Introduksjon

Denne siden gir en grundig analyse av den kjente historikken for insidernes handelsaktiviteter for Jason Lippert. Insidere er ledere, direktører eller betydelige investorer i et selskap. Det er ulovlig for insidere å gjøre handler i deres selskaper basert på spesifikke, ikke-offentlig informasjon. Dette betyr ikke at det er ulovlig for dem å gjøre noen handler i deres egne selskaper. Imidlertid må de rapportere alle handler til SEC via et skjema 4. Til tross for disse begrensningene, antyder akademisk forskning at insidere - generelt sett - har en tendens til å overgå markedet i sine egne selskaper.

Gjennomsnittlig handelslønnsomhet

Den gjennomsnittlige handelslønnsomheten er den gjennomsnittlige avkastningen av alle åpne markedskjøp gjort av insideren de siste tre årene. For å beregne dette, undersøker vi hvert eneste åpne marked, uplanlagte kjøp som er gjort av insideren, men dette inkluderer ikke alle handler som ble markert som en del av en 10b5-1 handelsplan. Vi beregner deretter gjennomsnittlig ytelse av disse handlene over 3, 6 og 12 måneder, gjennomsnittlig hver av disse varighetene for å generere en endelig ytelsesmåling for hver handel. Til slutt,

Dersom lønnsomheten for denne interne handelen er "N/A", har enten den interne personen ikke gjort noen åpen-markeds kjøp de siste tre årene, eller så er handlene for nylig til å beregne en pålitelig prestasjonsmåler.

Oppdateringsfrekvens: Daglig

Selskaper med rapporterte insiderposisjoner

SEC-arkiveringene indikerer at Jason Lippert har rapporterte beholdninger av handler i følgende selskaper:

| Verdipapir | Navn | Siste rapporterte høydepunkter |

|---|---|---|

| US:LCII / LCI Industries | President , CEO, Director | 384 973 |

| US:NX / Quanex Building Products Corporation | Director | 2 701 |

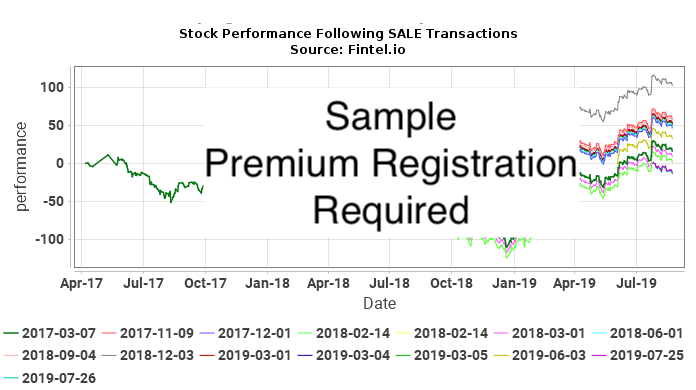

Hvordan tolke diagrammene

De følgende diagrammene viser aksjens ytelse etter hver åpen markedstransaksjon som ikke var planlagt, utført av Jason Lippert. Ikke-planlagte handler er handler som ikke ble gjort som en del av en 10b5-1 handelsplan. Aksjeytelsen er kartlagt som kumulativ prosentendring i aksjekursen. For eksempel, hvis en innsidehandel ble gjort 1. januar 2019, vil diagrammet vise daglig prosentendring for verdipapiret til dagens dato. Dersom aksjeprisen går fra $10 til $15 i løpet av denne tiden, vil den kumulative prosentendringen i aksjeprisen være 50%. En endring i prisen fra $10 til $20 vil være 100%, og en endring i prisen fra $10 til $5 vil være - 50%.

Til syvende og sist er målet vårt å avgjøre hvor tett insidernes handler korrelerer med overavkastninger (positiv eller negativ) i aksjekursen for å se om insidere timer sine handler for å tjene på intern informasjon. Se for deg en situasjon der en insider gjør dette. I denne situasjonen, forventer vi enten (a) positive avkastninger etter kjøp, eller (b) negative avkastninger etter salg. I tilfelle (a) KJØP-diagrammet ville vise en serie av oppadgående kurver, som indikerer positive avkastninger etter hver kjøpstransaksjon. I tilfelle (b) ville SALG-diagrammet vise en serie av nedadgående kurver, som indikerer negative avkastninger etter hver salgstransaksjon.

Imidlertid er dette alene ikke nok til å dra konklusjoner. Hvis, for eksempel, aksjeprisen for selskapet steg jevnt over mange år uten å følge en syklisk trend, ville vi forventet at alle postkjøpsdiagrammer skal ha en stigende trend. På samme måte vil ikke-sykliske nedganger over mange år resultere i nedadgående trend i post-trade diagrammer. Ingen av disse diagrammene ville antyde aktiviteter som insidertrening.

Den sterkeste indikatoren ville vært en situasjon der aksjekursen var ekstremt syklisk, og det var både positive signaler i KJØPSdiagrammet og negative plot i SALGSdiagrammet. Denne situasjonen ville vært sterkt antydende om en insider som timet handler til sin økonomiske fordel.

Internkjøp LCII / LCI Industries - Analyse av kortsiktig fortjeneste

I denne seksjonen analyserer vi lønnsomheten av hvert uplanlagt, åpen-marked internsalg som er gjort i LCII / LCI Industries. Denne analysen hjelper til å forstå om den interne personen regelmessig genererer unormale avkastninger, og er verdt å følge. Denne analysen gjelder ett år etter hver handel, og resultatene er teoretiske.

Følgende tabell viser de mest nylige åpne markedskjøpene som ikke var en del av en handelsplan.

Justert pris er prisen justert for splitt. Justerte aksjer er aksjene justert for splitt.

Internhandel LCII / LCI Industries - Analyse av kortsiktig tap

I denne seksjonen analyserer vi unngåelsen av kortsiktig tap for hvert uplanlagt, åpen-marked internsalg som er gjort i LCII / LCI Industries. Et jevnt mønster av tap unngåelse kan antyde at fremtidige salgstransaksjoner kan forutsi nedgang i pris. Denne analysen gjelder ett år etter hver handel, og resultatene er teoretiske.

Følgende tabell viser de mest nylige åpne markedskjøpene som ikke var en del av en handelsplan.

Justert pris er prisen justert for splitt. Justerte aksjer er aksjene justert for splitt.

