Introduksjon

Denne siden gir en grundig analyse av den kjente historikken for insidernes handelsaktiviteter for Ellen F Siminoff. Insidere er ledere, direktører eller betydelige investorer i et selskap. Det er ulovlig for insidere å gjøre handler i deres selskaper basert på spesifikke, ikke-offentlig informasjon. Dette betyr ikke at det er ulovlig for dem å gjøre noen handler i deres egne selskaper. Imidlertid må de rapportere alle handler til SEC via et skjema 4. Til tross for disse begrensningene, antyder akademisk forskning at insidere - generelt sett - har en tendens til å overgå markedet i sine egne selskaper.

Gjennomsnittlig handelslønnsomhet

Den gjennomsnittlige handelslønnsomheten er den gjennomsnittlige avkastningen av alle åpne markedskjøp gjort av insideren de siste tre årene. For å beregne dette, undersøker vi hvert eneste åpne marked, uplanlagte kjøp som er gjort av insideren, men dette inkluderer ikke alle handler som ble markert som en del av en 10b5-1 handelsplan. Vi beregner deretter gjennomsnittlig ytelse av disse handlene over 3, 6 og 12 måneder, gjennomsnittlig hver av disse varighetene for å generere en endelig ytelsesmåling for hver handel. Til slutt,

Dersom lønnsomheten for denne interne handelen er "N/A", har enten den interne personen ikke gjort noen åpen-markeds kjøp de siste tre årene, eller så er handlene for nylig til å beregne en pålitelig prestasjonsmåler.

Oppdateringsfrekvens: Daglig

Selskaper med rapporterte insiderposisjoner

SEC-arkiveringene indikerer at Ellen F Siminoff har rapporterte beholdninger av handler i følgende selskaper:

| Verdipapir | Navn | Siste rapporterte høydepunkter |

|---|---|---|

| US:TTWO / Take-Two Interactive Software, Inc. | Director | 3 147 |

| US:BIGC / Commerce.com, Inc. | Director | 253 333 |

| US:ZNGA / Zynga Inc - Class A | Director | 0 |

| US:US83417UAH95 / SolarWinds Holdings, Inc. 2018 Term Loan B | Director | 0 |

| US:PRTS / CarParts.com, Inc. | Director | 71 956 |

| US:JRN / Journal Communications, Inc. | Director | 84 698 |

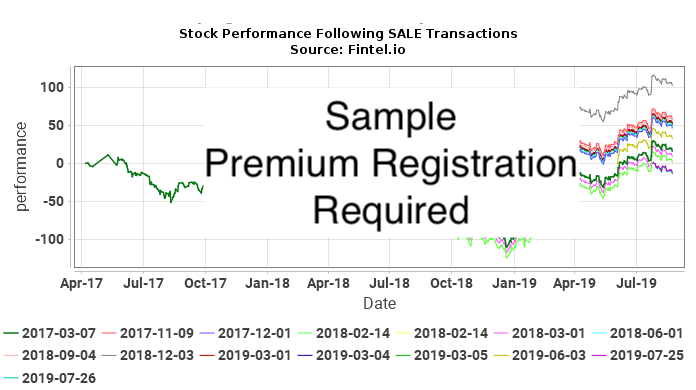

Hvordan tolke diagrammene

De følgende diagrammene viser aksjens ytelse etter hver åpen markedstransaksjon som ikke var planlagt, utført av Ellen F Siminoff. Ikke-planlagte handler er handler som ikke ble gjort som en del av en 10b5-1 handelsplan. Aksjeytelsen er kartlagt som kumulativ prosentendring i aksjekursen. For eksempel, hvis en innsidehandel ble gjort 1. januar 2019, vil diagrammet vise daglig prosentendring for verdipapiret til dagens dato. Dersom aksjeprisen går fra $10 til $15 i løpet av denne tiden, vil den kumulative prosentendringen i aksjeprisen være 50%. En endring i prisen fra $10 til $20 vil være 100%, og en endring i prisen fra $10 til $5 vil være - 50%.

Til syvende og sist er målet vårt å avgjøre hvor tett insidernes handler korrelerer med overavkastninger (positiv eller negativ) i aksjekursen for å se om insidere timer sine handler for å tjene på intern informasjon. Se for deg en situasjon der en insider gjør dette. I denne situasjonen, forventer vi enten (a) positive avkastninger etter kjøp, eller (b) negative avkastninger etter salg. I tilfelle (a) KJØP-diagrammet ville vise en serie av oppadgående kurver, som indikerer positive avkastninger etter hver kjøpstransaksjon. I tilfelle (b) ville SALG-diagrammet vise en serie av nedadgående kurver, som indikerer negative avkastninger etter hver salgstransaksjon.

Imidlertid er dette alene ikke nok til å dra konklusjoner. Hvis, for eksempel, aksjeprisen for selskapet steg jevnt over mange år uten å følge en syklisk trend, ville vi forventet at alle postkjøpsdiagrammer skal ha en stigende trend. På samme måte vil ikke-sykliske nedganger over mange år resultere i nedadgående trend i post-trade diagrammer. Ingen av disse diagrammene ville antyde aktiviteter som insidertrening.

Den sterkeste indikatoren ville vært en situasjon der aksjekursen var ekstremt syklisk, og det var både positive signaler i KJØPSdiagrammet og negative plot i SALGSdiagrammet. Denne situasjonen ville vært sterkt antydende om en insider som timet handler til sin økonomiske fordel.

Internkjøp CMRC / Commerce.com, Inc. - Analyse av kortsiktig fortjeneste

I denne seksjonen analyserer vi lønnsomheten av hvert uplanlagt, åpen-marked internsalg som er gjort i CMRC / Commerce.com, Inc.. Denne analysen hjelper til å forstå om den interne personen regelmessig genererer unormale avkastninger, og er verdt å følge. Denne analysen gjelder ett år etter hver handel, og resultatene er teoretiske.

