Introduksjon

Denne siden gir en grundig analyse av den kjente historikken for insidernes handelsaktiviteter for Eagle Point DIF GP I LLC. Insidere er ledere, direktører eller betydelige investorer i et selskap. Det er ulovlig for insidere å gjøre handler i deres selskaper basert på spesifikke, ikke-offentlig informasjon. Dette betyr ikke at det er ulovlig for dem å gjøre noen handler i deres egne selskaper. Imidlertid må de rapportere alle handler til SEC via et skjema 4. Til tross for disse begrensningene, antyder akademisk forskning at insidere - generelt sett - har en tendens til å overgå markedet i sine egne selskaper.

Gjennomsnittlig handelslønnsomhet

Den gjennomsnittlige handelslønnsomheten er den gjennomsnittlige avkastningen av alle åpne markedskjøp gjort av insideren de siste tre årene. For å beregne dette, undersøker vi hvert eneste åpne marked, uplanlagte kjøp som er gjort av insideren, men dette inkluderer ikke alle handler som ble markert som en del av en 10b5-1 handelsplan. Vi beregner deretter gjennomsnittlig ytelse av disse handlene over 3, 6 og 12 måneder, gjennomsnittlig hver av disse varighetene for å generere en endelig ytelsesmåling for hver handel. Til slutt,

Dersom lønnsomheten for denne interne handelen er "N/A", har enten den interne personen ikke gjort noen åpen-markeds kjøp de siste tre årene, eller så er handlene for nylig til å beregne en pålitelig prestasjonsmåler.

Oppdateringsfrekvens: Daglig

Selskaper med rapporterte insiderposisjoner

SEC-arkiveringene indikerer at Eagle Point DIF GP I LLC har rapporterte beholdninger av handler i følgende selskaper:

| Verdipapir | Navn | Siste rapporterte høydepunkter |

|---|---|---|

| US:ACR / ACRES Commercial Realty Corp. | 10% Owner | 791 797 |

| US:OCCI / OFS Credit Company, Inc. | 10% Owner | 26 715 |

| US:XFLT / XAI Octagon Floating Rate & Alternative Income Trust | 10% Owner | 348 303 |

| US:OXLC / Oxford Lane Capital Corp. | 10% Owner | 380 145 |

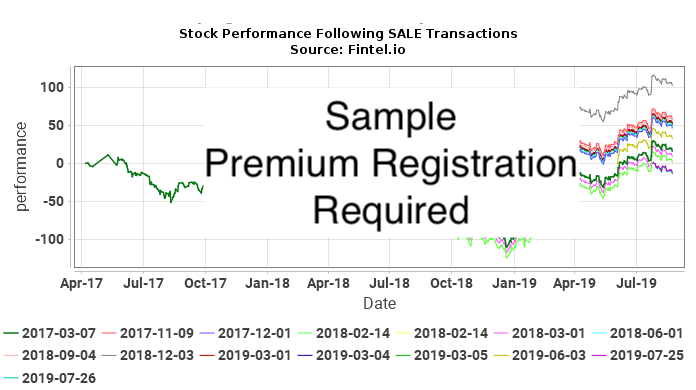

Hvordan tolke diagrammene

De følgende diagrammene viser aksjens ytelse etter hver åpen markedstransaksjon som ikke var planlagt, utført av Eagle Point DIF GP I LLC. Ikke-planlagte handler er handler som ikke ble gjort som en del av en 10b5-1 handelsplan. Aksjeytelsen er kartlagt som kumulativ prosentendring i aksjekursen. For eksempel, hvis en innsidehandel ble gjort 1. januar 2019, vil diagrammet vise daglig prosentendring for verdipapiret til dagens dato. Dersom aksjeprisen går fra $10 til $15 i løpet av denne tiden, vil den kumulative prosentendringen i aksjeprisen være 50%. En endring i prisen fra $10 til $20 vil være 100%, og en endring i prisen fra $10 til $5 vil være - 50%.

Til syvende og sist er målet vårt å avgjøre hvor tett insidernes handler korrelerer med overavkastninger (positiv eller negativ) i aksjekursen for å se om insidere timer sine handler for å tjene på intern informasjon. Se for deg en situasjon der en insider gjør dette. I denne situasjonen, forventer vi enten (a) positive avkastninger etter kjøp, eller (b) negative avkastninger etter salg. I tilfelle (a) KJØP-diagrammet ville vise en serie av oppadgående kurver, som indikerer positive avkastninger etter hver kjøpstransaksjon. I tilfelle (b) ville SALG-diagrammet vise en serie av nedadgående kurver, som indikerer negative avkastninger etter hver salgstransaksjon.

Imidlertid er dette alene ikke nok til å dra konklusjoner. Hvis, for eksempel, aksjeprisen for selskapet steg jevnt over mange år uten å følge en syklisk trend, ville vi forventet at alle postkjøpsdiagrammer skal ha en stigende trend. På samme måte vil ikke-sykliske nedganger over mange år resultere i nedadgående trend i post-trade diagrammer. Ingen av disse diagrammene ville antyde aktiviteter som insidertrening.

Den sterkeste indikatoren ville vært en situasjon der aksjekursen var ekstremt syklisk, og det var både positive signaler i KJØPSdiagrammet og negative plot i SALGSdiagrammet. Denne situasjonen ville vært sterkt antydende om en insider som timet handler til sin økonomiske fordel.

Internkjøp ACR / ACRES Commercial Realty Corp. - Analyse av kortsiktig fortjeneste

I denne seksjonen analyserer vi lønnsomheten av hvert uplanlagt, åpen-marked internsalg som er gjort i ACR / ACRES Commercial Realty Corp.. Denne analysen hjelper til å forstå om den interne personen regelmessig genererer unormale avkastninger, og er verdt å følge. Denne analysen gjelder ett år etter hver handel, og resultatene er teoretiske.

Følgende tabell viser de mest nylige åpne markedskjøpene som ikke var en del av en handelsplan.

Justert pris er prisen justert for splitt. Justerte aksjer er aksjene justert for splitt.

Internhandel ACR / ACRES Commercial Realty Corp. - Analyse av kortsiktig tap

I denne seksjonen analyserer vi unngåelsen av kortsiktig tap for hvert uplanlagt, åpen-marked internsalg som er gjort i ACR / ACRES Commercial Realty Corp.. Et jevnt mønster av tap unngåelse kan antyde at fremtidige salgstransaksjoner kan forutsi nedgang i pris. Denne analysen gjelder ett år etter hver handel, og resultatene er teoretiske.

Følgende tabell viser de mest nylige åpne markedskjøpene som ikke var en del av en handelsplan.

Justert pris er prisen justert for splitt. Justerte aksjer er aksjene justert for splitt.

Internkjøp OCCIN / OFS Credit Company, Inc. - Preferred Stock - Analyse av kortsiktig fortjeneste

I denne seksjonen analyserer vi lønnsomheten av hvert uplanlagt, åpen-marked internsalg som er gjort i ACR / ACRES Commercial Realty Corp.. Denne analysen hjelper til å forstå om den interne personen regelmessig genererer unormale avkastninger, og er verdt å følge. Denne analysen gjelder ett år etter hver handel, og resultatene er teoretiske.

