merket 10b-5.

| Fil dato |

Handels dato |

Skjema | Innsider | Ticker | Verdipapirnavn | Kode | Direkte | Utøvelses pris |

Enhets pris |

Enheter endret |

Verdi endret (1K) |

Gjenværende Opsjoner |

Gjenværende Aksjer |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2018-07-11 | 2018-05-22 | 4 | Hobey Michael | ELLH | Common Stock | D | 44 | 295 | ||||||

| 2018-07-11 | 2018-05-22 | 4 | Hogan Terrance J | ELLH | Common Stock | D | 167 | 473 | ||||||

| 2018-07-11 | 2018-05-22 | 4 | Webb C Clark By 210/RELY Partners, LP | ELLH | Common Stock | I | 48,3300 | 3 402 | 164 | 184 439 | ||||

| 2018-06-14 | 2018-06-14 | 4 | Brown Randolph E. | ELLH | Common Stock | D | 74,0000 | 22 | 2 | 100 | ||||

| 2018-06-14 | 2018-06-13 | 4 | Brown Randolph E. | ELLH | Common Stock | D | 65,0000 | 50 | 3 | 78 | ||||

| 2018-06-14 | 2018-06-12 | 4 | Brown Randolph E. | ELLH | Common Stock | D | 75,0000 | 18 | 1 | 28 | ||||

| 2018-06-14 | 2018-06-12 | 4 | Brown Randolph E. | ELLH | Common Stock | D | 70,0000 | 10 | 1 | 10 | ||||

| 2018-05-18 | 3 | Alpert Robert H By 210/RELY Partners, LP | RELYQ | Common Stock | I | 363 149 | ||||||||

| 2018-05-18 | 3 | Alpert Robert H | RELYQ | Common Stock | D | 183 187 | ||||||||

| 2018-05-18 | 3 | Alpert Robert H By 210/RELY Partners, LP | RELYQ | Common Stock | I | 363 149 | ||||||||

| 2018-05-18 | 3 | Alpert Robert H | RELYQ | Common Stock | D | 183 187 | ||||||||

| 2018-05-18 | 3 | Alpert Robert H By 210/RELY Partners, LP | RELYQ | Common Stock | I | 363 149 | ||||||||

| 2018-05-18 | 3 | Alpert Robert H | RELYQ | Common Stock | D | 183 187 | ||||||||

| 2018-05-18 | 3 | Alpert Robert H By 210/RELY Partners, LP | RELYQ | Common Stock | I | 363 149 | ||||||||

| 2018-05-18 | 3 | Alpert Robert H | RELYQ | Common Stock | D | 183 187 | ||||||||

| 2018-05-18 | 3 | Alpert Robert H By 210/RELY Partners, LP | RELYQ | Common Stock | I | 363 149 | ||||||||

| 2018-05-18 | 3 | Alpert Robert H By 210/RELY Partners, LP | RELYQ | Common Stock | I | 363 149 | ||||||||

| 2018-05-18 | 3 | Alpert Robert H | RELYQ | Common Stock | D | 183 187 | ||||||||

| 2018-05-18 | 3 | Alpert Robert H By 210/RELY Partners, LP | RELYQ | Common Stock | I | 363 149 | ||||||||

| 2018-05-18 | 3 | Alpert Robert H | RELYQ | Common Stock | D | 183 187 | ||||||||

| 2018-05-18 | 3 | Alpert Robert H By 210/RELY Partners, LP | RELYQ | Common Stock | I | 363 149 | ||||||||

| 2018-05-18 | 3 | Alpert Robert H | RELYQ | Common Stock | D | 183 187 | ||||||||

| 2018-05-18 | 3 | Alpert Robert H By 210/RELY Partners, LP | RELYQ | Common Stock | I | 363 149 | ||||||||

| 2018-05-18 | 3 | Alpert Robert H | RELYQ | Common Stock | D | 183 187 | ||||||||

| 2018-05-18 | 3 | Alpert Robert H By 210/RELY Partners, LP | RELYQ | Common Stock | I | 363 149 | ||||||||

| 2018-05-18 | 3 | Alpert Robert H | RELYQ | Common Stock | D | 183 187 | ||||||||

| 2018-05-18 | 3 | Alpert Robert H | RELYQ | Common Stock | D | 183 187 | ||||||||

| 2018-05-18 | 3 | Tabor Douglas | RELYQ | Common Stock | D | 13 396 | ||||||||

| 2018-05-18 | 3 | Tabor Douglas Texas Time Express, Inc. | RELYQ | Common Stock | I | 8 066 | ||||||||

| 2018-05-18 | 3 | Tabor Douglas Texas Time Express, Inc. | RELYQ | Common Stock | I | 8 066 | ||||||||

| 2018-05-18 | 3 | Tabor Douglas | RELYQ | Common Stock | D | 13 396 | ||||||||

| 2018-05-18 | 3 | Tabor Douglas Texas Time Express, Inc. | RELYQ | Common Stock | I | 8 066 | ||||||||

| 2018-05-18 | 3 | Tabor Douglas | RELYQ | Common Stock | D | 13 396 | ||||||||

| 2018-05-18 | 3 | Goldman Sachs Middle Market Lending Corp. See footnotes | RELYQ | Common Stock | I | 362 072 | ||||||||

| 2018-05-18 | 3 | Goldman Sachs Middle Market Lending Corp. See footnotes | RELYQ | Common Stock | I | 362 072 | ||||||||

