Grunnleggende statistikk

| Porteføljeverdi | $ 1 862 202 159 |

| Nåværende posisjoner | 1 030 |

Siste beholdninger, prestasjoner, forvaltet kapital (fra 13F, 13D)

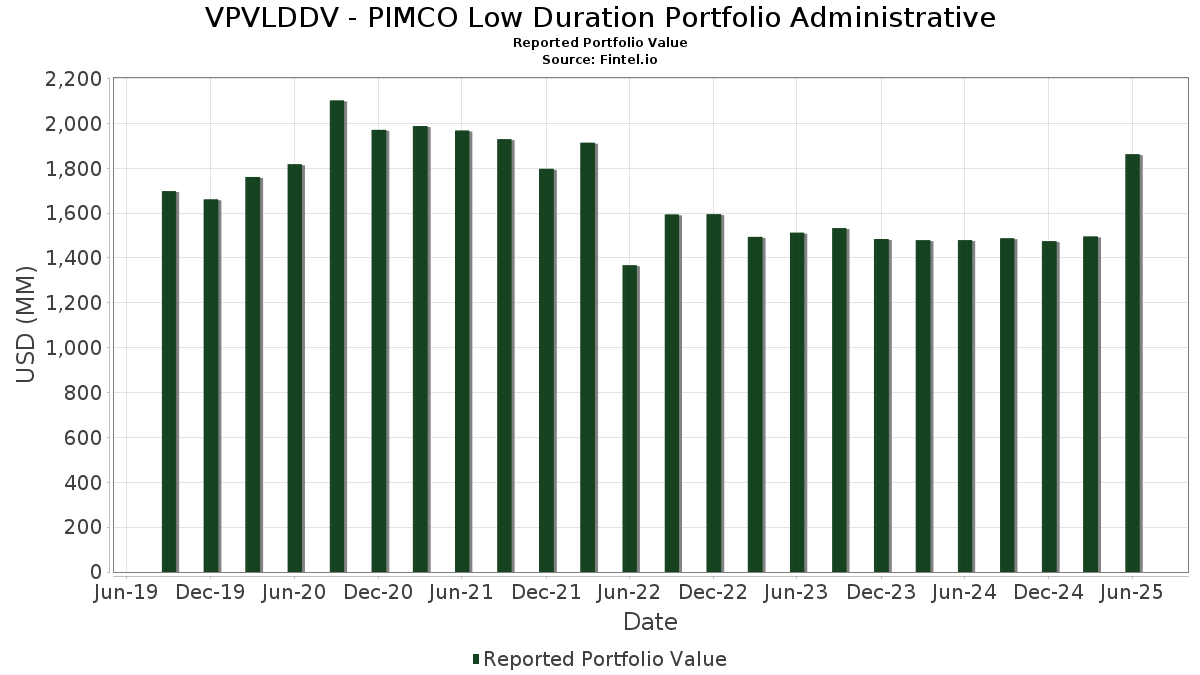

VPVLDDV - PIMCO Low Duration Portfolio Administrative har oppgitt 1 030 totale beholdninger i sine siste SEC-arkiveringer. Siste porteføljeverdi er beregnet til 1 862 202 159 USD. Faktisk forvaltet kapital (AUM) er denne verdien pluss kontanter (som ikke er oppgitt). VPVLDDV - PIMCO Low Duration Portfolio Administratives største beholdninger er TREASURY NOTE (US:US91282CHB00) , Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , PIMCO ST FLOATING NAV PORT IV MUTUAL FUND (US:US72202G3801) , United States Treasury Note/Bond (US:US91282CGE57) , and Edwards Lifesciences Corporation (US:EW) . VPVLDDV - PIMCO Low Duration Portfolio Administratives nye posisjoner inkluderer TREASURY NOTE (US:US91282CHB00) , Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , PIMCO ST FLOATING NAV PORT IV MUTUAL FUND (US:US72202G3801) , United States Treasury Note/Bond (US:US91282CGE57) , and Edwards Lifesciences Corporation (US:EW) .

De største økningene dette kvartalet

Vi bruker endringen i porteføljeallokeringen fordi dette er det mest meningsfulle målet. Endringer kan skyldes handler eller endringer i aksjekursene.

| Verdipapirer | Aksjer (MM) |

Verdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 141,84 | 10,6103 | 10,6103 | ||

| 94,40 | 7,0617 | 7,0617 | ||

| 94,40 | 7,0617 | 7,0617 | ||

| 15,80 | 1,1819 | 1,1819 | ||

| 122,35 | 9,1525 | 0,4870 | ||

| 151,05 | 11,2995 | 0,4686 | ||

| 6,00 | 0,4489 | 0,4489 | ||

| 6,00 | 0,4489 | 0,4489 | ||

| 5,30 | 0,3965 | 0,3965 | ||

| 5,30 | 0,3965 | 0,3965 |

De største reduksjonene dette kvartalet

Vi bruker endringen i porteføljeallokeringen fordi dette er det mest meningsfulle målet. Endringer kan skyldes handler eller endringer i aksjekurser.

| Verdipapirer | Aksjer (MM) |

Verdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 16,06 | 1,2017 | −1,9397 | ||

| 27,21 | 2,0353 | −0,8701 | ||

| −54,60 | −4,0841 | −0,2284 | ||

| −2,56 | −0,1915 | −0,1915 | ||

| 2,25 | 0,1681 | −0,1539 | ||

| −31,06 | −2,3232 | −0,1315 | ||

| −0,91 | −0,0683 | −0,0683 | ||

| −0,91 | −0,0683 | −0,0683 | ||

| −0,86 | −0,0646 | −0,0646 | ||

| −0,86 | −0,0646 | −0,0646 |

13F- og Fondsarkiveringer

Dette skjemaet ble sendt inn den 2025-08-29 for rapporteringsperioden 2025-06-30. Denne investoren har ikke oppgitt verdipapirer som regnes i aksjer, så de aksjerelaterte kolonnene i tabellen nedenfor er utelatt. Klikk på lenkeikonet for å se hele transaksjonshistorikken.

Oppgradere for å låse opp premiedata og eksportere til Excel![]() .

.

| Verdipapirer | Type | ΔAksjer (%) |

Verdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|

| US91282CHB00 / TREASURY NOTE | 151,05 | 0,07 | 11,2995 | 0,4686 | ||

| US01F0606834 / Uniform Mortgage-Backed Security, TBA | 141,84 | 10,6103 | 10,6103 | |||

| US72202G3801 / PIMCO ST FLOATING NAV PORT IV MUTUAL FUND | 122,35 | 1,31 | 9,1525 | 0,4870 | ||

| REPO BANK AMERICA REPO / RA (000000000) | 94,40 | 7,0617 | 7,0617 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 94,40 | 7,0617 | 7,0617 | |||

| FNMA POOL MA5387 FN 06/54 FIXED 5 / ABS-MBS (US31418E6Z86) | 70,54 | −1,75 | 5,2769 | 0,1252 | ||

| FNMA POOL MA5387 FN 06/54 FIXED 5 / ABS-MBS (US31418E6Z86) | 70,54 | −1,75 | 5,2769 | 0,1252 | ||

| US91282CGE57 / United States Treasury Note/Bond | 53,03 | 0,03 | 3,9671 | 0,1631 | ||

| EW / Edwards Lifesciences Corporation | 38,22 | 0,40 | 2,8592 | 0,1275 | ||

| US3134GWZV19 / FHLMC | 28,77 | 0,89 | 2,1523 | 0,1062 | ||

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 27,21 | −32,81 | 2,0353 | −0,8701 | ||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 23,10 | 8,57 | 1,7278 | 0,2013 | ||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 23,10 | 8,57 | 1,7278 | 0,2013 | ||

| US3134GW5R39 / FREDDIE MAC 0.65 10/25 | 19,37 | 0,94 | 1,4489 | 0,0721 | ||

| US3134GWJN76 / FREDDIE MAC NOTES 08/25 0.68 | 18,73 | 0,90 | 1,4010 | 0,0692 | ||

| US01F0506844 / UMBS TBA | 16,06 | −65,02 | 1,2017 | −1,9397 | ||

| CITIGROUP REPO REPO 5807 / RA (000000000) | 15,80 | 1,1819 | 1,1819 | |||

| US31418ET595 / FNCL UMBS 5.0 MA5071 07-01-53 | 15,39 | −2,01 | 1,1513 | 0,0243 | ||

| US38382YC277 / GOVERNMENT NATIONAL MORTGAGE A GNR 2022 H24 BF | 12,63 | 0,13 | 0,9447 | 0,0397 | ||

| US3140MJ6N00 / FNMA POOL BV5376 FN 04/52 FIXED 3 | 12,37 | −1,28 | 0,9254 | 0,0263 | ||

| US3134GW6C50 / FEDERAL HOME LOAN MORTGAGE CORP 0.80000000 | 11,32 | 0,86 | 0,8468 | 0,0415 | ||

| US38382YC921 / GOVERNMENT NATIONAL MORTGAGE A GNR 2022 H24 FD | 11,04 | 0,05 | 0,8259 | 0,0341 | ||

| US01F0526800 / Uniform Mortgage-Backed Security, TBA | 10,29 | 1,31 | 0,7698 | 0,0409 | ||

| US91282CEZ05 / U.S. Treasury Inflation Linked Notes | 9,48 | 0,91 | 0,7090 | 0,0351 | ||

| US3140QNGC08 / Fannie Mae Pool | 9,32 | −1,94 | 0,6970 | 0,0153 | ||

| US91282CGK18 / U.S. Treasury Inflation Linked Notes | 9,06 | 0,75 | 0,6777 | 0,0324 | ||

| US3140Q7S730 / FNMA POOL CA0541 FN 10/47 FIXED 3.5 | 8,76 | −0,48 | 0,6551 | 0,0238 | ||

| US TREASURY N/B 04/26 4.875 / DBT (US91282CKK61) | 8,65 | −0,23 | 0,6474 | 0,0250 | ||

| US TREASURY N/B 04/26 4.875 / DBT (US91282CKK61) | 8,65 | −0,23 | 0,6474 | 0,0250 | ||

| US3140Q7XY81 / FNMA POOL CA0694 FN 11/47 FIXED 3.5 | 7,66 | −2,38 | 0,5733 | 0,0100 | ||

| US38383KEA60 / GOVERNMENT NATIONAL MORTGAGE A GNR 2023 H21 FA | 6,94 | −1,70 | 0,5188 | 0,0125 | ||

| US3140Q75W33 / FNMA POOL CA0860 FN 12/47 FIXED 3.5 | 6,69 | −0,95 | 0,5008 | 0,0159 | ||

| US3140QNS866 / FNMA POOL CB3242 FN 04/52 FIXED 3 | 6,53 | −2,19 | 0,4885 | 0,0095 | ||

| US3140QNUC42 / Federal National Mortgage Association | 6,50 | −1,75 | 0,4861 | 0,0115 | ||

| XS2419216622 / Toro European CLO 7 DAC | 6,25 | 7,90 | 0,4679 | 0,0519 | ||

| US3140QNUB68 / Federal National Mortgage Association | 6,04 | −2,12 | 0,4519 | 0,0090 | ||

| FED HM LN PC POOL SD7578 FR 04/55 FIXED 6 / ABS-MBS (US3132DVM362) | 6,00 | 0,4489 | 0,4489 | |||

| FED HM LN PC POOL SD7578 FR 04/55 FIXED 6 / ABS-MBS (US3132DVM362) | 6,00 | 0,4489 | 0,4489 | |||

| US22877LAA52 / CRSNT Trust 2021-MOON | 5,93 | 0,24 | 0,4434 | 0,0191 | ||

| US912828XL95 / United States Treasury Inflation Indexed Bonds | 5,61 | 0,77 | 0,4197 | 0,0202 | ||

| FREDDIE MAC FHR 5513 MF / ABS-MBS (US3137HKEX87) | 5,42 | −5,18 | 0,4051 | −0,0047 | ||

| FREDDIE MAC FHR 5513 MF / ABS-MBS (US3137HKEX87) | 5,42 | −5,18 | 0,4051 | −0,0047 | ||

| CARLYLE GLOBAL MARKET STRATEGI CGMSE 2025 1A A1 144A / ABS-CBDO (XS3065225669) | 5,30 | 0,3965 | 0,3965 | |||

| CARLYLE GLOBAL MARKET STRATEGI CGMSE 2025 1A A1 144A / ABS-CBDO (XS3065225669) | 5,30 | 0,3965 | 0,3965 | |||

| US86562MCA62 / Sumitomo Mitsui Financial Group Inc | 5,30 | 0,72 | 0,3962 | 0,0190 | ||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/28 5.05 / DBT (US928668CP53) | 5,23 | 9,00 | 0,3913 | 0,0469 | ||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/28 5.05 / DBT (US928668CP53) | 5,23 | 9,00 | 0,3913 | 0,0469 | ||

| INTC / Intel Corporation - Depositary Receipt (Common Stock) | 5,15 | 0,3852 | 0,3852 | |||

