Grunnleggende statistikk

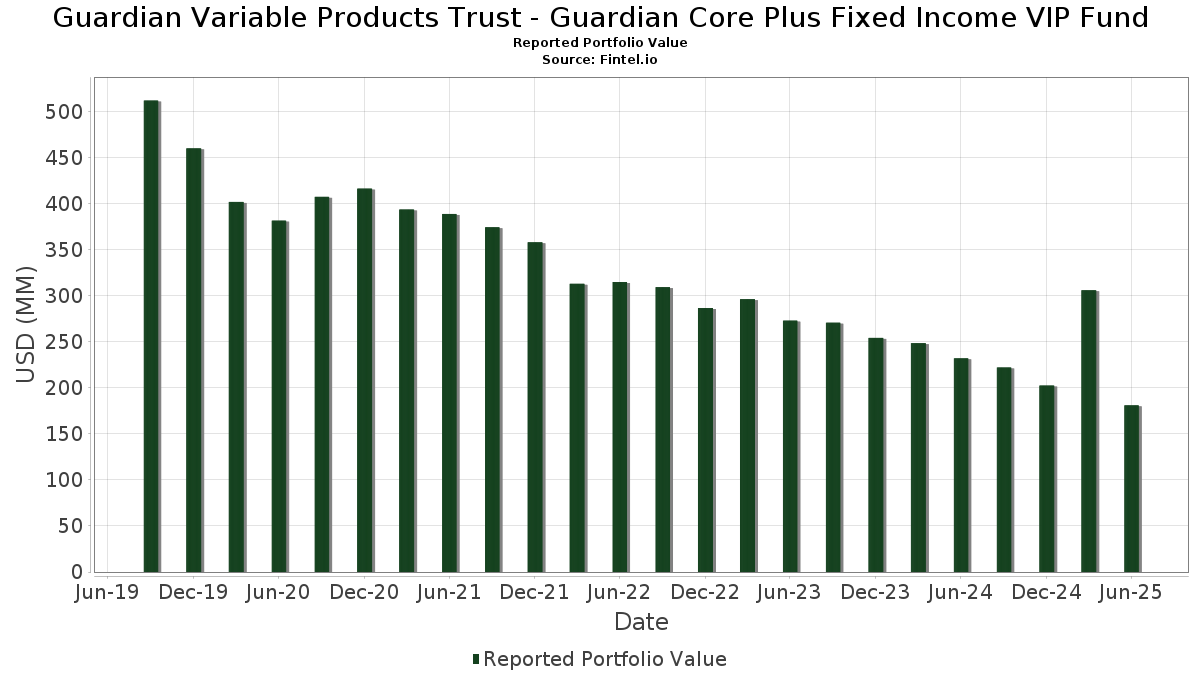

| Porteføljeverdi | $ 181 050 457 |

| Nåværende posisjoner | 445 |

Siste beholdninger, prestasjoner, forvaltet kapital (fra 13F, 13D)

Guardian Variable Products Trust - Guardian Core Plus Fixed Income VIP Fund har oppgitt 445 totale beholdninger i sine siste SEC-arkiveringer. Siste porteføljeverdi er beregnet til 181 050 457 USD. Faktisk forvaltet kapital (AUM) er denne verdien pluss kontanter (som ikke er oppgitt). Guardian Variable Products Trust - Guardian Core Plus Fixed Income VIP Funds største beholdninger er Uniform Mortgage-Backed Security, TBA (US:US01F0524821) , Ginnie Mae (US:US21H0526788) , Ginnie Mae (US:US21H0606713) , U.S. Treasury Bonds (US:US912810TK43) , and FEDERAL NATIONAL MORTGAGE ASSOCIATION 30YR TBA AUG (XX:US01F0226831) . Guardian Variable Products Trust - Guardian Core Plus Fixed Income VIP Funds nye posisjoner inkluderer Uniform Mortgage-Backed Security, TBA (US:US01F0524821) , Ginnie Mae (US:US21H0526788) , Ginnie Mae (US:US21H0606713) , U.S. Treasury Bonds (US:US912810TK43) , and FEDERAL NATIONAL MORTGAGE ASSOCIATION 30YR TBA AUG (XX:US01F0226831) .

De største økningene dette kvartalet

Vi bruker endringen i porteføljeallokeringen fordi dette er det mest meningsfulle målet. Endringer kan skyldes handler eller endringer i aksjekursene.

| Verdipapirer | Aksjer (MM) |

Verdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 3,72 | 2,4700 | 2,4700 | ||

| 6,08 | 4,0371 | 2,4018 | ||

| 3,06 | 2,0335 | 2,0335 | ||

| 3,01 | 1,9963 | 1,9963 | ||

| 2,46 | 1,6342 | 1,6342 | ||

| 2,42 | 1,6051 | 1,4216 | ||

| 2,80 | 1,8582 | 1,2330 | ||

| 2,07 | 1,3754 | 1,1038 | ||

| 2,82 | 1,8710 | 1,0526 | ||

| 1,97 | 1,3116 | 1,0459 |

De største reduksjonene dette kvartalet

Vi bruker endringen i porteføljeallokeringen fordi dette er det mest meningsfulle målet. Endringer kan skyldes handler eller endringer i aksjekurser.

| Verdipapirer | Aksjer (MM) |

Verdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,54 | 0,3560 | −1,5173 | ||

| 0,27 | 0,1806 | −1,2618 | ||

| 0,04 | 0,0259 | −1,1032 | ||

| 4,23 | 2,8097 | −1,1024 | ||

| 0,43 | 0,2882 | −0,9886 | ||

| 0,61 | 0,4027 | −0,9671 | ||

| 0,18 | 0,1222 | −0,8802 | ||

| 0,25 | 0,1647 | −0,5920 | ||

| 0,46 | 0,3086 | −0,5506 | ||

| 0,15 | 0,0993 | −0,4710 |

13F- og Fondsarkiveringer

Dette skjemaet ble sendt inn den 2025-08-15 for rapporteringsperioden 2025-06-30. Denne investoren har ikke oppgitt verdipapirer som regnes i aksjer, så de aksjerelaterte kolonnene i tabellen nedenfor er utelatt. Klikk på lenkeikonet for å se hele transaksjonshistorikken.

Oppgradere for å låse opp premiedata og eksportere til Excel![]() .

.

| Verdipapirer | Type | ΔAksjer (%) |

Verdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|

| U.S. Treasury Bonds / DBT (US912810UE63) | 6,08 | 125,99 | 4,0371 | 2,4018 | ||

| U.S. Treasury Bonds / DBT (US912810UF39) | 4,23 | −34,28 | 2,8097 | −1,1024 | ||

| U.S. Treasury Notes / DBT (US91282CMY48) | 3,72 | 2,4700 | 2,4700 | |||

| U.S. Treasury Bonds / DBT (US912810UJ50) | 3,06 | 2,0335 | 2,0335 | |||

| U.S. Treasury Notes / DBT (US91282CMU26) | 3,01 | 1,9963 | 1,9963 | |||

| US01F0524821 / Uniform Mortgage-Backed Security, TBA | 2,82 | 71,92 | 1,8710 | 1,0526 | ||

| US21H0526788 / Ginnie Mae | 2,80 | 123,40 | 1,8582 | 1,2330 | ||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 2,46 | 1,6342 | 1,6342 | |||

| US21H0606713 / Ginnie Mae | 2,42 | 558,31 | 1,6051 | 1,4216 | ||

| US912810TK43 / U.S. Treasury Bonds | 2,07 | 364,13 | 1,3754 | 1,1038 | ||

| US01F0226831 / FEDERAL NATIONAL MORTGAGE ASSOCIATION 30YR TBA AUG | 1,97 | 271,05 | 1,3116 | 1,0459 | ||

| US01F0224778 / UMBS TBA | 1,52 | 1,0097 | 1,0097 | |||

| US3140XGTN91 / Fannie Mae Pool | 1,49 | −1,97 | 0,9904 | 0,0661 | ||

| US01F0526800 / Uniform Mortgage-Backed Security, TBA | 1,45 | 17,76 | 0,9652 | 0,3493 | ||