| 2018-05-18 | 3 | Goldman Sachs Middle Market Lending Corp. See footnotes | RELYQ | Common Stock | I | 362 072 | ||||||||

| 2018-05-18 | 3 | Goldman Sachs Middle Market Lending Corp. See footnotes | RELYQ | Common Stock | I | 362 072 | ||||||||

| 2018-05-18 | 3 | Goldman Sachs Middle Market Lending Corp. See footnotes | RELYQ | Common Stock | I | 362 072 | ||||||||

| 2018-05-18 | 3 | Goldman Sachs Middle Market Lending Corp. See footnotes | RELYQ | Common Stock | I | 362 072 | ||||||||

| 2018-05-10 | 2018-05-09 | 4 | Hobey Michael | RELY | Restricted Stock Units | D | −4 859 | 0 | ||||||

| 2018-05-10 | 2018-05-09 | 4 | Hobey Michael | RELY | Restricted Stock Units | D | −32 827 | 4 859 | ||||||

| 2018-05-10 | 2018-05-09 | 4 | Hogan Terrance J | RELY | Restricted Stock Units | D | −17 354 | 0 | ||||||

| 2018-05-10 | 2018-05-09 | 4 | Hogan Terrance J | RELY | Restricted Stock Units | D | −32 827 | 17 354 | ||||||

| 2018-05-10 | 2018-05-09 | 4 | Howard Kelly G | RELY | Restricted Stock Units | D | −16 414 | 0 | ||||||

| 2018-05-10 | 2018-05-09 | 4 | Ross Kyle By the Ross Family Trust | RELY | Warrants | I | 5,64 | −233 750 | 0 | |||||

| 2018-05-10 | 2018-05-09 | 4 | Ross Kyle | RELY | Common Stock Options | D | 5,72 | −162 000 | 0 | |||||

| 2018-05-10 | 2018-05-09 | 4 | Ross Kyle | RELY | Restricted Stock Units | D | −19 089 | 0 | ||||||

| 2018-05-10 | 2018-05-09 | 4 | Ross Kyle | RELY | Restricted Stock Units | D | −32 827 | 19 089 | ||||||

| 2018-03-30 | 2018-03-29 | 4 | Hobey Michael | RELY | Common Stock | D | 0,3100 | −1 303 | −0 | 50 134 | ||||

| 2018-03-30 | 2018-03-29 | 4 | Hogan Terrance J | RELY | Common Stock | D | 0,3100 | −3 485 | −1 | 61 207 | ||||

| 2018-03-20 | 2018-03-16 | 4 | Hobey Michael | RELY | Common Stock | D | 0,3100 | −4 804 | −1 | 51 437 | ||||

| 2018-03-20 | 2018-03-16 | 4 | Hogan Terrance J | RELY | Common Stock | D | 0,3100 | −6 053 | −2 | 64 692 | ||||

| 2018-03-20 | 2018-03-16 | 4 | Howard Kelly G | RELY | Common Stock | D | 0,3100 | −1 735 | −1 | 43 760 | ||||

| 2018-03-20 | 2018-03-16 | 4 | Ross Kyle | RELY | Common Stock | D | 0,3100 | −6 787 | −2 | 232 253 | ||||

| 2018-03-01 | 2018-02-27 | 4 | Ross Kyle | RELY | Common Stock | D | 0,2399 | −2 551 | −1 | 239 040 | ||||

| 2018-02-12 | 2017-10-05 | 5 | Maheshwari Raj | RELY | Common Stock | D | −13 935 | 80 427 | ||||||

| 2017-11-27 | 2017-11-22 | 4 | Deconinck Patrick | RELY | Common Stock | D | −13 935 | 39 711 | ||||||

| 2017-11-17 | 2017-11-15 | 4 | Miller John A | RELY | Restricted Stock Unit | D | −32 827 | 0 | ||||||

| 2017-11-17 | 2017-11-15 | 4 | Miller John A | RELY | Restricted Stock Unit | D | −17 354 | 32 827 | ||||||

| 2017-11-17 | 2017-11-15 | 4 | Miller John A | RELY | Common Stock | D | −29 412 | 20 291 | ||||||

| 2017-11-17 | 2017-11-15 | 4 | Miller John A | RELY | Common Stock | D | −14 837 | 53 118 | ||||||

| 2017-11-17 | 2017-11-15 | 4 | Miller John A | RELY | Common Stock | D | −8 143 | 67 955 | ||||||

| 2017-10-04 | 2017-10-02 | 4 | BYNOE PETER C B | RELY | Common Stock | D | 8 109 | 92 801 | ||||||

| 2017-10-04 | 2017-10-02 | 4 | HALL WILLIAM K | RELY | Common Stock | D | 2 703 | 51 477 | ||||||

| 2017-10-04 | 2017-10-02 | 4 | Hobey Michael | RELY | Common Stock | D | 1,8220 | −1 500 | −3 | 56 241 | ||||

| 2017-10-04 | 2017-10-02 | 4 | LAMB PATRICK E | RELY | Common Stock | D | 3 244 | 108 955 | ||||||

| 2017-10-04 | 2017-10-02 | 4 | Maheshwari Raj | RELY | Common Stock | D | 5 946 | 94 362 | ||||||

| 2017-07-03 | 2017-07-03 | 4 | BYNOE PETER C B | RELY | Common Stock | D | 5 358 | 84 692 | ||||||

| 2017-07-03 | 2017-07-03 | 4 | HALL WILLIAM K | RELY | Common Stock | D | 1 786 | 48 774 | ||||||