| INTC / Intel Corporation - Depositary Receipt (Common Stock) | 5,15 | 0,3852 | 0,3852 | |||

| US05571AAQ85 / BPCE SA | 5,12 | −0,33 | 0,3830 | 0,0144 | ||

| US29278GAZ19 / Enel Finance International NV | 5,03 | −0,36 | 0,3763 | 0,0141 | ||

| US46647PCQ72 / JPMorgan Chase & Co | 5,01 | −0,12 | 0,3750 | 0,0148 | ||

| US00130HCE36 / CORP. NOTE | 5,00 | 0,87 | 0,3743 | 0,0184 | ||

| XS2418762923 / Madison Park Euro Funding XIV DAC | 4,92 | 8,25 | 0,3681 | 0,0419 | ||

| US20268JAE38 / CommonSpirit Health | 4,86 | 0,79 | 0,3636 | 0,0176 | ||

| US26210YAA47 / DROP Mortgage Trust, Series 2021-FILE, Class A | 4,86 | 2,04 | 0,3633 | 0,0218 | ||

| XS2373706519 / Carlyle Euro CLO 2019-2 DAC | 4,85 | 8,40 | 0,3632 | 0,0418 | ||

| US404280DU06 / HSBC Holdings PLC | 4,68 | 0,32 | 0,3501 | 0,0154 | ||

| US251526CN70 / Deutsche Bank AG/New York NY | 4,60 | −0,37 | 0,3442 | 0,0128 | ||

| US06738EBZ79 / Barclays PLC | 4,50 | −0,16 | 0,3367 | 0,0132 | ||

| US87166PAL58 / SYNIT 23-A2 A 5.74% 10-15-29/26 | 4,48 | −0,18 | 0,3353 | 0,0131 | ||

| US62955HAA59 / NYO COMMERCIAL MORTGAGE TRUST 2021-1290 SER 2021-1290 CL A V/R REGD 144A P/P 1.17500000 | 4,39 | 0,55 | 0,3287 | 0,0151 | ||

| US87166FAD50 / Synchrony Bank | 4,30 | −0,16 | 0,3216 | 0,0126 | ||

| US3140QNKS04 / FNMA POOL CB3004 FN 02/52 FIXED 3 | 4,25 | −1,53 | 0,3180 | 0,0082 | ||

| US225401AY40 / Credit Suisse Group AG | 4,20 | −0,31 | 0,3145 | 0,0119 | ||

| US87020PAT49 / Swedbank AB | 4,18 | 0,43 | 0,3130 | 0,0140 | ||

| US63874AAA60 / NCMS 2021 APPL A 144A | 4,16 | 0,73 | 0,3111 | 0,0148 | ||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 4,14 | 0,3101 | 0,3101 | |||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 4,14 | 0,3101 | 0,3101 | |||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 4,14 | 0,00 | 0,3098 | 0,0126 | ||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 4,14 | 0,00 | 0,3098 | 0,0126 | ||

| US 2YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 4,13 | 0,3092 | 0,3092 | |||

| US 2YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 4,13 | 0,3092 | 0,3092 | |||

| US38145GAM24 / Goldman Sachs Group Inc/The | 4,11 | −0,27 | 0,3071 | 0,0117 | ||

| US14040HCU77 / Capital One Financial Corp | 4,10 | −0,05 | 0,3067 | 0,0124 | ||

| US59217GFC87 / Metropolitan Life Global Funding I | 4,10 | 0,10 | 0,3064 | 0,0128 | ||

| US87277JAA97 / TRTX 2022-FL5 Issuer Ltd | 4,07 | −8,00 | 0,3048 | −0,0129 | ||

| US294429AV70 / Equifax, Inc. | 4,07 | 0,30 | 0,3041 | 0,0132 | ||

| US55285AAA51 / MF1 2022-FL9 LLC SER 2022-FL9 CL A V/R REGD 144A P/P 2.96000000 | 4,06 | −4,47 | 0,3037 | −0,0012 | ||

| HYUNDAI CAPITAL AMERICA HYUNDAI CAPITAL AMERICA / DBT (US44891ACW53) | 4,02 | −0,47 | 0,3011 | 0,0109 | ||

| HYUNDAI CAPITAL AMERICA HYUNDAI CAPITAL AMERICA / DBT (US44891ACW53) | 4,02 | −0,47 | 0,3011 | 0,0109 | ||

| ABN / ABN AMRO Bank N.V. - Depositary Receipt (Common Stock) | 3,94 | 0,33 | 0,2944 | 0,0129 | ||

| REPUBLIC OF POLAND REPUBLIC OF POLAND / DBT (US731011AX08) | 3,91 | 1,40 | 0,2926 | 0,0159 | ||

| REPUBLIC OF POLAND REPUBLIC OF POLAND / DBT (US731011AX08) | 3,91 | 1,40 | 0,2926 | 0,0159 | ||

| US38380QGA40 / GOVERNMENT NATIONAL MORTGAGE A GNR 2020 H14 FH | 3,90 | −0,10 | 0,2915 | 0,0116 | ||

| US12564NAA00 / CLNY Trust 2019-IKPR | 3,83 | −11,41 | 0,2863 | −0,0236 | ||

| FANNIE MAE FNR 2024 90 FA / ABS-MBS (US3136BTXB47) | 3,74 | −9,49 | 0,2797 | −0,0167 | ||

| FANNIE MAE FNR 2024 90 FA / ABS-MBS (US3136BTXB47) | 3,74 | −9,49 | 0,2797 | −0,0167 | ||

| ATHENE GLOBAL FUNDING SECURED 144A 07/26 VAR / DBT (US04685A4J75) | 3,71 | 0,08 | 0,2772 | 0,0116 | ||

| ATHENE GLOBAL FUNDING SECURED 144A 07/26 VAR / DBT (US04685A4J75) | 3,71 | 0,08 | 0,2772 | 0,0116 | ||

| US68784HAD35 / OSCAR US FUNDING XIV LLC | 3,71 | −16,55 | 0,2772 | −0,0415 | ||

| 4020 / Saudi Real Estate Company | 3,66 | 0,41 | 0,2739 | 0,0123 | ||

| 4020 / Saudi Real Estate Company | 3,66 | 0,41 | 0,2739 | 0,0123 | ||

| US37046US851 / General Motors Financial Co Inc | 3,65 | 0,50 | 0,2733 | 0,0125 | ||

| US01F0226831 / FEDERAL NATIONAL MORTGAGE ASSOCIATION 30YR TBA AUG | 3,65 | 1,45 | 0,2730 | 0,0149 | ||

| US55284JAA79 / MF1 2022-FL8 Ltd | 3,64 | −12,57 | 0,2726 | −0,0265 | ||

| US902674ZV55 / UBS AG/London | 3,61 | −0,25 | 0,2700 | 0,0103 | ||

| US04965JAA16 / Atrium Hotel Portfolio Trust 2017-ATRM | 3,53 | −0,51 | 0,2644 | 0,0095 | ||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 3,53 | 0,17 | 0,2638 | 0,0112 | ||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 3,53 | 0,17 | 0,2638 | 0,0112 | ||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 3,48 | 0,58 | 0,2600 | 0,0120 | ||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 3,48 | 0,58 | 0,2600 | 0,0120 | ||

| US48275EAA47 / KREF 2022-FL3 Ltd | 3,46 | −13,55 | 0,2591 | −0,0284 | ||

| US53946PAA84 / LoanCore 2022-CRE7 Issuer Ltd | 3,45 | −5,51 | 0,2578 | −0,0039 | ||

| US36265LAB36 / GS MORTGAGE BACKED SECURITIES GSMBS 2022 HP1 A2 144A | 3,39 | −2,42 | 0,2539 | 0,0043 | ||

| MORGAN STANLEY BANK NA SR UNSECURED 01/29 VAR / DBT (US61690DK726) | 3,35 | 0,36 | 0,2508 | 0,0111 | ||

| MORGAN STANLEY BANK NA SR UNSECURED 01/29 VAR / DBT (US61690DK726) | 3,35 | 0,36 | 0,2508 | 0,0111 | ||

| US67114WAA99 / ONSLOW BAY FINANCIAL LLC OBX 2022 INV2 A1 144A | 3,35 | −2,02 | 0,2504 | 0,0053 | ||

| US00192NAA54 / AOA 2021-1177 Mortgage Trust | 3,26 | 1,50 | 0,2436 | 0,0134 | ||

| US61755CAD48 / Morgan Stanley ABS Capital I Incorporated Trust | 3,25 | −1,69 | 0,2434 | 0,0059 | ||

| CASSA DEPOSITI E PRESTIT SR UNSECURED 144A 04/29 5.875 / DBT (US147918AC06) | 3,25 | 0,71 | 0,2427 | 0,0115 | ||

| CASSA DEPOSITI E PRESTIT SR UNSECURED 144A 04/29 5.875 / DBT (US147918AC06) | 3,25 | 0,71 | 0,2427 | 0,0115 | ||

| FREDDIE MAC FHR 5511 FB / ABS-MBS (US3137HKKK92) | 3,24 | −5,95 | 0,2424 | −0,0048 | ||

| FREDDIE MAC FHR 5511 FB / ABS-MBS (US3137HKKK92) | 3,24 | −5,95 | 0,2424 | −0,0048 | ||

| US80281LAS43 / SANTANDER UK GROUP HOLDINGS PLC | 3,23 | −0,43 | 0,2414 | 0,0088 | ||

| BANK OF AMERICA CORP SR UNSECURED 05/29 VAR / DBT (US06051GMT30) | 3,22 | 0,2409 | 0,2409 | |||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 3,19 | 0,2390 | 0,2390 | |||

| US639057AG33 / NatWest Group PLC | 3,13 | −0,67 | 0,2342 | 0,0081 | ||

| US46647PDW32 / JPMorgan Chase & Co | 3,07 | −0,20 | 0,2294 | 0,0090 | ||

| US86562MCT53 / Sumitomo Mitsui Financial Group Inc | 3,02 | −0,23 | 0,2256 | 0,0087 | ||

| US74153WCR88 / Pricoa Global Funding I | 3,00 | 0,07 | 0,2242 | 0,0093 | ||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 2,95 | 0,2204 | 0,2204 | |||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 2,95 | 0,2204 | 0,2204 | |||

| ADNOC MURBAN RSC LTD ADNOC MURBAN RSC LTD / DBT (US00723L2A68) | 2,89 | 1,37 | 0,2161 | 0,0116 | ||

| US38382Y5K59 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2023-H12 CL FA V/R 6.06629000 | 2,88 | −2,34 | 0,2152 | 0,0039 | ||

| FANNIE MAE FNR 2025 19 FC / ABS-MBS (US3136BVBY34) | 2,86 | −4,06 | 0,2140 | 0,0001 | ||

| IBM / International Business Machines Corporation - Depositary Receipt (Common Stock) | 2,83 | 0,50 | 0,2119 | 0,0097 | ||

| IBM / International Business Machines Corporation - Depositary Receipt (Common Stock) | 2,83 | 0,50 | 0,2119 | 0,0097 | ||

| MERCEDES BENZ FIN NA COMPANY GUAR 144A 03/28 4.75 / DBT (US58769JBE64) | 2,82 | 0,75 | 0,2112 | 0,0101 | ||

| MERCEDES BENZ FIN NA COMPANY GUAR 144A 03/28 4.75 / DBT (US58769JBE64) | 2,82 | 0,75 | 0,2112 | 0,0101 | ||

| US3140J5TD14 / FNMA POOL BM1447 FN 07/47 FIXED VAR | 2,81 | −1,99 | 0,2102 | 0,0045 | ||

| FNMA POOL BL0449 FN 12/25 FIXED 3.59 / ABS-MBS (US3140HRQB20) | 2,78 | 0,14 | 0,2081 | 0,0088 | ||

| FNMA POOL BL0449 FN 12/25 FIXED 3.59 / ABS-MBS (US3140HRQB20) | 2,78 | 0,14 | 0,2081 | 0,0088 | ||

| FNMA POOL BL1942 FN 03/26 FIXED 3.15 / ABS-MBS (US3140HTEQ82) | 2,77 | 0,22 | 0,2073 | 0,0089 | ||

| FNMA POOL BL1942 FN 03/26 FIXED 3.15 / ABS-MBS (US3140HTEQ82) | 2,77 | 0,22 | 0,2073 | 0,0089 | ||

| XS1150797600 / EUROSAIL PLC ESAIL 2007 4X A3 REGS | 2,74 | −9,88 | 0,2047 | −0,0131 | ||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 2,72 | 0,2036 | 0,2036 | |||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 2,72 | 0,2036 | 0,2036 | |||

| CCG RECEIVABLES TRUST CCG 2025 1 A2 144A / ABS-O (US12515XAB64) | 2,71 | 0,11 | 0,2025 | 0,0085 | ||

| US38376RJR84 / GOVERNMENT NATIONAL MORTGAGE A GNR 2015 H26 FA | 2,70 | −16,14 | 0,2021 | −0,0290 | ||

| BMW US CAPITAL LLC COMPANY GUAR 144A 03/28 4.75 / DBT (US05565ECW30) | 2,70 | 9,09 | 0,2021 | 0,0244 | ||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 2,69 | 0,2014 | 0,2014 | |||