Følgende tabell viser de mest nylige åpne markedskjøpene som ikke var en del av en handelsplan.

Justert pris er prisen justert for splitt. Justerte aksjer er aksjene justert for splitt.

Internhandel CMRC / Commerce.com, Inc. - Analyse av kortsiktig tap

I denne seksjonen analyserer vi unngåelsen av kortsiktig tap for hvert uplanlagt, åpen-marked internsalg som er gjort i CMRC / Commerce.com, Inc.. Et jevnt mønster av tap unngåelse kan antyde at fremtidige salgstransaksjoner kan forutsi nedgang i pris. Denne analysen gjelder ett år etter hver handel, og resultatene er teoretiske.

Følgende tabell viser de mest nylige åpne markedskjøpene som ikke var en del av en handelsplan.

| Handelsdato | Ticker | Innsider | Rapporterte aksjer |

Rapportert pris |

Justerte aksjer |

Justert pris |

Kostpris | Dager til min |

Pris ved min |

Maks tap unngått ($) |

Maks tap unngått (%) |

|---|---|---|---|---|---|---|---|

| Det er ingen kjente uplanlagte handler på det åpne markedet for denne insideren og verdipapirkombinasjonen. |

Justert pris er prisen justert for splitt. Justerte aksjer er aksjene justert for splitt.

Internkjøp PRTS / CarParts.com, Inc. - Analyse av kortsiktig fortjeneste

I denne seksjonen analyserer vi lønnsomheten av hvert uplanlagt, åpen-marked internsalg som er gjort i CMRC / Commerce.com, Inc.. Denne analysen hjelper til å forstå om den interne personen regelmessig genererer unormale avkastninger, og er verdt å følge. Denne analysen gjelder ett år etter hver handel, og resultatene er teoretiske.

Følgende tabell viser de mest nylige åpne markedskjøpene som ikke var en del av en handelsplan.

| Handelsdato | Ticker | Innsider | Rapporterte aksjer |

Rapportert pris |

Justerte aksjer |

Justert pris |

Kostpris | Dager til maks |

Pris ved maks |

Maks fortjeneste ($) |

Maks fortjeneste (%) |

|---|---|---|---|---|---|---|---|

| Det er ingen kjente uplanlagte handler på det åpne markedet for denne insideren og verdipapirkombinasjonen. |

Justert pris er prisen justert for splitt. Justerte aksjer er aksjene justert for splitt.

Internhandel PRTS / CarParts.com, Inc. - Analyse av kortsiktig tap

I denne seksjonen analyserer vi unngåelsen av kortsiktig tap for hvert uplanlagt, åpen-marked internsalg som er gjort i CMRC / Commerce.com, Inc.. Et jevnt mønster av tap unngåelse kan antyde at fremtidige salgstransaksjoner kan forutsi nedgang i pris. Denne analysen gjelder ett år etter hver handel, og resultatene er teoretiske.

Følgende tabell viser de mest nylige åpne markedskjøpene som ikke var en del av en handelsplan.

| Handelsdato | Ticker | Innsider | Rapporterte aksjer |

Rapportert pris |

Justerte aksjer |

Justert pris |

Kostpris | Dager til min |

Pris ved min |

Maks tap unngått ($) |

Maks tap unngått (%) |

|---|---|---|---|---|---|---|---|

| Det er ingen kjente uplanlagte handler på det åpne markedet for denne insideren og verdipapirkombinasjonen. |

Justert pris er prisen justert for splitt. Justerte aksjer er aksjene justert for splitt.

Innsidernes handelshistorikk

Tabellen viser den komplette listen over innsidehandler gjort av Ellen F Siminoff som avslørt til Securies Exchange Comission (SEC).

| Fildato | Transaksjonsdato | Skjema | Ticker | Verdipapir | Kode | Aksjer | Gjenværende aksjer | Prosent endring |

Aksje pris |

Transaksjons verdi |

Gjenværende verdi |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-18 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