| 2017-07-03 | 2017-07-03 | 4 | LAMB PATRICK E | RELY | Common Stock | D | 2 143 | 105 711 | ||||||

| 2017-07-03 | 2017-07-03 | 4 | Maheshwari Raj | RELY | Common Stock | D | 3 929 | 88 416 | ||||||

| 2017-06-16 | 2017-06-14 | 4 | Howard Kelly G | RELY | Common Stock | D | 2,8000 | −5 909 | −17 | 45 495 | ||||

| 2017-05-18 | 2017-05-18 | 4 | TINKLER PHILIP | RELY | Common Stock | D | −13 935 | 92 084 | ||||||

| 2017-05-18 | 2017-05-18 | 4 | McIntosh Joseph | RELY | Common Stock | D | 2,9000 | 18 309 | 53 | 18 309 | ||||

| 2017-04-03 | 2017-04-03 | 4 | Hogan Terrance J | RELY | Common Stock | D | 2,8000 | −2 806 | −8 | 70 745 | ||||

| 2017-04-03 | 2017-04-03 | 4 | LAMB PATRICK E | RELY | Common Stock | D | 2 728 | 103 568 | ||||||

| 2017-04-03 | 2017-04-03 | 4 | Maheshwari Raj | RELY | Common Stock | D | 5 000 | 84 487 | ||||||

| 2017-04-03 | 2017-04-03 | 4 | TINKLER PHILIP | RELY | Common Stock | D | 6 819 | 106 019 | ||||||

| 2017-04-03 | 2017-04-03 | 4 | BYNOE PETER C B | RELY | Common Stock | D | 6 819 | 79 334 | ||||||

| 2017-04-03 | 2017-04-03 | 4 | HALL WILLIAM K | RELY | Common Stock | D | 2 273 | 46 988 | ||||||

| 2017-04-03 | 2017-04-03 | 4 | Hobey Michael | RELY | Common Stock | D | 2,8000 | −1 282 | −4 | 57 741 | ||||

| 2017-03-21 | 2017-03-20 | 4 | Hobey Michael | RELY | Common Stock | D | 3,6000 | −1 137 | −4 | 59 023 | ||||

| 2017-03-21 | 2017-03-20 | 4 | Hogan Terrance J | RELY | Common Stock | D | 3,6000 | −2 547 | −9 | 73 551 | ||||

| 2017-03-01 | 2017-02-28 | 4 | Miller John A | RELY | Restricted Stock Unit | D | 32 827 | 50 181 | ||||||

| 2017-03-01 | 2017-02-28 | 4 | Miller John A | RELY | Common Stock | D | 29 412 | 76 098 | ||||||

| 2017-03-01 | 2017-02-28 | 4 | Ross Kyle | RELY | Restricted Stock Unit | D | 32 827 | 51 916 | ||||||

| 2017-03-01 | 2017-02-28 | 4 | Ross Kyle | RELY | Common Stock | D | 29 412 | 241 591 | ||||||

| 2017-03-01 | 2017-02-28 | 4 | Ross Kyle | RELY | Common Stock | D | 5,3000 | −2 428 | −13 | 212 179 | ||||

| 2017-03-01 | 2017-02-27 | 4 | Ross Kyle | RELY | Common Stock | D | 4,8000 | −1 141 | −5 | 214 607 | ||||

| 2017-03-01 | 2017-02-28 | 4 | Hobey Michael | RELY | Restricted Stock Units | D | 32 827 | 37 686 | ||||||

| 2017-03-01 | 2017-02-28 | 4 | Hobey Michael | RELY | Common Stock | D | 29 412 | 60 160 | ||||||

| 2017-03-01 | 2017-02-28 | 4 | Hogan Terrance J | RELY | Restricted Stock Unit | D | 32 827 | 50 181 | ||||||

| 2017-03-01 | 2017-02-28 | 4 | Hogan Terrance J | RELY | Common Stock | D | 29 412 | 76 098 | ||||||

| 2017-03-01 | 2017-02-28 | 4 | Howard Kelly G | RELY | Restricted Stock Unit | D | 16 414 | 16 414 | ||||||

| 2017-03-01 | 2017-02-28 | 4 | Howard Kelly G | RELY | Common Stock | D | 14 706 | 51 404 | ||||||

| 2017-02-07 | 2017-02-07 | 4 | Ross Kyle | RELY | Common Stock | D | 5,4500 | −3 181 | −17 | 215 748 | ||||

| 2017-01-05 | 2017-01-03 | 4 | HALL WILLIAM K | RELY | Common Stock | D | 1 069 | 44 715 | ||||||

| 2017-01-05 | 2017-01-03 | 4 | HALL WILLIAM K | RELY | Common Stock | D | 13 935 | 43 646 | ||||||

| 2017-01-05 | 2017-01-03 | 4 | Deconinck Patrick | RELY | Common Stock | D | 13 935 | 53 646 | ||||||

| 2017-01-05 | 2017-01-03 | 4 | BYNOE PETER C B | RELY | Common Stock | D | 3 206 | 72 515 | ||||||

| 2017-01-05 | 2017-01-03 | 4 | BYNOE PETER C B | RELY | Common Stock | D | 13 935 | 69 309 | ||||||

| 2017-01-05 | 2017-01-03 | 4 | LAMB PATRICK E | RELY | Common Stock | D | 1 283 | 100 840 | ||||||

| 2017-01-05 | 2017-01-03 | 4 | LAMB PATRICK E | RELY | Common Stock | D | 13 935 | 99 557 | ||||||