Internkjøp NX / Quanex Building Products Corporation - Analyse av kortsiktig fortjeneste

I denne seksjonen analyserer vi lønnsomheten av hvert uplanlagt, åpen-marked internsalg som er gjort i LCII / LCI Industries. Denne analysen hjelper til å forstå om den interne personen regelmessig genererer unormale avkastninger, og er verdt å følge. Denne analysen gjelder ett år etter hver handel, og resultatene er teoretiske.

Følgende tabell viser de mest nylige åpne markedskjøpene som ikke var en del av en handelsplan.

Justert pris er prisen justert for splitt. Justerte aksjer er aksjene justert for splitt.

Internhandel NX / Quanex Building Products Corporation - Analyse av kortsiktig tap

I denne seksjonen analyserer vi unngåelsen av kortsiktig tap for hvert uplanlagt, åpen-marked internsalg som er gjort i LCII / LCI Industries. Et jevnt mønster av tap unngåelse kan antyde at fremtidige salgstransaksjoner kan forutsi nedgang i pris. Denne analysen gjelder ett år etter hver handel, og resultatene er teoretiske.

Følgende tabell viser de mest nylige åpne markedskjøpene som ikke var en del av en handelsplan.

| Handelsdato | Ticker | Innsider | Rapporterte aksjer |

Rapportert pris |

Justerte aksjer |

Justert pris |

Kostpris | Dager til min |

Pris ved min |

Maks tap unngått ($) |

Maks tap unngått (%) |

|---|---|---|---|---|---|---|---|

| Det er ingen kjente uplanlagte handler på det åpne markedet for denne insideren og verdipapirkombinasjonen. |

Justert pris er prisen justert for splitt. Justerte aksjer er aksjene justert for splitt.

Innsidernes handelshistorikk

Tabellen viser den komplette listen over innsidehandler gjort av Jason Lippert som avslørt til Securies Exchange Comission (SEC).

| Fildato | Transaksjonsdato | Skjema | Ticker | Verdipapir | Kode | Aksjer | Gjenværende aksjer | Prosent endring |

Aksje pris |

Transaksjons verdi |

Gjenværende verdi |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025-03-04 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −9 331 | 384 973 | −2,37 | ||||

| 2025-03-04 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 7 309 | 394 304 | 1,89 | 103,82 | 758 820 | 40 936 641 | |

| 2025-03-04 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 7 203 | 386 995 | 1,90 | 103,82 | 747 815 | 40 177 821 | |

| 2025-03-04 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 6 647 | 379 792 | 1,78 | 103,82 | 690 092 | 39 430 005 | |

| 2024-11-27 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

S - Sale | X | −5 000 | 373 145 | −1,32 | 127,00 | −635 000 | 47 389 415 |

| 2024-11-27 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

S - Sale | X | −5 000 | 378 145 | −1,30 | 125,00 | −625 000 | 47 268 125 |

| 2024-03-05 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −28 482 | 383 145 | −6,92 | ||||

| 2024-03-05 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 48 473 | 411 627 | 13,35 | 126,61 | 6 137 167 | 52 116 094 | |

| 2024-03-05 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 6 934 | 363 154 | 1,95 | 126,61 | 877 914 | 45 978 928 | |

| 2024-03-05 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 6 397 | 356 220 | 1,83 | 126,61 | 809 924 | 45 101 014 | |

| 2024-03-05 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 5 386 | 349 823 | 1,56 | 126,61 | 681 921 | 44 291 090 | |

| 2023-03-02 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −27 935 | 344 437 | −7,50 | ||||

| 2023-03-02 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

A - Award | 63 130 | 372 372 | 20,41 | 114,31 | 7 216 390 | 42 565 843 | |

| 2023-03-02 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −2 731 | 309 242 | −0,88 | ||||

| 2023-03-02 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 6 173 | 311 973 | 2,02 | 114,31 | 705 636 | 35 661 634 | |

| 2023-03-02 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −2 300 | 305 800 | −0,75 | ||||

| 2023-03-02 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 5 197 | 308 100 | 1,72 | 114,31 | 594 069 | 35 218 911 | |

| 2023-03-02 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −3 104 | 302 903 | −1,01 | ||||

| 2023-03-02 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 7 015 | 306 007 | 2,35 | 114,31 | 801 885 | 34 979 660 | |

| 2022-05-26 |

|

4 | NX |

Quanex Building Products CORP

Phantom Stock Units |

A - Award | 1 114 | 2 701 | 70,17 | 19,64 | 21 875 | 53 049 | |

| 2022-04-01 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

P - Purchase | 9 265 | 298 992 | 3,20 | 108,00 | 1 000 620 | 32 291 136 | |

| 2022-03-08 |

|

4 | LCII |

LCI INDUSTRIES

Restricted Stock Unit |

M - Exercise | −11 460 | 0 | −100,00 | 110,26 | −1 263 580 | ||

| 2022-03-08 |

|

4 | LCII |

LCI INDUSTRIES

Restricted Stock Unit |

M - Exercise | −11 020 | 0 | −100,00 | 110,26 | −1 215 065 | ||

| 2022-03-08 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Unit |

M - Exercise | −51 093 | 0 | −100,00 | 110,26 | −5 633 514 | ||

| 2022-03-08 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Unit |

A - Award | 16 710 | 51 093 | 48,60 | ||||

| 2022-03-08 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −4 885 | 289 727 | −1,66 | ||||

| 2022-03-08 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −5 080 | 294 612 | −1,70 | ||||

| 2022-03-08 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 11 020 | 299 692 | 3,82 | 110,26 | 1 215 065 | 33 044 040 | |

| 2022-03-08 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 11 460 | 288 672 | 4,13 | 110,26 | 1 263 580 | 31 828 975 | |

| 2022-03-08 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −22 650 | 277 212 | −7,55 | ||||

| 2022-03-08 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 51 093 | 299 862 | 20,54 | 110,26 | 5 633 514 | 33 062 784 | |

| 2022-03-02 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Unit |

A - Award | 35 622 | 35 622 | |||||

| 2022-03-02 |

|

4 | LCII |

LCI INDUSTRIES

Restricted Stock Unit |

A - Award | 17 811 | 17 811 | |||||

| 2022-03-02 |

|

4 | LCII |

LCI INDUSTRIES

Restricted Stock Unit |

M - Exercise | −4 999 | 9 996 | −33,34 | 122,07 | −610 228 | 1 220 212 | |

| 2022-03-02 |

|

4 | LCII |

LCI INDUSTRIES

Restricted Stock Unit |

M - Exercise | −6 746 | 6 747 | −50,00 | 122,07 | −823 484 | 823 606 | |

| 2022-03-02 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −2 990 | 248 769 | −1,19 | ||||