S - Sale | X | −143 | 3 147 | −4,35 | 233,65 | −33 412 | 735 297 |

| 2025-08-18 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

S - Sale | X | −268 | 4 158 | −6,06 | 233,65 | −62 618 | 971 517 |

| 2025-08-18 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

A - Award | 356 | 7 191 | 5,21 | ||||

| 2025-07-16 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

S - Sale | X | −144 | 3 290 | −4,19 | 237,80 | −34 243 | 782 362 |

| 2025-07-16 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

S - Sale | X | −270 | 4 426 | −5,75 | 237,80 | −64 206 | 1 052 503 |

| 2025-06-17 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

S - Sale | X | −143 | 3 434 | −4,00 | 230,95 | −33 026 | 793 082 |

| 2025-06-17 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

S - Sale | X | −268 | 4 696 | −5,40 | 230,95 | −61 895 | 1 084 541 |

| 2025-06-05 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

S - Sale | X | −143 | 3 577 | −3,84 | 229,52 | −32 821 | 820 993 |

| 2025-06-05 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

S - Sale | X | −270 | 4 964 | −5,16 | 229,52 | −61 970 | 1 139 337 |

| 2025-05-30 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

A - Award | 367 | 6 835 | 5,67 | ||||

| 2025-03-10 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

P - Purchase | 177 158 | 253 333 | 232,57 | 6,64 | 1 176 382 | 1 682 207 | |

| 2025-02-26 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

P - Purchase | 19 603 | 76 175 | 34,65 | 6,49 | 127 276 | 494 581 | |

| 2025-02-26 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

P - Purchase | 3 239 | 56 572 | 6,07 | 6,28 | 20 349 | 355 414 | |

| 2025-02-19 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

A - Award | 435 | 8 126 | 5,66 | ||||

| 2024-11-25 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

A - Award | 2 207 | 77 986 | 2,91 | ||||

| 2024-11-18 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

A - Award | 509 | 7 691 | 7,09 | ||||

| 2024-08-20 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

A - Award | 556 | 7 182 | 8,39 | ||||

| 2024-08-16 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

A - Award | 1 678 | 75 779 | 2,26 | ||||

| 2024-06-03 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

A - Award | 562 | 6 626 | 9,27 | ||||

| 2024-05-20 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

A - Award | 28 777 | 74 101 | 63,49 | ||||

| 2024-05-20 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

A - Award | 2 003 | 45 324 | 4,62 | ||||

| 2024-03-12 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

A - Award | 1 524 | 43 321 | 3,65 | ||||

| 2024-02-21 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

A - Award | 492 | 6 064 | 8,83 | ||||

| 2023-11-17 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

A - Award | 566 | 5 572 | 11,31 | ||||

| 2023-11-13 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

A - Award | 1 333 | 41 797 | 3,29 | ||||

| 2023-08-17 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

A - Award | 526 | 5 006 | 11,74 | ||||

| 2023-08-14 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

A - Award | 1 243 | 40 464 | 3,17 | ||||

| 2023-06-07 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

A - Award | 599 | 4 480 | 15,43 | ||||

| 2023-05-22 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

A - Award | 1 602 | 39 221 | 4,26 | ||||

| 2023-05-22 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

A - Award | 23 007 | 37 619 | 157,45 | ||||

| 2023-03-07 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

A - Award | 1 105 | 14 612 | 8,18 | ||||

| 2023-02-16 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

A - Award | 756 | 3 881 | 24,19 | ||||

| 2022-11-16 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

A - Award | 629 | 3 125 | 25,20 | ||||

| 2022-11-10 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

A - Award | 755 | 13 507 | 5,92 | ||||

| 2022-08-18 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

A - Award | 627 | 2 496 | 33,55 | ||||

| 2022-08-11 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

A - Award | 620 | 12 752 | 5,11 | ||||

| 2022-05-25 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

A - Award | 211 | 1 869 | 12,73 | ||||

| 2022-05-25 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

A - Award | 3 720 | 3 720 | |||||

| 2022-05-25 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

A - Award | 3 576 | 3 576 | |||||

| 2022-05-25 |

|

4 | TTWO |

TAKE TWO INTERACTIVE SOFTWARE INC

Common Stock |

A - Award | 1 658 | 1 658 | |||||

| 2022-05-24 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

D - Sale to Issuer | −91 639 | 0 | −100,00 | ||||

| 2022-05-24 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

D - Sale to Issuer | −88 087 | 0 | −100,00 | ||||

| 2022-05-24 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

D - Sale to Issuer | −40 846 | 0 | −100,00 | ||||

| 2022-05-19 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

A - Award | 10 023 | 12 132 | 475,25 | ||||

| 2022-05-19 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | 5 548 | 0 | −100,00 | ||||

| 2022-05-19 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 5 548 | 40 846 | 15,72 | ||||

| 2022-03-15 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

A - Award | 381 | 2 109 | 22,05 | ||||

| 2022-02-22 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | 5 547 | 5 548 | 554 700,00 | ||||

| 2022-02-22 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 5 547 | 35 298 | 18,64 | ||||

| 2021-12-17 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 88 087 | −5,37 | 6,18 | −30 900 | 544 378 |

| 2021-11-17 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | 5 547 | 11 095 | 99,98 | ||||

| 2021-11-17 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 5 547 | 29 751 | 22,92 | ||||

| 2021-11-17 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 93 087 | −5,10 | 7,58 | −37 900 | 705 599 |

| 2021-11-15 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

A - Award | 211 | 1 728 | 13,91 | ||||

| 2021-11-15 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

A - Award | 211 | 1 728 | 13,91 | ||||

| 2021-11-09 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

S - Sale | X | −2 500 | 53 333 | −4,48 | 52,75 | −131 875 | 2 813 316 |

| 2021-10-19 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 98 087 | −4,85 | 7,46 | −37 300 | 731 729 |

| 2021-09-28 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

S - Sale | X | −2 500 | 55 833 | −4,29 | 53,34 | −133 350 | 2 978 132 |

| 2021-09-17 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 103 087 | −4,63 | 8,03 | −40 150 | 827 789 |

| 2021-08-30 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

S - Sale | X | −406 | 58 333 | −0,69 | 58,26 | −23 654 | 3 398 521 |

| 2021-08-30 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

S - Sale | X | −2 094 | 58 739 | −3,44 | 57,50 | −120 414 | 3 377 739 |

| 2021-08-18 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | 5 547 | 16 642 | 50,00 | ||||

| 2021-08-18 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 5 547 | 24 204 | 29,73 | ||||

| 2021-08-18 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 108 087 | −4,42 | 8,18 | −40 900 | 884 152 |

| 2021-07-28 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

S - Sale | X | −506 | 60 833 | −0,82 | 69,01 | −34 920 | 4 198 152 |

| 2021-07-28 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

S - Sale | X | −1 994 | 61 339 | −3,15 | 67,73 | −135 049 | 4 154 343 |

| 2021-07-15 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 113 087 | −4,23 | 10,39 | −51 950 | 1 174 974 |

| 2021-06-30 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

S - Sale | X | −300 | 63 333 | −0,47 | 65,08 | −19 525 | 4 121 921 |

| 2021-06-30 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

S - Sale | X | −2 200 | 63 633 | −3,34 | 64,43 | −141 739 | 4 099 658 |

| 2021-06-30 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

G - Gift | 65 833 | 65 833 | |||||

| 2021-06-30 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

G - Gift | −65 833 | 1 306 | −98,05 | ||||

| 2021-06-17 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 118 087 | −4,06 | 10,44 | −52 200 | 1 232 828 |