| US03880RAA77 / Arbor Realty Collateralized Loan Obligation Ltd | 2,68 | −15,78 | 0,2005 | −0,0278 | ||

| US04002VAA98 / AREIT Trust, Series 2022-CRE6, Class A | 2,65 | −0,26 | 0,1979 | 0,0076 | ||

| US38376R6F85 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2017-H15 CL FE V/R 3.31025000 | 2,63 | −11,56 | 0,1970 | −0,0167 | ||

| US44891ACL98 / Hyundai Capital America | 2,60 | −0,15 | 0,1946 | 0,0076 | ||

| FREDDIE MAC FHR 5557 FM / ABS-MBS (US3137HLZ217) | 2,60 | 0,1946 | 0,1946 | |||

| FREDDIE MAC FHR 5557 FM / ABS-MBS (US3137HLZ217) | 2,60 | 0,1946 | 0,1946 | |||

| FHR 5557 FM SOFR30A+110BP / ABS-MBS (955TAMII5) | 2,60 | 0,1944 | 0,1944 | |||

| FHR 5557 FM SOFR30A+110BP / ABS-MBS (955TAMII5) | 2,60 | 0,1944 | 0,1944 | |||

| US86360PAE79 / STRUCTURED ASSET SECURITIES CO SASC 2006 NC1 A5 | 2,58 | −3,63 | 0,1928 | 0,0009 | ||

| CNQ / Canadian Natural Resources Limited | 2,54 | 0,1898 | 0,1898 | |||

| CNQ / Canadian Natural Resources Limited | 2,54 | 0,1898 | 0,1898 | |||

| CITIBANK NA CITIBANK NA / DBT (US17325FBF45) | 2,52 | −0,32 | 0,1885 | 0,0072 | ||

| GM FINANCIAL AUTOMOBILE LEASIN GMALT 2025 1 A3 / ABS-O (US36271VAD91) | 2,52 | 0,16 | 0,1884 | 0,0080 | ||

| GM FINANCIAL AUTOMOBILE LEASIN GMALT 2025 1 A3 / ABS-O (US36271VAD91) | 2,52 | 0,16 | 0,1884 | 0,0080 | ||

| FREDDIE MAC FHR 5442 FB / ABS-MBS (US3137HF4U64) | 2,51 | −8,02 | 0,1880 | −0,0081 | ||

| FREDDIE MAC FHR 5442 FB / ABS-MBS (US3137HF4U64) | 2,51 | −8,02 | 0,1880 | −0,0081 | ||

| FANNIE MAE FNR 2024 90 ED / ABS-MBS (US3136BTYL10) | 2,51 | −3,69 | 0,1876 | 0,0007 | ||

| FANNIE MAE FNR 2024 90 ED / ABS-MBS (US3136BTYL10) | 2,51 | −3,69 | 0,1876 | 0,0007 | ||

| US38382YV269 / GOVERNMENT NATIONAL MORTGAGE A GNR 2023 H05 JF | 2,47 | −0,96 | 0,1850 | 0,0058 | ||

| DANSKE / Danske Bank A/S | 2,44 | 0,08 | 0,1827 | 0,0076 | ||

| DANSKE / Danske Bank A/S | 2,44 | 0,08 | 0,1827 | 0,0076 | ||

| US14686TAC27 / CARVANA AUTO RECEIVABLES TRUST CRVNA 2023 P2 A3 144A | 2,44 | −22,47 | 0,1826 | −0,0433 | ||

| US07335YAA47 / BDS 2021-FL10 LTD / BDS 2021-FL10 LLC 1ML+135 12/18/2036 144A | 2,42 | −18,08 | 0,1807 | −0,0309 | ||

| US83206NAB38 / SMB PRIVATE EDUCATION LOAN TRUST 2022-B SER 2022-B CL A1B V/R REGD 144A P/P 1.83000000 | 2,36 | −5,06 | 0,1768 | −0,0018 | ||

| CHESAPEAKE FUNDING II LLC CFII 2024 1A A1 144A / ABS-O (US165183DE19) | 2,34 | −11,69 | 0,1747 | −0,0150 | ||

| FREDDIE MAC FHR 5517 FE / ABS-MBS (US3137HKGJ75) | 2,31 | −6,25 | 0,1728 | −0,0040 | ||

| FREDDIE MAC FHR 5517 FE / ABS-MBS (US3137HKGJ75) | 2,31 | −6,25 | 0,1728 | −0,0040 | ||

| FREDDIE MAC FHR 5505 AF / ABS-MBS (US3137HJ6H53) | 2,29 | −6,58 | 0,1711 | −0,0046 | ||

| FREDDIE MAC FHR 5505 AF / ABS-MBS (US3137HJ6H53) | 2,29 | −6,58 | 0,1711 | −0,0046 | ||

| US83206NAA54 / SMB Private Education Loan Trust 2022-B | 2,28 | −4,04 | 0,1708 | 0,0001 | ||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 2,25 | 0,40 | 0,1686 | 0,0075 | ||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 2,25 | 0,40 | 0,1686 | 0,0075 | ||

| CH1230759495 / CREDIT SUISSE SCHWEIZ AG /EUR/ REGD REG S EMTN 3.39000000 | 2,25 | 8,70 | 0,1683 | 0,0198 | ||

| ATHENE GLOBAL FUNDING SECURED REGS 02/27 VAR / DBT (XS2757986224) | 2,25 | 8,86 | 0,1683 | 0,0200 | ||

| ATHENE GLOBAL FUNDING SECURED REGS 02/27 VAR / DBT (XS2757986224) | 2,25 | 8,86 | 0,1683 | 0,0200 | ||

| US42806MBA62 / Hertz Vehicle Financing LLC | 2,25 | −49,93 | 0,1681 | −0,1539 | ||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 2,25 | 0,1680 | 0,1680 | |||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 2,25 | 0,1680 | 0,1680 | |||

| US69291QAA31 / PFP III PFP 2022 9 A 144A | 2,24 | −21,87 | 0,1676 | −0,0381 | ||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2024 H11 FD / ABS-MBS (US38383KZS40) | 2,21 | −2,38 | 0,1656 | 0,0029 | ||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2024 H11 FD / ABS-MBS (US38383KZS40) | 2,21 | −2,38 | 0,1656 | 0,0029 | ||

| US00084DBC39 / ABN AMRO Bank NV | 2,21 | −0,45 | 0,1654 | 0,0060 | ||

| SANDSTONE PEAK LTD. SAND 2021 1A A1R 144A / ABS-CBDO (US800130AN66) | 2,20 | 0,05 | 0,1647 | 0,0068 | ||

| SANDSTONE PEAK LTD. SAND 2021 1A A1R 144A / ABS-CBDO (US800130AN66) | 2,20 | 0,05 | 0,1647 | 0,0068 | ||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 2,20 | 0,1644 | 0,1644 | |||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 2,20 | 0,1644 | 0,1644 | |||

| SANTANDER UK GROUP HLDGS SANTANDER UK GROUP HLDGS / DBT (US80281LAU98) | 2,20 | 0,83 | 0,1644 | 0,0080 | ||

| SANTANDER UK GROUP HLDGS SANTANDER UK GROUP HLDGS / DBT (US80281LAU98) | 2,20 | 0,83 | 0,1644 | 0,0080 | ||

| US78432WAA18 / SFO Commercial Mortgage Trust 2021-555 | 2,19 | 0,97 | 0,1639 | 0,0082 | ||

| US83207DAA63 / SMB PRIVATE EDUCATION LOAN TRUST 2023-C SER 2023-C CL A1A REGD 144A P/P 5.67000000 | 2,17 | −4,67 | 0,1620 | −0,0010 | ||

| US05583JAN28 / BPCE SA | 2,11 | −0,24 | 0,1582 | 0,0061 | ||

| FREDDIE MAC FHR 5508 DF / ABS-MBS (US3137HJG849) | 2,11 | −2,90 | 0,1578 | 0,0019 | ||

| FREDDIE MAC FHR 5508 DF / ABS-MBS (US3137HJG849) | 2,11 | −2,90 | 0,1578 | 0,0019 | ||

| JETD / MAX Airlines -3X Inverse Leveraged ETNs due May 28, 2043 - Structured Product | 2,11 | 0,19 | 0,1575 | 0,0067 | ||

| JETD / MAX Airlines -3X Inverse Leveraged ETNs due May 28, 2043 - Structured Product | 2,11 | 0,19 | 0,1575 | 0,0067 | ||

| US87276WAA18 / TPG Real Estate Finance Issuer LTD | 2,11 | −4,97 | 0,1575 | −0,0015 | ||

| US17305EGP43 / Citibank Credit Card Issuance Trust | 2,10 | −0,10 | 0,1572 | 0,0062 | ||

| US38383KDE91 / GOVERNMENT NATIONAL MORTGAGE A GNR 2023 H20 FE | 2,06 | −1,25 | 0,1542 | 0,0045 | ||

| KOREA EXPRESSWAY CORP KOREA EXPRESSWAY CORP / DBT (US50066HAD08) | 2,03 | 0,10 | 0,1520 | 0,0064 | ||

| KOREA EXPRESSWAY CORP KOREA EXPRESSWAY CORP / DBT (US50066HAD08) | 2,03 | 0,10 | 0,1520 | 0,0064 | ||

| DGZ / DB Gold Short ETN | 2,02 | 1,26 | 0,1508 | 0,0079 | ||

| DGZ / DB Gold Short ETN | 2,02 | 1,26 | 0,1508 | 0,0079 | ||

| US33830CAA80 / DBGS 2018-5BP Mortgage Trust | 2,01 | 2,39 | 0,1506 | 0,0095 | ||

| PROTECTIVE LIFE GLOBAL SECURED 144A 07/26 VAR / DBT (US743672AG20) | 2,00 | 0,00 | 0,1498 | 0,0061 | ||

| PROTECTIVE LIFE GLOBAL SECURED 144A 07/26 VAR / DBT (US743672AG20) | 2,00 | 0,00 | 0,1498 | 0,0061 | ||

| HOLCIM FIN US LLC 07/25 ZCP / DBT (US43475FUG52) | 2,00 | 0,1493 | 0,1493 | |||

| HOLCIM FIN US LLC 07/25 ZCP / DBT (US43475FUG52) | 2,00 | 0,1493 | 0,1493 | |||

| US05565ECE32 / BMW US CAPITAL LLC 144A LIFE SR UNSEC 5.05% 08-11-28 | 1,97 | 0,92 | 0,1471 | 0,0073 | ||

| US91282CEP23 / WI TREASURY N/B REGD 2.87500000 | 1,96 | 0,82 | 0,1466 | 0,0072 | ||

| FANNIE MAE FNR 2025 24 FB / ABS-MBS (US3136BVSA74) | 1,94 | −3,00 | 0,1451 | 0,0016 | ||

| FANNIE MAE FNR 2025 24 FB / ABS-MBS (US3136BVSA74) | 1,94 | −3,00 | 0,1451 | 0,0016 | ||

| US31418CLK89 / Fannie Mae Pool | 1,94 | −5,29 | 0,1448 | −0,0018 | ||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 1,92 | 0,37 | 0,1433 | 0,0063 | ||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 1,91 | −0,26 | 0,1430 | 0,0055 | ||

| STELLANTIS FINANCIAL UNDERWRIT SFUEL 2025 AA A2 144A / ABS-O (US858928AB07) | 1,91 | 0,1425 | 0,1425 | |||

| STELLANTIS FINANCIAL UNDERWRIT SFUEL 2025 AA A2 144A / ABS-O (US858928AB07) | 1,91 | 0,1425 | 0,1425 | |||

| US004421XW81 / ACE SECURITIES CORP. ACE 2006 SD1 M1 | 1,90 | −4,85 | 0,1424 | −0,0011 | ||

| ABU DHABI DEVELOPMENTAL ABU DHABI DEVELOPMENTAL / DBT (US00402D2A25) | 1,86 | 0,49 | 0,1388 | 0,0063 | ||

| ABU DHABI DEVELOPMENTAL ABU DHABI DEVELOPMENTAL / DBT (US00402D2A25) | 1,86 | 0,49 | 0,1388 | 0,0063 | ||

| US38383KCV26 / GNMA, Series 2023-H20, Class FA | 1,85 | −1,90 | 0,1387 | 0,0031 | ||

| US38375UWU05 / GOVERNMENT NATIONAL MORTGAGE A GNR 2016 H11 FJ | 1,84 | −22,55 | 0,1374 | −0,0328 | ||

| US38382YAZ60 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2021-H12 CL DF V/R 6.17700000 | 1,79 | −0,56 | 0,1340 | 0,0048 | ||

| US 5YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 1,72 | 0,1286 | 0,1286 | |||

| US 5YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 1,72 | 0,1286 | 0,1286 | |||