| 2022-03-02 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −2 216 | 251 759 | −0,87 | ||||

| 2022-03-02 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 6 746 | 253 975 | 2,73 | 122,07 | 823 484 | 31 002 728 | |

| 2022-03-02 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 4 999 | 247 229 | 2,06 | 122,07 | 610 228 | 30 179 244 | |

| 2022-02-23 |

|

4 | NX |

Quanex Building Products CORP

Phantom Stock Units |

A - Award | 986 | 1 581 | 165,53 | 22,19 | 21 875 | 35 090 | |

| 2021-12-29 |

|

4 | NX |

Quanex Building Products CORP

Common Stock |

P - Purchase | 7 003 | 20 450 | 52,08 | 25,54 | 178 828 | 522 209 | |

| 2021-12-29 |

|

4 | NX |

Quanex Building Products CORP

Common Stock |

P - Purchase | 3 447 | 13 447 | 34,47 | 24,53 | 84 540 | 329 798 | |

| 2021-12-23 |

|

4 | NX |

Quanex Building Products CORP

Common Stock |

P - Purchase | 10 | 10 000 | 0,10 | 23,77 | 238 | 237 700 | |

| 2021-12-23 |

|

4 | NX |

Quanex Building Products CORP

Common Stock |

P - Purchase | 4 990 | 9 990 | 99,80 | 23,80 | 118 762 | 237 762 | |

| 2021-12-22 |

|

4 | NX |

Quanex Building Products CORP

Common Stock |

P - Purchase | 5 000 | 5 000 | 23,40 | 117 000 | 117 000 | ||

| 2021-12-13 |

|

4 | NX |

Quanex Building Products CORP

Phantom Stock Units |

A - Award | 594 | 594 | 22,11 | 13 125 | 13 125 | ||

| 2021-11-02 |

|

4 | NX |

Quanex Building Products CORP

Restricted Stock Units |

A - Award | 4 797 | 4 797 | |||||

| 2021-04-29 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

S - Sale | −10 000 | 242 230 | −3,96 | 155,00 | −1 550 000 | 37 545 650 | |

| 2021-03-15 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

G - Gift | −6 896 | 252 230 | −2,66 | ||||

| 2021-03-09 |

|

4 | LCII |

LCI INDUSTRIES

Restricted Stock Unit |

M - Exercise | −11 173 | 11 171 | −50,00 | 134,37 | −1 501 316 | 1 501 047 | |

| 2021-03-09 |

|

4 | LCII |

LCI INDUSTRIES

Restricted Stock Unit |

M - Exercise | −10 743 | 10 742 | −50,00 | 134,37 | −1 443 537 | 1 443 403 | |

| 2021-03-09 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −4 953 | 259 126 | −1,88 | ||||

| 2021-03-09 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −4 763 | 264 079 | −1,77 | ||||

| 2021-03-09 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 11 173 | 268 842 | 4,34 | 134,37 | 1 501 316 | 36 124 300 | |

| 2021-03-09 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 10 743 | 257 669 | 4,35 | 134,37 | 1 443 537 | 34 622 984 | |

| 2021-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Unit |

A - Award | 21 925 | 21 925 | |||||

| 2021-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Restricted Stock Unit |

A - Award | 14 617 | 14 617 | |||||

| 2021-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Restricted Stock Unit |

M - Exercise | −6 576 | 13 153 | −33,33 | 143,54 | −943 919 | 1 887 982 | |

| 2021-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Unit |

M - Exercise | −6 806 | 0 | −100,00 | 143,54 | −976 933 | ||

| 2021-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Unit |

D - Sale to Issuer | −569 | 6 806 | −7,72 | ||||

| 2021-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Restricted Stock Unit |

M - Exercise | −4 102 | 0 | −100,00 | 143,54 | −588 801 | ||

| 2021-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −2 915 | 246 926 | −1,17 | ||||

| 2021-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −1 819 | 249 841 | −0,72 | ||||

| 2021-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 6 576 | 251 660 | 2,68 | 143,54 | 943 919 | 36 123 276 | |

| 2021-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 4 102 | 245 084 | 1,70 | 143,54 | 588 801 | 35 179 357 | |

| 2021-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −3 017 | 240 982 | −1,24 | ||||

| 2021-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 6 806 | 243 999 | 2,87 | 143,54 | 976 933 | 35 023 616 | |

| 2021-02-24 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

S - Sale | −10 000 | 237 193 | −4,05 | 151,40 | −1 514 000 | 35 911 020 | |

| 2021-01-14 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

S - Sale | −5 875 | 247 193 | −2,32 | 145,02 | −851 992 | 35 847 929 | |

| 2021-01-14 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

S - Sale | −4 125 | 253 068 | −1,60 | 145,00 | −598 125 | 36 694 860 | |

| 2021-01-08 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

S - Sale | −10 000 | 257 193 | −3,74 | 140,00 | −1 400 000 | 36 007 020 | |

| 2020-12-22 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

S - Sale | −10 000 | 267 193 | −3,61 | 135,00 | −1 350 000 | 36 071 055 | |

| 2020-11-24 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

S - Sale | X | −5 000 | 277 193 | −1,77 | 130,00 | −650 000 | 36 035 090 |

| 2020-03-10 |

|

4 | LCII |

LCI INDUSTRIES

Restricted Stock Unit |

M - Exercise | −10 851 | 21 701 | −33,33 | ||||

| 2020-03-10 |

|

4 | LCII |

LCI INDUSTRIES

Restricted Stock Unit |

M - Exercise | −10 433 | 20 867 | −33,33 | ||||

| 2020-03-10 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −4 810 | 282 193 | −1,68 | 91,44 | −439 826 | 25 803 728 | |

| 2020-03-10 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −4 624 | 287 003 | −1,59 | 91,44 | −422 819 | 26 243 554 | |

| 2020-03-10 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 10 851 | 291 627 | 3,86 | ||||

| 2020-03-10 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 10 433 | 280 776 | 3,86 | ||||

| 2020-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Restricted Stock Unit |