| US21H0506723 / Ginnie Mae | 1,44 | 48,05 | 0,9585 | 0,4718 | ||

| US3140X7TQ26 / Fannie Mae Pool | 1,29 | −3,31 | 0,8552 | 0,0458 | ||

| US21H0226710 / GNII II 2.5% 07/01/2050 #TBA | 1,27 | 1,04 | 0,8410 | 0,2156 | ||

| US01F0504864 / Uniform Mortgage-Backed Security, TBA | 1,20 | 48,33 | 0,7973 | 0,4587 | ||

| US21H0426799 / Ginnie Mae | 1,18 | 17,85 | 0,7807 | 0,2823 | ||

| US21H0626778 / Ginnie Mae | 1,09 | 36,58 | 0,7269 | 0,3264 | ||

| US01F0524748 / Uniform Mortgage-Backed Security, TBA | 1,09 | 330,31 | 0,7264 | 0,5994 | ||

| US80287FAE25 / SDART 22-7 C 6.69% 03-17-31/11-16-26 | 1,09 | 0,46 | 0,7216 | 0,0641 | ||

| US3137H8TZ49 / FEDERAL HOME LN MTG MLT CTF GT 3.123% 08/25/2032 | 1,06 | 0,96 | 0,7028 | 0,0661 | ||

| FMCC / Federal Home Loan Mortgage Corporation | 1,05 | 0,6996 | 0,6996 | |||

| XS1040508167 / Imperial Brands Finance plc | 1,04 | 26,00 | 0,6926 | 0,1896 | ||

| US96042XAF24 / Westlake Automobile Receivables Trust, Series 2023-1A, Class C | 1,02 | −0,20 | 0,6783 | 0,0561 | ||

| US61747YES00 / Morgan Stanley | 1,00 | 1,63 | 0,6637 | 0,0656 | ||

| US21H0306744 / Ginnie Mae | 0,99 | −18,36 | 0,6559 | 0,0517 | ||

| US01F0606834 / Uniform Mortgage-Backed Security, TBA | 0,96 | −1,33 | 0,6402 | 0,1526 | ||

| US3140XH3N53 / Fannie Mae Pool | 0,96 | −1,85 | 0,6350 | 0,0434 | ||

| U.S. Treasury Notes / DBT (US91282CMP31) | 0,95 | 0,6304 | 0,6304 | |||

| US00792FAA66 / Affirm Asset Securitization Trust, Series 2023-B, Class A | 0,95 | −0,42 | 0,6302 | 0,0511 | ||

| U.S. Treasury Bonds / DBT (US912810UG12) | 0,94 | 0,6249 | 0,6249 | |||

| US21H0306827 / Ginnie Mae | 0,89 | −36,75 | 0,5900 | −0,1115 | ||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,87 | 0,5757 | 0,5757 | |||

| US3140XHXH50 / Fannie Mae Pool | 0,84 | −2,31 | 0,5608 | 0,0350 | ||

| First National Master Note Trust / ABS-O (US32113CCB46) | 0,82 | 0,12 | 0,5455 | 0,0469 | ||

| US05369LAE74 / Avid Automobile Receivables Trust 2021-1 | 0,80 | −3,52 | 0,5284 | 0,0274 | ||

| US345340AA14 / Ford Credit Auto Owner Trust 2021-REV1 | 0,78 | 0,5187 | 0,5187 | |||

| US3140XHPS08 / Fannie Mae Pool | 0,77 | −2,78 | 0,5122 | 0,0305 | ||

| US17331KAD19 / Citizens Auto Receivables Trust | 0,75 | −22,34 | 0,4994 | −0,0886 | ||

| US22822VAR24 / SR UNSECURED 07/30 3.3 | 0,74 | 64,75 | 0,4936 | 0,2194 | ||

| US00130HCC79 / AES CORP 3.95% 07/15/2030 144A | 0,74 | 1,23 | 0,4929 | 0,0478 | ||

| US01F0206791 / UMBS, 30 Year, Single Family | 0,73 | 0,4858 | 0,4858 | |||

| US06051GJZ37 / Bank of America Corp | 0,72 | 1,41 | 0,4789 | 0,0469 | ||

| US212015AT84 / Continental Resources Inc/OK | 0,72 | −34,10 | 0,4780 | −0,1855 | ||

| US52607MAA71 / LENDMARK FUNDING TRUST 21-1A A 1.9% 11/20/2031 144A | 0,72 | 0,99 | 0,4763 | 0,0445 | ||

| Athene Global Funding / DBT (US04685A3V13) | 0,72 | −0,14 | 0,4759 | 0,0396 | ||

| US3132DNQK27 / Freddie Mac Pool | 0,70 | −3,44 | 0,4660 | 0,0245 | ||

| US225401AY40 / Credit Suisse Group AG | 0,69 | −0,43 | 0,4586 | 0,0372 | ||

| Foundry JV Holdco LLC / DBT (US350930AG89) | 0,67 | 47,25 | 0,4457 | 0,1687 | ||

| USB / U.S. Bancorp - Depositary Receipt (Common Stock) | 0,66 | 1,70 | 0,4374 | 0,0435 | ||

| US12565VAA17 / CIM Trust 2021-J3 | 0,66 | −1,20 | 0,4374 | 0,0321 | ||

| US50212YAD67 / LPL Holdings Inc | 0,65 | 1,24 | 0,4338 | 0,0421 | ||

| US3132E0Y638 / FR SD4333 | 0,64 | −4,46 | 0,4277 | 0,0183 | ||

| BANK5 2025-5YR14 / ABS-MBS (US06604MAC29) | 0,63 | 0,4218 | 0,4218 | |||

| US21H0506806 / GNMA | 0,62 | 4,36 | 0,4135 | 0,1158 | ||

| US51507KAA43 / Lending Funding Trust 2020-2 | 0,61 | −32,12 | 0,4076 | −0,1419 | ||

| Benchmark 2024-V7 Mortgage Trust / ABS-MBS (US08163YAC57) | 0,61 | 0,66 | 0,4061 | 0,0369 | ||

| US01F0226757 / Uniform Mortgage-Backed Security, TBA | 0,61 | −88,02 | 0,4027 | −0,9671 | ||

| US3137H74A85 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,60 | 1,35 | 0,3998 | 0,0390 | ||

| US674599ED34 / Occidental Petroleum Corp | 0,58 | −37,35 | 0,3871 | −0,1779 | ||

| US052113AB36 / Ausgrid Finance Pty Ltd | 0,58 | 0,70 | 0,3831 | 0,0351 | ||

| US00928QAU58 / Aircastle Ltd | 0,57 | 0,88 | 0,3795 | 0,0352 | ||

| US29250NBT19 / Enbridge, Inc. | 0,57 | 1,06 | 0,3791 | 0,0359 | ||

| SBNA Auto Receivables Trust 2024-A / ABS-O (US78437PAC77) | 0,56 | −16,01 | 0,3700 | −0,0328 | ||

| Citizens Auto Receivables Trust 2024-2 / ABS-O (US17331XAE13) | 0,55 | −0,18 | 0,3673 | 0,0310 | ||

| EW / Edwards Lifesciences Corporation | 0,55 | 265,77 | 0,3622 | 0,2629 | ||

| GXO / GXO Logistics, Inc. | 0,54 | 2,06 | 0,3614 | 0,0373 | ||

| R2RX34 / Regal Rexnord Corporation - Depositary Receipt (Common Stock) | 0,54 | −0,18 | 0,3614 | 0,0299 | ||

| US3137HAD860 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,54 | 0,3571 | 0,3571 | |||

| US01F0506844 / UMBS TBA | 0,54 | −89,71 | 0,3560 | −1,5173 | ||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,53 | 0,3547 | 0,3547 | |||

| US225401AV01 / Credit Suisse Group AG | 0,53 | 0,00 | 0,3513 | 0,0302 | ||

| DLLAD 2023-1 LLC / ABS-O (US233258AD43) | 0,52 | 0,59 | 0,3424 | 0,0311 | ||

| BBCMS Mortgage Trust 2025-5C33 / ABS-MBS (US072924AD56) | 0,50 | 0,40 | 0,3337 | 0,0296 | ||

| US62928CAA09 / NGPL PipeCo LLC | 0,50 | 1,83 | 0,3334 | 0,0339 | ||

| AB BSL CLO 3 Ltd / ABS-CBDO (US00037QAN97) | 0,50 | 0,20 | 0,3320 | 0,0292 | ||

| US15135BAY74 / Centene Corp | 0,50 | 1,84 | 0,3311 | 0,0335 | ||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 0,50 | 127,52 | 0,3297 | 0,1966 | ||