| C1PB34 / The Campbell's Company - Depositary Receipt (Common Stock) | 1,71 | −0,18 | 0,1278 | 0,0050 | ||

| C1PB34 / The Campbell's Company - Depositary Receipt (Common Stock) | 1,71 | −0,18 | 0,1278 | 0,0050 | ||

| COOPERAT RABOBANK UA/NY 08/26 VAR / DBT (US21688ABG67) | 1,70 | −0,12 | 0,1275 | 0,0051 | ||

| US91282CAQ42 / USTN TII 0.125% 10/15/2025 | 1,66 | 0,60 | 0,1244 | 0,0057 | ||

| CITIBANK NA SR UNSECURED 11/27 VAR / DBT (US17325FBL13) | 1,61 | 0,12 | 0,1204 | 0,0051 | ||

| CITIBANK NA SR UNSECURED 11/27 VAR / DBT (US17325FBL13) | 1,61 | 0,12 | 0,1204 | 0,0051 | ||

| ACA / Crédit Agricole S.A. | 1,61 | −0,25 | 0,1204 | 0,0046 | ||

| ACA / Crédit Agricole S.A. | 1,61 | −0,25 | 0,1204 | 0,0046 | ||

| FHLMC MULTIFAMILY STRUCTURED P FHMS Q034 APT2 / ABS-MBS (US3137HLY301) | 1,60 | 0,1193 | 0,1193 | |||

| FHLMC MULTIFAMILY STRUCTURED P FHMS Q034 APT2 / ABS-MBS (US3137HLY301) | 1,60 | 0,1193 | 0,1193 | |||

| US38383KDF66 / GOVERNMENT NATIONAL MORTGAGE A GNR 2023 H20 FG | 1,57 | −0,76 | 0,1175 | 0,0039 | ||

| US12551JAL08 / CIFC FUNDING LTD CIFC 2017 4A A1R 144A | 1,54 | −23,46 | 0,1152 | −0,0292 | ||

| US50203JAA60 / LFT CRE 2021-FL1 Ltd | 1,54 | −22,55 | 0,1149 | −0,0274 | ||

| S56431109 / Northam Platinum Holdings Ltd | 1,53 | 1,19 | 0,1145 | 0,0060 | ||

| US3132Y16V51 / FED HM LN PC POOL Q58083 FG 08/48 FIXED 4 | 1,52 | −0,39 | 0,1138 | 0,0043 | ||

| CITIBANK NA CITIBANK NA / DBT (US17325FBJ66) | 1,51 | 0,00 | 0,1130 | 0,0046 | ||

| CITIBANK NA CITIBANK NA / DBT (US17325FBJ66) | 1,51 | 0,00 | 0,1130 | 0,0046 | ||

| US78433XAA81 / Stonepeak ABS, Series 2021-1A | 1,50 | −10,11 | 0,1124 | −0,0076 | ||

| US31418CFM10 / Fannie Mae Pool | 1,44 | −5,25 | 0,1081 | −0,0013 | ||

| US36264BAA89 / GPMT LTD. GPMT 2021 FL3 A 144A | 1,44 | −19,47 | 0,1077 | −0,0205 | ||

| BANQUE FED CRED MUTUEL BANQUE FED CRED MUTUEL / DBT (US06675DCM20) | 1,43 | 0,28 | 0,1067 | 0,0047 | ||

| BANQUE FED CRED MUTUEL BANQUE FED CRED MUTUEL / DBT (US06675DCM20) | 1,43 | 0,28 | 0,1067 | 0,0047 | ||

| INDIGO CREDIT MANAGEMENT INDI 2A A 144A / ABS-CBDO (XS2916992865) | 1,42 | 9,18 | 0,1059 | 0,0128 | ||

| INDIGO CREDIT MANAGEMENT INDI 2A A 144A / ABS-CBDO (XS2916992865) | 1,42 | 9,18 | 0,1059 | 0,0128 | ||

| RFR USD SOFR/2.00000 12/21/22-10Y CME / DIR (EZFXDWH0DRR4) | 1,41 | −5,31 | 0,1054 | −0,0014 | ||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 1,41 | 0,07 | 0,1053 | 0,0043 | ||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 1,41 | 0,07 | 0,1053 | 0,0043 | ||

| GOLDMAN SACHS BANK USA GOLDMAN SACHS BANK USA / DBT (US38151LAH33) | 1,40 | 0,00 | 0,1051 | 0,0043 | ||

| GOLDMAN SACHS BANK USA GOLDMAN SACHS BANK USA / DBT (US38151LAH33) | 1,40 | 0,00 | 0,1051 | 0,0043 | ||

| BAIN CAPITAL CREDIT CLO, LIMIT BCC 2021 4A A1R 144A / ABS-CBDO (US05685AAQ13) | 1,40 | 0,36 | 0,1050 | 0,0046 | ||

| BAIN CAPITAL CREDIT CLO, LIMIT BCC 2021 4A A1R 144A / ABS-CBDO (US05685AAQ13) | 1,40 | 0,36 | 0,1050 | 0,0046 | ||

| US3140H7LS41 / FNMA POOL BJ5736 FN 04/48 FIXED 4 | 1,40 | −0,28 | 0,1049 | 0,0040 | ||

| WESTLAKE AUTOMOBILE RECEIVABLE WLAKE 2024 3A A2A 144A / ABS-O (US96043CAB63) | 1,38 | −31,25 | 0,1036 | −0,0408 | ||

| WESTLAKE AUTOMOBILE RECEIVABLE WLAKE 2024 3A A2A 144A / ABS-O (US96043CAB63) | 1,38 | −31,25 | 0,1036 | −0,0408 | ||

| US38375UKC35 / GNMA, Series 2014-H11, Class VA | 1,35 | −13,62 | 0,1011 | −0,0111 | ||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 1,35 | 0,1007 | 0,1007 | |||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 1,35 | 0,1007 | 0,1007 | |||

| FANNIE MAE FNR 2012 120 WE / ABS-MBS (US3136A9N533) | 1,34 | −15,16 | 0,1005 | −0,0131 | ||

| FANNIE MAE FNR 2012 120 WE / ABS-MBS (US3136A9N533) | 1,34 | −15,16 | 0,1005 | −0,0131 | ||

| KOREA HOUSING FINANCE CO 08/27 4.875 / DBT (US50065RAP29) | 1,32 | 0,15 | 0,0986 | 0,0042 | ||

| KOREA HOUSING FINANCE CO 08/27 4.875 / DBT (US50065RAP29) | 1,32 | 0,15 | 0,0986 | 0,0042 | ||

| HYUNDAI CAPITAL AMERICA SR UNSECURED 144A 06/27 4.875 / DBT (US44891ADU88) | 1,31 | 0,0979 | 0,0979 | |||

| HYUNDAI CAPITAL AMERICA SR UNSECURED 144A 06/27 4.875 / DBT (US44891ADU88) | 1,31 | 0,0979 | 0,0979 | |||

| FNMA POOL BW7013 FN 08/52 FIXED 5 / ABS-MBS (US3140MYYK23) | 1,28 | −10,50 | 0,0957 | −0,0069 | ||

| FNMA POOL BW7013 FN 08/52 FIXED 5 / ABS-MBS (US3140MYYK23) | 1,28 | −10,50 | 0,0957 | −0,0069 | ||

| US34535QAA31 / Ford Credit Auto Owner Trust 2023-REV1 | 1,27 | 0,40 | 0,0949 | 0,0042 | ||

| FREDDIE MAC FHR 5345 A / ABS-MBS (US3137HAQS82) | 1,25 | −12,90 | 0,0935 | −0,0095 | ||

| FREDDIE MAC FHR 5345 A / ABS-MBS (US3137HAQS82) | 1,25 | −12,90 | 0,0935 | −0,0095 | ||

| NOCG34 / Northrop Grumman Corporation - Depositary Receipt (Common Stock) | 1,25 | 0,0932 | 0,0932 | |||

| NOCG34 / Northrop Grumman Corporation - Depositary Receipt (Common Stock) | 1,25 | 0,0932 | 0,0932 | |||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 1,23 | 0,08 | 0,0916 | 0,0038 | ||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 1,23 | 0,08 | 0,0916 | 0,0038 | ||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 1,22 | 0,0910 | 0,0910 | |||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 1,22 | 0,0910 | 0,0910 | |||

| SCE.PRK / SCE Trust V - Preferred Security | 1,21 | 0,08 | 0,0902 | 0,0038 | ||

| SCE.PRK / SCE Trust V - Preferred Security | 1,21 | 0,08 | 0,0902 | 0,0038 | ||

| ELEVATION CLO LTD AWPT 2018 3A A1R2 144A / ABS-CBDO (US28623VAN91) | 1,20 | 0,08 | 0,0898 | 0,0037 | ||

| ELEVATION CLO LTD AWPT 2018 3A A1R2 144A / ABS-CBDO (US28623VAN91) | 1,20 | 0,08 | 0,0898 | 0,0037 | ||

| FREDDIE MAC SLST SLST 2023 1 A11 144A / ABS-MBS (US35564CNN38) | 1,19 | −32,92 | 0,0892 | −0,0383 | ||

| FREDDIE MAC SLST SLST 2023 1 A11 144A / ABS-MBS (US35564CNN38) | 1,19 | −32,92 | 0,0892 | −0,0383 | ||

| FANNIE MAE FNR 2024 38 FA / ABS-MBS (US3136BR4S35) | 1,15 | −5,37 | 0,0857 | −0,0012 | ||

| FANNIE MAE FNR 2024 38 FA / ABS-MBS (US3136BR4S35) | 1,15 | −5,37 | 0,0857 | −0,0012 | ||

| FANNIE MAE FNR 2024 38 AF / ABS-MBS (US3136BR5A18) | 1,14 | −5,77 | 0,0855 | −0,0016 | ||

| FANNIE MAE FNR 2024 38 AF / ABS-MBS (US3136BR5A18) | 1,14 | −5,77 | 0,0855 | −0,0016 | ||

| US3140HNY970 / FNMA POOL BK8835 FN 08/48 FIXED 4 | 1,14 | −0,26 | 0,0853 | 0,0033 | ||

| FORD AUTO SECURITIZATION TRUST FASTR 2023 BA A2 144A / ABS-O (CA345214AY60) | 1,14 | −11,47 | 0,0849 | −0,0071 | ||

| FORD AUTO SECURITIZATION TRUST FASTR 2023 BA A2 144A / ABS-O (CA345214AY60) | 1,14 | −11,47 | 0,0849 | −0,0071 | ||

| US05401AAB70 / Avolon Holdings Funding Ltd | 1,12 | 1,82 | 0,0839 | 0,0048 | ||

| US05401AAB70 / Avolon Holdings Funding Ltd | 1,12 | 1,82 | 0,0839 | 0,0048 | ||

| FREDDIE MAC FHR 5511 FG / ABS-MBS (US3137HKKP89) | 1,11 | −9,08 | 0,0831 | −0,0046 | ||

| FREDDIE MAC FHR 5511 FG / ABS-MBS (US3137HKKP89) | 1,11 | −9,08 | 0,0831 | −0,0046 | ||

| PIKES PEAK CLO PIPK 2019 4A ARR 144A / ABS-CBDO (US72132WAN92) | 1,10 | 0,27 | 0,0823 | 0,0036 | ||

| PIKES PEAK CLO PIPK 2019 4A ARR 144A / ABS-CBDO (US72132WAN92) | 1,10 | 0,27 | 0,0823 | 0,0036 | ||

| FHLMC MULTIFAMILY STRUCTURED P FHMS Q029 A / ABS-MBS (US3137HHH387) | 1,10 | −0,09 | 0,0823 | 0,0033 | ||

| FHLMC MULTIFAMILY STRUCTURED P FHMS Q029 A / ABS-MBS (US3137HHH387) | 1,10 | −0,09 | 0,0823 | 0,0033 | ||

| GM FINANCIAL CONSUMER AUTOMOBI GMCAR 2024 2 A2B / ABS-O (US379931AC24) | 1,06 | −43,28 | 0,0796 | −0,0549 | ||

| GM FINANCIAL CONSUMER AUTOMOBI GMCAR 2024 2 A2B / ABS-O (US379931AC24) | 1,06 | −43,28 | 0,0796 | −0,0549 | ||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 1,01 | 0,70 | 0,0759 | 0,0036 | ||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 1,01 | 0,70 | 0,0759 | 0,0036 | ||

| HARDWOOD FUNDING LLC CORP0HRE5 / DBT (955NUFII1) | 1,01 | 0,0756 | 0,0756 | |||

| HARDWOOD FUNDING LLC CORP0HRE5 / DBT (955NUFII1) | 1,01 | 0,0756 | 0,0756 | |||

| PIKES PEAK CLO PIPK 2018 2A ARR 144A / ABS-CBDO (US72133JAY38) | 1,00 | 0,20 | 0,0749 | 0,0033 | ||

| PIKES PEAK CLO PIPK 2018 2A ARR 144A / ABS-CBDO (US72133JAY38) | 1,00 | 0,20 | 0,0749 | 0,0033 | ||

| US38383KCS96 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2023-H19 CL FA V/R 6.20000000 | 0,99 | −0,50 | 0,0744 | 0,0027 | ||