A - Award | 19 161 | 19 161 | |||||

| 2020-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Unit |

A - Award | 28 741 | 28 741 | |||||

| 2020-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Unit |

A - Award | 7 163 | 7 163 | |||||

| 2020-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Unit |

M - Exercise | −3 382 | 0 | −100,00 | ||||

| 2020-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Unit |

D - Sale to Issuer | −24 127 | 0 | −100,00 | ||||

| 2020-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Restricted Stock Unit |

M - Exercise | −4 058 | 3 984 | −50,46 | ||||

| 2020-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Deferred Stock Units |

M - Exercise | −4 270 | 0 | −100,00 | ||||

| 2020-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −1 382 | 270 343 | −0,51 | 96,55 | −133 432 | 26 101 617 | |

| 2020-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −1 657 | 271 725 | −0,61 | 96,55 | −159 983 | 26 235 049 | |

| 2020-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −1 744 | 273 382 | −0,63 | 96,55 | −168 383 | 26 395 032 | |

| 2020-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 4 058 | 275 126 | 1,50 | ||||

| 2020-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 4 270 | 271 068 | 1,60 | ||||

| 2020-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 3 382 | 266 798 | 1,28 | ||||

| 2019-11-22 |

|

4 | LCII |

LCI INDUSTRIES

Deferred Stock Units |

M - Exercise | −1 261 | 0 | −100,00 | ||||

| 2019-11-22 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −559 | 263 416 | −0,21 | 104,52 | −58 427 | 27 532 240 | |

| 2019-11-22 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 1 261 | 263 975 | 0,48 | ||||