Følgende tabell viser de mest nylige åpne markedskjøpene som ikke var en del av en handelsplan.

| Handelsdato | Ticker | Innsider | Rapporterte aksjer |

Rapportert pris |

Justerte aksjer |

Justert pris |

Kostpris | Dager til maks |

Pris ved maks |

Maks fortjeneste ($) |

Maks fortjeneste (%) |

|---|---|---|---|---|---|---|---|

| Det er ingen kjente uplanlagte handler på det åpne markedet for denne insideren og verdipapirkombinasjonen. |

Justert pris er prisen justert for splitt. Justerte aksjer er aksjene justert for splitt.

Internhandel OCCIN / OFS Credit Company, Inc. - Preferred Stock - Analyse av kortsiktig tap

I denne seksjonen analyserer vi unngåelsen av kortsiktig tap for hvert uplanlagt, åpen-marked internsalg som er gjort i ACR / ACRES Commercial Realty Corp.. Et jevnt mønster av tap unngåelse kan antyde at fremtidige salgstransaksjoner kan forutsi nedgang i pris. Denne analysen gjelder ett år etter hver handel, og resultatene er teoretiske.

Følgende tabell viser de mest nylige åpne markedskjøpene som ikke var en del av en handelsplan.

| Handelsdato | Ticker | Innsider | Rapporterte aksjer |

Rapportert pris |

Justerte aksjer |

Justert pris |

Kostpris | Dager til min |

Pris ved min |

Maks tap unngått ($) |

Maks tap unngått (%) |

|---|---|---|---|---|---|---|---|

| Det er ingen kjente uplanlagte handler på det åpne markedet for denne insideren og verdipapirkombinasjonen. |

Justert pris er prisen justert for splitt. Justerte aksjer er aksjene justert for splitt.

Internkjøp OXLCI / Oxford Lane Capital Corp. - Preferred Security - Analyse av kortsiktig fortjeneste

I denne seksjonen analyserer vi lønnsomheten av hvert uplanlagt, åpen-marked internsalg som er gjort i ACR / ACRES Commercial Realty Corp.. Denne analysen hjelper til å forstå om den interne personen regelmessig genererer unormale avkastninger, og er verdt å følge. Denne analysen gjelder ett år etter hver handel, og resultatene er teoretiske.

Følgende tabell viser de mest nylige åpne markedskjøpene som ikke var en del av en handelsplan.

| Handelsdato | Ticker | Innsider | Rapporterte aksjer |

Rapportert pris |

Justerte aksjer |

Justert pris |

Kostpris | Dager til maks |

Pris ved maks |

Maks fortjeneste ($) |

Maks fortjeneste (%) |

|---|---|---|---|---|---|---|---|

| Det er ingen kjente uplanlagte handler på det åpne markedet for denne insideren og verdipapirkombinasjonen. |

Justert pris er prisen justert for splitt. Justerte aksjer er aksjene justert for splitt.

Internhandel OXLCI / Oxford Lane Capital Corp. - Preferred Security - Analyse av kortsiktig tap

I denne seksjonen analyserer vi unngåelsen av kortsiktig tap for hvert uplanlagt, åpen-marked internsalg som er gjort i ACR / ACRES Commercial Realty Corp.. Et jevnt mønster av tap unngåelse kan antyde at fremtidige salgstransaksjoner kan forutsi nedgang i pris. Denne analysen gjelder ett år etter hver handel, og resultatene er teoretiske.

Følgende tabell viser de mest nylige åpne markedskjøpene som ikke var en del av en handelsplan.

| Handelsdato | Ticker | Innsider | Rapporterte aksjer |

Rapportert pris |

Justerte aksjer |

Justert pris |

Kostpris | Dager til min |

Pris ved min |

Maks tap unngått ($) |

Maks tap unngått (%) |

|---|---|---|---|---|---|---|---|

| Det er ingen kjente uplanlagte handler på det åpne markedet for denne insideren og verdipapirkombinasjonen. |

Justert pris er prisen justert for splitt. Justerte aksjer er aksjene justert for splitt.

Internkjøp XFLT / XAI Octagon Floating Rate & Alternative Income Trust - Analyse av kortsiktig fortjeneste

I denne seksjonen analyserer vi lønnsomheten av hvert uplanlagt, åpen-marked internsalg som er gjort i ACR / ACRES Commercial Realty Corp.. Denne analysen hjelper til å forstå om den interne personen regelmessig genererer unormale avkastninger, og er verdt å følge. Denne analysen gjelder ett år etter hver handel, og resultatene er teoretiske.

Følgende tabell viser de mest nylige åpne markedskjøpene som ikke var en del av en handelsplan.

| Handelsdato | Ticker | Innsider | Rapporterte aksjer |

Rapportert pris |

Justerte aksjer |

Justert pris |

Kostpris | Dager til maks |

Pris ved maks |

Maks fortjeneste ($) |

Maks fortjeneste (%) |

|---|---|---|---|---|---|---|---|

| Det er ingen kjente uplanlagte handler på det åpne markedet for denne insideren og verdipapirkombinasjonen. |

Justert pris er prisen justert for splitt. Justerte aksjer er aksjene justert for splitt.

Internhandel XFLT / XAI Octagon Floating Rate & Alternative Income Trust - Analyse av kortsiktig tap

I denne seksjonen analyserer vi unngåelsen av kortsiktig tap for hvert uplanlagt, åpen-marked internsalg som er gjort i ACR / ACRES Commercial Realty Corp.. Et jevnt mønster av tap unngåelse kan antyde at fremtidige salgstransaksjoner kan forutsi nedgang i pris. Denne analysen gjelder ett år etter hver handel, og resultatene er teoretiske.

Følgende tabell viser de mest nylige åpne markedskjøpene som ikke var en del av en handelsplan.

| Handelsdato | Ticker | Innsider | Rapporterte aksjer |

Rapportert pris |

Justerte aksjer |

Justert pris |

Kostpris | Dager til min |

Pris ved min |

Maks tap unngått ($) |

Maks tap unngått (%) |

|---|---|---|---|---|---|---|---|

| Det er ingen kjente uplanlagte handler på det åpne markedet for denne insideren og verdipapirkombinasjonen. |

Justert pris er prisen justert for splitt. Justerte aksjer er aksjene justert for splitt.