| Glencore Funding LLC / DBT (US378272BU12) | 0,49 | 1,65 | 0,3275 | 0,0323 | ||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0,49 | 53,75 | 0,3273 | 0,1326 | ||

| US902613AH15 / UBS Group AG | 0,49 | 1,04 | 0,3238 | 0,0303 | ||

| GM Financial Automobile Leasing Trust 2024-3 / ABS-O (US38012QAD07) | 0,48 | 0,21 | 0,3188 | 0,0278 | ||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 0,48 | 0,3171 | 0,3171 | |||

| US3140QPAL19 / Fannie Mae Pool | 0,47 | −2,48 | 0,3137 | 0,0189 | ||

| HCA Inc / DBT (US404119DA49) | 0,47 | 2,40 | 0,3126 | 0,0330 | ||

| US21H0626851 / Ginnie Mae | 0,47 | −67,92 | 0,3110 | −0,4178 | ||

| US21H0206753 / GINNIE MAE II POOL 30YR TBA (JULY) | 0,47 | 0,65 | 0,3095 | 0,0783 | ||

| Uniform Mortgage-Backed Security, TBA / ABS-MBS (US01F0706824) | 0,46 | −73,02 | 0,3086 | −0,5506 | ||

| US902613AC28 / UBS Group AG | 0,46 | 0,87 | 0,3085 | 0,0286 | ||

| US03674XAQ97 / Antero Resources Corp | 0,46 | 0,22 | 0,3063 | 0,0265 | ||

| US36262WAB28 / GS Mortgage-Backed Securities Trust | 0,46 | −2,34 | 0,3061 | 0,0193 | ||

| Affirm Asset Securitization Trust 2024-A / ABS-O (US00834BAF40) | 0,46 | 0,00 | 0,3037 | 0,0254 | ||

| US3132DNNR07 / Freddie Mac Pool | 0,45 | −3,00 | 0,3013 | 0,0173 | ||

| Neuberger Berman Loan Advisers CLO 46 Ltd / ABS-CBDO (US64134QAN79) | 0,45 | 0,67 | 0,2993 | 0,0275 | ||

| Vistra Operations Co LLC / DBT (US92840VAU61) | 0,45 | 33,33 | 0,2983 | 0,0940 | ||

| US33852CAB90 / Flagstar Mortgage Trust 2021-3INV | 0,44 | −2,21 | 0,2948 | 0,0190 | ||

| US15135BAV36 / CENTENE CORP 3.375% 02/15/2030 | 0,44 | −23,92 | 0,2936 | −0,0596 | ||

| US05635JAB61 / Bacardi Ltd / Bacardi-Martini BV | 0,44 | 1,62 | 0,2913 | 0,0293 | ||

| AS Mileage Plan IP Ltd / DBT (US00218QAB68) | 0,44 | 19,73 | 0,2905 | 0,0681 | ||

| US90353TAK60 / Uber Technologies Inc | 0,44 | 1,16 | 0,2895 | 0,0278 | ||

| Uniform Mortgage-Backed Security, TBA / ABS-MBS (US01F0604854) | 0,43 | −83,06 | 0,2882 | −0,9886 | ||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 0,43 | −25,34 | 0,2877 | −0,0652 | ||

| US14318MAF68 / Carmax Auto Owner Trust | 0,43 | 0,2863 | 0,2863 | |||

| US07274EAK91 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.375% 11-21-30 | 0,43 | 1,91 | 0,2831 | 0,0287 | ||

| World Omni Automobile Lease Securitization Trust 2025-A / ABS-O (US98164PAF71) | 0,43 | 0,00 | 0,2828 | 0,0243 | ||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0,42 | −31,11 | 0,2814 | −0,0923 | ||

| US3137H9PB99 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,42 | 0,95 | 0,2811 | 0,0261 | ||

| US35564KQC61 / Freddie Mac STACR REMIC Trust 2022-DNA1 | 0,42 | 14,67 | 0,2808 | 0,0569 | ||

| US05400KAJ97 / Avolon TLB Borrower 1 (US) LLC 2023 Term Loan B6 | 0,42 | 0,24 | 0,2804 | 0,0242 | ||

| US3137H7ZB24 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,42 | 1,20 | 0,2792 | 0,0267 | ||

| Brighthouse Financial Global Funding / DBT (US10921U2L15) | 0,42 | 0,72 | 0,2772 | 0,0252 | ||

| US225401BC11 / UBS Group AG | 0,41 | −0,24 | 0,2748 | 0,0230 | ||

| US15135BAR24 / Centene Corp | 0,41 | 0,73 | 0,2742 | 0,0255 | ||

| US00135TAD63 / AIB Group PLC | 0,41 | 0,24 | 0,2733 | 0,0237 | ||

| US11135FBT75 / Broadcom, Inc. | 0,41 | 1,73 | 0,2731 | 0,0269 | ||

| US459506AN18 / CORP. NOTE | 0,41 | −58,44 | 0,2730 | −0,3284 | ||

| Westlake Automobile Receivables Trust 2024-2 / ABS-O (US96042YAF07) | 0,41 | −0,25 | 0,2694 | 0,0221 | ||

| Warwick Capital CLO 6 Ltd / ABS-CBDO (US93656EAA91) | 0,41 | 0,2690 | 0,2690 | |||

| NVT / Nvent Finance Sarl | 0,40 | 0,75 | 0,2680 | 0,0245 | ||

| US05369AAK79 / Aviation Capital Group LLC | 0,40 | 0,75 | 0,2668 | 0,0245 | ||

| US92852LAC37 / Viterra Finance BV | 0,40 | 0,25 | 0,2650 | 0,0233 | ||

| US33845XAE76 / Flagship Credit Auto Trust 2020-4 | 0,40 | 0,76 | 0,2648 | 0,0245 | ||

| US44891ABN63 / Hyundai Capital America | 0,40 | 0,76 | 0,2647 | 0,0243 | ||

| US05553WAE93 / Barclays Commercial Mortgage S | 0,39 | 0,26 | 0,2617 | 0,0232 | ||

| MF1 2024-FL14 LLC / ABS-CBDO (US55416AAA79) | 0,39 | 0,00 | 0,2593 | 0,0220 | ||

| GLS Auto Select Receivables Trust 2025-3 / ABS-O (US36272GAC33) | 0,39 | 0,2591 | 0,2591 | |||

| FMCC / Federal Home Loan Mortgage Corporation | 0,39 | −4,91 | 0,2575 | 0,0099 | ||

| Carmax Select Receivables Trust 2024-A / ABS-O (US14319FAD50) | 0,38 | 0,00 | 0,2552 | 0,0216 | ||

| USP6777MAB83 / Minera Mexico SA de CV | 0,38 | 2,41 | 0,2550 | 0,0272 | ||

| FMCC / Federal Home Loan Mortgage Corporation | 0,38 | −5,94 | 0,2528 | 0,0070 | ||

| Silver Point CLO 10 Ltd / ABS-CBDO (US827920AA76) | 0,38 | 0,2524 | 0,2524 | |||

| Huntington Auto Trust 2024-1 / ABS-O (US446144AE71) | 0,38 | 0,2518 | 0,2518 | |||

| CNO Global Funding / DBT (US18977W2D15) | 0,37 | 0,00 | 0,2470 | 0,0213 | ||

| SWCH Commercial Mortgage Trust 2025-DATA / ABS-MBS (US78489CAA71) | 0,37 | 0,2437 | 0,2437 | |||

| Flutter Financing BV 2024 Term Loan B / LON (XAN3313EAG51) | 0,37 | 0,00 | 0,2430 | 0,0207 | ||

| US902613AS79 / UBS Group AG | 0,37 | 0,27 | 0,2429 | 0,0211 | ||

| US78433DAA28 / SEB Funding LLC | 0,36 | 0,55 | 0,2418 | 0,0217 | ||

| US64128XAG51 / Neuberger Berman Group LLC / Neuberger Berman Finance Corp | 0,36 | 0,28 | 0,2417 | 0,0212 | ||

| Mercury Financial Credit Card Master Trust / ABS-O (US58940BAZ94) | 0,36 | 0,00 | 0,2412 | 0,0202 | ||