| 2019-03-11 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Unit |

A - Award | 31 646 | 31 646 | |||||

| 2019-03-11 |

|

4 | LCII |

LCI INDUSTRIES

Restricted Stock Unit |

A - Award | 31 646 | 31 646 | |||||

| 2019-03-11 |

|

4 | LCII |

LCI INDUSTRIES

Restricted Stock Unit |

A - Award | 30 429 | 30 429 | |||||

| 2019-03-05 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Awards |

M - Exercise | −52 106 | 0 | −100,00 | ||||

| 2019-03-05 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Units |

D - Sale to Issuer | −5 509 | 3 288 | −62,62 | ||||

| 2019-03-05 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Units |

M - Exercise | −18 646 | 0 | −100,00 | ||||

| 2019-03-05 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Awards |

D - Sale to Issuer | −24 900 | 0 | −100,00 | ||||

| 2019-03-05 |

|

4 | LCII |

LCI INDUSTRIES

Restricted Stock Units |

M - Exercise | −3 910 | 7 818 | −33,34 | ||||

| 2019-03-05 |

|

4 | LCII |

LCI INDUSTRIES

Deferred Stock Units |

M - Exercise | −4 151 | 0 | −100,00 | ||||

| 2019-03-05 |

|

4 | LCII |

LCI INDUSTRIES

Deferred Stock Units |

M - Exercise | −5 771 | 0 | −100,00 | ||||

| 2019-03-05 |

|

4 | LCII |

LCI INDUSTRIES

LCII Common Stock |

F - Taxes | −1 677 | 262 714 | −0,63 | 82,73 | −138 738 | 21 734 329 | |

| 2019-03-05 |

|

4 | LCII |

LCI INDUSTRIES

LCII Common Stock |

M - Exercise | 3 910 | 264 391 | 1,50 | ||||

| 2019-03-05 |

|

4 | LCII |

LCI INDUSTRIES

LCII Common Stock |

F - Taxes | −1 780 | 260 481 | −0,68 | 82,73 | −147 259 | 21 549 593 | |

| 2019-03-05 |

|

4 | LCII |

LCI INDUSTRIES

LCII Common Stock |

M - Exercise | 4 151 | 262 261 | 1,61 | ||||

| 2019-03-05 |

|

4 | LCII |

LCI INDUSTRIES

LCII Common Stock |

F - Taxes | −2 475 | 258 110 | −0,95 | 82,73 | −204 757 | 21 353 440 | |

| 2019-03-05 |

|

4 | LCII |

LCI INDUSTRIES

LCII Common Stock |

M - Exercise | 5 771 | 260 585 | 2,26 | ||||

| 2019-03-05 |

|

4 | LCII |

LCI INDUSTRIES

LCII Common Stock |

F - Taxes | −7 998 | 254 814 | −3,04 | 82,73 | −661 675 | 21 080 762 | |

| 2019-03-05 |

|

4 | LCII |

LCI INDUSTRIES

LCII Common Stock |

M - Exercise | 18 646 | 262 812 | 7,64 | ||||

| 2019-03-05 |

|

4 | LCII |

LCI INDUSTRIES

LCII Common Stock |

F - Taxes | −22 350 | 244 166 | −8,39 | 82,73 | −1 849 016 | 20 199 853 | |

| 2019-03-05 |

|

4 | LCII |

LCI INDUSTRIES

LCII Common Stock |

M - Exercise | 52 106 | 266 516 | 24,30 | ||||

| 2018-11-23 |

|

4 | LCII |

LCI INDUSTRIES

Deferred Stock Units |

M - Exercise | −1 223 | 0 | −100,00 | 72,83 | −89 071 | ||

| 2018-11-23 |

|

4 | LCII |

LCI INDUSTRIES

Deferred Stock Units |

M - Exercise | −1 271 | 0 | −100,00 | 72,83 | −92 567 | ||

| 2018-11-23 |

|

4 | LCII |

LCI INDUSTRIES

LCII Common Stock |

F - Taxes | −542 | 214 410 | −0,25 | 72,83 | −39 474 | 15 615 480 | |

| 2018-11-23 |

|

4 | LCII |

LCI INDUSTRIES

LCII Common Stock |

F - Taxes | −564 | 214 952 | −0,26 | 72,83 | −41 076 | 15 654 954 | |

| 2018-11-23 |

|

4 | LCII |

LCI INDUSTRIES

LCII Common Stock |

M - Exercise | 1 271 | 215 516 | 0,59 | 72,83 | 92 567 | 15 696 030 | |

| 2018-11-23 |

|

4 | LCII |

LCI INDUSTRIES

LCII Common Stock |

M - Exercise | 1 223 | 214 245 | 0,57 | 72,83 | 89 071 | 15 603 463 | |

| 2018-06-06 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

P - Purchase | 6 000 | 213 022 | 2,90 | 83,83 | 502 980 | 17 857 634 | |

| 2018-04-06 |

|

4/A | LCII |

LCI INDUSTRIES

Performance Stock Units |

A - Award | 8 567 | 31 712 | 37,01 | ||||

| 2018-03-05 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Units |

A - Award | 8 478 | 31 322 | 37,11 | ||||

| 2018-03-05 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Units |

A - Award | 22 844 | 22 844 | |||||

| 2018-03-05 |

|

4 | LCII |

LCI INDUSTRIES

Restricted Stock Units |

A - Award | 11 422 | 11 422 | |||||

| 2018-03-05 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Awards |

M - Exercise | −54 362 | 93 159 | −36,85 | ||||

| 2018-03-05 |

|

4 | LCII |

LCI INDUSTRIES

Deferred Stock Units. |

M - Exercise | −28 445 | 17 357 | −62,10 | ||||

| 2018-03-05 |

|

4 | LCII |

LCI INDUSTRIES

Deferred Stock Units |

M - Exercise | −15 708 | 45 802 | −25,54 | ||||

| 2018-03-05 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −43 228 | 207 022 | −17,27 | 106,43 | −4 600 756 | 22 033 351 | |

| 2018-03-05 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 28 445 | 250 250 | 12,82 | ||||

| 2018-03-05 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 54 362 | 221 805 | 32,47 | ||||

| 2018-03-05 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 15 708 | 167 443 | 10,35 | ||||

| 2018-03-01 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Awards |

A - Award | 16 519 | 147 521 | 12,61 | ||||

| 2018-03-01 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Awards |

A - Award | 9 066 | 131 002 | 7,44 | ||||

| 2017-11-30 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

S - Sale | −7 500 | 151 735 | −4,71 | 127,22 | −954 150 | 19 303 727 | |

| 2017-11-22 |

|

4 | LCII |

LCI INDUSTRIES

Deferred Stock Units |

M - Exercise | −3 751 | 61 237 | −5,77 | ||||

| 2017-11-22 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −1 761 | 159 235 | −1,09 | 119,70 | −210 792 | 19 060 430 | |

| 2017-11-22 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 3 752 | 160 996 | 2,39 | ||||

| 2017-09-29 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

S - Sale | −5 890 | 157 244 | −3,61 | 116,15 | −684 124 | 18 263 891 | |

| 2017-09-29 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

S - Sale | −1 610 | 163 134 | −0,98 | 115,25 | −185 552 | 18 801 194 | |

| 2017-09-29 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

S - Sale | −7 500 | 164 744 | −4,35 | 113,65 | −852 375 | 18 723 156 | |

| 2017-06-23 |

|

4/A | LCII |

LCI INDUSTRIES

Deferred Stock Units |

A - Award | 18 516 | 64 662 | 40,12 | ||||

| 2017-03-17 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Awards |

A - Award | 8 918 | 119 574 | 8,06 | ||||

| 2017-03-17 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Awards |

A - Award | 23 781 | 110 656 | 27,37 | ||||

| 2017-03-17 |

|

4 | LCII |

LCI INDUSTRIES

Deferred Stock Units |

A - Award | 11 891 | 45 487 | 35,39 | ||||

| 2017-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Deferred Stock Units |

M - Exercise | −13 600 | 33 597 | −28,82 | ||||

| 2017-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −6 383 | 172 244 | −3,57 | 110,83 | −707 428 | 19 089 803 | |

| 2017-03-03 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 13 601 | 178 627 | 8,24 | ||||

| 2017-02-28 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Awards |

A - Award | 17 197 | 86 875 | 24,68 | ||||

| 2017-02-28 |

|

4 | LCII |

LCI INDUSTRIES

Performance Stock Awards |

M - Exercise | −34 647 | 69 677 | −33,21 | ||||

| 2017-02-28 |

|

4 | LCII |

LCI INDUSTRIES

Deferred Stock Units |

M - Exercise | −11 690 | 47 197 | −19,85 | ||||

| 2017-02-28 |

|

4 | LCII |

LCI INDUSTRIES

Deferred Stock Units |

M - Exercise | −941 | 58 886 | −1,57 | ||||

| 2017-02-28 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −16 261 | 165 026 | −8,97 | 108,47 | −1 763 831 | 17 900 370 | |

| 2017-02-28 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 34 648 | 181 287 | 23,63 | ||||

| 2017-02-28 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −5 486 | 146 639 | −3,61 | 108,47 | −595 066 | 15 905 932 | |

| 2017-02-28 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 11 690 | 152 125 | 8,32 | ||||

| 2017-02-28 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

F - Taxes | −441 | 140 435 | −0,31 | 108,47 | −47 835 | 15 232 984 | |

| 2017-02-28 |

|

4 | LCII |

LCI INDUSTRIES

Common Stock |

M - Exercise | 941 | 140 876 | 0,67 | ||||

| 2016-12-22 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −1 500 | 139 935 | −1,06 | 112,50 | −168 750 | 15 742 688 | |