| 2021-05-27 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

S - Sale | X | −1 750 | 67 139 | −2,54 | 56,02 | −98 043 | 3 761 422 |

| 2021-05-27 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

S - Sale | X | −750 | 68 889 | −1,08 | 54,99 | −41 244 | 3 788 344 |

| 2021-05-19 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

A - Award | 22 189 | 22 189 | |||||

| 2021-05-19 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −6 219 | 0 | −100,00 | ||||

| 2021-05-19 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 123 087 | −3,90 | 10,09 | −50 450 | 1 241 948 |

| 2021-05-19 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 6 219 | 18 657 | 50,00 | ||||

| 2021-05-18 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

A - Award | 818 | 69 639 | 1,19 | ||||

| 2021-05-18 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

A - Award | 194 | 68 821 | 0,28 | ||||

| 2021-04-28 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

S - Sale | X | −2 100 | 68 627 | −2,97 | 55,78 | −117 136 | 3 827 959 |

| 2021-04-28 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

S - Sale | X | −400 | 70 727 | −0,56 | 54,80 | −21 920 | 3 875 840 |

| 2021-04-16 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 128 087 | −3,76 | 10,69 | −53 450 | 1 369 250 |

| 2021-03-30 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

S - Sale | X | −2 500 | 71 127 | −3,40 | 53,81 | −134 532 | 3 827 529 |

| 2021-03-19 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

A - Award | 151 | 73 627 | 0,21 | ||||

| 2021-03-17 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 133 087 | −3,62 | 10,13 | −50 650 | 1 348 171 |

| 2021-02-22 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −6 219 | 6 219 | −50,00 | ||||

| 2021-02-22 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 6 219 | 12 438 | 100,00 | ||||

| 2021-02-16 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 138 087 | −3,49 | 11,55 | −57 750 | 1 594 905 |

| 2021-01-20 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 143 087 | −3,38 | 9,83 | −49 148 | 1 406 502 |

| 2020-12-18 |

|

4 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

A - Award | 143 | 73 476 | 0,20 | ||||

| 2020-12-17 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 148 087 | −3,27 | 9,00 | −45 000 | 1 332 783 |

| 2020-11-23 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −6 219 | 12 438 | −33,33 | ||||

| 2020-11-23 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 6 219 | 6 219 | |||||

| 2020-11-17 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 153 087 | −3,16 | 7,94 | −39 700 | 1 215 511 |

| 2020-11-12 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 158 087 | −3,07 | 8,20 | −41 000 | 1 296 313 |

| 2020-09-17 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 109 610 | −4,36 | 8,50 | −42 500 | 931 685 |

| 2020-08-20 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −6 218 | 18 657 | −25,00 | ||||

| 2020-08-20 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 6 218 | 145 116 | 4,48 | ||||

| 2020-08-18 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 114 610 | −4,18 | 9,34 | −46 700 | 1 070 457 |

| 2020-08-04 | 3 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

146 666 | ||||||||

| 2020-08-04 | 3 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

146 666 | ||||||||

| 2020-08-04 | 3 | BIGC |

BigCommerce Holdings, Inc.

Series 1 Common Stock |

146 666 | ||||||||

| 2020-07-17 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 119 610 | −4,01 | 9,46 | −47 300 | 1 131 511 |

| 2020-06-17 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 144 610 | −3,34 | 9,13 | −45 650 | 1 320 289 |

| 2020-05-21 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

A - Award | 24 875 | 24 875 | |||||

| 2020-05-18 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 149 610 | −3,23 | 7,90 | −39 500 | 1 181 919 |

| 2020-05-08 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −8 210 | 0 | −100,00 | ||||

| 2020-05-08 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 8 210 | 138 898 | 6,28 | ||||

| 2020-04-17 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 154 610 | −3,13 | 7,38 | −36 900 | 1 141 022 |

| 2020-03-17 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 159 610 | −3,04 | 6,20 | −31 000 | 989 582 |

| 2020-02-19 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 179 610 | −2,71 | 6,94 | −34 700 | 1 246 493 |

| 2020-02-11 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −8 210 | 8 210 | −50,00 | ||||

| 2020-02-11 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 8 210 | 130 688 | 6,70 | ||||

| 2020-01-17 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 184 610 | −2,64 | 6,85 | −34 250 | 1 264 578 |

| 2019-12-17 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 189 610 | −2,57 | 6,27 | −31 350 | 1 188 855 |

| 2019-11-19 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 186 400 | −2,61 | 6,29 | −31 450 | 1 172 456 |

| 2019-11-08 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −8 210 | 16 420 | −33,33 | ||||

| 2019-11-08 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 8 210 | 130 688 | 6,70 | ||||

| 2019-10-17 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 191 400 | −2,55 | 6,16 | −30 800 | 1 179 024 |

| 2019-09-20 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −5 000 | 89 786 | −5,28 | 6,11 | −30 550 | 548 592 |

| 2019-08-09 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −8 210 | 24 630 | −25,00 | ||||

| 2019-08-09 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 8 210 | 229 092 | 3,72 | ||||

| 2019-05-09 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

A - Award | 32 840 | 32 840 | |||||

| 2019-04-30 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −14 535 | 0 | −100,00 | ||||

| 2019-04-30 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 14 535 | 220 882 | 7,04 | ||||

| 2019-01-29 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −14 535 | 14 535 | −50,00 | ||||

| 2019-01-29 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 14 535 | 206 347 | 7,58 | ||||

| 2018-11-27 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 191 812 | −5,89 | 3,52 | −42 240 | 675 178 |

| 2018-10-29 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −14 535 | 29 070 | −33,33 | ||||

| 2018-10-29 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 14 535 | 203 812 | 7,68 | ||||