| C1FG34 / Citizens Financial Group, Inc. - Depositary Receipt (Common Stock) | 0,36 | 1,69 | 0,2408 | 0,0241 | ||

| M&T Equipment 2025-LEAF1 Notes / ABS-O (US55340QAC96) | 0,36 | 0,2406 | 0,2406 | |||

| Benchmark 2024-V9 Mortgage Trust / ABS-MBS (US081919AN29) | 0,36 | 0,2403 | 0,2403 | |||

| US25470DAR08 / Discovery, Inc. Bond | 0,36 | 45,75 | 0,2397 | 0,0890 | ||

| US072732AC42 / Bayer Corp | 0,36 | 0,00 | 0,2382 | 0,0203 | ||

| ROCK Trust 2024-CNTR / ABS-MBS (US74970WAA80) | 0,36 | 1,42 | 0,2376 | 0,0232 | ||

| US46592XAC83 / JP Morgan Mortgage Trust 2021-13 | 0,36 | −2,46 | 0,2376 | 0,0147 | ||

| US3140QPAM91 / Fannie Mae Pool | 0,35 | −3,01 | 0,2355 | 0,0135 | ||

| GA Global Funding Trust / DBT (US36143L2Q77) | 0,35 | 0,57 | 0,2344 | 0,0216 | ||

| US95000U2S19 / Wells Fargo & Co | 0,35 | 0,86 | 0,2337 | 0,0220 | ||

| R1OL34 / Rollins, Inc. - Depositary Receipt (Common Stock) | 0,35 | 0,2326 | 0,2326 | |||

| New Residential Mortgage Loan Trust 2025-NQM3 / ABS-MBS (US64832CAC73) | 0,35 | 0,2321 | 0,2321 | |||

| GA Global Funding Trust / DBT (US36143L2T17) | 0,35 | 0,87 | 0,2317 | 0,0214 | ||

| Wells Fargo Commercial Mortgage Trust 2024-MGP / ABS-MBS (US95003TAS24) | 0,35 | 0,00 | 0,2313 | 0,0194 | ||

| PEAC Solutions Receivables 2024-1 LLC / ABS-O (US69433BAC19) | 0,35 | 0,2304 | 0,2304 | |||

| US36264DAB29 / GS Mortgage-Backed Securities Trust 2021-PJ2 | 0,35 | −1,98 | 0,2302 | 0,0150 | ||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0,35 | 1,47 | 0,2301 | 0,0224 | ||

| US576323AP42 / MasTec Inc | 0,35 | 1,17 | 0,2300 | 0,0218 | ||

| US46654RAG74 / J.P. Morgan Mortgage Trust 2021-INV8 | 0,35 | −3,09 | 0,2298 | 0,0130 | ||

| Mars Inc / DBT (US571676BA26) | 0,34 | 0,58 | 0,2285 | 0,0206 | ||

| Appalachian Power Co / DBT (US037735DB08) | 0,34 | 1,48 | 0,2285 | 0,0227 | ||

| US3140XHWU70 / Fannie Mae Pool | 0,34 | −2,29 | 0,2273 | 0,0141 | ||

| U1HS34 / Universal Health Services, Inc. - Depositary Receipt (Common Stock) | 0,34 | 0,88 | 0,2272 | 0,0210 | ||

| US39530LAD29 / Greenko Dutch BV | 0,34 | 1,49 | 0,2260 | 0,0217 | ||

| KKR CLO 35 Ltd / ABS-CBDO (US48254LAQ86) | 0,34 | 0,00 | 0,2256 | 0,0194 | ||

| Alpha Generation LLC Term Loan B / LON (US02072UAC62) | 0,34 | 0,2247 | 0,2247 | |||

| US631005BJ39 / Narragansett Electric Co/The | 0,34 | 0,90 | 0,2246 | 0,0206 | ||

| US46590XAU00 / JBS USA LUX SA / JBS USA Food Co / JBS USA Finance Inc | 0,33 | 1,52 | 0,2224 | 0,0220 | ||

| US55608JAN81 / Macquarie Group Ltd | 0,33 | 0,60 | 0,2222 | 0,0199 | ||

| US034863BB50 / Anglo American Capital PLC | 0,33 | 0,91 | 0,2204 | 0,0207 | ||

| US345370CX67 / Ford Motor Co | 0,33 | 0,91 | 0,2202 | 0,0202 | ||

| RAD CLO 27 Ltd / ABS-CBDO (US749972AA38) | 0,33 | 0,30 | 0,2195 | 0,0192 | ||

| 2914 / Japan Tobacco Inc. | 0,33 | 0,2194 | 0,2194 | |||

| Clover CLO 2018-1 LLC / ABS-CBDO (US18914GAE17) | 0,33 | 0,2193 | 0,2193 | |||

| US26884LAG41 / EQT Corp | 0,33 | 0,61 | 0,2187 | 0,0193 | ||

| BATBC / British American Tobacco Bangladesh Company Limited | 0,33 | −37,48 | 0,2174 | −0,1006 | ||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 0,33 | 1,25 | 0,2163 | 0,0207 | ||

| US33852JAA60 / Flagstar Mortgage Trust 2021-7 | 0,33 | −2,11 | 0,2163 | 0,0140 | ||

| US073685AD12 / Beacon Roofing Supply Inc 4.875% 11/01/2025 144a Bond | 0,33 | 0,2160 | 0,2160 | |||

| 29364W405 / Entergy Louisiana LLC, 5.875% Series First Mortgage Bonds due 6/15/2041 | 0,32 | 0,00 | 0,2144 | 0,0182 | ||

| US01F0206874 / UMBS TBA 30YR 2% AUG 20 TO BE ANNOUNCED 2.00000000 | 0,32 | −71,86 | 0,2130 | −0,3550 | ||

| US35564KTJ87 / Freddie Mac STACR REMIC Trust 2022-HQA1 | 0,32 | 0,32 | 0,2118 | 0,0189 | ||

| Nuveen LLC / DBT (US67080LAD73) | 0,32 | 1,94 | 0,2102 | 0,0214 | ||

| Verizon Master Trust / ABS-O (US92348KCH41) | 0,32 | 52,17 | 0,2097 | 0,0836 | ||

| US87612BBQ41 / CORPORATE BONDS | 0,31 | 0,64 | 0,2089 | 0,0188 | ||

| US01F0504781 / Fannie Mae or Freddie Mac | 0,31 | 0,2088 | 0,2088 | |||

| PEAC Solutions Receivables 2024-2 LLC / ABS-O (US69392BAB27) | 0,31 | −12,15 | 0,2067 | −0,0089 | ||

| VICI / VICI Properties Inc. | 0,31 | 0,66 | 0,2046 | 0,0191 | ||

| BX Trust 2025-ROIC / ABS-MBS (US05593VAG86) | 0,31 | 0,00 | 0,2044 | 0,0176 | ||

| US366651AC11 / Gartner Inc | 0,31 | 0,66 | 0,2031 | 0,0187 | ||

| US3140X7YL73 / Fannie Mae Pool | 0,30 | −2,88 | 0,2017 | 0,0118 | ||

| US034863AW07 / Anglo American Capital PLC | 0,30 | 0,2012 | 0,2012 | |||

| JP Morgan Mortgage Trust Series 2025-DSC1 / ABS-MBS (US46593TAA07) | 0,30 | 0,2006 | 0,2006 | |||

| US59217GFC87 / Metropolitan Life Global Funding I | 0,30 | 0,00 | 0,2004 | 0,0173 | ||

| Jackson National Life Global Funding / DBT (US46849LVB43) | 0,30 | 1,01 | 0,2001 | 0,0186 | ||

| XS2574267188 / Hungary Government International Bond | 0,30 | 0,1987 | 0,1987 | |||

| Avant Loans Funding Trust 2024-REV1 / ABS-O (US05352UAA43) | 0,30 | −39,80 | 0,1982 | −0,1030 | ||

| TEXAS Commercial Mortgage Trust 2025-TWR / ABS-MBS (US88231WAC91) | 0,30 | 49,75 | 0,1981 | 0,0770 | ||

| US115236AC57 / Brown & Brown, Inc. | 0,30 | 2,41 | 0,1976 | 0,0212 | ||

| US05366DAA63 / Aviation Capital Group LLC | 0,30 | 1,37 | 0,1974 | 0,0188 | ||

| Allied Universal Holdco LLC / DBT (US019576AD90) | 0,30 | −16,19 | 0,1965 | −0,0179 | ||