| 2017-01-05 | 2017-01-03 | 4 | Maheshwari Raj | RELY | Common Stock | D | 2 351 | 79 487 | ||||||

| 2017-01-05 | 2017-01-03 | 4 | Maheshwari Raj | RELY | Common Stock | D | 13 935 | 77 136 | ||||||

| 2017-01-05 | 2017-01-03 | 4 | TINKLER PHILIP | RELY | Common Stock | D | 3 206 | 99 200 | ||||||

| 2017-01-05 | 2017-01-03 | 4 | TINKLER PHILIP | RELY | Common Stock | D | 13 935 | 95 994 | ||||||

| 2016-12-15 | 2016-12-14 | 4 | Howard Kelly G | RELY | Common Stock | D | 18 349 | 36 698 | ||||||

| 2016-12-15 | 2016-12-14 | 4 | Howard Kelly G | RELY | Common Stock | D | 18 349 | 36 698 | ||||||

| 2016-10-03 | 2016-09-30 | 4 | Hobey Michael | RELY | Common Stock | D | 12 255 | 30 748 | ||||||

| 2016-09-21 | 3 | Hobey Michael | RELY | Common Stock | D | 36 986 | ||||||||

| 2016-09-21 | 3 | Hobey Michael | RELY | Common Stock | D | 36 986 | ||||||||

| 2016-09-15 | 2016-09-13 | 4 | Ross Kyle | RELY | Real Industry, Inc. Common Stock | D | 116 668 | 218 929 | ||||||

| 2016-09-09 | 2016-09-08 | 4 | Real Industry, Inc. | RELY | Real Industry, Inc. Common Stock | D | 6,4540 | 5 000 | 32 | 82 059 | ||||

| 2016-09-09 | 2016-09-08 | 4 | TINKLER PHILIP | RELY | Real Industry, Inc. Common Stock | D | 6,4540 | 5 000 | 32 | 82 059 | ||||

| 2016-09-02 | 2016-09-01 | 4 | Bouchard Craig T By Bouchard 10S LLC | RELY | Common Stock | I | 6,7000 | −70 000 | −469 | 24 823 | ||||

| 2016-08-31 | 2016-08-29 | 4 | Bouchard Craig T By Bouchard 10S LLC | RELY | Common Stock | I | 7,1310 | −98 396 | −702 | 94 823 | ||||

| 2016-08-25 | 2016-08-23 | 4 | Bouchard Craig T | RELY | Restricted Stock Unit | D | −27 765 | 27 766 | ||||||

| 2016-08-25 | 2016-08-23 | 4 | Bouchard Craig T | RELY | Common Stock | D | −56 697 | 89 974 | ||||||

| 2016-08-25 | 2016-08-25 | 4 | HALL WILLIAM K | RELY | Common Stock | D | 7,0249 | 10 000 | 70 | 29 711 | ||||

| 2016-08-12 | 2016-08-11 | 4 | Deconinck Patrick | RELY | Common Stock | D | 7,6123 | 10 000 | 76 | 39 711 | ||||

| 2016-05-23 | 2016-05-20 | 4 | Bouchard Craig T By Bouchard 10S LLC | RELY | Common Stock | I | 6,8573 | 15 000 | 103 | 193 219 | ||||

| 2016-05-17 | 2016-05-17 | 4 | Maheshwari Raj By Charlestown Jupiter Fund, LLC | RELY | Common Stock | I | −94 000 | 17 996 | ||||||

| 2016-02-29 | 2016-02-29 | 4 | Ross Kyle | RELY | Common Stock | D | 6,7701 | −2 379 | −16 | 102 261 | ||||

| 2016-02-29 | 2016-02-25 | 4 | Ross Kyle | RELY | Restricted Stock Unit | D | 19 089 | 19 089 | ||||||

| 2016-02-29 | 2016-02-25 | 4 | Ross Kyle | RELY | Common Stock | D | 20 401 | 104 640 | ||||||

| 2016-02-29 | 2016-02-25 | 4 | Ross Kyle | RELY | Common Stock | D | 6,4601 | −1 123 | −7 | 84 239 | ||||

| 2016-02-29 | 2016-02-25 | 4 | Bouchard Craig T | RELY | Restricted Stock Unit | D | 55 531 | 55 531 | ||||||

| 2016-02-29 | 2016-02-25 | 4 | Bouchard Craig T | RELY | Common Stock | D | 59 348 | 146 671 | ||||||

| 2016-02-29 | 2016-02-25 | 4 | Hogan Terrance J | RELY | Restricted Stock Unit | D | 17 354 | 17 354 | ||||||

| 2016-02-29 | 2016-02-25 | 4 | Hogan Terrance J | RELY | Comon Stock | D | 22 256 | 46 686 | ||||||

| 2016-02-29 | 2016-02-25 | 4 | Miller John A | RELY | Restricted Stock Unit | D | 17 354 | 17 354 | ||||||

| 2016-02-29 | 2016-02-25 | 4 | Miller John A | RELY | Common Stock | D | 22 256 | 46 686 | ||||||

| 2016-02-09 | 2016-02-08 | 4 | Ross Kyle | RELY | Common Stock | D | 6,0557 | −3 220 | −19 | 85 362 | ||||

| 2016-01-06 | 2016-01-04 | 4 | Deconinck Patrick | RELY | Common Stock | D | 10 586 | 29 711 | ||||||

| 2016-01-06 | 2016-01-04 | 4 | Maheshwari Raj | RELY | Common Stock | D | 10 586 | 45 205 | ||||||