| 2018-10-25 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 189 277 | −5,96 | 3,93 | −47 160 | 743 859 |

| 2018-09-26 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 201 277 | −5,63 | 3,90 | −46 800 | 784 980 |

| 2018-08-27 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 213 277 | −5,33 | 3,92 | −47 075 | 836 664 |

| 2018-07-26 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −14 534 | 43 605 | −25,00 | ||||

| 2018-07-26 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 14 534 | 225 277 | 6,90 | ||||

| 2018-07-26 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 210 743 | −5,39 | 4,20 | −50 400 | 885 121 |

| 2018-06-26 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 222 743 | −5,11 | 4,10 | −49 242 | 914 026 |

| 2018-05-29 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 234 743 | −4,86 | 4,11 | −49 320 | 964 794 |

| 2018-04-27 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

A - Award | 58 139 | 58 139 | |||||

| 2018-04-27 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −17 422 | 0 | −100,00 | ||||

| 2018-04-27 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 17 422 | 246 743 | 7,60 | ||||

| 2018-04-24 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 229 321 | −4,97 | 3,52 | −42 240 | 807 210 |

| 2018-03-28 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 241 321 | −4,74 | 3,80 | −45 636 | 917 744 |

| 2018-03-15 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −17 421 | 17 422 | −50,00 | ||||

| 2018-03-15 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 17 421 | 253 321 | 7,38 | ||||

| 2018-02-28 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 235 900 | −4,84 | 3,62 | −43 472 | 854 595 |

| 2018-01-26 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 247 900 | −4,62 | 3,74 | −44 850 | 926 526 |

| 2017-12-29 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 259 900 | −4,41 | 3,97 | −47 640 | 1 031 803 |

| 2017-11-03 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −17 422 | 34 843 | −33,33 | ||||

| 2017-11-03 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 127 900 | −8,58 | 3,86 | −46 320 | 493 694 |

| 2017-11-03 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 17 422 | 139 900 | 14,22 | ||||

| 2017-10-02 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 122 478 | −8,92 | 3,79 | −45 480 | 464 192 |

| 2017-09-05 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 134 478 | −8,19 | 3,77 | −45 240 | 506 982 |

| 2017-08-03 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −17 421 | 52 265 | −25,00 | ||||

| 2017-08-03 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 146 478 | −7,57 | 3,62 | −43 440 | 530 250 |

| 2017-08-03 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 17 421 | 158 478 | 12,35 | ||||

| 2017-07-06 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 141 057 | −7,84 | 3,64 | −43 680 | 513 447 |

| 2017-06-02 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 153 057 | −7,27 | 3,56 | −42 720 | 544 883 |

| 2017-05-03 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | 69 686 | 69 686 | |||||

| 2017-05-03 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −19 084 | 0 | −100,00 | ||||

| 2017-05-03 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 165 057 | −6,78 | 2,91 | −34 920 | 480 316 |

| 2017-05-03 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 19 084 | 177 057 | 12,08 | ||||

| 2017-04-04 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 157 973 | −7,06 | 2,84 | −34 080 | 448 643 |

| 2017-03-10 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −19 084 | 19 084 | −50,00 | ||||

| 2017-03-10 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 19 084 | 169 973 | 12,65 | ||||

| 2017-03-03 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 150 889 | −7,37 | 2,69 | −32 280 | 405 891 |

| 2017-02-03 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 162 889 | −6,86 | 2,54 | −30 480 | 413 738 |

| 2017-01-04 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 174 889 | −6,42 | 2,59 | −31 080 | 452 963 |

| 2016-12-09 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −19 084 | 38 168 | −33,33 | ||||

| 2016-12-09 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 19 084 | 186 889 | 11,37 | ||||

| 2016-12-09 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −12 000 | 167 805 | −6,67 | 2,91 | −34 920 | 488 313 |

| 2016-09-09 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −19 083 | 57 252 | −25,00 | ||||

| 2016-09-09 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 19 083 | 35 805 | 114,12 | ||||

| 2016-06-13 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

A - Award | 76 335 | 76 335 | |||||

| 2016-06-13 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −16 722 | 0 | −100,00 | ||||

| 2016-06-13 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 16 722 | 16 722 | |||||

| 2016-06-13 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

G - Gift | 50 167 | 390 786 | 14,73 | ||||

| 2016-06-13 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

G - Gift | −50 167 | 0 | −100,00 | ||||

| 2016-03-15 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | 16 722 | 16 722 | |||||

| 2016-03-15 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 16 722 | 50 167 | 50,00 | ||||

| 2016-02-09 |

|

4 | SWI |

SolarWinds, Inc.

Stock Option (right to buy) |

D - Sale to Issuer | −8 816 | 0 | −100,00 | 11,55 | −101 825 | ||

| 2016-02-09 |

|

4 | SWI |

SolarWinds, Inc.

Stock Option (right to buy) |

D - Sale to Issuer | −10 706 | 0 | −100,00 | 22,72 | −243 240 | ||

| 2016-02-09 |

|

4 | SWI |

SolarWinds, Inc.

Stock Option (right to buy) |

D - Sale to Issuer | −6 109 | 0 | −100,00 | 15,46 | −94 445 | ||

| 2016-02-09 |

|

4 | SWI |

SolarWinds, Inc.

Stock Option (right to buy) |

D - Sale to Issuer | −5 579 | 0 | −100,00 | 15,05 | −83 964 | ||

| 2016-02-09 |

|

4 | SWI |

SolarWinds, Inc.

Stock Option (right to buy) |

D - Sale to Issuer | −11 221 | 0 | −100,00 | 36,50 | −409 566 | ||

| 2016-02-09 |

|

4 | SWI |

SolarWinds, Inc.

Stock Option (right to buy) |

D - Sale to Issuer | −4 969 | 0 | −100,00 | 41,69 | −207 158 | ||

| 2016-02-09 |

|

4 | SWI |

SolarWinds, Inc.