Innsidernes handelshistorikk

Tabellen viser den komplette listen over innsidehandler gjort av Eagle Point DIF GP I LLC som avslørt til Securies Exchange Comission (SEC).

| Fildato | Transaksjonsdato | Skjema | Ticker | Verdipapir | Kode | Aksjer | Gjenværende aksjer | Prosent endring |

Aksje pris |

Transaksjons verdi |

Gjenværende verdi |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025-09-08 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −2 188 | 791 797 | −0,28 | 22,43 | −49 077 | 17 760 007 | |

| 2025-09-08 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −90 | 793 985 | −0,01 | 22,40 | −2 016 | 17 785 264 | |

| 2025-09-08 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −910 | 794 075 | −0,11 | 22,35 | −20 338 | 17 747 576 | |

| 2025-09-02 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −100 | 794 985 | −0,01 | 22,35 | −2 235 | 17 767 915 | |

| 2025-09-02 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −658 | 795 085 | −0,08 | 22,52 | −14 818 | 17 905 314 | |

| 2025-09-02 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −323 | 795 743 | −0,04 | 22,35 | −7 219 | 17 784 856 | |

| 2025-08-27 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −1 349 | 796 066 | −0,17 | 22,35 | −30 150 | 17 792 075 | |

| 2025-08-27 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −850 | 797 415 | −0,11 | 22,35 | −18 998 | 17 822 225 | |

| 2025-08-27 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −744 | 798 265 | −0,09 | 22,30 | −16 591 | 17 801 310 | |

| 2025-08-21 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −4 291 | 799 009 | −0,53 | 22,31 | −95 732 | 17 825 891 | |

| 2025-08-21 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −1 674 | 803 300 | −0,21 | 22,30 | −37 330 | 17 913 590 | |

| 2025-08-01 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −13 008 | 804 974 | −1,59 | 22,30 | −290 078 | 17 950 920 | |

| 2025-08-01 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −1 727 | 817 982 | −0,21 | 22,20 | −38 339 | 18 159 200 | |

| 2025-07-24 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −100 | 819 709 | −0,01 | 22,32 | −2 232 | 18 295 905 | |

| 2025-07-24 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −15 084 | 819 809 | −1,81 | 22,30 | −336 373 | 18 281 741 | |

| 2025-07-18 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −199 | 834 893 | −0,02 | 22,18 | −4 414 | 18 517 927 | |

| 2025-07-14 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −6 160 | 835 092 | −0,73 | 22,21 | −136 814 | 18 547 393 | |

| 2025-07-09 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −1 676 | 841 252 | −0,20 | 22,20 | −37 207 | 18 675 794 | |

| 2025-07-09 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −273 | 842 928 | −0,03 | 22,20 | −6 061 | 18 713 002 | |

| 2025-06-30 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −56 | 843 201 | −0,01 | 22,52 | −1 261 | 18 988 887 | |

| 2025-06-30 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −1 958 | 843 257 | −0,23 | 22,48 | −44 016 | 18 956 417 | |

| 2025-06-30 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −54 | 845 215 | −0,01 | 22,48 | −1 214 | 19 000 433 | |

| 2025-06-26 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −10 | 845 269 | 0,00 | 22,48 | −225 | 19 001 647 | |

| 2025-06-26 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −2 222 | 845 279 | −0,26 | 22,45 | −49 884 | 18 976 514 | |

| 2025-06-17 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −11 071 | 847 501 | −1,29 | 22,39 | −247 880 | 18 975 547 | |

| 2025-06-17 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −553 | 858 572 | −0,06 | 22,30 | −12 332 | 19 146 156 | |

| 2025-06-17 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −400 | 859 125 | −0,05 | 22,25 | −8 900 | 19 115 531 | |

| 2025-04-01 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −1 172 | 859 525 | −0,14 | 22,48 | −26 347 | 19 322 122 | |

| 2025-03-28 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −826 | 860 697 | −0,10 | 22,48 | −18 568 | 19 348 469 | |

| 2025-03-28 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −3 384 | 861 523 | −0,39 | 22,48 | −76 072 | 19 367 037 | |

| 2025-03-26 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −705 | 864 907 | −0,08 | 22,43 | −15 813 | 19 399 864 | |

| 2025-03-26 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −854 | 865 612 | −0,10 | 22,45 | −19 172 | 19 432 989 | |

| 2025-03-21 |

|

4 | ACR |

ACRES Commercial Realty Corp.

Common Stock, $0.001 par value |

S - Sale | −375 | 1 177 060 | −0,03 | 23,60 | −8 850 | 27 778 616 | |

| 2025-03-21 |

|

4 | ACR |

ACRES Commercial Realty Corp.

Common Stock, $0.001 par value |

S - Sale | −4 861 | 1 177 435 | −0,41 | 23,74 | −115 400 | 27 952 307 | |

| 2025-03-21 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −5 076 | 866 466 | −0,58 | 22,44 | −113 905 | 19 443 497 | |

| 2025-03-19 |

|

4 | ACR |

ACRES Commercial Realty Corp.

Common Stock, $0.001 par value |

S - Sale | −9 011 | 1 182 296 | −0,76 | 23,70 | −213 561 | 28 020 415 | |

| 2025-03-19 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −2 500 | 871 542 | −0,29 | 22,48 | −56 200 | 19 592 264 | |

| 2025-03-19 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −3 180 | 874 042 | −0,36 | 22,47 | −71 455 | 19 639 724 | |

| 2025-03-18 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −317 | 877 222 | −0,04 | 22,46 | −7 120 | 19 702 406 | |

| 2025-03-18 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −8 657 | 877 539 | −0,98 | 22,47 | −194 523 | 19 718 301 | |

| 2025-02-24 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −1 498 | 886 196 | −0,17 | 22,46 | −33 645 | 19 903 962 | |

| 2025-02-24 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −1 237 | 887 694 | −0,14 | 22,40 | −27 709 | 19 884 346 | |

| 2025-02-03 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −29 907 | 393 646 | −7,06 | 24,87 | −743 787 | 9 789 976 | |

| 2025-02-03 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −811 | 423 553 | −0,19 | 24,90 | −20 194 | 10 546 470 | |

| 2025-01-24 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −100 | 888 931 | −0,01 | 22,40 | −2 240 | 19 912 054 | |

| 2025-01-24 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −7 335 | 889 031 | −0,82 | 22,40 | −164 304 | 19 914 294 | |

| 2025-01-02 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −816 | 424 364 | −0,19 | 25,20 | −20 563 | 10 693 973 | |

| 2025-01-02 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −200 | 425 180 | −0,05 | 25,20 | −5 040 | 10 714 536 | |

| 2024-12-30 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −2 820 | 896 366 | −0,31 | 23,05 | −65 001 | 20 661 236 | |

| 2024-12-30 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −1 | 425 380 | 0,00 | 25,20 | −25 | 10 719 576 | |

| 2024-12-30 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −420 | 425 381 | −0,10 | 25,20 | −10 584 | 10 719 601 | |

| 2024-12-26 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −557 | 425 801 | −0,13 | 25,20 | −14 036 | 10 730 185 | |

| 2024-12-26 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −2 388 | 426 358 | −0,56 | 25,20 | −60 178 | 10 744 222 | |

| 2024-12-23 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −100 | 428 746 | −0,02 | 25,20 | −2 520 | 10 804 399 | |

| 2024-12-23 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −1 021 | 899 186 | −0,11 | 23,05 | −23 534 | 20 726 237 | |

| 2024-12-23 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −5 728 | 428 846 | −1,32 | 25,18 | −144 231 | 10 798 342 | |

| 2024-12-19 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −5 500 | 434 574 | −1,25 | 25,18 | −138 490 | 10 942 573 | |

| 2024-12-19 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −1 316 | 900 207 | −0,15 | 23,07 | −30 360 | 20 767 775 | |

| 2024-12-19 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −2 677 | 440 074 | −0,60 | 25,18 | −67 407 | 11 081 063 | |

| 2024-12-19 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −2 965 | 901 523 | −0,33 | 23,10 | −68 492 | 20 825 181 | |