| 2016-01-06 | 2016-01-04 | 4 | BYNOE PETER C B | RELY | Common Stock | D | 10 586 | 55 374 | ||||||

| 2016-01-06 | 2016-01-04 | 4 | HALL WILLIAM K | RELY | Common Stock | D | 10 586 | 19 711 | ||||||

| 2016-01-06 | 2016-01-04 | 4 | LAMB PATRICK E | RELY | Common Stock | D | 10 586 | 85 622 | ||||||

| 2016-01-06 | 2016-01-04 | 4 | TINKLER PHILIP | RELY | Common Stock | D | 10 586 | 77 059 | ||||||

| 2015-11-18 | 2015-11-18 | 4 | Maheshwari Raj By Charlestown Capital Advisors LLC | RELY | Common Stock | I | −67 313 | 111 996 | ||||||

| 2015-08-19 | 2015-08-19 | 4 | Maheshwari Raj Family custodial accounts and trusts | RELY | Common Stock | I | −34 059 | 0 | ||||||

| 2015-06-08 | 3 | HALL WILLIAM K | RELY | Common Stock | D | 10 000 | ||||||||

| 2015-06-08 | 3 | HALL WILLIAM K | RELY | Common Stock | D | 10 000 | ||||||||

| 2015-06-08 | 3 | Deconinck Patrick | RELY | Common Stock | D | 30 000 | ||||||||

| 2015-06-08 | 3 | Deconinck Patrick | RELY | Common Stock | D | 30 000 | ||||||||

| 2015-06-08 | 2015-06-05 | 4 | Deconinck Patrick | RELY | Common Stock | D | 4 125 | 4 125 | ||||||

| 2015-06-08 | 2015-06-05 | 4 | HALL WILLIAM K | RELY | Common Stock | D | 4 125 | 4 125 | ||||||

| 2015-06-03 | 2015-06-01 | 4 | Bouchard Craig T | RELY | Performance Shares | D | 0,00 | 10 000 | 260 000 | |||||

| 2015-06-03 | 2015-06-01 | 4 | Bouchard Craig T | RELY | Peformance Shares | D | 0,00 | 100 000 | 250 000 | |||||

| 2015-06-03 | 2015-06-01 | 4 | Bouchard Craig T | RELY | Performance Shares | D | 0,00 | 150 000 | 150 000 | |||||

| 2015-04-02 | 2015-03-31 | 4 | Hogan Terrance J | SGRH | Common Stock | D | 24 430 | 24 430 | ||||||

| 2015-04-02 | 2015-03-31 | 4 | Miller John A | SGRH | Common Stock | D | 24 430 | 24 430 | ||||||

| 2015-03-03 | 2015-02-27 | 4 | BYNOE PETER C B | SGRH | Subscription Rights (right to buy) | D | 5,64 | −21 958 | 0 | |||||

| 2015-03-03 | 2015-02-27 | 4 | BYNOE PETER C B | SGRH | Common Stock | D | 5,6400 | 12 340 | 70 | 44 788 | ||||

| 2015-03-03 | 2015-02-27 | 4 | Manderson William Christopher | SGRH | Common Stock | D | 5 350 | 28 832 | ||||||

| 2015-03-03 | 2015-02-27 | 4 | Ross Kyle | SGRH | Subscription Rights (right to buy) | D | 5,64 | −8 300 | 0 | |||||

| 2015-03-03 | 2015-02-27 | 4 | Ross Kyle | SGRH | Common Stock | D | 5,6400 | 4 665 | 26 | 88 582 | ||||

| 2015-03-03 | 2015-02-27 | 4 | Ross Kyle | SGRH | Common Stock | D | 18 724 | 83 917 | ||||||

| 2015-03-03 | 2015-02-27 | 4 | Bouchard Craig T By Bouchard 10S LLC | SGRH | Subscription Rights (right to buy) | I | 5,64 | −82 083 | 0 | |||||

| 2015-03-03 | 2015-02-27 | 4 | Bouchard Craig T By Bouchard 10S LLC | SGRH | Common Stock | I | 5,6400 | 46 132 | 260 | 178 219 | ||||

| 2015-03-03 | 2015-02-27 | 4 | Bouchard Craig T | SGRH | Common Stock | D | 48 146 | 87 323 | ||||||

| 2015-03-03 | 2015-02-27 | 4 | LAMB PATRICK E | SGRH | Subscription Rights (right to buy) | D | 5,64 | −7 000 | 0 | |||||

| 2015-03-03 | 2015-02-27 | 4 | LAMB PATRICK E | SGRH | Common Stock | D | 5,6400 | 3 934 | 22 | 75 036 | ||||

| 2015-03-03 | 2015-02-27 | 4 | Maheshwari Raj Family custodial accounts and trusts | SGRH | Subscription Rights (right to buy) | I | 5,64 | −17 156 | 0 | |||||

| 2015-03-03 | 2015-02-27 | 4 | Maheshwari Raj By Charlestown Capital Advisors LLC | SGRH | Subscription Rights (right to buy) | I | 5,64 | −114 730 | 0 | |||||

| 2015-03-03 | 2015-02-27 | 4 | Maheshwari Raj | SGRH | Subscription Rights (right to buy) | D | 5,64 | −22 162 | 0 | |||||

| 2015-03-03 | 2015-02-27 | 4 | Maheshwari Raj Family custodial accounts and trusts | SGRH | Common Stock | I | 5,6400 | 9 643 | 54 | 34 059 | ||||