Stock Option (right to buy) |

D - Sale to Issuer | −2 681 | 0 | −100,00 | 40,11 | −107 535 | ||

| 2016-02-09 |

|

4 | SWI |

SolarWinds, Inc.

Stock Option (right to buy) |

D - Sale to Issuer | −3 176 | 0 | −100,00 | 50,70 | −161 023 | ||

| 2016-02-09 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

D - Sale to Issuer | −5 000 | 0 | −100,00 | 60,10 | −300 500 | ||

| 2016-02-09 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

D - Sale to Issuer | −3 604 | 0 | −100,00 | 60,10 | −216 600 | ||

| 2016-02-09 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

D - Sale to Issuer | −13 723 | 3 604 | −79,20 | 60,10 | −824 752 | 216 600 | |

| 2015-12-15 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | 16 722 | 33 444 | 100,00 | ||||

| 2015-12-15 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 16 722 | 33 445 | 99,99 | ||||

| 2015-10-30 |

|

4 | SWI |

SolarWinds, Inc.

Employee Stock Option (right to buy) |

M - Exercise | −1 804 | 3 176 | −36,22 | ||||

| 2015-10-30 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

S - Sale | X | −1 804 | 17 327 | −9,43 | 57,82 | −104 307 | 1 001 847 |

| 2015-10-30 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

M - Exercise | 1 804 | 19 131 | 10,41 | 9,40 | 16 958 | 179 831 | |

| 2015-09-17 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −10 000 | 340 619 | −2,85 | 2,48 | −24 846 | 846 302 |

| 2015-09-15 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

A - Award | 16 723 | 50 166 | 50,00 | ||||

| 2015-09-15 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 16 723 | 16 723 | |||||

| 2015-09-09 |

|

4 | SWI |

SolarWinds, Inc.

Employee Stock Option (right to buy) |

M - Exercise | −1 804 | 4 980 | −26,59 | ||||

| 2015-09-09 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

S - Sale | X | −1 804 | 17 327 | −9,43 | 40,00 | −72 160 | 693 080 |

| 2015-09-09 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

M - Exercise | 1 804 | 19 131 | 10,41 | 9,40 | 16 958 | 179 831 | |

| 2015-08-21 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −10 000 | 350 619 | −2,77 | 2,66 | −26 607 | 932 892 |

| 2015-08-06 |

|

4 | SWI |

SolarWinds, Inc.

Employee Stock Option (right to buy) |

M - Exercise | −1 804 | 6 784 | −21,01 | ||||

| 2015-08-06 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

S - Sale | X | −1 804 | 17 327 | −9,43 | 40,53 | −73 116 | 702 263 |

| 2015-08-06 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

M - Exercise | 1 804 | 19 131 | 10,41 | 9,40 | 16 958 | 179 831 | |

| 2015-08-03 |

|

4 | SWI |

SolarWinds, Inc.

Employee Stock Option (right to buy) |

M - Exercise | −1 804 | 8 588 | −17,36 | ||||

| 2015-08-03 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

S - Sale | X | −1 804 | 17 327 | −9,43 | 40,00 | −72 160 | 693 080 |

| 2015-08-03 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

M - Exercise | 1 804 | 19 131 | 10,41 | 9,40 | 16 958 | 179 831 | |

| 2015-07-17 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −10 000 | 360 619 | −2,70 | 2,77 | −27 667 | 997 725 |

| 2015-07-17 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

G - Gift | 78 616 | 370 619 | 26,92 | ||||

| 2015-07-17 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

G - Gift | −78 616 | 0 | −100,00 | ||||

| 2015-06-17 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −10 000 | 292 003 | −3,31 | 3,00 | −29 988 | 875 659 |

| 2015-06-15 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

A - Award | 66 889 | 66 889 | |||||

| 2015-06-11 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −19 654 | 0 | −100,00 | ||||

| 2015-06-11 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 19 654 | 78 616 | 33,33 | ||||

| 2015-06-09 |

|

4 | SWI |

SolarWinds, Inc.

Employee Stock Option (right to buy) |

M - Exercise | −1 804 | 10 392 | −14,79 | ||||

| 2015-06-09 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

S - Sale | X | −1 804 | 17 327 | −9,43 | 48,06 | −86 700 | 832 736 |

| 2015-06-09 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

M - Exercise | 1 804 | 19 131 | 10,41 | 9,40 | 16 958 | 179 831 | |

| 2015-05-19 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −10 000 | 302 003 | −3,21 | 3,04 | −30 415 | 918 542 |

| 2015-05-18 |

|

4 | SWI |

SolarWinds, Inc.

Stock Option (right to buy) |

A - Award | 8 816 | 8 816 | |||||

| 2015-05-18 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

A - Award | 3 604 | 17 327 | 26,26 | ||||

| 2015-05-06 |

|

4 | SWI |

SolarWinds, Inc.

Employee Stock Option (right to buy) |

M - Exercise | −1 804 | 12 196 | −12,89 | ||||

| 2015-05-06 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

S - Sale | X | −1 804 | 13 723 | −11,62 | 48,18 | −86 917 | 661 174 |

| 2015-05-06 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

M - Exercise | 1 804 | 15 527 | 13,15 | 9,40 | 16 958 | 145 954 | |

| 2015-04-17 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −10 000 | 312 003 | −3,11 | 2,44 | −24 372 | 760 414 |

| 2015-04-07 |

|

4 | SWI |

SolarWinds, Inc.

