Grunnleggende statistikk

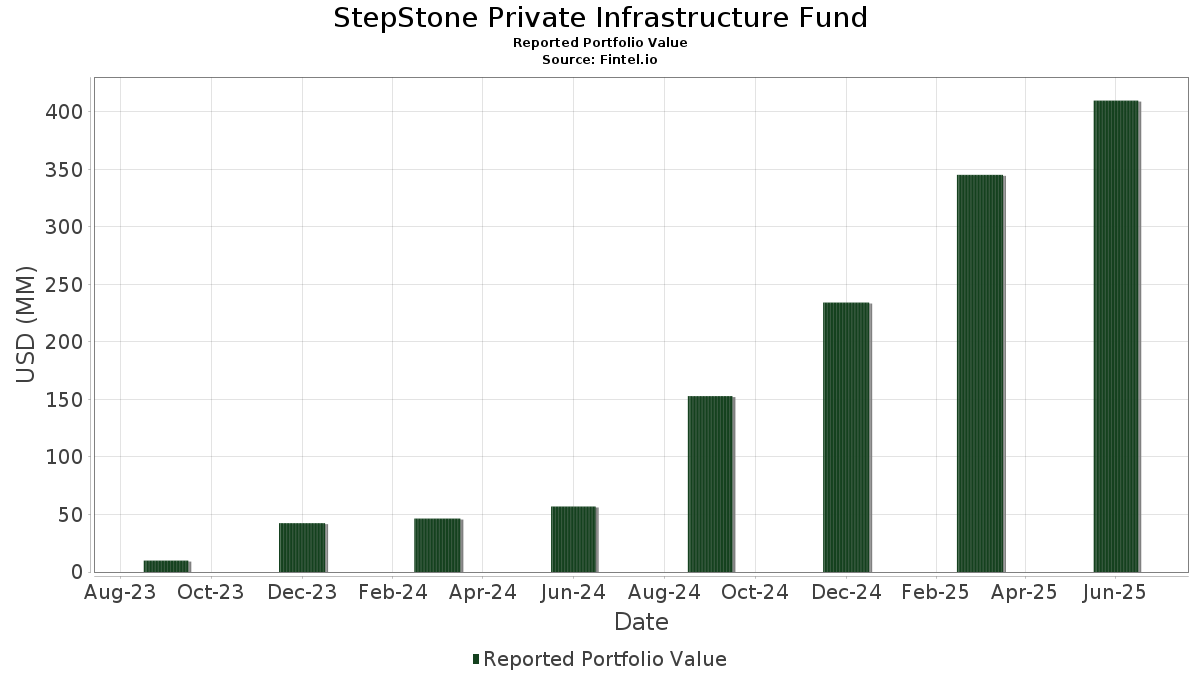

| Porteføljeverdi | $ 409 896 360 |

| Nåværende posisjoner | 51 |

Siste beholdninger, prestasjoner, forvaltet kapital (fra 13F, 13D)

StepStone Private Infrastructure Fund har oppgitt 51 totale beholdninger i sine siste SEC-arkiveringer. Siste porteføljeverdi er beregnet til 409 896 360 USD. Faktisk forvaltet kapital (AUM) er denne verdien pluss kontanter (som ikke er oppgitt). StepStone Private Infrastructure Funds største beholdninger er Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I (US:FIGXX) . StepStone Private Infrastructure Funds nye posisjoner inkluderer Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I (US:FIGXX) .