| 2024-12-17 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −102 | 904 488 | −0,01 | 23,04 | −2 350 | 20 839 404 | |

| 2024-12-17 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −4 084 | 442 751 | −0,91 | 25,18 | −102 835 | 11 148 470 | |

| 2024-12-17 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −130 | 904 590 | −0,01 | 23,06 | −2 998 | 20 859 845 | |

| 2024-12-13 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −3 226 | 904 720 | −0,36 | 23,06 | −74 392 | 20 862 843 | |

| 2024-12-13 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −1 036 | 907 946 | −0,11 | 23,06 | −23 890 | 20 937 235 | |

| 2024-12-13 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −2 614 | 446 835 | −0,58 | 25,19 | −65 847 | 11 255 774 | |

| 2024-12-13 |

|

5 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

P - Purchase | −100 | 26 715 | −0,37 | 23,10 | −2 310 | 617 116 | |

| 2024-12-10 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −3 766 | 449 449 | −0,83 | 25,19 | −94 866 | 11 321 620 | |

| 2024-12-10 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −1 241 | 453 215 | −0,27 | 25,18 | −31 248 | 11 411 954 | |

| 2024-12-09 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −4 098 | 454 456 | −0,89 | 25,18 | −103 188 | 11 443 202 | |

| 2024-12-09 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −1 289 | 458 554 | −0,28 | 25,18 | −32 457 | 11 546 390 | |

| 2024-12-09 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −774 | 908 982 | −0,09 | 23,10 | −17 879 | 20 997 484 | |

| 2024-12-05 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −27 | 909 756 | 0,00 | 23,10 | −624 | 21 015 364 | |

| 2024-12-05 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −620 | 459 843 | −0,13 | 25,20 | −15 624 | 11 588 044 | |

| 2024-12-05 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −1 406 | 460 463 | −0,30 | 25,18 | −35 403 | 11 594 458 | |

| 2024-12-03 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −3 806 | 461 869 | −0,82 | 25,19 | −95 873 | 11 634 480 | |

| 2024-12-03 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −1 936 | 465 675 | −0,41 | 25,15 | −48 690 | 11 711 726 | |

| 2024-11-27 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −4 182 | 467 611 | −0,89 | 25,14 | −105 135 | 11 755 741 | |

| 2024-11-25 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −1 674 | 471 793 | −0,35 | 25,11 | −42 034 | 11 846 722 | |

| 2024-11-21 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −6 232 | 473 467 | −1,30 | 25,10 | −156 423 | 11 884 022 | |

| 2024-11-21 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −270 | 909 783 | −0,03 | 23,30 | −6 291 | 21 197 944 | |

| 2024-11-19 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −1 923 | 479 699 | −0,40 | 25,06 | −48 190 | 12 021 257 | |

| 2024-11-19 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −420 | 481 622 | −0,09 | 25,04 | −10 517 | 12 059 815 | |

| 2024-11-15 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −3 637 | 910 053 | −0,40 | 23,36 | −84 960 | 21 258 838 | |

| 2024-11-15 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −200 | 482 042 | −0,04 | 25,02 | −5 004 | 12 060 691 | |

| 2024-11-15 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −5 128 | 913 690 | −0,56 | 23,41 | −120 046 | 21 389 483 | |

| 2024-11-12 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −2 625 | 482 242 | −0,54 | 25,00 | −65 625 | 12 056 050 | |

| 2024-11-12 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −2 249 | 918 818 | −0,24 | 23,30 | −52 402 | 21 408 459 | |

| 2024-11-12 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −11 | 921 067 | 0,00 | 23,33 | −257 | 21 488 493 | |

| 2024-11-12 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −1 301 | 484 867 | −0,27 | 24,98 | −32 499 | 12 111 978 | |

| 2024-11-06 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −600 | 486 168 | −0,12 | 24,94 | −14 964 | 12 125 030 | |

| 2024-11-06 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −129 | 486 768 | −0,03 | 24,94 | −3 217 | 12 139 994 | |

| 2024-11-01 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −10 000 | 486 897 | −2,01 | 24,92 | −249 200 | 12 133 473 | |

| 2024-11-01 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −2 394 | 496 897 | −0,48 | 24,91 | −59 635 | 12 377 704 | |

| 2024-10-25 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −100 | 499 291 | −0,02 | 24,89 | −2 489 | 12 427 353 | |

| 2024-10-22 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −10 000 | 921 078 | −1,07 | 23,29 | −232 900 | 21 451 907 | |

| 2024-10-22 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −601 | 499 391 | −0,12 | 24,90 | −14 965 | 12 434 836 | |

| 2024-10-18 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −26 709 | 931 078 | −2,79 | 23,20 | −619 649 | 21 601 010 | |

| 2024-10-18 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −3 506 | 957 787 | −0,36 | 23,23 | −81 444 | 22 249 392 | |

| 2024-10-18 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −2 803 | 499 992 | −0,56 | 24,87 | −69 711 | 12 434 801 | |

| 2024-10-16 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −4 200 | 502 795 | −0,83 | 24,86 | −104 412 | 12 499 484 | |

| 2024-10-16 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −4 630 | 506 995 | −0,90 | 24,85 | −115 056 | 12 598 826 | |

| 2024-10-11 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −5 000 | 511 625 | −0,97 | 24,82 | −124 100 | 12 698 532 | |

| 2024-10-11 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −113 | 516 625 | −0,02 | 24,80 | −2 802 | 12 812 300 | |

| 2024-10-01 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −615 | 516 738 | −0,12 | 25,26 | −15 535 | 13 052 802 | |

| 2024-10-01 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −6 063 | 517 353 | −1,16 | 25,23 | −152 969 | 13 052 816 | |

| 2024-09-27 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −937 | 523 416 | −0,18 | 25,22 | −23 631 | 13 200 552 | |

| 2024-09-27 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −4 | 524 353 | 0,00 | 25,22 | −101 | 13 224 183 | |

| 2024-09-25 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −500 | 12 339 | −3,89 | 24,68 | −12 340 | 304 527 | |

| 2024-09-25 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −100 | 31 007 | −0,32 | 23,66 | −2 366 | 733 626 | |

| 2024-09-25 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −109 | 12 839 | −0,84 | 24,52 | −2 673 | 314 812 | |

| 2024-09-24 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −5 159 | 524 357 | −0,97 | 25,22 | −130 110 | 13 224 284 | |

| 2024-09-24 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −10 400 | 961 293 | −1,07 | 23,44 | −243 776 | 22 532 708 | |

| 2024-09-24 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −6 675 | 529 516 | −1,24 | 25,21 | −168 277 | 13 349 098 | |

| 2024-09-23 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −1 375 | 31 107 | −4,23 | 23,52 | −32 340 | 731 637 | |

| 2024-09-20 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −10 000 | 971 693 | −1,02 | 23,15 | −231 500 | 22 494 693 | |

| 2024-09-20 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −20 000 | 536 191 | −3,60 | 25,15 | −503 000 | 13 485 204 | |

| 2024-09-20 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −10 000 | 981 693 | −1,01 | 23,06 | −230 600 | 22 637 841 | |

| 2024-09-20 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −17 196 | 556 191 | −3,00 | 25,08 | −431 276 | 13 949 270 | |