Employee Stock Option (right to buy) |

M - Exercise | −2 000 | 4 969 | −28,70 | ||||

| 2015-04-07 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

S - Sale | X | −2 000 | 13 723 | −12,72 | 51,62 | −103 248 | 708 439 |

| 2015-04-07 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

M - Exercise | 2 000 | 15 723 | 14,57 | 18,41 | 36 820 | 289 460 | |

| 2015-03-17 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −10 000 | 322 003 | −3,01 | 2,55 | −25 549 | 822 685 |

| 2015-03-13 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −19 654 | 19 654 | −50,00 | ||||

| 2015-03-13 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 19 654 | 58 962 | 50,00 | ||||

| 2015-03-06 |

|

4 | SWI |

SolarWinds, Inc.

Employee Stock Option (right to buy) |

M - Exercise | −2 000 | 6 969 | −22,30 | ||||

| 2015-03-06 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

S - Sale | X | −2 000 | 13 723 | −12,72 | 48,95 | −97 893 | 671 693 |

| 2015-03-06 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

M - Exercise | 2 000 | 15 723 | 14,57 | 18,41 | 36 820 | 289 460 | |

| 2015-02-18 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −10 000 | 332 003 | −2,92 | 2,24 | −22 438 | 744 948 |

| 2015-02-05 |

|

4 | SWI |

SolarWinds, Inc.

Employee Stock Option (right to buy) |

M - Exercise | −2 000 | 2 681 | −42,73 | ||||

| 2015-02-05 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

S - Sale | X | −2 000 | 13 723 | −12,72 | 49,75 | −99 505 | 682 752 |

| 2015-02-05 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

M - Exercise | 2 000 | 15 723 | 14,57 | 19,99 | 39 980 | 314 303 | |

| 2015-01-20 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −10 000 | 342 003 | −2,84 | 2,57 | −25 713 | 879 392 |

| 2015-01-05 |

|

4 | SWI |

SolarWinds, Inc.

Employee Stock Option (right to buy) |

M - Exercise | −2 000 | 4 681 | −29,94 | ||||

| 2015-01-05 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

S - Sale | X | −2 000 | 13 723 | −12,72 | 49,97 | −99 940 | 685 738 |

| 2015-01-05 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

M - Exercise | 2 000 | 15 723 | 14,57 | 19,99 | 39 980 | 314 303 | |

| 2014-12-15 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −10 000 | 352 003 | −2,76 | 2,51 | −25 118 | 884 161 |

| 2014-12-15 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −19 654 | 39 308 | −33,33 | ||||

| 2014-12-15 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

M - Exercise | 19 654 | 39 308 | 100,00 | ||||

| 2014-12-08 |

|

4 | SWI |

SolarWinds, Inc.

Employee Stock Option (right to buy) |

M - Exercise | −2 000 | 14 000 | −12,50 | ||||

| 2014-12-08 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

S - Sale | X | −2 000 | 13 723 | −12,72 | 53,08 | −106 158 | 728 406 |

| 2014-12-08 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

M - Exercise | 2 000 | 15 723 | 14,57 | 9,40 | 18 800 | 147 796 | |

| 2014-11-19 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | X | −10 000 | 362 003 | −2,69 | 2,75 | −27 500 | 995 508 |

| 2014-11-13 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

S - Sale | −10 000 | 372 003 | −2,62 | 2,63 | −26 334 | 979 633 | |

| 2014-11-07 |

|

4 | SWI |

SolarWinds, Inc.

Employee Stock Option (right to buy) |

M - Exercise | −2 000 | 16 000 | −11,11 | ||||

| 2014-11-07 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

S - Sale | X | −2 000 | 13 723 | −12,72 | 47,65 | −95 304 | 653 931 |

| 2014-11-07 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

M - Exercise | 2 000 | 15 723 | 14,57 | 9,40 | 18 800 | 147 796 | |

| 2014-10-07 |

|

4 | SWI |

SolarWinds, Inc.

Employee Stock Option (right to buy) |

M - Exercise | −2 000 | 18 000 | −10,00 | ||||

| 2014-10-07 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

S - Sale | X | −2 000 | 13 723 | −12,72 | 42,46 | −84 926 | 582 717 |

| 2014-10-07 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

M - Exercise | 2 000 | 15 723 | 14,57 | 9,40 | 18 800 | 147 796 | |

| 2014-09-15 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −19 654 | 58 962 | −25,00 | ||||

| 2014-09-15 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

C - Conversion | 19 654 | 101 621 | 23,98 | ||||

| 2014-09-09 |

|

4 | SWI |

SolarWinds, Inc.

Employee Stock Option (right to buy) |

M - Exercise | −2 000 | 20 000 | −9,09 | ||||

| 2014-09-09 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

S - Sale | X | −2 000 | 13 723 | −12,72 | 43,56 | −87 121 | 597 783 |

| 2014-09-09 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

M - Exercise | 2 000 | 15 723 | 14,57 | 9,40 | 18 800 | 147 796 | |

| 2014-08-07 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

G - Gift | 81 967 | 382 003 | 27,32 | ||||

| 2014-08-07 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

G - Gift | −81 967 | 0 | −100,00 | ||||

| 2014-08-06 |

|

4 | SWI |

SolarWinds, Inc.

Employee Stock Option (right to buy) |

M - Exercise | −6 000 | 22 000 | −21,43 | ||||

| 2014-08-06 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

S - Sale | X | −6 000 | 13 723 | −30,42 | 40,45 | −242 674 | 555 035 |

| 2014-08-06 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

M - Exercise | 6 000 | 19 723 | 43,72 | 9,40 | 56 400 | 185 396 | |

| 2014-06-13 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

A - Award | 78 616 | 78 616 | |||||

| 2014-06-13 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −81 967 | 0 | −100,00 | ||||

| 2014-06-13 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

C - Conversion | 81 967 | 81 967 | |||||

| 2014-05-19 |

|

4 | SWI |

SolarWinds, Inc.