| 2015-03-03 | 2015-02-27 | 4 | Maheshwari Raj By Charlestown Capital Advisors LLC | SGRH | Common Stock | I | 5,6400 | 64 479 | 364 | 179 309 | ||||

| 2015-03-03 | 2015-02-27 | 4 | Maheshwari Raj | SGRH | Common Stock | D | 5,6400 | 12 457 | 70 | 34 619 | ||||

| 2015-03-03 | 2015-02-27 | 4 | TINKLER PHILIP | SGRH | Subscription Rights (right to buy) | D | 5,64 | −35 840 | 0 | |||||

| 2015-03-03 | 2015-02-27 | 4 | TINKLER PHILIP | SGRH | Common Stock | D | 5,6400 | 20 143 | 114 | 66 473 | ||||

| 2015-02-11 | 2015-02-06 | 4/A | Bouchard Craig T | SGGH | Common Stock | D | 26 677 | 39 177 | ||||||

| 2015-02-09 | 2015-02-06 | 4 | Ross Kyle | SGGH | Common Stock | D | 20 961 | 65 193 | ||||||

| 2015-02-09 | 2015-02-06 | 4 | Bouchard Craig T | SGGH | Common Stock | D | −26 677 | 39 177 | ||||||

| 2015-02-09 | 2015-02-06 | 4 | Manderson William Christopher | SGGH | Common Stock | D | 3 811 | 23 482 | ||||||

| 2015-01-05 | 2015-01-02 | 4 | Maheshwari Raj | SGGH | Common Stock | D | 10 490 | 22 163 | ||||||

| 2015-01-05 | 2015-01-02 | 4 | BYNOE PETER C B | SGGH | Common Stock | D | 10 490 | 32 448 | ||||||

| 2015-01-05 | 2015-01-02 | 4 | LAMB PATRICK E | SGGH | Common Stock | D | 10 490 | 71 102 | ||||||

| 2015-01-05 | 2015-01-02 | 4 | TINKLER PHILIP | SGGH | Common Stock | D | 10 490 | 46 330 | ||||||

| 2014-06-12 | 2014-06-11 | 4 | Ross Kyle By Signature Group Holdings, LLC | SGGH | Warrants | I | 6,90 | −10 000 | 65 000 | |||||

| 2014-06-12 | 2014-06-11 | 4 | Ross Kyle By the Ross Family Trust | SGGH | Warrants | I | 6,90 | 233 750 | 233 750 | |||||

| 2014-06-12 | 2014-06-11 | 4 | Ross Kyle By Signature Group Holdings, LLC | SGGH | Warrants | I | 6,90 | −233 750 | 75 000 | |||||

| 2014-02-26 | 2014-02-24 | 4 | Manderson William Christopher | SGGH | Common Stock | D | 7 500 | 19 671 | ||||||

| 2014-02-26 | 2014-02-24 | 4 | Ross Kyle | SGGH | Common Stock | D | 7 500 | 44 323 | ||||||

| 2014-02-26 | 2014-02-24 | 4 | Bouchard Craig T | SGGH | Common Stock | D | −12 500 | 12 500 | ||||||

| 2014-01-06 | 2014-01-02 | 4 | Maheshwari Raj | SGGH | Common Stock | D | 6 977 | 11 673 | ||||||

| 2014-01-06 | 2014-01-02 | 4 | BYNOE PETER C B | SGGH | Common Stock | D | 6 977 | 21 958 | ||||||

| 2014-01-06 | 2014-01-02 | 4 | LAMB PATRICK E | SGGH | Common Stock | D | 6 977 | 60 612 | ||||||

| 2014-01-06 | 2014-01-02 | 4 | TINKLER PHILIP | SGGH | Common Stock | D | 6 977 | 35 840 | ||||||

| 2014-01-03 | 2013-12-31 | 4 | Manderson William Christopher | SGGH | Common Stock | D | 10,7500 | −7 329 | −79 | 12 171 | ||||

| 2014-01-03 | 2013-12-31 | 4 | Ross Kyle | SGGH | Common Stock | D | 10,7500 | −15 659 | −168 | 36 732 | ||||

| 2013-08-09 | 2013-08-08 | 4 | BYNOE PETER C B | SGGH | Common Stock | D | 24 805 | 149 805 | ||||||

| 2013-08-09 | 2013-08-08 | 4 | Maheshwari Raj | SGGH | Common Stock | D | 24 805 | 46 955 | ||||||

| 2013-08-05 | 2013-08-02 | 4 | BYNOE PETER C B | SGGH | Common Stock | D | 1,1869 | 125 000 | 148 | 125 000 | ||||

| 2013-08-05 | 2013-08-05 | 4 | Bouchard Craig T By Bouchard 10S LLC | SGGH | Common Stock | I | 1,2895 | 30 000 | 39 | 1 070 866 | ||||

| 2013-08-05 | 2013-08-02 | 4 | Bouchard Craig T By Bouchard 10S LLC | SGGH | Common Stock | I | 1,1914 | 70 000 | 83 | 1 040 866 | ||||

| 2013-07-25 | 3 | Maheshwari Raj Family custodial accounts and trusts. | SGGH | Common Stock | I | 244 051 | ||||||||

| 2013-07-25 | 3 | Maheshwari Raj | SGGH | Common Stock | D | 22 150 | ||||||||

| 2013-07-25 | 3 | Maheshwari Raj By Charlestown Capital Advisors LLC. | SGGH | Common Stock | I | 1 148 300 | ||||||||