| 2024-09-18 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −6 224 | 991 693 | −0,62 | 23,00 | −143 152 | 22 808 939 | |

| 2024-09-18 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −2 367 | 573 387 | −0,41 | 25,04 | −59 270 | 14 357 610 | |

| 2024-09-18 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −2 620 | 997 917 | −0,26 | 22,90 | −59 998 | 22 852 299 | |

| 2024-09-18 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −2 611 | 575 754 | −0,45 | 25,02 | −65 327 | 14 405 365 | |

| 2024-09-16 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −503 | 578 365 | −0,09 | 25,00 | −12 575 | 14 459 125 | |

| 2024-09-16 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −1 000 | 1 000 537 | −0,10 | 22,88 | −22 880 | 22 892 287 | |

| 2024-09-16 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −8 300 | 1 001 537 | −0,82 | 22,84 | −189 572 | 22 875 105 | |

| 2024-09-13 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −462 | 12 948 | −3,45 | 24,46 | −11 301 | 316 708 | |

| 2024-09-13 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −189 | 13 410 | −1,39 | 24,46 | −4 623 | 328 009 | |

| 2024-09-11 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −3 576 | 578 868 | −0,61 | 24,98 | −89 328 | 14 460 123 | |

| 2024-09-11 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −3 648 | 582 444 | −0,62 | 24,99 | −91 164 | 14 555 276 | |

| 2024-09-11 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −5 300 | 1 009 837 | −0,52 | 22,76 | −120 628 | 22 983 890 | |

| 2024-09-11 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −699 | 586 092 | −0,12 | 24,98 | −17 461 | 14 640 578 | |

| 2024-09-09 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −900 | 586 791 | −0,15 | 24,99 | −22 491 | 14 663 907 | |

| 2024-09-09 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −725 | 587 691 | −0,12 | 24,99 | −18 118 | 14 686 398 | |

| 2024-09-04 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −190 | 13 599 | −1,38 | 24,42 | −4 640 | 332 088 | |

| 2024-09-04 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −551 | 13 789 | −3,84 | 24,42 | −13 455 | 336 727 | |

| 2024-09-03 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −100 | 588 416 | −0,02 | 24,98 | −2 498 | 14 698 632 | |

| 2024-09-03 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −2 714 | 588 516 | −0,46 | 24,94 | −67 687 | 14 677 589 | |

| 2024-09-03 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −894 | 591 230 | −0,15 | 24,93 | −22 287 | 14 739 364 | |

| 2024-08-28 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −1 200 | 592 124 | −0,20 | 24,92 | −29 904 | 14 755 730 | |

| 2024-08-28 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −2 502 | 593 324 | −0,42 | 24,91 | −62 325 | 14 779 701 | |

| 2024-08-28 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −2 100 | 595 826 | −0,35 | 24,91 | −52 311 | 14 842 026 | |

| 2024-08-27 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −422 | 14 340 | −2,86 | 24,42 | −10 305 | 350 183 | |

| 2024-08-27 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −300 | 14 762 | −1,99 | 24,42 | −7 326 | 360 488 | |

| 2024-08-27 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −123 | 15 062 | −0,81 | 24,40 | −3 001 | 367 513 | |

| 2024-08-23 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −1 369 | 1 015 137 | −0,13 | 23,65 | −32 377 | 24 007 990 | |

| 2024-08-23 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −3 759 | 597 926 | −0,62 | 24,91 | −93 637 | 14 894 337 | |

| 2024-08-23 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −2 824 | 1 016 506 | −0,28 | 23,61 | −66 675 | 23 999 707 | |

| 2024-08-23 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −420 | 601 685 | −0,07 | 24,87 | −10 445 | 14 963 906 | |

| 2024-08-23 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −1 390 | 602 105 | −0,23 | 24,87 | −34 569 | 14 974 351 | |

| 2024-08-21 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −68 | 15 185 | −0,45 | 24,40 | −1 659 | 370 514 | |

| 2024-08-21 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −182 | 15 253 | −1,18 | 24,40 | −4 441 | 372 173 | |

| 2024-08-21 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −1 742 | 15 435 | −10,14 | 24,37 | −42 453 | 376 151 | |

| 2024-08-20 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −1 | 603 495 | 0,00 | 24,87 | −32 | 15 008 921 | |

| 2024-08-20 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −3 119 | 604 792 | −0,51 | 24,87 | −77 570 | 15 041 177 | |

| 2024-08-20 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −566 | 607 911 | −0,09 | 24,87 | −14 076 | 15 118 747 | |

| 2024-08-15 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −4 706 | 608 477 | −0,77 | 24,87 | −117 038 | 15 132 823 | |

| 2024-08-15 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −1 500 | 613 183 | −0,24 | 24,87 | −37 305 | 15 249 861 | |

| 2024-08-15 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −1 309 | 614 683 | −0,21 | 24,85 | −32 529 | 15 274 873 | |

| 2024-08-15 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −100 | 17 177 | −0,58 | 24,42 | −2 442 | 419 462 | |

| 2024-08-15 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −777 | 17 277 | −4,30 | 24,40 | −18 959 | 421 559 | |

| 2024-08-12 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −565 | 18 054 | −3,03 | 24,38 | −13 775 | 440 157 | |

| 2024-08-12 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −8 | 18 619 | −0,04 | 24,38 | −195 | 453 931 | |

| 2024-08-12 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −375 | 18 627 | −1,97 | 24,38 | −9 142 | 454 126 | |

| 2024-08-09 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −100 | 615 992 | −0,02 | 24,85 | −2 485 | 15 307 401 | |

| 2024-08-09 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −1 008 | 616 092 | −0,16 | 24,83 | −25 029 | 15 297 564 | |

| 2024-08-09 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

S - Sale | −805 | 1 019 330 | −0,08 | 23,99 | −19 312 | 24 453 727 | |

| 2024-08-09 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −3 859 | 617 100 | −0,62 | 24,86 | −95 935 | 15 341 106 | |

| 2024-08-07 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −100 | 19 002 | −0,52 | 24,35 | −2 435 | 462 699 | |

| 2024-08-07 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −102 | 19 102 | −0,53 | 24,35 | −2 484 | 465 134 | |

| 2024-08-07 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −1 578 | 19 204 | −7,59 | 24,35 | −38 424 | 467 617 | |

| 2024-08-07 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −840 | 20 782 | −3,88 | 24,33 | −20 437 | 505 626 | |

| 2024-08-06 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −2 635 | 620 959 | −0,42 | 24,88 | −65 559 | 15 449 460 | |

| 2024-08-02 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −15 096 | 623 594 | −2,36 | 24,86 | −375 287 | 15 502 547 | |

| 2024-07-30 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −376 | 638 690 | −0,06 | 24,75 | −9 306 | 15 807 578 | |

| 2024-07-30 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −1 978 | 639 066 | −0,31 | 24,75 | −48 956 | 15 816 884 | |

| 2024-07-25 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −100 | 641 044 | −0,02 | 24,75 | −2 475 | 15 865 839 | |

| 2024-07-25 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −386 | 641 144 | −0,06 | 24,75 | −9 554 | 15 868 314 | |