| CARVAL CLO LTD CARVL 2019 2A AR2 144A / ABS-CBDO (US14686WAW10) | 0,99 | −1,00 | 0,0738 | 0,0022 | ||

| CARVAL CLO LTD CARVL 2019 2A AR2 144A / ABS-CBDO (US14686WAW10) | 0,99 | −1,00 | 0,0738 | 0,0022 | ||

| FNMA POOL AN7957 FN 01/28 FIXED 3.22 / ABS-MBS (US3138LLZX68) | 0,98 | 0,82 | 0,0736 | 0,0035 | ||

| FNMA POOL AN7957 FN 01/28 FIXED 3.22 / ABS-MBS (US3138LLZX68) | 0,98 | 0,82 | 0,0736 | 0,0035 | ||

| FANNIE MAE FNR 2025 12 FG / ABS-MBS (US3136BVFH64) | 0,95 | −4,13 | 0,0712 | −0,0000 | ||

| FANNIE MAE FNR 2025 12 FG / ABS-MBS (US3136BVFH64) | 0,95 | −4,13 | 0,0712 | −0,0000 | ||

| SMB PRIVATE EDUCATION LOAN TRU SMB 2024 D A1A 144A / ABS-O (US83207QAA76) | 0,91 | −2,68 | 0,0679 | 0,0010 | ||

| SMB PRIVATE EDUCATION LOAN TRU SMB 2024 D A1A 144A / ABS-O (US83207QAA76) | 0,91 | −2,68 | 0,0679 | 0,0010 | ||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2024 H07 FC / ABS-MBS (US38383KVE99) | 0,90 | −9,15 | 0,0676 | −0,0038 | ||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2024 H07 FC / ABS-MBS (US38383KVE99) | 0,90 | −9,15 | 0,0676 | −0,0038 | ||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVE00) | 0,89 | 0,0669 | 0,0669 | |||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVE00) | 0,89 | 0,0669 | 0,0669 | |||

| WIND RIVER CLO LTD WINDR 2016 1KRA A1R3 144A / ABS-CBDO (US97314DAN84) | 0,89 | −0,45 | 0,0668 | 0,0024 | ||

| WIND RIVER CLO LTD WINDR 2016 1KRA A1R3 144A / ABS-CBDO (US97314DAN84) | 0,89 | −0,45 | 0,0668 | 0,0024 | ||

| FNMA POOL BL3670 FN 10/26 FIXED 2.08 / ABS-MBS (US3140HVCG74) | 0,88 | 0,69 | 0,0655 | 0,0031 | ||

| FNMA POOL BL3670 FN 10/26 FIXED 2.08 / ABS-MBS (US3140HVCG74) | 0,88 | 0,69 | 0,0655 | 0,0031 | ||

| FREDDIE MAC FHR 5426 CF / ABS-MBS (US3137HCY227) | 0,86 | −6,02 | 0,0642 | −0,0013 | ||

| FREDDIE MAC FHR 5426 CF / ABS-MBS (US3137HCY227) | 0,86 | −6,02 | 0,0642 | −0,0013 | ||

| 01626P148 / Alimentation Couche-Tard Inc | 0,85 | 0,0633 | 0,0633 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 0,85 | 0,0633 | 0,0633 | |||

| US3133C23A45 / UMBS | 0,83 | −0,36 | 0,0622 | 0,0023 | ||

| 01626P148 / Alimentation Couche-Tard Inc | 0,80 | 0,0598 | 0,0598 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 0,80 | 0,0598 | 0,0598 | |||

| US07384M4F63 / BEAR STEARNS ADJUSTABLE RATE M BSARM 2004 10 14A1 | 0,78 | −1,76 | 0,0585 | 0,0014 | ||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0,75 | 0,13 | 0,0564 | 0,0024 | ||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0,75 | 0,13 | 0,0564 | 0,0024 | ||

| US3132HUCJ07 / FREDDIEMAC STRIP FHS 332 V1 | 0,75 | −1,70 | 0,0562 | 0,0014 | ||

| US17331KAD19 / Citizens Auto Receivables Trust | 0,75 | −22,43 | 0,0560 | −0,0132 | ||

| 01626P148 / Alimentation Couche-Tard Inc | 0,75 | 0,0559 | 0,0559 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 0,75 | 0,0559 | 0,0559 | |||

| GNMA II POOL MA2273 G2 10/29 FIXED 3.5 / ABS-MBS (US36179QQ200) | 0,72 | −10,43 | 0,0540 | −0,0038 | ||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 0,71 | 0,28 | 0,0531 | 0,0023 | ||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 0,71 | 0,28 | 0,0531 | 0,0023 | ||

| MERCEDES BENZ FIN NA COMPANY GUAR 144A 11/27 4.9 / DBT (US58769JAZ03) | 0,71 | 0,0530 | 0,0530 | |||

| MERCEDES BENZ FIN NA COMPANY GUAR 144A 11/27 4.9 / DBT (US58769JAZ03) | 0,71 | 0,0530 | 0,0530 | |||

| US05610AAW80 / BX Trust, Series 2022-FOX2, Class A2 | 0,71 | −6,12 | 0,0528 | −0,0012 | ||

| ROMARK CREDIT FUNDING LTD RCF 2024 3A A 144A / ABS-CBDO (US77587BAA26) | 0,70 | 0,0525 | 0,0525 | |||

| ROMARK CREDIT FUNDING LTD RCF 2024 3A A 144A / ABS-CBDO (US77587BAA26) | 0,70 | 0,0525 | 0,0525 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 0,70 | 0,0523 | 0,0523 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 0,70 | 0,0523 | 0,0523 | |||

| CBRE SVCS INC / DBT (US12610BUA87) | 0,70 | 0,0523 | 0,0523 | |||

| CBRE SVCS INC / DBT (US12610BUA87) | 0,70 | 0,0523 | 0,0523 | |||

| A3KMYN / Air Lease Corporation - Preferred Stock | 0,70 | 0,0523 | 0,0523 | |||

| FANNIE MAE FNR 2024 54 FC / ABS-MBS (US3136BSSC02) | 0,70 | −12,47 | 0,0520 | −0,0049 | ||

| FANNIE MAE FNR 2024 54 FC / ABS-MBS (US3136BSSC02) | 0,70 | −12,47 | 0,0520 | −0,0049 | ||

| US3133BXWB37 / FED HM LN PC POOL QF9642 FR 03/53 FIXED 5 | 0,68 | −5,56 | 0,0509 | −0,0008 | ||

| US3133C2MQ84 / FED HM LN PC POOL QG2167 FR 04/53 FIXED 5 | 0,66 | −10,41 | 0,0496 | −0,0035 | ||

| US004421JH70 / ACE SECURITIES CORP. ACE 2004 HE4 M1 | 0,65 | −0,61 | 0,0485 | 0,0017 | ||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVF74) | 0,65 | 0,0483 | 0,0483 | |||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVF74) | 0,65 | 0,0483 | 0,0483 | |||

| US842400HS51 / Southern California Edison Co. | 0,62 | 0,16 | 0,0460 | 0,0019 | ||

| 01626P148 / Alimentation Couche-Tard Inc | 0,60 | 0,0448 | 0,0448 | |||

| MDLZ / Mondelez International, Inc. - Depositary Receipt (Common Stock) | 0,60 | 0,0446 | 0,0446 | |||

| MDLZ / Mondelez International, Inc. - Depositary Receipt (Common Stock) | 0,60 | 0,0446 | 0,0446 | |||

| CHASE AUTO OWNER TRUST CHAOT 2024 1A A2 144A / ABS-O (US16144BAB45) | 0,60 | −54,65 | 0,0445 | −0,0496 | ||

| CHASE AUTO OWNER TRUST CHAOT 2024 1A A2 144A / ABS-O (US16144BAB45) | 0,60 | −54,65 | 0,0445 | −0,0496 | ||

| US669884AA68 / NOVASTAR HOME EQUITY LOAN NHEL 2006 1 A1A | 0,59 | −15,11 | 0,0442 | −0,0057 | ||

| US3133BX6R70 / FHLG 30YR 5% 04/01/2053#QF9880 | 0,58 | −8,37 | 0,0434 | −0,0020 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,57 | 0,0424 | 0,0424 | |||

| FORTRESS CREDIT BSL LIMITED FCBSL 2019 1A A1R 144A / ABS-CBDO (US34956NAL64) | 0,56 | −27,17 | 0,0415 | −0,0132 | ||

| FORTRESS CREDIT BSL LIMITED FCBSL 2019 1A A1R 144A / ABS-CBDO (US34956NAL64) | 0,56 | −27,17 | 0,0415 | −0,0132 | ||

| FNMA POOL MA5352 FN 05/54 FIXED 5 / ABS-MBS (US31418E5N65) | 0,55 | −2,14 | 0,0412 | 0,0008 | ||

| FNMA POOL MA5352 FN 05/54 FIXED 5 / ABS-MBS (US31418E5N65) | 0,55 | −2,14 | 0,0412 | 0,0008 | ||

| NXP BV NXP FDG NXP USA DISC CO / DBT (US67122RU186) | 0,55 | 0,0411 | 0,0411 | |||

| US3132DWFG33 / Freddie Mac Pool | 0,53 | −2,02 | 0,0400 | 0,0009 | ||

| US92916MAF86 / VOYA CLO LTD VOYA 2017 1A A1R 144A | 0,52 | −24,82 | 0,0390 | −0,0107 | ||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 0,51 | 0,0382 | 0,0382 | |||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 0,51 | 0,0382 | 0,0382 | |||

| MORGAN STANLEY BANK NA MORGAN STANLEY BANK NA / DBT (US61690U8E33) | 0,51 | 0,40 | 0,0379 | 0,0017 | ||

| MORGAN STANLEY BANK NA MORGAN STANLEY BANK NA / DBT (US61690U8E33) | 0,51 | 0,40 | 0,0379 | 0,0017 | ||

| US89233FHN15 / Toyota Motor Credit Corporation | 0,50 | 0,00 | 0,0375 | 0,0015 | ||

| US89233FHN15 / Toyota Motor Credit Corporation | 0,50 | 0,00 | 0,0375 | 0,0015 | ||

| JONES LANG LASALLE FIN BV 4/A2 07/25 ZCP / DBT (US48002AU933) | 0,50 | 0,0374 | 0,0374 | |||

| JONES LANG LASALLE FIN BV 4/A2 07/25 ZCP / DBT (US48002AU933) | 0,50 | 0,0374 | 0,0374 | |||

| TESLA SUSTAINABLE ENERGY TRUST TSET 2024 1A A2 144A / ABS-O (US88164AAB08) | 0,49 | −3,19 | 0,0363 | 0,0003 | ||

| TESLA SUSTAINABLE ENERGY TRUST TSET 2024 1A A2 144A / ABS-O (US88164AAB08) | 0,49 | −3,19 | 0,0363 | 0,0003 | ||

| FNMA POOL AB3968 FN 12/26 FIXED 3 / ABS-MBS (US31417AMS59) | 0,48 | −20,13 | 0,0359 | −0,0072 | ||

| FNMA POOL AB3968 FN 12/26 FIXED 3 / ABS-MBS (US31417AMS59) | 0,48 | −20,13 | 0,0359 | −0,0072 | ||

| US3138ENEW53 / Fannie Mae Pool | 0,48 | −5,17 | 0,0358 | −0,0004 | ||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 0,45 | 0,0336 | 0,0336 | |||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 0,45 | 0,0336 | 0,0336 | |||

| CA34527ACL22 / Ford Credit Canada Co | 0,45 | 4,92 | 0,0336 | 0,0029 | ||

| STELLANTIS FIN US INC COMPANY GUAR 144A 03/28 5.35 / DBT (US85855CAM29) | 0,40 | 0,0302 | 0,0302 | |||

| STELLANTIS FIN US INC COMPANY GUAR 144A 03/28 5.35 / DBT (US85855CAM29) | 0,40 | 0,0302 | 0,0302 | |||

| RFR USD SOFR/3.25000 06/18/25-10Y CME / DIR (EZXZ4DC8KGZ4) | 0,37 | 0,0280 | 0,0280 | |||

| RFR USD SOFR/3.25000 06/18/25-10Y CME / DIR (EZXZ4DC8KGZ4) | 0,37 | 0,0280 | 0,0280 | |||

| FORD CREDIT CANADA CO/CA COMPANY GUAR REGS 09/25 6.777 / DBT (CA34527ACK49) | 0,37 | 4,83 | 0,0276 | 0,0024 | ||

| FORD CREDIT CANADA CO/CA COMPANY GUAR REGS 09/25 6.777 / DBT (CA34527ACK49) | 0,37 | 4,83 | 0,0276 | 0,0024 | ||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,35 | 0,0263 | 0,0263 | |||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,35 | 0,0263 | 0,0263 | |||

| SCE.PRK / SCE Trust V - Preferred Security | 0,30 | 0,00 | 0,0226 | 0,0010 | ||