| 2016-12-07 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

S - Sale | −1 000 | 141 435 | −0,70 | 108,95 | −108 950 | 15 409 343 | |

| 2016-12-07 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

S - Sale | −5 000 | 142 435 | −3,39 | 105,55 | −527 750 | 15 034 014 | |

| 2016-11-28 |

|

4 | DW |

DREW INDUSTRIES Inc

Employee Stock Options |

M - Exercise | −2 800 | 0 | −100,00 | ||||

| 2016-11-28 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

S - Sale | −2 800 | 147 435 | −1,86 | 102,47 | −286 916 | 15 107 664 | |

| 2016-11-28 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

M - Exercise | 2 800 | 150 235 | 1,90 | 17,17 | 48 076 | 2 579 535 | |

| 2016-11-22 |

|

4 | DW |

DREW INDUSTRIES Inc

Deferred Stock Units |

M - Exercise | −3 678 | 59 555 | −5,82 | ||||

| 2016-11-22 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

F - Taxes | −1 728 | 147 435 | −1,16 | 100,63 | −173 889 | 14 836 384 | |

| 2016-11-22 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

M - Exercise | 3 678 | 149 163 | 2,53 | ||||

| 2016-08-19 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

S - Sale | −10 000 | 145 485 | −6,43 | 99,93 | −999 300 | 14 538 316 | |

| 2016-05-16 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

S - Sale | −10 000 | 155 485 | −6,04 | 74,13 | −741 300 | 11 526 103 | |

| 2016-03-17 |

|

4 | DW |

DREW INDUSTRIES Inc

Deferred Stock Units |

M - Exercise | −1 889 | 62 520 | −2,93 | ||||

| 2016-03-17 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

F - Taxes | −888 | 165 485 | −0,53 | 62,07 | −55 118 | 10 271 654 | |

| 2016-03-17 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

M - Exercise | 1 890 | 166 373 | 1,15 | ||||

| 2016-03-03 |

|

4 | DW |

DREW INDUSTRIES Inc

Deferred Stock Units |

M - Exercise | −5 835 | 64 410 | −8,31 | ||||

| 2016-03-03 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

F - Taxes | −2 743 | 164 483 | −1,64 | 60,65 | −166 363 | 9 975 894 | |

| 2016-03-03 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

M - Exercise | 5 836 | 167 226 | 3,62 | ||||

| 2016-02-12 |

|

4 | DW |

DREW INDUSTRIES Inc

Performance Stock Awards |

A - Award | 33 037 | 102 680 | 47,44 | ||||

| 2016-02-12 |

|

4 | DW |

DREW INDUSTRIES Inc

Performance Stock Awards |

M - Exercise | −35 453 | 69 643 | −33,73 | ||||

| 2016-02-12 |

|

4 | DW |

DREW INDUSTRIES Inc

Performance Stock Awards |

M - Exercise | −17 567 | 105 096 | −14,32 | ||||

| 2016-02-12 |

|

4 | DW |

DREW INDUSTRIES Inc

Deferred Stock Units |

A - Award | 16 272 | 70 245 | 30,15 | ||||

| 2016-02-12 |

|

4 | DW |

DREW INDUSTRIES Inc

Deferred Stock Units |

A - Award | 2 127 | 43 581 | 5,13 | ||||

| 2016-02-12 |

|

4 | DW |

DREW INDUSTRIES Inc

Deferred Stock Units |

M - Exercise | −4 861 | 51 846 | −8,57 | ||||

| 2016-02-12 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

F - Taxes | −16 662 | 161 390 | −9,36 | 55,22 | −920 076 | 8 911 956 | |

| 2016-02-12 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

M - Exercise | 35 453 | 178 052 | 24,86 | ||||

| 2016-02-12 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

F - Taxes | −8 257 | 142 599 | −5,47 | 55,22 | −455 952 | 7 874 317 | |

| 2016-02-12 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

M - Exercise | 17 568 | 150 856 | 13,18 | ||||

| 2016-02-12 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

F - Taxes | −2 284 | 133 288 | −1,68 | 55,22 | −126 122 | 7 360 163 | |

| 2016-02-12 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

M - Exercise | 4 861 | 135 572 | 3,72 | ||||

| 2015-12-02 |

|

4 | DW |

DREW INDUSTRIES Inc

Employee Stock Options |

M - Exercise | −5 600 | 2 800 | −66,67 | ||||

| 2015-12-02 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

S - Sale | −5 600 | 130 711 | −4,11 | 60,62 | −339 472 | 7 923 701 | |

| 2015-12-02 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

M - Exercise | 5 600 | 136 311 | 4,28 | 13,67 | 76 552 | 1 863 371 | |

| 2015-11-24 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

S - Sale | −2 800 | 130 711 | −2,10 | 59,80 | −167 440 | 7 816 518 | |

| 2015-11-24 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

M - Exercise | 2 800 | 133 511 | 2,14 | 17,17 | 48 076 | 2 292 384 | |

| 2015-11-24 |

|

4 | DW |

DREW INDUSTRIES Inc

Employee Stock Options |

M - Exercise | −2 800 | 8 400 | −25,00 | ||||

| 2015-11-24 |

|

4 | DW |

DREW INDUSTRIES Inc

Deferred Stock Units |

M - Exercise | −3 636 | 56 707 | −6,03 | ||||

| 2015-11-24 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

F - Taxes | −1 708 | 130 711 | −1,29 | 58,68 | −100 225 | 7 670 121 | |

| 2015-11-24 |

|

4 | DW |

DREW INDUSTRIES Inc

Common Stock |

M - Exercise | 3 636 | 132 419 | 2,82 | ||||

| 2015-03-02 |

|

4 | DW |

DREW INDUSTRIES INC

Performance Stock Awards |

A - Award | 34 394 | 118 702 | 40,80 | ||||

| 2015-03-02 |

|

4 | DW |

DREW INDUSTRIES INC

Deferred Stock Units |

A - Award | 16 940 | 58 395 | 40,87 | ||||

| 2015-03-02 |

|

4 | DW |

DREW INDUSTRIES INC

Deferred Stock Units |

A - Award | 8 932 | 41 454 | 27,46 | ||||

| 2015-03-02 |

|

4 | DW |

DREW INDUSTRIES INC

Deferred Stock Units |

M - Exercise | −5 822 | 32 523 | −15,18 | ||||

| 2015-03-02 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

F - Taxes | −17 092 | 128 783 | −11,72 | 60,24 | −1 029 622 | 7 757 888 | |

| 2015-03-02 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

A - Award | 36 368 | 145 875 | 33,21 | ||||

| 2015-03-02 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

F - Taxes | −8 306 | 109 507 | −7,05 | 60,24 | −500 353 | 6 596 702 | |

| 2015-03-02 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

A - Award | 17 674 | 117 813 | 17,65 | ||||

| 2015-03-02 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

F - Taxes | −2 736 | 100 139 | −2,66 | 60,24 | −164 817 | 6 032 373 | |

| 2015-03-02 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

M - Exercise | 5 822 | 102 875 | 6,00 | ||||

| 2015-02-13 |

|

4 | DW |

DREW INDUSTRIES INC

Deferred Stock Units |

M - Exercise | −24 168 | 38 345 | −38,66 | ||||

| 2015-02-13 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

F - Taxes | −8 552 | 97 053 | −8,10 | 51,99 | −444 618 | 5 045 785 | |

| 2015-02-13 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

M - Exercise | 24 169 | 105 605 | 29,68 | ||||

| 2014-12-19 |

|

4 | DW |

DREW INDUSTRIES INC

Employee Stock Options |

M - Exercise | −5 600 | 11 200 | −33,33 | ||||

| 2014-12-19 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −5 600 | 81 436 | −6,43 | 50,00 | −280 000 | 4 071 800 | |