| 2024-07-22 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −651 | 21 622 | −2,92 | 24,32 | −15 832 | 525 847 | |

| 2024-07-22 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −8 | 22 273 | −0,04 | 24,32 | −195 | 541 679 | |

| 2024-07-17 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −596 | 22 281 | −2,61 | 24,32 | −14 495 | 541 874 | |

| 2024-07-15 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −679 | 641 530 | −0,11 | 24,67 | −16 751 | 15 826 545 | |

| 2024-07-15 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −7 200 | 642 209 | −1,11 | 24,63 | −177 336 | 15 817 608 | |

| 2024-07-15 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −1 900 | 649 409 | −0,29 | 24,63 | −46 797 | 15 994 944 | |

| 2024-07-11 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −129 | 32 482 | −0,40 | 23,30 | −3 006 | 756 831 | |

| 2024-07-11 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −926 | 22 877 | −3,89 | 24,25 | −22 456 | 554 767 | |

| 2024-07-08 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −1 210 | 651 309 | −0,19 | 24,80 | −30 008 | 16 152 463 | |

| 2024-07-08 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −2 220 | 652 519 | −0,34 | 24,67 | −54 767 | 16 097 644 | |

| 2024-07-08 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −100 | 32 611 | −0,31 | 23,30 | −2 330 | 759 836 | |

| 2024-07-08 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −938 | 23 803 | −3,79 | 24,25 | −22 746 | 577 223 | |

| 2024-07-08 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −192 | 32 711 | −0,58 | 23,27 | −4 468 | 761 185 | |

| 2024-07-08 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −546 | 24 741 | −2,16 | 24,22 | −13 224 | 599 227 | |

| 2024-07-08 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −100 | 32 903 | −0,30 | 23,27 | −2 327 | 765 653 | |

| 2024-07-08 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −3 372 | 25 287 | −11,77 | 24,24 | −81 737 | 612 957 | |

| 2024-07-02 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −4 528 | 654 739 | −0,69 | 25,00 | −113 200 | 16 368 475 | |

| 2024-07-02 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −4 698 | 28 659 | −14,08 | 24,20 | −113 692 | 693 548 | |

| 2024-07-02 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −100 | 33 003 | −0,30 | 23,27 | −2 327 | 767 980 | |

| 2024-07-02 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −4 | 33 357 | −0,01 | 24,20 | −97 | 807 239 | |

| 2024-07-02 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −514 | 33 361 | −1,52 | 24,20 | −12 439 | 807 336 | |

| 2024-06-27 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −44 | 33 875 | −0,13 | 24,23 | −1 066 | 820 791 | |

| 2024-06-27 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −18 464 | 659 267 | −2,72 | 25,00 | −461 600 | 16 481 675 | |

| 2024-06-27 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −7 100 | 677 731 | −1,04 | 25,02 | −177 642 | 16 956 830 | |

| 2024-06-27 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

S - Sale | −7 005 | 684 831 | −1,01 | 25,01 | −175 195 | 17 127 623 | |

| 2024-06-24 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −27 | 33 919 | −0,08 | 24,23 | −654 | 821 857 | |

| 2024-06-24 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −2 000 | 33 946 | −5,56 | 24,20 | −48 400 | 821 493 | |

| 2024-06-24 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −11 | 35 946 | −0,03 | 24,24 | −267 | 871 331 | |

| 2024-06-18 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −125 | 35 957 | −0,35 | 24,22 | −3 028 | 870 879 | |

| 2024-06-18 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −220 | 36 082 | −0,61 | 24,22 | −5 328 | 873 906 | |

| 2024-06-18 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −343 | 33 103 | −1,03 | 23,35 | −8 009 | 772 955 | |

| 2024-06-03 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −302 | 36 302 | −0,83 | 24,26 | −7 327 | 880 687 | |

| 2024-06-03 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −100 | 36 604 | −0,27 | 24,22 | −2 422 | 886 549 | |

| 2024-06-03 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −5 | 33 446 | −0,01 | 23,35 | −117 | 780 964 | |

| 2024-05-29 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −2 | 36 704 | −0,01 | 24,22 | −48 | 888 971 | |

| 2024-05-20 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −25 | 36 706 | −0,07 | 24,20 | −605 | 888 285 | |

| 2024-05-20 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −233 | 36 731 | −0,63 | 24,24 | −5 648 | 890 359 | |

| 2024-05-20 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −30 | 33 451 | −0,09 | 23,33 | −700 | 780 412 | |

| 2024-05-15 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −5 124 | 36 964 | −12,17 | 24,16 | −123 796 | 893 050 | |

| 2024-05-15 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −801 | 33 481 | −2,34 | 23,29 | −18 655 | 779 772 | |

| 2024-05-15 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −707 | 34 282 | −2,02 | 23,29 | −16 466 | 798 428 | |

| 2024-05-09 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −1 305 | 34 989 | −3,60 | 23,24 | −30 328 | 813 144 | |

| 2024-04-18 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −83 | 42 088 | −0,20 | 24,16 | −2 005 | 1 016 846 | |

| 2024-04-18 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −74 | 42 171 | −0,18 | 24,16 | −1 788 | 1 018 851 | |

| 2024-04-12 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −17 | 42 245 | −0,04 | 24,16 | −411 | 1 020 639 | |

| 2024-03-28 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −63 | 42 262 | −0,15 | 24,12 | −1 520 | 1 019 359 | |

| 2024-03-25 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −1 | 42 325 | 0,00 | 24,12 | −24 | 1 020 879 | |

| 2024-03-15 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −6 | 42 326 | −0,01 | 24,12 | −145 | 1 020 903 | |

| 2024-03-15 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −28 | 42 332 | −0,07 | 24,12 | −675 | 1 021 048 | |

| 2024-03-15 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −11 | 42 360 | −0,03 | 24,10 | −265 | 1 020 876 | |

| 2024-03-11 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −100 | 36 294 | −0,27 | 24,03 | −2 403 | 872 145 | |

| 2024-02-13 |

|

5 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 276 | 691 836 | 0,04 | 21,94 | 6 055 | 15 178 882 | |

| 2024-02-13 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −15 872 | 36 394 | −30,37 | 22,71 | −360 453 | 826 508 | |

| 2024-02-13 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −42 531 | 52 266 | −44,87 | 22,63 | −962 477 | 1 182 780 | |

| 2024-02-13 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −14 531 | 94 797 | −13,29 | 22,63 | −328 837 | 2 145 256 | |

| 2024-02-08 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −1 500 | 109 328 | −1,35 | 22,64 | −33 960 | 2 475 186 | |

| 2024-02-08 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −12 405 | 110 828 | −10,07 | 22,66 | −281 097 | 2 511 362 | |

| 2024-02-08 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −13 515 | 123 233 | −9,88 | 22,62 | −305 709 | 2 787 530 | |

| 2024-02-05 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −9 343 | 136 748 | −6,40 | 22,66 | −211 712 | 3 098 710 | |

| 2024-02-05 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −21 100 | 146 091 | −12,62 | 22,65 | −477 915 | 3 308 961 | |

| 2024-02-05 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −5 000 | 167 191 | −2,90 | 22,90 | −114 500 | 3 828 674 | |