| US95000U2U64 / Wells Fargo & Co | 0,29 | 2,08 | 0,1954 | 0,0199 | ||

| US95003FBR38 / Wells Fargo Mortgage Backed Securities 2021-INV2 Trust | 0,29 | −2,66 | 0,1953 | 0,0121 | ||

| US69380CAA62 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,29 | −5,18 | 0,1951 | 0,0067 | ||

| US29450YAA73 / EquipmentShare.com, Inc. | 0,29 | 2,10 | 0,1945 | 0,0201 | ||

| Enel Finance International NV / DBT (US29278GBD97) | 0,29 | 1,04 | 0,1942 | 0,0180 | ||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 0,29 | 1,39 | 0,1934 | 0,0189 | ||

| Hudson Yards 2025-SPRL Mortgage Trust / ABS-MBS (US44855PAA66) | 0,29 | −25,39 | 0,1916 | −0,0435 | ||

| US345397D427 / FORD MOTOR CREDIT CO LLC REGD 7.20000000 | 0,29 | 1,42 | 0,1900 | 0,0182 | ||

| US06652KAB98 / BankUnited Inc | 0,28 | 0,71 | 0,1892 | 0,0175 | ||

| US05401AAM36 / Avolon Holdings Funding Ltd | 0,28 | −63,76 | 0,1886 | −0,2864 | ||

| B1BT34 / Truist Financial Corporation - Depositary Receipt (Common Stock) | 0,28 | 1,44 | 0,1879 | 0,0184 | ||

| US56848DAA72 / Mariner Finance Issuance Trust 2021-A | 0,28 | 0,72 | 0,1866 | 0,0176 | ||

| US11135FAS02 / BROADCOM INC 4.3% 11/15/2032 | 0,28 | 1,83 | 0,1848 | 0,0184 | ||

| LoanCore 2025 2025-CRE8 Issuer LLC / ABS-CBDO (US53947FAA93) | 0,28 | −1,08 | 0,1840 | 0,0141 | ||

| US753272AA11 / Rand Parent LLC | 0,28 | −21,59 | 0,1839 | −0,0301 | ||

| Atlassian Corp / DBT (US049468AB74) | 0,28 | 0,73 | 0,1833 | 0,0172 | ||

| US629377CL46 / NRG Energy Inc | 0,28 | 1,48 | 0,1830 | 0,0179 | ||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,28 | 0,1829 | 0,1829 | |||

| Wells Fargo Commercial Mortgage Trust 2025-5C3 / ABS-MBS (US95004JAC80) | 0,27 | 0,74 | 0,1824 | 0,0166 | ||

| US345397B280 / FORD MTR CR CO LLC 3.375% 11/13/2025 | 0,27 | 0,74 | 0,1814 | 0,0163 | ||

| US01F0326821 / Fannie Mae or Freddie Mac | 0,27 | −93,23 | 0,1806 | −1,2618 | ||

| US38141GYJ74 / Goldman Sachs Group Inc/The | 0,27 | 1,89 | 0,1799 | 0,0185 | ||

| Beacon Funding Trust / DBT (US073952AB93) | 0,27 | −0,37 | 0,1795 | 0,0143 | ||

| US46655GAD79 / J.P. Morgan Mortgage Trust 2022-4 | 0,27 | −2,88 | 0,1795 | 0,0100 | ||

| OCP CLO 2021-22 Ltd / ABS-CBDO (US67117TAS42) | 0,27 | 0,37 | 0,1792 | 0,0160 | ||

| US75079LAB71 / Rain Carbon, Inc. | 0,27 | 1,14 | 0,1774 | 0,0166 | ||

| US3140XHVB09 / Fannie Mae Pool | 0,26 | −2,23 | 0,1753 | 0,0114 | ||

| Santander Drive Auto Receivables Trust 2025-2 / ABS-O (US80287NAD75) | 0,26 | 0,38 | 0,1740 | 0,0154 | ||

| US46115HBZ91 / Intesa Sanpaolo SpA | 0,26 | −44,68 | 0,1729 | −0,1130 | ||

| Howden UK Refinance PLC / Howden UK Refinance 2 PLC / Howden US Refinance LLC / DBT (US44287GAA40) | 0,26 | 2,37 | 0,1726 | 0,0185 | ||

| Kimmeridge Texas Gas LLC / DBT (US49446BAA26) | 0,26 | 3,20 | 0,1719 | 0,0198 | ||

| US852060AT99 / Sprint Capital Corp 8.750% Notes 03/15/32 | 0,26 | 1,18 | 0,1709 | 0,0158 | ||

| US00130HCG83 / CORP. NOTE | 0,26 | 2,39 | 0,1707 | 0,0180 | ||

| Citadel Securities Global Holdings LLC / DBT (US17289RAB24) | 0,26 | 0,1705 | 0,1705 | |||

| APA Corp / DBT (US03743QAF54) | 0,26 | 0,79 | 0,1703 | 0,0153 | ||

| Novelis Corp / DBT (US670001AL04) | 0,26 | 2,41 | 0,1697 | 0,0177 | ||

| Uniform Mortgage-Backed Security, TBA / ABS-MBS (US01F0604771) | 0,26 | 0,1694 | 0,1694 | |||

| F2IC34 / Fair Isaac Corporation - Depositary Receipt (Common Stock) | 0,25 | 0,1687 | 0,1687 | |||

| US345397XL24 / FORD MOTOR CREDIT CO LLC | 0,25 | 0,40 | 0,1677 | 0,0147 | ||

| RPRX / Royalty Pharma plc | 0,25 | 2,86 | 0,1676 | 0,0181 | ||

| FMCC / Federal Home Loan Mortgage Corporation | 0,25 | 0,1669 | 0,1669 | |||

| Silver Point Clo 4 Ltd / ABS-CBDO (US82809EAJ91) | 0,25 | 0,1668 | 0,1668 | |||

| Trinitas CLO XXVII LTD / ABS-CBDO (US89642VAE83) | 0,25 | 0,40 | 0,1668 | 0,0142 | ||

| Octagon 69 Ltd / ABS-CBDO (US67578UAC80) | 0,25 | 0,1668 | 0,1668 | |||

| Regatta XXVIII Funding Ltd / ABS-CBDO (US75901PAC05) | 0,25 | 0,1667 | 0,1667 | |||

| ALA Trust 2025-OANA / ABS-MBS (US009920AA71) | 0,25 | 0,1667 | 0,1667 | |||

| Galaxy 31 Clo Ltd / ABS-CBDO (US36320HAN98) | 0,25 | 0,1666 | 0,1666 | |||

| Generate CLO 14 Ltd / ABS-CBDO (US37149QAC06) | 0,25 | 0,00 | 0,1666 | 0,0142 | ||

| US95001VAT70 / Wells Fargo Commercial Mortgage Trust 2019-C51 | 0,25 | 0,1664 | 0,1664 | |||

| US05401AAB70 / Avolon Holdings Funding Ltd | 0,25 | 1,63 | 0,1657 | 0,0164 | ||

| MSBAM / ABS-MBS (US61778GAE61) | 0,25 | 0,1656 | 0,1656 | |||

| US01F0526727 / Uniform Mortgage-Backed Security, TBA | 0,25 | −83,70 | 0,1647 | −0,5920 | ||

| EQT / EQT Corporation | 0,25 | 0,1643 | 0,1643 | |||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0,25 | 0,82 | 0,1637 | 0,0150 | ||

| Freddie Mac Stacr Remic Trust 2025-Hqa1 / ABS-MBS (US35564NGZ06) | 0,24 | −10,95 | 0,1626 | −0,0042 | ||

| US46579R2031 / IVANPLATS LTD 144A | 0,24 | −0,81 | 0,1624 | 0,0124 | ||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 0,24 | 0,1617 | 0,1617 | |||

| US666807BN13 / Northrop Grumman Corp | 0,24 | 0,1616 | 0,1616 | |||

| Mars Inc / DBT (US571676AZ85) | 0,24 | 0,84 | 0,1602 | 0,0147 | ||

| BMO 2024-5C5 Mortgage Trust / ABS-MBS (US05593RAC60) | 0,24 | 0,1591 | 0,1591 | |||