| US31418ELX66 / FNMA 30YR 5% 12/01/2052#MA4841 | 0,30 | −2,27 | 0,0226 | 0,0004 | ||

| US3128MJ3T51 / FEDERAL HOME LOAN MORTGAGE CORP 4.00% 04/01/2048 G30 FGLMC | 0,30 | −1,64 | 0,0225 | 0,0006 | ||

| S1YK34 / Stryker Corporation - Depositary Receipt (Common Stock) | 0,30 | 1,01 | 0,0224 | 0,0011 | ||

| RTX / RTX Corporation - Depositary Receipt (Common Stock) | 0,30 | 0,0224 | 0,0224 | |||

| RTX / RTX Corporation - Depositary Receipt (Common Stock) | 0,30 | 0,0224 | 0,0224 | |||

| US031162DP23 / Amgen Inc | 0,29 | 0,35 | 0,0216 | 0,0010 | ||

| TREASURY BILL 07/25 0.00000 / DBT (US912797LW51) | 0,27 | 0,0204 | 0,0204 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797LW51) | 0,27 | 0,0204 | 0,0204 | |||

| US225401AZ15 / Credit Suisse Group AG | 0,27 | 1,87 | 0,0203 | 0,0011 | ||

| US38376REV42 / GOVERNMENT NATIONAL MORTGAGE A GNR 2015 H17 FL | 0,26 | −19,06 | 0,0194 | −0,0036 | ||

| US38375UXM79 / Government National Mortgage Association | 0,26 | −17,04 | 0,0194 | −0,0030 | ||

| US31416VJD73 / Fannie Mae Pool | 0,25 | −1,56 | 0,0190 | 0,0005 | ||

| G1PI34 / Global Payments Inc. - Depositary Receipt (Common Stock) | 0,25 | 0,0187 | 0,0187 | |||

| G1PI34 / Global Payments Inc. - Depositary Receipt (Common Stock) | 0,25 | 0,0187 | 0,0187 | |||

| NXP BV NXP FDG NXP USA DISC CO / DBT (US67122RU269) | 0,25 | 0,0187 | 0,0187 | |||

| NXP BV NXP FDG NXP USA DISC CO / DBT (US67122RU269) | 0,25 | 0,0187 | 0,0187 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 0,25 | 0,0187 | 0,0187 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 0,25 | 0,0187 | 0,0187 | |||

| US46652LU215 / JABIL INC | 0,25 | 0,0187 | 0,0187 | |||

| BACARDI MARTINI B V / DBT (US05634EU340) | 0,25 | 0,0187 | 0,0187 | |||

| BACARDI MARTINI B V / DBT (US05634EU340) | 0,25 | 0,0187 | 0,0187 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 0,25 | 0,0187 | 0,0187 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 0,25 | 0,0187 | 0,0187 | |||

| BACARDI MARTINI B V / DBT (US05634EUA80) | 0,25 | 0,0187 | 0,0187 | |||

| BACARDI MARTINI B V / DBT (US05634EUA80) | 0,25 | 0,0187 | 0,0187 | |||

| ENBRIDGE (US) INC / DBT (US29251UUB24) | 0,25 | 0,0187 | 0,0187 | |||

| ENBRIDGE (US) INC / DBT (US29251UUB24) | 0,25 | 0,0187 | 0,0187 | |||

| CNQ / Canadian Natural Resources Limited | 0,25 | 0,0187 | 0,0187 | |||

| CNQ / Canadian Natural Resources Limited | 0,25 | 0,0187 | 0,0187 | |||

| JONES LANG LASALLE FIN BV 4/A2 07/25 ZCP / DBT (US48002AUE27) | 0,25 | 0,0187 | 0,0187 | |||

| JONES LANG LASALLE FIN BV 4/A2 07/25 ZCP / DBT (US48002AUE27) | 0,25 | 0,0187 | 0,0187 | |||

| HOLCIM FIN US LLC 07/25 ZCP / DBT (US43475FUF79) | 0,25 | 0,0187 | 0,0187 | |||

| JONES LANG LASALLE FIN BV 4/A2 07/25 ZCP / DBT (US48002AUG74) | 0,25 | 0,0187 | 0,0187 | |||

| JONES LANG LASALLE FIN BV 4/A2 07/25 ZCP / DBT (US48002AUG74) | 0,25 | 0,0187 | 0,0187 | |||

| A3KMYN / Air Lease Corporation - Preferred Stock | 0,25 | 0,0187 | 0,0187 | |||

| A3KMYN / Air Lease Corporation - Preferred Stock | 0,25 | 0,0187 | 0,0187 | |||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0,25 | 0,0186 | 0,0186 | |||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0,25 | 0,0186 | 0,0186 | |||

| CBRE SVCS INC 07/25 ZCP / DBT (US12610BUQ30) | 0,25 | 0,0186 | 0,0186 | |||

| CBRE SVCS INC 07/25 ZCP / DBT (US12610BUQ30) | 0,25 | 0,0186 | 0,0186 | |||

| T / TELUS Corporation | 0,25 | 0,0185 | 0,0185 | |||

| T / TELUS Corporation | 0,25 | 0,0185 | 0,0185 | |||

| US126671K623 / Countrywide Asset-Backed Certificates | 0,25 | −3,91 | 0,0184 | 0,0001 | ||

| US3132AEGL48 / FR ZT2003 | 0,23 | −8,70 | 0,0173 | −0,0009 | ||

| RFR USD SOFR/3.50000 12/18/24-1Y LCH / DIR (EZXN18T2XBB5) | 0,23 | 19,47 | 0,0170 | 0,0034 | ||

| RFR USD SOFR/3.50000 12/18/24-1Y LCH / DIR (EZXN18T2XBB5) | 0,23 | 19,47 | 0,0170 | 0,0034 | ||

| FANNIE MAE FNR 2019 51 AF / ABS-MBS (US3136B5P584) | 0,22 | −2,21 | 0,0166 | 0,0003 | ||

| FANNIE MAE FNR 2019 51 AF / ABS-MBS (US3136B5P584) | 0,22 | −2,21 | 0,0166 | 0,0003 | ||

| US76111XYD91 / RFMSI Series 2005-SA4 Trust | 0,21 | −0,95 | 0,0157 | 0,0005 | ||

| US38375B4Y56 / GNMA, Series 2013-H16, Class FA | 0,21 | −13,08 | 0,0154 | −0,0016 | ||

| US3140QQ2L85 / Fannie Mae Pool | 0,20 | −2,86 | 0,0153 | 0,0002 | ||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0,20 | 1,00 | 0,0152 | 0,0007 | ||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0,20 | 1,00 | 0,0152 | 0,0007 | ||

| US01F0424758 / Fannie Mae or Freddie Mac | 0,20 | 1,02 | 0,0149 | 0,0015 | ||

| US12669GBA85 / CHL Mortgage Pass-Through Trust 2004-HYB6 | 0,18 | −7,61 | 0,0137 | −0,0005 | ||

| US3133BNSV64 / FHLG 30YR 5% 10/01/2052#QF1432 | 0,17 | −6,08 | 0,0128 | −0,0003 | ||

| 317U7HTA5 PIMCO SWAPTION 3.75 CALL USD 2025103 / DIR (000000000) | 0,16 | 0,0121 | 0,0121 | |||

| 317U7HTA5 PIMCO SWAPTION 3.75 CALL USD 2025103 / DIR (000000000) | 0,16 | 0,0121 | 0,0121 | |||

| US939336X656 / WaMu Mortgage Pass-Through Certificates Series 2005-AR1 Trust | 0,15 | −4,37 | 0,0115 | −0,0000 | ||

| US31393BX754 / Fannie Mae Trust 2003-W6 | 0,15 | −4,40 | 0,0114 | −0,0001 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,15 | 0,0113 | 0,0113 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,15 | 0,0113 | 0,0113 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,15 | 0,0113 | 0,0113 | |||

| US86358EGW03 / STRUCTURED ASSET INVESTMENT LO SAIL 2004 2 A4 | 0,14 | −2,74 | 0,0107 | 0,0002 | ||

| US3140J6GM33 / FANNIE MAE 4% 10/01/2047 FNL | 0,14 | −2,10 | 0,0105 | 0,0002 | ||

| 317U6RTA4 PIMCO SWAPTION 3.75 CALL USD 2025080 / DIR (000000000) | 0,12 | 0,0090 | 0,0090 | |||

| US924933AA27 / Veros Auto Receivables Trust, Series 2023-1, Class A | 0,12 | −65,80 | 0,0088 | −0,0160 | ||

| US68383NCU54 / Opteum Mortgage Acceptance Corp. Asset-Backed Pass-Through Certificates, Series 2005-5, Class 1APT | 0,12 | −6,50 | 0,0087 | −0,0002 | ||

| US126670LE60 / CHL Mortgage Pass-Through Trust 2005-HYB9 | 0,11 | −4,20 | 0,0086 | 0,0000 | ||

| SCE.PRK / SCE Trust V - Preferred Security | 0,11 | 0,00 | 0,0086 | 0,0004 | ||

| SCE.PRK / SCE Trust V - Preferred Security | 0,11 | 0,00 | 0,0086 | 0,0004 | ||

| US07402FAA30 / BEAR STEARNS STRUCTURED PRODUC BSSP 2007 R6 1A1 | 0,11 | −2,65 | 0,0083 | 0,0001 | ||

| US41161PMX86 / HARBORVIEW MORTGAGE LOAN TRUST HVMLT 2005 4 3A1 | 0,10 | −2,86 | 0,0076 | 0,0001 | ||

| US07402FAC95 / BEAR STEARNS STRUCTURED PRODUC BSSP 2007 R6 2A1 | 0,10 | 1,00 | 0,0076 | 0,0004 | ||

| US842400HQ95 / SOUTHERN CAL EDISON REGD SER D 4.70000000 | 0,10 | 1,01 | 0,0075 | 0,0003 | ||

| US23308LAA26 / DBGS 2021-W52 Mortgage Trust | 0,10 | 0,00 | 0,0074 | 0,0003 | ||

| FNMA POOL BW7921 FN 08/52 FIXED 5 / ABS-MBS (US3140N0YT65) | 0,10 | −9,26 | 0,0074 | −0,0004 | ||

| FNMA POOL BW7921 FN 08/52 FIXED 5 / ABS-MBS (US3140N0YT65) | 0,10 | −9,26 | 0,0074 | −0,0004 | ||

| US3138WHZY11 / FNMA POOL AS7958 FN 08/46 FIXED 4.5 | 0,09 | −4,17 | 0,0069 | 0,0000 | ||

| US3128MJ3B44 / Freddie Mac Gold Pool | 0,09 | −2,27 | 0,0065 | 0,0001 | ||

| US76110WVV52 / RESIDENTIAL ASSET SECURITIES C RASC 2003 KS11 MII1 | 0,08 | −37,88 | 0,0062 | −0,0033 | ||

| US12669F6Z19 / CWMBS, Inc. | 0,08 | −3,66 | 0,0060 | 0,0001 | ||

| US007036LJ33 / Adjustable Rate Mortgage Trust, Series 2005-5, Class 2A1 | 0,08 | −10,34 | 0,0059 | −0,0004 | ||

| FNMA POOL AJ8540 FN 01/27 FIXED 3 / ABS-MBS (US3138E1P273) | 0,08 | −23,47 | 0,0057 | −0,0014 | ||

| FNMA POOL AJ8540 FN 01/27 FIXED 3 / ABS-MBS (US3138E1P273) | 0,08 | −23,47 | 0,0057 | −0,0014 | ||

| US05949ALH13 / BOAMS 2004 G 2A7 | 0,07 | −1,35 | 0,0055 | 0,0001 | ||

| US05949AHR41 / Banc of America Mortgage Trust, Series 2004-F, Class 1A1 | 0,07 | −2,82 | 0,0052 | 0,0001 | ||

| US863579JG47 / Structured Adjustable Rate Mortgage Loan Trust | 0,07 | −2,94 | 0,0050 | 0,0001 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,07 | 0,0049 | 0,0049 | |||

| US3140FAAZ54 / FNMA POOL BD2723 FN 08/46 FIXED 4.5 | 0,07 | 0,00 | 0,0049 | 0,0002 | ||

| US36179Q2A86 / Ginnie Mae II Pool | 0,06 | −7,35 | 0,0047 | −0,0002 | ||

| US07387QAX88 / Bear Stearns ALT-A Trust, Series 2006-8, Class 3A1 | 0,06 | −4,69 | 0,0046 | 0,0000 | ||

| US05951EAM93 / BANC OF AMERICA FUNDING CORPOR BAFC 2006 J 4A1 | 0,06 | −5,17 | 0,0042 | 0,0000 | ||

| US362341RX95 / GSR Mortgage Loan Trust, Series 2005-AR6, Class 2A1 | 0,06 | −3,51 | 0,0041 | 0,0000 | ||

| US31395M2F53 / Freddie Mac Structured Pass-Through Certificates | 0,05 | −3,77 | 0,0038 | 0,0000 | ||