| 2024-01-31 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −3 975 | 172 191 | −2,26 | 22,92 | −91 107 | 3 946 618 | |

| 2024-01-31 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −894 | 176 166 | −0,50 | 22,91 | −20 482 | 4 035 963 | |

| 2024-01-31 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −8 300 | 177 060 | −4,48 | 22,94 | −190 402 | 4 061 756 | |

| 2024-01-26 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −400 | 185 360 | −0,22 | 22,90 | −9 160 | 4 244 744 | |

| 2024-01-26 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −6 600 | 185 760 | −3,43 | 22,91 | −151 206 | 4 255 762 | |

| 2024-01-26 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −6 674 | 192 360 | −3,35 | 22,85 | −152 501 | 4 395 426 | |

| 2024-01-23 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −76 601 | 199 034 | −27,79 | 22,84 | −1 749 567 | 4 545 937 | |

| 2024-01-23 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −24 665 | 275 635 | −8,21 | 22,64 | −558 416 | 6 240 376 | |

| 2024-01-23 |

|

4 | OCCI |

OFS Credit Company, Inc.

5.25% Series E Term Preferred Stock due 2026 |

S - Sale | −9 700 | 300 300 | −3,13 | 22,72 | −220 384 | 6 822 816 | |

| 2023-12-05 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 7 370 | 691 836 | 1,08 | 22,25 | 163 982 | 15 393 351 | |

| 2023-10-25 |

|

4 | ACR |

ACRES Commercial Realty Corp.

Common Stock, $0.001 par value |

P - Purchase | 1 209 | 1 191 307 | 0,10 | 6,90 | 8 342 | 8 220 018 | |

| 2023-10-17 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 700 | 684 190 | 0,10 | 21,55 | 15 085 | 14 744 294 | |

| 2023-10-17 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 561 | 1 020 135 | 0,06 | 17,70 | 9 930 | 18 056 390 | |

| 2023-10-06 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 630 | 1 019 574 | 0,06 | 17,84 | 11 239 | 18 189 200 | |

| 2023-10-06 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 2 700 | 683 490 | 0,40 | 21,61 | 58 347 | 14 770 219 | |

| 2023-10-06 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 493 | 1 018 944 | 0,05 | 17,90 | 8 825 | 18 239 098 | |

| 2023-10-06 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 14 | 680 790 | 0,00 | 21,65 | 303 | 14 739 104 | |

| 2023-10-03 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 565 | 1 018 451 | 0,06 | 18,15 | 10 255 | 18 484 886 | |

| 2023-10-03 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 5 117 | 680 776 | 0,76 | 21,67 | 110 885 | 14 752 416 | |

| 2023-10-03 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 1 723 | 675 659 | 0,26 | 21,77 | 37 510 | 14 709 096 | |

| 2023-10-03 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 580 | 1 017 886 | 0,06 | 18,40 | 10 672 | 18 729 102 | |

| 2023-09-28 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 265 | 1 017 306 | 0,03 | 18,90 | 5 008 | 19 227 083 | |

| 2023-09-28 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 54 | 673 936 | 0,01 | 22,15 | 1 196 | 14 927 682 | |

| 2023-09-28 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 416 | 1 017 041 | 0,04 | 19,00 | 7 904 | 19 323 779 | |

| 2023-09-28 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 55 | 673 882 | 0,01 | 22,15 | 1 218 | 14 926 486 | |

| 2023-09-25 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 824 | 673 827 | 0,12 | 22,13 | 18 235 | 14 911 792 | |

| 2023-09-25 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 213 | 1 016 625 | 0,02 | 19,00 | 4 047 | 19 315 875 | |

| 2023-09-20 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 565 | 1 016 412 | 0,06 | 19,20 | 10 848 | 19 515 110 | |

| 2023-09-15 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 1 410 | 1 015 847 | 0,14 | 19,24 | 27 128 | 19 544 896 | |

| 2023-09-08 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 734 | 673 003 | 0,11 | 22,19 | 16 287 | 14 933 937 | |

| 2023-09-08 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 23 | 672 269 | 0,00 | 22,20 | 511 | 14 924 372 | |

| 2023-09-08 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 63 | 1 014 437 | 0,01 | 19,24 | 1 212 | 19 517 768 | |

| 2023-09-05 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 100 | 672 246 | 0,01 | 22,20 | 2 220 | 14 923 861 | |

| 2023-09-05 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 396 | 672 146 | 0,06 | 22,25 | 8 811 | 14 955 248 | |

| 2023-09-05 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 5 000 | 671 750 | 0,75 | 22,30 | 111 500 | 14 980 025 | |

| 2023-09-05 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 784 | 1 014 374 | 0,08 | 19,40 | 15 210 | 19 678 856 | |

| 2023-08-30 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 1 410 | 1 013 590 | 0,14 | 19,50 | 27 495 | 19 765 005 | |

| 2023-08-30 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 1 042 | 1 012 180 | 0,10 | 19,50 | 20 319 | 19 737 510 | |

| 2023-08-30 |

|

4 | OCCI |

OFS Credit Company, Inc.

6.125% Series C Term Preferred Stock due 2026 |

S - Sale | −245 | 42 471 | −0,57 | 22,98 | −5 630 | 975 984 | |

| 2023-08-07 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 10 034 | 666 750 | 1,53 | 22,40 | 224 762 | 14 935 200 | |

| 2023-05-26 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 2 717 | 1 011 138 | 0,27 | 16,88 | 45 863 | 17 068 009 | |

| 2023-05-23 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 662 | 1 008 421 | 0,07 | 16,95 | 11 221 | 17 092 736 | |

| 2023-05-23 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 81 226 | 656 716 | 14,11 | 19,80 | 1 608 275 | 13 002 977 | |

| 2023-05-23 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 49 425 | 1 007 759 | 5,16 | 17,09 | 844 673 | 17 222 601 | |

| 2023-05-18 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 8 500 | 575 490 | 1,50 | 19,76 | 167 960 | 11 371 682 | |

| 2023-05-18 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 103 | 958 334 | 0,01 | 16,95 | 1 746 | 16 243 761 | |

| 2023-05-18 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 557 | 566 990 | 0,10 | 19,70 | 10 973 | 11 169 703 | |

| 2023-05-18 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 440 | 958 231 | 0,05 | 16,95 | 7 458 | 16 242 015 | |

| 2023-05-15 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 1 113 | 957 791 | 0,12 | 17,00 | 18 921 | 16 282 447 | |

| 2023-05-15 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 6 884 | 956 678 | 0,72 | 17,07 | 117 510 | 16 330 493 | |

| 2023-05-10 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 1 430 | 949 794 | 0,15 | 17,24 | 24 653 | 16 374 449 | |

| 2023-05-10 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 2 100 | 566 433 | 0,37 | 19,80 | 41 580 | 11 215 373 | |

| 2023-05-05 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 423 | 564 333 | 0,08 | 19,80 | 8 375 | 11 173 793 | |

| 2023-05-05 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 125 | 948 364 | 0,01 | 17,25 | 2 156 | 16 359 279 | |

| 2023-05-05 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 23 426 | 563 910 | 4,33 | 19,85 | 465 006 | 11 193 614 | |