De største økningene dette kvartalet

Vi bruker endringen i porteføljeallokeringen fordi dette er det mest meningsfulle målet. Endringer kan skyldes handler eller endringer i aksjekursene.

| Verdipapirer | Aksjer (MM) |

Verdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 34,16 | 6,1428 | 6,1428 | ||

| 22,00 | 3,9555 | 3,9555 | ||

| 16,93 | 3,0439 | 3,0439 | ||

| 13,60 | 2,4455 | 2,4455 | ||

| 12,39 | 2,2279 | 2,2279 | ||

| 12,31 | 2,2142 | 2,2142 | ||

| 11,16 | 2,0061 | 2,0061 | ||

| 10,81 | 1,9445 | 1,9445 | ||

| 10,81 | 1,9445 | 1,9445 | ||

| 10,13 | 1,8215 | 1,8215 |

De største reduksjonene dette kvartalet

Vi bruker endringen i porteføljeallokeringen fordi dette er det mest meningsfulle målet. Endringer kan skyldes handler eller endringer i aksjekurser.

| Verdipapirer | Aksjer (MM) |

Verdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 81,26 | 14,6135 | −6,0273 |

13F- og Fondsarkiveringer

Dette skjemaet ble sendt inn den 2025-08-29 for rapporteringsperioden 2025-06-30. Denne investoren har ikke oppgitt verdipapirer som regnes i aksjer, så de aksjerelaterte kolonnene i tabellen nedenfor er utelatt. Klikk på lenkeikonet for å se hele transaksjonshistorikken.

Oppgradere for å låse opp premiedata og eksportere til Excel![]() .

.

| Verdipapirer | Type | ΔAksjer (%) |

Verdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|

| FIGXX / Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I | 81,26 | 0,81 | 14,6135 | −6,0273 | ||

| Global Infrastructure Partners IV-C, L.P. / (999999999) | 34,16 | 6,1428 | 6,1428 | |||

| MML Keystone SCSp / (999999999) | 22,00 | 3,9555 | 3,9555 | |||

| KKR Dino Co-Invest L.P. / (999999999) | 16,93 | 3,0439 | 3,0439 | |||

| EQT Active Core Infrastructure Co-Investment (G) SCSP / (999999999) | 13,60 | 2,4455 | 2,4455 | |||

| Verrus, LLC / ABS-CBDO (999999999) | 12,39 | 2,2279 | 2,2279 | |||

| Blue Road Capital PV II, L.P. / (999999999) | 12,31 | 2,2142 | 2,2142 | |||

| KKR Global Infrastructure Investors IV (EUR) SCSp / (999999999) | 11,16 | 2,0061 | 2,0061 | |||

| EQT Infrastructure V (No.1) EUR SCSp / (999999999) | 10,81 | 1,9445 | 1,9445 | |||

| EQT Infrastructure V (No.1) EUR SCSp / (999999999) | 10,81 | 1,9445 | 1,9445 | |||

| KKR Global Infrastructure Investors IV (USD) SCSp / (999999999) | 10,13 | 1,8215 | 1,8215 | |||

| KKR Global Infrastructure Investors IV (USD) SCSp / (999999999) | 10,13 | 1,8215 | 1,8215 | |||

| EQT Infrastructure IV (No.2) USD SCSp / (999999999) | 9,17 | 1,6499 | 1,6499 | |||

| Strategic Value Spurs A, L.P. / (999999999) | 9,12 | 1,6405 | 1,6405 | |||

| Macquarie European Infrastructure Fund 6 SCSp / (999999999) | 8,86 | 1,5939 | 1,5939 | |||

| KKR Global Infrastructure Investors III EEA (EUR) SCSp / (999999999) | 6,40 | 1,1503 | 1,1503 | |||

| KKR Global Infrastructure Investors III EEA (EUR) SCSp / (999999999) | 6,40 | 1,1503 | 1,1503 | |||

| Oak Hill Digital Opportunities Partners (TE 892), L.P. / (999999999) | 6,32 | 1,1362 | 1,1362 | |||

| InfraVia European Fund V FPCI / (999999999) | 6,07 | 1,0914 | 1,0914 | |||

| ECP V (California Co-Invest), LP / (999999999) | 6,01 | 1,0817 | 1,0817 | |||

| DIF Core Infrastructure Fund II SCSp / (999999999) | 5,87 | 1,0561 | 1,0561 | |||