| USG60744AG74 / MGM China Holdings Ltd | 0,24 | 0,85 | 0,1579 | 0,0149 | ||

| US65480CAF23 / Nissan Motor Acceptance Co. LLC | 0,24 | 0,1575 | 0,1575 | |||

| LAD Auto Receivables Trust 2024-3 / ABS-O (US505709AD72) | 0,24 | 0,1571 | 0,1571 | |||

| US3137HB2X13 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,24 | 0,1569 | 0,1569 | |||

| OPAL BIDCO / DBT (US68348BAA17) | 0,23 | 0,1557 | 0,1557 | |||

| COLOSSUS ACQUIRECO LLC TERM LOAN B / LON (000000000) | 0,23 | 0,1556 | 0,1556 | |||

| US20754QAA67 / Fannie Mae Connecticut Avenue Securities | 0,23 | −4,10 | 0,1556 | 0,0070 | ||

| US378272BP27 / Glencore Funding LLC | 0,23 | 1,32 | 0,1538 | 0,0146 | ||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 0,23 | 1,32 | 0,1538 | 0,0151 | ||

| US28414BAF31 / ELANCO ANIMAL HEALTH INCORPORA TERM LOAN B | 0,23 | 0,1533 | 0,1533 | |||

| US780153BK72 / Royal Caribbean Cruises Ltd | 0,23 | −22,18 | 0,1517 | 0,0214 | ||

| Cherry Securitization Trust 2025-1 / ABS-O (US16473RAA23) | 0,23 | 0,1516 | 0,1516 | |||

| US055988AC30 / BMO 2023-C5 Mortgage Trust | 0,23 | 0,44 | 0,1505 | 0,0137 | ||

| K1EY34 / KeyCorp - Depositary Receipt (Common Stock) | 0,23 | 1,35 | 0,1495 | 0,0141 | ||

| Baiterek National Managing Holding JSC / DBT (US05709VAA26) | 0,22 | 0,1491 | 0,1491 | |||

| MUTHOOTFIN / Muthoot Finance Limited | 0,22 | 0,1488 | 0,1488 | |||

| Host Hotels & Resorts LP / DBT (US44107TBD72) | 0,22 | 0,1476 | 0,1476 | |||

| BATBC / British American Tobacco Bangladesh Company Limited | 0,22 | 0,91 | 0,1475 | 0,0142 | ||

| US65480MAD56 / Nissan Auto Receivables Owner Trust, Series 2023-B, Class A3 | 0,22 | 0,1474 | 0,1474 | |||

| US35640YAL11 / CORP. NOTE | 0,22 | 0,45 | 0,1473 | 0,0133 | ||

| Towd Point Mortgage Trust 2019-HY1 / ABS-MBS (US89177EAD13) | 0,22 | 0,91 | 0,1471 | 0,0136 | ||

| Prime Security Services Borrower LLC 2025 Incremental Term Loan B / LON (US03765VAQ32) | 0,22 | 0,1464 | 0,1464 | |||

| KIND Commercial Mortgage Trust 2024-1 / ABS-MBS (US494925AA88) | 0,22 | 0,46 | 0,1463 | 0,0126 | ||

| BBCMS Mortgage Trust 2025-5C34 / ABS-MBS (US07337BAC81) | 0,22 | 0,1454 | 0,1454 | |||

| Benchmark 2024-V12 Mortgage Trust / ABS-MBS (US081915AB68) | 0,22 | 0,46 | 0,1452 | 0,0131 | ||

| US928881AF82 / Vontier Corp | 0,22 | 0,1445 | 0,1445 | |||

| BMO 2024-5C8 Mortgage Trust / ABS-MBS (US09661XAC20) | 0,22 | 0,46 | 0,1444 | 0,0129 | ||

| US257375AJ44 / Dominion Energy Gas Holdings LLC | 0,22 | 0,1432 | 0,1432 | |||

| US096630AH15 / Boardwalk Pipelines LP | 0,21 | 1,43 | 0,1417 | 0,0138 | ||

| US46590XAY22 / JBS USA LUX SA / JBS USA Food Co. / JBS USA Finance, Inc. | 0,21 | 0,1414 | 0,1414 | |||

| JBS USA Holding Lux Sarl / JBS USA Foods Group Holdings Inc / JBS USA Food Co / DBT (US472140AJ19) | 0,21 | 0,1412 | 0,1412 | |||

| Sammons Financial Group Global Funding / DBT (US79587J2A00) | 0,21 | 1,44 | 0,1406 | 0,0139 | ||

| US69335PEV31 / PFS Financing Corp | 0,21 | 0,1404 | 0,1404 | |||

| Charter Communications Operating LLC 2024 Term Loan B5 / LON (US16117LCE74) | 0,21 | 0,48 | 0,1403 | 0,0123 | ||

| EMRLD Borrower LP / Emerald Co-Issuer Inc / DBT (US26873CAB81) | 0,21 | 2,93 | 0,1403 | 0,0156 | ||

| US031162DP23 / Amgen Inc | 0,21 | 0,1398 | 0,1398 | |||

| CONE Trust 2024-DFW1 / ABS-MBS (US20682AAA88) | 0,21 | 0,00 | 0,1393 | 0,0122 | ||

| US030288AC89 / American Transmission Systems Inc | 0,21 | 2,45 | 0,1391 | 0,0149 | ||

| US12503MAA62 / Cboe Global Markets Inc | 0,21 | 0,1384 | 0,1384 | |||

| Jane Street Group / JSG Finance Inc / DBT (US47077WAE84) | 0,21 | 0,1383 | 0,1383 | |||

| 70GD / Antofagasta plc - Preferred Security | 0,21 | 0,49 | 0,1380 | 0,0124 | ||

| Arcos Dorados BV / DBT (US03965TAC71) | 0,21 | 0,1379 | 0,1379 | |||

| US01741RAN26 / ATI Inc | 0,21 | 1,97 | 0,1375 | 0,0140 | ||

| 088350 / Hanwha Life Insurance Co., Ltd. | 0,21 | 0,1371 | 0,1371 | |||

| Capital Power US Holdings Inc / DBT (US14041TAB44) | 0,21 | 0,1371 | 0,1371 | |||

| Foundry JV Holdco LLC / DBT (US350930AF07) | 0,21 | 0,99 | 0,1362 | 0,0127 | ||

| Windfall Mining Group Inc / Groupe Minier Windfall Inc / DBT (US973244AA44) | 0,20 | 0,1357 | 0,1357 | |||

| Navoi Mining & Metallurgical Combinat / DBT (US63890CAC82) | 0,20 | 0,1355 | 0,1355 | |||

| US91324PEV04 / UnitedHealth Group Inc | 0,20 | 0,1353 | 0,1353 | |||

| US034863BD17 / Anglo American Capital PLC | 0,20 | 0,1350 | 0,1350 | |||

| Rentokil Terminix Funding LLC / DBT (US760130AB09) | 0,20 | 0,1348 | 0,1348 | |||

| FIEMEX Energia - Banco Actinver SA Institucion de Banca Multiple / DBT (US05974EAA82) | 0,20 | 2,03 | 0,1339 | 0,0139 | ||

| MO / Altria Group, Inc. - Depositary Receipt (Common Stock) | 0,20 | 0,1326 | 0,1326 | |||

| US914908BD90 / Univision Communications Inc. 2022 First Lien Term Loan B | 0,20 | 2,58 | 0,1324 | 0,0141 | ||

| Santander Drive Auto Receivables Trust 2024-2 / ABS-O (US80286YAE23) | 0,20 | 21,47 | 0,1322 | 0,0328 | ||

| US46593FAD42 / J.P. Morgan Mortgage Trust 2022-INV3 | 0,20 | 0,1317 | 0,1317 | |||

| 29364W405 / Entergy Louisiana LLC, 5.875% Series First Mortgage Bonds due 6/15/2041 | 0,20 | 0,51 | 0,1310 | 0,0118 | ||

| US98313RAH93 / Wynn Macau Ltd | 0,20 | −19,01 | 0,1305 | −0,0001 | ||

| Chile Electricity Lux Mpc II Sarl / DBT (US16882LAA08) | 0,20 | −1,51 | 0,1304 | 0,0091 | ||