| 2014-12-19 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

M - Exercise | 5 600 | 87 036 | 6,88 | 15,67 | 87 752 | 1 363 854 | |

| 2014-11-21 |

|

4 | DW |

DREW INDUSTRIES INC

Deferred Stock Units |

M - Exercise | −2 399 | 38 345 | −5,89 | ||||

| 2014-11-21 |

|

4 | DW |

DREW INDUSTRIES INC

Deferred Stock Units |

A - Award | 5 600 | 40 743 | 15,93 | ||||

| 2014-11-21 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

F - Taxes | −1 130 | 81 436 | −1,37 | 46,95 | −53 054 | 3 823 420 | |

| 2014-11-21 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

M - Exercise | 2 399 | 82 566 | 2,99 | ||||

| 2014-11-21 |

|

4 | DW |

DREW INDUSTRIES INC

Deferred Stock Units |

A - Award | 5 600 | 35 143 | 18,96 | ||||

| 2014-11-21 |

|

4 | DW |

DREW INDUSTRIES INC

Employee Stock Options |

M - Exercise | −2 800 | 16 800 | −14,29 | ||||

| 2014-11-21 |

|

4 | DW |

DREW INDUSTRIES INC

Employee Stock Options |

M - Exercise | −3 200 | 19 600 | −14,04 | ||||

| 2014-11-21 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −6 000 | 80 167 | −6,96 | 47,04 | −282 240 | 3 771 056 | |

| 2014-11-21 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

M - Exercise | 3 200 | 86 167 | 3,86 | 15,49 | 49 568 | 1 334 727 | |

| 2014-11-21 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

M - Exercise | 2 800 | 82 967 | 3,49 | 19,17 | 53 676 | 1 590 477 | |

| 2014-03-18 |

|

4 | DW |

DREW INDUSTRIES INC

Deferred Stock Units |

M - Exercise | −25 225 | 53 711 | −31,96 | ||||

| 2014-03-18 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

M - Exercise | 25 226 | 80 167 | 45,91 | ||||

| 2014-03-14 |

|

4 | DW |

DREW INDUSTRIES INC

Employee Stock Options |

M - Exercise | −8 680 | 22 800 | −27,57 | ||||

| 2014-03-14 |

|

4 | DW |

DREW INDUSTRIES INC

Employee Stock Options |

M - Exercise | −2 800 | 31 480 | −8,17 | ||||

| 2014-03-14 |

|

4 | DW |

DREW INDUSTRIES INC

Employee Stock Options |

M - Exercise | −5 600 | 34 280 | −14,04 | ||||

| 2014-03-14 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −17 080 | 54 941 | −23,72 | 52,00 | −888 160 | 2 856 932 | |

| 2014-03-14 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

M - Exercise | 8 680 | 72 021 | 13,70 | 19,17 | 166 396 | 1 380 643 | |

| 2014-03-14 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

M - Exercise | 2 800 | 63 341 | 4,62 | 19,17 | 53 676 | 1 214 247 | |

| 2014-03-14 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

M - Exercise | 5 600 | 60 541 | 10,19 | 15,67 | 87 752 | 948 677 | |

| 2014-03-14 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −192 | 54 941 | −0,35 | 52,50 | −10 080 | 2 884 402 | |

| 2014-03-04 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −10 066 | 55 133 | −15,44 | 50,17 | −505 011 | 2 766 023 | |

| 2014-03-04 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −978 | 65 199 | −1,48 | 50,00 | −48 900 | 3 259 950 | |

| 2014-02-28 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −8 756 | 66 177 | −11,69 | 50,00 | −437 800 | 3 308 850 | |

| 2014-02-24 |

|

4 | DW |

DREW INDUSTRIES INC

Deferred Stock Units |

M - Exercise | −3 383 | 78 937 | −4,11 | ||||

| 2014-02-24 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

M - Exercise | 3 384 | 74 933 | 4,73 | ||||

| 2014-02-20 |

|

4 | DW |

DREW INDUSTRIES INC

Employee Stock Options |

M - Exercise | −3 200 | 39 880 | −7,43 | ||||

| 2014-02-20 |

|

4 | DW |

DREW INDUSTRIES INC

Employee Stock Options |

M - Exercise | −6 000 | 43 080 | −12,22 | ||||

| 2014-02-20 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −10 000 | 71 549 | −12,26 | 50,00 | −500 000 | 3 577 450 | |

| 2014-02-20 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

M - Exercise | 3 200 | 81 549 | 4,08 | 15,49 | 49 568 | 1 263 194 | |

| 2014-02-20 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

M - Exercise | 6 000 | 78 349 | 8,29 | 6,09 | 36 540 | 477 145 | |

| 2014-02-13 |

|

4 | DW |

DREW INDUSTRIES INC

Deferred Stock Units |

A - Award | 11 134 | 82 320 | 15,64 | ||||

| 2014-02-13 |

|

4 | DW |

DREW INDUSTRIES INC

Deferred Stock Units |

M - Exercise | −6 171 | 71 186 | −7,98 | ||||

| 2014-02-13 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

A - Award | 18 735 | 72 349 | 34,94 | ||||

| 2014-02-13 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

M - Exercise | 6 172 | 53 614 | 13,01 | ||||

| 2013-11-22 |

|

4 | DW |

DREW INDUSTRIES INC

Deferred Stock Units |

M - Exercise | −1 187 | 72 907 | −1,60 | ||||

| 2013-11-22 |

|

4 | DW |

DREW INDUSTRIES INC

Deferred Stock Units |

A - Award | 5 600 | 74 094 | 8,18 | ||||

| 2013-11-22 |

|

4 | DW |

DREW INDUSTRIES INC

Deferred Stock Units |

A - Award | 5 600 | 74 094 | 8,18 | ||||

| 2013-11-22 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

M - Exercise | 1 188 | 47 442 | 2,57 | ||||

| 2013-06-12 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −5 000 | 46 254 | −9,76 | 39,76 | −198 800 | 1 839 059 | |

| 2013-06-12 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −10 000 | 51 254 | −16,33 | 39,15 | −391 500 | 2 006 594 | |