| US34706CAA71 / FORT CRE 2022-FL3 ISSUER LLC SER 2022-FL3 CL A V/R REGD 144A P/P 1.90000000 | 0,05 | −93,63 | 0,0037 | −0,0526 | ||

| US69336RBM16 / PHHMC MORTGAGE PASS THROUGH CE PHHMC 2005 4 A7 | 0,05 | −2,08 | 0,0036 | 0,0001 | ||

| US32051D6B35 / FIRST HORIZON ALTERNATIVE MORTGAGE SECURITIES | 0,05 | −8,00 | 0,0035 | −0,0001 | ||

| US3140F5JF12 / FNMA POOL BC9261 FN 04/46 FIXED 4 | 0,05 | −2,13 | 0,0035 | 0,0001 | ||

| US57563NAA63 / MASSACHUSETTS EDUCATIONAL FINANCING AUTHORITY SER 2008-1 CL A1 V/R 2.88963000 | 0,05 | −6,25 | 0,0034 | −0,0000 | ||

| US3138ELA520 / FNMA POOL AL3627 FN 04/32 FIXED VAR | 0,04 | −4,44 | 0,0033 | −0,0000 | ||

| FED HM LN PC POOL ZS7743 FR 01/29 FIXED 2.5 / ABS-MBS (US3132A8S835) | 0,04 | −12,50 | 0,0032 | −0,0003 | ||

| FED HM LN PC POOL ZS7743 FR 01/29 FIXED 2.5 / ABS-MBS (US3132A8S835) | 0,04 | −12,50 | 0,0032 | −0,0003 | ||

| US07384MQ705 / Bear Stearns ARM Trust 2004-3 | 0,04 | −2,33 | 0,0032 | 0,0001 | ||

| FED HM LN PC POOL G07793 FG 06/31 FIXED 5 / ABS-MBS (US3128M97E62) | 0,04 | −10,87 | 0,0031 | −0,0002 | ||

| FED HM LN PC POOL G07793 FG 06/31 FIXED 5 / ABS-MBS (US3128M97E62) | 0,04 | −10,87 | 0,0031 | −0,0002 | ||

| US31396V4Q81 / Fannie Mae REMICS | 0,04 | 0,00 | 0,0030 | 0,0001 | ||

| US863579VM76 / Structured Adjustable Rate Mortgage Loan Trust Series 2005-17 | 0,04 | −4,88 | 0,0030 | 0,0000 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,04 | 0,0028 | 0,0028 | |||

| US31409FL309 / FNMA POOL 869846 FN 04/36 FIXED 6.5 | 0,04 | −2,63 | 0,0028 | 0,0000 | ||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0,04 | 0,0027 | 0,0027 | |||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0,04 | 0,0027 | 0,0027 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,03 | 0,0026 | 0,0026 | |||

| US31391XDM83 / FNMA POOL 679708 FN 09/41 FLOATING VAR | 0,03 | −5,88 | 0,0024 | −0,0000 | ||

| US3132DN3T88 / FNCL UMBS 5.0 SD1710 10-01-52 | 0,03 | −3,12 | 0,0024 | 0,0001 | ||

| US32051GQL22 / First Horizon Mortgage Pass-Through Trust 2005-AR3 | 0,03 | 0,00 | 0,0023 | 0,0001 | ||

| US17307GTK49 / Citigroup Mortgage Loan Trust 2005-3 | 0,03 | −9,09 | 0,0023 | −0,0001 | ||

| US31402LPB26 / FANNIE MAE 2.757% 06/01/2043 FAR FNARM | 0,03 | −3,45 | 0,0021 | 0,0000 | ||

| US86359LRW18 / STRUCTURED ASSET MORTGAGE INVE SAMI 2005 AR8 A1A | 0,03 | −3,70 | 0,0020 | 0,0000 | ||

| FED HM LN PC POOL J17884 FG 01/27 FIXED 3 / ABS-MBS (US3128PXXM34) | 0,03 | −19,35 | 0,0019 | −0,0003 | ||

| FED HM LN PC POOL J17884 FG 01/27 FIXED 3 / ABS-MBS (US3128PXXM34) | 0,03 | −19,35 | 0,0019 | −0,0003 | ||

| US86359BGG05 / Structured Adjustable Rate Mortgage Loan Trust, Series 2004-1, Class 4A2 | 0,03 | −3,85 | 0,0019 | −0,0000 | ||

| US41161PLR28 / HARBORVIEW MORTGAGE LOAN TRUST 2005-2 SER 2005-2 CL 2A1A V/R REGD 2.17325000 | 0,02 | −8,00 | 0,0018 | −0,0000 | ||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0,02 | 0,0018 | 0,0018 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0,02 | 0,0018 | 0,0018 | |||

| FNMA POOL BY3411 FN 06/53 FIXED 5 / ABS-MBS (US3140NKYH80) | 0,02 | 0,00 | 0,0017 | 0,0001 | ||

| FNMA POOL BY3411 FN 06/53 FIXED 5 / ABS-MBS (US3140NKYH80) | 0,02 | 0,00 | 0,0017 | 0,0001 | ||

| US92925CBA99 / WaMu Mortgage Pass-Through Certificates Series 2005-AR19 Trust | 0,02 | −4,55 | 0,0016 | −0,0000 | ||

| RFR USD SOFR/3.23100 09/18/24-10Y LCH / DIR (EZ8Z99V6R391) | 0,02 | −12,50 | 0,0016 | −0,0001 | ||

| RFR USD SOFR/3.23100 09/18/24-10Y LCH / DIR (EZ8Z99V6R391) | 0,02 | −12,50 | 0,0016 | −0,0001 | ||

| US31394JD872 / Freddie Mac Structured Pass-Through Certificates | 0,02 | 0,00 | 0,0016 | 0,0000 | ||

| US3133TSQG11 / Freddie Mac Structured Pass-Through Certificates | 0,02 | −13,04 | 0,0015 | −0,0001 | ||

| US07384M4J85 / Bear Stearns ARM Trust 2004-10 | 0,02 | 0,00 | 0,0015 | 0,0001 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,02 | 0,0015 | 0,0015 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,02 | 0,0015 | 0,0015 | |||

| US3136ABFP36 / Fannie Mae REMICS | 0,02 | 0,00 | 0,0014 | 0,0000 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,02 | 0,0014 | 0,0014 | |||

| US36242DFP33 / GSR Mortgage Loan Trust 2004-11 | 0,02 | −5,56 | 0,0013 | 0,0000 | ||

| US31407VFQ32 / FNMA POOL 841775 FN 09/35 FLOATING VAR | 0,02 | −19,05 | 0,0013 | −0,0003 | ||

| US36185MBG69 / GMAC MORTGAGE CORPORATION LOAN GMACM 2005 AR6 1A1 | 0,02 | 0,00 | 0,0013 | 0,0000 | ||

| US59020UGF66 / Merrill Lynch Mortgage Investors Trust, Series 2004-D, Class A1 | 0,02 | −5,88 | 0,0013 | −0,0000 | ||

| US00442BAB71 / ACE SECURITIES CORP. ACE 2006 HE4 A2A | 0,02 | 0,00 | 0,0012 | 0,0001 | ||

| US59020UL789 / Merrill Lynch Mortgage Capital Inc. | 0,02 | 0,00 | 0,0012 | 0,0000 | ||

| US12669GHG91 / COUNTRYWIDE HOME LOANS CWHL 2004 HYB9 1A1 | 0,02 | 0,00 | 0,0012 | 0,0000 | ||

| BOUGHT NZD SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0011 | 0,0011 | |||

| US3128JMN943 / FED HM LN PC POOL 1B2315 FH 09/35 FLOATING VAR | 0,01 | 0,00 | 0,0011 | 0,0000 | ||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0,01 | 0,0010 | 0,0010 | |||

| RFR USD SOFR/3.24000 09/16/24-10Y LCH / DIR (EZH06W9H2QV9) | 0,01 | −14,29 | 0,0010 | −0,0001 | ||

| RFR USD SOFR/3.24000 09/16/24-10Y LCH / DIR (EZH06W9H2QV9) | 0,01 | −14,29 | 0,0010 | −0,0001 | ||

| US31396L4R81 / FNMA, REMIC, Series 2006-118, Class A1 | 0,01 | 0,00 | 0,0009 | 0,0000 | ||

| US3138EQAG70 / FNMA POOL AL7206 FN 08/45 FIXED VAR | 0,01 | 0,00 | 0,0009 | 0,0000 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,01 | 0,0009 | 0,0009 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,01 | 0,0009 | 0,0009 | |||

| US31390STH49 / FNMA POOL 654952 FN 07/42 FLOATING VAR | 0,01 | −8,33 | 0,0009 | −0,0001 | ||

| CDX IG44 5Y ICE / DCR (EZPF6RHH0ZV8) | 0,01 | 0,0008 | 0,0008 | |||

| CDX IG44 5Y ICE / DCR (EZPF6RHH0ZV8) | 0,01 | 0,0008 | 0,0008 | |||

| RFR USD SOFR/3.27750 09/16/24-10Y LCH / DIR (EZH06W9H2QV9) | 0,01 | −28,57 | 0,0008 | −0,0002 | ||

| RFR USD SOFR/3.27750 09/16/24-10Y LCH / DIR (EZH06W9H2QV9) | 0,01 | −28,57 | 0,0008 | −0,0002 | ||

| BOUGHT CHF SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0008 | 0,0008 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,01 | 0,0008 | 0,0008 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,01 | 0,0008 | 0,0008 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,01 | 0,0007 | 0,0007 | |||

| US04541GCG55 / Asset Backed Securities Corp Home Equity Loan Trust | 0,01 | −25,00 | 0,0007 | −0,0002 | ||

| US31407YHH53 / FNMA POOL 844532 FN 11/35 FLOATING VAR | 0,01 | 0,00 | 0,0007 | 0,0000 | ||

| BOUGHT ZAR SOLD USD 20250723 / DFE (000000000) | 0,01 | 0,0007 | 0,0007 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0007 | 0,0007 | |||

| US3128QJ4L75 / FED HM LN PC POOL 1G1727 FH 07/35 FLOATING VAR | 0,01 | 0,00 | 0,0006 | 0,0000 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,01 | 0,0006 | 0,0006 | |||

| US3138WDKD25 / Fannie Mae Pool | 0,01 | 0,00 | 0,0006 | 0,0000 | ||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0,01 | 0,0006 | 0,0006 | |||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0,01 | 0,0006 | 0,0006 | |||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0,01 | 0,0006 | 0,0006 | |||

| RFR USD SOFR/3.28000 09/16/24-10Y LCH / DIR (EZH06W9H2QV9) | 0,01 | −50,00 | 0,0006 | −0,0005 | ||

| RFR USD SOFR/3.28000 09/16/24-10Y LCH / DIR (EZH06W9H2QV9) | 0,01 | −50,00 | 0,0006 | −0,0005 | ||

| US31393XGV38 / FNMA, Series 2004-W2, Class 5AF | 0,01 | 0,00 | 0,0005 | −0,0000 | ||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,01 | 0,0005 | 0,0005 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,01 | 0,0005 | 0,0005 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,01 | 0,0005 | 0,0005 | |||

| US31371NV775 / Fannie Mae Pool | 0,01 | −14,29 | 0,0005 | −0,0000 | ||

| US31371NDS18 / Fannie Mae Pool | 0,01 | −14,29 | 0,0005 | −0,0001 | ||

| RFR USD SOFR/3.23200 09/10/24-10Y LCH / DIR (EZ7VRSSQ00Z9) | 0,01 | −14,29 | 0,0005 | −0,0000 | ||

| RFR USD SOFR/3.23200 09/10/24-10Y LCH / DIR (EZ7VRSSQ00Z9) | 0,01 | −14,29 | 0,0005 | −0,0000 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,01 | 0,0005 | 0,0005 | |||

| MORGAN STANLEY SNR S* ICE / DCR (EZ95R0LYJLM3) | 0,01 | 0,0005 | 0,0005 | |||

| MORGAN STANLEY SNR S* ICE / DCR (EZ95R0LYJLM3) | 0,01 | 0,0005 | 0,0005 | |||

| US17307GW530 / Citigroup Mortgage Loan Trust 2005-11 | 0,01 | 0,00 | 0,0004 | 0,0000 | ||

| RFR USD SOFR/3.51400 09/04/24-10Y LCH / DIR (EZSXZYY2VD17) | 0,01 | −28,57 | 0,0004 | −0,0001 | ||

| RFR USD SOFR/3.51400 09/04/24-10Y LCH / DIR (EZSXZYY2VD17) | 0,01 | −28,57 | 0,0004 | −0,0001 | ||

| BOUGHT ZAR SOLD USD 20250723 / DFE (000000000) | 0,01 | 0,0004 | 0,0004 | |||

| BOUGHT ZAR SOLD USD 20250723 / DFE (000000000) | 0,01 | 0,0004 | 0,0004 | |||

| RFR USD SOFR/3.40750 09/05/24-10Y LCH / DIR (EZQK0T1M7D98) | 0,01 | −16,67 | 0,0004 | −0,0001 | ||

| RFR USD SOFR/3.40750 09/05/24-10Y LCH / DIR (EZQK0T1M7D98) | 0,01 | −16,67 | 0,0004 | −0,0001 | ||

| BOUGHT PLN SOLD USD 20250710 / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | |||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | |||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | |||