| 2013-06-11 | 2013-06-11 | 4 | Bouchard Craig T By Bouchard 10S LLC | SGGH | Common Stock | I | 0,7950 | 50 000 | 40 | 970 866 | ||||

| 2013-06-11 | 2013-06-10 | 4 | Bouchard Craig T By Bouchard 10S LLC | SGGH | Common Stock | I | 0,7984 | 480 366 | 384 | 920 866 | ||||

| 2013-06-07 | 3 | Bouchard Craig T By Bouchard 10S LLC | SGGH | Common Stock | I | 400 000 | ||||||||

| 2013-06-07 | 2013-06-07 | 4 | Bouchard Craig T By Bouchard 10S LLC | SGGH | Common Stock | I | 0,6983 | 40 500 | 28 | 440 500 | ||||

| 2013-06-07 | 2013-06-05 | 4 | Bouchard Craig T | SGGH | Non-qualified stock option (right-to-buy) | D | 1,00 | 1 500 000 | 1 500 000 | |||||

| 2013-06-07 | 2013-06-05 | 4 | Bouchard Craig T | SGGH | Non-qualified stock option (right-to-buy) | D | 0,85 | 500 000 | 500 000 | |||||

| 2013-06-07 | 2013-06-05 | 4 | Bouchard Craig T | SGGH | Common Stock | D | 250 000 | 250 000 | ||||||

| 2013-05-07 | 2013-05-03 | 4 | COLVILLE G CHRISTOPHER | SGGH | Common Stock | D | 250 000 | 788 622 | ||||||

| 2013-01-04 | 2013-01-02 | 4 | TINKLER PHILIP | SGGH | Common Stock | D | 182 927 | 288 622 | ||||||

| 2013-01-04 | 2013-01-02 | 4 | Koral John | SGGH | Common Stock | D | 182 927 | 1 461 125 | ||||||

| 2013-01-04 | 2013-01-02 | 4 | LAMB PATRICK E | SGGH | Common Stock | D | 182 927 | 536 345 | ||||||

| 2013-01-04 | 2013-01-02 | 4 | COLVILLE G CHRISTOPHER | SGGH | Common Stock | D | 182 927 | 538 622 | ||||||

| 2013-01-03 | 2013-01-01 | 4 | Olson Stephen J. | SGGH | Common Stock | D | 0,4100 | −52 089 | −21 | 293 744 | ||||

| 2012-12-19 | 2012-12-17 | 4 | Ross Kyle | SGGH | Common Stock | D | 0,4400 | 57 234 | 25 | 523 901 | ||||

| 2012-12-19 | 2012-12-17 | 4 | Donatelli Thomas | SGGH | Common Stock | D | 0,4400 | 28 617 | 13 | 407 405 | ||||

| 2012-12-19 | 2012-12-17 | 4 | Crusinberry Jeffrey | SGGH | Common Stock | D | 0,4400 | 20 979 | 9 | 20 979 | ||||

| 2012-12-19 | 2012-12-17 | 4 | Noell Craig Forrest | SGGH | Common Stock | D | 0,4400 | 67 641 | 30 | 859 865 | ||||

| 2012-12-19 | 2012-12-17 | 4 | Olson Stephen J. | SGGH | Common Stock | D | 0,4400 | 12 500 | 6 | 345 833 | ||||

| 2012-11-16 | 3 | Manderson William Christopher | SGGH | SGGH Common Stock | D | 195 000 | ||||||||

| 2012-09-05 | 2012-08-31 | 4 | Noell Craig Forrest | SGGH | SGGH Common Stock | D | 0,3100 | 300 000 | 93 | 1 550 000 | ||||

| 2012-09-05 | 2012-08-31 | 4 | Noell Craig Forrest Owned by Minor Children | SGGH | SGGH Common Stock | I | 0,3100 | 300 000 | 93 | 1 550 000 | ||||

| 2012-09-04 | 2012-08-31 | 4 | Donatelli Thomas Owned by Spouse | SGGH | SGGH Common Stock | I | 0,3100 | 1 000 000 | 310 | 2 593 750 | ||||

| 2012-08-22 | 2012-08-21 | 4 | Ross Kyle | SGGH | SGH Common Stock | D | 0,2950 | 8 713 | 3 | 466 667 | ||||

| 2012-08-22 | 2012-08-21 | 4 | Ross Kyle | SGGH | SGH Common Stock | D | 0,2900 | 937 | 0 | 457 954 | ||||

| 2012-08-22 | 2012-08-20 | 4 | Ross Kyle | SGGH | SGH Common Stock | D | 0,2900 | 40 350 | 12 | 457 017 | ||||

| 2012-08-16 | 3 | COLVILLE G CHRISTOPHER | SGGH | SGH Common Stock | D | 250 000 | ||||||||

| 2012-08-16 | 3 | COLVILLE G CHRISTOPHER | SGGH | SGH Common Stock | D | 105 695 | ||||||||

| 2012-08-15 | 3 | TINKLER PHILIP | SGGH | SGGH Common Stock | D | 105 695 | ||||||||

| 2012-05-22 | 3 | Crusinberry Jeffrey | SGGH | SGGH Common Stock | D | 11 002 | ||||||||

| 2012-05-21 | 2012-05-18 | 4/A | Schwab Robert | SGGH | SGGH Common | D | 0,3600 | 83 000 | 30 | 3 304 762 | ||||

| 2012-05-18 | 2012-05-18 | 4 | Schwab Robert | SGGH | SGGH Common Stock | D | 0,3600 | 83 000 | 30 | 3 284 762 | ||||