| FMCC / Federal Home Loan Mortgage Corporation | 0,20 | −3,45 | 0,1302 | 0,0062 | ||

| Crescent Energy Finance LLC / DBT (US45344LAE39) | 0,20 | −0,51 | 0,1297 | 0,0100 | ||

| US345397B777 / Ford Motor Credit Co LLC | 0,19 | 1,04 | 0,1294 | 0,0122 | ||

| US86722AAD54 / SunCoke Energy Inc | 0,19 | 1,57 | 0,1293 | 0,0127 | ||

| Lightning Power LLC / DBT (US53229KAA79) | 0,19 | 2,12 | 0,1286 | 0,0133 | ||

| LPL Holdings Inc / DBT (US50212YAQ70) | 0,19 | 0,1276 | 0,1276 | |||

| Rocket Cos Inc / DBT (US77311WAB72) | 0,19 | 0,1273 | 0,1273 | |||

| US30251GBC06 / FMG Resources August 2006 Pty Ltd | 0,19 | 2,70 | 0,1269 | 0,0141 | ||

| US502160AN46 / LSB Industries Inc | 0,19 | 2,70 | 0,1266 | 0,0139 | ||

| US91324PER91 / UnitedHealth Group Inc | 0,19 | 0,1265 | 0,1265 | |||

| US489399AL90 / KENNEDY-WILSON INC 4.75% 03/01/2029 | 0,19 | 2,73 | 0,1252 | 0,0134 | ||

| 67705BA36 / Oglethorpe Power Corp | 0,19 | 0,1252 | 0,1252 | |||

| Chase Home Lending Mortgage Trust Series 2024-RPL2 / ABS-MBS (US161930AB85) | 0,19 | −1,05 | 0,1251 | 0,0095 | ||

| US03065WAF23 / AmeriCredit Automobile Receivables Trust 2022-2 | 0,19 | 0,1238 | 0,1238 | |||

| US948596AE12 / Weibo Corp | 0,19 | 1,09 | 0,1236 | 0,0113 | ||

| Fannie Mae Connecticut Avenue Securities / ABS-MBS (US20755TAA97) | 0,18 | 0,1227 | 0,1227 | |||

| US01F0606750 / Uniform Mortgage-Backed Security, TBA | 0,18 | −90,88 | 0,1222 | −0,8802 | ||

| US105340AP80 / Brandywine Operating Partnership LP | 0,18 | 3,98 | 0,1218 | 0,0145 | ||

| Exeter Automobile Receivables Trust / ABS-O (US30166XAD66) | 0,18 | 0,1206 | 0,1206 | |||

| US131347CK09 / Calpine Corp. Bond | 0,18 | 0,00 | 0,1201 | 0,0106 | ||

| US465965AC53 / JB Poindexter & Co Inc | 0,18 | −1,10 | 0,1198 | 0,0088 | ||

| US422704AH97 / Hecla Mining Co | 0,18 | 0,00 | 0,1198 | 0,0100 | ||

| US26884UAD19 / EPR Properties | 0,18 | 1,13 | 0,1190 | 0,0110 | ||

| US30161MAN39 / Exelon Generation Co LLC | 0,18 | 223,64 | 0,1186 | 0,1009 | ||

| US3140XCYM40 / Fannie Mae Pool | 0,18 | −4,30 | 0,1183 | 0,0052 | ||

| US88034QAC15 / Tengizchevroil Finance Co International Ltd | 0,18 | 1,72 | 0,1182 | 0,0118 | ||

| A2XO34 / Axon Enterprise, Inc. - Depositary Receipt (Common Stock) | 0,18 | 1,73 | 0,1173 | 0,0120 | ||

| Hyundai Auto Lease Securitization Trust 2025-B / ABS-O (US44935DAF69) | 0,18 | 0,1173 | 0,1173 | |||

| US00084DAV29 / ABN AMRO Bank NV | 0,18 | 1,16 | 0,1169 | 0,0114 | ||

| UEPCN / Union Electric Company - Preferred Stock | 0,17 | 1,17 | 0,1153 | 0,0110 | ||

| US92332YAB74 / Venture Global LNG, Inc. | 0,17 | 2,37 | 0,1153 | 0,0124 | ||

| US53219LAV18 / LifePoint Health Inc | 0,17 | 2,99 | 0,1143 | 0,0123 | ||

| Jane Street Group / JSG Finance Inc / DBT (US47077WAD02) | 0,17 | 0,1112 | 0,1112 | |||

| Exeter Automobile Receivables Trust 2024-4 / ABS-O (US30166UAE01) | 0,17 | 0,00 | 0,1107 | 0,0093 | ||

| US1248EPCD32 / CCO Holdings LLC / CCO Holdings Capital Corp. | 0,17 | −30,67 | 0,1101 | 0,0168 | ||

| US91324PCW05 / UnitedHealth Group, Inc. | 0,17 | 0,1098 | 0,1098 | |||

| FMCC / Federal Home Loan Mortgage Corporation | 0,16 | 0,1094 | 0,1094 | |||

| US923725AD77 / Vermilion Energy Inc | 0,16 | −1,80 | 0,1094 | 0,0077 | ||

| USN7163RAD54 / Prosus NV | 0,16 | −0,61 | 0,1091 | 0,0084 | ||

| ZF North America Capital Inc / DBT (US98877DAF24) | 0,16 | 1,24 | 0,1087 | 0,0105 | ||

| US01883LAE39 / Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer | 0,16 | 0,1080 | 0,1080 | |||

| US46654WAE12 / J.P. Morgan Mortgage Trust 2022-1 | 0,16 | −2,42 | 0,1071 | 0,0066 | ||

| US85236FAA12 / SRM Escrow Issuer, LLC | 0,16 | −34,44 | 0,1054 | −0,0414 | ||

| Mars Inc / DBT (US571676BC81) | 0,16 | −0,63 | 0,1054 | 0,0087 | ||

| US77289KAA34 / Rockcliff Energy II LLC | 0,16 | −49,84 | 0,1050 | −0,0866 | ||

| JetBlue Airways Corp / JetBlue Loyalty LP / DBT (US476920AA15) | 0,16 | −1,26 | 0,1048 | 0,0076 | ||

| US55607PAG00 / Macquarie Group Ltd | 0,16 | −44,91 | 0,1047 | −0,0691 | ||

| SM / SM Energy Company | 0,16 | −23,79 | 0,1046 | −0,0207 | ||

| US29365TAH77 / Entergy Texas Inc. | 0,16 | −0,64 | 0,1041 | 0,0084 | ||

| Aethon United BR LP / Aethon United Finance Corp / DBT (US00810GAD60) | 0,16 | −42,86 | 0,1037 | −0,0627 | ||

| US20755DAA46 / Fannie Mae Connecticut Avenue Securities | 0,16 | 0,1030 | 0,1030 | |||

| US46285MAA80 / Iron Mountain Information Management Services Inc | 0,15 | −25,60 | 0,1026 | −0,0236 | ||

| US1248EPCN14 / CORPORATE BONDS | 0,15 | −44,12 | 0,1014 | −0,0646 | ||

| US382550BN08 / Goodyear Tire & Rubber Co/The | 0,15 | −39,44 | 0,1013 | −0,0516 | ||

| US04649VAY65 / ASURION LLC | 0,15 | 0,1012 | 0,1012 | |||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 0,15 | 2,01 | 0,1011 | 0,0101 | ||

| US46654FAD06 / JP Morgan Mortgage Trust | 0,15 | −1,94 | 0,1010 | 0,0065 | ||

| US25461LAA08 / DIRECTV Holdings LLC/DIRECTV Financing Co., Inc. | 0,15 | −22,96 | 0,1006 | −0,0190 | ||

| US11134LAH24 / Broadcom Corp / Broadcom Cayman Finance Ltd | 0,15 | −89,39 | 0,0997 | −0,3142 | ||

| US44332EAP16 / Hub International Ltd., Term Loan | 0,15 | −21,58 | 0,0994 | −0,0164 | ||