Stock Option (right to buy) |

A - Award | 10 706 | 10 706 | |||||

| 2014-05-19 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

A - Award | 4 681 | 13 723 | 51,77 | ||||

| 2014-05-07 |

|

4 | SWI |

SolarWinds, Inc.

Employee Stock Option (right to buy) |

M - Exercise | −2 000 | 28 000 | −6,67 | ||||

| 2014-05-07 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

S - Sale | X | −2 000 | 9 042 | −18,11 | 40,14 | −80 273 | 362 914 |

| 2014-05-07 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

M - Exercise | 2 000 | 11 042 | 22,12 | 9,40 | 18 800 | 103 795 | |

| 2013-07-24 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

G - Gift | 50 036 | 300 036 | 20,01 | ||||

| 2013-07-24 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

G - Gift | −50 036 | 0 | −100,00 | ||||

| 2013-07-09 |

|

4 | PRTS |

U.S. Auto Parts Network, Inc.

Common Stock |

A - Award | 919 | 71 956 | 1,29 | 1,12 | 1 029 | 80 591 | |

| 2013-07-01 |

|

4 | PRTS |

U.S. Auto Parts Network, Inc.

Common Stock |

A - Award | 8 296 | 71 037 | 13,22 | 1,13 | 9 374 | 80 272 | |

| 2013-06-18 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

C - Conversion | 50 036 | 50 036 | |||||

| 2013-06-18 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

M - Exercise | −50 036 | 0 | −100,00 | ||||

| 2013-06-06 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

A - Award | 81 967 | 81 967 | |||||

| 2013-05-28 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

P - Purchase | 5 000 | 5 000 | 40,59 | 202 950 | 202 950 | ||

| 2013-05-13 |

|

4 | SWI |

SolarWinds, Inc.

Stock Option (right to buy) |

A - Award | 6 109 | 6 109 | |||||

| 2013-05-13 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

A - Award | 2 688 | 9 042 | 42,30 | ||||

| 2013-05-09 |

|

4 | JRN |

JOURNAL COMMUNICATIONS INC

Class B Common Stock |

A - Award | 1 127 | 84 698 | 1,35 | ||||

| 2013-04-05 |

|

4 | JRN |

JOURNAL COMMUNICATIONS INC

Class B Common Stock |

S - Sale | −15 000 | 83 571 | −15,22 | 6,64 | −99 603 | 554 928 | |

| 2013-04-02 |

|

4 | PRTS |

U.S. Auto Parts Network, Inc.

Common Stock |

A - Award | 8 367 | 62 741 | 15,39 | 1,22 | 10 208 | 76 544 | |

| 2013-02-14 |

|

4 | JRN |

JOURNAL COMMUNICATIONS INC

Class B Common Stock |

A - Award | 1 657 | 98 571 | 1,71 | ||||

| 2013-01-02 |

|

4 | PRTS |

U.S. Auto Parts Network, Inc.

Common Stock |

A - Award | 5 806 | 54 374 | 11,95 | 1,83 | 10 625 | 99 504 | |

| 2012-12-17 |

|

4 | JRN |

JOURNAL COMMUNICATIONS INC

Class B Common Stock |

A - Award | 546 | 96 914 | 0,57 | ||||

| 2012-11-02 |

|

4 | ZNGA |

ZYNGA INC

Class A Common Stock |

P - Purchase | 250 000 | 250 000 | 2,22 | 556 050 | 556 050 | ||

| 2012-10-11 |

|

4 | JRN |

JOURNAL COMMUNICATIONS INC

Class B Common Stock |

A - Award | 2 586 | 96 368 | 2,76 | ||||

| 2012-10-02 |

|

4 | PRTS |

U.S. Auto Parts Network, Inc.

Common Stock |

A - Award | 3 053 | 48 568 | 6,71 | 3,48 | 10 624 | 169 017 | |

| 2012-08-27 |

|

4/A | ZNGA |

ZYNGA INC

Restricted Stock Unit |

A - Award | 50 036 | 50 036 | |||||

| 2012-07-19 |

|

4 | ZNGA |

ZYNGA INC

Restricted Stock Unit |

A - Award | 50 036 | 50 036 | |||||

| 2012-07-12 |

|

4 | JRN |

JOURNAL COMMUNICATIONS INC

Class B Common Stock |

A - Award | 2 019 | 93 782 | 2,20 | ||||

| 2012-07-03 |

|

4 | PRTS |

U.S. Auto Parts Network, Inc.

Common Stock |

A - Award | 2 529 | 45 515 | 5,88 | 4,20 | 10 622 | 191 163 | |

| 2012-05-18 |

|

4 | SWI |

SolarWinds, Inc.

Stock Option (right to buy) |

A - Award | 6 277 | 6 277 | |||||

| 2012-05-18 |

|

4 | SWI |

SolarWinds, Inc.

Common Stock |

A - Award | 999 | 4 689 | 27,07 | ||||

| 2012-05-16 |

|

4 | PRTS |

U.S. Auto Parts Network, Inc.

Option (right To buy) |

A - Award | 20 000 | 185 000 | 12,12 | ||||

| 2012-05-10 |

|

4 | JRN |

JOURNAL COMMUNICATIONS INC

Class B Common Stock |

A - Award | 12 190 | 91 763 | 15,32 | ||||

| 2012-04-03 |

|

4 | PRTS |

U.S. Auto Parts Network, Inc.

Common Stock |

A - Award | 3 018 | 42 986 | 7,55 | 3,52 | 10 623 | 151 311 | |

| 2012-02-08 |

|

4 | JRN |

JOURNAL COMMUNICATIONS INC

Class B Common Stock |

A - Award | 1 676 | 79 573 | 2,15 | ||||

| 2012-01-03 |

|

4 | PRTS |

U.S. Auto Parts Network, Inc.

Common Stock |

A - Award | 2 299 | 39 968 | 6,10 | 4,62 | 10 621 | 184 652 |