| 2012-05-18 | 2012-05-16 | 4 | Schwab Robert | SGGH | SGGH Common Stock | D | 0,3600 | 180 000 | 65 | 3 201 762 | ||||

| 2012-05-18 | 2012-05-16 | 4 | Schwab Robert | SGGH | SGGH Common Stock | D | 0,3590 | 20 000 | 7 | 3 041 762 | ||||

| 2012-05-18 | 2012-05-16 | 4 | Schwab Robert | SGGH | SGGH Common Stock | D | 0,3580 | 3 564 | 1 | 3 021 762 | ||||

| 2012-05-18 | 2012-05-16 | 4 | Schwab Robert | SGGH | SGGH Common Stock | D | 0,3550 | 70 000 | 25 | 3 018 198 | ||||

| 2012-05-18 | 2012-05-16 | 4 | Schwab Robert | SGGH | SGGH Common Stock | D | 0,3500 | 215 000 | 75 | 2 948 198 | ||||

| 2012-05-14 | 2012-05-11 | 4 | Schwab Robert | SGGH | SGGH Common Stock | D | 0,3500 | 107 500 | 38 | 2 733 198 | ||||

| 2012-05-14 | 2012-05-11 | 4 | Schwab Robert | SGGH | SGGH Common Stock | D | 0,3450 | 2 500 | 1 | 2 625 698 | ||||

| 2012-05-14 | 2012-05-11 | 4 | Schwab Robert | SGGH | SGGH Common Stock | D | 0,3400 | 55 000 | 19 | 2 623 198 | ||||

| 2012-05-14 | 2012-05-11 | 4 | Schwab Robert | SGGH | SGGH Common Stock | D | 0,3360 | 15 000 | 5 | 2 568 198 | ||||

| 2012-05-14 | 2012-05-11 | 4 | Schwab Robert | SGGH | SGGH Common Stock | D | 0,3350 | 5 000 | 2 | 2 553 198 | ||||

| 2012-05-14 | 2012-05-11 | 4 | Schwab Robert | SGGH | SGGH Common Stock | D | 0,3200 | 10 000 | 3 | 2 548 198 | ||||

| 2012-05-14 | 2012-05-11 | 4 | Schwab Robert | SGGH | SGGH Common Stock | D | 0,3151 | 5 000 | 2 | 2 538 198 | ||||

| 2012-05-14 | 2012-05-14 | 4 | Brody David N | SGGH | SGGH Common Stock | D | 0,3800 | 13 000 | 5 | 14 215 | ||||

| 2012-05-11 | 2012-05-09 | 4 | Schwab Robert | SGGH | SGGH Common Stock | D | 0,3000 | 667 500 | 200 | 2 533 198 | ||||

| 2012-05-11 | 2012-05-09 | 4 | Schwab Robert | SGGH | SGGH Common Stock | D | 0,2950 | 190 000 | 56 | 1 865 698 | ||||

| 2012-05-10 | 3 | Brody David N | SGGH | Common Stock | D | 1 215 | ||||||||

| 2012-05-10 | 3 | Olson Stephen J. | SGGH | SGGH Common Stock | D | 333 333 | ||||||||

| 2012-04-13 | 2012-04-11 | 4 | GROSSMAN KENNETH S Wife, 2 Children, Brother and Sister-In-Law | SGGH | Common Stock | I | 296 375 | 356 250 | ||||||

| 2012-04-13 | 2012-04-11 | 4 | GROSSMAN KENNETH S | SGGH | Common Stock | D | 59 375 | 59 375 | ||||||

| 2012-04-13 | 2012-04-11 | 4 | GROSSMAN KENNETH S Atlantic Beach Partners - Partnership | SGGH | Common Stock | I | −475 000 | 0 | ||||||

| 2012-01-05 | 2012-01-03 | 4/A | Gidumal Steven L | SGGH.PK | Common Stock | D | 0,2700 | 277 778 | 75 | 1 860 366 | ||||

| 2012-01-05 | 2012-01-03 | 4 | Gidumal Steven L | SGGH.PK | Common Stock | D | 0,2700 | 227 778 | 62 | 1 810 366 | ||||

| 2012-01-05 | 2012-01-03 | 4 | Koral John | SGGH.PK | Common Stock | D | 0,2700 | 277 778 | 75 | 1 278 198 | ||||

| 2012-01-05 | 2012-01-03 | 4 | LAMB PATRICK E | SGGH.PK | Common Stock | D | 0,2700 | 277 778 | 75 | 353 618 | ||||

| 2012-01-05 | 2012-01-03 | 4 | MIDANEK DEBORAH H | SGGH.PK | Common Stock | D | 0,2700 | 277 778 | 75 | 353 618 | ||||

| 2012-01-05 | 2012-01-03 | 4 | Schwab Robert | SGGH.PK | Common Stock | D | 0,2700 | 277 778 | 75 | 1 675 698 | ||||

| 2012-01-05 | 2012-01-03 | 4 | NICKOLL JOHN F | SGGH.PK | Common Stock | D | 0,2700 | 277 778 | 75 | 425 698 | ||||

| 2011-04-25 | 3 | LAMB PATRICK E | SGGH.PK | Common Stock | D | 0 | ||||||||

| 2010-06-21 | 3 | PEISER ROBERT A | SGGH.PK | Common Stock | D | 1 000 | ||||||||

| 2010-06-21 | 3 | BLITZER MICHAEL Kingstown Capital Partners, LLC | SGGH.PK | Common Stock | I | 700 000 |