| 2023-05-05 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 5 436 | 948 239 | 0,58 | 17,75 | 96 489 | 16 831 242 | |

| 2023-05-05 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 1 000 | 540 484 | 0,19 | 19,99 | 19 990 | 10 804 275 | |

| 2023-05-01 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 245 | 942 803 | 0,03 | 18,00 | 4 410 | 16 970 454 | |

| 2023-04-19 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 133 | 942 558 | 0,01 | 18,00 | 2 394 | 16 966 044 | |

| 2023-04-19 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 587 | 942 425 | 0,06 | 18,00 | 10 566 | 16 963 650 | |

| 2023-04-19 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 962 | 539 484 | 0,18 | 20,09 | 19 327 | 10 838 234 | |

| 2023-04-10 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 1 466 | 538 522 | 0,27 | 20,00 | 29 320 | 10 770 440 | |

| 2023-03-28 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 445 | 537 056 | 0,08 | 20,14 | 8 962 | 10 816 308 | |

| 2023-01-04 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 512 | 941 838 | 0,05 | 17,80 | 9 114 | 16 764 716 | |

| 2023-01-04 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 7 281 | 536 611 | 1,38 | 19,77 | 143 945 | 10 608 799 | |

| 2023-01-04 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 3 738 | 941 326 | 0,40 | 17,96 | 67 134 | 16 906 215 | |

| 2023-01-04 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 6 025 | 529 330 | 1,15 | 19,98 | 120 380 | 10 576 013 | |

| 2022-12-27 |

|

4 | ACR |

ACRES Commercial Realty Corp.

Common Stock, $0.001 par value |

P - Purchase | 5 653 | 1 190 098 | 0,48 | 7,87 | 44 489 | 9 366 071 | |

| 2022-12-27 |

|

4 | ACR |

ACRES Commercial Realty Corp.

Common Stock, $0.001 par value |

P - Purchase | 17 700 | 1 184 445 | 1,52 | 8,21 | 145 317 | 9 724 293 | |

| 2022-12-21 |

|

4 | ACR |

ACRES Commercial Realty Corp.

Common Stock, $0.001 par value |

P - Purchase | 6 500 | 1 166 745 | 0,56 | 8,96 | 58 240 | 10 454 035 | |

| 2022-12-21 |

|

4 | ACR |

ACRES Commercial Realty Corp.

Common Stock, $0.001 par value |

P - Purchase | 1 002 | 1 160 245 | 0,09 | 9,05 | 9 068 | 10 500 217 | |

| 2022-12-19 |

|

4 | ACR |

ACRES Commercial Realty Corp.

Common Stock, $0.001 par value |

P - Purchase | 979 | 1 159 243 | 0,08 | 9,07 | 8 880 | 10 514 334 | |

| 2022-12-19 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 33 | 523 305 | 0,01 | 20,45 | 675 | 10 701 587 | |

| 2022-12-19 |

|

4 | ACR |

ACRES Commercial Realty Corp.

Common Stock, $0.001 par value |

P - Purchase | 6 003 | 1 158 264 | 0,52 | 9,14 | 54 867 | 10 586 533 | |

| 2022-12-19 |

|

4 | ACR |

ACRES Commercial Realty Corp.

Common Stock, $0.001 par value |

P - Purchase | 3 109 | 1 152 261 | 0,27 | 9,22 | 28 665 | 10 623 846 | |

| 2022-12-13 |

|

4 | ACR |

ACRES Commercial Realty Corp.

Common Stock, $0.001 par value |

P - Purchase | 9 305 | 1 149 152 | 0,82 | 9,31 | 86 630 | 10 698 605 | |

| 2022-12-13 |

|

4 | ACR |

ACRES Commercial Realty Corp.

Common Stock, $0.001 par value |

P - Purchase | 643 | 1 139 847 | 0,06 | 9,29 | 5 973 | 10 589 179 | |

| 2022-11-22 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 825 | 937 588 | 0,09 | 18,50 | 15 262 | 17 345 378 | |

| 2022-11-14 |

|

4 | ACR |

ACRES Commercial Realty Corp.

Common Stock, $0.001 par value |

P - Purchase | 2 134 | 1 139 204 | 0,19 | 9,72 | 20 742 | 11 073 063 | |

| 2022-11-08 |

|

4 | ACR |

ACRES Commercial Realty Corp.

Common Stock, $0.001 par value |

P - Purchase | 1 704 | 1 137 070 | 0,15 | 9,70 | 16 529 | 11 029 579 | |

| 2022-11-08 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 643 | 936 763 | 0,07 | 18,50 | 11 896 | 17 330 116 | |

| 2022-10-21 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 2 354 | 523 272 | 0,45 | 19,50 | 45 903 | 10 203 804 | |

| 2022-10-21 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 598 | 520 918 | 0,11 | 19,65 | 11 751 | 10 236 039 | |

| 2022-10-21 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 2 824 | 520 320 | 0,55 | 19,71 | 55 661 | 10 255 507 | |

| 2022-10-17 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 1 694 | 517 496 | 0,33 | 19,90 | 33 711 | 10 298 170 | |

| 2022-10-12 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 2 306 | 515 802 | 0,45 | 20,20 | 46 581 | 10 419 200 | |

| 2022-10-12 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 787 | 936 120 | 0,08 | 19,00 | 14 953 | 17 786 280 | |

| 2022-10-03 |

|

4 | ACR |

ACRES Commercial Realty Corp.

Common Stock, $0.001 par value |

P - Purchase | 463 | 1 135 366 | 0,04 | 8,15 | 3 773 | 9 253 233 | |

| 2022-10-03 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 1 766 | 935 333 | 0,19 | 19,10 | 33 731 | 17 864 860 | |

| 2022-10-03 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 2 194 | 513 496 | 0,43 | 21,00 | 46 074 | 10 783 416 | |

| 2022-10-03 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 756 | 933 567 | 0,08 | 19,85 | 15 007 | 18 531 305 | |

| 2022-09-28 |

|

4 | ACR |

ACRES Commercial Realty Corp.

Common Stock, $0.001 par value |

P - Purchase | 2 112 | 1 134 903 | 0,19 | 8,57 | 18 100 | 9 726 119 | |

| 2022-09-28 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 201 | 932 811 | 0,02 | 19,85 | 3 990 | 18 516 298 | |

| 2022-09-28 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 4 590 | 511 302 | 0,91 | 21,05 | 96 620 | 10 762 907 | |

| 2022-09-28 |

|

4 | ACR |

ACRES Commercial Realty Corp.

Common Stock, $0.001 par value |

P - Purchase | 2 755 | 1 132 791 | 0,24 | 8,72 | 24 024 | 9 877 938 | |

| 2022-09-28 |

|

4 | ACR |

ACRES Commercial Realty Corp.

7.875% Series D Preferred Stock |

P - Purchase | 3 373 | 932 610 | 0,36 | 20,03 | 67 561 | 18 680 178 | |

| 2022-09-28 |

|

4 | ACR |

ACRES Commercial Realty Corp.

8.625% Series C Preferred Stock |

P - Purchase | 4 562 | 506 712 | 0,91 | 21,22 | 96 806 | 10 752 429 | |

| 2022-09-23 |