| US466247ZP16 / J.P. Morgan Mortgage Trust 2005-A1 | 0,00 | 0,00 | 0,0003 | 0,0000 | ||

| IRS EUR 2.45000 05/05/25-10Y LCH / DIR (EZCDFQCSBVM0) | 0,00 | 0,0003 | 0,0003 | |||

| IRS EUR 2.45000 05/05/25-10Y LCH / DIR (EZCDFQCSBVM0) | 0,00 | 0,0003 | 0,0003 | |||

| BARCLAYS BANK PLC SNR SE ICE / DCR (EZB88Z42LS80) | 0,00 | −20,00 | 0,0003 | −0,0001 | ||

| BARCLAYS BANK PLC SNR SE ICE / DCR (EZB88Z42LS80) | 0,00 | −20,00 | 0,0003 | −0,0001 | ||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT CHF SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT CHF SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT CHF SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| US12669E4A13 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2003 J2 A1 | 0,00 | −25,00 | 0,0003 | −0,0000 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| US3138Y3E568 / FNMA POOL AX1955 FN 08/44 FIXED 4 | 0,00 | 0,00 | 0,0003 | 0,0000 | ||

| IRS EUR 2.39000 10/01/24-10Y LCH / DIR (EZHK1QM5FKM1) | 0,00 | −85,00 | 0,0003 | −0,0012 | ||

| IRS EUR 2.39000 10/01/24-10Y LCH / DIR (EZHK1QM5FKM1) | 0,00 | −85,00 | 0,0003 | −0,0012 | ||

| GOLDMAN SACHS GROUP INC SNR S* ICE / DCR (EZC75LZ075F3) | 0,00 | 0,0003 | 0,0003 | |||

| GOLDMAN SACHS GROUP INC SNR S* ICE / DCR (EZC75LZ075F3) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| US07384MZS42 / Bear Stearns ARM Trust 2003-8 | 0,00 | 0,00 | 0,0002 | 0,0000 | ||

| RFR USD SOFR/3.55800 08/21/24-10Y LCH / DIR (EZHZRCBWPB39) | 0,00 | −25,00 | 0,0002 | −0,0001 | ||

| RFR USD SOFR/3.55800 08/21/24-10Y LCH / DIR (EZHZRCBWPB39) | 0,00 | −25,00 | 0,0002 | −0,0001 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| US929227QB55 / WaMu Mortgage Pass-Through Certificates Series 2002-AR6 Trust | 0,00 | −33,33 | 0,0002 | 0,0000 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| US16678RAS67 / Chevy Chase Funding LLC Mortgage-Backed Certificates Series 2004-1 | 0,00 | 0,00 | 0,0002 | 0,0000 | ||

| US36829JAA97 / GE WMC MORTGAGE SECURITIES LLC GEWMC 2006 1 A2A | 0,00 | 0,00 | 0,0002 | 0,0000 | ||

| US31418CA201 / FNMA POOL MA2724 FN 08/46 FIXED 4.5 | 0,00 | 0,00 | 0,0002 | −0,0000 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT ZAR SOLD USD 20250723 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| RFR USD SOFR/3.60500 08/28/24-10Y LCH / DIR (EZT3B05TS4Z8) | 0,00 | −33,33 | 0,0002 | −0,0001 | ||

| RFR USD SOFR/3.60500 08/28/24-10Y LCH / DIR (EZT3B05TS4Z8) | 0,00 | −33,33 | 0,0002 | −0,0001 | ||

| US31392GVX05 / FANNIEMAE WHOLE LOAN FNW 2003 W1 1A1 | 0,00 | 0,00 | 0,0002 | 0,0000 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| IRS EUR 2.53000 04/23/25-10Y LCH / DIR (EZP376MT1B98) | 0,00 | 0,0002 | 0,0002 | |||

| IRS EUR 2.53000 04/23/25-10Y LCH / DIR (EZP376MT1B98) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| IRS EUR 2.40000 02/12/25-10Y LCH / DIR (EZNHC24BF987) | 0,00 | −50,00 | 0,0001 | −0,0000 | ||

| IRS EUR 2.40000 02/12/25-10Y LCH / DIR (EZNHC24BF987) | 0,00 | −50,00 | 0,0001 | −0,0000 | ||

| US31393APU50 / FNMA, REMIC, Series 2003-25, Class KP | 0,00 | 0,00 | 0,0001 | −0,0000 | ||

| US31402RN628 / FANNIE MAE 3.454% 07/01/2035 FNMA ARM | 0,00 | 0,00 | 0,0001 | 0,0000 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| US31416CLT17 / Fannie Mae Pool | 0,00 | 0,00 | 0,0001 | 0,0000 | ||

| US31359PK398 / FANNIE MAE FNR G97 4 FB | 0,00 | −50,00 | 0,0001 | −0,0000 | ||

| US22540A7A01 / CREDIT SUISSE FIRST BOSTON MOR CSFB 2001 HE17 A1 | 0,00 | 0,00 | 0,0001 | 0,0000 | ||

| IRS EUR 2.52000 04/09/25-10Y LCH / DIR (EZTHL4ZCB733) | 0,00 | 0,0001 | 0,0001 | |||

| IRS EUR 2.52000 04/09/25-10Y LCH / DIR (EZTHL4ZCB733) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| IRS EUR 2.61000 03/24/25-10Y LCH / DIR (EZPS73SKDR02) | 0,00 | −200,00 | 0,0001 | 0,0002 | ||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| IRS EUR 2.55000 04/16/25-10Y LCH / DIR (EZ15F0SX71M6) | 0,00 | 0,0001 | 0,0001 | |||

| IRS EUR 2.55000 04/16/25-10Y LCH / DIR (EZ15F0SX71M6) | 0,00 | 0,0001 | 0,0001 | |||

| US3138EMAL51 / FNMA POOL AL4510 FN 01/27 FIXED VAR | 0,00 | −100,00 | 0,0001 | −0,0000 | ||

| US74160MDL37 / Prime Mortgage Trust 2004-CL1 | 0,00 | 0,0001 | −0,0000 | |||

| RFR USD SOFR/3.67900 08/13/24-10Y LCH / DIR (EZCBVMK12M33) | 0,00 | −100,00 | 0,0000 | −0,0000 | ||

| RFR USD SOFR/3.67900 08/13/24-10Y LCH / DIR (EZCBVMK12M33) | 0,00 | −100,00 | 0,0000 | −0,0000 | ||

| US31416VC441 / FNMA POOL AB0090 FN 03/29 FIXED 4.5 | 0,00 | −100,00 | 0,0000 | −0,0000 | ||

| US3138EGKN30 / FNMA POOL AL0300 FN 06/26 FIXED VAR | 0,00 | 0,0000 | −0,0000 | |||

| US31400MZF21 / FNMA POOL 692042 FN 02/33 FIXED 6 | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT PLN SOLD USD 20250710 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT PLN SOLD USD 20250710 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| US31385HJE36 / FANNIE MAE POOL P#544861 4.18600000 | 0,00 | 0,0000 | −0,0000 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| US31385HJD52 / Fannie Mae Pool | 0,00 | 0,0000 | −0,0000 | |||

| US07384MTN29 / Bear Stearns ARM Trust 2003-1 | 0,00 | 0,0000 | 0,0000 | |||

| US79549AXP91 / SALOMON BROTHERS MORTGAGE SECU SBM7 2003 UP2 A1 | 0,00 | 0,0000 | 0,0000 | |||

| US22540VK434 / Credit Suisse First Boston Mortgage Securities Corp | 0,00 | 0,0000 | 0,0000 | |||

| US05948XBV29 / Banc of America Mortgage Trust, Series 2003-D, Class 2A4 | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| US86358HNX34 / Structured Asset Mortgage Investments Trust 2002-AR3 | 0,00 | 0,0000 | −0,0000 | |||

| BOUGHT ILS SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT ILS SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT MYR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT MYR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| US3138AFYD64 / FNMA POOL AI2507 FN 05/26 FIXED 4.5 | 0,00 | 0,0000 | −0,0000 | |||

| SOLD INR BOUGHT USD 20250820 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| US36228FNB84 / GSR MORTGAGE LOAN TRUST | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| SOLD INR BOUGHT USD 20250820 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| SOLD INR BOUGHT USD 20250820 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| 317U4UUA7 PIMCO SWAPTION 5.0 PUT USD 20250708 / DIR (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| SOLD INR BOUGHT USD 20250820 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| SOLD INR BOUGHT USD 20250820 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT MXN SOLD USD 20250917 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| 317U9G6A0 PIMCO SWAPTION 4.065 PUT USD 2025070 / DIR (EZJQZP36X547) | 0,00 | 0,0000 | 0,0000 | |||

| 317U9EOA5 PIMCO SWAPTION 4.101 PUT USD 2025063 / DIR (EZXJWB9HGZH3) | 0,00 | 0,0000 | 0,0000 | |||

| SOLD INR BOUGHT USD 20250820 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| 317U9G6A0 PIMCO SWAPTION 4.065 PUT USD 2025070 / DIR (EZJQZP36X547) | 0,00 | 0,0000 | 0,0000 | |||

| 317U9EOA5 PIMCO SWAPTION 4.101 PUT USD 2025063 / DIR (EZXJWB9HGZH3) | 0,00 | 0,0000 | 0,0000 | |||

| 317U9EOA5 PIMCO SWAPTION 4.101 PUT USD 2025063 / DIR (EZXJWB9HGZH3) | 0,00 | 0,0000 | 0,0000 | |||

| 317U9FTA7 PIMCO SWAPTION 4.05 PUT USD 20250630 / DIR (EZXJWB9HGZH3) | 0,00 | 0,0000 | 0,0000 | |||

| 317U9GMA2 PIMCO SWAPTION 4.1 PUT USD 20250703 / DIR (EZ78N9X8M3Y4) | 0,00 | 0,0000 | 0,0000 | |||

| 317U9GMA2 PIMCO SWAPTION 4.1 PUT USD 20250703 / DIR (EZ78N9X8M3Y4) | 0,00 | 0,0000 | 0,0000 | |||

| 317U9GBA4 PIMCO SWAPTION 2.38 CALL EUR 2025070 / DIR (EZ8HHXRGV1D7) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9GBA4 PIMCO SWAPTION 2.38 CALL EUR 2025070 / DIR (EZ8HHXRGV1D7) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9IZA4 PIMCO SWAPTION 4.125 PUT USD 2025070 / DIR (EZY1VWC6W1B5) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9IZA4 PIMCO SWAPTION 4.125 PUT USD 2025070 / DIR (EZY1VWC6W1B5) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD INR BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9JKA8 PIMCO SWAPTION 4.14 PUT USD 20250709 / DIR (EZYG54DQ9CL7) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9JKA8 PIMCO SWAPTION 4.14 PUT USD 20250709 / DIR (EZYG54DQ9CL7) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9JKA8 PIMCO SWAPTION 4.14 PUT USD 20250709 / DIR (EZYG54DQ9CL7) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD INR BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9JRA1 PIMCO SWAPTION 4.12 PUT USD 20250709 / DIR (EZYG54DQ9CL7) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9HMA0 PIMCO SWAPTION 4.019 PUT USD 2025070 / DIR (EZY1VWC6W1B5) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9HMA0 PIMCO SWAPTION 4.019 PUT USD 2025070 / DIR (EZY1VWC6W1B5) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9JSA0 PIMCO SWAPTION 4.122 PUT USD 2025071 / DIR (EZMLYZSNFH30) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9JSA0 PIMCO SWAPTION 4.122 PUT USD 2025071 / DIR (EZMLYZSNFH30) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD ILS BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD ILS BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| US 10YR FUT OPTN AUG25P 108.5 EXP 07/25/2025 / DIR (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| US 10YR FUT OPTN AUG25P 108.5 EXP 07/25/2025 / DIR (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9L5A0 PIMCO SWAPTION 4.064 PUT USD 2025071 / DIR (EZQM9CB4TVR9) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9L5A0 PIMCO SWAPTION 4.064 PUT USD 2025071 / DIR (EZQM9CB4TVR9) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9L3A2 PIMCO SWAPTION 4.0525 PUT USD 202507 / DIR (EZQM9CB4TVR9) | −0,00 | −0,0000 | −0,0000 | |||

| 317U9L3A2 PIMCO SWAPTION 4.0525 PUT USD 202507 / DIR (EZQM9CB4TVR9) | −0,00 | −0,0000 | −0,0000 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | −0,00 | −0,0000 | −0,0000 | |||

| 31750QN88 PIMCO CDSOPT PUT USD 0.85 20250716 / DCR (EZ967XY50V92) | −0,00 | −0,0000 | −0,0000 | |||