| US63938CAP32 / Navient Corp. | 0,15 | −13,37 | 0,0993 | −0,0053 | ||

| EW / Edwards Lifesciences Corporation | 0,15 | −86,95 | 0,0993 | −0,4710 | ||

| US88632QAE35 / Picard Midco, Inc. | 0,15 | −28,02 | 0,0992 | −0,0267 | ||

| US893647BP15 / CORP. NOTE | 0,15 | −44,81 | 0,0991 | −0,0210 | ||

| XS2066744231 / Carnival PLC | 0,15 | −14,45 | 0,0985 | −0,0070 | ||

| Clydesdale Acquisition Holdings Inc / DBT (US18972EAD76) | 0,15 | −5,77 | 0,0980 | 0,0030 | ||

| N1RG34 / NRG Energy, Inc. - Depositary Receipt (Common Stock) | 0,15 | −33,18 | 0,0980 | −0,0359 | ||

| NFG / National Fuel Gas Company | 0,15 | 0,68 | 0,0978 | 0,0087 | ||

| Medline Borrower LP/Medline Co-Issuer Inc / DBT (US58506DAA63) | 0,15 | 0,0975 | 0,0975 | |||

| US92840VAP76 / Vistra Operations Co. LLC | 0,15 | −51,50 | 0,0974 | −0,0860 | ||

| REYN / Reynolds Consumer Products Inc. | 0,15 | 0,00 | 0,0969 | 0,0082 | ||

| FMCC / Federal Home Loan Mortgage Corporation | 0,15 | 0,0965 | 0,0965 | |||

| HRI / Herc Holdings Inc. | 0,14 | 0,0954 | 0,0954 | |||

| US20754QAB41 / Connecticut Avenue Securities Trust 2023-R04 | 0,14 | 0,0947 | 0,0947 | |||

| Trans Union LLC 2024 Term Loan B9 / LON (US89334GBG82) | 0,14 | 0,00 | 0,0941 | 0,0081 | ||

| US29365TAH77 / Entergy Texas Inc. | 0,14 | 1,45 | 0,0932 | 0,0089 | ||

| Chase Home Lending Mortgage Trust 2024-RPL4 / ABS-MBS (US16160NAB73) | 0,14 | −1,43 | 0,0923 | 0,0067 | ||

| C2AC34 / CACI International Inc - Depositary Receipt (Common Stock) | 0,14 | 0,0913 | 0,0913 | |||

| HCA Inc / DBT (US404121AK12) | 0,14 | −47,08 | 0,0904 | −0,0661 | ||

| BSTN Commercial Mortgage Trust 2025-1C / ABS-MBS (US05615EAA38) | 0,13 | 0,0882 | 0,0882 | |||

| PSEG Power LLC / DBT (US69362BBE11) | 0,13 | 0,0848 | 0,0848 | |||

| EQT / EQT Corporation | 0,13 | 0,0837 | 0,0837 | |||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,12 | 0,0823 | 0,0823 | |||

| US89236TKJ33 / Toyota Motor Credit Corp. | 0,12 | 0,0819 | 0,0819 | |||

| SeaWorld Parks & Entertainment Inc 2024 Term Loan B3 / LON (US78488CAL46) | 0,12 | 266,67 | 0,0808 | 0,0609 | ||

| E1CO34 / Ecopetrol S.A. - Depositary Receipt (Common Stock) | 0,12 | −0,82 | 0,0808 | 0,0062 | ||

| US88233FAK66 / Vistra Operations Co. LLC, Term Loan | 0,12 | 0,00 | 0,0801 | 0,0070 | ||

| US20754BAA98 / CAS_22-R02 | 0,12 | −29,76 | 0,0789 | −0,0236 | ||

| Six Flags Entertainment Corporation 2024 Term Loan B / LON (US15018LAN10) | 0,12 | 0,0784 | 0,0784 | |||

| Uniform Mortgage-Backed Security, TBA / ABS-MBS (US01F0706741) | 0,12 | 0,0769 | 0,0769 | |||

| American Airlines Inc 2025 Term Loan / LON (US02376CBS35) | 0,11 | −49,33 | 0,0763 | −0,0605 | ||

| US292505AG96 / Encana Corp 6.5% Notes 2/1/38 | 0,11 | −67,15 | 0,0757 | −0,1337 | ||

| EQT / EQT Corporation | 0,11 | 0,0747 | 0,0747 | |||

| US257375AJ44 / Dominion Energy Gas Holdings LLC | 0,11 | 0,0738 | 0,0738 | |||

| BX Trust 2025-TAIL / ABS-MBS (US123912AA54) | 0,11 | 0,0732 | 0,0732 | |||

| Florida Power & Light Co / DBT (US341081GZ45) | 0,11 | −0,92 | 0,0721 | 0,0055 | ||

| US55903VBB80 / Warnermedia Holdings Inc | 0,11 | 0,0714 | 0,0714 | |||

| Albertsons Cos Inc / Safeway Inc / New Albertsons LP / Albertsons LLC / DBT (US01309QAB41) | 0,10 | 1,98 | 0,0686 | 0,0071 | ||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,10 | −6,48 | 0,0677 | 0,0019 | ||

| GM Financial Consumer Automobile Receivables Trust 2024-2 / ABS-O (US379931AG38) | 0,10 | 0,0643 | 0,0643 | |||

| Jersey Central Power & Light Co / DBT (US476556DF91) | 0,09 | 0,0630 | 0,0630 | |||

| US ULTRA BOND CBT SEP25 / DIR (000000000) | 0,09 | 0,0602 | 0,0602 | |||

| US20753AAA25 / Connecticut Avenue Securities Trust 2023-R03 | 0,09 | −71,70 | 0,0601 | −0,1334 | ||

| US459200AS04 / Ibm Corp 6.50% Debentures 01/15/2028 | 0,09 | 0,0583 | 0,0583 | |||

| Hudson River Trading LLC 2024 Term Loan B / LON (US44413EAJ73) | 0,08 | 0,0531 | 0,0531 | |||

| BRO / Brown & Brown, Inc. | 0,08 | 0,0529 | 0,0529 | |||

| WBAD / Walgreens Boots Alliance, Inc. - Depositary Receipt (Common Stock) | 0,08 | −57,98 | 0,0528 | −0,0619 | ||

| N1RG34 / NRG Energy, Inc. - Depositary Receipt (Common Stock) | 0,08 | 0,00 | 0,0516 | 0,0044 | ||

| US05401AAR23 / Avolon Holdings Funding Ltd | 0,07 | 0,0492 | 0,0492 | |||

| US36265LAB36 / GS MORTGAGE BACKED SECURITIES GSMBS 2022 HP1 A2 144A | 0,07 | 0,0468 | 0,0468 | |||

| Trans Union LLC 2024 Term Loan B8 / LON (US89334GBF00) | 0,06 | 0,00 | 0,0403 | 0,0035 | ||

| Clarios Global LP / Clarios US Finance Co / DBT (US18060TAD72) | 0,06 | 0,0366 | 0,0366 | |||

| RPRX / Royalty Pharma plc | 0,05 | 0,0361 | 0,0361 | |||

| DTE Electric Co / DBT (US23338VAZ94) | 0,05 | 0,0307 | 0,0307 | |||

| US01F0306781 / UMBS TBA | 0,04 | −99,09 | 0,0259 | −1,1032 | ||

| BRO / Brown & Brown, Inc. | 0,04 | 0,0258 | 0,0258 | |||

| US 2YR NOTE (CBT) SEP25 / DIR (000000000) | 0,03 | 0,0228 | 0,0228 | |||

| US055983AA86 / BSPRT 2022-FL8 Issuer Ltd | 0,03 | −25,00 | 0,0225 | −0,0046 | ||

| EW / Edwards Lifesciences Corporation | 0,03 | −95,41 | 0,0169 | −0,3452 | ||

| US21H0606895 / Ginnie Mae | 0,02 | −94,65 | 0,0162 | −0,2083 | ||

| US88167AAE10 / Teva Pharmaceutical Fin Neth 10/01/2026 3.150 Bond | 0,02 | 0,0150 | 0,0150 | |||

| US 5YR NOTE (CBT) SEP25 / DIR (000000000) | 0,01 | 0,0081 | 0,0081 | |||

| US172967ME81 / Citigroup Inc | 0,01 | 0,00 | 0,0046 | 0,0004 | ||

| US55316HAB15 / GENESEE+WYOMING INC TERM LOAN | 0,00 | −100,00 | 0,0000 | −0,1084 | ||

| US 10YR ULTRA FUT SEP25 / DIR (000000000) | −0,02 | −0,0159 | −0,0159 |