| 2013-03-07 |

|

4 | DW |

DREW INDUSTRIES INC

Employee Stock Options |

X - Other | −5 320 | 49 080 | −9,78 | ||||

| 2013-03-07 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −5 320 | 61 254 | −7,99 | 36,80 | −195 776 | 2 254 147 | |

| 2013-03-07 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

X - Other | 5 320 | 66 574 | 8,69 | 21,17 | 112 624 | 1 409 372 | |

| 2013-02-28 |

|

4 | DW |

DREW INDUSTRIES INC

Employee Stock Options |

X - Other | −20 000 | 54 400 | −26,88 | ||||

| 2013-02-28 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −20 000 | 61 254 | −24,61 | 36,08 | −721 600 | 2 210 044 | |

| 2013-02-28 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

X - Other | 20 000 | 81 254 | 32,65 | 29,11 | 582 200 | 2 365 304 | |

| 2013-02-21 |

|

4 | DW |

DREW INDUSTRIES INC

Deferred Stock Units |

A - Award | 1 759 | 37 894 | 4,87 | ||||

| 2012-12-26 |

|

4 | DW |

DREW INDUSTRIES INC

Deferred Stock Units |

J - Other | 336 | 36 135 | 0,94 | 33,32 | 11 200 | 1 204 034 | |

| 2012-12-26 |

|

4 | DW |

DREW INDUSTRIES INC

Deferred Stock Units |

J - Other | 336 | 36 135 | 0,94 | 33,32 | 11 200 | 1 204 034 | |

| 2012-12-26 |

|

4 | DW |

DREW INDUSTRIES INC

Deferred Stock Units |

J - Other | 1 374 | 35 463 | 4,03 | 33,32 | 45 779 | 1 181 634 | |

| 2012-12-19 |

|

4 | DW |

DREW INDUSTRIES INC

Employee Stock Options |

X - Other | −5 600 | 74 400 | −7,00 | ||||

| 2012-12-19 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −5 600 | 61 254 | −8,38 | 31,00 | −173 600 | 1 898 874 | |

| 2012-12-19 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

X - Other | 5 600 | 66 854 | 9,14 | 17,67 | 98 952 | 1 181 310 | |

| 2012-11-23 |

|

4 | DW |

DREW INDUSTRIES INC

Deferred Stock Units |

A - Award | 5 600 | 34 089 | 19,66 | ||||

| 2012-11-23 |

|

4 | DW |

DREW INDUSTRIES INC

Deferred Stock Units |

A - Award | 5 600 | 34 089 | 19,66 | ||||

| 2012-11-21 |

|

4 | DW |

DREW INDUSTRIES INC

Employee Stock Options |

X - Other | −2 800 | 80 000 | −3,38 | ||||

| 2012-11-21 |

|

4 | DW |

DREW INDUSTRIES INC

Employee Stock Options |

X - Other | −3 200 | 82 800 | −3,72 | ||||

| 2012-11-21 |

|

4 | DW |

DREW INDUSTRIES INC

Employee Stock Options |

X - Other | −3 997 | 86 000 | −4,44 | ||||

| 2012-11-21 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −2 800 | 61 254 | −4,37 | 30,27 | −84 756 | 1 854 159 | |

| 2012-11-21 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

X - Other | 2 800 | 64 054 | 4,57 | 23,17 | 64 876 | 1 484 131 | |

| 2012-11-21 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −3 200 | 61 254 | −4,96 | 30,27 | −96 864 | 1 854 159 | |

| 2012-11-21 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

X - Other | 3 200 | 64 454 | 5,22 | 19,49 | 62 368 | 1 256 208 | |

| 2012-11-21 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −3 997 | 61 254 | −6,13 | 30,00 | −119 910 | 1 837 620 | |

| 2012-11-21 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

X - Other | 3 997 | 65 251 | 6,53 | 10,09 | 40 330 | 658 383 | |

| 2012-11-19 |

|

4 | DW |

DREW INDUSTRIES INC

Employee Stock Options |

X - Other | −2 003 | 89 997 | −2,18 | ||||

| 2012-11-19 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −2 003 | 61 254 | −3,17 | 30,00 | −60 090 | 1 837 620 | |

| 2012-11-19 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

X - Other | 2 003 | 63 257 | 3,27 | 10,09 | 20 210 | 638 263 | |

| 2012-08-17 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −3 982 | 61 254 | −6,10 | 29,50 | −117 469 | 1 806 993 | |

| 2012-08-17 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −518 | 65 236 | −0,79 | 29,50 | −15 281 | 1 924 462 | |

| 2012-08-08 |

|

4 | DW |

DREW INDUSTRIES INC

Employee Stock Options |

X - Other | −5 600 | 92 000 | −5,74 | ||||

| 2012-08-08 |

|

4 | DW |

DREW INDUSTRIES INC

Employee Stock Options |

X - Other | −6 400 | 97 600 | −6,15 | ||||

| 2012-08-08 |

|

4 | DW |

DREW INDUSTRIES INC

Employee Stock Options |

X - Other | −516 | 104 000 | −0,49 | ||||

| 2012-08-08 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −500 | 65 754 | −0,75 | 29,50 | −14 750 | 1 939 743 | |

| 2012-08-08 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −22 514 | 66 254 | −25,36 | 28,80 | −648 403 | 1 908 115 | |

| 2012-08-08 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

X - Other | 5 600 | 88 768 | 6,73 | 19,67 | 110 152 | 1 746 067 | |

| 2012-08-08 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

X - Other | 6 400 | 83 168 | 8,34 | 19,49 | 124 736 | 1 620 944 | |

| 2012-08-08 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

X - Other | 516 | 76 768 | 0,68 | 10,09 | 5 206 | 774 589 | |

| 2012-08-08 |

|

4 | DW |

DREW INDUSTRIES INC

Employee Stock Options |

X - Other | −484 | 104 516 | −0,46 | ||||

| 2012-08-08 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −486 | 76 252 | −0,63 | 28,80 | −13 997 | 2 196 058 | |

| 2012-08-08 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

X - Other | 484 | 76 738 | 0,63 | 10,09 | 4 884 | 774 286 | |

| 2012-01-03 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −220 | 76 254 | −0,29 | 25,25 | −5 555 | 1 925 414 | |

| 2012-01-03 |

|

4 | DW |

DREW INDUSTRIES INC

Common Stock |

S - Sale | −1 000 | 76 474 | −1,29 | 25,10 | −25 100 | 1 919 497 |