| ARDIAN Infrastructure Fund IV S.C.A., SICAR / (999999999) | 5,82 | 1,0458 | 1,0458 | |||

| Compass European Infrastructure SCSp / (999999999) | 5,65 | 1,0167 | 1,0167 | |||

| InfraVia European Fund III SCSp / (999999999) | 5,48 | 0,9846 | 0,9846 | |||

| GIP Pegasus Fund, L.P. / (999999999) | 5,44 | 0,9774 | 0,9774 | |||

| KKR Devonshire Co-Invest L.P. / (999999999) | 5,43 | 0,9772 | 0,9772 | |||

| Daiwa ICP Infrastructure Investments 2 L.P. / (999999999) | 5,39 | 0,9702 | 0,9702 | |||

| DIF Infrastructure VI SCSp / (999999999) | 5,20 | 0,9354 | 0,9354 | |||

| ARDIAN Infrastructure Fund V S.C.A., SICAR / (999999999) | 5,15 | 0,9265 | 0,9265 | |||

| NIC Battery Acquisition LP / (999999999) | 5,14 | 0,9244 | 0,9244 | |||

| KKR Optics Co-Invest Blocker L.P. / (999999999) | 4,81 | 0,8659 | 0,8659 | |||

| InfraVia European Fund IV FPCI / (999999999) | 4,62 | 0,8306 | 0,8306 | |||

| Pan-European Infrastructure III, SCSp / (999999999) | 4,61 | 0,8284 | 0,8284 | |||

| Stonepeak Ace (Co-Invest) Holdings (CYM) LP / (999999999) | 4,45 | 0,7995 | 0,7995 | |||

| Buckeye Co-Invest II, LP / (999999999) | 4,44 | 0,7986 | 0,7986 | |||

| Brookfield Infrastructure Fund IV (ER) SCSP / (999999999) | 4,41 | 0,7930 | 0,7930 | |||

| InfraVia European Fund III FPCI / (999999999) | 4,30 | 0,7735 | 0,7735 | |||

| Global Infrastructure Partners III-C, L.P. / (999999999) | 3,28 | 0,5891 | 0,5891 | |||

| Pan-European Infrastructure II, S.C.S. / (999999999) | 3,18 | 0,5723 | 0,5723 | |||

| Sandbrook rPlus Co-Invest II LP / (999999999) | 3,11 | 0,5585 | 0,5585 | |||

| InstarAGF Essential Infrastructure Fund LP / (999999999) | 2,81 | 0,5057 | 0,5057 | |||

| iCON Infrastructure Partners III, L.P. / (999999999) | 2,06 | 0,3697 | 0,3697 | |||

| Brookfield Infrastructure Fund III-A, L.P. / (999999999) | 1,91 | 0,3437 | 0,3437 | |||

| Global Energy & Power Infrastructure Fund II, L.P. / (999999999) | 1,08 | 0,1935 | 0,1935 | |||

| Stonepeak Infrastructure Fund LP / (999999999) | 0,78 | 0,1399 | 0,1399 | |||

| KKR Global Infrastructure Investors II (EEA) L.P. / (999999999) | 0,46 | 0,0821 | 0,0821 | |||

| EQT Infrastructure Fund III (No.1) SCSp / (999999999) | 0,41 | 0,0737 | 0,0737 | |||

| Stonepeak Infrastructure Fund II LP / (999999999) | 0,23 | 0,0409 | 0,0409 | |||

| Brookfield Americas Infrastructure Fund, L.P. / (999999999) | 0,18 | 0,0321 | 0,0321 | |||

| EQT Infrastructure Fund II (No.1) SCSp / (999999999) | 0,18 | 0,0315 | 0,0315 | |||

| Antin Infrastructure Partners II LP / (999999999) | 0,00 | 0,0002 | 0,0002 |